Key Insights

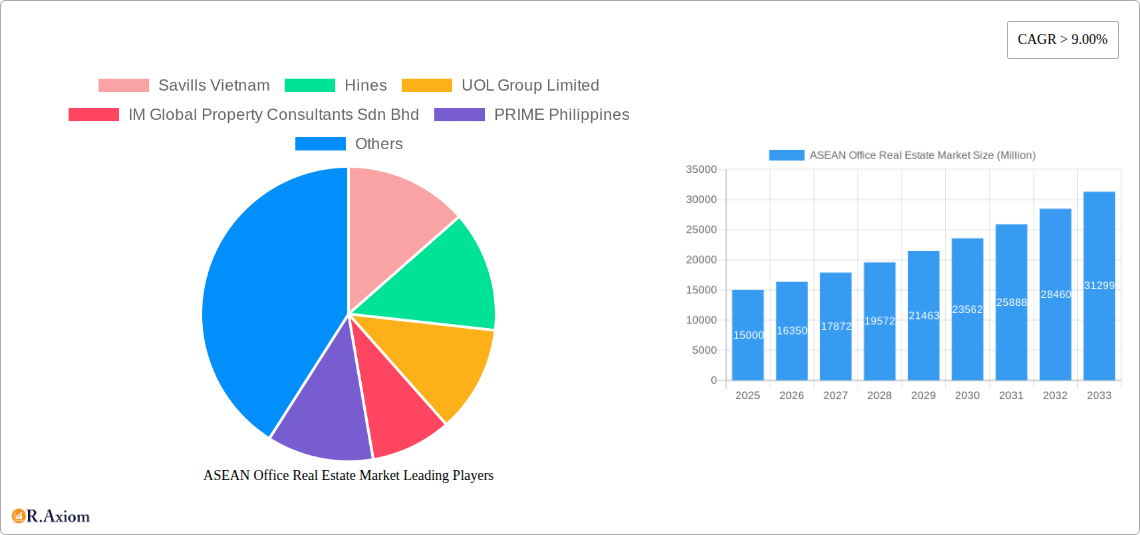

The ASEAN office real estate market is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 9% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, rapid urbanization and economic development across Southeast and South Asia are creating a surge in demand for modern office spaces, particularly in major cities like Singapore, Jakarta, Bangkok, and Ho Chi Minh City. Secondly, the increasing presence of multinational corporations and burgeoning technology sectors are driving the need for high-quality Grade A and B office spaces. Furthermore, government initiatives promoting infrastructure development and attracting foreign investment are further bolstering the market. While constraints such as fluctuating economic conditions and potential supply chain disruptions exist, the long-term outlook remains positive, with sustained growth expected throughout the forecast period. The market is segmented by office grade (A, B, C), location (Southeast Asia, South Asia), and end-user (corporate, SME, government). Major players like Savills Vietnam, Hines, UOL Group Limited, and CBRE Vietnam are shaping the market landscape through their development and management activities. The strong performance of the ASEAN economies, particularly in digital transformation and infrastructure investments, promises continued expansion for the foreseeable future.

ASEAN Office Real Estate Market Market Size (In Billion)

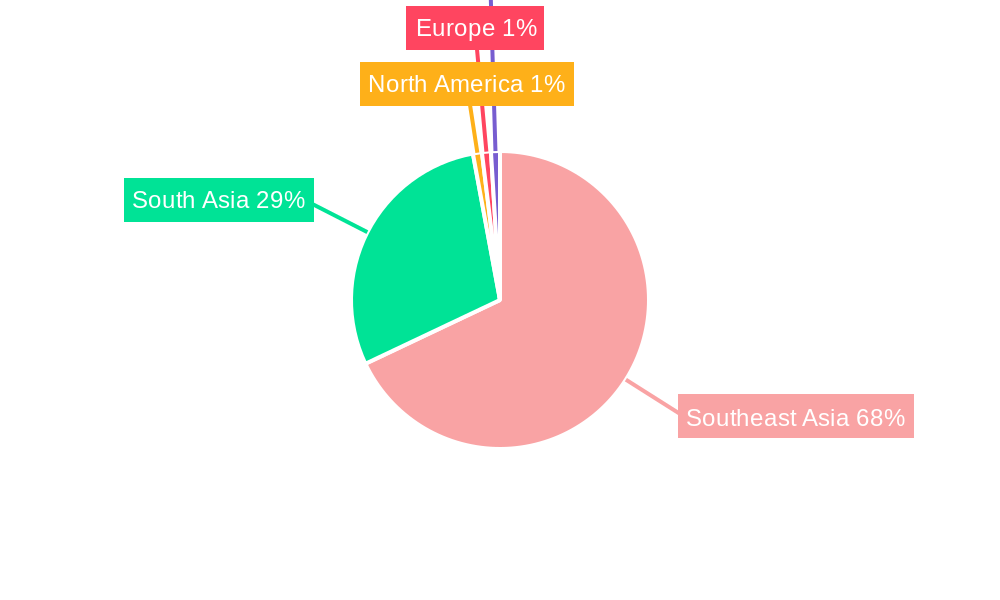

The market segmentation reveals significant opportunities. Grade A offices, commanding premium rents, are expected to experience the highest growth, driven by the demand from multinational corporations and tech firms. Southeast Asia, with its rapidly expanding economies and young, tech-savvy population, is projected to capture a larger share of the market compared to South Asia. The corporate sector, followed by SMEs, will remain the primary end-users, while government agencies also contribute significantly to the demand. The competitive landscape is marked by a mix of international and local players, indicating a dynamic and evolving market with significant potential for both established and emerging companies. Analyzing specific countries within the region allows for a more granular understanding of growth drivers and potential investment opportunities, allowing strategic players to position themselves effectively.

ASEAN Office Real Estate Market Company Market Share

ASEAN Office Real Estate Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the ASEAN office real estate market, offering invaluable insights for investors, developers, and industry stakeholders. With a focus on the period 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report delves into market dynamics, key players, and future growth potential. The analysis covers various segments, including Grade A, B, and C offices across Southeast and South Asia, catering to corporate offices, SMEs, and government agencies. The report utilizes data from the historical period (2019-2024) to project future trends.

ASEAN Office Real Estate Market Market Concentration & Innovation

The ASEAN office real estate market exhibits a moderate level of concentration, with several large players holding significant market share. However, the market is also characterized by a high degree of competition, particularly in major cities like Singapore, Bangkok, and Jakarta. Innovation in the sector is driven by the increasing demand for sustainable and technologically advanced office spaces, including smart building technologies and flexible workspaces. Regulatory frameworks vary across the ASEAN region, influencing development costs and timelines. Product substitutes, such as co-working spaces and remote work arrangements, are impacting traditional office demand. End-user trends are shifting towards flexible lease terms and amenity-rich spaces. Mergers and acquisitions (M&A) activity is robust, with deal values exceeding xx Million in recent years.

- Market Share: Top 5 players hold approximately xx% of the market share.

- M&A Deal Values: Total M&A deal value in 2024 reached approximately xx Million, with an average deal size of xx Million.

- Innovation Drivers: Smart building technology, flexible workspaces, sustainable design.

- Regulatory Frameworks: Vary significantly across ASEAN countries, impacting development costs.

ASEAN Office Real Estate Market Industry Trends & Insights

The ASEAN office real estate market is experiencing robust growth, driven by strong economic expansion, urbanization, and increasing foreign direct investment (FDI). The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is estimated at xx%, indicating significant market expansion. Technological disruptions, such as the rise of remote work, are impacting demand, while consumer preferences are increasingly focused on sustainable and technologically advanced spaces. Competitive dynamics are intense, with both local and international players vying for market share. Market penetration of Grade A office spaces is expected to increase to xx% by 2033, while Grade B and C office segments will continue to cater to a significant portion of the market. The increasing adoption of smart building technology is contributing to higher rental yields and attracting tenants.

Dominant Markets & Segments in ASEAN Office Real Estate Market

By Type: Grade A offices dominate the market in terms of rental rates and occupancy, driven by high demand from multinational corporations and leading businesses. This segment is projected to experience the highest CAGR of xx% during the forecast period. Grade B and C offices cater to SMEs and other businesses, which remain vital to the overall market size.

By Location: Southeast Asia, particularly Singapore, Jakarta, and Bangkok, dominates the ASEAN office real estate market, fueled by robust economic growth, substantial FDI, and advanced infrastructure. Singapore maintains a leading position due to its sophisticated infrastructure and strategic location.

By End-User: Corporate offices, representing a significant portion of the demand, are driving the growth in premium office spaces. SMEs constitute a large portion of the market, particularly for Grade B and C offices. Government agencies account for a steady, though less volatile, demand for office space.

Key Drivers:

- Economic Policies: Supportive government policies promoting foreign investment and infrastructure development.

- Infrastructure Development: Continued expansion of transportation networks and utilities.

- Urbanization: Rapid urbanization across ASEAN cities.

ASEAN Office Real Estate Market Product Developments

Recent innovations in the ASEAN office real estate market include the integration of smart building technologies, focusing on energy efficiency, security, and workspace optimization. The increasing adoption of flexible workspaces and co-working facilities is reshaping the office landscape, providing adaptability to evolving business needs. These developments enhance the tenant experience and create a competitive advantage for building owners. The market is trending towards sustainable building practices, meeting growing environmental concerns and creating healthier work environments.

Report Scope & Segmentation Analysis

By Type: The report segments the market by office grade (A, B, C), analyzing growth projections, market sizes, and competitive landscapes for each. Grade A offices are expected to witness significant growth fueled by high demand.

By Location: The report analyzes Southeast and South Asia, with a focus on key markets like Singapore, Thailand, Indonesia, Malaysia, Vietnam, and the Philippines. Growth projections vary by location depending on economic conditions and infrastructure development.

By End-User: The report provides a detailed analysis of corporate offices, SME offices, and government agencies. Demand trends and preferences vary among these end-users.

Key Drivers of ASEAN Office Real Estate Market Growth

Several key factors are driving growth in the ASEAN office real estate market. Strong economic expansion across the region is attracting substantial foreign direct investment, stimulating demand for office space. Rapid urbanization is increasing the concentration of businesses and employees in major cities. Government initiatives aimed at improving infrastructure and easing business regulations are creating a favorable environment for real estate development. Moreover, the increasing adoption of advanced building technologies is boosting the attractiveness of modern office spaces.

Challenges in the ASEAN Office Real Estate Market Sector

The ASEAN office real estate market faces several challenges. Varied regulatory frameworks across different countries can create complexities for developers and investors. Supply chain disruptions can impact construction costs and timelines. Intense competition among developers and landlords can lead to price wars and reduced profit margins. Furthermore, fluctuations in global economic conditions can impact demand, creating uncertainty in the market.

Emerging Opportunities in ASEAN Office Real Estate Market

The ASEAN office real estate market presents several emerging opportunities. The growth of e-commerce and technology companies is generating demand for innovative and technologically advanced office spaces. The increasing focus on sustainability presents opportunities for developers to build green buildings. Expansion into secondary cities offers potential for growth as businesses seek more affordable locations. Finally, the adoption of flexible work models creates opportunities for co-working spaces and flexible office solutions.

Leading Players in the ASEAN Office Real Estate Market Market

- Savills Vietnam

- Hines

- UOL Group Limited

- IM Global Property Consultants Sdn Bhd

- PRIME Philippines

- Frasers Property

- City Developments Limited

- PT Ciputra Development Tbk

- CBRE Vietnam

- Malton Berhad

Key Developments in ASEAN Office Real Estate Market Industry

- September 2022: Ciputra International inaugurated the Propan Tower in Jakarta, a 17-floor project comprising 10 buildings (6 offices, 3 apartments, 1 hotel) across 7.4 hectares, reflecting the growing demand for office space in Jakarta.

- February 2022: Hulic acquired Trust Beneficiary Rights in the Shintomicho Building in Tokyo for USD 25.4 Million, highlighting cross-border investment activity and capital flow into the sector.

Strategic Outlook for ASEAN Office Real Estate Market Market

The ASEAN office real estate market is poised for continued growth driven by strong economic fundamentals and urbanization. The increasing adoption of technology and focus on sustainability will shape future developments. Opportunities exist in expanding into secondary cities and developing flexible workspace solutions. The market will continue to experience dynamic competition among both local and international players. Investors should focus on projects with strong ESG credentials and adaptability to evolving work patterns.

ASEAN Office Real Estate Market Segmentation

-

1. Geography

- 1.1. Singapore

- 1.2. Thailand

- 1.3. Vietnam

- 1.4. Indonesia

- 1.5. Malaysia

- 1.6. Philippines

- 1.7. Rest of ASEAN

ASEAN Office Real Estate Market Segmentation By Geography

- 1. Singapore

- 2. Thailand

- 3. Vietnam

- 4. Indonesia

- 5. Malaysia

- 6. Philippines

- 7. Rest of ASEAN

ASEAN Office Real Estate Market Regional Market Share

Geographic Coverage of ASEAN Office Real Estate Market

ASEAN Office Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing geriatric population; Growing cases of chronic disease among senior citizens

- 3.3. Market Restrains

- 3.3.1. High cost of elderly care services; Lack of skilled staff

- 3.4. Market Trends

- 3.4.1. Demand for Co-Working Spaces Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 5.1.1. Singapore

- 5.1.2. Thailand

- 5.1.3. Vietnam

- 5.1.4. Indonesia

- 5.1.5. Malaysia

- 5.1.6. Philippines

- 5.1.7. Rest of ASEAN

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Singapore

- 5.2.2. Thailand

- 5.2.3. Vietnam

- 5.2.4. Indonesia

- 5.2.5. Malaysia

- 5.2.6. Philippines

- 5.2.7. Rest of ASEAN

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 6. Singapore ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 6.1.1. Singapore

- 6.1.2. Thailand

- 6.1.3. Vietnam

- 6.1.4. Indonesia

- 6.1.5. Malaysia

- 6.1.6. Philippines

- 6.1.7. Rest of ASEAN

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 7. Thailand ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 7.1.1. Singapore

- 7.1.2. Thailand

- 7.1.3. Vietnam

- 7.1.4. Indonesia

- 7.1.5. Malaysia

- 7.1.6. Philippines

- 7.1.7. Rest of ASEAN

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 8. Vietnam ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 8.1.1. Singapore

- 8.1.2. Thailand

- 8.1.3. Vietnam

- 8.1.4. Indonesia

- 8.1.5. Malaysia

- 8.1.6. Philippines

- 8.1.7. Rest of ASEAN

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 9. Indonesia ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Geography

- 9.1.1. Singapore

- 9.1.2. Thailand

- 9.1.3. Vietnam

- 9.1.4. Indonesia

- 9.1.5. Malaysia

- 9.1.6. Philippines

- 9.1.7. Rest of ASEAN

- 9.1. Market Analysis, Insights and Forecast - by Geography

- 10. Malaysia ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Geography

- 10.1.1. Singapore

- 10.1.2. Thailand

- 10.1.3. Vietnam

- 10.1.4. Indonesia

- 10.1.5. Malaysia

- 10.1.6. Philippines

- 10.1.7. Rest of ASEAN

- 10.1. Market Analysis, Insights and Forecast - by Geography

- 11. Philippines ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Geography

- 11.1.1. Singapore

- 11.1.2. Thailand

- 11.1.3. Vietnam

- 11.1.4. Indonesia

- 11.1.5. Malaysia

- 11.1.6. Philippines

- 11.1.7. Rest of ASEAN

- 11.1. Market Analysis, Insights and Forecast - by Geography

- 12. Rest of ASEAN ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Geography

- 12.1.1. Singapore

- 12.1.2. Thailand

- 12.1.3. Vietnam

- 12.1.4. Indonesia

- 12.1.5. Malaysia

- 12.1.6. Philippines

- 12.1.7. Rest of ASEAN

- 12.1. Market Analysis, Insights and Forecast - by Geography

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Savills Vietnam

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Hines

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 UOL Group Limited

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 IM Global Property Consultants Sdn Bhd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 PRIME Philippines

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Frasers Property

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 City Developments Limited

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 PT Ciputra Development Tbk

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 CBRE Vietnam

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Malton Berhad

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Savills Vietnam

List of Figures

- Figure 1: Global ASEAN Office Real Estate Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Singapore ASEAN Office Real Estate Market Revenue (undefined), by Geography 2025 & 2033

- Figure 3: Singapore ASEAN Office Real Estate Market Revenue Share (%), by Geography 2025 & 2033

- Figure 4: Singapore ASEAN Office Real Estate Market Revenue (undefined), by Country 2025 & 2033

- Figure 5: Singapore ASEAN Office Real Estate Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Thailand ASEAN Office Real Estate Market Revenue (undefined), by Geography 2025 & 2033

- Figure 7: Thailand ASEAN Office Real Estate Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: Thailand ASEAN Office Real Estate Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: Thailand ASEAN Office Real Estate Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Vietnam ASEAN Office Real Estate Market Revenue (undefined), by Geography 2025 & 2033

- Figure 11: Vietnam ASEAN Office Real Estate Market Revenue Share (%), by Geography 2025 & 2033

- Figure 12: Vietnam ASEAN Office Real Estate Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Vietnam ASEAN Office Real Estate Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Indonesia ASEAN Office Real Estate Market Revenue (undefined), by Geography 2025 & 2033

- Figure 15: Indonesia ASEAN Office Real Estate Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Indonesia ASEAN Office Real Estate Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Indonesia ASEAN Office Real Estate Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Malaysia ASEAN Office Real Estate Market Revenue (undefined), by Geography 2025 & 2033

- Figure 19: Malaysia ASEAN Office Real Estate Market Revenue Share (%), by Geography 2025 & 2033

- Figure 20: Malaysia ASEAN Office Real Estate Market Revenue (undefined), by Country 2025 & 2033

- Figure 21: Malaysia ASEAN Office Real Estate Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Philippines ASEAN Office Real Estate Market Revenue (undefined), by Geography 2025 & 2033

- Figure 23: Philippines ASEAN Office Real Estate Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Philippines ASEAN Office Real Estate Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Philippines ASEAN Office Real Estate Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of ASEAN ASEAN Office Real Estate Market Revenue (undefined), by Geography 2025 & 2033

- Figure 27: Rest of ASEAN ASEAN Office Real Estate Market Revenue Share (%), by Geography 2025 & 2033

- Figure 28: Rest of ASEAN ASEAN Office Real Estate Market Revenue (undefined), by Country 2025 & 2033

- Figure 29: Rest of ASEAN ASEAN Office Real Estate Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global ASEAN Office Real Estate Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 2: Global ASEAN Office Real Estate Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global ASEAN Office Real Estate Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Global ASEAN Office Real Estate Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: Global ASEAN Office Real Estate Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: Global ASEAN Office Real Estate Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global ASEAN Office Real Estate Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Global ASEAN Office Real Estate Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global ASEAN Office Real Estate Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 10: Global ASEAN Office Real Estate Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Global ASEAN Office Real Estate Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Global ASEAN Office Real Estate Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global ASEAN Office Real Estate Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 14: Global ASEAN Office Real Estate Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: Global ASEAN Office Real Estate Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Global ASEAN Office Real Estate Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ASEAN Office Real Estate Market?

The projected CAGR is approximately 5.67%.

2. Which companies are prominent players in the ASEAN Office Real Estate Market?

Key companies in the market include Savills Vietnam, Hines, UOL Group Limited, IM Global Property Consultants Sdn Bhd, PRIME Philippines, Frasers Property, City Developments Limited, PT Ciputra Development Tbk, CBRE Vietnam, Malton Berhad.

3. What are the main segments of the ASEAN Office Real Estate Market?

The market segments include Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing geriatric population; Growing cases of chronic disease among senior citizens.

6. What are the notable trends driving market growth?

Demand for Co-Working Spaces Driving the Market.

7. Are there any restraints impacting market growth?

High cost of elderly care services; Lack of skilled staff.

8. Can you provide examples of recent developments in the market?

September 2022 - Ciputra International (a real estate company), inaugurated the Propan Tower. This project has 17 floors and is spread across 7.4 hectares, consisting of 10 buildings, 6 offices, 3 apartments, and 1 hotel. The project was developed to meet the increasing demand for office space in Jakarta.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ASEAN Office Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ASEAN Office Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ASEAN Office Real Estate Market?

To stay informed about further developments, trends, and reports in the ASEAN Office Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence