Key Insights

The global Alcoholic Beverages Market is projected to reach $2564.92 billion by 2025, expanding at a CAGR of 2.37%. This growth is fueled by evolving consumer preferences for premium and craft options, the rising popularity of ready-to-drink (RTD) cocktails, and increasing disposable incomes in emerging economies. Consumers are seeking innovative flavors, sustainable sourcing, and unique consumption experiences, driving product development and marketing strategies. The expansion of e-commerce platforms is enhancing market accessibility and catering to convenience-focused consumers. Furthermore, the industry is observing a trend towards healthier, lower-alcohol alternatives, aligning with global wellness initiatives.

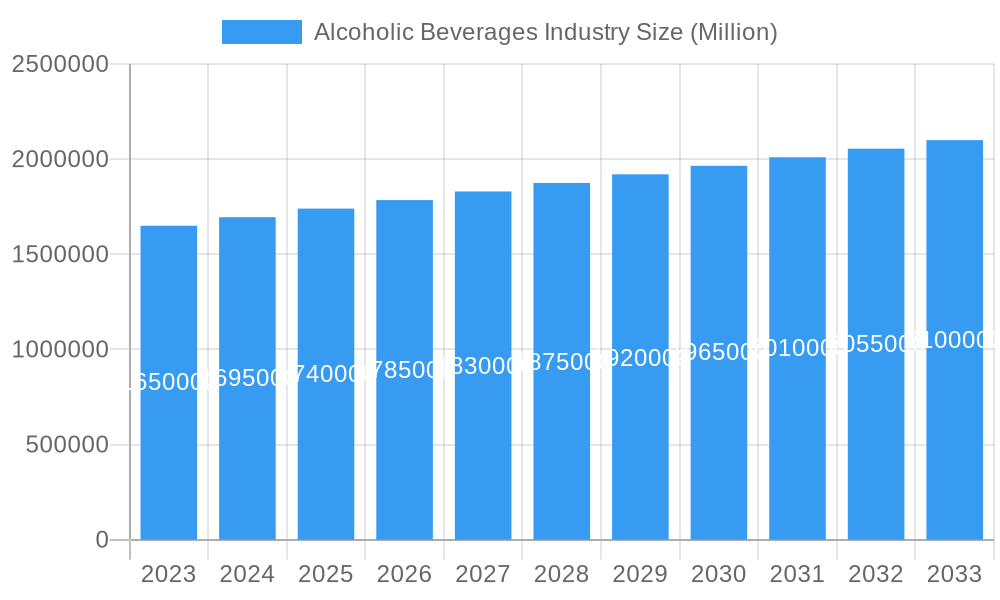

Alcoholic Beverages Industry Market Size (In Million)

Key restraints include stringent regulatory policies affecting production, marketing, and sales, alongside fluctuating raw material costs and supply chain vulnerabilities. Geographically, North America and Europe hold significant market share, supported by mature consumer bases and robust distribution networks. The Asia Pacific region, particularly China and India, is anticipated to experience the most rapid expansion, driven by a growing young adult demographic, rising incomes, and increasing acceptance of alcoholic beverages. Distribution channels are segmented, with both on-trade (bars, restaurants) and off-trade (retail, online) channels crucial for reaching varied consumer segments. Leading companies such as Heineken Holding NV, Anheuser-Busch InBev, and Diageo PLC are actively pursuing strategic acquisitions and portfolio diversification to leverage market opportunities.

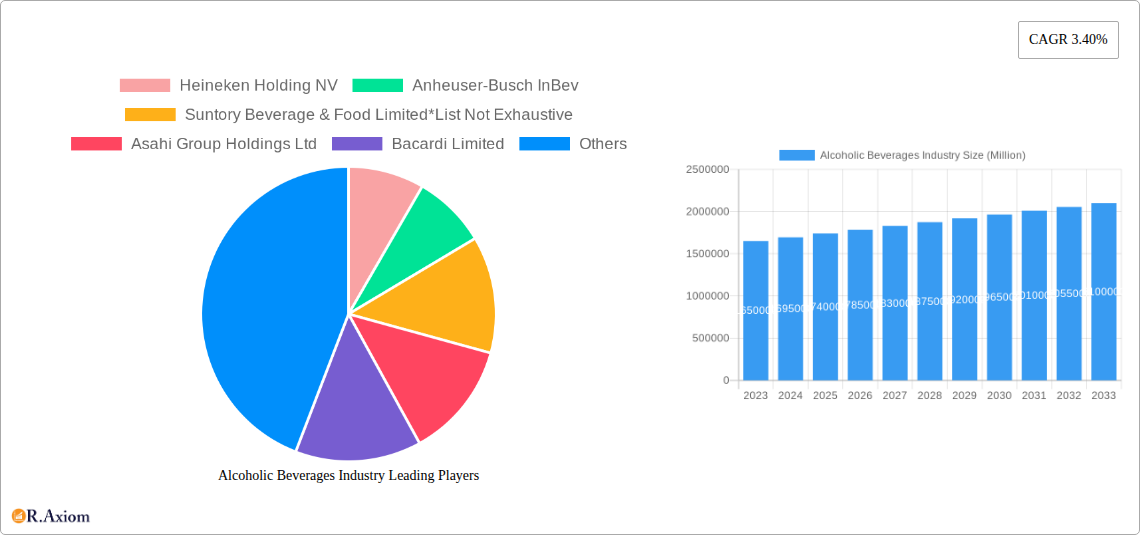

Alcoholic Beverages Industry Company Market Share

This report provides an in-depth analysis of the Alcoholic Beverages Industry, including market size, growth forecasts, and key trends.

Alcoholic Beverages Industry Market Concentration & Innovation

The global Alcoholic Beverages Industry is characterized by a moderately concentrated market, with a few dominant players holding significant market share. Leading companies like Anheuser-Busch InBev, Heineken Holding NV, and Diageo PLC consistently invest in research and development to drive innovation. Key innovation drivers include the growing demand for premium and craft alcoholic beverages, the rise of ready-to-drink (RTD) cocktails, and advancements in sustainable production and packaging. Regulatory frameworks surrounding alcohol production, distribution, and marketing significantly influence market dynamics and necessitate continuous adaptation by industry players. The availability of product substitutes, such as non-alcoholic beverages and emerging functional drinks, also shapes consumer choices and forces alcoholic beverage companies to differentiate their offerings. End-user trends are increasingly leaning towards healthier options, ethical sourcing, and unique flavor profiles. Mergers and acquisitions (M&A) are a common strategy for market expansion and portfolio diversification. For instance, recent M&A activities have focused on acquiring craft distilleries and expanding into emerging markets. The total value of M&A deals in the sector is projected to reach over $100 Million in the forecast period.

Alcoholic Beverages Industry Industry Trends & Insights

The Alcoholic Beverages Industry is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.5% from 2025 to 2033. This expansion is fueled by a confluence of evolving consumer preferences, economic development in emerging markets, and innovative product development. The increasing disposable income in developing economies is a significant market growth driver, enabling a larger consumer base to access and consume alcoholic beverages. Technological disruptions are playing a crucial role, from advanced brewing and distilling techniques to sophisticated supply chain management and e-commerce platforms that enhance distribution and accessibility. Consumer preferences are rapidly shifting towards premiumization, with a growing demand for craft beers, artisanal spirits, and high-quality wines. Health and wellness trends are also influencing the market, leading to the rise of lower-alcohol content options, organic beverages, and innovative mixers. The competitive landscape is dynamic, with both established global players and agile craft producers vying for market share. E-commerce penetration is expected to surge, further democratizing access to a wider variety of alcoholic beverages and fostering personalized consumption experiences. The global market penetration of alcoholic beverages is estimated to reach XX% by 2033.

Dominant Markets & Segments in Alcoholic Beverages Industry

The Alcoholic Beverages Industry exhibits distinct dominance across various geographical regions and product segments.

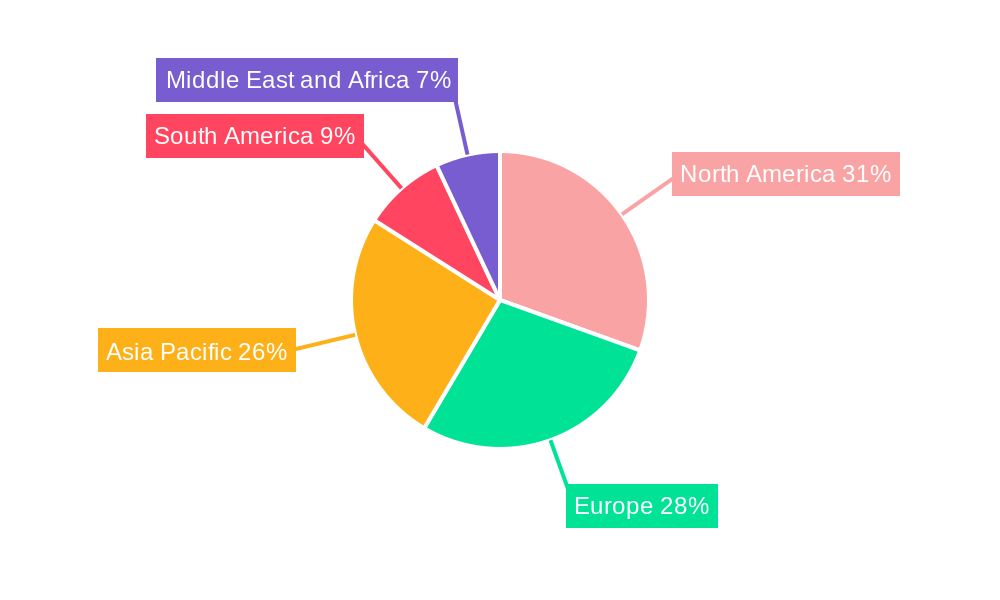

Leading Region: North America and Europe currently hold the largest market share due to established consumption patterns and high disposable incomes. However, Asia-Pacific is witnessing the fastest growth, driven by increasing urbanization, a growing middle class, and a burgeoning youth population adopting Western consumption trends. Economic policies in these regions, such as favorable trade agreements and relaxed import duties, further bolster market expansion.

Dominant Product Type - Beer: Beer, particularly Lager and Ale varieties, remains the largest segment within the alcoholic beverages market. This dominance is attributed to its widespread appeal, affordability, and continuous innovation in flavor profiles and brewing techniques. The increasing popularity of craft breweries and the introduction of unique hybrid styles further cement beer's leading position. Market share of Beer segment is expected to be XX% in 2025.

Dominant Distribution Channel - Off-trade: The off-trade channel, encompassing supermarkets/hypermarkets and online stores, commands a significant share. The convenience of purchasing alcoholic beverages for home consumption, coupled with aggressive promotional activities by retailers and the ease of online ordering and delivery, fuels this dominance. Online stores are experiencing particularly rapid growth, catering to a younger demographic and a demand for niche products. Market share of Off-trade channel is estimated to be XX% in 2025.

Dominant Product Type - Spirits: Spirits, especially Whiskey and Vodka, constitute a substantial and growing segment. The premiumization trend is highly evident here, with consumers willing to spend more on aged spirits and artisanal creations. The expansion of ready-to-drink (RTD) spirit-based beverages is also a key growth driver. Market share of Spirits segment is projected to be XX% in 2025.

Dominant Product Type - Wines: Wines continue to be a strong performer, with growth driven by an increasing appreciation for diverse varietals and regions, as well as the availability of accessible price points. The rise of wine-based cocktails and the growing popularity of sparkling wines also contribute to this segment's strength. Market share of Wines segment is estimated to be XX% in 2025.

Alcoholic Beverages Industry Product Developments

Product development in the Alcoholic Beverages Industry is a dynamic arena driven by innovation and a keen understanding of consumer desires. Companies are focusing on creating novel flavors, lower-alcohol alternatives, and functional beverages. For instance, the rise of RTD cocktails, infused spirits, and craft beers with unique botanicals or experimental brewing methods highlights the industry's agility. Technological advancements in fermentation and distillation are enabling greater precision and consistency, leading to premium quality products. These developments offer competitive advantages by catering to evolving health-conscious trends, a desire for convenience, and a pursuit of novel taste experiences, thereby expanding the market appeal and driving sales.

Report Scope & Segmentation Analysis

This report offers a comprehensive analysis of the global Alcoholic Beverages Industry, segmented by Product Type and Distribution Channel.

Product Type Segmentation: The analysis covers Beer (including Ale, Lager, and Hybrid varieties), Spirits (comprising Rum, Vodka, Whiskey, and Other Spirits), Wines, and Other Product Types. Each segment's market size, growth projections, and competitive dynamics are detailed, with Beer expected to maintain its leading position, while Spirits and Wines are anticipated to witness significant expansion.

Distribution Channel Segmentation: The report further breaks down the market by Distribution Channel, including On-trade (bars, restaurants, hotels) and Off-trade (Supermarkets/Hypermarkets, Specialist Stores, Online Stores, and Other Off-trade Channels). The Off-trade channel, particularly online sales, is projected for substantial growth, driven by convenience and e-commerce advancements.

Key Drivers of Alcoholic Beverages Industry Growth

The Alcoholic Beverages Industry's growth is propelled by several key factors. Economic development in emerging markets significantly increases disposable income and consumer spending power. The growing trend of premiumization, where consumers opt for higher-quality, artisanal, and craft beverages, is a major revenue driver. Technological advancements in production, distribution, and packaging enhance efficiency and product appeal. Evolving consumer preferences for unique flavors, lower-alcohol options, and healthier alternatives are also shaping market demand. Furthermore, strategic marketing campaigns and expanding distribution networks, especially through online channels, are crucial for reaching a wider consumer base.

Challenges in the Alcoholic Beverages Industry Sector

Despite its growth potential, the Alcoholic Beverages Industry faces several challenges. Stringent and complex regulatory frameworks across different regions can impede market entry and product promotion. Public health concerns and rising awareness about the harmful effects of excessive alcohol consumption lead to increased scrutiny and potential taxation. Supply chain disruptions, including fluctuations in raw material prices and logistical complexities, can impact production costs and availability. Intense competition from both established global brands and a proliferation of craft producers puts pressure on profit margins. The threat of product substitutes, such as non-alcoholic beverages and functional drinks, also requires continuous innovation and differentiation.

Emerging Opportunities in Alcoholic Beverages Industry

The Alcoholic Beverages Industry is ripe with emerging opportunities. The rapidly expanding market for Ready-to-Drink (RTD) beverages, including hard seltzers and pre-mixed cocktails, presents significant growth potential. The increasing demand for low-alcohol and no-alcohol alternatives caters to health-conscious consumers and offers new avenues for product development. The rise of e-commerce and direct-to-consumer (DTC) sales channels provides unprecedented reach and personalized engagement opportunities. Furthermore, the growing interest in sustainable and ethically sourced alcoholic products opens doors for brands that prioritize these values. Exploring niche markets and unique flavor profiles, such as exotic fruit-infused spirits or heritage grain beers, also offers untapped potential.

Leading Players in the Alcoholic Beverages Industry Market

- Heineken Holding NV

- Anheuser-Busch InBev

- Suntory Beverage & Food Limited

- Asahi Group Holdings Ltd

- Bacardi Limited

- Constellation Brands Inc

- Carlsberg Group

- Molson Coors Brewing Company

- Boston Beer Company Inc

- Diageo PLC

Key Developments in Alcoholic Beverages Industry Industry

- November 2022: Diageo acquired Balcones Distilling (often known as "Balcones"), a Texas craft distiller and one of the leading manufacturers of American Single Malt Whisky in the United States, significantly bolstering its premium spirits portfolio.

- October 2022: Bacardi launched an Indian-made whiskey named Legacy. Bacardi intends to create a discount pricing category for its customers through Legacy in order to further strengthen its expansion plan in India.

- March 2022: Constellation Brands Inc., a leading beverage alcohol company, entered a brand authorization agreement with The Coca-Cola Company in the United States to bring the FRESCA brand into the alcohol beverages category, signaling a move into novel RTD categories.

Strategic Outlook for Alcoholic Beverages Industry Market

The strategic outlook for the Alcoholic Beverages Industry is marked by continued innovation and global expansion. Companies will focus on capitalizing on premiumization trends, developing healthier and lower-alcohol alternatives, and leveraging the burgeoning e-commerce landscape for direct-to-consumer sales. Investment in sustainable practices and ethical sourcing will become increasingly crucial for brand reputation and consumer loyalty. Strategic partnerships and targeted acquisitions will remain vital for market consolidation and entering new geographies or product categories. The industry's ability to adapt to evolving consumer preferences and regulatory landscapes will be key to sustained growth and profitability in the coming years, with a projected market value exceeding $1 Trillion by 2033.

Alcoholic Beverages Industry Segmentation

-

1. Product Type

-

1.1. Beer

- 1.1.1. Ale

- 1.1.2. Lager

- 1.1.3. Hybrid

-

1.2. Spirits

- 1.2.1. Rum

- 1.2.2. Vodka

- 1.2.3. Whiskey

- 1.2.4. Other Spirits

- 1.3. Wines

- 1.4. Other Product Types

-

1.1. Beer

-

2. Distribution Channel

- 2.1. On-trade

-

2.2. Off -trade

- 2.2.1. Supemarkets/Hypermarkets

- 2.2.2. Specialist Stores

- 2.2.3. Online Stores

- 2.2.4. Other Off-trade Channels

Alcoholic Beverages Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Spain

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Alcoholic Beverages Industry Regional Market Share

Geographic Coverage of Alcoholic Beverages Industry

Alcoholic Beverages Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.37% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Convenience Offered By Online Food Delivery Services; Attractive Offers And Memberships Along With Advertisements And Marketing By Players

- 3.3. Market Restrains

- 3.3.1. Consumers Desire For Fine Dining Experience

- 3.4. Market Trends

- 3.4.1. Premiumization is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Alcoholic Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Beer

- 5.1.1.1. Ale

- 5.1.1.2. Lager

- 5.1.1.3. Hybrid

- 5.1.2. Spirits

- 5.1.2.1. Rum

- 5.1.2.2. Vodka

- 5.1.2.3. Whiskey

- 5.1.2.4. Other Spirits

- 5.1.3. Wines

- 5.1.4. Other Product Types

- 5.1.1. Beer

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-trade

- 5.2.2. Off -trade

- 5.2.2.1. Supemarkets/Hypermarkets

- 5.2.2.2. Specialist Stores

- 5.2.2.3. Online Stores

- 5.2.2.4. Other Off-trade Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Alcoholic Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Beer

- 6.1.1.1. Ale

- 6.1.1.2. Lager

- 6.1.1.3. Hybrid

- 6.1.2. Spirits

- 6.1.2.1. Rum

- 6.1.2.2. Vodka

- 6.1.2.3. Whiskey

- 6.1.2.4. Other Spirits

- 6.1.3. Wines

- 6.1.4. Other Product Types

- 6.1.1. Beer

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-trade

- 6.2.2. Off -trade

- 6.2.2.1. Supemarkets/Hypermarkets

- 6.2.2.2. Specialist Stores

- 6.2.2.3. Online Stores

- 6.2.2.4. Other Off-trade Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Alcoholic Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Beer

- 7.1.1.1. Ale

- 7.1.1.2. Lager

- 7.1.1.3. Hybrid

- 7.1.2. Spirits

- 7.1.2.1. Rum

- 7.1.2.2. Vodka

- 7.1.2.3. Whiskey

- 7.1.2.4. Other Spirits

- 7.1.3. Wines

- 7.1.4. Other Product Types

- 7.1.1. Beer

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-trade

- 7.2.2. Off -trade

- 7.2.2.1. Supemarkets/Hypermarkets

- 7.2.2.2. Specialist Stores

- 7.2.2.3. Online Stores

- 7.2.2.4. Other Off-trade Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Alcoholic Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Beer

- 8.1.1.1. Ale

- 8.1.1.2. Lager

- 8.1.1.3. Hybrid

- 8.1.2. Spirits

- 8.1.2.1. Rum

- 8.1.2.2. Vodka

- 8.1.2.3. Whiskey

- 8.1.2.4. Other Spirits

- 8.1.3. Wines

- 8.1.4. Other Product Types

- 8.1.1. Beer

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-trade

- 8.2.2. Off -trade

- 8.2.2.1. Supemarkets/Hypermarkets

- 8.2.2.2. Specialist Stores

- 8.2.2.3. Online Stores

- 8.2.2.4. Other Off-trade Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Alcoholic Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Beer

- 9.1.1.1. Ale

- 9.1.1.2. Lager

- 9.1.1.3. Hybrid

- 9.1.2. Spirits

- 9.1.2.1. Rum

- 9.1.2.2. Vodka

- 9.1.2.3. Whiskey

- 9.1.2.4. Other Spirits

- 9.1.3. Wines

- 9.1.4. Other Product Types

- 9.1.1. Beer

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. On-trade

- 9.2.2. Off -trade

- 9.2.2.1. Supemarkets/Hypermarkets

- 9.2.2.2. Specialist Stores

- 9.2.2.3. Online Stores

- 9.2.2.4. Other Off-trade Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Alcoholic Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Beer

- 10.1.1.1. Ale

- 10.1.1.2. Lager

- 10.1.1.3. Hybrid

- 10.1.2. Spirits

- 10.1.2.1. Rum

- 10.1.2.2. Vodka

- 10.1.2.3. Whiskey

- 10.1.2.4. Other Spirits

- 10.1.3. Wines

- 10.1.4. Other Product Types

- 10.1.1. Beer

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. On-trade

- 10.2.2. Off -trade

- 10.2.2.1. Supemarkets/Hypermarkets

- 10.2.2.2. Specialist Stores

- 10.2.2.3. Online Stores

- 10.2.2.4. Other Off-trade Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Heineken Holding NV

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Anheuser-Busch InBev

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Suntory Beverage & Food Limited*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Asahi Group Holdings Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bacardi Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Constellation Brands Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Carlsberg Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Molson Coors Brewing Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Boston Beer Company Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Diageo PLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Heineken Holding NV

List of Figures

- Figure 1: Global Alcoholic Beverages Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Alcoholic Beverages Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Alcoholic Beverages Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Alcoholic Beverages Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: North America Alcoholic Beverages Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Alcoholic Beverages Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Alcoholic Beverages Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Alcoholic Beverages Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 9: Europe Alcoholic Beverages Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Alcoholic Beverages Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 11: Europe Alcoholic Beverages Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Alcoholic Beverages Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Alcoholic Beverages Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Alcoholic Beverages Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Alcoholic Beverages Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Alcoholic Beverages Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Alcoholic Beverages Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Alcoholic Beverages Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Alcoholic Beverages Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Alcoholic Beverages Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 21: South America Alcoholic Beverages Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Alcoholic Beverages Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: South America Alcoholic Beverages Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Alcoholic Beverages Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Alcoholic Beverages Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Alcoholic Beverages Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Alcoholic Beverages Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Alcoholic Beverages Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Alcoholic Beverages Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Alcoholic Beverages Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Alcoholic Beverages Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Alcoholic Beverages Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Alcoholic Beverages Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Alcoholic Beverages Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Alcoholic Beverages Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Global Alcoholic Beverages Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Alcoholic Beverages Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Alcoholic Beverages Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Alcoholic Beverages Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Alcoholic Beverages Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Alcoholic Beverages Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Alcoholic Beverages Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: Global Alcoholic Beverages Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Alcoholic Beverages Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 14: United Kingdom Alcoholic Beverages Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Germany Alcoholic Beverages Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Spain Alcoholic Beverages Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Alcoholic Beverages Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Alcoholic Beverages Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Russia Alcoholic Beverages Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Alcoholic Beverages Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Alcoholic Beverages Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Global Alcoholic Beverages Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Alcoholic Beverages Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: China Alcoholic Beverages Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Japan Alcoholic Beverages Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: India Alcoholic Beverages Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Australia Alcoholic Beverages Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Alcoholic Beverages Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Alcoholic Beverages Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 30: Global Alcoholic Beverages Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Alcoholic Beverages Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Brazil Alcoholic Beverages Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Argentina Alcoholic Beverages Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Alcoholic Beverages Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Global Alcoholic Beverages Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 36: Global Alcoholic Beverages Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Alcoholic Beverages Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 38: United Arab Emirates Alcoholic Beverages Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: South Africa Alcoholic Beverages Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Alcoholic Beverages Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Alcoholic Beverages Industry?

The projected CAGR is approximately 2.37%.

2. Which companies are prominent players in the Alcoholic Beverages Industry?

Key companies in the market include Heineken Holding NV, Anheuser-Busch InBev, Suntory Beverage & Food Limited*List Not Exhaustive, Asahi Group Holdings Ltd, Bacardi Limited, Constellation Brands Inc, Carlsberg Group, Molson Coors Brewing Company, Boston Beer Company Inc, Diageo PLC.

3. What are the main segments of the Alcoholic Beverages Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2564.92 billion as of 2022.

5. What are some drivers contributing to market growth?

Convenience Offered By Online Food Delivery Services; Attractive Offers And Memberships Along With Advertisements And Marketing By Players.

6. What are the notable trends driving market growth?

Premiumization is Driving the Market.

7. Are there any restraints impacting market growth?

Consumers Desire For Fine Dining Experience.

8. Can you provide examples of recent developments in the market?

November 2022: Diageo acquired Balcones Distilling (often known as "Balcones"), a Texas craft distiller and one of the leading manufacturers of American Single Malt Whisky in the United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Alcoholic Beverages Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Alcoholic Beverages Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Alcoholic Beverages Industry?

To stay informed about further developments, trends, and reports in the Alcoholic Beverages Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence