Key Insights

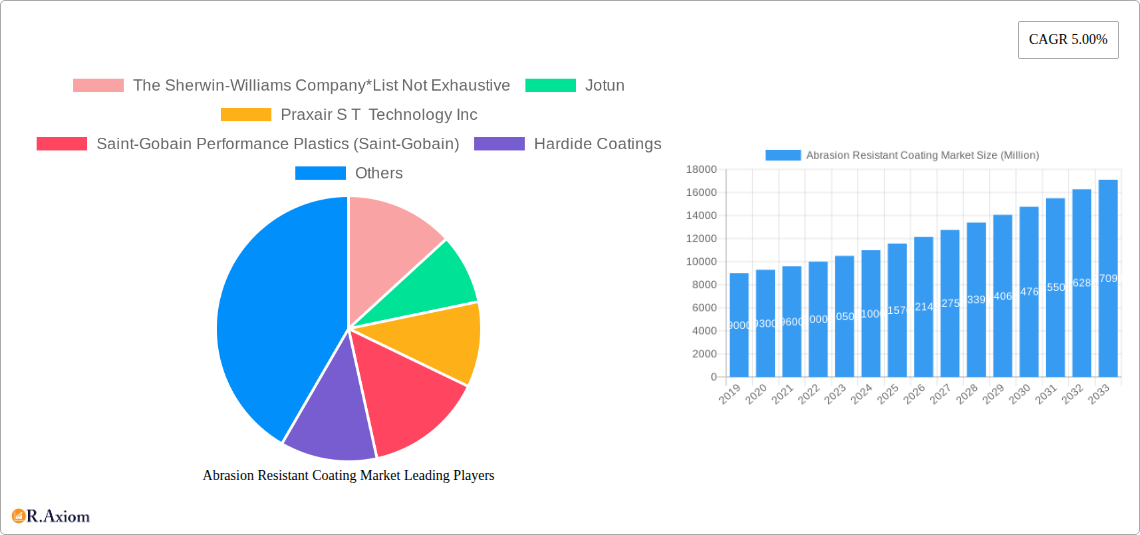

The global Abrasion Resistant Coating Market is poised for robust expansion, with a current market size estimated at approximately USD 11,570 million. This growth is projected to continue at a Compound Annual Growth Rate (CAGR) of 5.00% over the forecast period of 2025-2033. A primary driver of this sustained growth is the increasing demand for enhanced durability and extended lifespan of components across a multitude of industries. As manufacturing processes become more demanding and operational environments harsher, the need for protective coatings that can withstand significant wear and tear is paramount. This fundamental requirement fuels the adoption of advanced abrasion-resistant solutions.

Abrasion Resistant Coating Market Market Size (In Billion)

The market's trajectory is further shaped by significant trends such as the development of high-performance, environmentally friendly coating formulations and the integration of smart coating technologies that offer real-time performance monitoring. Key industries like Oil and Gas, Marine, and Power Generation are leading this demand due to the critical nature of their assets and the substantial costs associated with premature failure and maintenance. While the market benefits from technological advancements and a growing awareness of the long-term economic advantages of investing in these coatings, certain restraints, such as the initial cost of application and the complexity of surface preparation for optimal adhesion, need to be addressed for even more accelerated growth. The market is segmented into Metal/Ceramic Coatings and Polymer Coatings, with distinct sub-segments like Carbide Coatings and Polyester coatings showing particular traction, catering to diverse application needs.

Abrasion Resistant Coating Market Company Market Share

Here is the detailed report description for the Abrasion Resistant Coating Market, optimized for SEO and structured as requested:

Abrasion Resistant Coating Market Market Concentration & Innovation

The Abrasion Resistant Coating Market exhibits moderate to high concentration, driven by a blend of established global players and specialized innovators. The market is intensely competitive, with key players like The Sherwin-Williams Company, Jotun, Praxair S T Technology Inc, Saint-Gobain Performance Plastics (Saint-Gobain), Hardide Coatings, Arkema Group, Hempel A/S, Akzo Nobel N V, Bodycote, and PPG Industries investing significantly in research and development. Innovation is a primary driver, focusing on enhanced durability, novel material compositions (e.g., advanced ceramics and nanocomposites), and environmentally compliant formulations. Regulatory frameworks, particularly concerning VOC emissions and material safety, are increasingly shaping product development and market access. Product substitutes, while present, often fall short of the specialized performance offered by dedicated abrasion-resistant coatings, especially in demanding industrial applications. End-user trends indicate a growing demand for solutions that extend asset lifespan, reduce maintenance costs, and improve operational efficiency. Mergers and acquisitions (M&A) are prevalent, with recent transactions aimed at expanding product portfolios, geographical reach, and technological capabilities. For instance, a significant M&A deal in the recent past, valued at approximately $500 million, saw a major coatings manufacturer acquire a specialized ceramic coating producer to bolster its offerings in the power generation sector. This strategic consolidation underscores the industry's pursuit of market dominance and comprehensive solution provision, ensuring that leading companies maintain a substantial market share by offering integrated and superior performance.

Abrasion Resistant Coating Market Industry Trends & Insights

The Abrasion Resistant Coating Market is poised for robust growth, driven by escalating industrialization and the perpetual need to protect valuable assets from wear and tear. The projected Compound Annual Growth Rate (CAGR) for the forecast period 2025–2033 is approximately 6.5%, with the global market size estimated to reach over $15,000 million by 2025 and grow to an estimated $25,000 million by the end of 2033. This expansion is fueled by several key factors. Firstly, the booming oil and gas sector, particularly in exploration and production, demands highly resilient coatings to withstand corrosive environments and abrasive materials, contributing significantly to market penetration. Secondly, the marine industry's continuous need for anti-corrosion and anti-fouling coatings that also resist abrasive forces from water and operational activities further propels demand. Power generation facilities, facing extreme thermal and mechanical stresses, are increasingly adopting advanced abrasion-resistant coatings to ensure longevity and minimize downtime. The transportation sector, from automotive to aerospace, is witnessing a rise in lightweight yet durable coatings that enhance fuel efficiency and protect components from wear. Technological disruptions are at the forefront, with advancements in nanotechnology enabling the development of coatings with unparalleled hardness and self-healing properties. Innovations in application techniques, such as thermal spraying and advanced PVD/CVD processes, are also contributing to more efficient and effective coating solutions. Consumer preferences are shifting towards sustainable and eco-friendly coatings, prompting manufacturers to invest in water-borne and low-VOC formulations. The competitive dynamics are characterized by intense innovation, strategic partnerships, and a global push towards higher performance standards, ensuring that companies continuously adapt to meet the evolving needs of diverse industrial applications. The market penetration of specialized abrasion-resistant coatings is expected to rise as industries recognize the long-term economic benefits of preventative protection.

Dominant Markets & Segments in Abrasion Resistant Coating Market

The Abrasion Resistant Coating Market is segmented across various types and end-user industries, with distinct regions and specific segments exhibiting dominant growth and demand.

Type Segmentation:

- Metal/Ceramic Coatings: This segment, encompassing Carbide Coatings, Oxide Coatings, and Nitride Coatings, is a major growth area. Carbide coatings, such as Tungsten Carbide and Chromium Carbide, are particularly dominant due to their exceptional hardness and wear resistance, vital for heavy-duty applications in mining and oil and gas. The demand for these coatings is projected to reach approximately $8,000 million by 2025.

- Key Drivers:

- High performance in extreme conditions (temperature, pressure, chemical exposure).

- Extended lifespan of critical components.

- Cost-effectiveness over the lifecycle of equipment.

- Key Drivers:

- Polymer Coatings: This segment includes Polyester, Fluoropolymer, Epoxy, and Polyurethane coatings. While generally offering a broader range of applications, they are often chosen for their versatility, chemical resistance, and cost-effectiveness. Epoxy and Polyurethane coatings are particularly strong in construction and general industrial applications. The market size for polymer coatings is estimated at over $7,000 million by 2025.

- Key Drivers:

- Ease of application and formulation flexibility.

- Good chemical and corrosion resistance.

- Aesthetic appeal and surface protection.

- Key Drivers:

End-user Industry Segmentation:

- Oil and Gas: This sector is a primary driver of the abrasion-resistant coating market, with an estimated market share of over 25%. The harsh environments encountered in exploration, extraction, and refining necessitate coatings that can withstand extreme abrasion, corrosion, and high temperatures. The value of coatings used in this sector is projected to exceed $3,500 million by 2025.

- Dominance Drivers:

- Presence of offshore drilling platforms and onshore extraction sites.

- Strict safety and operational integrity regulations.

- Continuous need for equipment protection in challenging geological formations.

- Dominance Drivers:

- Marine: The marine industry's relentless exposure to saltwater, harsh weather, and mechanical wear makes abrasion-resistant coatings indispensable. Applications include ship hulls, offshore structures, and port infrastructure. The market for marine abrasion-resistant coatings is estimated to be around $2,500 million by 2025.

- Dominance Drivers:

- Global shipping volume and maritime trade.

- Requirement for anti-corrosion and anti-fouling properties.

- Regulations related to environmental protection and vessel longevity.

- Dominance Drivers:

- Power Generation: This sector relies heavily on abrasion-resistant coatings for turbines, boilers, and other critical components exposed to high temperatures, steam, and abrasive particles. The market size is projected to reach approximately $2,000 million by 2025.

- Dominance Drivers:

- Growing demand for energy and aging infrastructure.

- Need for increased efficiency and reduced maintenance in thermal and renewable power plants.

- Advancements in coating technology for extreme thermal environments.

- Dominance Drivers:

- Transportation: Encompassing automotive, aerospace, and rail, this sector demands coatings for enhanced durability, fuel efficiency, and component protection. The market size is estimated to be around $1,800 million by 2025.

- Dominance Drivers:

- Lightweighting trends and demand for durable materials.

- Stringent safety and performance standards.

- Increasing production of vehicles and aircraft.

- Dominance Drivers:

- Mining: The mining industry's intensive operations involving crushing, grinding, and material transport create extreme abrasive conditions, making abrasion-resistant coatings crucial for equipment longevity. This segment is valued at approximately $1,500 million by 2025.

- Dominance Drivers:

- High volume of material handling and processing.

- Wear and tear on heavy machinery like excavators, crushers, and conveyors.

- Demand for reduced downtime and maintenance costs.

- Dominance Drivers:

- Construction: While often using more general-purpose coatings, specialized abrasion-resistant coatings are essential for infrastructure projects, flooring, and structural protection. This segment is projected to be around $1,200 million by 2025.

- Dominance Drivers:

- Global infrastructure development and urban expansion.

- Need for durable and protective coatings for concrete, steel, and other building materials.

- Increased focus on lifespan extension of built assets.

- Dominance Drivers:

- Others: This includes segments like industrial manufacturing, electronics, and textiles, which collectively represent a growing demand for specialized coatings, estimated at over $1,000 million by 2025.

Geographically, North America and Europe currently dominate the market due to established industrial bases and significant investments in R&D. However, the Asia-Pacific region is expected to witness the fastest growth, driven by rapid industrialization, infrastructure development, and increasing adoption of advanced coating technologies.

Abrasion Resistant Coating Market Product Developments

Product development in the abrasion-resistant coating market is characterized by a relentless pursuit of enhanced performance and broader applicability. Key innovations include the development of nanocomposite coatings incorporating materials like graphene and carbon nanotubes for superior hardness and scratch resistance. Advanced ceramic coatings, such as optimized PVD/CVD deposited titanium nitride and chromium nitride, are offering unprecedented wear resistance in high-temperature environments. Furthermore, there's a strong focus on developing eco-friendly, low-VOC, and water-borne polymer coatings, meeting stringent environmental regulations without compromising protective qualities. These advancements enable coatings to withstand extreme abrasive conditions, chemical attacks, and thermal stress, thereby extending the lifespan of critical industrial equipment across sectors like oil and gas, mining, and power generation, providing significant competitive advantages to manufacturers and end-users alike.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global Abrasion Resistant Coating Market, segmenting it across key categories to offer detailed insights into market dynamics and growth prospects.

Type Segmentation: The market is analyzed based on the primary types of abrasion-resistant coatings.

- Metal/Ceramic Coatings: This includes sub-segments like Carbide Coatings, Oxide Coatings, and Nitride Coatings. These are high-performance coatings offering extreme hardness and durability, crucial for heavy-duty applications. Projections indicate strong growth, with market sizes reaching approximately $8,000 million by 2025.

- Polymer Coatings: This category encompasses Polyester, Fluoropolymer, Epoxy, and Polyurethane coatings. These offer versatility, chemical resistance, and ease of application, catering to a wide array of industrial and consumer needs. The market size is estimated at over $7,000 million by 2025.

End-user Industry Segmentation: The report further segments the market by the primary industries that utilize abrasion-resistant coatings.

- Oil and Gas: A dominant segment due to the harsh operating environments, with an estimated market share exceeding 25% and a market value of over $3,500 million by 2025.

- Marine: Essential for protecting vessels and offshore structures from saltwater and abrasion, valued at approximately $2,500 million by 2025.

- Power Generation: Critical for maintaining the efficiency and longevity of power plant equipment, estimated at around $2,000 million by 2025.

- Transportation: Including automotive, aerospace, and rail, where durability and performance are paramount, with a market size of approximately $1,800 million by 2025.

- Mining: Essential for wear resistance in heavy machinery, projected at $1,500 million by 2025.

- Construction: For protecting infrastructure and building materials, valued at around $1,200 million by 2025.

- Others: Encompassing various niche applications, contributing over $1,000 million by 2025.

This detailed segmentation allows for a granular understanding of market drivers, regional dominance, and the specific needs of each industry, providing actionable insights for stakeholders.

Key Drivers of Abrasion Resistant Coating Market Growth

Several key factors are propelling the growth of the abrasion-resistant coating market. Technologically, advancements in material science have led to the development of coatings with superior hardness, adhesion, and chemical inertness. Economically, the increasing lifespan of industrial equipment, driven by the adoption of these protective coatings, translates to significant cost savings for businesses in terms of reduced maintenance and replacement cycles. Regulatory frameworks, particularly those mandating enhanced safety and environmental standards in industries like oil and gas and power generation, also indirectly drive demand for high-performance coatings that ensure operational integrity and compliance. For example, strict regulations in the marine sector to prevent pollution necessitate durable coatings that also offer anti-corrosion properties.

Challenges in the Abrasion Resistant Coating Market Sector

Despite the promising growth trajectory, the abrasion-resistant coating market faces several challenges. The high cost of advanced coating materials and application technologies can be a significant barrier for small and medium-sized enterprises. Fluctuations in raw material prices, particularly for specialized metals and polymers, can impact profitability and pricing strategies. Stringent and evolving environmental regulations in various regions necessitate continuous investment in R&D to develop compliant, low-VOC, and sustainable coating solutions, which can be resource-intensive. Furthermore, the market experiences intense competitive pressure, requiring continuous innovation to maintain market share and a strong focus on application expertise to ensure optimal performance, as improper application can negate the benefits of even the most advanced coatings. Supply chain disruptions, as seen in recent global events, can also impact the availability and cost of key raw materials.

Emerging Opportunities in Abrasion Resistant Coating Market

Emerging opportunities in the abrasion-resistant coating market are abundant and diverse. The increasing adoption of renewable energy sources, such as wind turbines and solar panels, presents a growing demand for coatings that protect against erosion and harsh environmental conditions. The burgeoning aerospace industry, with its focus on lightweight, durable components, offers significant potential for advanced abrasion-resistant coatings. The expansion of electric vehicles (EVs) also creates opportunities for coatings designed to protect battery casings and other critical components from wear and tear. Furthermore, the growing emphasis on smart coatings with self-healing capabilities and integrated sensors for real-time condition monitoring represents a significant technological frontier. The development of bio-based and sustainable coating formulations is another area ripe for innovation and market penetration, aligning with global sustainability goals.

Leading Players in the Abrasion Resistant Coating Market Market

- The Sherwin-Williams Company

- Jotun

- Praxair S T Technology Inc

- Saint-Gobain Performance Plastics (Saint-Gobain)

- Hardide Coatings

- Arkema Group

- Hempel A/S

- Akzo Nobel N V

- Bodycote

- PPG Industries

Key Developments in Abrasion Resistant Coating Market Industry

- 2023/05: PPG Industries announced a strategic acquisition of a specialized coatings manufacturer, expanding its product portfolio in industrial coatings and bolstering its market presence in the construction sector.

- 2023/02: Arkema Group partnered with a leading research institution to accelerate the development of novel, eco-friendly polymer coatings with enhanced abrasion resistance for automotive applications.

- 2022/11: Jotun invested over $50 million in upgrading its research and development facilities in Scandinavia, focusing on advanced material science for next-generation marine and industrial coatings.

- 2022/07: Saint-Gobain Performance Plastics launched a new line of high-performance ceramic coatings designed for extreme wear applications in the oil and gas industry, offering superior durability and reduced maintenance costs.

- 2021/10: Hempel A/S entered into a joint venture with a technology firm to develop innovative, sustainable coating solutions for the renewable energy sector, emphasizing reduced environmental impact.

Strategic Outlook for Abrasion Resistant Coating Market Market

The strategic outlook for the abrasion-resistant coating market is exceptionally positive, driven by persistent industrial demand for enhanced durability and operational efficiency. Future growth will be significantly influenced by continued innovation in material science, leading to the development of thinner, tougher, and more environmentally sustainable coatings. The increasing emphasis on asset longevity and risk mitigation across all major end-user industries, from oil and gas to transportation, will ensure sustained demand. Strategic investments in R&D, coupled with potential M&A activities aimed at expanding technological capabilities and market reach, will be crucial for key players. Furthermore, the growing global focus on sustainability will drive opportunities for companies that can offer eco-friendly coating solutions without compromising performance, positioning them for long-term success in this dynamic and essential market.

Abrasion Resistant Coating Market Segmentation

-

1. Type

-

1.1. Metal/Ceramic Coatings

- 1.1.1. Carbide Coatings

- 1.1.2. Oxide Coatings

- 1.1.3. Nitride Coatings

- 1.1.4. Others

-

1.2. Polymer Coatings

- 1.2.1. Polyester

- 1.2.2. Fluoropolymer

- 1.2.3. Epoxy

- 1.2.4. Polyurethane

-

1.1. Metal/Ceramic Coatings

-

2. End-user Industry

- 2.1. Oil and Gas

- 2.2. Marine

- 2.3. Power Generation

- 2.4. Transportation

- 2.5. Mining

- 2.6. Construction

- 2.7. Others

Abrasion Resistant Coating Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Abrasion Resistant Coating Market Regional Market Share

Geographic Coverage of Abrasion Resistant Coating Market

Abrasion Resistant Coating Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increased Demand from Power Generation Industry; Enforcement of VOC Emission Regulations

- 3.3. Market Restrains

- 3.3.1. ; Capital-Intensive Operations for Ceramic Coatings; Unfavorable Conditions Arising Due to COVID-19 Outbreak

- 3.4. Market Trends

- 3.4.1. Increased Demand from Power Generation Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Abrasion Resistant Coating Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Metal/Ceramic Coatings

- 5.1.1.1. Carbide Coatings

- 5.1.1.2. Oxide Coatings

- 5.1.1.3. Nitride Coatings

- 5.1.1.4. Others

- 5.1.2. Polymer Coatings

- 5.1.2.1. Polyester

- 5.1.2.2. Fluoropolymer

- 5.1.2.3. Epoxy

- 5.1.2.4. Polyurethane

- 5.1.1. Metal/Ceramic Coatings

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil and Gas

- 5.2.2. Marine

- 5.2.3. Power Generation

- 5.2.4. Transportation

- 5.2.5. Mining

- 5.2.6. Construction

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Abrasion Resistant Coating Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Metal/Ceramic Coatings

- 6.1.1.1. Carbide Coatings

- 6.1.1.2. Oxide Coatings

- 6.1.1.3. Nitride Coatings

- 6.1.1.4. Others

- 6.1.2. Polymer Coatings

- 6.1.2.1. Polyester

- 6.1.2.2. Fluoropolymer

- 6.1.2.3. Epoxy

- 6.1.2.4. Polyurethane

- 6.1.1. Metal/Ceramic Coatings

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Oil and Gas

- 6.2.2. Marine

- 6.2.3. Power Generation

- 6.2.4. Transportation

- 6.2.5. Mining

- 6.2.6. Construction

- 6.2.7. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Abrasion Resistant Coating Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Metal/Ceramic Coatings

- 7.1.1.1. Carbide Coatings

- 7.1.1.2. Oxide Coatings

- 7.1.1.3. Nitride Coatings

- 7.1.1.4. Others

- 7.1.2. Polymer Coatings

- 7.1.2.1. Polyester

- 7.1.2.2. Fluoropolymer

- 7.1.2.3. Epoxy

- 7.1.2.4. Polyurethane

- 7.1.1. Metal/Ceramic Coatings

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Oil and Gas

- 7.2.2. Marine

- 7.2.3. Power Generation

- 7.2.4. Transportation

- 7.2.5. Mining

- 7.2.6. Construction

- 7.2.7. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Abrasion Resistant Coating Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Metal/Ceramic Coatings

- 8.1.1.1. Carbide Coatings

- 8.1.1.2. Oxide Coatings

- 8.1.1.3. Nitride Coatings

- 8.1.1.4. Others

- 8.1.2. Polymer Coatings

- 8.1.2.1. Polyester

- 8.1.2.2. Fluoropolymer

- 8.1.2.3. Epoxy

- 8.1.2.4. Polyurethane

- 8.1.1. Metal/Ceramic Coatings

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Oil and Gas

- 8.2.2. Marine

- 8.2.3. Power Generation

- 8.2.4. Transportation

- 8.2.5. Mining

- 8.2.6. Construction

- 8.2.7. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Abrasion Resistant Coating Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Metal/Ceramic Coatings

- 9.1.1.1. Carbide Coatings

- 9.1.1.2. Oxide Coatings

- 9.1.1.3. Nitride Coatings

- 9.1.1.4. Others

- 9.1.2. Polymer Coatings

- 9.1.2.1. Polyester

- 9.1.2.2. Fluoropolymer

- 9.1.2.3. Epoxy

- 9.1.2.4. Polyurethane

- 9.1.1. Metal/Ceramic Coatings

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Oil and Gas

- 9.2.2. Marine

- 9.2.3. Power Generation

- 9.2.4. Transportation

- 9.2.5. Mining

- 9.2.6. Construction

- 9.2.7. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Abrasion Resistant Coating Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Metal/Ceramic Coatings

- 10.1.1.1. Carbide Coatings

- 10.1.1.2. Oxide Coatings

- 10.1.1.3. Nitride Coatings

- 10.1.1.4. Others

- 10.1.2. Polymer Coatings

- 10.1.2.1. Polyester

- 10.1.2.2. Fluoropolymer

- 10.1.2.3. Epoxy

- 10.1.2.4. Polyurethane

- 10.1.1. Metal/Ceramic Coatings

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Oil and Gas

- 10.2.2. Marine

- 10.2.3. Power Generation

- 10.2.4. Transportation

- 10.2.5. Mining

- 10.2.6. Construction

- 10.2.7. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 The Sherwin-Williams Company*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Jotun

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Praxair S T Technology Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Saint-Gobain Performance Plastics (Saint-Gobain)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hardide Coatings

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Arkema Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hempel A/S

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Akzo Nobel N V

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bodycote

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 PPG Industries

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 The Sherwin-Williams Company*List Not Exhaustive

List of Figures

- Figure 1: Global Abrasion Resistant Coating Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Abrasion Resistant Coating Market Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Abrasion Resistant Coating Market Revenue (Million), by Type 2025 & 2033

- Figure 4: Asia Pacific Abrasion Resistant Coating Market Volume (K Tons), by Type 2025 & 2033

- Figure 5: Asia Pacific Abrasion Resistant Coating Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: Asia Pacific Abrasion Resistant Coating Market Volume Share (%), by Type 2025 & 2033

- Figure 7: Asia Pacific Abrasion Resistant Coating Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 8: Asia Pacific Abrasion Resistant Coating Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 9: Asia Pacific Abrasion Resistant Coating Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: Asia Pacific Abrasion Resistant Coating Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 11: Asia Pacific Abrasion Resistant Coating Market Revenue (Million), by Country 2025 & 2033

- Figure 12: Asia Pacific Abrasion Resistant Coating Market Volume (K Tons), by Country 2025 & 2033

- Figure 13: Asia Pacific Abrasion Resistant Coating Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Abrasion Resistant Coating Market Volume Share (%), by Country 2025 & 2033

- Figure 15: North America Abrasion Resistant Coating Market Revenue (Million), by Type 2025 & 2033

- Figure 16: North America Abrasion Resistant Coating Market Volume (K Tons), by Type 2025 & 2033

- Figure 17: North America Abrasion Resistant Coating Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: North America Abrasion Resistant Coating Market Volume Share (%), by Type 2025 & 2033

- Figure 19: North America Abrasion Resistant Coating Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 20: North America Abrasion Resistant Coating Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 21: North America Abrasion Resistant Coating Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: North America Abrasion Resistant Coating Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 23: North America Abrasion Resistant Coating Market Revenue (Million), by Country 2025 & 2033

- Figure 24: North America Abrasion Resistant Coating Market Volume (K Tons), by Country 2025 & 2033

- Figure 25: North America Abrasion Resistant Coating Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: North America Abrasion Resistant Coating Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Abrasion Resistant Coating Market Revenue (Million), by Type 2025 & 2033

- Figure 28: Europe Abrasion Resistant Coating Market Volume (K Tons), by Type 2025 & 2033

- Figure 29: Europe Abrasion Resistant Coating Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Europe Abrasion Resistant Coating Market Volume Share (%), by Type 2025 & 2033

- Figure 31: Europe Abrasion Resistant Coating Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 32: Europe Abrasion Resistant Coating Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 33: Europe Abrasion Resistant Coating Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 34: Europe Abrasion Resistant Coating Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 35: Europe Abrasion Resistant Coating Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe Abrasion Resistant Coating Market Volume (K Tons), by Country 2025 & 2033

- Figure 37: Europe Abrasion Resistant Coating Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Abrasion Resistant Coating Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Abrasion Resistant Coating Market Revenue (Million), by Type 2025 & 2033

- Figure 40: South America Abrasion Resistant Coating Market Volume (K Tons), by Type 2025 & 2033

- Figure 41: South America Abrasion Resistant Coating Market Revenue Share (%), by Type 2025 & 2033

- Figure 42: South America Abrasion Resistant Coating Market Volume Share (%), by Type 2025 & 2033

- Figure 43: South America Abrasion Resistant Coating Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 44: South America Abrasion Resistant Coating Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 45: South America Abrasion Resistant Coating Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: South America Abrasion Resistant Coating Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: South America Abrasion Resistant Coating Market Revenue (Million), by Country 2025 & 2033

- Figure 48: South America Abrasion Resistant Coating Market Volume (K Tons), by Country 2025 & 2033

- Figure 49: South America Abrasion Resistant Coating Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Abrasion Resistant Coating Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Abrasion Resistant Coating Market Revenue (Million), by Type 2025 & 2033

- Figure 52: Middle East and Africa Abrasion Resistant Coating Market Volume (K Tons), by Type 2025 & 2033

- Figure 53: Middle East and Africa Abrasion Resistant Coating Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Middle East and Africa Abrasion Resistant Coating Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Middle East and Africa Abrasion Resistant Coating Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 56: Middle East and Africa Abrasion Resistant Coating Market Volume (K Tons), by End-user Industry 2025 & 2033

- Figure 57: Middle East and Africa Abrasion Resistant Coating Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 58: Middle East and Africa Abrasion Resistant Coating Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 59: Middle East and Africa Abrasion Resistant Coating Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East and Africa Abrasion Resistant Coating Market Volume (K Tons), by Country 2025 & 2033

- Figure 61: Middle East and Africa Abrasion Resistant Coating Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Abrasion Resistant Coating Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Abrasion Resistant Coating Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Abrasion Resistant Coating Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: Global Abrasion Resistant Coating Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Abrasion Resistant Coating Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 5: Global Abrasion Resistant Coating Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Abrasion Resistant Coating Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Global Abrasion Resistant Coating Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Abrasion Resistant Coating Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 9: Global Abrasion Resistant Coating Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Abrasion Resistant Coating Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Abrasion Resistant Coating Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Abrasion Resistant Coating Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: China Abrasion Resistant Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: China Abrasion Resistant Coating Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: India Abrasion Resistant Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: India Abrasion Resistant Coating Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Japan Abrasion Resistant Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Japan Abrasion Resistant Coating Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: South Korea Abrasion Resistant Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: South Korea Abrasion Resistant Coating Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Rest of Asia Pacific Abrasion Resistant Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Abrasion Resistant Coating Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Global Abrasion Resistant Coating Market Revenue Million Forecast, by Type 2020 & 2033

- Table 24: Global Abrasion Resistant Coating Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 25: Global Abrasion Resistant Coating Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 26: Global Abrasion Resistant Coating Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 27: Global Abrasion Resistant Coating Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Abrasion Resistant Coating Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 29: United States Abrasion Resistant Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United States Abrasion Resistant Coating Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Canada Abrasion Resistant Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Canada Abrasion Resistant Coating Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 33: Mexico Abrasion Resistant Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Mexico Abrasion Resistant Coating Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 35: Global Abrasion Resistant Coating Market Revenue Million Forecast, by Type 2020 & 2033

- Table 36: Global Abrasion Resistant Coating Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 37: Global Abrasion Resistant Coating Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 38: Global Abrasion Resistant Coating Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 39: Global Abrasion Resistant Coating Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Abrasion Resistant Coating Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 41: Germany Abrasion Resistant Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Germany Abrasion Resistant Coating Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 43: United Kingdom Abrasion Resistant Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: United Kingdom Abrasion Resistant Coating Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 45: France Abrasion Resistant Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: France Abrasion Resistant Coating Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 47: Italy Abrasion Resistant Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Italy Abrasion Resistant Coating Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 49: Rest of Europe Abrasion Resistant Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Rest of Europe Abrasion Resistant Coating Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 51: Global Abrasion Resistant Coating Market Revenue Million Forecast, by Type 2020 & 2033

- Table 52: Global Abrasion Resistant Coating Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 53: Global Abrasion Resistant Coating Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 54: Global Abrasion Resistant Coating Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 55: Global Abrasion Resistant Coating Market Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Global Abrasion Resistant Coating Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 57: Brazil Abrasion Resistant Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Brazil Abrasion Resistant Coating Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 59: Argentina Abrasion Resistant Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Argentina Abrasion Resistant Coating Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 61: Rest of South America Abrasion Resistant Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of South America Abrasion Resistant Coating Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 63: Global Abrasion Resistant Coating Market Revenue Million Forecast, by Type 2020 & 2033

- Table 64: Global Abrasion Resistant Coating Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 65: Global Abrasion Resistant Coating Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 66: Global Abrasion Resistant Coating Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 67: Global Abrasion Resistant Coating Market Revenue Million Forecast, by Country 2020 & 2033

- Table 68: Global Abrasion Resistant Coating Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 69: Saudi Arabia Abrasion Resistant Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: Saudi Arabia Abrasion Resistant Coating Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 71: South Africa Abrasion Resistant Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: South Africa Abrasion Resistant Coating Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 73: Rest of Middle East and Africa Abrasion Resistant Coating Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Rest of Middle East and Africa Abrasion Resistant Coating Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Abrasion Resistant Coating Market?

The projected CAGR is approximately 5.00%.

2. Which companies are prominent players in the Abrasion Resistant Coating Market?

Key companies in the market include The Sherwin-Williams Company*List Not Exhaustive, Jotun, Praxair S T Technology Inc, Saint-Gobain Performance Plastics (Saint-Gobain), Hardide Coatings, Arkema Group, Hempel A/S, Akzo Nobel N V, Bodycote, PPG Industries.

3. What are the main segments of the Abrasion Resistant Coating Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 11570 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increased Demand from Power Generation Industry; Enforcement of VOC Emission Regulations.

6. What are the notable trends driving market growth?

Increased Demand from Power Generation Industry.

7. Are there any restraints impacting market growth?

; Capital-Intensive Operations for Ceramic Coatings; Unfavorable Conditions Arising Due to COVID-19 Outbreak.

8. Can you provide examples of recent developments in the market?

Acquisitions and mergers to enhance product offerings and market presence

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Abrasion Resistant Coating Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Abrasion Resistant Coating Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Abrasion Resistant Coating Market?

To stay informed about further developments, trends, and reports in the Abrasion Resistant Coating Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence