Key Insights

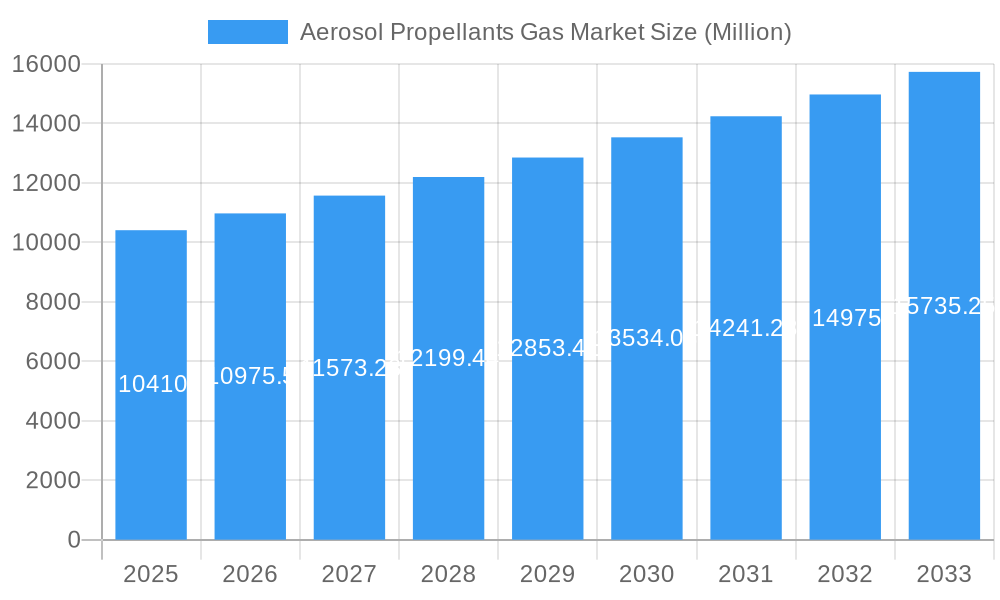

The Aerosol Propellants Gas market, valued at $10.41 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 5% from 2025 to 2033. This expansion is driven by several factors. The increasing demand for convenience in personal care and household products fuels the consumption of aerosol propellants. Furthermore, the automotive and medical sectors rely heavily on aerosol technology for various applications, boosting market demand. Growth in emerging economies, particularly in Asia-Pacific, further contributes to market expansion, as disposable incomes rise and consumer preferences shift towards convenience-based products. However, environmental concerns surrounding the impact of certain propellants, particularly HFCs and their contribution to global warming, represent a significant restraint. Consequently, the market is witnessing a shift towards more environmentally friendly alternatives like HFOs and DME, which are expected to gain considerable market share in the coming years. The segmentation by type (DME, HFCs, HFOs, and others) and application (personal care, household, medical, automotive, and others) provides a nuanced understanding of market dynamics and allows for targeted strategies by manufacturers. The competitive landscape is diverse, featuring both established players like Honeywell International Inc. and Shell PLC, alongside regional manufacturers. This competition stimulates innovation and drives down costs, benefitting consumers.

Aerosol Propellants Gas Market Market Size (In Billion)

The market's regional distribution reflects global economic trends. While North America and Europe maintain significant market shares, the Asia-Pacific region is expected to witness the fastest growth due to its rapidly expanding middle class and increasing industrialization. Technological advancements in propellant formulation and the development of sustainable alternatives will be crucial in shaping the market's trajectory in the coming decade. The market will likely see further consolidation through mergers and acquisitions, as companies strategically position themselves to benefit from the shift towards environmentally friendly solutions and increasing demand in emerging markets. Continuous regulatory scrutiny surrounding propellant composition and environmental impact will also significantly influence market strategies and growth patterns.

Aerosol Propellants Gas Market Company Market Share

This comprehensive report provides a detailed analysis of the Aerosol Propellants Gas market, offering invaluable insights for industry stakeholders, investors, and market researchers. The study covers the period from 2019 to 2033, with 2025 as the base year and a forecast period spanning 2025-2033. The report utilizes a robust methodology, incorporating both primary and secondary research to deliver accurate and reliable market estimations. The total market size in 2025 is estimated at xx Million, with a projected CAGR of xx% during the forecast period.

Aerosol Propellants Gas Market Concentration & Innovation

This section analyzes the competitive landscape of the Aerosol Propellants Gas market, focusing on market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities. The market is characterized by a moderately concentrated structure, with several major players holding significant market shares. For example, Honeywell International Inc and Shell PLC are prominent players, commanding a combined market share of approximately xx%. The market is highly innovative, driven by the increasing demand for eco-friendly propellants and stringent environmental regulations.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately concentrated market.

- Innovation Drivers: Stringent environmental regulations, consumer preference for sustainable products, and advancements in propellant technology are driving innovation.

- Regulatory Frameworks: Regulations concerning ozone depletion and greenhouse gas emissions significantly influence propellant choices and market dynamics.

- Product Substitutes: The market faces competition from alternative packaging technologies and dispensing methods.

- End-User Trends: Growing demand from personal care, household, and medical sectors is a key market driver.

- M&A Activities: The past five years have witnessed xx M&A deals in the Aerosol Propellants Gas market, with a total deal value of approximately xx Million. These activities reflect consolidation and expansion strategies among key players.

Aerosol Propellants Gas Market Industry Trends & Insights

The Aerosol Propellants Gas market is experiencing robust and dynamic growth, propelled by a confluence of favorable economic, technological, and societal factors. A significant contributor is the steady rise in disposable incomes across emerging economies, which directly translates to increased consumer spending on a wide array of aerosol-based products. Simultaneously, the inherent convenience, efficacy, and user-friendliness of aerosols continue to cement their popularity across diverse consumer segments.

Technological innovation is a key enabler of this market expansion. The development and widespread adoption of Hydrofluoroolefins (HFOs) represent a paradigm shift, offering significantly lower Global Warming Potential (GWP) compared to legacy propellants. This aligns perfectly with a growing global consciousness and consumer preference for environmentally sustainable products. As regulations around ozone-depleting substances and high GWP gases become more stringent, the demand for eco-friendly and sustainable propellant solutions is set to surge. The competitive landscape is characterized by intense innovation, with established players and emerging entrants alike investing heavily in research and development to enhance propellant performance, safety, and environmental profiles. This focus on next-generation propellants is crucial for maintaining market share and capturing new opportunities.

The market demonstrated a Compound Annual Growth Rate (CAGR) of approximately **XX%** during the historical period (2019-2024). Projections indicate a sustained and possibly accelerated growth trajectory, with an anticipated CAGR of **XX%** expected during the forecast period (2025-2033). The market penetration of HFOs, a key indicator of sustainability adoption, was estimated at around **XX%** in 2025 and is projected to climb significantly to **XX%** by 2033, underscoring the market's transition towards greener alternatives.

Dominant Markets & Segments in Aerosol Propellants Gas Market

The global Aerosol Propellants Gas market presents a varied picture of regional dominance and segment growth. Currently, North America and Europe command the largest market shares, attributed to their mature industrial bases, high consumer spending power, and well-established aerosol product manufacturing sectors. However, the dynamism of the market is shifting, with the Asia-Pacific region poised to emerge as the fastest-growing territory. This surge is driven by rapid industrialization, a burgeoning middle class with increasing disposable incomes, and a growing demand for consumer goods, including those packaged in aerosol form.

By Type:

- HFOs (Hydrofluoroolefins): This segment is witnessing exponential growth and is increasingly dominating the market. Their triumph is primarily due to their superior environmental credentials, characterized by ultra-low GWP and zero Ozone Depletion Potential (ODP), coupled with excellent performance characteristics. Stringent global environmental regulations, such as the Kigali Amendment to the Montreal Protocol, and a powerful consumer push for sustainable choices are the principal catalysts for HFO adoption.

- HFCs (Hydrofluorocarbons): This segment is experiencing a gradual but significant decline. The high Global Warming Potential (GWP) associated with most HFCs makes them increasingly untenable under evolving environmental mandates and consumer expectations for reduced climate impact.

- DME (Dimethyl Ether): DME continues to hold a strong position in the market, exhibiting steady growth. Its appeal lies in its favorable cost-effectiveness, non-flammable nature in many formulations, and a relatively lower environmental impact compared to HFCs. It serves as a vital propellant for a wide range of applications.

- Other Types: This category encompasses a variety of less common propellants and blends catering to specific niche applications. While their growth is generally slower, they play a crucial role in specialized product formulations.

By Application:

- Personal Care: This remains the largest and most influential application segment. The enduring popularity of aerosolized products like hairsprays, deodorants, antiperspirants, mousses, and shaving foams, particularly among younger demographics, fuels consistent and substantial demand for aerosol propellants.

- Household: This broad segment includes a wide array of products such as cleaning sprays, disinfectants, air fresheners, insecticides, and polishes. The convenience and efficacy of aerosol delivery systems make them indispensable in modern households.

- Medical: This segment is experiencing significant growth, primarily driven by the increasing global prevalence of respiratory diseases like asthma and COPD. Metered-dose inhalers (MDIs), a critical medical application, rely heavily on precise propellant formulations for effective drug delivery.

- Automotive: The automotive sector contributes to market growth through its use of aerosol propellants in products like spray paints, undercoatings, lubricants, and cleaning agents. The demand for quick and efficient application solutions in automotive maintenance and repair supports this segment.

- Other Applications: This encompasses a diverse range of uses including industrial paints and coatings, food and beverage (e.g., whipped cream, cooking sprays), fire extinguishers, and specialized industrial sprays. This segment is expected to witness consistent and moderate growth as new applications are developed and existing ones expand.

Aerosol Propellants Gas Market Product Developments

The landscape of product development within the Aerosol Propellants Gas market is keenly focused on innovation driven by sustainability and enhanced performance. A primary area of advancement is the continuous refinement of HFO-based propellants. Manufacturers are not only introducing new HFO blends but also optimizing existing ones to achieve superior product efficacy, lower flammability risks, and improved shelf-life stability for a broader spectrum of aerosolized goods. This includes developing propellants tailored for sensitive formulations in pharmaceuticals and cosmetics.

Research and development efforts are also concentrated on improving the overall efficiency of propellant systems, aiming to reduce the amount of propellant required per actuation while maintaining product output. This not only enhances cost-effectiveness for manufacturers but also contributes to reduced environmental footprints. Furthermore, advancements in formulation science are enabling the development of propellants that are compatible with new packaging materials and can withstand a wider range of operating temperatures. These strategic innovations are crucial for enabling aerosol product manufacturers to meet evolving consumer demands for safe, sustainable, and high-performing products, thereby strengthening their market positioning and competitive edge.

Report Scope & Segmentation Analysis

This report segments the Aerosol Propellants Gas market by Type (Dimethyl Ether (DME), Hyrdofluorocarbons (HFC), Hydrofluoro Olefins (HFO), Other Types (Nitrous Oxide, and Carbon Dioxide, etc.)) and Application (Personal Care, Household, Medical, Automotive, Other Applications (Paints and Coatings, Food and Beverage, etc.)). Each segment's growth projection, market size, and competitive dynamics are thoroughly analyzed. The HFO segment is expected to witness the highest growth, driven by its environmentally friendly properties. The personal care application segment holds the largest market share, while the medical segment shows promising growth potential.

Key Drivers of Aerosol Propellants Gas Market Growth

The sustained growth of the Aerosol Propellants Gas market is underpinned by a multifaceted set of influential factors:

- Increasing Consumer Demand for Aerosol-Based Products: The inherent convenience, ease of use, and effectiveness of aerosol delivery systems continue to drive widespread consumer adoption across personal care, household, and industrial applications.

- Technological Advancements in Propellant Formulations: The development and commercialization of next-generation propellants, particularly HFOs, offer environmentally friendly alternatives with enhanced performance, safety, and efficiency.

- Stringent Environmental Regulations: Global initiatives and national regulations aimed at reducing greenhouse gas emissions and protecting the ozone layer are compelling the industry to transition towards propellants with lower GWP and ODP, such as HFOs and DME.

- Expansion of Key End-Use Sectors: The robust growth of the personal care industry, coupled with steady expansion in household, medical, and automotive sectors, creates a consistent and growing demand for aerosol propellants.

- Rising Disposable Incomes in Emerging Economies: As economies develop and consumer purchasing power increases in regions like Asia-Pacific, demand for consumer goods packaged in convenient aerosol formats is expected to surge.

- Focus on Sustainability and Eco-Friendly Products: Growing consumer awareness and preference for environmentally responsible products are actively pushing manufacturers to adopt and promote greener propellant solutions.

Challenges in the Aerosol Propellants Gas Market Sector

The market faces challenges, including stringent environmental regulations and their associated compliance costs, fluctuations in raw material prices, intense competition among existing players, and potential supply chain disruptions. These factors can impact production costs and market profitability.

Emerging Opportunities in Aerosol Propellants Gas Market

Emerging opportunities include the growing demand for sustainable and environmentally friendly propellants, expansion into new and developing markets, and the exploration of new applications for aerosol technology in diverse sectors. Further development of innovative propellant blends and efficient dispensing technologies will drive future growth.

Leading Players in the Aerosol Propellants Gas Market Market

- Jiutai Energy Group

- Aveflor AS

- Shell PLC

- Honeywell International Inc

- Nouryon

- Emirates Gas LLC

- Diversified CPC International

- BOC

- Arkema Group

- The Chemours Company

- Aeropres Corporation

- Shanghai Cal Custom Manufacturing & Aerosol Propellant Co Ltd

- Grillo Werke AG

Key Developments in Aerosol Propellants Gas Market Industry

- Q1 2023: Honeywell International Inc. launched a new HFO-based propellant.

- Q3 2022: Shell PLC invested in a new manufacturing facility for HFO propellants.

- Q4 2021: Arkema Group acquired a smaller propellant manufacturer, expanding its market share.

- Further details on other key developments are available within the complete report.

Strategic Outlook for Aerosol Propellants Gas Market Market

The Aerosol Propellants Gas market presents significant growth potential, driven by the increasing demand for sustainable and high-performing aerosol products. Further technological advancements in propellant formulations, coupled with expanding application areas, will fuel market expansion. Companies focused on innovation, sustainability, and strategic partnerships are poised for success in this evolving market.

Aerosol Propellants Gas Market Segmentation

-

1. Type

- 1.1. Dimethyl Ether (DME)

- 1.2. Hyrdofluorocarbons (HFC)

- 1.3. Hydrofluoro Olefins (HFO)

- 1.4. Other Ty

-

2. Application

- 2.1. Personal Care

- 2.2. Household

- 2.3. Medical

- 2.4. Automotive

- 2.5. Other Ap

Aerosol Propellants Gas Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Malaysia

- 1.6. Indonesia

- 1.7. Thailand

- 1.8. Vietnam

- 1.9. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Spain

- 3.6. Russia

- 3.7. Turkey

- 3.8. NORDIC Countries

- 3.9. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Aerosol Propellants Gas Market Regional Market Share

Geographic Coverage of Aerosol Propellants Gas Market

Aerosol Propellants Gas Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from the Personal Care Industry; Increasing Applications of Aerosol Propellants in the Food and Beverage Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations on the Use of Aerosol; Other Restraints

- 3.4. Market Trends

- 3.4.1. Personal Care Application to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aerosol Propellants Gas Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Dimethyl Ether (DME)

- 5.1.2. Hyrdofluorocarbons (HFC)

- 5.1.3. Hydrofluoro Olefins (HFO)

- 5.1.4. Other Ty

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Personal Care

- 5.2.2. Household

- 5.2.3. Medical

- 5.2.4. Automotive

- 5.2.5. Other Ap

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Aerosol Propellants Gas Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Dimethyl Ether (DME)

- 6.1.2. Hyrdofluorocarbons (HFC)

- 6.1.3. Hydrofluoro Olefins (HFO)

- 6.1.4. Other Ty

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Personal Care

- 6.2.2. Household

- 6.2.3. Medical

- 6.2.4. Automotive

- 6.2.5. Other Ap

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Aerosol Propellants Gas Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Dimethyl Ether (DME)

- 7.1.2. Hyrdofluorocarbons (HFC)

- 7.1.3. Hydrofluoro Olefins (HFO)

- 7.1.4. Other Ty

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Personal Care

- 7.2.2. Household

- 7.2.3. Medical

- 7.2.4. Automotive

- 7.2.5. Other Ap

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Aerosol Propellants Gas Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Dimethyl Ether (DME)

- 8.1.2. Hyrdofluorocarbons (HFC)

- 8.1.3. Hydrofluoro Olefins (HFO)

- 8.1.4. Other Ty

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Personal Care

- 8.2.2. Household

- 8.2.3. Medical

- 8.2.4. Automotive

- 8.2.5. Other Ap

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Aerosol Propellants Gas Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Dimethyl Ether (DME)

- 9.1.2. Hyrdofluorocarbons (HFC)

- 9.1.3. Hydrofluoro Olefins (HFO)

- 9.1.4. Other Ty

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Personal Care

- 9.2.2. Household

- 9.2.3. Medical

- 9.2.4. Automotive

- 9.2.5. Other Ap

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Aerosol Propellants Gas Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Dimethyl Ether (DME)

- 10.1.2. Hyrdofluorocarbons (HFC)

- 10.1.3. Hydrofluoro Olefins (HFO)

- 10.1.4. Other Ty

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Personal Care

- 10.2.2. Household

- 10.2.3. Medical

- 10.2.4. Automotive

- 10.2.5. Other Ap

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Jiutai Energy Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Aveflor AS

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Shell PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Honeywell International Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nouryon

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Emirates Gas LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Diversified CPC International

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BOC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Arkema Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 The Chemours Company*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Aeropres Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Shanghai Cal Custom Manufacturing & Aerosol Propellant Co Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Grillo Werke AG

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Jiutai Energy Group

List of Figures

- Figure 1: Global Aerosol Propellants Gas Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Aerosol Propellants Gas Market Revenue (Million), by Type 2025 & 2033

- Figure 3: Asia Pacific Aerosol Propellants Gas Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Aerosol Propellants Gas Market Revenue (Million), by Application 2025 & 2033

- Figure 5: Asia Pacific Aerosol Propellants Gas Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Aerosol Propellants Gas Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Aerosol Propellants Gas Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Aerosol Propellants Gas Market Revenue (Million), by Type 2025 & 2033

- Figure 9: North America Aerosol Propellants Gas Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Aerosol Propellants Gas Market Revenue (Million), by Application 2025 & 2033

- Figure 11: North America Aerosol Propellants Gas Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Aerosol Propellants Gas Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Aerosol Propellants Gas Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Aerosol Propellants Gas Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Aerosol Propellants Gas Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Aerosol Propellants Gas Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Europe Aerosol Propellants Gas Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Aerosol Propellants Gas Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Aerosol Propellants Gas Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Aerosol Propellants Gas Market Revenue (Million), by Type 2025 & 2033

- Figure 21: South America Aerosol Propellants Gas Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Aerosol Propellants Gas Market Revenue (Million), by Application 2025 & 2033

- Figure 23: South America Aerosol Propellants Gas Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Aerosol Propellants Gas Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Aerosol Propellants Gas Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Aerosol Propellants Gas Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Aerosol Propellants Gas Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Aerosol Propellants Gas Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Aerosol Propellants Gas Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Aerosol Propellants Gas Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Aerosol Propellants Gas Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aerosol Propellants Gas Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Aerosol Propellants Gas Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Aerosol Propellants Gas Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Aerosol Propellants Gas Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Aerosol Propellants Gas Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Aerosol Propellants Gas Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Malaysia Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Indonesia Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Thailand Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Vietnam Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Asia Pacific Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Aerosol Propellants Gas Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Aerosol Propellants Gas Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global Aerosol Propellants Gas Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United States Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Mexico Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Aerosol Propellants Gas Market Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Global Aerosol Propellants Gas Market Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Aerosol Propellants Gas Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Germany Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Italy Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: France Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Spain Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Russia Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Turkey Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: NORDIC Countries Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of Europe Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Aerosol Propellants Gas Market Revenue Million Forecast, by Type 2020 & 2033

- Table 35: Global Aerosol Propellants Gas Market Revenue Million Forecast, by Application 2020 & 2033

- Table 36: Global Aerosol Propellants Gas Market Revenue Million Forecast, by Country 2020 & 2033

- Table 37: Brazil Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Argentina Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global Aerosol Propellants Gas Market Revenue Million Forecast, by Type 2020 & 2033

- Table 41: Global Aerosol Propellants Gas Market Revenue Million Forecast, by Application 2020 & 2033

- Table 42: Global Aerosol Propellants Gas Market Revenue Million Forecast, by Country 2020 & 2033

- Table 43: Saudi Arabia Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: South Africa Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Rest of Middle East and Africa Aerosol Propellants Gas Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aerosol Propellants Gas Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Aerosol Propellants Gas Market?

Key companies in the market include Jiutai Energy Group, Aveflor AS, Shell PLC, Honeywell International Inc, Nouryon, Emirates Gas LLC, Diversified CPC International, BOC, Arkema Group, The Chemours Company*List Not Exhaustive, Aeropres Corporation, Shanghai Cal Custom Manufacturing & Aerosol Propellant Co Ltd, Grillo Werke AG.

3. What are the main segments of the Aerosol Propellants Gas Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.41 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from the Personal Care Industry; Increasing Applications of Aerosol Propellants in the Food and Beverage Industry; Other Drivers.

6. What are the notable trends driving market growth?

Personal Care Application to Dominate the Market.

7. Are there any restraints impacting market growth?

Stringent Government Regulations on the Use of Aerosol; Other Restraints.

8. Can you provide examples of recent developments in the market?

The recent developments pertaining to the major players in the market are being covered in the complete study.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aerosol Propellants Gas Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aerosol Propellants Gas Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aerosol Propellants Gas Market?

To stay informed about further developments, trends, and reports in the Aerosol Propellants Gas Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence