Key Insights

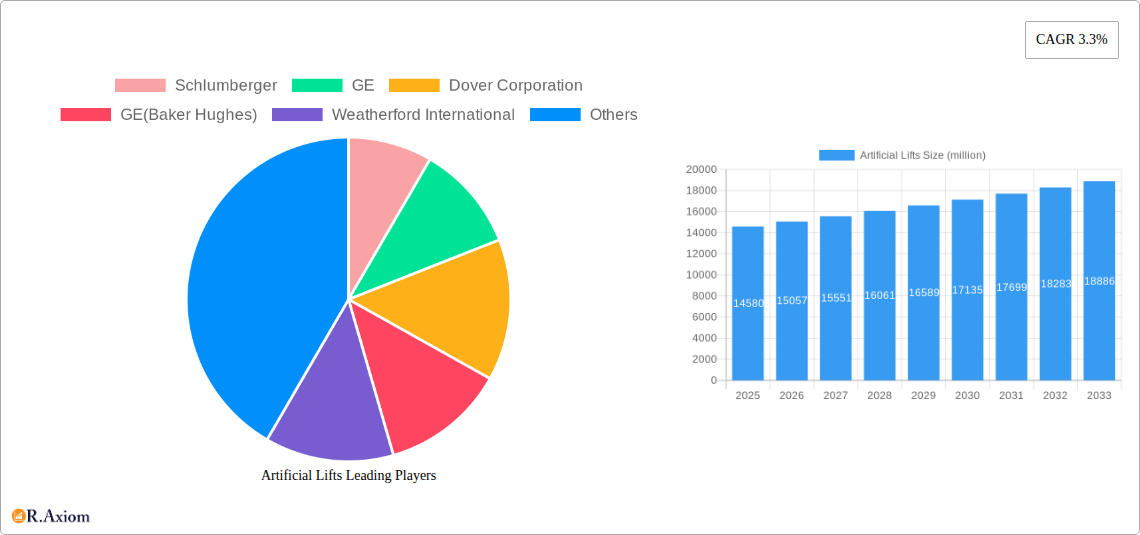

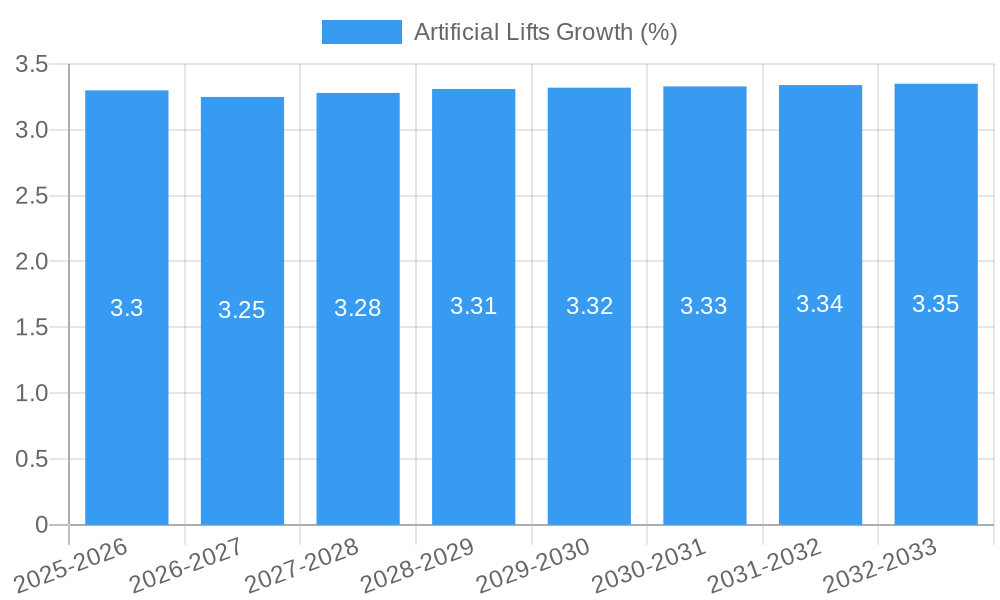

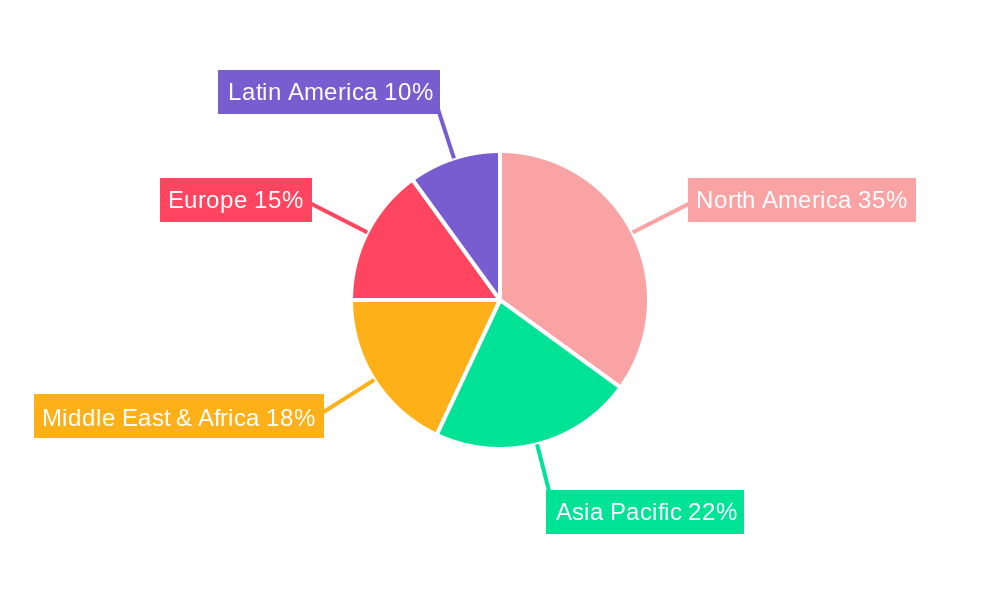

The global Artificial Lifts market is projected to experience robust growth, reaching an estimated market size of $14,580 million. This expansion is driven by a consistent Compound Annual Growth Rate (CAGR) of 3.3% over the forecast period of 2025-2033. The primary impetus for this growth stems from the increasing demand for oil and gas, particularly in mature fields where natural reservoir pressure is insufficient to bring hydrocarbons to the surface. The necessity for enhanced oil recovery (EOR) techniques and the continuous exploration of new reserves globally further bolster the market. Additionally, technological advancements in artificial lift systems, leading to improved efficiency, reduced operational costs, and extended well life, are key factors contributing to this positive trajectory. The market's expansion is also influenced by the ongoing need to optimize production from existing wells to meet the world's energy demands reliably.

The artificial lifts market is segmented by application and type, catering to diverse operational needs within the oil and gas industry. While specific segment details were not provided, it's understood that applications range from onshore to offshore operations, and types can include various mechanical, hydraulic, and gas lift systems. The competitive landscape features major industry players such as Schlumberger, GE (Baker Hughes), Halliburton Company, and National Oilwell Varco, alongside other significant contributors. These companies are continuously innovating, focusing on developing smarter, more automated, and environmentally friendly artificial lift solutions. Emerging trends likely include the integration of digital technologies like AI and IoT for predictive maintenance and performance optimization, as well as a growing emphasis on solutions that minimize environmental impact. However, market restraints could include fluctuating oil prices, stringent environmental regulations, and the high initial investment costs associated with advanced artificial lift technologies.

This in-depth market research report provides a thorough analysis of the global Artificial Lifts market, covering historical trends, current dynamics, and future projections. With a study period from 2019 to 2033, a base year of 2025, and a forecast period of 2025–2033, this report offers actionable insights for industry stakeholders, including oil and gas operators, equipment manufacturers, and service providers. We delve into market concentration, innovation drivers, regulatory landscapes, competitive strategies, and emerging opportunities, presenting a comprehensive view of this critical segment of the energy industry. The report utilizes million for all monetary values and incorporates high-traffic keywords for maximum search visibility.

Artificial Lifts Market Concentration & Innovation

The artificial lifts market exhibits a moderate to high concentration, with key players like Schlumberger, GE (Baker Hughes), Weatherford International, and Halliburton Company commanding significant market share, estimated to be collectively around 60% of the total market value, which is projected to reach over 200 million by 2025. Innovation remains a primary driver, fueled by the demand for enhanced oil recovery (EOR) techniques, improved operational efficiency, and reduced environmental impact. Regulatory frameworks, particularly those concerning emissions and safety standards, are increasingly influencing product development and market entry strategies. The development of intelligent artificial lift systems, incorporating IoT and AI for real-time monitoring and predictive maintenance, represents a significant technological advancement. Product substitutes, while present in nascent forms like advanced natural flow technologies, are not yet posing a substantial threat to the dominant artificial lift methods. End-user trends point towards a preference for robust, reliable, and cost-effective solutions capable of handling diverse reservoir conditions, from conventional to unconventional oil and gas fields. Mergers and acquisitions (M&A) activity is moderately active, with an estimated cumulative deal value of over 500 million in the past five years, as larger companies seek to consolidate their offerings and expand their technological portfolios.

Artificial Lifts Industry Trends & Insights

The artificial lifts market is poised for substantial growth, driven by a confluence of factors including the increasing demand for crude oil and natural gas, the natural decline of mature fields requiring enhanced production methods, and advancements in technology. The global artificial lifts market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 4.5% during the forecast period of 2025–2033, reaching a market size exceeding 300 million by the end of the forecast period. Technological disruptions are fundamentally reshaping the industry, with the integration of digital solutions such as AI-powered optimization, IoT-enabled remote monitoring, and advanced data analytics playing a pivotal role in improving the efficiency and reliability of artificial lift operations. Consumer preferences are shifting towards smart, integrated systems that offer predictive maintenance capabilities, thereby minimizing downtime and operational costs. The competitive landscape is characterized by intense competition among established global players and emerging regional manufacturers, all vying for market share by offering innovative products and comprehensive service packages. Market penetration of advanced artificial lift technologies is steadily increasing, particularly in regions with challenging production environments and a focus on maximizing hydrocarbon recovery. The increasing focus on sustainability and reducing carbon footprints is also driving the development of more energy-efficient artificial lift systems.

Dominant Markets & Segments in Artificial Lifts

The global artificial lifts market is segmented by Application and Type, with significant dominance observed in specific regions and sub-segments.

Application Dominance:

- Oil & Gas Production: This segment overwhelmingly dominates the artificial lifts market, accounting for an estimated 95% of market revenue.

- Key Drivers: The ever-increasing global energy demand necessitates sustained and optimized production from existing oil and gas wells. Many mature fields worldwide are experiencing natural declines in reservoir pressure, making artificial lift systems indispensable for maintaining viable production rates.

- Detailed Analysis: The need to maximize hydrocarbon recovery from both conventional and unconventional reserves, including shale oil and gas, is a primary driver for the widespread adoption of artificial lifts. Economic policies aimed at energy independence and security further bolster the demand for efficient production techniques. Infrastructure development in emerging oil and gas frontiers also supports the deployment of these systems.

Type Dominance:

Electric Submersible Pumps (ESPs): ESPs are the leading segment by market share and adoption, representing over 40% of the artificial lifts market.

- Key Drivers: ESPs are highly versatile and efficient for high-volume fluid production, making them ideal for a wide range of well conditions. Their ability to handle high flow rates and variable reservoir pressures contributes to their dominance.

- Detailed Analysis: Technological advancements in ESP design, including materials science for improved wear resistance and energy-efficient motor technologies, have further solidified their position. The development of intelligent ESP systems with integrated downhole sensors and surface control units offers enhanced performance and reliability, catering to the evolving needs of oil and gas operators.

Sucker Rod Pumps (SRPs): SRPs, while a mature technology, continue to hold a significant market share due to their reliability and cost-effectiveness in certain applications, particularly for lower to moderate production volumes.

Progressing Cavity Pumps (PCPs): PCPs are gaining traction for their ability to handle viscous and gassy fluids, finding increasing application in unconventional oil and gas plays and heavy oil production.

Artificial Lifts Product Developments

Recent product developments in artificial lifts are centered on enhancing efficiency, reliability, and automation. Innovations include advanced materials for pump components to withstand corrosive environments and abrasive fluids, leading to longer service life and reduced maintenance. The integration of IoT sensors and AI algorithms for predictive analytics allows for real-time performance monitoring, anomaly detection, and proactive maintenance scheduling, minimizing downtime. Smart control systems offering remote operation and optimization capabilities are becoming standard. These developments offer significant competitive advantages by reducing operational expenditures, increasing hydrocarbon recovery rates, and improving overall well productivity, directly addressing market demands for cost-effective and sustainable production solutions.

Report Scope & Segmentation Analysis

This report segments the Artificial Lifts market by Application, including Oil & Gas Production and other niche applications, and by Type, encompassing Electric Submersible Pumps (ESPs), Sucker Rod Pumps (SRPs), Progressing Cavity Pumps (PCPs), Gas Lift Systems, and others. The Oil & Gas Production application segment is projected to hold the largest market share, estimated at over 250 million by 2025, and is expected to grow at a CAGR of approximately 4.2% during the forecast period. The ESP segment is anticipated to lead in market size, projected to exceed 120 million by 2025, with a CAGR of around 4.8%. Competitive dynamics within these segments are driven by technological innovation and cost-effectiveness.

Key Drivers of Artificial Lifts Growth

The growth of the artificial lifts market is propelled by several key factors. Firstly, the increasing global demand for energy, particularly from developing economies, necessitates the optimization of production from existing oil and gas fields. Secondly, the depletion of easily recoverable reserves in mature fields requires advanced techniques like artificial lift to maintain and enhance production rates. Thirdly, technological advancements in intelligent artificial lift systems, incorporating IoT and AI for remote monitoring and predictive maintenance, are improving efficiency and reducing operational costs. Fourthly, favorable regulatory environments and government initiatives aimed at boosting domestic energy production also contribute significantly to market expansion.

Challenges in the Artificial Lifts Sector

Despite robust growth prospects, the artificial lifts sector faces several challenges. Regulatory hurdles, including stringent environmental regulations and evolving safety standards, can increase compliance costs and necessitate product redesign. Supply chain disruptions, exacerbated by geopolitical factors and raw material price volatility, can impact the availability and cost of components. Intense competition among numerous players leads to price pressures, impacting profit margins. Furthermore, the inherent complexity of subsurface conditions and the diverse nature of oil and gas reservoirs present ongoing technical challenges in designing and implementing optimal artificial lift solutions.

Emerging Opportunities in Artificial Lifts

Emerging opportunities in the artificial lifts market are primarily driven by technological innovation and the evolving needs of the energy industry. The increasing adoption of digital technologies, such as AI and machine learning for real-time performance optimization and predictive maintenance, presents a significant growth avenue. The demand for artificial lift solutions in unconventional oil and gas plays, particularly in regions with challenging geological formations, is on the rise. Furthermore, the development of more energy-efficient and environmentally friendly artificial lift systems to meet sustainability goals is creating new market niches. Exploring new geographical markets with untapped hydrocarbon reserves also represents a key opportunity for market expansion.

Leading Players in the Artificial Lifts Market

- Schlumberger

- GE

- Dover Corporation

- GE (Baker Hughes)

- Weatherford International

- Halliburton Company

- JJ Tech

- National Oilwell Varco

- BCP Group

- NOVOMET

- Aker Solutions

- Occidental Petroleum

- Flotek Industries

- Borets International

Key Developments in Artificial Lifts Industry

- 2023/08: Schlumberger launches an advanced ESP system with enhanced diagnostics for improved reliability in challenging wells.

- 2023/05: GE (Baker Hughes) acquires a leading provider of artificial lift optimization software to bolster its digital offerings.

- 2022/11: Weatherford International introduces a new gas lift valve designed for increased efficiency and reduced emissions.

- 2022/07: Halliburton Company announces a strategic partnership to develop AI-powered artificial lift solutions.

- 2021/10: National Oilwell Varco (NOV) unveils a novel PCP design for heavy oil applications, improving wear resistance.

- 2021/04: JJ Tech receives a significant order for its specialized artificial lift systems for a major Middle Eastern oil producer.

Strategic Outlook for Artificial Lifts Market

- 2023/08: Schlumberger launches an advanced ESP system with enhanced diagnostics for improved reliability in challenging wells.

- 2023/05: GE (Baker Hughes) acquires a leading provider of artificial lift optimization software to bolster its digital offerings.

- 2022/11: Weatherford International introduces a new gas lift valve designed for increased efficiency and reduced emissions.

- 2022/07: Halliburton Company announces a strategic partnership to develop AI-powered artificial lift solutions.

- 2021/10: National Oilwell Varco (NOV) unveils a novel PCP design for heavy oil applications, improving wear resistance.

- 2021/04: JJ Tech receives a significant order for its specialized artificial lift systems for a major Middle Eastern oil producer.

Strategic Outlook for Artificial Lifts Market

The strategic outlook for the artificial lifts market remains highly positive, driven by sustained global energy demand and the imperative to maximize hydrocarbon recovery from existing and new reserves. Key growth catalysts include the continued integration of digital technologies for enhanced operational efficiency and predictive capabilities, the development of specialized solutions for unconventional and challenging reservoir environments, and a growing focus on sustainable and energy-efficient artificial lift technologies. Companies that invest in innovation, forge strategic partnerships, and adapt to evolving regulatory landscapes will be best positioned to capitalize on the significant opportunities within this dynamic market. The focus on cost optimization and maximizing production will ensure a consistent demand for effective artificial lift solutions.

Artificial Lifts Segmentation

-

1. Application

- 1.1. undefined

-

2. Type

- 2.1. undefined

Artificial Lifts Segmentation By Geography

- 1. undefined

- 2. undefined

- 3. undefined

- 4. undefined

- 5. undefined

Artificial Lifts REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.3% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Artificial Lifts Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1.

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1.

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1.

- 5.3.2.

- 5.3.3.

- 5.3.4.

- 5.3.5.

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. undefined Artificial Lifts Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1.

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1.

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. undefined Artificial Lifts Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1.

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1.

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. undefined Artificial Lifts Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1.

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1.

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. undefined Artificial Lifts Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1.

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1.

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. undefined Artificial Lifts Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1.

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1.

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Schlumberger

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 GE

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dover Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GE(Baker Hughes)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Weatherford International

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Halliburton Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 JJ Tech

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 National Oilwell Varco

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BCP Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 NOVOMET

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Aker Solutions

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Occidental Petroleum

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Flotek Industries

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Borets International

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Schlumberger

List of Figures

- Figure 1: Global Artificial Lifts Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Artificial Lifts Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: undefined Artificial Lifts Revenue (million), by Application 2024 & 2032

- Figure 4: undefined Artificial Lifts Volume (K), by Application 2024 & 2032

- Figure 5: undefined Artificial Lifts Revenue Share (%), by Application 2024 & 2032

- Figure 6: undefined Artificial Lifts Volume Share (%), by Application 2024 & 2032

- Figure 7: undefined Artificial Lifts Revenue (million), by Type 2024 & 2032

- Figure 8: undefined Artificial Lifts Volume (K), by Type 2024 & 2032

- Figure 9: undefined Artificial Lifts Revenue Share (%), by Type 2024 & 2032

- Figure 10: undefined Artificial Lifts Volume Share (%), by Type 2024 & 2032

- Figure 11: undefined Artificial Lifts Revenue (million), by Country 2024 & 2032

- Figure 12: undefined Artificial Lifts Volume (K), by Country 2024 & 2032

- Figure 13: undefined Artificial Lifts Revenue Share (%), by Country 2024 & 2032

- Figure 14: undefined Artificial Lifts Volume Share (%), by Country 2024 & 2032

- Figure 15: undefined Artificial Lifts Revenue (million), by Application 2024 & 2032

- Figure 16: undefined Artificial Lifts Volume (K), by Application 2024 & 2032

- Figure 17: undefined Artificial Lifts Revenue Share (%), by Application 2024 & 2032

- Figure 18: undefined Artificial Lifts Volume Share (%), by Application 2024 & 2032

- Figure 19: undefined Artificial Lifts Revenue (million), by Type 2024 & 2032

- Figure 20: undefined Artificial Lifts Volume (K), by Type 2024 & 2032

- Figure 21: undefined Artificial Lifts Revenue Share (%), by Type 2024 & 2032

- Figure 22: undefined Artificial Lifts Volume Share (%), by Type 2024 & 2032

- Figure 23: undefined Artificial Lifts Revenue (million), by Country 2024 & 2032

- Figure 24: undefined Artificial Lifts Volume (K), by Country 2024 & 2032

- Figure 25: undefined Artificial Lifts Revenue Share (%), by Country 2024 & 2032

- Figure 26: undefined Artificial Lifts Volume Share (%), by Country 2024 & 2032

- Figure 27: undefined Artificial Lifts Revenue (million), by Application 2024 & 2032

- Figure 28: undefined Artificial Lifts Volume (K), by Application 2024 & 2032

- Figure 29: undefined Artificial Lifts Revenue Share (%), by Application 2024 & 2032

- Figure 30: undefined Artificial Lifts Volume Share (%), by Application 2024 & 2032

- Figure 31: undefined Artificial Lifts Revenue (million), by Type 2024 & 2032

- Figure 32: undefined Artificial Lifts Volume (K), by Type 2024 & 2032

- Figure 33: undefined Artificial Lifts Revenue Share (%), by Type 2024 & 2032

- Figure 34: undefined Artificial Lifts Volume Share (%), by Type 2024 & 2032

- Figure 35: undefined Artificial Lifts Revenue (million), by Country 2024 & 2032

- Figure 36: undefined Artificial Lifts Volume (K), by Country 2024 & 2032

- Figure 37: undefined Artificial Lifts Revenue Share (%), by Country 2024 & 2032

- Figure 38: undefined Artificial Lifts Volume Share (%), by Country 2024 & 2032

- Figure 39: undefined Artificial Lifts Revenue (million), by Application 2024 & 2032

- Figure 40: undefined Artificial Lifts Volume (K), by Application 2024 & 2032

- Figure 41: undefined Artificial Lifts Revenue Share (%), by Application 2024 & 2032

- Figure 42: undefined Artificial Lifts Volume Share (%), by Application 2024 & 2032

- Figure 43: undefined Artificial Lifts Revenue (million), by Type 2024 & 2032

- Figure 44: undefined Artificial Lifts Volume (K), by Type 2024 & 2032

- Figure 45: undefined Artificial Lifts Revenue Share (%), by Type 2024 & 2032

- Figure 46: undefined Artificial Lifts Volume Share (%), by Type 2024 & 2032

- Figure 47: undefined Artificial Lifts Revenue (million), by Country 2024 & 2032

- Figure 48: undefined Artificial Lifts Volume (K), by Country 2024 & 2032

- Figure 49: undefined Artificial Lifts Revenue Share (%), by Country 2024 & 2032

- Figure 50: undefined Artificial Lifts Volume Share (%), by Country 2024 & 2032

- Figure 51: undefined Artificial Lifts Revenue (million), by Application 2024 & 2032

- Figure 52: undefined Artificial Lifts Volume (K), by Application 2024 & 2032

- Figure 53: undefined Artificial Lifts Revenue Share (%), by Application 2024 & 2032

- Figure 54: undefined Artificial Lifts Volume Share (%), by Application 2024 & 2032

- Figure 55: undefined Artificial Lifts Revenue (million), by Type 2024 & 2032

- Figure 56: undefined Artificial Lifts Volume (K), by Type 2024 & 2032

- Figure 57: undefined Artificial Lifts Revenue Share (%), by Type 2024 & 2032

- Figure 58: undefined Artificial Lifts Volume Share (%), by Type 2024 & 2032

- Figure 59: undefined Artificial Lifts Revenue (million), by Country 2024 & 2032

- Figure 60: undefined Artificial Lifts Volume (K), by Country 2024 & 2032

- Figure 61: undefined Artificial Lifts Revenue Share (%), by Country 2024 & 2032

- Figure 62: undefined Artificial Lifts Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Artificial Lifts Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Artificial Lifts Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Artificial Lifts Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Artificial Lifts Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Artificial Lifts Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Artificial Lifts Volume K Forecast, by Type 2019 & 2032

- Table 7: Global Artificial Lifts Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Artificial Lifts Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Artificial Lifts Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Artificial Lifts Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Artificial Lifts Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Artificial Lifts Volume K Forecast, by Type 2019 & 2032

- Table 13: Global Artificial Lifts Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Artificial Lifts Volume K Forecast, by Country 2019 & 2032

- Table 15: Global Artificial Lifts Revenue million Forecast, by Application 2019 & 2032

- Table 16: Global Artificial Lifts Volume K Forecast, by Application 2019 & 2032

- Table 17: Global Artificial Lifts Revenue million Forecast, by Type 2019 & 2032

- Table 18: Global Artificial Lifts Volume K Forecast, by Type 2019 & 2032

- Table 19: Global Artificial Lifts Revenue million Forecast, by Country 2019 & 2032

- Table 20: Global Artificial Lifts Volume K Forecast, by Country 2019 & 2032

- Table 21: Global Artificial Lifts Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Artificial Lifts Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Artificial Lifts Revenue million Forecast, by Type 2019 & 2032

- Table 24: Global Artificial Lifts Volume K Forecast, by Type 2019 & 2032

- Table 25: Global Artificial Lifts Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Artificial Lifts Volume K Forecast, by Country 2019 & 2032

- Table 27: Global Artificial Lifts Revenue million Forecast, by Application 2019 & 2032

- Table 28: Global Artificial Lifts Volume K Forecast, by Application 2019 & 2032

- Table 29: Global Artificial Lifts Revenue million Forecast, by Type 2019 & 2032

- Table 30: Global Artificial Lifts Volume K Forecast, by Type 2019 & 2032

- Table 31: Global Artificial Lifts Revenue million Forecast, by Country 2019 & 2032

- Table 32: Global Artificial Lifts Volume K Forecast, by Country 2019 & 2032

- Table 33: Global Artificial Lifts Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Artificial Lifts Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Artificial Lifts Revenue million Forecast, by Type 2019 & 2032

- Table 36: Global Artificial Lifts Volume K Forecast, by Type 2019 & 2032

- Table 37: Global Artificial Lifts Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Artificial Lifts Volume K Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Artificial Lifts?

The projected CAGR is approximately 3.3%.

2. Which companies are prominent players in the Artificial Lifts?

Key companies in the market include Schlumberger, GE, Dover Corporation, GE(Baker Hughes), Weatherford International, Halliburton Company, JJ Tech, National Oilwell Varco, BCP Group, NOVOMET, Aker Solutions, Occidental Petroleum, Flotek Industries, Borets International.

3. What are the main segments of the Artificial Lifts?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 14580 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Artificial Lifts," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Artificial Lifts report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Artificial Lifts?

To stay informed about further developments, trends, and reports in the Artificial Lifts, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence