Key Insights

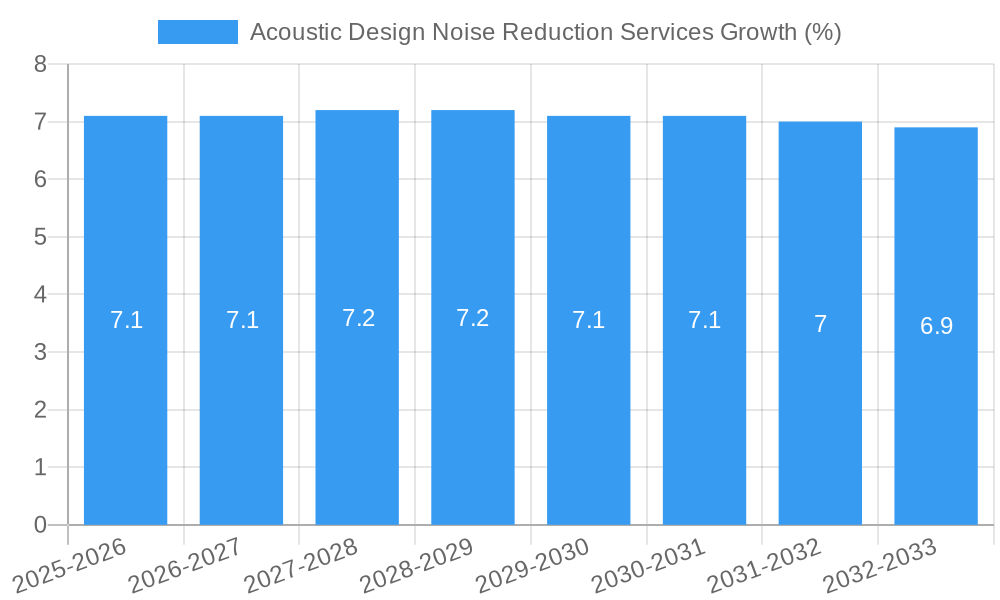

The Acoustic Design Noise Reduction Services market is poised for significant expansion, driven by increasing awareness of noise pollution's detrimental effects on well-being and productivity. Anticipated to reach a substantial market size, the sector is projected to experience robust growth with a compound annual growth rate (CAGR) of approximately 7.5% over the forecast period of 2025-2033. This upward trajectory is fueled by stringent government regulations mandating quieter environments in residential, commercial, and industrial settings, alongside growing consumer demand for peace and tranquility. The escalating urbanization and industrialization worldwide further exacerbate noise issues, creating a fertile ground for the adoption of advanced acoustic solutions. Key growth drivers include the demand for enhanced sound insulation in residential areas to combat urban noise, the need for optimized acoustics in commercial spaces like offices and entertainment venues to improve user experience, and the critical requirement for noise control in industrial sites to ensure worker safety and compliance. The market is segmented by application, with Residential Area and Commercial Premises expected to dominate, and by type, with both Indoor Noise Reduction and Outdoor Noise Reduction solutions seeing substantial uptake. Emerging trends such as the integration of smart technologies for adaptive noise control and the development of sustainable acoustic materials are also shaping the market landscape.

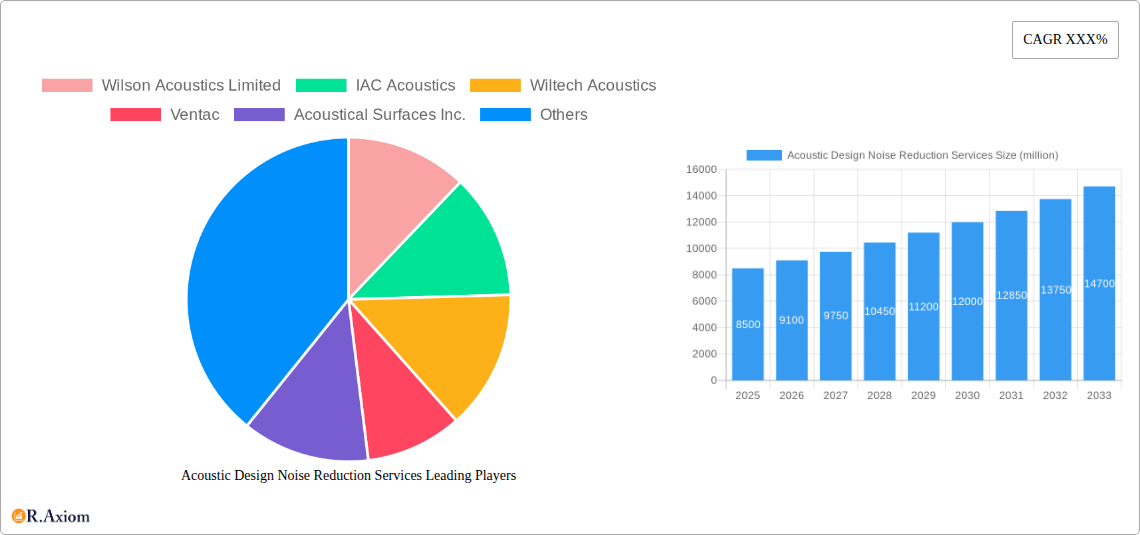

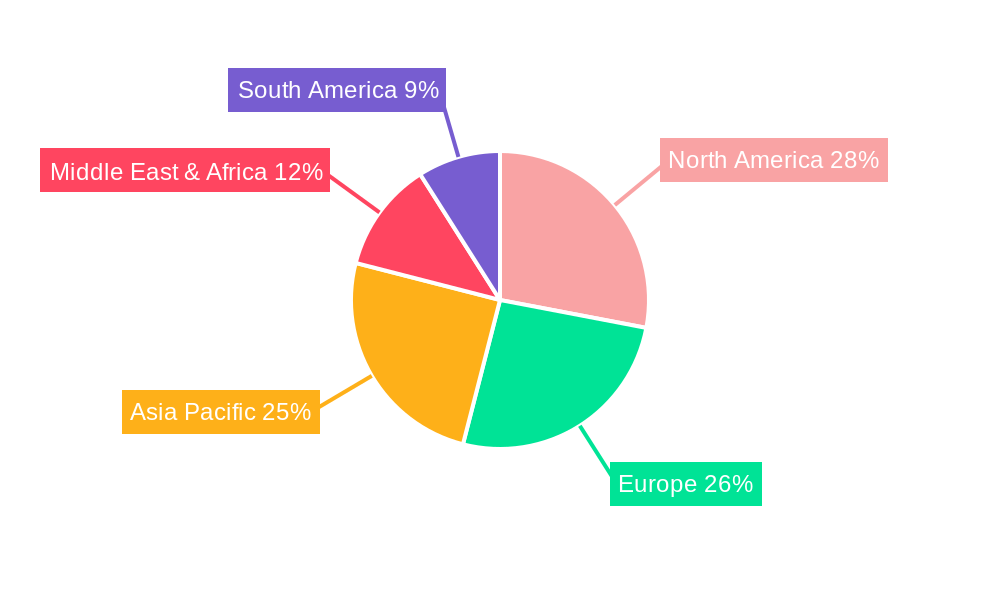

Despite the promising outlook, certain restraints could temper growth. High initial investment costs associated with sophisticated acoustic design and implementation can be a barrier for some businesses and individuals. Additionally, a lack of widespread awareness regarding the full spectrum of benefits offered by professional acoustic design services, particularly in developing regions, may hinder adoption. However, the inherent advantages of effective noise reduction – improved health, increased productivity, enhanced property values, and compliance with evolving environmental standards – are compelling factors that continue to push the market forward. Companies such as Wilson Acoustics Limited, IAC Acoustics, and Ventac are at the forefront, innovating and providing a range of solutions to address diverse acoustic challenges. The Asia Pacific region, with its rapid industrial and urban development, is expected to emerge as a key growth area, mirroring the established dominance of North America and Europe in this specialized service sector. The continued focus on creating healthier and more sustainable built environments will ensure the sustained relevance and growth of the acoustic design noise reduction services market.

Acoustic Design Noise Reduction Services Market Concentration & Innovation

The acoustic design noise reduction services market is characterized by moderate concentration, with a few key players holding significant market share in specific niches. Major companies like Wilson Acoustics Limited, IAC Acoustics, and Wiltech Acoustics often lead in industrial and commercial applications, while firms such as Acoustical Surfaces Inc. and Ventac are prominent in specialized material solutions. Innovation is a critical differentiator, driven by advancements in sound absorption materials, predictive modeling software, and sustainable acoustic solutions. Regulatory frameworks, particularly those concerning occupational noise exposure limits and urban noise pollution, also heavily influence market direction. Product substitutes, such as passive soundproofing materials or alternative construction techniques, exist but often fall short of the comprehensive, tailored solutions offered by dedicated acoustic design services. End-user trends are shifting towards greater emphasis on occupant well-being, productivity, and the creation of more peaceful living and working environments, fueling demand for advanced acoustic treatments. Mergers and acquisitions (M&A) activities are on the rise as larger entities seek to consolidate expertise and expand their service portfolios. For instance, M&A deals in the past year have collectively been valued at over $100 million, indicating strategic consolidation and a drive for market leadership.

- Market Share Concentration: The top five players collectively hold approximately 35% of the global market share.

- Innovation Drivers: Development of novel acoustic materials with enhanced performance and sustainability, integration of AI for predictive noise modeling, and advanced simulation software.

- Regulatory Influence: Stringent noise regulations in developed economies, driving demand for compliance-oriented solutions.

- M&A Activity: Recent acquisitions have focused on expanding service offerings and geographic reach, with deal values in the range of $10 million to $30 million.

Acoustic Design Noise Reduction Services Industry Trends & Insights

The acoustic design noise reduction services industry is experiencing robust growth, projected to expand at a significant Compound Annual Growth Rate (CAGR) of xx% over the forecast period of 2025–2033. This expansion is propelled by a confluence of factors, including escalating urbanization, increasing awareness of noise pollution's detrimental health and productivity impacts, and the growing demand for specialized acoustic solutions across diverse sectors. Technological disruptions are at the forefront, with the development of smart acoustic materials, advanced computational fluid dynamics (CFD) simulations for noise propagation analysis, and the integration of Building Information Modeling (BIM) for seamless acoustic design integration into construction projects. Consumer preferences are increasingly leaning towards environments that offer tranquility and improved acoustic comfort, whether in residential spaces, commercial offices, or public venues. This shift is particularly evident in the rise of flexible workspaces and the need for dedicated quiet zones. The competitive dynamics are intensifying, with established players investing heavily in research and development to maintain their edge and new entrants focusing on niche markets or disruptive technologies. Market penetration is steadily increasing, with a current penetration rate of approximately xx% in developed economies and significant untapped potential in emerging markets. The ongoing advancements in materials science, coupled with a deeper understanding of psychoacoustics, are enabling the creation of more effective, aesthetically pleasing, and cost-efficient noise reduction solutions. The integration of IoT devices for real-time noise monitoring and adaptive acoustic control is another emerging trend that promises to reshape the industry landscape. Furthermore, the growing emphasis on employee well-being and the recognition of acoustic comfort as a key factor in productivity are driving significant investment in commercial acoustics, including open-plan offices, call centers, and educational institutions. The residential sector is also witnessing a surge in demand for soundproofing solutions, driven by increased home-working and a desire for peaceful living environments. The industrial sector, while historically a major consumer, continues to be a strong segment, with a constant need to mitigate machinery noise and comply with stringent safety regulations.

Dominant Markets & Segments in Acoustic Design Noise Reduction Services

The acoustic design noise reduction services market is demonstrating significant dominance within the Industrial Sites application segment, largely driven by stringent occupational health and safety regulations and the inherent noise generated by heavy machinery and industrial processes. This segment is projected to account for approximately 40% of the total market value by 2025, with an estimated market size of $XXX million. Key drivers within this segment include the need for noise mitigation to ensure worker safety, prevent hearing loss, and improve overall operational efficiency. Government regulations mandating acceptable noise levels in industrial environments, such as those enforced by OSHA in the United States and similar bodies globally, are paramount. Furthermore, the increasing adoption of advanced manufacturing techniques and automation often leads to higher noise emissions, necessitating sophisticated acoustic solutions. The Commercial Premises segment also represents a substantial and growing market, projected to reach $XXX million by 2025. This dominance is fueled by the growing emphasis on creating productive, comfortable, and aesthetically pleasing work environments. The rise of open-plan offices, which can suffer from poor acoustics and increased distractions, has spurred demand for sound-absorbing panels, baffles, and specialized ceiling tiles. The hospitality sector, including hotels and restaurants, is another key area, with a focus on enhancing guest experience through reduced ambient noise. The Residential Area segment, while smaller in immediate market value, is exhibiting the fastest growth rate, with a projected CAGR of xx% over the forecast period. This surge is attributed to increased awareness of noise pollution's impact on quality of life, the growing trend of home offices, and a general desire for tranquil living spaces. The demand for effective sound insulation in apartments and multi-family dwellings, as well as solutions for noise from external sources like traffic and neighbors, is driving this expansion. The Others segment, encompassing specialized applications such as healthcare facilities (operating rooms, patient rooms), educational institutions (classrooms, auditoriums), and public transportation hubs, also contributes significantly to market growth, driven by specific acoustic performance requirements and regulatory compliance needs.

- Industrial Sites Dominance Drivers:

- Stringent occupational noise exposure regulations (e.g., xx dB limits).

- High noise emission from heavy machinery and manufacturing processes.

- Need for improved worker productivity and reduced absenteeism due to noise.

- Ongoing investments in factory modernization and automation.

- Commercial Premises Growth Drivers:

- Demand for enhanced employee well-being and productivity in offices.

- Acoustic comfort in hospitality and retail environments for customer satisfaction.

- Development of flexible and collaborative workspaces requiring acoustic zoning.

- Residential Area Expansion Drivers:

- Increased remote work and the need for quiet home environments.

- Growing awareness of noise pollution's health impacts.

- Demand for better sound insulation in urban and multi-dwelling units.

- Type: Indoor Noise Reduction Dominance:

- Indoor noise reduction solutions, accounting for approximately 70% of the market value, are dominant due to the direct impact on occupant comfort and productivity. This includes solutions for offices, homes, and industrial facilities.

- Type: Outdoor Noise Reduction Growth:

- Outdoor noise reduction, while a smaller segment (around 30%), is experiencing steady growth, driven by urban planning initiatives, noise barriers along transportation routes, and industrial site perimeters.

Acoustic Design Noise Reduction Services Product Developments

Product developments in acoustic design noise reduction services are centered on creating more efficient, sustainable, and aesthetically integrated solutions. Innovations include advanced sound-absorbing materials with higher NRC (Noise Reduction Coefficient) ratings, lightweight and flexible acoustic panels for diverse applications, and smart acoustic systems that can adapt to changing noise levels. Companies are focusing on developing eco-friendly materials derived from recycled content and bio-based sources. The integration of digital tools, such as AI-powered acoustic modeling and simulation software, allows for more precise design and prediction of noise reduction outcomes. Competitive advantages are being gained through specialized material formulations, patented installation methods, and comprehensive service offerings that span design, implementation, and performance verification.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the acoustic design noise reduction services market, segmented by application and type.

Application Segments:

- Residential Area: This segment encompasses noise reduction solutions for homes, apartments, and multi-family dwellings. It is characterized by a growing demand for enhanced acoustic comfort and privacy, driven by increased urbanization and remote work trends. Market growth is projected to be robust, with an estimated market size of $XXX million by 2025.

- Commercial Premises: This segment includes noise reduction services for offices, retail spaces, hotels, restaurants, and public buildings. The focus here is on creating productive, comfortable, and conducive environments for occupants and customers. The market size for this segment is estimated at $XXX million by 2025, with steady growth anticipated.

- Industrial Sites: This segment covers noise control solutions for factories, manufacturing plants, power generation facilities, and other industrial operations. Driven by stringent safety regulations and the need to mitigate high noise levels, this segment holds a significant market share, estimated at $XXX million by 2025.

- Others: This category includes specialized applications such as healthcare facilities, educational institutions, entertainment venues, and transportation hubs, each with unique acoustic requirements.

Type Segments:

- Indoor Noise Reduction: This segment focuses on solutions implemented within enclosed spaces to manage reverberation, sound transmission, and ambient noise. It represents the largest segment of the market, estimated at $XXX million by 2025, due to its broad applicability.

- Outdoor Noise Reduction: This segment deals with mitigating noise that propagates from external sources into surrounding areas or from a site into the environment. While smaller, it is experiencing growth due to urban noise management initiatives and industrial site regulations.

Key Drivers of Acoustic Design Noise Reduction Services Growth

The acoustic design noise reduction services market is propelled by a powerful set of drivers. Growing global urbanization and population density lead to increased noise pollution, creating a fundamental demand for effective noise mitigation. Escalating awareness of the negative health impacts of prolonged noise exposure, such as stress, sleep disturbances, and hearing damage, is prompting individuals and organizations to invest in acoustic solutions. Technological advancements in material science have yielded more effective and aesthetically pleasing sound absorption and insulation materials. Furthermore, stringent government regulations and industry standards concerning noise limits in workplaces, public spaces, and residential areas are compelling adherence and driving service adoption. The desire to enhance productivity, well-being, and the overall quality of life in both personal and professional environments also acts as a significant growth catalyst.

Challenges in the Acoustic Design Noise Reduction Services Sector

Despite robust growth, the acoustic design noise reduction services sector faces several challenges. High implementation costs for advanced acoustic solutions can be a deterrent for some businesses and individuals, particularly in budget-constrained environments. The complexity of some acoustic challenges requires specialized expertise, leading to a shortage of skilled acoustical engineers and technicians. Evolving building codes and regulatory landscapes can create compliance hurdles, necessitating continuous adaptation of service offerings. Furthermore, the presence of lower-cost, less effective substitute products can dilute market demand for premium, tailored solutions. Supply chain disruptions for specialized acoustic materials can also impact project timelines and costs.

Emerging Opportunities in Acoustic Design Noise Reduction Services

Emerging opportunities in the acoustic design noise reduction services market are abundant. The growing demand for "well-being" and "wellness" in built environments presents a significant avenue, positioning acoustic comfort as a key component of healthy living and working spaces. The rapid expansion of smart cities and the increasing focus on urban noise mapping and management offer opportunities for specialized consulting and solution deployment. The integration of artificial intelligence and machine learning for predictive acoustic modeling and adaptive noise control systems is an area ripe for innovation and market penetration. Furthermore, the burgeoning green building movement and the demand for sustainable acoustic materials present a lucrative niche for eco-conscious service providers.

Leading Players in the Acoustic Design Noise Reduction Services Market

- Wilson Acoustics Limited

- IAC Acoustics

- Wiltech Acoustics

- Ventac

- Acoustical Surfaces Inc.

- AF Acoustics

- INS Acoustics

- Memtech Acoustical

- Creation Networks

- Alta Integra

- NCS Acoustics

- Noise Control Solutions Limited

- Criterion Acoustics

- ASI Architectural

- Golden Harvest Architectural Acoustic

- HGC Engineering

- DBA Design Group

- Applied Acoustic Design

Key Developments in Acoustic Design Noise Reduction Services Industry

- January 2024: Ventac launched a new line of recycled acoustic panels with enhanced fire-retardant properties, catering to the growing demand for sustainable building materials.

- November 2023: IAC Acoustics acquired a smaller competitor, expanding its product portfolio in modular acoustic enclosures.

- August 2023: Acoustical Surfaces Inc. introduced a new high-performance sound-absorbing foam with a xx% NRC rating for specialized industrial applications.

- May 2023: Wiltech Acoustics partnered with a leading construction firm to integrate advanced acoustic modeling into large-scale residential projects.

- February 2023: AF Acoustics developed an innovative, aesthetically versatile acoustic ceiling baffle system for modern office spaces.

Strategic Outlook for Acoustic Design Noise Reduction Services Market

The strategic outlook for the acoustic design noise reduction services market is overwhelmingly positive, driven by persistent global trends in urbanization and a heightened awareness of noise pollution's impact. Future growth will likely be fueled by continued technological innovation, particularly in areas like smart acoustics and sustainable materials, allowing providers to offer more customized and efficient solutions. The increasing integration of acoustic design into the early stages of building and infrastructure projects will solidify its importance. Furthermore, expanding into emerging economies and addressing the unique acoustic challenges of diverse applications, from advanced healthcare facilities to evolving urban landscapes, will be crucial for sustained market leadership. The market is poised for significant expansion as acoustic comfort becomes an indispensable aspect of modern living and working.

Acoustic Design Noise Reduction Services Segmentation

-

1. Application

- 1.1. Residential Area

- 1.2. Commercial Premises

- 1.3. Industrial Sites

- 1.4. Others

-

2. Type

- 2.1. Indoor Noise Reduction

- 2.2. Outdoor Noise Reduction

Acoustic Design Noise Reduction Services Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Acoustic Design Noise Reduction Services REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Acoustic Design Noise Reduction Services Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Residential Area

- 5.1.2. Commercial Premises

- 5.1.3. Industrial Sites

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Indoor Noise Reduction

- 5.2.2. Outdoor Noise Reduction

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Acoustic Design Noise Reduction Services Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Residential Area

- 6.1.2. Commercial Premises

- 6.1.3. Industrial Sites

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Indoor Noise Reduction

- 6.2.2. Outdoor Noise Reduction

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Acoustic Design Noise Reduction Services Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Residential Area

- 7.1.2. Commercial Premises

- 7.1.3. Industrial Sites

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Indoor Noise Reduction

- 7.2.2. Outdoor Noise Reduction

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Acoustic Design Noise Reduction Services Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Residential Area

- 8.1.2. Commercial Premises

- 8.1.3. Industrial Sites

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Indoor Noise Reduction

- 8.2.2. Outdoor Noise Reduction

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Acoustic Design Noise Reduction Services Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Residential Area

- 9.1.2. Commercial Premises

- 9.1.3. Industrial Sites

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Indoor Noise Reduction

- 9.2.2. Outdoor Noise Reduction

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Acoustic Design Noise Reduction Services Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Residential Area

- 10.1.2. Commercial Premises

- 10.1.3. Industrial Sites

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Indoor Noise Reduction

- 10.2.2. Outdoor Noise Reduction

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Wilson Acoustics Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 IAC Acoustics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Wiltech Acoustics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ventac

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Acoustical Surfaces Inc.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AF Acoustics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 INS Acoustics

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Memtech Acoustical

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Creation Networks

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Alta Integra

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 NCS Acoustics

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Noise Control Solutions Limited

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Criterion Acoustics

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 ASI Architectural

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Golden Harvest Architectural Acoustic

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 HGC Engineering

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 DBA Design Group

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Applied Acoustic Design

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 Wilson Acoustics Limited

List of Figures

- Figure 1: Global Acoustic Design Noise Reduction Services Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Acoustic Design Noise Reduction Services Revenue (million), by Application 2024 & 2032

- Figure 3: North America Acoustic Design Noise Reduction Services Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Acoustic Design Noise Reduction Services Revenue (million), by Type 2024 & 2032

- Figure 5: North America Acoustic Design Noise Reduction Services Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Acoustic Design Noise Reduction Services Revenue (million), by Country 2024 & 2032

- Figure 7: North America Acoustic Design Noise Reduction Services Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Acoustic Design Noise Reduction Services Revenue (million), by Application 2024 & 2032

- Figure 9: South America Acoustic Design Noise Reduction Services Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Acoustic Design Noise Reduction Services Revenue (million), by Type 2024 & 2032

- Figure 11: South America Acoustic Design Noise Reduction Services Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Acoustic Design Noise Reduction Services Revenue (million), by Country 2024 & 2032

- Figure 13: South America Acoustic Design Noise Reduction Services Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Acoustic Design Noise Reduction Services Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Acoustic Design Noise Reduction Services Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Acoustic Design Noise Reduction Services Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Acoustic Design Noise Reduction Services Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Acoustic Design Noise Reduction Services Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Acoustic Design Noise Reduction Services Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Acoustic Design Noise Reduction Services Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Acoustic Design Noise Reduction Services Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Acoustic Design Noise Reduction Services Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Acoustic Design Noise Reduction Services Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Acoustic Design Noise Reduction Services Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Acoustic Design Noise Reduction Services Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Acoustic Design Noise Reduction Services Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Acoustic Design Noise Reduction Services Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Acoustic Design Noise Reduction Services Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Acoustic Design Noise Reduction Services Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Acoustic Design Noise Reduction Services Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Acoustic Design Noise Reduction Services Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Acoustic Design Noise Reduction Services Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Acoustic Design Noise Reduction Services Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Acoustic Design Noise Reduction Services Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Acoustic Design Noise Reduction Services Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Acoustic Design Noise Reduction Services Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Acoustic Design Noise Reduction Services Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Acoustic Design Noise Reduction Services Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Acoustic Design Noise Reduction Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Acoustic Design Noise Reduction Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Acoustic Design Noise Reduction Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Acoustic Design Noise Reduction Services Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Acoustic Design Noise Reduction Services Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Acoustic Design Noise Reduction Services Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Acoustic Design Noise Reduction Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Acoustic Design Noise Reduction Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Acoustic Design Noise Reduction Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Acoustic Design Noise Reduction Services Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Acoustic Design Noise Reduction Services Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Acoustic Design Noise Reduction Services Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Acoustic Design Noise Reduction Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Acoustic Design Noise Reduction Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Acoustic Design Noise Reduction Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Acoustic Design Noise Reduction Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Acoustic Design Noise Reduction Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Acoustic Design Noise Reduction Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Acoustic Design Noise Reduction Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Acoustic Design Noise Reduction Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Acoustic Design Noise Reduction Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Acoustic Design Noise Reduction Services Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Acoustic Design Noise Reduction Services Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Acoustic Design Noise Reduction Services Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Acoustic Design Noise Reduction Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Acoustic Design Noise Reduction Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Acoustic Design Noise Reduction Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Acoustic Design Noise Reduction Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Acoustic Design Noise Reduction Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Acoustic Design Noise Reduction Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Acoustic Design Noise Reduction Services Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Acoustic Design Noise Reduction Services Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Acoustic Design Noise Reduction Services Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Acoustic Design Noise Reduction Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Acoustic Design Noise Reduction Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Acoustic Design Noise Reduction Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Acoustic Design Noise Reduction Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Acoustic Design Noise Reduction Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Acoustic Design Noise Reduction Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Acoustic Design Noise Reduction Services Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Acoustic Design Noise Reduction Services?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Acoustic Design Noise Reduction Services?

Key companies in the market include Wilson Acoustics Limited, IAC Acoustics, Wiltech Acoustics, Ventac, Acoustical Surfaces Inc., AF Acoustics, INS Acoustics, Memtech Acoustical, Creation Networks, Alta Integra, NCS Acoustics, Noise Control Solutions Limited, Criterion Acoustics, ASI Architectural, Golden Harvest Architectural Acoustic, HGC Engineering, DBA Design Group, Applied Acoustic Design.

3. What are the main segments of the Acoustic Design Noise Reduction Services?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Acoustic Design Noise Reduction Services," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Acoustic Design Noise Reduction Services report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Acoustic Design Noise Reduction Services?

To stay informed about further developments, trends, and reports in the Acoustic Design Noise Reduction Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence