Key Insights

The APAC Poultry Feeds Market is projected for significant expansion, with an estimated market size of USD 73.97 billion in the base year 2025, and a projected Compound Annual Growth Rate (CAGR) of 3.2% through 2033. This growth is primarily driven by the escalating demand for animal protein, a direct consequence of a growing and increasingly affluent regional population. Poultry, as a cost-effective and widely consumed protein source, is particularly well-positioned to capitalize on this trend. Furthermore, the adoption of advanced animal husbandry practices, including sophisticated feed formulations designed to enhance animal health, growth rates, and overall productivity, is a significant contributor to market expansion. The market is segmented by animal type, with layer and broiler segments dominating due to their extensive commercial production. Ingredient-wise, cereal-based feeds and oilseed meals form the foundation of poultry nutrition, supplemented by essential vitamins, amino acids, and probiotics that improve feed efficiency and animal well-being. The increasing focus on disease prevention and immune system enhancement is also boosting demand for specialized supplements such as antibiotics, enzymes, and antioxidants.

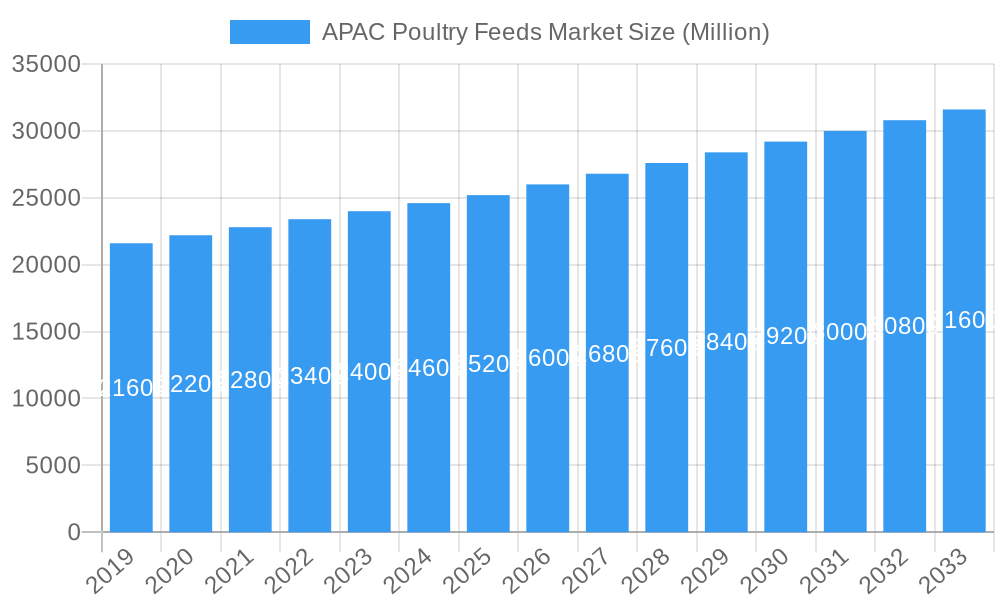

APAC Poultry Feeds Market Market Size (In Billion)

Geographically, the Asia-Pacific region, including key markets like India, China, Japan, and Australia, presents a dynamic landscape for poultry feed. China and India, with their large populations and expanding middle classes, are expected to be the primary growth engines. While growth prospects are strong, raw material price volatility (e.g., grains, protein sources) can impact manufacturer profitability. Additionally, evolving concerns regarding the environmental impact of intensive poultry farming and the regulatory landscape for feed additives and animal welfare present challenges. However, continuous innovation in feed formulation, including the development of sustainable and cost-effective ingredients, coupled with technological advancements in feed production and distribution, are expected to mitigate these challenges and drive market growth. The increasing emphasis on traceability and food safety within the poultry value chain also creates opportunities for providers of high-quality, traceable feed solutions.

APAC Poultry Feeds Market Company Market Share

This comprehensive report analyzes the dynamic APAC poultry feeds market, driven by rising protein demand, advancements in animal nutrition, and evolving farming practices. Examining the period from 2019 to 2024, with the base year 2025, and projecting growth through 2033, this study offers actionable insights for stakeholders across the value chain. The analysis includes market concentration, key industry trends, dominant geographies and segments, product developments, report scope, growth drivers, challenges, emerging opportunities, leading players, and critical industry developments. With an estimated market size reaching USD 73.97 billion by 2025, the APAC poultry feeds market is poised for substantial expansion, with a projected Compound Annual Growth Rate (CAGR) of 3.2% during the forecast period (2025-2033).

APAC Poultry Feeds Market Market Concentration & Innovation

The APAC poultry feeds market exhibits a moderate to high level of market concentration, with key players like Cargill Inc., Nutreco NV, and Archer Daniels Midland holding significant market shares, estimated at 25% collectively. Innovation is a crucial differentiator, driven by the pursuit of enhanced feed efficiency, improved animal health, and reduced environmental impact. Key innovation drivers include the development of novel feed additives, such as probiotics and prebiotics, alongside the integration of advanced formulation technologies and sustainable ingredient sourcing. Regulatory frameworks, particularly concerning feed safety and animal welfare, are becoming increasingly stringent across the region, influencing product development and market entry strategies. Product substitutes, such as alternative protein sources and insect-based feeds, are emerging but currently hold a niche position. End-user trends are leaning towards specialized feeds for different poultry types and life stages, alongside a growing demand for antibiotic-free and natural feed solutions. Mergers and acquisitions (M&A) activities are a significant aspect of market dynamics, with an estimated USD 5,000 Million in M&A deal values observed during the historical period, aimed at consolidating market presence, acquiring innovative technologies, and expanding geographical reach.

APAC Poultry Feeds Market Industry Trends & Insights

The APAC poultry feeds market is experiencing robust growth, propelled by several interconnected industry trends and insights. A primary growth driver is the escalating demand for poultry meat and eggs across Asia-Pacific, fueled by a burgeoning population, rising disposable incomes, and a dietary shift towards protein-rich foods. This increasing consumption necessitates higher poultry production, directly translating into a greater need for efficient and nutritious poultry feeds. Technological disruptions are playing a transformative role, with advancements in precision nutrition, feed formulation software, and automated feed delivery systems enhancing productivity and reducing operational costs for poultry farmers. The penetration of these technologies is estimated to be around 40% in developed markets within APAC and is rapidly expanding into developing economies. Consumer preferences are increasingly influencing feed production, with a growing emphasis on animal welfare, antibiotic-free poultry products, and sustainably sourced ingredients. This has led to a surge in demand for specialized feed formulations and organic additives. Competitive dynamics are characterized by intense rivalry among global and regional players, driven by price, product quality, innovation, and distribution networks. The market penetration of advanced feed additives is growing, with vitamins and amino acids currently dominating, followed by enzymes and probiotics. The overall market growth is underpinned by a projected CAGR of 6.5% from 2025 to 2033, indicating a sustained upward trajectory. The total market size is anticipated to reach approximately USD 150,000 Million by 2025. The strategic focus on optimizing feed conversion ratios (FCR) and minimizing feed wastage remains paramount for profitability and sustainability in the poultry sector.

Dominant Markets & Segments in APAC Poultry Feeds Market

The APAC poultry feeds market is characterized by the dominance of specific regions and segments, reflecting diverse agricultural practices and consumption patterns.

Geographical Dominance: China stands out as the largest and fastest-growing poultry market in APAC, driven by its massive population and a strong preference for poultry as a primary protein source. Government initiatives promoting modern farming practices and increased investment in the poultry sector further bolster its dominance. India follows closely, with its rapidly expanding middle class and a significant demand for affordable protein.

- Key Drivers for China: Large domestic consumption, government support for food security, and increasing adoption of advanced poultry farming technologies.

- Key Drivers for India: Growing population, rising disposable incomes, and a strong traditional preference for poultry products.

Animal Type Dominance: The Broiler segment commands the largest share within the APAC poultry feeds market. The high demand for broiler meat for consumption, coupled with shorter production cycles compared to layers, makes this segment a consistent driver of feed demand.

- Broiler Feed Dominance Drivers: Short growth cycles, high meat consumption demand, and efficient feed conversion for rapid weight gain.

- Layer Feed Considerations: Consistent demand for eggs, driving the need for specialized layer formulations for optimal egg production and shell quality.

Ingredient Dominance: Cereal (such as corn and wheat) and Oilseed Meal (like soybean meal) are the cornerstone ingredients, forming the bulk of poultry feed formulations due to their high energy and protein content, respectively. Their widespread availability and cost-effectiveness make them indispensable.

- Cereal Significance: Primary source of energy, essential for growth and development.

- Oilseed Meal Significance: Crucial for protein content, vital for muscle development and overall health.

- Molasses Role: Provides energy and palatability, contributing to feed intake.

Supplement Dominance: Amino Acids (like lysine and methionine) and Vitamins are critical supplements, playing a pivotal role in meeting the precise nutritional requirements of poultry, optimizing growth, and preventing deficiencies.

- Amino Acid Importance: Essential for protein synthesis, muscle growth, and feather development.

- Vitamin Significance: Crucial for metabolic functions, immune health, and disease prevention.

- Enzymes and Probiotics Growth: Increasing adoption for improved digestibility, gut health, and reduced antibiotic reliance.

The interplay of these dominant factors creates a robust market landscape, with significant opportunities for feed manufacturers to cater to specific regional and segment needs through tailored product offerings and advanced nutritional solutions.

APAC Poultry Feeds Market Product Developments

Recent product developments in the APAC poultry feeds market are focused on enhancing sustainability, improving animal health, and optimizing feed efficiency. Innovations include the development of novel feed additives such as microalgal-based supplements offering superior nutrient profiles and environmental benefits, and insect protein incorporated feeds, providing a sustainable alternative to traditional protein sources. Companies are also investing in R&D for gut health modulators and natural growth promoters, reducing the reliance on antibiotics. These advancements aim to address growing consumer demand for antibiotic-free poultry products and meet stringent regulatory requirements, providing a competitive edge to manufacturers who embrace these technological shifts.

Report Scope & Segmentation Analysis

This comprehensive report segments the APAC poultry feeds market by Animal Type, encompassing Layer, Broiler, Turkey, and Other Animal Types. The Broiler segment is expected to exhibit the highest growth, driven by consistent demand for poultry meat. The market is further analyzed by Ingredient, including Cereal, Oilseed Meal, Molasses, Fish Oil and Fish Meal, Supplements, and Other Ingredients. Cereals and oilseed meals will continue to dominate due to their foundational role in feed formulation. The Supplements segment is further detailed into Vitamins, Amino Acids, Antibiotics, Enzymes, Antioxidants, Acidifiers, Prebiotics, Probiotics, and Other Supplements. The Amino Acids and Vitamins sub-segments are anticipated to witness strong growth, alongside increasing adoption of Enzymes and Probiotics. Geographically, the report covers the entire Asia-Pacific region, with specific deep dives into India, China, Japan, Australia, Pakistan, and the Rest of Asia-Pacific. China and India are projected to be the leading markets, demonstrating robust expansion.

Key Drivers of APAC Poultry Feeds Market Growth

The APAC poultry feeds market is propelled by several key drivers. The escalating global population and rising disposable incomes across the Asia-Pacific region are significantly increasing the demand for protein-rich food sources, with poultry being a preferred and affordable option. Government initiatives in many APAC countries focusing on food security, agricultural modernization, and subsidies for livestock farming further bolster the sector. Technological advancements in animal nutrition, including precision feeding, the development of novel feed additives like probiotics and enzymes to improve gut health and nutrient absorption, and the increasing adoption of genetic advancements in poultry breeds that require specialized diets, are crucial growth catalysts. Furthermore, the growing consumer awareness regarding the health benefits of poultry and the trend towards antibiotic-free production are driving the demand for high-quality, specialized poultry feeds.

Challenges in the APAC Poultry Feeds Market Sector

Despite the promising growth trajectory, the APAC poultry feeds market faces several challenges. Volatility in the prices of key raw materials such as corn, soybean meal, and wheat, owing to factors like climate change, geopolitical events, and global supply chain disruptions, poses a significant threat to profit margins and feed affordability. Stringent and varying regulatory frameworks across different APAC countries regarding feed safety, additive usage, and import/export policies can create compliance hurdles for manufacturers. The increasing consumer demand for antibiotic-free and sustainable poultry products, while an opportunity, also presents a challenge in terms of developing and scaling cost-effective alternative solutions. Disease outbreaks within poultry populations can lead to supply chain disruptions and reduced demand for feed, impacting market stability. Competitive pressures from both established global players and emerging local manufacturers intensify price wars and necessitate continuous innovation.

Emerging Opportunities in APAC Poultry Feeds Market

The APAC poultry feeds market is ripe with emerging opportunities. The rising consumer consciousness around health and wellness is creating a demand for functional poultry feeds enriched with prebiotics, probiotics, and essential micronutrients that can enhance the nutritional value of poultry products. The growing trend towards sustainable agriculture presents a significant opportunity for the development and adoption of insect-based proteins and plant-based alternatives as feed ingredients, addressing environmental concerns and reducing reliance on traditional feed sources. Expansion into untapped rural markets within countries like India and Indonesia, where poultry farming is growing but often relies on traditional methods, offers substantial growth potential with tailored product offerings. Furthermore, advancements in biotechnology are paving the way for the development of personalized feed formulations that can optimize flock performance based on specific genetic traits and environmental conditions.

Leading Players in the APAC Poultry Feeds Market Market

- Kyodo Shiryo Company

- Nutreco NV

- BASF SE

- Alltech Inc

- Archer Daniels Midland

- Cargill Inc

- Kent Feeds

Key Developments in APAC Poultry Feeds Market Industry

- 2024: Launch of new antibiotic-free feed formulations by major players in India, responding to increasing consumer demand and regulatory pressure.

- 2023: Cargill Inc. expands its animal nutrition research facilities in Southeast Asia to focus on developing region-specific feed solutions and sustainable ingredients.

- 2023: Nutreco NV acquires a significant stake in a Chinese feed additive producer to strengthen its presence and product portfolio in the rapidly growing Chinese market.

- 2022: BASF SE introduces innovative enzyme-based feed solutions in Pakistan, aiming to improve nutrient digestibility and reduce feed costs for local poultry farmers.

- 2021: Archer Daniels Midland invests in a new feed production plant in Vietnam, anticipating increased demand for broiler feed in the country.

- 2020: Alltech Inc. launches a series of educational workshops across Australia focusing on gut health management in poultry through advanced feed supplements.

Strategic Outlook for APAC Poultry Feeds Market Market

The strategic outlook for the APAC poultry feeds market is overwhelmingly positive, driven by an unwavering demand for poultry products and continuous innovation. Key growth catalysts include the increasing adoption of advanced animal nutrition technologies, such as precision feeding and the integration of functional feed additives, which promise to enhance flock health, productivity, and sustainability. The shift towards antibiotic-free and natural feed solutions presents a significant opportunity for market players who can invest in research and development of effective alternatives. Furthermore, the expansion of modern farming practices into developing economies within the region will unlock substantial market potential. Collaborations and strategic partnerships between feed manufacturers, technology providers, and research institutions will be crucial for driving innovation and navigating the evolving regulatory landscape. Companies that prioritize sustainability, product quality, and customer-centric solutions will be best positioned to capitalize on the projected robust growth and secure a dominant market share in the coming years.

APAC Poultry Feeds Market Segmentation

-

1. Animal Type

- 1.1. Layer

- 1.2. Broiler

- 1.3. Turkey

- 1.4. Other Animal Types

-

2. Ingredient

- 2.1. Cereal

- 2.2. Oilseed Meal

- 2.3. Molasses

- 2.4. Fish Oil and Fish Meal

- 2.5. Supplements

- 2.6. Other Ingredients

-

3. Supplements

- 3.1. Vitamins

- 3.2. Amino Acids

- 3.3. Antibiotics

- 3.4. Enzymes

- 3.5. Antioxidants

- 3.6. Acidifiers

- 3.7. Prebiotics

- 3.8. Probiotics

- 3.9. Other Supplements

-

4. Geography

-

4.1. Asia-Pacific

- 4.1.1. India

- 4.1.2. China

- 4.1.3. Japan

- 4.1.4. Australia

- 4.1.5. Pakistan

- 4.1.6. Rest of Asia-Pacific

-

4.1. Asia-Pacific

APAC Poultry Feeds Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. India

- 1.2. China

- 1.3. Japan

- 1.4. Australia

- 1.5. Pakistan

- 1.6. Rest of Asia Pacific

APAC Poultry Feeds Market Regional Market Share

Geographic Coverage of APAC Poultry Feeds Market

APAC Poultry Feeds Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Increased Consumption of Poultry Meat

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. APAC Poultry Feeds Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 5.1.1. Layer

- 5.1.2. Broiler

- 5.1.3. Turkey

- 5.1.4. Other Animal Types

- 5.2. Market Analysis, Insights and Forecast - by Ingredient

- 5.2.1. Cereal

- 5.2.2. Oilseed Meal

- 5.2.3. Molasses

- 5.2.4. Fish Oil and Fish Meal

- 5.2.5. Supplements

- 5.2.6. Other Ingredients

- 5.3. Market Analysis, Insights and Forecast - by Supplements

- 5.3.1. Vitamins

- 5.3.2. Amino Acids

- 5.3.3. Antibiotics

- 5.3.4. Enzymes

- 5.3.5. Antioxidants

- 5.3.6. Acidifiers

- 5.3.7. Prebiotics

- 5.3.8. Probiotics

- 5.3.9. Other Supplements

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Asia-Pacific

- 5.4.1.1. India

- 5.4.1.2. China

- 5.4.1.3. Japan

- 5.4.1.4. Australia

- 5.4.1.5. Pakistan

- 5.4.1.6. Rest of Asia-Pacific

- 5.4.1. Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Animal Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kyodo Shiryo Compan

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nutreco NV

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BASF SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Alltech Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Archer Daniels Midland

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cargill Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kent Feeds

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Kyodo Shiryo Compan

List of Figures

- Figure 1: APAC Poultry Feeds Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: APAC Poultry Feeds Market Share (%) by Company 2025

List of Tables

- Table 1: APAC Poultry Feeds Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 2: APAC Poultry Feeds Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 3: APAC Poultry Feeds Market Revenue billion Forecast, by Supplements 2020 & 2033

- Table 4: APAC Poultry Feeds Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: APAC Poultry Feeds Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: APAC Poultry Feeds Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 7: APAC Poultry Feeds Market Revenue billion Forecast, by Ingredient 2020 & 2033

- Table 8: APAC Poultry Feeds Market Revenue billion Forecast, by Supplements 2020 & 2033

- Table 9: APAC Poultry Feeds Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: APAC Poultry Feeds Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: India APAC Poultry Feeds Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: China APAC Poultry Feeds Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Japan APAC Poultry Feeds Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Australia APAC Poultry Feeds Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Pakistan APAC Poultry Feeds Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Rest of Asia Pacific APAC Poultry Feeds Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Poultry Feeds Market?

The projected CAGR is approximately 3.2%.

2. Which companies are prominent players in the APAC Poultry Feeds Market?

Key companies in the market include Kyodo Shiryo Compan, Nutreco NV, BASF SE, Alltech Inc, Archer Daniels Midland, Cargill Inc, Kent Feeds.

3. What are the main segments of the APAC Poultry Feeds Market?

The market segments include Animal Type, Ingredient, Supplements, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 73.97 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Increased Consumption of Poultry Meat.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Poultry Feeds Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Poultry Feeds Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Poultry Feeds Market?

To stay informed about further developments, trends, and reports in the APAC Poultry Feeds Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence