Key Insights

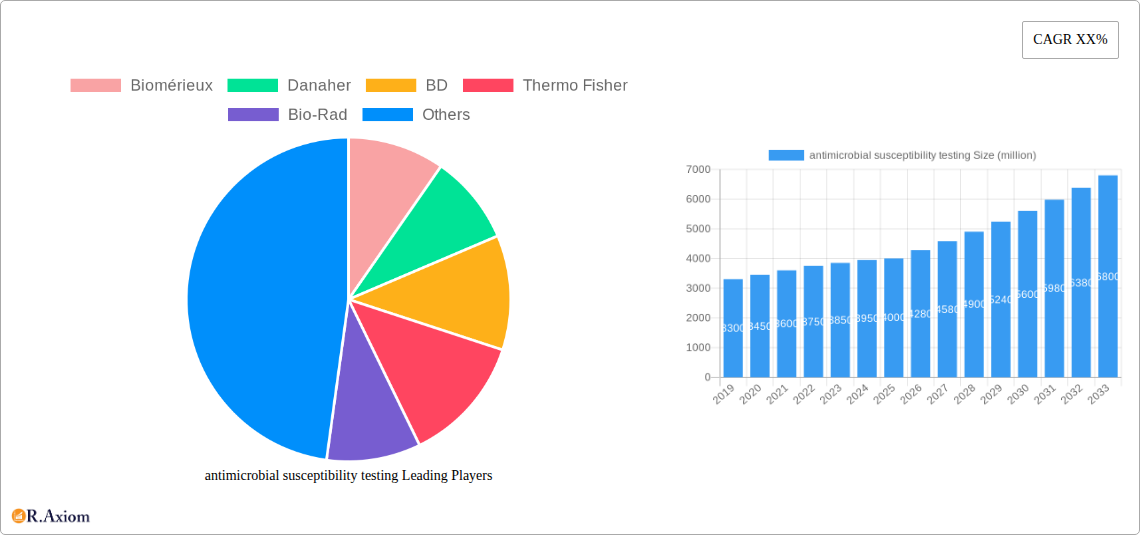

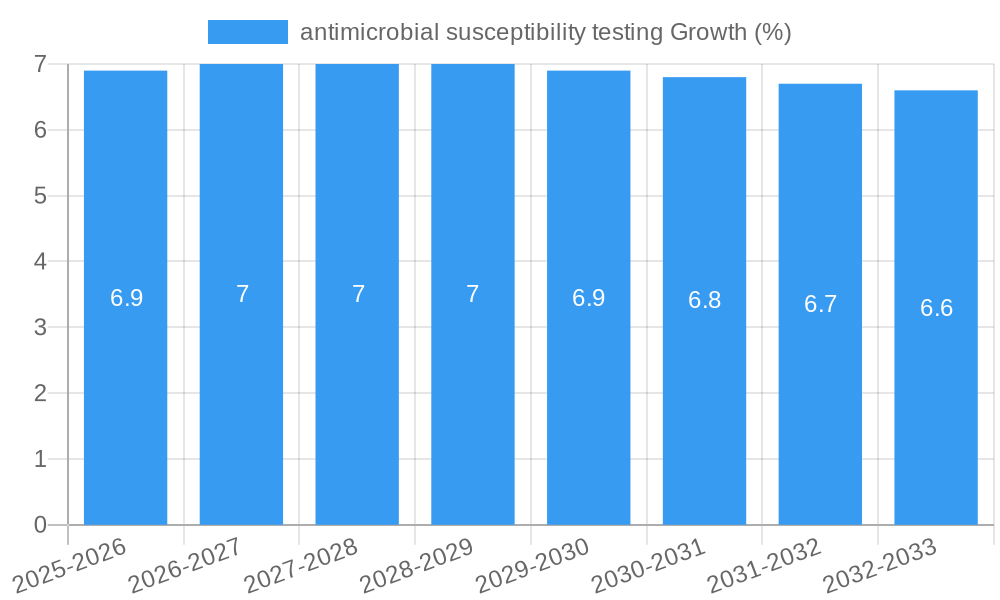

The global antimicrobial susceptibility testing (AST) market is poised for significant expansion, driven by escalating incidences of infectious diseases and the growing threat of antimicrobial resistance (AMR). Valued at approximately $4,000 million in 2025, this market is projected to witness a robust Compound Annual Growth Rate (CAGR) of 7.5% over the forecast period of 2025-2033, reaching an estimated $7,100 million by 2033. This growth trajectory is underpinned by several key drivers, including advancements in diagnostic technologies, increasing adoption of automated AST systems in clinical settings, and a heightened global focus on public health initiatives aimed at combating AMR. The rising prevalence of antibiotic-resistant bacteria, coupled with the urgent need for rapid and accurate susceptibility testing to guide effective treatment strategies, are pivotal factors propelling market growth. Furthermore, the expanding applications of AST in drug discovery and development, and epidemiological surveillance, contribute to its sustained upward momentum.

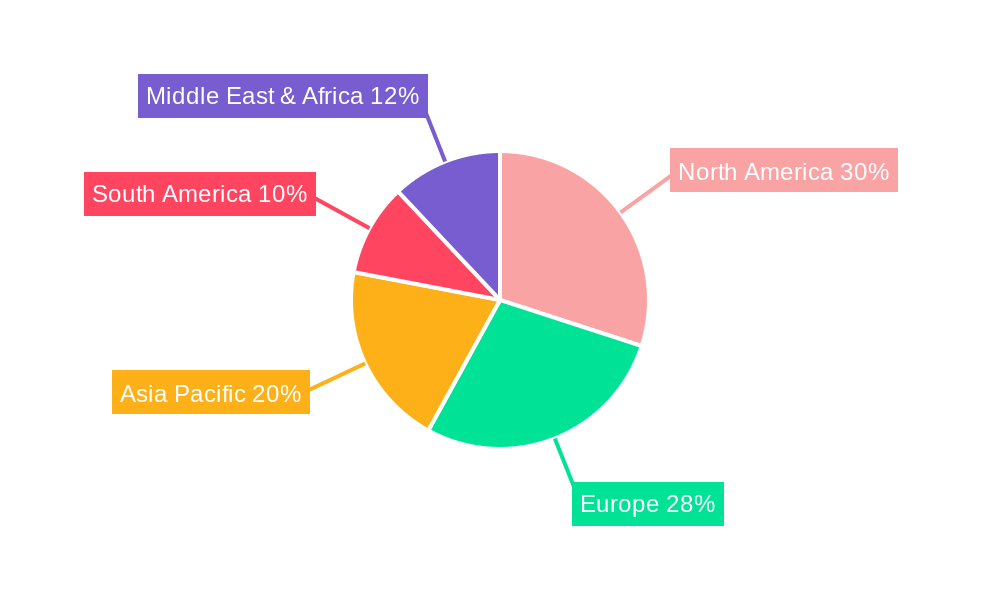

The market segmentation reveals a dynamic landscape, with clinical diagnostics dominating the application spectrum, reflecting the critical role of AST in patient care and treatment decisions. Antibacterial susceptibility testing is the largest segment by type, owing to the widespread nature of bacterial infections. However, the increasing concern over fungal infections is also fueling growth in antifungal susceptibility testing. Geographically, North America and Europe currently hold substantial market shares, driven by well-established healthcare infrastructures, higher healthcare expenditure, and stringent regulatory frameworks that promote the adoption of advanced diagnostic tools. The Asia Pacific region, however, is emerging as a high-growth market due to a burgeoning patient population, increasing awareness of infectious diseases, and significant investments in healthcare infrastructure and R&D. Restraints to market growth include the high cost of advanced AST systems and the need for skilled personnel to operate them, alongside evolving reimbursement policies in some regions. Despite these challenges, the persistent and growing threat of AMR ensures a sustained demand for effective AST solutions.

This in-depth report provides a definitive analysis of the global antimicrobial susceptibility testing (AST) market, offering crucial insights for stakeholders across clinical diagnostics, drug discovery, and public health. Covering a study period from 2019 to 2033, with a base year of 2025, this report delves into market dynamics, technological advancements, and competitive landscapes. With an estimated market size of over $5,000 million in 2025, the AST market is projected to experience significant growth, driven by the escalating threat of antimicrobial resistance (AMR) and the increasing demand for rapid and accurate diagnostic solutions. This report utilizes high-traffic keywords such as "antimicrobial susceptibility testing," "AMR," "clinical diagnostics," "drug discovery," "antibacterial susceptibility," "antifungal susceptibility," and "diagnostic solutions" to ensure maximum search visibility.

antimicrobial susceptibility testing Market Concentration & Innovation

The antimicrobial susceptibility testing market is characterized by moderate concentration, with key players like Biomérieux, Danaher, BD, Thermo Fisher, and Bio-Rad holding significant market shares, collectively accounting for an estimated 60% of the market value in 2025. Innovation is a primary driver, fueled by the urgent need for faster and more accurate diagnostic methods to combat rising antimicrobial resistance (AMR). Regulatory frameworks, particularly from agencies like the FDA and EMA, play a crucial role in shaping product development and market entry, ensuring the efficacy and safety of AST solutions. Product substitutes, while present in the form of traditional methods like disk diffusion, are increasingly being overshadowed by advanced automated systems and molecular diagnostics. End-user trends show a strong preference for integrated workflows, rapid results, and improved data management. Mergers and acquisitions (M&A) are a notable trend, with significant deal values in the past few years, reflecting the consolidation of the market and strategic expansion by leading companies. For instance, M&A activities in the historical period (2019-2024) have seen deals valued in the hundreds of millions, aiming to acquire innovative technologies and expand product portfolios.

antimicrobial susceptibility testing Industry Trends & Insights

The global antimicrobial susceptibility testing (AST) market is poised for substantial growth, driven by the relentless rise of antimicrobial resistance (AMR), a critical public health threat projected to impact millions of lives and incur billions in healthcare costs annually. The market is expected to witness a robust Compound Annual Growth Rate (CAGR) of approximately 8.5% from 2025 to 2033, projecting a market size to exceed $9,000 million by 2033. This expansion is fueled by several key trends. Technological disruptions are at the forefront, with the rapid adoption of automated, rapid AST platforms that provide results in hours rather than days, enabling timely and targeted antimicrobial therapy. Molecular diagnostic methods, including PCR-based assays and next-generation sequencing, are gaining traction for their ability to detect resistance genes directly. Consumer preferences are shifting towards cost-effective, user-friendly solutions with advanced data analytics capabilities that support antibiotic stewardship programs. Competitive dynamics are intense, with established players continuously innovating and smaller companies focusing on niche segments. The increasing prevalence of hospital-acquired infections (HAIs) and the growing immunocompromised patient population further escalate the demand for effective AST. The market penetration of advanced AST solutions is projected to increase significantly, moving from an estimated 40% in 2025 to over 70% by 2033 in developed markets. The proactive efforts by global health organizations and national governments to implement comprehensive AMR strategies are also significant growth catalysts.

Dominant Markets & Segments in antimicrobial susceptibility testing

The Clinical Diagnostics application segment is the undisputed leader in the antimicrobial susceptibility testing market, representing an estimated 70% of the total market value in 2025. This dominance is driven by the critical need for rapid and accurate identification of pathogens and their resistance profiles in patient samples to guide effective treatment decisions and prevent the spread of infections. Within this segment, Antibacterial Susceptibility Testing holds the largest share, reflecting the higher incidence and prevalence of bacterial infections. The economic policies supporting public health infrastructure and the increasing healthcare expenditure in developed and emerging economies further bolster the growth of this segment.

- Key Drivers for Clinical Diagnostics Dominance:

- Escalating rates of hospital-acquired infections (HAIs).

- Increasing incidence of multidrug-resistant organisms (MDROs).

- Growing demand for rapid point-of-care testing solutions.

- Government initiatives promoting antibiotic stewardship programs.

- Technological advancements in automated and molecular AST platforms.

The North America region is the leading geographical market for AST, driven by high healthcare spending, advanced technological adoption, a well-established regulatory framework, and a high prevalence of AMR. Within North America, the United States commands the largest share due to its extensive healthcare system and significant investment in R&D for infectious disease diagnostics.

- Key Drivers for North America's Dominance:

- High per capita healthcare spending and insurance coverage.

- Early adoption of innovative diagnostic technologies.

- Robust research and development ecosystem.

- Strong regulatory support for new diagnostic tools.

- High awareness and proactive response to AMR threats.

The Types segment is overwhelmingly dominated by Antibacterial Susceptibility Testing, estimated to account for over 85% of the market in 2025. This is primarily due to the widespread nature of bacterial infections across all age groups and health conditions. The increasing global burden of bacterial pathogens, including Gram-positive and Gram-negative bacteria, necessitates continuous and widespread AST.

- Key Drivers for Antibacterial Susceptibility Testing Dominance:

- Highest prevalence of bacterial infections compared to fungal or parasitic infections.

- Development of a wide range of antibacterial agents.

- Urgent need for prompt treatment of bacterial infections.

- Advancements in automated systems for bacterial AST.

antimicrobial susceptibility testing Product Developments

The antimicrobial susceptibility testing (AST) market is witnessing a surge in product innovations focused on speed, accuracy, and automation. Leading companies are introducing novel platforms that deliver results within hours, significantly reducing turnaround times compared to traditional methods. These developments include automated systems with advanced algorithms, real-time monitoring capabilities, and integrated data management for enhanced workflow efficiency. Innovations in molecular diagnostics are also enabling direct detection of resistance genes, offering faster identification of emerging resistance mechanisms. These advancements provide a distinct competitive advantage by addressing the critical need for rapid and precise diagnostics in combating antimicrobial resistance.

Report Scope & Segmentation Analysis

This report comprehensively segments the antimicrobial susceptibility testing (AST) market. The Application segment is analyzed across Clinical Diagnostics, Drug Discovery and Development, Epidemiology, and Other Applications. Clinical Diagnostics is the largest segment, projected to reach over $7,000 million by 2033, driven by routine diagnostic needs. Drug Discovery and Development is expected to grow at a CAGR of 7.8%, fueled by the pipeline of new antimicrobial agents. The Types segment is divided into Antibacterial Susceptibility Testing, Antifungal Susceptibility Testing, Antiparasitic Susceptibility Testing, and Other Susceptibility Testing. Antibacterial Susceptibility Testing is the dominant type, forecast to exceed $8,000 million by 2033, owing to the prevalence of bacterial infections. The competitive dynamics within each segment are shaped by technological advancements and regulatory approvals.

Key Drivers of antimicrobial susceptibility testing Growth

The antimicrobial susceptibility testing (AST) market is propelled by several critical growth drivers. The alarming global rise of antimicrobial resistance (AMR) is the foremost catalyst, necessitating accurate and rapid diagnostic tools for effective treatment. Technological advancements in automated platforms, molecular diagnostics, and AI-driven data analysis are significantly improving testing speed and precision. Increasing healthcare expenditure, particularly in emerging economies, and supportive government initiatives promoting antibiotic stewardship programs further fuel market expansion. The growing prevalence of immunocompromised patients and hospital-acquired infections also contributes to the sustained demand for AST solutions.

Challenges in the antimicrobial susceptibility testing Sector

Despite robust growth, the antimicrobial susceptibility testing (AST) sector faces several challenges. Regulatory hurdles and the lengthy approval processes for new diagnostic technologies can impede market entry and adoption. The high cost of advanced AST systems and reagents can be a barrier for resource-limited settings. Furthermore, the fragmented nature of the market, with numerous small players and diverse testing methodologies, can lead to standardization issues. Supply chain disruptions and the need for skilled personnel to operate sophisticated equipment also present significant restraints to widespread adoption.

Emerging Opportunities in antimicrobial susceptibility testing

The antimicrobial susceptibility testing (AST) market presents several promising emerging opportunities. The development of novel rapid AST methods, including point-of-care devices and lab-on-a-chip technologies, offers significant potential for decentralized testing. The increasing application of AI and machine learning in analyzing AST data can lead to predictive diagnostics and personalized treatment strategies. Expansion into underserved markets, particularly in developing countries with a high burden of infectious diseases, represents a substantial growth avenue. The growing interest in companion diagnostics for novel antimicrobial therapies also opens new avenues for AST innovation.

Leading Players in the antimicrobial susceptibility testing Market

Biomérieux Danaher BD Thermo Fisher Bio-Rad Hi-Media Merlin Liofilchem Accelerate Diagnostics Alifax Creative Diagnostics Merck Group Synbiosis Bioanalyse Zhuhai Dl Biotech

Key Developments in antimicrobial susceptibility testing Industry

- 2024 Q1: Biomérieux launches a new automated AST system with enhanced reporting capabilities for rapid identification of resistant pathogens.

- 2023 Q4: Danaher acquires a leading molecular diagnostics company, expanding its portfolio in rapid AST detection.

- 2023 Q3: BD introduces an updated platform for phenotypic AST, offering faster results for critical bacterial infections.

- 2023 Q2: Thermo Fisher announces strategic partnerships to integrate its AST solutions with hospital information systems for improved data management.

- 2023 Q1: Bio-Rad expands its offering of selective and differential culture media to support AST workflows.

- 2022 Q4: Accelerate Diagnostics receives expanded FDA clearance for its rapid phenotypic AST platform for blood culture analysis.

- 2022 Q3: Hi-Media introduces a new line of chromogenic media for rapid identification of specific bacterial pathogens in AST.

- 2022 Q2: Merlin secures CE-IVD marking for its rapid AST device, enhancing its market presence in Europe.

- 2022 Q1: Liofilchem launches a novel agar diffusion method for testing susceptibility to emerging antimicrobial agents.

- 2021 Q4: Alifax enhances its automated AST system with advanced artificial intelligence algorithms for predictive analysis.

Strategic Outlook for antimicrobial susceptibility testing Market

The strategic outlook for the antimicrobial susceptibility testing (AST) market remains highly positive, driven by the persistent global challenge of antimicrobial resistance. Future growth will be shaped by the continued development and adoption of rapid, automated, and molecular-based AST solutions. Key strategies for market players will include expanding into emerging economies, forging strategic partnerships for technology integration, and focusing on developing advanced diagnostic tools that support precision medicine and antibiotic stewardship. The increasing demand for comprehensive antimicrobial management solutions will create significant opportunities for companies that can offer innovative and cost-effective AST platforms.

antimicrobial susceptibility testing Segmentation

-

1. Application

- 1.1. Clinical Diagnostics

- 1.2. Drug Discovery and Development

- 1.3. Epidemiology

- 1.4. Other Applications

-

2. Types

- 2.1. Antibacterial Susceptibility Testing

- 2.2. Antifungal Susceptibility Testing

- 2.3. Antiparasitic Susceptibility Testing

- 2.4. Other Susceptibility Testing

antimicrobial susceptibility testing Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

antimicrobial susceptibility testing REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global antimicrobial susceptibility testing Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Clinical Diagnostics

- 5.1.2. Drug Discovery and Development

- 5.1.3. Epidemiology

- 5.1.4. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Antibacterial Susceptibility Testing

- 5.2.2. Antifungal Susceptibility Testing

- 5.2.3. Antiparasitic Susceptibility Testing

- 5.2.4. Other Susceptibility Testing

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America antimicrobial susceptibility testing Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Clinical Diagnostics

- 6.1.2. Drug Discovery and Development

- 6.1.3. Epidemiology

- 6.1.4. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Antibacterial Susceptibility Testing

- 6.2.2. Antifungal Susceptibility Testing

- 6.2.3. Antiparasitic Susceptibility Testing

- 6.2.4. Other Susceptibility Testing

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America antimicrobial susceptibility testing Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Clinical Diagnostics

- 7.1.2. Drug Discovery and Development

- 7.1.3. Epidemiology

- 7.1.4. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Antibacterial Susceptibility Testing

- 7.2.2. Antifungal Susceptibility Testing

- 7.2.3. Antiparasitic Susceptibility Testing

- 7.2.4. Other Susceptibility Testing

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe antimicrobial susceptibility testing Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Clinical Diagnostics

- 8.1.2. Drug Discovery and Development

- 8.1.3. Epidemiology

- 8.1.4. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Antibacterial Susceptibility Testing

- 8.2.2. Antifungal Susceptibility Testing

- 8.2.3. Antiparasitic Susceptibility Testing

- 8.2.4. Other Susceptibility Testing

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa antimicrobial susceptibility testing Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Clinical Diagnostics

- 9.1.2. Drug Discovery and Development

- 9.1.3. Epidemiology

- 9.1.4. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Antibacterial Susceptibility Testing

- 9.2.2. Antifungal Susceptibility Testing

- 9.2.3. Antiparasitic Susceptibility Testing

- 9.2.4. Other Susceptibility Testing

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific antimicrobial susceptibility testing Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Clinical Diagnostics

- 10.1.2. Drug Discovery and Development

- 10.1.3. Epidemiology

- 10.1.4. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Antibacterial Susceptibility Testing

- 10.2.2. Antifungal Susceptibility Testing

- 10.2.3. Antiparasitic Susceptibility Testing

- 10.2.4. Other Susceptibility Testing

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Biomérieux

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Danaher

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BD

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Thermo Fisher

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bio-Rad

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hi-Media

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Merlin

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Liofilchem

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Accelerate Diagnostics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Alifax

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Creative Diagnostics

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Merck Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Synbiosis

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Bioanalyse

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Zhuhai Dl Biotech

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Biomérieux

List of Figures

- Figure 1: Global antimicrobial susceptibility testing Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America antimicrobial susceptibility testing Revenue (million), by Application 2024 & 2032

- Figure 3: North America antimicrobial susceptibility testing Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America antimicrobial susceptibility testing Revenue (million), by Types 2024 & 2032

- Figure 5: North America antimicrobial susceptibility testing Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America antimicrobial susceptibility testing Revenue (million), by Country 2024 & 2032

- Figure 7: North America antimicrobial susceptibility testing Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America antimicrobial susceptibility testing Revenue (million), by Application 2024 & 2032

- Figure 9: South America antimicrobial susceptibility testing Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America antimicrobial susceptibility testing Revenue (million), by Types 2024 & 2032

- Figure 11: South America antimicrobial susceptibility testing Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America antimicrobial susceptibility testing Revenue (million), by Country 2024 & 2032

- Figure 13: South America antimicrobial susceptibility testing Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe antimicrobial susceptibility testing Revenue (million), by Application 2024 & 2032

- Figure 15: Europe antimicrobial susceptibility testing Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe antimicrobial susceptibility testing Revenue (million), by Types 2024 & 2032

- Figure 17: Europe antimicrobial susceptibility testing Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe antimicrobial susceptibility testing Revenue (million), by Country 2024 & 2032

- Figure 19: Europe antimicrobial susceptibility testing Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa antimicrobial susceptibility testing Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa antimicrobial susceptibility testing Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa antimicrobial susceptibility testing Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa antimicrobial susceptibility testing Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa antimicrobial susceptibility testing Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa antimicrobial susceptibility testing Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific antimicrobial susceptibility testing Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific antimicrobial susceptibility testing Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific antimicrobial susceptibility testing Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific antimicrobial susceptibility testing Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific antimicrobial susceptibility testing Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific antimicrobial susceptibility testing Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global antimicrobial susceptibility testing Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global antimicrobial susceptibility testing Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global antimicrobial susceptibility testing Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global antimicrobial susceptibility testing Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global antimicrobial susceptibility testing Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global antimicrobial susceptibility testing Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global antimicrobial susceptibility testing Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States antimicrobial susceptibility testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada antimicrobial susceptibility testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico antimicrobial susceptibility testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global antimicrobial susceptibility testing Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global antimicrobial susceptibility testing Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global antimicrobial susceptibility testing Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil antimicrobial susceptibility testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina antimicrobial susceptibility testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America antimicrobial susceptibility testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global antimicrobial susceptibility testing Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global antimicrobial susceptibility testing Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global antimicrobial susceptibility testing Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom antimicrobial susceptibility testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany antimicrobial susceptibility testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France antimicrobial susceptibility testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy antimicrobial susceptibility testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain antimicrobial susceptibility testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia antimicrobial susceptibility testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux antimicrobial susceptibility testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics antimicrobial susceptibility testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe antimicrobial susceptibility testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global antimicrobial susceptibility testing Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global antimicrobial susceptibility testing Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global antimicrobial susceptibility testing Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey antimicrobial susceptibility testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel antimicrobial susceptibility testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC antimicrobial susceptibility testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa antimicrobial susceptibility testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa antimicrobial susceptibility testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa antimicrobial susceptibility testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global antimicrobial susceptibility testing Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global antimicrobial susceptibility testing Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global antimicrobial susceptibility testing Revenue million Forecast, by Country 2019 & 2032

- Table 41: China antimicrobial susceptibility testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India antimicrobial susceptibility testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan antimicrobial susceptibility testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea antimicrobial susceptibility testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN antimicrobial susceptibility testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania antimicrobial susceptibility testing Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific antimicrobial susceptibility testing Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the antimicrobial susceptibility testing?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the antimicrobial susceptibility testing?

Key companies in the market include Biomérieux, Danaher, BD, Thermo Fisher, Bio-Rad, Hi-Media, Merlin, Liofilchem, Accelerate Diagnostics, Alifax, Creative Diagnostics, Merck Group, Synbiosis, Bioanalyse, Zhuhai Dl Biotech.

3. What are the main segments of the antimicrobial susceptibility testing?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "antimicrobial susceptibility testing," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the antimicrobial susceptibility testing report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the antimicrobial susceptibility testing?

To stay informed about further developments, trends, and reports in the antimicrobial susceptibility testing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence