Key Insights

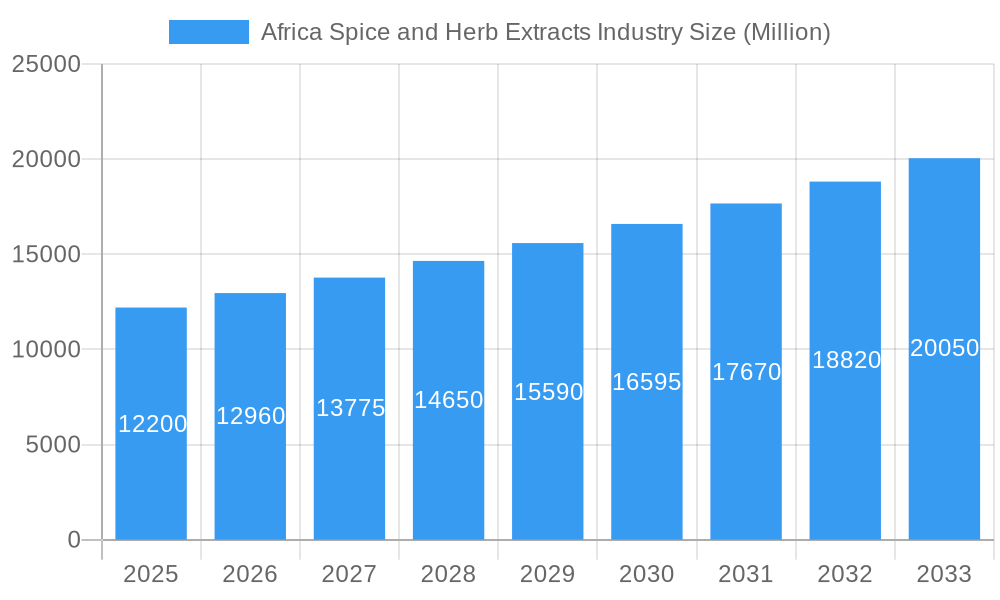

The African Spice and Herb Extracts market is poised for substantial growth, projected to reach a USD 12.2 billion valuation by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 6.1% throughout the forecast period (2025-2033). This expansion is primarily driven by the increasing consumer demand for natural and healthier food and beverage options, coupled with a growing awareness of the functional benefits of spices and herbs. The pharmaceutical sector also contributes significantly, leveraging the medicinal properties of these extracts for various applications. Key market players are actively investing in research and development to innovate product offerings and expand their distribution networks across the continent, catering to both domestic and international markets. The rising disposable incomes and evolving culinary preferences in Africa further amplify the demand for premium and diverse spice and herb extract formulations.

Africa Spice and Herb Extracts Industry Market Size (In Billion)

The market's trajectory is further shaped by emerging trends such as the preference for sustainable sourcing and clean-label products. Consumers are increasingly seeking transparency in ingredient origins and production processes, pushing manufacturers to adopt ethical and eco-friendly practices. While growth is robust, certain restraints, such as fluctuating raw material prices and logistical challenges in some African regions, need to be strategically managed by industry participants. The market is segmented by application, with Food Applications and Beverage Applications dominating, followed by Pharmaceuticals. Geographically, South Africa, Kenya, and the Rest of Africa are key markets, each presenting unique opportunities and challenges. Companies like Kalsec Inc., Sensient Technologies, and McCormick & Company Inc. are at the forefront, driving innovation and market penetration through strategic collaborations and product diversification.

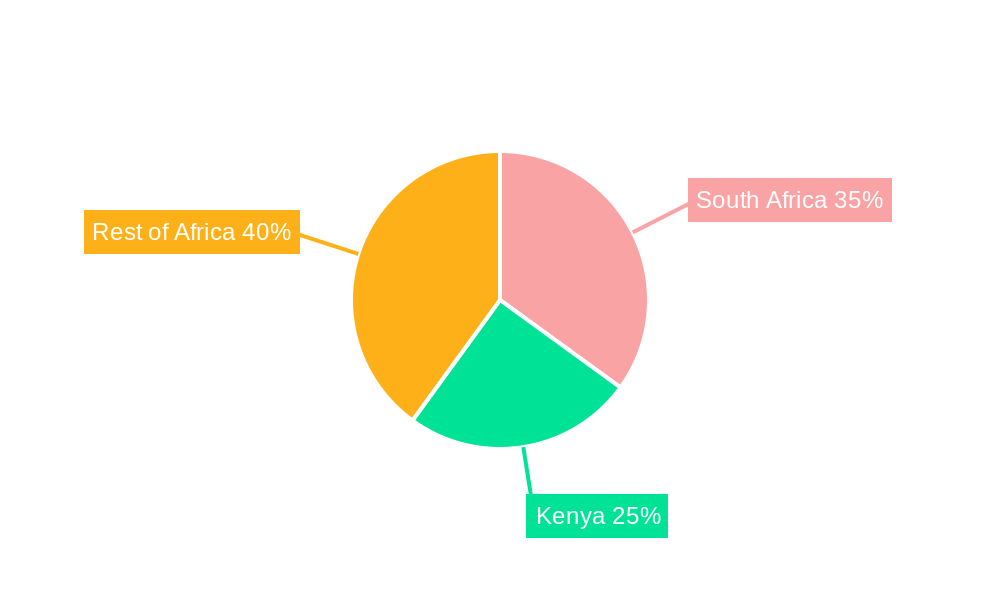

Africa Spice and Herb Extracts Industry Company Market Share

Africa Spice and Herb Extracts Industry Market Concentration & Innovation

The Africa Spice and Herb Extracts industry exhibits a moderate to high market concentration, driven by the presence of several large multinational corporations alongside a growing number of regional and local players. Key companies like Kalsec Inc., Sensient Technologies, McCormick & Company Inc., Kerry Inc., Olam International, Dohler GmbH, and Cape Herb and Spice (list not exhaustive) command significant market share. Innovation is a critical differentiator, fueled by advancements in extraction technologies, demand for natural and organic ingredients, and the expanding application spectrum across food, beverages, and pharmaceuticals. Regulatory frameworks, particularly concerning food safety and quality standards, play a pivotal role in shaping market entry and product development strategies. The threat of product substitutes, while present in the form of synthetic flavors and colors, is diminishing as consumer preference shifts towards natural alternatives. End-user trends are increasingly leaning towards health and wellness, driving demand for extracts with functional properties, such as antioxidants and antimicrobials. Merger and acquisition (M&A) activities, valued in the hundreds of billions, are strategically important for market consolidation and expansion into new geographies and product categories, further influencing market concentration.

Africa Spice and Herb Extracts Industry Industry Trends & Insights

The Africa Spice and Herb Extracts industry is poised for substantial growth, with an estimated Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This robust expansion is primarily propelled by several interconnected trends. A significant market growth driver is the escalating global demand for natural and clean-label ingredients. Consumers are increasingly scrutinizing product labels, seeking to avoid artificial additives and opting for products derived from natural sources, thereby boosting the market penetration of spice and herb extracts. Technological disruptions are transforming the extraction processes, leading to improved efficiency, higher yield, and preservation of the bioactive compounds. Supercritical CO2 extraction, ultrasound-assisted extraction, and microwave-assisted extraction are gaining traction, offering superior quality extracts with minimal solvent residues. Consumer preferences are shifting towards unique and exotic flavor profiles, creating opportunities for African spice and herb extracts with distinct regional characteristics. This surge in demand for authentic tastes is fueling the exploration and commercialization of lesser-known indigenous botanicals. The competitive dynamics are characterized by intense rivalry among established global players and agile regional companies vying for market share. Strategic partnerships, product differentiation, and a focus on sustainable sourcing are becoming crucial for competitive advantage. The increasing awareness of the health benefits associated with various spices and herbs, such as anti-inflammatory and digestive properties, further amplifies their demand in functional foods and nutraceuticals, contributing to the overall market growth. The burgeoning middle class in various African nations, coupled with rising disposable incomes, is also a significant factor driving domestic consumption of processed foods and beverages, which in turn boosts the demand for spice and herb extracts. Furthermore, the growing trend of culinary tourism and the popularization of ethnic cuisines globally are creating a wider appreciation and demand for diverse spice and herb profiles, presenting immense opportunities for African producers. The industry is also witnessing a trend towards the development of specialized extracts for specific applications, such as high-impact flavorings for savory snacks or potent botanical compounds for pharmaceutical applications. This specialization allows companies to cater to niche market demands and command premium pricing.

Dominant Markets & Segments in Africa Spice and Herb Extracts Industry

Within the Africa Spice and Herb Extracts industry, South Africa emerges as a dominant market, driven by a well-established food processing sector, robust agricultural infrastructure, and supportive government policies aimed at boosting agricultural exports. The country benefits from a diverse range of indigenous spices and herbs, coupled with a strong emphasis on quality control and international standards, making it a key player in both regional and global supply chains.

- Key Drivers of South Africa's Dominance:

- Economic Policies: Government initiatives promoting value addition to agricultural produce and incentivizing export-oriented industries have significantly bolstered the spice and herb extract sector.

- Infrastructure: Advanced logistics networks, including well-developed ports and transportation systems, facilitate efficient sourcing of raw materials and distribution of finished products to international markets.

- Research and Development: Investment in agricultural research and development has led to improved cultivation practices, higher yields, and the identification of unique botanical varieties with commercial potential.

- Food Processing Industry: A mature and diversified food processing industry in South Africa creates substantial domestic demand for a wide array of spice and herb extracts.

Application: Food Application stands out as the dominant segment within the Africa Spice and Herb Extracts industry, accounting for an estimated XX% of the total market share. This dominance is attributable to the widespread use of spice and herb extracts as flavor enhancers, colorants, preservatives, and functional ingredients in a vast array of food products. From savory snacks and processed meats to baked goods and dairy products, the demand for natural and authentic flavors is insatiable. The trend towards convenience foods and ready-to-eat meals further amplifies the consumption of these extracts.

- Key Drivers of Food Application Dominance:

- Consumer Preference for Natural Flavors: A global shift away from artificial ingredients towards natural alternatives makes spice and herb extracts the preferred choice for food manufacturers aiming to meet consumer demands for clean-label products.

- Versatility and Functionality: Extracts offer a wide range of sensory attributes and functional benefits, including antimicrobial properties, antioxidant activity, and enhanced shelf-life, making them indispensable in modern food formulations.

- Growth of Processed Food Market: The expanding processed food market, particularly in emerging economies, directly translates to increased demand for flavoring and preservation solutions like spice and herb extracts.

- Innovation in Food Products: Continuous innovation in the food industry, including the development of novel food categories and ethnic cuisines, requires diverse and authentic flavor profiles, which are readily provided by spice and herb extracts.

Geography: Kenya is emerging as a significant and rapidly growing market for spice and herb extracts, driven by its strong agricultural base, particularly in horticulture, and its increasing focus on value-added agricultural exports. The country's favorable climate supports the cultivation of a wide variety of spices and herbs, including pepper, ginger, and various indigenous herbs, which are gaining international recognition.

- Key Drivers of Kenya's Growth:

- Agricultural Expertise: Kenya possesses significant expertise in cultivating and processing high-value agricultural commodities, providing a strong foundation for the spice and herb extract sector.

- Growing Export Potential: Increased demand for Kenyan spices and herbs in international markets is driving investment and expansion within the local extract industry.

- Government Support: The Kenyan government is actively promoting agricultural diversification and value addition, creating a conducive environment for the growth of the spice and herb extract industry.

- Unique Botanical Offerings: Kenya is home to unique indigenous botanicals with potential medicinal and flavor applications, offering opportunities for niche market development.

Application: Beverage Application represents another substantial segment, driven by the growing demand for natural flavoring agents and functional ingredients in a wide array of beverages, including juices, teas, carbonated drinks, and alcoholic beverages.

- Key Drivers of Beverage Application Dominance:

- Health and Wellness Trend: Consumers are increasingly seeking healthier beverage options, leading to a demand for natural flavors and functional ingredients derived from spices and herbs.

- Demand for Unique Flavors: The beverage industry is constantly innovating with new flavor profiles, and spice and herb extracts offer a broad palette for creating exciting and differentiated products.

- Reduced Sugar Content: As manufacturers aim to reduce sugar content in beverages, spice and herb extracts can be used to enhance flavor perception without adding sweetness.

- Functional Beverages: The rise of functional beverages, fortified with ingredients offering health benefits, presents opportunities for extracts with antioxidant, anti-inflammatory, or digestive properties.

Geography: Rest of Africa represents a segment with substantial untapped potential. As economies develop and consumer purchasing power increases across the continent, the demand for processed foods and beverages, and consequently spice and herb extracts, is expected to grow significantly.

- Key Drivers for Rest of Africa's Growth:

- Growing Middle Class: An expanding middle class with increasing disposable incomes is a key driver for the consumption of processed goods, fueling demand for flavorings.

- Urbanization: Rapid urbanization leads to changes in dietary habits and increased reliance on convenience foods and beverages, which often incorporate spice and herb extracts.

- Investment in Food Processing: Governments and private entities are investing in the food processing sector, creating a demand for raw materials like spice and herb extracts.

- Potential for Local Sourcing: As the industry grows, there is potential for increased local sourcing of raw materials, fostering economic development and creating localized supply chains.

Application: Pharmaceuticals is a niche but rapidly growing segment. Spice and herb extracts are increasingly being recognized for their therapeutic properties, leading to their incorporation into dietary supplements, nutraceuticals, and traditional medicines.

- Key Drivers of Pharmaceutical Application Growth:

- Natural Remedies: A growing preference for natural and herbal remedies in healthcare drives the demand for pharmaceutical-grade spice and herb extracts.

- Research into Bioactive Compounds: Ongoing scientific research is uncovering new therapeutic applications for compounds found in spices and herbs, expanding their use in pharmaceuticals.

- Growth of Nutraceutical Market: The booming nutraceutical market, focused on products that provide health benefits beyond basic nutrition, creates a significant avenue for spice and herb extracts.

- Traditional Medicine Integration: The integration of traditional medicine practices with modern healthcare systems in some regions further boosts the demand for botanically derived ingredients.

Africa Spice and Herb Extracts Industry Product Developments

Product development in the Africa Spice and Herb Extracts industry is characterized by a focus on enhanced purity, concentrated potency, and novel delivery formats. Companies are leveraging advanced extraction techniques to isolate specific bioactive compounds and essential oils, resulting in extracts with superior flavor profiles and functional benefits. Innovations include the development of microencapsulated extracts for improved stability and controlled release, as well as water-soluble extracts for easier incorporation into liquid formulations. The trend towards natural and organic certification is also driving product development, with an emphasis on sustainable sourcing and ethical production practices. Competitive advantages are being gained through the ability to offer unique regional varietals, provide scientifically validated health claims, and customize extract solutions for specific application needs across food, beverage, and pharmaceutical sectors.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Africa Spice and Herb Extracts Industry, covering market dynamics, trends, and growth prospects. The segmentation encompasses key applications and geographies to offer granular insights.

Application: Food Application is projected to exhibit a significant market size, driven by the widespread demand for natural flavors and functional ingredients in processed foods. Growth projections indicate a XX% CAGR during the forecast period, with strong competitive dynamics observed among global and regional players.

Application: Beverage Application is also a substantial segment, with growth fueled by the health and wellness trend and the demand for unique flavor profiles in beverages. Market size projections anticipate a XX% CAGR, with key players focusing on innovation and natural ingredient offerings.

Application: Pharmaceuticals represents a niche but rapidly expanding segment. Driven by the growing acceptance of natural remedies and nutraceuticals, this segment is expected to witness a XX% CAGR, with a focus on high-purity extracts and scientifically validated therapeutic properties.

Geography: South Africa is anticipated to maintain its leading position, supported by a mature food processing industry and strong export capabilities. Market size is projected to grow at a XX% CAGR, with intense competition and a focus on quality standards.

Geography: Kenya is expected to be a high-growth region, capitalizing on its robust agricultural sector and increasing export potential for spices and herbs. Growth projections indicate a XX% CAGR, with emerging opportunities in value addition.

Geography: Rest of Africa presents a vast and growing market potential. As economies develop, demand for processed foods and beverages will rise, leading to a projected XX% CAGR for spice and herb extracts, with significant opportunities for new market entrants.

Key Drivers of Africa Spice and Herb Extracts Industry Growth

The Africa Spice and Herb Extracts industry's growth is propelled by several key drivers. Technological advancements in extraction methods, such as supercritical fluid extraction, are yielding higher-quality and more potent extracts, meeting the demand for natural and clean-label ingredients. Economic factors, including rising disposable incomes and a burgeoning middle class across Africa, are increasing consumer purchasing power, driving demand for processed foods and beverages that heavily utilize these extracts. Regulatory shifts towards stricter food safety standards and a preference for natural additives also favor the growth of this industry. Furthermore, the growing consumer awareness of the health benefits associated with various spices and herbs, leading to their incorporation into functional foods and pharmaceuticals, is a significant growth catalyst. For example, the increased use of turmeric extract for its curcuminoids and ginger extract for its anti-inflammatory properties exemplifies this trend.

Challenges in the Africa Spice and Herb Extracts Industry Sector

Despite its promising growth, the Africa Spice and Herb Extracts industry faces several challenges. Supply chain volatility due to climate change, geopolitical instability, and unpredictable weather patterns can disrupt the availability and price of raw materials, impacting production costs and leading to potential shortages. Stringent and varying regulatory landscapes across different African countries and international markets can pose significant compliance hurdles for manufacturers, requiring substantial investment in quality control and certification processes. Intense competition from established global players and emerging local producers can exert downward pressure on prices, challenging profitability. Additionally, infrastructure limitations, including inadequate transportation networks and cold chain facilities in some regions, can hinder efficient sourcing of raw materials and distribution of finished products. The lack of skilled labor in specialized extraction and processing techniques also presents a barrier to scaling up operations effectively.

Emerging Opportunities in Africa Spice and Herb Extracts Industry

The Africa Spice and Herb Extracts industry is ripe with emerging opportunities. The growing global demand for exotic and unique flavor profiles presents a significant opportunity for African spices and herbs with distinct regional characteristics. The expansion of the nutraceutical and functional food sectors offers a lucrative avenue for extracts with scientifically validated health benefits, such as antioxidants and immune boosters. Furthermore, the increasing trend towards sustainable and ethical sourcing creates opportunities for companies that can demonstrate transparent and eco-friendly supply chains. Investments in value-added processing and manufacturing within Africa can unlock new export markets and create local employment. The development of specialized extracts for niche applications, such as natural preservatives or cosmetic ingredients, also holds considerable promise.

Leading Players in the Africa Spice and Herb Extracts Industry Market

- Kalsec Inc.

- Sensient Technologies

- McCormick & Company Inc.

- Kerry Inc.

- Olam International

- Dohler GmbH

- Cape Herb and Spice

Key Developments in Africa Spice and Herb Extracts Industry Industry

- 2023: Launch of a new line of highly concentrated, sustainably sourced spice extracts by Olam International, targeting the global food and beverage industry.

- 2023: Kerry Inc. announced significant investment in expanding its natural flavor and extract production capacity in South Africa to meet growing regional demand.

- 2024: Kalsec Inc. acquired a local Kenyan spice processing company to enhance its direct sourcing capabilities and expand its product portfolio of African botanicals.

- 2024: Sensient Technologies introduced innovative encapsulated spice extracts offering extended shelf-life and improved flavor stability for baked goods and snacks.

- 2024: Cape Herb and Spice launched a new range of organic certified herb extracts, focusing on purity and traceability for the premium food market.

- 2025: Dohler GmbH expanded its research and development capabilities in Africa, focusing on exploring the potential of indigenous African botanicals for novel applications in beverages and pharmaceuticals.

Strategic Outlook for Africa Spice and Herb Extracts Industry Market

The strategic outlook for the Africa Spice and Herb Extracts Industry is exceptionally positive, driven by a confluence of sustained consumer demand for natural ingredients, technological advancements, and the rich biodiversity of the continent. Companies that prioritize sustainable sourcing, invest in advanced extraction technologies, and focus on product innovation will be best positioned for success. Strategic partnerships with local agricultural communities and research institutions will be crucial for ensuring a stable supply of high-quality raw materials and for unlocking the potential of indigenous botanicals. Furthermore, a strong emphasis on regulatory compliance and quality assurance will be paramount for gaining and maintaining market access, particularly in export-oriented markets. The growing recognition of the health benefits of various spices and herbs will continue to fuel demand in the pharmaceutical and nutraceutical sectors, presenting significant growth avenues. Overall, the market is poised for robust expansion, driven by both organic growth and strategic acquisitions.

Africa Spice and Herb Extracts Industry Segmentation

-

1. Application

- 1.1. Food Application

- 1.2. Beverage Application

- 1.3. Pharmaceuticals

-

2. Geography

- 2.1. South Africa

- 2.2. Kenya

- 2.3. Rest of Africa

Africa Spice and Herb Extracts Industry Segmentation By Geography

- 1. South Africa

- 2. Kenya

- 3. Rest of Africa

Africa Spice and Herb Extracts Industry Regional Market Share

Geographic Coverage of Africa Spice and Herb Extracts Industry

Africa Spice and Herb Extracts Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products

- 3.3. Market Restrains

- 3.3.1. High Processing Cost and Low Yield of Natural Food Colors

- 3.4. Market Trends

- 3.4.1. Increased Imports of Spices to South Africa

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Spice and Herb Extracts Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Food Application

- 5.1.2. Beverage Application

- 5.1.3. Pharmaceuticals

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. South Africa

- 5.2.2. Kenya

- 5.2.3. Rest of Africa

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.3.2. Kenya

- 5.3.3. Rest of Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. South Africa Africa Spice and Herb Extracts Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Food Application

- 6.1.2. Beverage Application

- 6.1.3. Pharmaceuticals

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. South Africa

- 6.2.2. Kenya

- 6.2.3. Rest of Africa

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Kenya Africa Spice and Herb Extracts Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Food Application

- 7.1.2. Beverage Application

- 7.1.3. Pharmaceuticals

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. South Africa

- 7.2.2. Kenya

- 7.2.3. Rest of Africa

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Rest of Africa Africa Spice and Herb Extracts Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Food Application

- 8.1.2. Beverage Application

- 8.1.3. Pharmaceuticals

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. South Africa

- 8.2.2. Kenya

- 8.2.3. Rest of Africa

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Kalsec Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Sensient Technologies

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 McCormick & Company Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Kerry Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Olam International

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Dohler GmbH

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Cape Herb and Spice*List Not Exhaustive

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.1 Kalsec Inc

List of Figures

- Figure 1: Africa Spice and Herb Extracts Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Africa Spice and Herb Extracts Industry Share (%) by Company 2025

List of Tables

- Table 1: Africa Spice and Herb Extracts Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Africa Spice and Herb Extracts Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 3: Africa Spice and Herb Extracts Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Africa Spice and Herb Extracts Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Africa Spice and Herb Extracts Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: Africa Spice and Herb Extracts Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Africa Spice and Herb Extracts Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Africa Spice and Herb Extracts Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 9: Africa Spice and Herb Extracts Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Africa Spice and Herb Extracts Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Africa Spice and Herb Extracts Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Africa Spice and Herb Extracts Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Spice and Herb Extracts Industry?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the Africa Spice and Herb Extracts Industry?

Key companies in the market include Kalsec Inc, Sensient Technologies, McCormick & Company Inc, Kerry Inc, Olam International, Dohler GmbH, Cape Herb and Spice*List Not Exhaustive.

3. What are the main segments of the Africa Spice and Herb Extracts Industry?

The market segments include Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products.

6. What are the notable trends driving market growth?

Increased Imports of Spices to South Africa.

7. Are there any restraints impacting market growth?

High Processing Cost and Low Yield of Natural Food Colors.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Spice and Herb Extracts Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Spice and Herb Extracts Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Spice and Herb Extracts Industry?

To stay informed about further developments, trends, and reports in the Africa Spice and Herb Extracts Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence