Key Insights

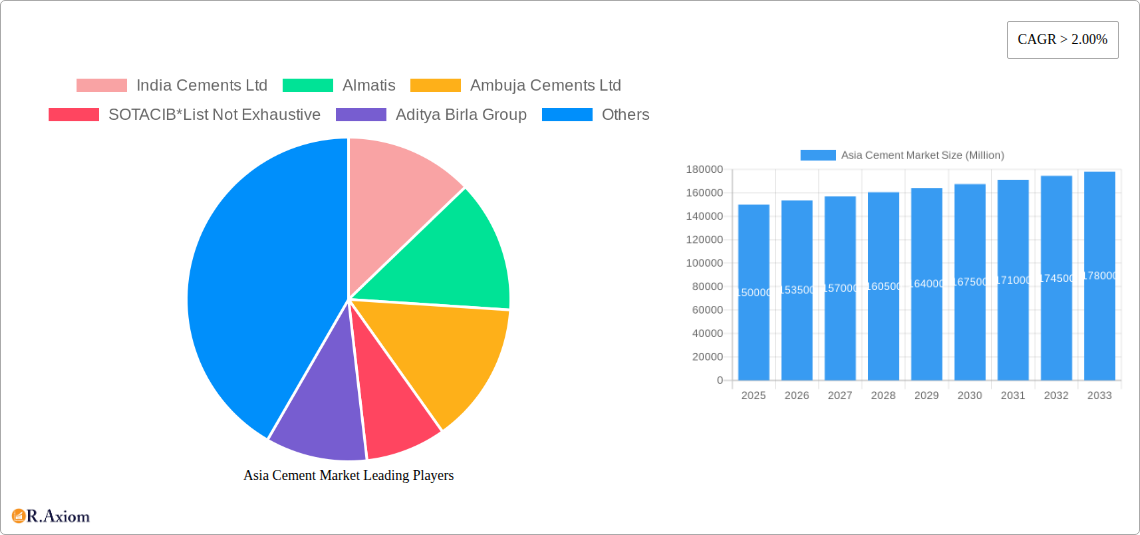

The Asia Cement Market is projected for significant expansion, anticipated to reach a market size of $178.4 billion by 2033. This growth is driven by robust construction activities across the region, with a Compound Annual Growth Rate (CAGR) of 5.2% from a base year of 2025. Key growth drivers include substantial infrastructure development, urbanization, and population growth in major Asian economies like China and India. Government initiatives supporting economic development and large-scale projects, alongside technological advancements in cement production and the adoption of sustainable building practices, are further bolstering market expansion.

Asia Cement Market Market Size (In Billion)

While the outlook is positive, the Asia Cement Market encounters challenges such as fluctuating raw material prices and stringent environmental regulations, which can impact operational costs and necessitate capital investment. The market segmentation by type indicates that Type I and Type III cements will lead due to their broad construction applications. Demand is strong across Residential and Non-residential sectors, with Commercial and Infrastructure projects exhibiting particularly high growth potential. Leading companies such as India Cements Ltd, Ambuja Cements Ltd, and Aditya Birla Group are actively influencing the market through strategic investments and product innovation in key Asian countries including China, India, Indonesia, and Vietnam.

Asia Cement Market Company Market Share

Asia Cement Market Market Concentration & Innovation

The Asia Cement Market is characterized by a moderate to high market concentration, with a few major players dominating significant portions of the regional output. Key companies such as India Cements Ltd, Ambuja Cements Ltd, Aditya Birla Group, and JK Cement Ltd hold substantial market shares, driving innovation and influencing pricing strategies. The market exhibits a dynamic landscape of innovation, fueled by the increasing demand for sustainable and high-performance cement. This includes the development of green cement alternatives, blended cements with reduced clinker factors, and advanced admixture technologies aimed at improving durability and reducing environmental impact. Regulatory frameworks across Asian nations play a crucial role, with governments increasingly implementing stringent environmental standards and building codes that encourage the adoption of sustainable construction materials. While India Cements Ltd's market share is estimated to be around 15%, Ambuja Cements Ltd follows with approximately 12%. Aditya Birla Group commands a significant presence, with an estimated 10% market share, and JK Cement Ltd holds about 8%. The report analyzes numerous M&A activities, with a total deal value estimated to be over $5,000 Million during the historical period, indicating a consolidation trend. For instance, an acquisition in the North Asian region by Aditya Birla Group for approximately $800 Million in 2022 significantly reshaped its market position. The report also delves into the threat of product substitutes such as ready-mix concrete and alternative building materials, though cement's foundational role in construction keeps its market penetration robust. End-user trends are increasingly focused on durability, cost-effectiveness, and eco-friendly construction, driving manufacturers to invest in research and development.

Asia Cement Market Industry Trends & Insights

The Asia Cement Market is poised for robust growth, driven by an estimated Compound Annual Growth Rate (CAGR) of 6.2% from 2025 to 2033. This expansion is primarily propelled by a confluence of factors including rapid urbanization, substantial investments in infrastructure development across the region, and a growing population demanding new residential and commercial spaces. The market penetration of cement in key economies like China and India is already high, but continued economic development and population growth will sustain demand. Technological disruptions are reshaping the industry, with a significant focus on energy efficiency in cement production, leading to the adoption of advanced grinding technologies and alternative fuel sources. The development of low-carbon cements, such as Portland Limestone Cement (PLC) and geopolymer cements, is gaining traction as environmental consciousness rises among both producers and consumers. Consumer preferences are evolving, with a growing demand for durable, aesthetically pleasing, and environmentally friendly building materials. This shift is compelling manufacturers to innovate and offer a wider range of specialized cement products. Competitive dynamics are intensifying, with both domestic and international players vying for market share. Strategic partnerships, mergers, and acquisitions are becoming more common as companies seek to expand their geographical reach and product portfolios. The market size, valued at approximately $180,000 Million in 2024, is projected to reach over $300,000 Million by 2033. The increasing adoption of digital technologies in the supply chain and production processes, such as AI-powered process optimization and IoT for real-time monitoring, are further enhancing operational efficiency and reducing costs. The demand for cement in the non-residential sector, particularly for infrastructure projects like high-speed rail, airports, and smart cities, is a significant growth catalyst. The residential segment also continues to be a major contributor, fueled by expanding middle-class populations and housing initiatives. The industrial/institutional segment is experiencing steady growth due to the construction of factories, warehouses, and educational facilities. The report provides in-depth analysis of these trends, offering actionable insights for stakeholders to navigate the evolving landscape of the Asia Cement Market.

Dominant Markets & Segments in Asia Cement Market

The Asia Cement Market is experiencing significant dominance from specific regions and segments, driven by a powerful interplay of economic policies, infrastructure initiatives, and demographic trends. South Asia, particularly India, is emerging as a powerhouse in cement consumption and production, largely attributed to its burgeoning population, rapid urbanization, and proactive government policies aimed at boosting infrastructure development. The Indian government's focus on projects such as the National Infrastructure Pipeline and Smart Cities Mission directly fuels the demand for cement.

Key Drivers of Dominance:

- Economic Policies: Favorable government policies promoting construction and real estate development.

- Infrastructure Spending: Massive public and private investment in roads, bridges, airports, and public utilities.

- Urbanization: Rapid migration to urban centers necessitates extensive housing and commercial construction.

- Population Growth: A sustained increase in population directly translates to higher demand for new residential and commercial structures.

Within the Type segmentation, Type I cement, also known as Ordinary Portland Cement (OPC), continues to hold the largest market share due to its versatility and widespread application in general construction. Its market share is estimated to be around 70%. However, Type III cement, or High Early Strength Cement, is witnessing accelerated growth, driven by the need for faster construction cycles in large-scale infrastructure and commercial projects. The development of "Other Types" of cement, including blended cements and specialized cements for specific applications like marine environments or sulphate resistance, is also on the rise, capturing an estimated 15% of the market.

In terms of Application, the Non-residential segment is the most dominant force. This segment, encompassing Commercial, Infrastructure, and Industrial/Institutional applications, accounts for approximately 60% of the total market demand. The sheer scale of infrastructure projects, such as high-speed rail networks, airports, dams, and power plants, drives this dominance. The Infrastructure sub-segment alone is a major consumer, supported by government-led development projects across the region. The Commercial sub-segment, driven by the construction of offices, retail spaces, and hospitality facilities, also contributes significantly. The Industrial/Institutional sub-segment, which includes factories, warehouses, and educational institutions, is experiencing steady growth. The Residential segment, while substantial, accounts for the remaining 40% of the market, driven by the growing need for housing due to population growth and urbanization. The dominance of South Asia, propelled by India, is further amplified by the strong performance of these non-residential applications, making it a critical focus for market players.

Asia Cement Market Product Developments

The Asia Cement Market is witnessing a surge in product developments centered around sustainability, performance enhancement, and cost-efficiency. Innovations include the widespread adoption of low-carbon cements, such as Portland Limestone Cement (PLC) and blended cements incorporating fly ash and slag, significantly reducing the carbon footprint of construction. Companies are investing in advanced admixtures to improve cement's workability, durability, and strength, catering to complex construction needs in sectors like high-rise buildings and infrastructure. For instance, the development of self-healing concrete and high-performance concrete (HPC) is gaining traction, offering enhanced longevity and reduced maintenance costs. These product advancements are not only driven by environmental regulations but also by a growing demand from end-users for more resilient and sustainable construction solutions, providing a significant competitive advantage.

Asia Cement Market Report Scope & Segmentation Analysis

This comprehensive report on the Asia Cement Market provides an in-depth analysis of various market segments to offer a granular understanding of market dynamics. The segmentation is categorized by Type and Application.

Type Segmentation:

- Type I: This segment, comprising Ordinary Portland Cement (OPC), is expected to maintain a dominant market share due to its widespread use in general construction. Projected market size for this segment is around $130,000 Million in 2025, with a steady growth rate.

- Type III: High Early Strength Cement is anticipated to exhibit the fastest growth rate, driven by the demand for rapid construction in infrastructure and commercial projects. Its market share is projected to increase, with a forecast market size of $35,000 Million in 2025.

- Other Types: This encompasses blended cements and specialized cements, which are gaining traction due to their environmental benefits and specific performance characteristics. This segment is forecast to grow at a healthy pace, reaching an estimated $25,000 Million by 2025.

Application Segmentation:

- Residential: This segment, driven by population growth and urbanization, is a significant contributor to the market. The projected market size for residential applications is around $75,000 Million in 2025, with consistent growth anticipated.

- Non-residential: This broad category, including Commercial, Infrastructure, and Industrial/Institutional applications, is the largest and most dynamic segment.

- Commercial: Driven by office buildings, retail spaces, and hospitality.

- Infrastructure: Fueled by large-scale government and private projects like roads, bridges, and public utilities.

- Industrial/Institutional: Encompassing factories, warehouses, and educational facilities. The non-residential segment is projected to reach over $100,000 Million in 2025, with the Infrastructure sub-segment being a key growth engine.

Key Drivers of Asia Cement Market Growth

The Asia Cement Market's growth is propelled by several interconnected factors. Rapid urbanization across developing economies necessitates extensive construction of residential, commercial, and industrial facilities, directly boosting cement demand. Significant government investments in infrastructure development, including transportation networks, energy projects, and urban renewal initiatives, are creating substantial demand for cement. Furthermore, a growing population and rising disposable incomes are leading to increased spending on housing and real estate, further fueling market expansion. Technological advancements in cement production, leading to more sustainable and cost-effective products, also play a crucial role in driving adoption and market growth.

Challenges in the Asia Cement Market Sector

Despite robust growth prospects, the Asia Cement Market faces several significant challenges. Increasing environmental regulations and pressure to reduce carbon emissions are compelling manufacturers to invest in cleaner production technologies, which can be capital-intensive. Volatile raw material costs, particularly for energy and limestone, can impact profit margins and pricing strategies. Intense competition among a large number of players, including both established multinational corporations and local manufacturers, can lead to price wars and reduced profitability. Supply chain disruptions, exacerbated by logistical complexities and geopolitical factors, can affect the timely delivery of raw materials and finished products.

Emerging Opportunities in Asia Cement Market

The Asia Cement Market presents numerous emerging opportunities for growth and innovation. The increasing focus on sustainable construction is driving demand for green cement alternatives and blended cements, creating a niche for eco-friendly products. The ongoing digital transformation in the construction industry, including the adoption of Building Information Modeling (BIM) and smart technologies, opens avenues for specialized cement products that integrate with these advanced systems. Furthermore, emerging economies within Asia are experiencing rapid industrialization and urbanization, presenting untapped market potential for cement manufacturers. Investments in renewable energy projects and smart city development are also creating new avenues for demand.

Leading Players in the Asia Cement Market Market

- India Cements Ltd

- Almatis

- Ambuja Cements Ltd

- SOTACIB*List Not Exhaustive

- Aditya Birla Group

- JK Cement Ltd

- Royal El Minya Cement

- Cementir Holding N V

Key Developments in Asia Cement Market Industry

- January 2024: Ambuja Cements Ltd announces plans for a new greenfield cement plant in Rajasthan, India, to increase production capacity by 3 Million Tonnes Per Annum.

- November 2023: Aditya Birla Group invests in advanced research for low-carbon cement production, aiming to reduce its carbon footprint by 20% by 2030.

- July 2023: JK Cement Ltd expands its product portfolio with the launch of a new range of specialized cements for industrial applications.

- March 2023: India Cements Ltd acquires a smaller regional player in South India, strengthening its market presence in the southern states.

- December 2022: SOTACIB (Tunisia) reports significant progress in the development of innovative blended cement formulations to meet evolving market demands.

- September 2022: Royal El Minya Cement enhances its production efficiency through the adoption of state-of-the-art grinding technologies.

- April 2022: Cementir Holding N.V. announces strategic partnerships to explore opportunities in sustainable construction materials across Southeast Asia.

Strategic Outlook for Asia Cement Market Market

The strategic outlook for the Asia Cement Market is highly positive, driven by sustained demand from rapid urbanization and massive infrastructure investments across the region. Companies are focusing on enhancing operational efficiency through digitalization and automation, while also prioritizing the development and promotion of sustainable cement products to meet stringent environmental regulations and evolving consumer preferences. Strategic partnerships and mergers & acquisitions will continue to be pivotal for consolidating market share and expanding geographical reach. The market is expected to witness significant growth in specialized and blended cements, offering higher margins and catering to niche applications. Innovation in raw material sourcing and energy consumption reduction will be critical for long-term competitiveness.

Asia Cement Market Segmentation

-

1. Type

- 1.1. Type I

- 1.2. Type III

- 1.3. Other Types

-

2. Application

- 2.1. Residential

-

2.2. Non-residential

- 2.2.1. Commercial

- 2.2.2. Infrastructure

- 2.2.3. Industrial/Institutional

Asia Cement Market Segmentation By Geography

-

1. Asia

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Indonesia

- 1.6. Malaysia

- 1.7. Singapore

- 1.8. Thailand

- 1.9. Vietnam

- 1.10. Philippines

- 1.11. Bangladesh

- 1.12. Pakistan

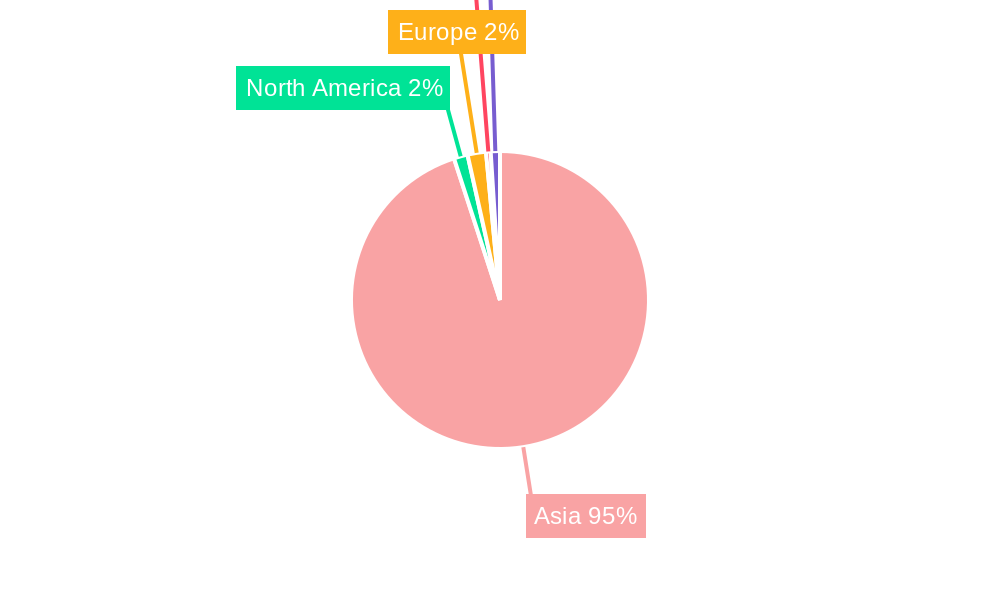

Asia Cement Market Regional Market Share

Geographic Coverage of Asia Cement Market

Asia Cement Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand from the Construction Industry; Increasing Demand for Precast Concrete

- 3.3. Market Restrains

- 3.3.1. ; High Production Cost; Other Restraints

- 3.4. Market Trends

- 3.4.1. Growing Demand from the Construction Industry in Asia-Pacific

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Cement Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Type I

- 5.1.2. Type III

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Non-residential

- 5.2.2.1. Commercial

- 5.2.2.2. Infrastructure

- 5.2.2.3. Industrial/Institutional

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 India Cements Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Almatis

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ambuja Cements Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SOTACIB*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Aditya Birla Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 JK Cement Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Royal El Minya Cement

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cementir Holding N V

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 India Cements Ltd

List of Figures

- Figure 1: Asia Cement Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Cement Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Cement Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Asia Cement Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Asia Cement Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Asia Cement Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Asia Cement Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Asia Cement Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Asia Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: India Asia Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Indonesia Asia Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Malaysia Asia Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Singapore Asia Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Thailand Asia Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Vietnam Asia Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Philippines Asia Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Bangladesh Asia Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Pakistan Asia Cement Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Cement Market?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Asia Cement Market?

Key companies in the market include India Cements Ltd, Almatis, Ambuja Cements Ltd, SOTACIB*List Not Exhaustive, Aditya Birla Group, JK Cement Ltd, Royal El Minya Cement, Cementir Holding N V.

3. What are the main segments of the Asia Cement Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 178.4 billion as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand from the Construction Industry; Increasing Demand for Precast Concrete.

6. What are the notable trends driving market growth?

Growing Demand from the Construction Industry in Asia-Pacific.

7. Are there any restraints impacting market growth?

; High Production Cost; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Cement Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Cement Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Cement Market?

To stay informed about further developments, trends, and reports in the Asia Cement Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence