Key Insights

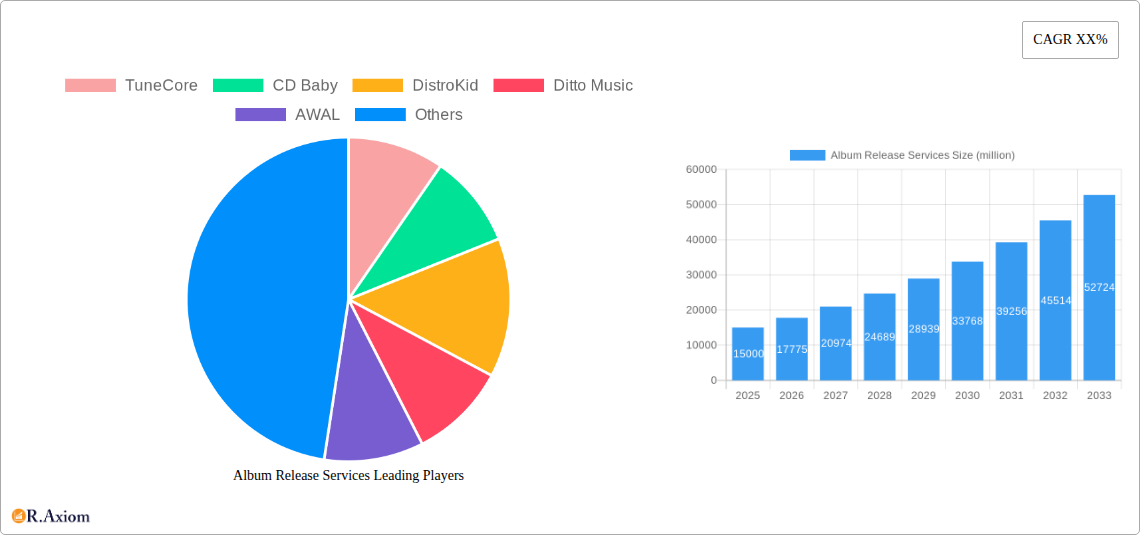

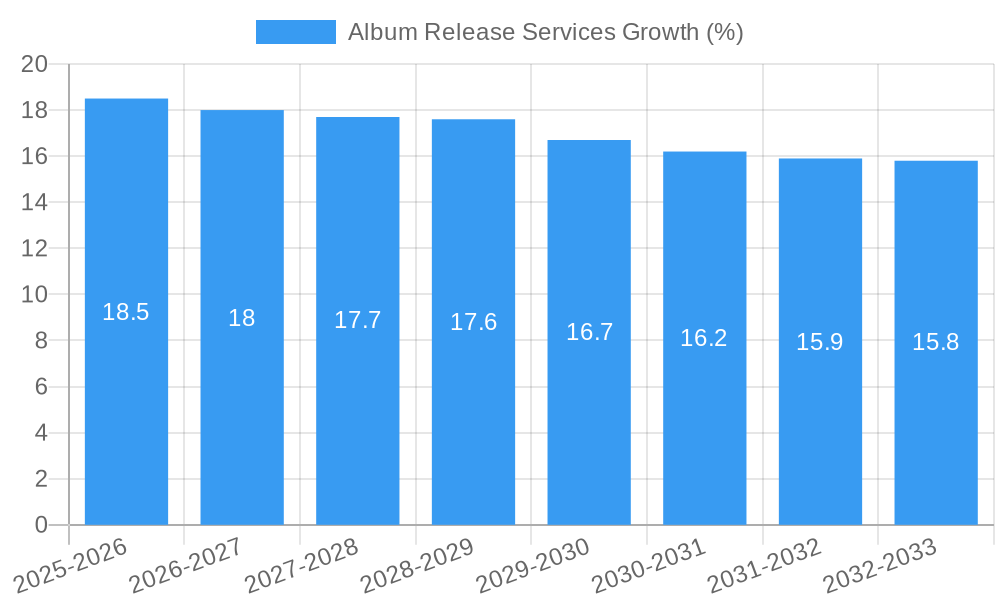

The global Album Release Services market is poised for robust expansion, projected to reach an estimated market size of 15,000 million USD by 2025, with a significant Compound Annual Growth Rate (CAGR) of 18.5% anticipated through 2033. This substantial growth is fueled by the burgeoning independent music scene and the increasing number of artists leveraging digital platforms for wider reach. The market is driven by the undeniable shift towards digital distribution, which offers artists greater control, higher royalty percentages, and global accessibility compared to traditional physical distribution models. This digital revolution democratizes music release, empowering independent musicians to bypass traditional gatekeepers and connect directly with their audience. Furthermore, the rising demand for comprehensive release solutions, encompassing everything from distribution and royalty collection to marketing and promotion, is a key growth catalyst. Entertainment companies and individual music creators alike are increasingly relying on specialized service providers to navigate the complex landscape of music release and monetization.

The market's trajectory is further shaped by evolving consumer listening habits, with streaming services dominating consumption. This trend directly benefits digital distribution platforms that seamlessly integrate with major streaming players. While the digital segment experiences exponential growth, physical distribution, though declining, still holds a niche presence, catering to specific collector markets and artist branding initiatives. Key restraints include the increasing competition among service providers, potentially leading to price wars, and the constant need for adaptation to evolving platform algorithms and industry regulations. However, the overarching trend of artist empowerment and the continuous innovation in release technologies and artist support services are expected to outweigh these challenges, ensuring sustained market growth. Prominent players like TuneCore, CD Baby, DistroKid, and Believe are instrumental in shaping this dynamic market through their competitive offerings and strategic expansions.

This in-depth report provides a detailed analysis of the global Album Release Services market, offering critical insights for industry stakeholders, including entertainment companies, music creators, and technology providers. Spanning a study period from 2019 to 2033, with a base and estimated year of 2025, this report leverages historical data from 2019–2024 and forecasts market dynamics through 2033. It meticulously examines market concentration, innovation drivers, regulatory landscapes, competitive strategies, and emerging trends within both physical and digital distribution segments.

Album Release Services Market Concentration & Innovation

The global album release services market exhibits a moderate to high degree of concentration, with key players like TuneCore, CD Baby, DistroKid, and Believe holding significant market share. The innovation landscape is driven by advancements in digital distribution technology, streaming platform integration, and data analytics for artist promotion. Regulatory frameworks, while evolving to address copyright and royalty distribution, remain a critical factor influencing market entry and operational strategies for companies such as AWAL, LANDR, and Symphonic Distribution. Product substitutes, primarily DIY artist tools and direct-to-fan platforms, are increasingly prevalent, forcing traditional distributors to adapt. End-user trends highlight a growing demand for transparent royalty reporting, global reach, and value-added services like marketing and playlist pitching. Merger and acquisition (M&A) activities, with estimated deal values reaching hundreds of millions, are a significant indicator of market consolidation and strategic expansion by entities like The Orchard and Kobalt Label Services. Companies such as Horus Music, Amuse, and Octiive are actively participating in this dynamic.

Album Release Services Industry Trends & Insights

The album release services industry is experiencing robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 15% over the forecast period. This expansion is fueled by the insatiable global demand for music across diverse platforms and the democratization of music creation and distribution, empowering independent artists and small labels. Technological disruptions, particularly the widespread adoption of AI in music production and recommendation algorithms, are reshaping how music is discovered and consumed. Consumer preferences are increasingly leaning towards personalized listening experiences and direct engagement with artists, necessitating sophisticated digital distribution strategies. The competitive dynamics are intensifying, with established players like TuneCore, CD Baby, and DistroKid constantly innovating to retain market share, while agile new entrants such as United Masters and Kanjian Music are carving out niches. The penetration of digital distribution services is nearing saturation in developed markets, pushing service providers to focus on emerging economies and value-added services.

Dominant Markets & Segments in Album Release Services

The Digital Distribution segment is demonstrably the dominant force within the album release services market, driven by the global ubiquity of streaming platforms like Spotify, Apple Music, and YouTube Music. Key drivers for this dominance include:

- Economic Policies: Favorable digital infrastructure investments and the growth of e-commerce globally.

- Infrastructure: Widespread internet penetration and the proliferation of affordable mobile devices enabling constant music access.

- Consumer Behavior: The shift from ownership to access, with consumers preferring subscription-based streaming models.

Among applications, Music Creators represent the largest and fastest-growing segment, as independent artists and emerging bands increasingly leverage digital distributors to reach a global audience without the need for traditional record labels. The accessibility and cost-effectiveness of services offered by companies like RouteNote, ONErpm, and FreshTunes are particularly attractive to this demographic.

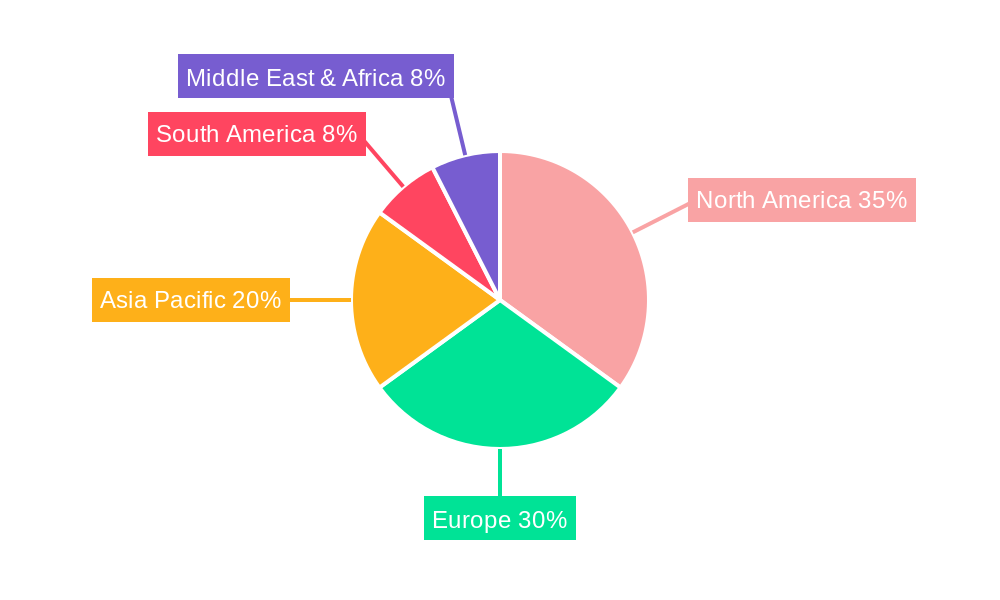

Geographically, North America and Europe continue to lead in market value due to mature digital music ecosystems and high per capita music spending. However, the Asia-Pacific region is exhibiting the most significant growth trajectory, propelled by a burgeoning middle class, rapid technological adoption, and a rising appetite for diverse musical genres. Countries like India and South Korea are becoming pivotal markets for album release services. While Physical Distribution still holds a niche, particularly for collectors and legacy artists, its market share is steadily declining relative to digital.

Album Release Services Product Developments

Product innovations in album release services are heavily focused on enhancing artist revenue streams and streamlining the release process. This includes advanced analytics dashboards providing deep insights into listener demographics and engagement, AI-powered promotional tools for targeted marketing campaigns, and seamless integration with social media platforms for direct fan interaction. Companies are also developing sophisticated royalty tracking and payment systems, ensuring transparency and efficiency for creators. Competitive advantages are being built on the breadth of distribution networks, the quality of metadata management, and the availability of value-added services such as playlist pitching and music video promotion. The integration of blockchain technology for transparent royalty distribution is an emerging area of development.

Report Scope & Segmentation Analysis

This report comprehensively segments the album release services market by Application and Type.

Application Segments:

- Entertainment Company: This segment includes established record labels and music publishing houses seeking efficient digital distribution solutions. Projections indicate a steady growth rate of approximately 10%, with market sizes estimated to reach over $500 million by 2033. Competitive dynamics are driven by comprehensive catalog management and global reach capabilities.

- Music Creator: This segment, encompassing independent artists, bands, and producers, is the fastest-growing, with projected growth exceeding 20%. Market sizes are anticipated to surpass $1 billion by 2033. Growth is fueled by the demand for accessible, affordable, and artist-centric distribution services.

- Others: This residual segment includes entities like music supervisors, content creators, and aggregators, with modest growth expected at around 5%.

Type Segments:

- Physical Distribution: While declining in overall market share, this segment remains relevant for niche markets and collector's editions. Projected to see a negative CAGR of -2%, its market size is expected to stabilize around $100 million.

- Digital Distribution: This is the dominant and fastest-growing segment, projected to achieve a CAGR of over 18%. Market sizes are anticipated to reach over $2.5 billion by 2033, driven by streaming and digital download platforms.

Key Drivers of Album Release Services Growth

The growth of the album release services market is propelled by several key factors. The exponential rise of digital streaming platforms globally continues to be the primary driver, providing unprecedented access to music for billions. Technological advancements in music production and distribution software have lowered barriers to entry for aspiring artists. Furthermore, favorable economic conditions in emerging markets are creating new consumer bases for music consumption. The increasing demand for independent artists to reach global audiences without traditional label constraints is also a significant growth catalyst. Regulatory shifts that promote fair royalty distribution and protect intellectual property rights further bolster confidence and investment in the sector.

Challenges in the Album Release Services Sector

Despite its growth, the album release services sector faces considerable challenges. Intense competition among distributors leads to pressure on pricing and profit margins. Piracy and copyright infringement remain persistent issues, impacting revenue streams for artists and distributors alike. Navigating the complex and ever-changing landscape of global music licensing and royalty collection presents significant operational hurdles. Supply chain disruptions, particularly for physical distribution, can impact timely releases and inventory management. The increasing volume of music being released daily also creates challenges for artists and distributors in achieving significant visibility and breaking through the noise.

Emerging Opportunities in Album Release Services

Emerging opportunities in the album release services market lie in leveraging new technologies and catering to evolving consumer behaviors. The burgeoning creator economy presents a significant avenue for growth, with platforms increasingly offering tools for artists to monetize their content beyond streaming royalties, such as NFTs and fan subscriptions. The continued expansion of emerging markets, particularly in Asia and Africa, offers untapped potential for digital distribution. Furthermore, the development of AI-powered tools for music discovery, promotion, and even content creation represents a significant opportunity for service providers to offer enhanced value. Partnerships with emerging social media and short-form video platforms can unlock new avenues for music promotion and discovery.

Leading Players in the Album Release Services Market

- TuneCore

- CD Baby

- DistroKid

- Ditto Music

- AWAL

- LANDR

- Horus Music

- Amuse

- Octiive

- ReverbNation

- Believe

- Symphonic Distribution

- The Orchard

- United Masters

- Kanjian Music

- RouteNote

- ONErpm

- FreshTunes

- Musicinfo

- Record Union

- Kobalt Label Services

- Unchained Music

- Music Gateway

Key Developments in Album Release Services Industry

- 2023: Major streaming platforms introduce new royalty payout models, impacting artist earnings and distribution strategies.

- 2023: Increased investment in AI-powered music discovery and promotion tools by leading distributors.

- 2022: Expansion of blockchain-based royalty tracking solutions gaining traction.

- 2022: Significant M&A activity, with larger entities acquiring smaller distributors to consolidate market share.

- 2021: Growing emphasis on international distribution for independent artists targeting emerging markets.

- 2020: COVID-19 pandemic accelerates the shift to digital distribution and online promotion.

- 2019: Introduction of new direct-to-fan monetization features by several key players.

Strategic Outlook for Album Release Services Market

- 2023: Major streaming platforms introduce new royalty payout models, impacting artist earnings and distribution strategies.

- 2023: Increased investment in AI-powered music discovery and promotion tools by leading distributors.

- 2022: Expansion of blockchain-based royalty tracking solutions gaining traction.

- 2022: Significant M&A activity, with larger entities acquiring smaller distributors to consolidate market share.

- 2021: Growing emphasis on international distribution for independent artists targeting emerging markets.

- 2020: COVID-19 pandemic accelerates the shift to digital distribution and online promotion.

- 2019: Introduction of new direct-to-fan monetization features by several key players.

Strategic Outlook for Album Release Services Market

The strategic outlook for the album release services market is overwhelmingly positive, characterized by sustained innovation and expanding global reach. The continued evolution of digital distribution channels, coupled with the increasing demand from independent artists for comprehensive support services, will drive significant growth. Service providers that can offer transparent royalty management, effective global promotion, and cutting-edge data analytics will be best positioned for success. Strategic partnerships with social media platforms, emerging technologies like AI, and a focus on underserved emerging markets will be crucial for long-term competitive advantage. The market is expected to see further consolidation as established players seek to expand their service offerings and market penetration.

Album Release Services Segmentation

-

1. Application

- 1.1. Entertainment Company

- 1.2. Music Creator

- 1.3. Others

-

2. Types

- 2.1. Physical Distribution

- 2.2. Digital Distribution

Album Release Services Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Album Release Services REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Album Release Services Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Entertainment Company

- 5.1.2. Music Creator

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Physical Distribution

- 5.2.2. Digital Distribution

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Album Release Services Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Entertainment Company

- 6.1.2. Music Creator

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Physical Distribution

- 6.2.2. Digital Distribution

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Album Release Services Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Entertainment Company

- 7.1.2. Music Creator

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Physical Distribution

- 7.2.2. Digital Distribution

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Album Release Services Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Entertainment Company

- 8.1.2. Music Creator

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Physical Distribution

- 8.2.2. Digital Distribution

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Album Release Services Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Entertainment Company

- 9.1.2. Music Creator

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Physical Distribution

- 9.2.2. Digital Distribution

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Album Release Services Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Entertainment Company

- 10.1.2. Music Creator

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Physical Distribution

- 10.2.2. Digital Distribution

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 TuneCore

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CD Baby

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DistroKid

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ditto Music

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AWAL

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LANDR

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Horus Music

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Amuse

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Octiive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ReverbNation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Believe

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Symphonic Distribution

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 The Orchard

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 United Masters

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Kanjian Music

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 RouteNote

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 ONErpm

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 FreshTunes

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Musicinfo

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Record Union

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Kobalt Label Services

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Unchained Music

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Music Gateway

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.1 TuneCore

List of Figures

- Figure 1: Global Album Release Services Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Album Release Services Revenue (million), by Application 2024 & 2032

- Figure 3: North America Album Release Services Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Album Release Services Revenue (million), by Types 2024 & 2032

- Figure 5: North America Album Release Services Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Album Release Services Revenue (million), by Country 2024 & 2032

- Figure 7: North America Album Release Services Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Album Release Services Revenue (million), by Application 2024 & 2032

- Figure 9: South America Album Release Services Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Album Release Services Revenue (million), by Types 2024 & 2032

- Figure 11: South America Album Release Services Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Album Release Services Revenue (million), by Country 2024 & 2032

- Figure 13: South America Album Release Services Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Album Release Services Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Album Release Services Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Album Release Services Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Album Release Services Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Album Release Services Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Album Release Services Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Album Release Services Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Album Release Services Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Album Release Services Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Album Release Services Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Album Release Services Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Album Release Services Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Album Release Services Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Album Release Services Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Album Release Services Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Album Release Services Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Album Release Services Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Album Release Services Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Album Release Services Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Album Release Services Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Album Release Services Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Album Release Services Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Album Release Services Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Album Release Services Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Album Release Services Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Album Release Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Album Release Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Album Release Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Album Release Services Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Album Release Services Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Album Release Services Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Album Release Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Album Release Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Album Release Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Album Release Services Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Album Release Services Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Album Release Services Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Album Release Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Album Release Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Album Release Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Album Release Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Album Release Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Album Release Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Album Release Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Album Release Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Album Release Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Album Release Services Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Album Release Services Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Album Release Services Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Album Release Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Album Release Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Album Release Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Album Release Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Album Release Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Album Release Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Album Release Services Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Album Release Services Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Album Release Services Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Album Release Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Album Release Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Album Release Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Album Release Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Album Release Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Album Release Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Album Release Services Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Album Release Services?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Album Release Services?

Key companies in the market include TuneCore, CD Baby, DistroKid, Ditto Music, AWAL, LANDR, Horus Music, Amuse, Octiive, ReverbNation, Believe, Symphonic Distribution, The Orchard, United Masters, Kanjian Music, RouteNote, ONErpm, FreshTunes, Musicinfo, Record Union, Kobalt Label Services, Unchained Music, Music Gateway.

3. What are the main segments of the Album Release Services?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Album Release Services," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Album Release Services report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Album Release Services?

To stay informed about further developments, trends, and reports in the Album Release Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence