Key Insights

The African swine feed market, valued at approximately $4.32 billion in 2025, is projected for robust expansion with a compound annual growth rate (CAGR) of 3.9% from 2025 to 2033. This growth is propelled by rising pork demand from Africa's expanding populations, increased adoption of intensive farming for enhanced productivity, and growing farmer awareness of balanced nutrition's importance for swine health. Key ingredients include cereals, oilseed meals, and oils, while supplements focus on antibiotics, vitamins, and antioxidants. Major players such as Cargill, Nutreco, and Alltech are strategically positioned. Significant growth is anticipated in South Africa, Kenya, and Tanzania due to population increases and agricultural investment.

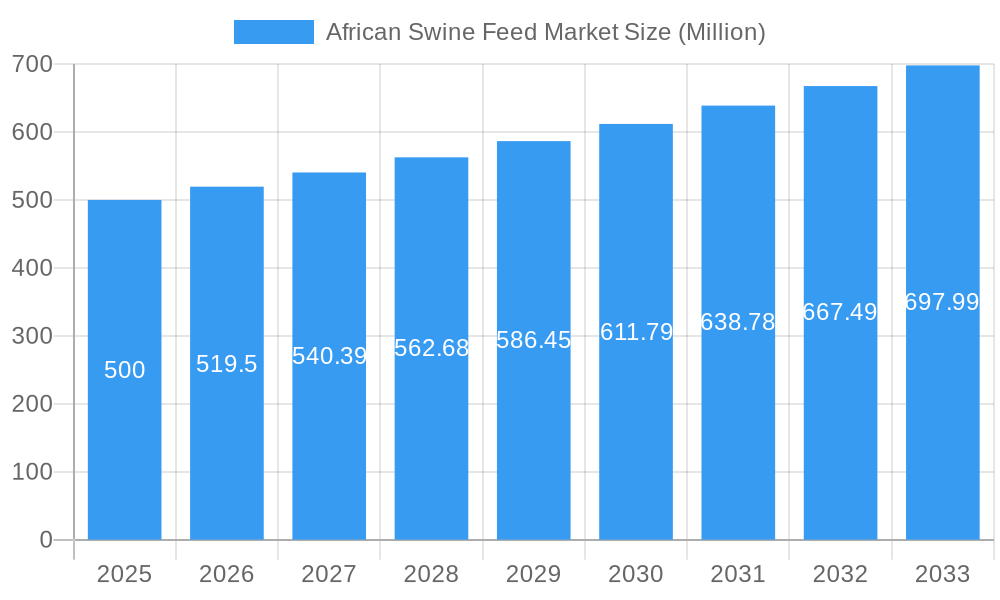

African Swine Feed Market Market Size (In Billion)

However, market expansion faces constraints including inconsistent feed quality, volatile raw material prices (particularly for imports), and the impact of animal diseases on feed efficiency. Addressing these requires improved infrastructure, supply chain management, and disease prevention. Future innovations will likely emphasize sustainable, locally sourced ingredients to reduce import reliance and promote affordability, fostering greater self-sufficiency in Africa's agricultural sector. The integration of technology in feed manufacturing and precision feeding holds significant potential for enhanced productivity and reduced waste, driving a more profitable swine feed industry.

African Swine Feed Market Company Market Share

This report offers a comprehensive analysis of the African swine feed market, providing critical insights for stakeholders and decision-makers. Covering 2019-2033 with a focus on the 2025 base year and a 2025-2033 forecast period, it examines market segmentation, competitive dynamics, growth drivers, challenges, and emerging opportunities. Key companies profiled include Serfco Feeds, Cargill Incorporated, Elanc, Novus International, Nutreco NV, Alltech Inc, Novafeeds, and Kemin Industries Inc.

African Swine Feed Market Concentration & Innovation

This section analyzes the competitive landscape of the African swine feed market, assessing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities. The report uses a combination of descriptive analysis and quantitative data to determine the current state of the market and project future trends. Key metrics such as market share for major players and the value of M&A deals within the sector will be analyzed in detail. The level of market concentration will be determined, and factors impacting competition such as regulatory hurdles, the availability of substitutes and technological innovations influencing market dynamics will be discussed. End-user trends, including shifts in dietary preferences for pork and the resulting demand for specialized feed, are also investigated. A detailed analysis of recent mergers and acquisitions (M&A) will provide insight into consolidation and strategic growth within the industry, including an analysis of deal values where available. For example, we will explore the impact of a potential XX Million deal in 2024 on market concentration. The overall impact of innovation, regulation, and competitive activity on shaping the future of this market will be examined.

African Swine Feed Market Industry Trends & Insights

This section provides a comprehensive overview of the key industry trends and insights shaping the African swine feed market. The analysis explores factors driving market growth, including population growth, rising incomes, and changing dietary habits. It delves into technological disruptions, analyzing their impact on production efficiency and feed formulation. Consumer preferences for sustainably produced pork and the growing demand for specialized feed additives will be meticulously examined. Furthermore, the report analyzes competitive dynamics, including pricing strategies, product differentiation, and market share competition among key players. The report will provide a detailed quantitative analysis, including a Compound Annual Growth Rate (CAGR) for the forecast period, shedding light on the market's potential and future trajectory. Market penetration of various feed types will also be assessed, helping to gauge the success of different product strategies within the market.

Dominant Markets & Segments in African Swine Feed Market

This section identifies the leading regions, countries, and segments within the African swine feed market. A detailed analysis of the dominant segments is presented, categorized by ingredient (Cereals, Cereals By-Product, Oilseed Meal, Oils, Molasses, Other Ingredients) and supplement (Antibiotics, Vitamins, Antioxidants, Enzymes, Acidifiers, Others).

- By Ingredient: The report will pinpoint the dominant ingredient category, analyzing its market share and key drivers. For example, the dominance of cereals might be attributed to their cost-effectiveness and wide availability.

- By Supplement: Similarly, the most prevalent supplement category will be identified, examining the factors behind its market leadership. The prevalence of antibiotics might be linked to disease prevention and improved animal health.

The analysis will include key drivers for each dominant segment's success, such as:

- Economic policies supporting the swine industry.

- Existing infrastructure supporting feed production and distribution.

- Consumer demand for specific pork characteristics impacted by feed type.

Detailed analysis will offer a nuanced view of the factors influencing regional and segmental dominance. The report will consider factors including variations in feed consumption habits, production technologies and government regulations across different regions of Africa to inform its findings.

African Swine Feed Market Product Developments

This section examines recent product innovations, applications, and competitive advantages within the African swine feed market. It emphasizes technological advancements in feed formulation, such as the use of precision feeding technologies and the incorporation of novel feed ingredients tailored to specific nutritional needs of swine. The competitive advantages of newly introduced products, such as improved feed conversion ratios or enhanced animal health, will be outlined. The market fit of these innovations, considering factors like cost-effectiveness and acceptance by farmers, will be rigorously assessed.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation analysis of the African swine feed market.

By Ingredient: The market is segmented by various ingredients including Cereals (market size: XX Million in 2025, projected growth: xx%), Cereals By-Products (market size: XX Million in 2025, projected growth: xx%), Oilseed Meal (market size: XX Million in 2025, projected growth: xx%), Oils (market size: XX Million in 2025, projected growth: xx%), Molasses (market size: XX Million in 2025, projected growth: xx%), and Other Ingredients (market size: XX Million in 2025, projected growth: xx%). Each segment's growth projections and competitive dynamics are evaluated.

By Supplement: The market is further segmented by supplements such as Antibiotics (market size: XX Million in 2025, projected growth: xx%), Vitamins (market size: XX Million in 2025, projected growth: xx%), Antioxidants (market size: XX Million in 2025, projected growth: xx%), Enzymes (market size: XX Million in 2025, projected growth: xx%), Acidifiers (market size: XX Million in 2025, projected growth: xx%), and Others (market size: XX Million in 2025, projected growth: xx%). The competitive intensity and growth potential within each segment are assessed.

Key Drivers of African Swine Feed Market Growth

Several factors drive the growth of the African swine feed market. Rising demand for pork due to population growth and increasing urbanization significantly contributes. Technological advancements in feed formulation, such as the use of precision feeding technologies, improve efficiency and reduce waste. Supportive government policies and investments in agricultural infrastructure also play a crucial role. Finally, the increasing adoption of improved farming practices and focus on animal health enhances market demand.

Challenges in the African Swine Feed Market Sector

The African swine feed market faces numerous challenges. Supply chain inefficiencies, including unreliable transportation networks and storage facilities, impact the availability and cost of feed ingredients. Regulatory hurdles and inconsistent enforcement of quality standards pose risks to both producers and consumers. Furthermore, the volatile prices of key feed ingredients and intense competition among feed manufacturers create uncertainty within the sector. These challenges, if left unaddressed, could constrain the market's growth potential.

Emerging Opportunities in African Swine Feed Market

Despite the challenges, the African swine feed market presents several promising opportunities. The rising demand for high-quality, specialized feeds for improved animal health and productivity opens avenues for innovation. The growing awareness of sustainable farming practices provides a platform for environmentally friendly feed solutions. Furthermore, expanding investments in agricultural infrastructure and technology could create new markets and improve the sector's efficiency.

Leading Players in the African Swine Feed Market Market

- Serfco Feeds

- Cargill Incorporated

- Elanc

- Novus International

- Nutreco NV

- Alltech Inc

- Novafeeds

- Kemin Industries Inc

Key Developments in African Swine Feed Market Industry

- Jan 2023: Launch of a new feed formulation by Cargill incorporating locally sourced ingredients.

- Jun 2022: Acquisition of a smaller feed mill by Novus International, expanding their market reach.

- Oct 2021: Introduction of a new disease prevention supplement by Alltech Inc.

- Further developments will be detailed within the full report.

Strategic Outlook for African Swine Feed Market Market

The African swine feed market exhibits robust growth potential, driven by factors like population growth, rising incomes, and increased pork consumption. Further investments in infrastructure and technology, coupled with a greater focus on sustainable feed production, will shape the market's future. Companies with a strong focus on innovation, supply chain efficiency, and customer relationships are well-positioned to capitalize on the market's growth opportunities. The forecast period promises a substantial expansion, offering significant returns for strategic investors and market players.

African Swine Feed Market Segmentation

-

1. Ingredient

- 1.1. Cereals

- 1.2. Cereals By Product

- 1.3. Oilseed Meal

- 1.4. Molasses

- 1.5. Other Ingredients

-

2. Supplement

- 2.1. Antibiotics

- 2.2. Vitamins

- 2.3. Antioxidants

- 2.4. Enzymes

- 2.5. Acidifiers

- 2.6. Others

-

3. Geography

- 3.1. South Africa

- 3.2. Egypt

- 3.3. Rest of South Africa

African Swine Feed Market Segmentation By Geography

- 1. South Africa

- 2. Egypt

- 3. Rest of South Africa

African Swine Feed Market Regional Market Share

Geographic Coverage of African Swine Feed Market

African Swine Feed Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Pet Humanization; Growing Trend of E-commerce

- 3.3. Market Restrains

- 3.3.1. Rising Cost of Raw Material Production; Growing Concern Over Environment and Pet Health

- 3.4. Market Trends

- 3.4.1. Rising Swine Production Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. African Swine Feed Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ingredient

- 5.1.1. Cereals

- 5.1.2. Cereals By Product

- 5.1.3. Oilseed Meal

- 5.1.4. Molasses

- 5.1.5. Other Ingredients

- 5.2. Market Analysis, Insights and Forecast - by Supplement

- 5.2.1. Antibiotics

- 5.2.2. Vitamins

- 5.2.3. Antioxidants

- 5.2.4. Enzymes

- 5.2.5. Acidifiers

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South Africa

- 5.3.2. Egypt

- 5.3.3. Rest of South Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.4.2. Egypt

- 5.4.3. Rest of South Africa

- 5.1. Market Analysis, Insights and Forecast - by Ingredient

- 6. South Africa African Swine Feed Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Ingredient

- 6.1.1. Cereals

- 6.1.2. Cereals By Product

- 6.1.3. Oilseed Meal

- 6.1.4. Molasses

- 6.1.5. Other Ingredients

- 6.2. Market Analysis, Insights and Forecast - by Supplement

- 6.2.1. Antibiotics

- 6.2.2. Vitamins

- 6.2.3. Antioxidants

- 6.2.4. Enzymes

- 6.2.5. Acidifiers

- 6.2.6. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. South Africa

- 6.3.2. Egypt

- 6.3.3. Rest of South Africa

- 6.1. Market Analysis, Insights and Forecast - by Ingredient

- 7. Egypt African Swine Feed Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Ingredient

- 7.1.1. Cereals

- 7.1.2. Cereals By Product

- 7.1.3. Oilseed Meal

- 7.1.4. Molasses

- 7.1.5. Other Ingredients

- 7.2. Market Analysis, Insights and Forecast - by Supplement

- 7.2.1. Antibiotics

- 7.2.2. Vitamins

- 7.2.3. Antioxidants

- 7.2.4. Enzymes

- 7.2.5. Acidifiers

- 7.2.6. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. South Africa

- 7.3.2. Egypt

- 7.3.3. Rest of South Africa

- 7.1. Market Analysis, Insights and Forecast - by Ingredient

- 8. Rest of South Africa African Swine Feed Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Ingredient

- 8.1.1. Cereals

- 8.1.2. Cereals By Product

- 8.1.3. Oilseed Meal

- 8.1.4. Molasses

- 8.1.5. Other Ingredients

- 8.2. Market Analysis, Insights and Forecast - by Supplement

- 8.2.1. Antibiotics

- 8.2.2. Vitamins

- 8.2.3. Antioxidants

- 8.2.4. Enzymes

- 8.2.5. Acidifiers

- 8.2.6. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. South Africa

- 8.3.2. Egypt

- 8.3.3. Rest of South Africa

- 8.1. Market Analysis, Insights and Forecast - by Ingredient

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Serfco Feeds

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Cargill Incorporated

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Elanc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Novus International

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Nutreco NV

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Alltech Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Novafeeds

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Kemin Industries Inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 Serfco Feeds

List of Figures

- Figure 1: African Swine Feed Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: African Swine Feed Market Share (%) by Company 2025

List of Tables

- Table 1: African Swine Feed Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 2: African Swine Feed Market Revenue billion Forecast, by Supplement 2020 & 2033

- Table 3: African Swine Feed Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: African Swine Feed Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: African Swine Feed Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 6: African Swine Feed Market Revenue billion Forecast, by Supplement 2020 & 2033

- Table 7: African Swine Feed Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: African Swine Feed Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: African Swine Feed Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 10: African Swine Feed Market Revenue billion Forecast, by Supplement 2020 & 2033

- Table 11: African Swine Feed Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: African Swine Feed Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: African Swine Feed Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 14: African Swine Feed Market Revenue billion Forecast, by Supplement 2020 & 2033

- Table 15: African Swine Feed Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: African Swine Feed Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the African Swine Feed Market?

The projected CAGR is approximately 3.9%.

2. Which companies are prominent players in the African Swine Feed Market?

Key companies in the market include Serfco Feeds, Cargill Incorporated, Elanc, Novus International, Nutreco NV, Alltech Inc, Novafeeds, Kemin Industries Inc.

3. What are the main segments of the African Swine Feed Market?

The market segments include Ingredient, Supplement, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.32 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Pet Humanization; Growing Trend of E-commerce.

6. What are the notable trends driving market growth?

Rising Swine Production Drives the Market.

7. Are there any restraints impacting market growth?

Rising Cost of Raw Material Production; Growing Concern Over Environment and Pet Health.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "African Swine Feed Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the African Swine Feed Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the African Swine Feed Market?

To stay informed about further developments, trends, and reports in the African Swine Feed Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence