Key Insights

The Argentinian fertilizer market is set for significant expansion, projected to reach a market size of $1.28 billion by 2024, with a Compound Annual Growth Rate (CAGR) of 2.76% through 2033. This growth is propelled by Argentina's robust agricultural sector and the increasing adoption of advanced farming techniques aimed at maximizing crop yields. Key drivers include government initiatives supporting sustainable agriculture, rising demand for high-quality produce both domestically and internationally, and the continuous need for soil nutrient replenishment. A notable trend is the growing adoption of specialized and micronutrient fertilizers, reflecting a deeper understanding of soil health and specific crop requirements. Furthermore, innovations in fertilizer application technology, enhancing nutrient use efficiency and minimizing environmental impact, are contributing to market dynamism.

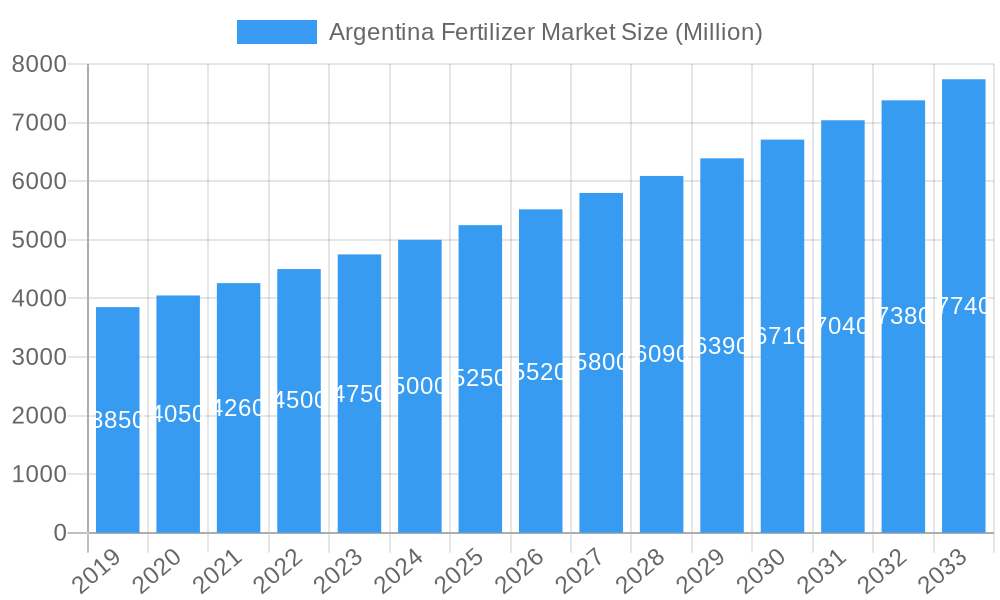

Argentina Fertilizer Market Market Size (In Billion)

However, the market encounters restraints that may influence its growth. Fluctuations in raw material prices, affected by global commodity markets and geopolitical events, can impact production costs and fertilizer pricing. Dependence on imported raw materials for certain fertilizer types introduces supply chain vulnerabilities and currency exchange rate risks. Additionally, stringent environmental regulations and growing farmer awareness of the potential environmental impact of excessive fertilizer use are driving a shift towards more sustainable and efficient fertilization practices. The market is analyzed by production, consumption, import, export, and price trends, with major players such as Bunge, Yara International AS, and Nutrien Ltd actively shaping the market landscape. Argentina's prominent position in the South American fertilizer market highlights its importance.

Argentina Fertilizer Market Company Market Share

This comprehensive report offers a detailed analysis of the Argentina Fertilizer Market, examining production, consumption, import/export dynamics, price trends, and key industry developments. With a study period from 2019 to 2033, including a base year of 2024 and a forecast period from 2025 to 2033, this report provides actionable insights for stakeholders. Understand the competitive landscape, market drivers, emerging opportunities, and prepare for future challenges in one of South America's vital agricultural regions.

Argentina Fertilizer Market Market Concentration & Innovation

The Argentina Fertilizer Market exhibits a moderate to high level of market concentration, with a few key global and regional players dominating production and distribution. Innovation in the fertilizer sector is primarily driven by the increasing demand for enhanced crop yields, soil health improvement, and sustainable agricultural practices. Companies are investing heavily in research and development to create advanced fertilizer formulations, including slow-release fertilizers, micronutrient-enriched products, and bio-fertilizers. Regulatory frameworks, overseen by entities such as the Ministry of Agriculture, Livestock, and Fishing, aim to ensure product quality, safety, and environmental compliance. The presence of product substitutes, such as organic amendments and soil conditioners, influences market dynamics, pushing fertilizer manufacturers to offer competitive and differentiated solutions. End-user trends are shifting towards precision agriculture, where farmers seek customized fertilization plans based on soil analysis and specific crop needs. Mergers and acquisitions (M&A) are significant drivers of market evolution. For instance, Nouryon's acquisition of ADOB in April 2023 for an undisclosed value, aimed at expanding its innovative crop nutrition portfolio, exemplifies this trend. ICL Group Ltd's strategic partnership with General Mills in January 2023 further highlights the consolidation and collaboration efforts within the specialty fertilizer segment. These M&A activities contribute to market concentration by consolidating market share and expanding product offerings, with estimated deal values in the tens to hundreds of millions of dollars across various transactions in recent years.

Argentina Fertilizer Market Industry Trends & Insights

The Argentina Fertilizer Market is poised for significant growth, driven by the nation's prominent role as a global agricultural powerhouse. The market is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.8% during the forecast period of 2025–2033, reaching an estimated market value of over USD 7,500 Million by 2033. This robust growth is underpinned by several key trends. Firstly, the increasing demand for food due to a growing global population necessitates higher agricultural productivity, directly translating to increased fertilizer consumption. Argentina, with its vast arable land and strong export orientation for commodities like soybeans, corn, and wheat, is at the forefront of this demand. Secondly, technological advancements in fertilizer production and application are revolutionizing the industry. The development of enhanced efficiency fertilizers (EEFs) that reduce nutrient losses and improve uptake efficiency is gaining traction. Precision agriculture technologies, including GPS-guided applicators and sensor-based nutrient management, are enabling farmers to optimize fertilizer use, leading to better yields and reduced environmental impact. Consumer preferences are also evolving, with a growing emphasis on sustainable farming practices. This is spurring the adoption of bio-fertilizers and organic nutrient sources, alongside traditional chemical fertilizers. The competitive dynamics within the market are characterized by both global giants and local players vying for market share. Companies are focused on strengthening their distribution networks, offering customized solutions, and building strong relationships with farmers. Market penetration of advanced fertilizer solutions is steadily increasing as farmers recognize their economic and environmental benefits. The drive for soil health and long-term farm sustainability is another critical insight, pushing for balanced nutrient management and the use of fertilizers that contribute to soil structure and microbial activity.

Dominant Markets & Segments in Argentina Fertilizer Market

Production Analysis: Argentina's production capacity for fertilizers is substantial, driven by both domestic demand and export potential. Key production hubs are often located near agricultural centers and transportation infrastructure. Economic policies that support agricultural output, such as government subsidies or favorable export tariffs, significantly influence production levels. Infrastructure, including port facilities for raw material imports and finished product exports, plays a crucial role in the cost-effectiveness of production. The dominant segment in production is likely nitrogenous fertilizers, given their widespread use across major crops.

Consumption Analysis: The Pampas region, Argentina's breadbasket, represents the dominant area for fertilizer consumption. This region accounts for the largest share of arable land dedicated to crops like soybeans, corn, and wheat, which have high nutrient demands. The economic viability of farming, influenced by commodity prices and input costs, directly impacts consumption. Government initiatives promoting soil fertility and sustainable agriculture also contribute to increased consumption of a wider range of fertilizers, including specialty nutrients.

Import Market Analysis (Value & Volume): Argentina is a significant importer of fertilizers and fertilizer raw materials. The import market is driven by the gap between domestic production capabilities and the high demand from the agricultural sector. Key importing regions are those with the highest agricultural activity. Value and volume are heavily influenced by global commodity prices, currency exchange rates, and international trade agreements. For instance, the import of nitrogenous fertilizers, particularly urea and diammonium phosphate (DAP), typically dominates both value and volume. The estimated import market value for fertilizers in 2025 is projected to be around USD 2,500 Million.

Export Market Analysis (Value & Volume): While Argentina is a net importer of many fertilizer types, it also possesses export capabilities, particularly for domestically produced fertilizers or those with competitive production costs. The export market is driven by international demand for Argentine agricultural produce, which indirectly influences the demand for fertilizers. Key export destinations could include neighboring South American countries. The estimated export market value for fertilizers in 2025 is projected to be around USD 800 Million.

Price Trend Analysis: Fertilizer prices in Argentina are influenced by a complex interplay of global supply and demand dynamics, domestic production costs, currency fluctuations, and government policies. The price of key raw materials like natural gas (for nitrogenous fertilizers) and phosphate rock significantly impacts pricing. Seasonal demand patterns also play a role, with prices typically rising before and during the planting seasons. The estimated average price for nitrogenous fertilizers in 2025 is expected to be around USD 450 per ton, while phosphatic fertilizers could average USD 600 per ton.

Argentina Fertilizer Market Product Developments

Product innovation in the Argentina Fertilizer Market is increasingly focused on enhancing nutrient use efficiency and addressing specific soil and crop needs. Companies are introducing advanced formulations, such as slow-release nitrogen fertilizers to minimize losses and provide a sustained nutrient supply, and micronutrient-enriched fertilizers to combat deficiencies crucial for optimal crop development. The development of specialty products, including foliar fertilizers and chelating micronutrients, offers targeted solutions for immediate nutrient delivery and improved plant absorption. These innovations aim to provide farmers with tools to increase yields, improve crop quality, and promote more sustainable agricultural practices, thereby gaining a competitive advantage in a market that values both performance and environmental responsibility.

Report Scope & Segmentation Analysis

This report segments the Argentina Fertilizer Market into key areas: Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis. Production analysis will delve into manufacturing capacities and regional distribution of fertilizer production within Argentina. Consumption analysis will focus on the demand drivers and regional consumption patterns across various agricultural regions. The import and export market analyses will detail the trade flows, key trading partners, and the value and volume of fertilizers entering and leaving the country. Price trend analysis will track historical and projected price movements of various fertilizer types. Each segment is analyzed with growth projections and competitive dynamics to provide a comprehensive market overview.

Key Drivers of Argentina Fertilizer Market Growth

The growth of the Argentina Fertilizer Market is propelled by several key drivers. Firstly, Argentina's status as a major agricultural exporter, particularly for soybeans, corn, and wheat, fuels a consistent demand for fertilizers to maximize yields. Secondly, the ongoing adoption of advanced agricultural technologies, including precision farming and the use of enhanced efficiency fertilizers, leads to higher demand for specialized nutrient solutions. Thirdly, government policies aimed at boosting agricultural productivity and promoting sustainable farming practices encourage increased fertilizer application. Furthermore, the growing global demand for food products, driven by population growth, creates sustained pressure on Argentine agriculture to increase output, thereby driving fertilizer consumption.

Challenges in the Argentina Fertilizer Market Sector

Despite its growth potential, the Argentina Fertilizer Market faces several challenges. Volatility in global fertilizer prices, influenced by energy costs and geopolitical factors, can significantly impact input costs for local producers and farmers. Fluctuations in the Argentine Peso and currency exchange rates can also create uncertainty and affect import costs. Regulatory hurdles and environmental concerns related to fertilizer use, such as nutrient runoff and greenhouse gas emissions, necessitate careful management and can lead to increased compliance costs. Supply chain disruptions, both domestically and internationally, can affect the availability and timely delivery of fertilizers. Competitive pressures from global players and the need for continuous innovation to meet evolving farmer needs also present ongoing challenges.

Emerging Opportunities in Argentina Fertilizer Market

The Argentina Fertilizer Market presents several emerging opportunities. The increasing adoption of bio-fertilizers and other sustainable nutrient management solutions, driven by growing environmental awareness and demand for organic produce, offers a significant growth avenue. The expansion of precision agriculture technologies presents opportunities for companies offering data-driven fertilization services and specialized nutrient delivery systems. Furthermore, the development of value-added fertilizer products, such as those with enhanced micronutrient profiles or improved soil health benefits, can cater to specific crop requirements and command premium pricing. Exploring untapped rural markets and strengthening distribution networks in less developed agricultural regions also represents a substantial opportunity.

Leading Players in the Argentina Fertilizer Market Market

- Bunge

- Nouryon

- Grupa Azoty S A (Compo Expert)

- EuroChem Group

- ICL Group Ltd

- Sociedad Quimica y Minera de Chile SA

- Haifa Group

- Yara International AS

- Nutrien Ltd

Key Developments in Argentina Fertilizer Market Industry

- April 2023: ADOB, a major provider of chelating micronutrients, foliar, and other specialty farming solutions based in Poland, has been purchased by Nouryon. Through the acquisition, the company has broadened its innovative crop nutrition portfolio.

- January 2023: ICL has entered into a strategic partnership agreement with General Mills, in which it will be the supplier of strategic specialty phosphate solutions to General Mills. The long-term agreement will also focus on international expansion.

- May 2022: ICL launched three new NPK formulations of Solinure, a product with increased trace elements to optimize yields.

Strategic Outlook for Argentina Fertilizer Market Market

The strategic outlook for the Argentina Fertilizer Market is positive, driven by the sustained importance of agriculture in the national economy and the increasing global demand for food. Key growth catalysts include the continuous adoption of advanced agricultural technologies, the growing preference for sustainable and efficient fertilizer solutions, and supportive government policies aimed at enhancing food production. Companies that focus on product innovation, particularly in areas like bio-fertilizers and precision nutrition, and invest in robust distribution networks are well-positioned for success. The market is expected to see further consolidation and strategic partnerships as players seek to expand their offerings and market reach.

Argentina Fertilizer Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Argentina Fertilizer Market Segmentation By Geography

- 1. Argentina

Argentina Fertilizer Market Regional Market Share

Geographic Coverage of Argentina Fertilizer Market

Argentina Fertilizer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.76% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Awareness of Landscaping Maintenance; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Shortage of Skilled Labor; Wastage of High Amount of Water For Irrigating Lawns

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Argentina Fertilizer Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Argentina

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bunge

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nouryon

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Grupa Azoty S A (Compo Expert)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 EuroChem Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ICL Group Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sociedad Quimica y Minera de Chile SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Haifa Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Yara International AS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nutrien Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Bunge

List of Figures

- Figure 1: Argentina Fertilizer Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Argentina Fertilizer Market Share (%) by Company 2025

List of Tables

- Table 1: Argentina Fertilizer Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Argentina Fertilizer Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Argentina Fertilizer Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Argentina Fertilizer Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Argentina Fertilizer Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Argentina Fertilizer Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Argentina Fertilizer Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Argentina Fertilizer Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Argentina Fertilizer Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Argentina Fertilizer Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Argentina Fertilizer Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Argentina Fertilizer Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Argentina Fertilizer Market?

The projected CAGR is approximately 2.76%.

2. Which companies are prominent players in the Argentina Fertilizer Market?

Key companies in the market include Bunge, Nouryon, Grupa Azoty S A (Compo Expert), EuroChem Group, ICL Group Ltd, Sociedad Quimica y Minera de Chile SA, Haifa Group, Yara International AS, Nutrien Ltd.

3. What are the main segments of the Argentina Fertilizer Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.28 billion as of 2022.

5. What are some drivers contributing to market growth?

Awareness of Landscaping Maintenance; Technological Advancements.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Shortage of Skilled Labor; Wastage of High Amount of Water For Irrigating Lawns.

8. Can you provide examples of recent developments in the market?

April 2023: ADOB, a major provider of chelating micronutrients, foliar, and other specialty farming solutions based in Poland, has been purchased by Nouryon. Through the acquisition, the company has broadened its innovative crop nutrition portfolio.January 2023: ICL has entered into a strategic partnership agreement with General Mills, in which it will be the supplier of strategic specialty phosphate solutions to General Mills. The long-term agreement will also focus on international expansion.May 2022: ICL launched three new NPK formulations of Solinure, a product with increased trace elements to optimize yields.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Argentina Fertilizer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Argentina Fertilizer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Argentina Fertilizer Market?

To stay informed about further developments, trends, and reports in the Argentina Fertilizer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence