Key Insights

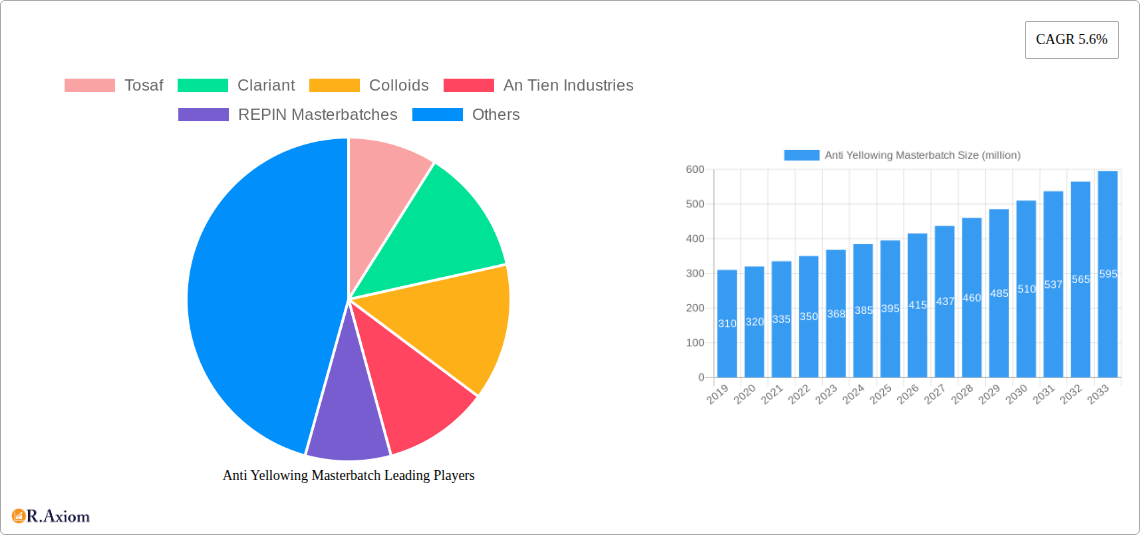

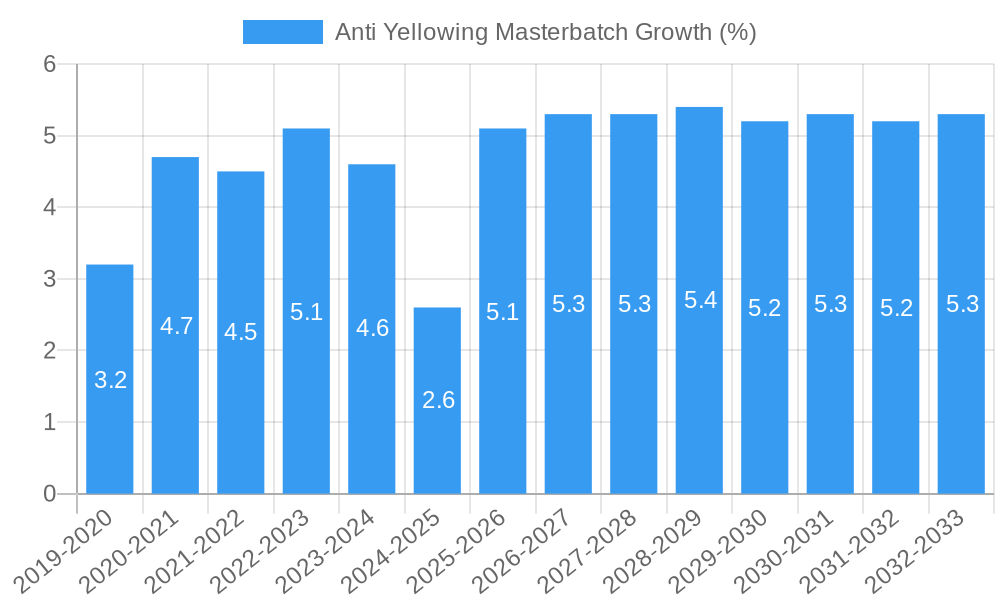

The global Anti Yellowing Masterbatch market is poised for robust expansion, projected to reach approximately $395 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 5.6% during the forecast period of 2025-2033. This growth is underpinned by increasing demand across diverse applications, notably in the construction and automobile sectors, where enhanced durability and aesthetic longevity of plastic components are paramount. The rising adoption of advanced polymer additives, designed to combat UV degradation and maintain color integrity, is a primary driver. Furthermore, the burgeoning packaging industry, particularly for sensitive products requiring extended shelf life and visual appeal, is contributing significantly to market uptake. The continuous innovation in masterbatch formulations, offering improved performance and cost-effectiveness, is also fueling market penetration.

Key trends shaping the anti yellowing masterbatch landscape include the development of eco-friendly and sustainable masterbatch solutions, aligning with global environmental regulations and consumer preferences for greener products. The integration of advanced UV stabilizers and antioxidants within these masterbatches is a critical focus for manufacturers seeking to offer superior protection against yellowing and material degradation. The market is also witnessing a growing preference for customized masterbatch solutions tailored to specific polymer types and end-use requirements, thereby enhancing product performance and brand value for plastic manufacturers. While the market demonstrates a strong upward trajectory, challenges such as fluctuating raw material prices and intense competition among key players like Tosaf, Clariant, and Colloids are factors that require strategic navigation. However, the overarching demand for high-performance plastic products across major industries is expected to propel the anti yellowing masterbatch market towards sustained and significant growth.

This detailed report provides an in-depth analysis of the global Anti Yellowing Masterbatch Market, covering the historical period (2019–2024), base year (2025), and a comprehensive forecast period (2025–2033). The study offers actionable insights for industry stakeholders, including manufacturers, suppliers, and investors, to navigate the evolving landscape of UV stabilizers and colorants for plastics. Our analysis focuses on market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, M&A activities, industry trends, dominant markets and segments, product developments, key drivers, challenges, emerging opportunities, leading players, and strategic outlook. With a projected market size of over $1,000 million by 2025 and a compound annual growth rate (CAGR) of 6.5% during the forecast period, the anti-yellowing masterbatch sector presents significant growth potential.

Anti Yellowing Masterbatch Market Concentration & Innovation

The Anti Yellowing Masterbatch Market exhibits a moderate level of concentration, with a significant presence of both large multinational corporations and specialized regional players. Innovation is a key differentiator, driven by the constant demand for enhanced UV protection, improved color stability, and eco-friendly solutions. Regulatory frameworks, particularly those concerning REACH and RoHS compliance, are shaping product development and market entry strategies. Product substitutes, such as standalone UV stabilizers and alternative polymer formulations, pose a competitive challenge, but the cost-effectiveness and ease of incorporation of masterbatches maintain their dominance. End-user trends lean towards increased demand for durable, aesthetically pleasing plastic products across various applications. Mergers and acquisitions (M&A) are observed as companies seek to expand their product portfolios, geographical reach, and technological capabilities. Notable M&A deals have been valued in the range of $10 million to $100 million. Companies like Tosaf, Clariant, and Colloids are actively engaged in strategic acquisitions to consolidate their market positions.

Key Innovation Drivers:

- Development of advanced UV absorber technologies.

- Creation of masterbatches with enhanced thermal stability.

- Introduction of sustainable and bio-based masterbatch formulations.

- Customization of masterbatches for specific polymer types and applications.

Regulatory Impact:

- Stringent environmental regulations drive the adoption of safer and compliant masterbatch formulations.

- Compliance with global standards ensures market access and broad applicability.

Anti Yellowing Masterbatch Industry Trends & Insights

The Anti Yellowing Masterbatch Industry is experiencing robust growth, fueled by escalating demand for high-performance and long-lasting plastic products across diverse sectors. The increasing awareness regarding the detrimental effects of UV radiation on polymer integrity and aesthetics is a primary growth driver. Technological advancements in polymer science and additive manufacturing are leading to the development of more effective and specialized anti-yellowing masterbatches. Consumer preferences are shifting towards products with superior visual appeal and extended service life, directly impacting the demand for these critical additives. The competitive landscape is characterized by intense rivalry among established players and emerging manufacturers, leading to continuous innovation and price competition. The market penetration of anti-yellowing masterbatches is steadily increasing as industries recognize their value in preventing premature degradation and maintaining product quality. The CAGR for this market is estimated at 6.5% over the forecast period. The global market size is projected to exceed $1,000 million by the end of 2025.

Market Growth Drivers:

- Expanding applications in the construction industry, including siding, window profiles, and roofing materials, requiring enhanced weatherability.

- Growth in the automotive sector, demanding durable interior and exterior plastic components that resist sun damage and maintain aesthetic appeal.

- Increasing use of plastics in agriculture for greenhouses, irrigation systems, and protective films, necessitating UV resistance.

- Rising demand for consumer goods, electronics, and packaging that require long-term color stability and material integrity.

- Technological advancements in masterbatch formulations, offering improved performance and cost-effectiveness.

Technological Disruptions:

- Development of nano-particle based UV stabilizers for superior protection.

- Integration of anti-yellowing properties with other functionalities, such as flame retardancy and antistatic properties.

- Focus on high-performance polymers like TPU and PET requiring specialized masterbatch solutions.

Dominant Markets & Segments in Anti Yellowing Masterbatch

The Anti Yellowing Masterbatch Market is segmented by Application and Type, with distinct regional dominance and segment-specific growth drivers. The Automobile application segment is a leading market due to the stringent requirements for UV resistance in interior and exterior plastic components, contributing approximately 30% of the total market revenue. The Construction sector follows closely, driven by the need for durable building materials like window profiles, siding, and roofing membranes that withstand prolonged UV exposure, accounting for an estimated 25% of market share. The Agriculture sector, with its use of films, pipes, and greenhouse coverings, represents a growing segment, contributing around 20% to market revenue, driven by the need for extended product lifespan in harsh environmental conditions. The "Others" category, encompassing consumer goods, electronics, and packaging, collectively holds the remaining 25% share.

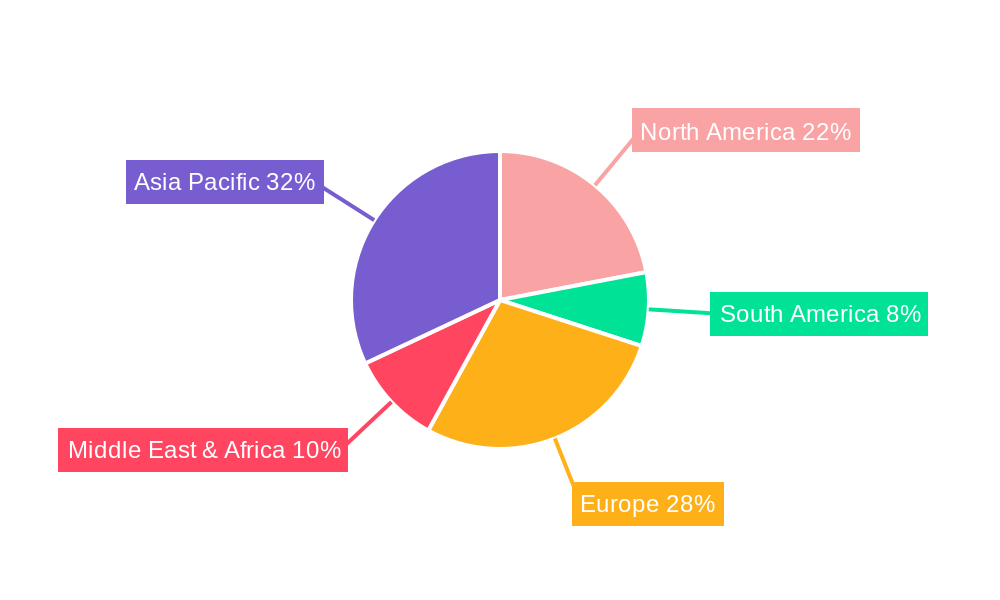

In terms of material Type, PP Material dominates the market due to its widespread use in various applications, including automotive parts, consumer goods, and packaging, representing approximately 40% of the market. TPU Material is a significant and growing segment, particularly in automotive and footwear applications, where flexibility and UV resistance are crucial, accounting for around 25% of the market. PET Material, used in packaging and textiles, also holds a substantial share, estimated at 20%. The "Others" material type, including various specialized polymers, constitutes the remaining 15%. Geographically, Asia-Pacific emerges as the dominant region, driven by its robust manufacturing base, growing automotive and construction industries, and increasing investments in plastic production. North America and Europe follow, with mature markets demanding high-performance and sustainable solutions.

Dominant Application Segments:

- Automobile: High demand for UV-resistant interior and exterior components.

- Construction: Essential for weather-resistant building materials like profiles, siding, and roofing.

- Agriculture: Crucial for extending the lifespan of films, pipes, and greenhouse structures.

- Others: Encompasses consumer goods, electronics, and packaging requiring color stability.

Dominant Material Types:

- PP Material: Versatile and widely used across various industries.

- TPU Material: High-performance, flexible, and UV-resistant applications.

- PET Material: Dominant in packaging and textile industries.

- Others: Specialized polymers catering to niche applications.

Anti Yellowing Masterbatch Product Developments

Product developments in the Anti Yellowing Masterbatch sector are focused on enhancing UV protection efficiency, improving long-term color stability, and offering eco-friendly alternatives. Innovations include the development of advanced UV absorber chemistries and hindered amine light stabilizers (HALS) that provide superior performance at lower concentrations. Manufacturers are also introducing masterbatches with enhanced compatibility with a wider range of polymer matrices, including challenging materials like TPU and PET. Competitive advantages are being achieved through customized formulations tailored to specific end-user requirements, ensuring optimal performance and cost-effectiveness. The integration of anti-yellowing properties with other functional additives, such as antioxidants and flame retardants, is also a key trend, offering a consolidated solution for manufacturers.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the Anti Yellowing Masterbatch Market by Application and Type. The Application segments include Agriculture, Construction, Automobile, and Others. The Type segments cover TPU Material, PET Material, PP Material, and Others.

Application Segments:

- Agriculture: Expected to witness a CAGR of 7.0%, driven by the growing need for durable agricultural films and irrigation systems. Market size projected to reach $200 million by 2033.

- Construction: Projected to grow at a CAGR of 6.8%, fueled by increasing infrastructure development and demand for weather-resistant building materials. Market size estimated to reach $250 million by 2033.

- Automobile: Anticipated to grow at a CAGR of 6.2%, supported by the increasing use of lightweight plastics and the demand for aesthetic durability in vehicles. Market size forecast to be $300 million by 2033.

- Others: Expected to experience a CAGR of 6.0%, encompassing a broad range of consumer goods, electronics, and packaging. Market size projected to reach $250 million by 2033.

Type Segments:

- TPU Material: Expected to grow at a CAGR of 7.5%, driven by its use in high-performance applications requiring flexibility and UV resistance. Market size projected to reach $250 million by 2033.

- PET Material: Anticipated to grow at a CAGR of 6.5%, supported by its widespread use in packaging and textiles. Market size forecast to be $200 million by 2033.

- PP Material: Expected to witness a CAGR of 6.3%, due to its broad applicability across industries. Market size projected to reach $400 million by 2033.

- Others: Projected to grow at a CAGR of 5.8%, covering specialized polymers. Market size estimated to reach $150 million by 2033.

Key Drivers of Anti Yellowing Masterbatch Growth

The Anti Yellowing Masterbatch Market is propelled by several key drivers. Technological advancements in UV stabilization, such as the development of highly efficient UV absorbers and hindered amine light stabilizers (HALS), are crucial. Economic factors, including the growing global demand for durable and aesthetically pleasing plastic products in construction, automotive, and consumer goods sectors, play a significant role. Regulatory frameworks, such as REACH and RoHS compliance, are pushing manufacturers to adopt safer and more effective masterbatch solutions. Increasing awareness among end-users regarding the benefits of UV protection for extending product lifespan and maintaining visual appeal further fuels market expansion. The widespread adoption of plastics in various industries also directly contributes to the demand for anti-yellowing masterbatches.

Challenges in the Anti Yellowing Masterbatch Sector

Despite the positive growth trajectory, the Anti Yellowing Masterbatch Sector faces certain challenges. Regulatory hurdles, particularly the evolving compliance requirements across different regions, can pose difficulties for manufacturers. Supply chain disruptions and raw material price volatility can impact production costs and market stability. Intense competition among established players and emerging manufacturers can lead to price erosion. The development of alternative materials and advanced polymer formulations that inherently possess better UV resistance could also pose a competitive threat. Ensuring consistent product quality and performance across diverse polymer types and processing conditions requires significant R&D investment.

Emerging Opportunities in Anti Yellowing Masterbatch

Emerging opportunities within the Anti Yellowing Masterbatch Market are abundant. The growing demand for sustainable and bio-based masterbatch solutions presents a significant avenue for innovation and market penetration. The expansion of plastic applications in emerging economies, particularly in infrastructure development and the automotive sector, offers substantial growth potential. The development of smart masterbatches with integrated functionalities, such as self-healing properties or color-changing indicators, represents a future trend. Furthermore, the increasing focus on circular economy principles encourages the development of masterbatches that enhance the recyclability and durability of plastic products.

Leading Players in the Anti Yellowing Masterbatch Market

- Tosaf

- Clariant

- Colloids

- An Tien Industries

- REPIN Masterbatches

- Prime Minister

- Kanpur Plastipack

- Artience Group

- XINOMER

- Sonali Group

- GO YEN Chemical Industrial

- Dongguan Excelle Chemical Technology

Key Developments in Anti Yellowing Masterbatch Industry

- 2024 Q1: Clariant launches a new range of high-performance UV stabilizers for demanding automotive applications.

- 2023 Q4: Tosaf expands its production capacity for anti-yellowing masterbatches to meet rising demand in Asia.

- 2023 Q3: Colloids introduces a new bio-based anti-yellowing masterbatch, aligning with sustainability trends.

- 2023 Q2: An Tien Industries announces a strategic partnership to enhance its distribution network for anti-yellowing masterbatches in Southeast Asia.

- 2023 Q1: REPIN Masterbatches develops a specialized anti-yellowing solution for TPU materials, targeting the footwear industry.

- 2022 Q4: Artience Group acquires a smaller player in the masterbatch sector to strengthen its product portfolio.

- 2022 Q3: XINOMER invests in R&D to develop advanced UV protection technologies for high-temperature polymer applications.

- 2022 Q2: Sonali Group launches an innovative anti-yellowing masterbatch for agricultural films with extended UV protection.

- 2022 Q1: GO YEN Chemical Industrial focuses on expanding its product offerings for the construction industry.

- 2021 Q4: Dongguan Excelle Chemical Technology introduces cost-effective anti-yellowing masterbatch solutions for general-purpose plastics.

Strategic Outlook for Anti Yellowing Masterbatch Market

- 2024 Q1: Clariant launches a new range of high-performance UV stabilizers for demanding automotive applications.

- 2023 Q4: Tosaf expands its production capacity for anti-yellowing masterbatches to meet rising demand in Asia.

- 2023 Q3: Colloids introduces a new bio-based anti-yellowing masterbatch, aligning with sustainability trends.

- 2023 Q2: An Tien Industries announces a strategic partnership to enhance its distribution network for anti-yellowing masterbatches in Southeast Asia.

- 2023 Q1: REPIN Masterbatches develops a specialized anti-yellowing solution for TPU materials, targeting the footwear industry.

- 2022 Q4: Artience Group acquires a smaller player in the masterbatch sector to strengthen its product portfolio.

- 2022 Q3: XINOMER invests in R&D to develop advanced UV protection technologies for high-temperature polymer applications.

- 2022 Q2: Sonali Group launches an innovative anti-yellowing masterbatch for agricultural films with extended UV protection.

- 2022 Q1: GO YEN Chemical Industrial focuses on expanding its product offerings for the construction industry.

- 2021 Q4: Dongguan Excelle Chemical Technology introduces cost-effective anti-yellowing masterbatch solutions for general-purpose plastics.

Strategic Outlook for Anti Yellowing Masterbatch Market

The strategic outlook for the Anti Yellowing Masterbatch Market is highly positive, driven by sustained demand for durable and visually appealing plastic products. Growth catalysts include the continued innovation in UV stabilization technologies, the increasing adoption of sustainable solutions, and the expansion of plastic applications in key industries like automotive, construction, and agriculture. Emerging markets present significant untapped potential, and companies that focus on developing customized formulations, ensuring regulatory compliance, and investing in R&D for enhanced performance will be well-positioned for success. Strategic collaborations and potential M&A activities are expected to shape the competitive landscape, further consolidating the market and driving technological advancements.

Anti Yellowing Masterbatch Segmentation

-

1. Application

- 1.1. Agriculture

- 1.2. Construction

- 1.3. Automobile

- 1.4. Others

-

2. Type

- 2.1. TPU Material

- 2.2. PET Material

- 2.3. PP Material

- 2.4. Others

Anti Yellowing Masterbatch Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Anti Yellowing Masterbatch REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.6% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Anti Yellowing Masterbatch Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Agriculture

- 5.1.2. Construction

- 5.1.3. Automobile

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. TPU Material

- 5.2.2. PET Material

- 5.2.3. PP Material

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Anti Yellowing Masterbatch Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Agriculture

- 6.1.2. Construction

- 6.1.3. Automobile

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. TPU Material

- 6.2.2. PET Material

- 6.2.3. PP Material

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Anti Yellowing Masterbatch Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Agriculture

- 7.1.2. Construction

- 7.1.3. Automobile

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. TPU Material

- 7.2.2. PET Material

- 7.2.3. PP Material

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Anti Yellowing Masterbatch Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Agriculture

- 8.1.2. Construction

- 8.1.3. Automobile

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. TPU Material

- 8.2.2. PET Material

- 8.2.3. PP Material

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Anti Yellowing Masterbatch Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Agriculture

- 9.1.2. Construction

- 9.1.3. Automobile

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. TPU Material

- 9.2.2. PET Material

- 9.2.3. PP Material

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Anti Yellowing Masterbatch Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Agriculture

- 10.1.2. Construction

- 10.1.3. Automobile

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. TPU Material

- 10.2.2. PET Material

- 10.2.3. PP Material

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Tosaf

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Clariant

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Colloids

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 An Tien Industries

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 REPIN Masterbatches

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Prime Minister

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kanpur Plastipack

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Artience Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 XINOMER

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sonali Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 GO YEN Chemical Industrial

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Dongguan Excelle Chemical Technology

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Tosaf

List of Figures

- Figure 1: Global Anti Yellowing Masterbatch Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Anti Yellowing Masterbatch Revenue (million), by Application 2024 & 2032

- Figure 3: North America Anti Yellowing Masterbatch Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Anti Yellowing Masterbatch Revenue (million), by Type 2024 & 2032

- Figure 5: North America Anti Yellowing Masterbatch Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Anti Yellowing Masterbatch Revenue (million), by Country 2024 & 2032

- Figure 7: North America Anti Yellowing Masterbatch Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Anti Yellowing Masterbatch Revenue (million), by Application 2024 & 2032

- Figure 9: South America Anti Yellowing Masterbatch Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Anti Yellowing Masterbatch Revenue (million), by Type 2024 & 2032

- Figure 11: South America Anti Yellowing Masterbatch Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Anti Yellowing Masterbatch Revenue (million), by Country 2024 & 2032

- Figure 13: South America Anti Yellowing Masterbatch Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Anti Yellowing Masterbatch Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Anti Yellowing Masterbatch Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Anti Yellowing Masterbatch Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Anti Yellowing Masterbatch Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Anti Yellowing Masterbatch Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Anti Yellowing Masterbatch Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Anti Yellowing Masterbatch Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Anti Yellowing Masterbatch Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Anti Yellowing Masterbatch Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Anti Yellowing Masterbatch Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Anti Yellowing Masterbatch Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Anti Yellowing Masterbatch Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Anti Yellowing Masterbatch Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Anti Yellowing Masterbatch Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Anti Yellowing Masterbatch Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Anti Yellowing Masterbatch Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Anti Yellowing Masterbatch Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Anti Yellowing Masterbatch Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Anti Yellowing Masterbatch Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Anti Yellowing Masterbatch Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Anti Yellowing Masterbatch Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Anti Yellowing Masterbatch Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Anti Yellowing Masterbatch Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Anti Yellowing Masterbatch Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Anti Yellowing Masterbatch Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Anti Yellowing Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Anti Yellowing Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Anti Yellowing Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Anti Yellowing Masterbatch Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Anti Yellowing Masterbatch Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Anti Yellowing Masterbatch Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Anti Yellowing Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Anti Yellowing Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Anti Yellowing Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Anti Yellowing Masterbatch Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Anti Yellowing Masterbatch Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Anti Yellowing Masterbatch Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Anti Yellowing Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Anti Yellowing Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Anti Yellowing Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Anti Yellowing Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Anti Yellowing Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Anti Yellowing Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Anti Yellowing Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Anti Yellowing Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Anti Yellowing Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Anti Yellowing Masterbatch Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Anti Yellowing Masterbatch Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Anti Yellowing Masterbatch Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Anti Yellowing Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Anti Yellowing Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Anti Yellowing Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Anti Yellowing Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Anti Yellowing Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Anti Yellowing Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Anti Yellowing Masterbatch Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Anti Yellowing Masterbatch Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Anti Yellowing Masterbatch Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Anti Yellowing Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Anti Yellowing Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Anti Yellowing Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Anti Yellowing Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Anti Yellowing Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Anti Yellowing Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Anti Yellowing Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Anti Yellowing Masterbatch?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the Anti Yellowing Masterbatch?

Key companies in the market include Tosaf, Clariant, Colloids, An Tien Industries, REPIN Masterbatches, Prime Minister, Kanpur Plastipack, Artience Group, XINOMER, Sonali Group, GO YEN Chemical Industrial, Dongguan Excelle Chemical Technology.

3. What are the main segments of the Anti Yellowing Masterbatch?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 395 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Anti Yellowing Masterbatch," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Anti Yellowing Masterbatch report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Anti Yellowing Masterbatch?

To stay informed about further developments, trends, and reports in the Anti Yellowing Masterbatch, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence