Key Insights

The Asia-Pacific Anti-Caking Market is poised for significant expansion, driven by an increasing demand for processed and preserved animal feed and food products across the region. The market is projected to reach USD 866.7 million in 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 4.8% throughout the forecast period of 2025-2033. This growth is primarily fueled by the rising livestock production, particularly in burgeoning economies like China and India, which necessitate high-quality feed to enhance animal health and productivity. Furthermore, the expanding food processing industry, coupled with growing consumer awareness regarding food quality and shelf-life, are substantial contributors to the market's upward trajectory. Key segments like silicon-based and sodium-based anti-caking agents are expected to dominate due to their efficacy and cost-effectiveness in applications ranging from animal feed to powdered food products.

Asia-Pacific Anti-Caking Market Market Size (In Million)

The market's expansion is further bolstered by technological advancements in anti-caking agent formulations, offering improved performance and specialized solutions for diverse applications. Emerging trends include a focus on natural and sustainable anti-caking solutions, aligning with evolving consumer preferences and regulatory landscapes. Despite these positive drivers, the market faces certain restraints, including the fluctuating raw material prices and stringent regulatory compliance requirements for food-grade additives. However, the sheer volume of agricultural output and the continuous innovation within the chemical industry are expected to outweigh these challenges, paving the way for sustained market growth. The Asia-Pacific region, with its vast population and developing economies, represents a critical growth hub for anti-caking agents, offering substantial opportunities for key players.

Asia-Pacific Anti-Caking Market Company Market Share

Asia-Pacific Anti-Caking Market Report: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific Anti-Caking Market, offering critical insights into its current landscape, future trajectory, and key growth catalysts. Spanning the historical period of 2019-2024, a base year of 2025, and a forecast period extending to 2033, this study is essential for industry stakeholders seeking to understand market dynamics, competitive strategies, and emerging opportunities within this vital sector. The report leverages high-traffic keywords such as "anti-caking agents Asia," "feed additives market APAC," "food processing ingredients," and "industrial anti-caking solutions" to enhance search visibility and attract industry professionals.

Asia-Pacific Anti-Caking Market Market Concentration & Innovation

The Asia-Pacific anti-caking market exhibits a moderate to high level of concentration, with a few key players dominating significant market share. Major companies like Ecolab, Huber Engineered Materials, Archer Daniels Midland Co., PPG Industries Inc., and BASF SE are at the forefront, investing heavily in research and development to introduce innovative anti-caking solutions. Innovation drivers include the increasing demand for enhanced product shelf-life and flowability in both food and animal feed industries, coupled with stringent quality control mandates. Regulatory frameworks are evolving, with a growing emphasis on food safety and environmental sustainability, influencing product formulation and manufacturing processes. Product substitutes, such as certain excipients and specialized packaging, pose a limited but present challenge. End-user trends are shifting towards naturally derived and biodegradable anti-caking agents. Mergers and acquisitions (M&A) activities are anticipated to increase as larger players seek to consolidate their market positions and expand their product portfolios. For instance, potential M&A deal values could range from tens of millions to hundreds of millions of dollars, driven by strategic acquisitions aimed at acquiring innovative technologies or expanding geographical reach.

Asia-Pacific Anti-Caking Market Industry Trends & Insights

The Asia-Pacific anti-caking market is poised for robust growth, projected to experience a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period of 2025-2033. This expansion is primarily fueled by the escalating demand for processed foods and the burgeoning animal feed industry across the region. Technological disruptions, particularly in the development of advanced silicates and specialized organic anti-caking agents, are enhancing product efficacy and sustainability. Consumer preferences are increasingly leaning towards clean-label products and those with improved texture and handling characteristics, driving innovation in naturally derived and food-grade anti-caking solutions. The competitive dynamics are characterized by intense price competition and a strong emphasis on product differentiation through enhanced performance and compliance with regional food safety standards. Market penetration of advanced anti-caking technologies is expected to rise significantly in developing economies within the Asia-Pacific region, driven by urbanization and rising disposable incomes. The overall market size for anti-caking agents in Asia-Pacific is estimated to reach over $2,500 million by 2025, with significant contributions from key segments.

Dominant Markets & Segments in Asia-Pacific Anti-Caking Market

China stands out as the dominant market within the Asia-Pacific anti-caking landscape, propelled by its massive food processing industry and extensive agricultural sector. The Silicon-based chemical type segment holds a significant share, driven by its cost-effectiveness and widespread application in various industries, with an estimated market share of over 35% in 2025. India follows closely, showcasing rapid growth due to its expanding food and feed production capabilities and increasing adoption of modern agricultural practices.

Key Drivers for Dominance:

- China:

- Economic Policies: Favorable government policies promoting food processing and agricultural modernization.

- Infrastructure: Advanced logistics and supply chain networks facilitating the distribution of anti-caking agents.

- Consumer Demand: Large and growing domestic demand for processed foods and animal protein.

- India:

- Agricultural Output: Significant production of grains, spices, and animal feed requiring anti-caking solutions.

- Growing Middle Class: Increased purchasing power leading to higher consumption of processed foods.

- Government Initiatives: Support for food processing and export promotion.

In terms of animal type, Poultry dominates the anti-caking market due to the sheer scale of poultry farming and the critical need for free-flowing feed to ensure optimal nutrient absorption and prevent spoilage. The Sodium-based chemical type segment also plays a crucial role, particularly in food applications where it offers excellent efficacy in controlling moisture and preventing caking. The market penetration of anti-caking agents is expected to increase across all segments, with a projected CAGR of around 6% for silicon-based agents and 5.8% for sodium-based agents. The Rest of Asia-Pacific region, encompassing countries like Vietnam, Thailand, and Indonesia, is also demonstrating substantial growth potential, driven by expanding manufacturing bases and increasing exports of food and feed products. The market for anti-caking agents in the Rest of Asia-Pacific is projected to grow at a CAGR of over 7% during the forecast period.

Asia-Pacific Anti-Caking Market Product Developments

Product development in the Asia-Pacific anti-caking market is characterized by a focus on enhancing efficacy, ensuring safety, and meeting specific application requirements. Innovations include the development of highly porous and surface-modified silica derivatives for superior moisture absorption and flowability in challenging environments. Furthermore, there is a growing trend towards natural and plant-derived anti-caking agents, catering to the rising demand for clean-label products. Companies are also investing in advanced formulations that offer extended shelf-life and improved processing characteristics for ingredients and final products. The competitive advantage lies in developing solutions that are not only effective but also cost-efficient and compliant with stringent regional food and feed safety regulations.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Asia-Pacific Anti-Caking Market segmented by Chemical Type, Animal Type, and Geography.

Chemical Type Segmentation: This analysis covers Silicon-based, Sodium-based, Calcium-based, Potassium-based, and Other Chemical Types, detailing their respective market sizes, growth projections, and competitive landscapes. Silicon-based anti-caking agents are expected to lead the market, with an estimated market value exceeding $900 million in 2025.

Animal Type Segmentation: The report examines Ruminants, Poultry, Swine, Aquaculture, and Other Animal Types. The Poultry segment is projected to hold the largest market share, driven by the high volume of feed production, with an estimated market value of over $700 million in 2025.

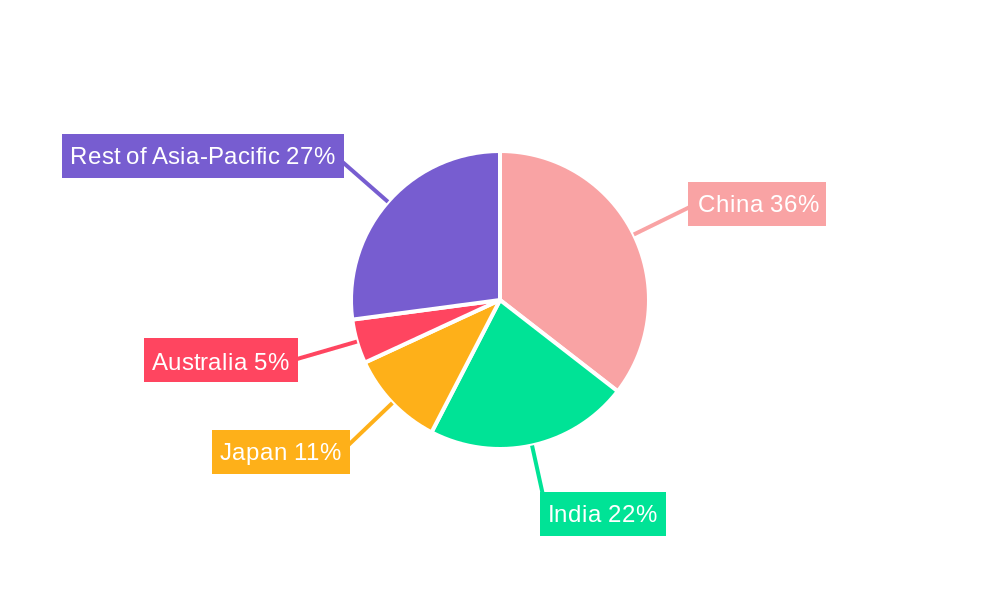

Geography Segmentation: The geographical scope includes China, India, Japan, Australia, and the Rest of Asia-Pacific. China is anticipated to be the largest market, with an estimated market value exceeding $800 million in 2025, followed by India.

Key Drivers of Asia-Pacific Anti-Caking Market Growth

The growth of the Asia-Pacific anti-caking market is significantly driven by several key factors. The expanding food processing industry across the region, fueled by urbanization and changing consumer lifestyles, necessitates effective anti-caking solutions to maintain product quality and shelf-life. The burgeoning animal feed industry, particularly for poultry and swine, also plays a crucial role, as anti-caking agents are vital for ensuring the flowability and nutritional integrity of feed. Furthermore, increasing stringency in food safety regulations and quality standards across Asia-Pacific countries mandates the use of approved and effective anti-caking agents. Technological advancements leading to the development of more efficient, cost-effective, and environmentally friendly anti-caking solutions also contribute to market expansion.

Challenges in the Asia-Pacific Anti-Caking Market Sector

Despite the promising growth, the Asia-Pacific anti-caking market faces several challenges. Fluctuating raw material prices, particularly for silica and other mineral-based anti-caking agents, can impact profit margins and create pricing volatility. The increasing demand for natural and organic alternatives, while an opportunity, also presents a challenge for manufacturers of synthetic anti-caking agents, requiring significant R&D investment to develop comparable or superior natural solutions. Stringent and varying regulatory frameworks across different countries in the Asia-Pacific region can complicate market entry and compliance for global players. Moreover, the presence of counterfeit or low-quality anti-caking agents in some local markets can erode trust and create an uneven playing field for legitimate manufacturers.

Emerging Opportunities in Asia-Pacific Anti-Caking Market

Emerging opportunities in the Asia-Pacific anti-caking market are abundant and varied. The growing trend towards health and wellness is driving demand for anti-caking agents used in dietary supplements and functional foods, creating a niche market. The increasing focus on sustainable agriculture and aquaculture presents opportunities for bio-based and environmentally friendly anti-caking solutions. Furthermore, the rapid development of the pharmaceutical industry in countries like India and China necessitates high-purity anti-caking agents for drug formulation, offering a lucrative segment. The expansion of e-commerce for food and feed products also indirectly boosts the demand for effective anti-caking agents, ensuring product integrity during transit and storage.

Leading Players in the Asia-Pacific Anti-Caking Market Market

- Ecolab

- Huber Engineered Materials

- Archer Daniels Midland Co.

- PPG Industries Inc.

- NOVUS INTERNATIONAL

- BASF SE

- Kemin Industries Inc.

- Kao Corporation

- Evonik Industries

Key Developments in Asia-Pacific Anti-Caking Market Industry

- 2023/Q4: Launch of a new range of advanced silica-based anti-caking agents by Huber Engineered Materials, focusing on enhanced moisture control for challenging food ingredients.

- 2024/Q1: BASF SE expands its portfolio of anti-caking solutions with a focus on sustainable and naturally derived options for the animal feed industry.

- 2024/Q2: Archer Daniels Midland Co. announces strategic partnerships to strengthen its supply chain for key anti-caking raw materials in Southeast Asia.

- 2024/Q3: Ecolab invests in R&D for novel anti-caking solutions tailored for the rapidly growing snack food market in China.

- 2024/Q4: Kemin Industries Inc. introduces innovative anti-caking solutions designed to improve pellet quality and feed flowability in the Indian poultry sector.

Strategic Outlook for Asia-Pacific Anti-Caking Market Market

The strategic outlook for the Asia-Pacific anti-caking market is highly optimistic, driven by sustained demand from the food and feed sectors and ongoing technological advancements. Companies are expected to focus on product innovation, particularly in developing eco-friendly and high-performance anti-caking agents. Strategic collaborations and partnerships will be crucial for market expansion, especially in emerging economies within the region. The emphasis on product diversification to cater to specialized applications, such as pharmaceuticals and cosmetics, presents a significant growth avenue. Furthermore, investments in building robust distribution networks and ensuring compliance with evolving regulatory landscapes will be key to capturing market share and achieving long-term success in this dynamic market. The estimated market value for the Asia-Pacific Anti-Caking Market is projected to surpass $4,000 million by 2033.

Asia-Pacific Anti-Caking Market Segmentation

-

1. Chemical Type

- 1.1. Silicon-based

- 1.2. Sodium-based

- 1.3. Calcium-based

- 1.4. Potassium-based

- 1.5. Other Chemical Types

-

2. Animal Type

- 2.1. Ruminants

- 2.2. Poultry

- 2.3. Swine

- 2.4. Aquaculture

- 2.5. Other Animal Types

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest ofAsia-Pacific

Asia-Pacific Anti-Caking Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Australia

- 5. Rest ofAsia Pacific

Asia-Pacific Anti-Caking Market Regional Market Share

Geographic Coverage of Asia-Pacific Anti-Caking Market

Asia-Pacific Anti-Caking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Pet Humanization; Growing Trend of E-commerce

- 3.3. Market Restrains

- 3.3.1. Rising Cost of Raw Material Production; Growing Concern Over Environment and Pet Health

- 3.4. Market Trends

- 3.4.1. Increase in Livestock Production is Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Anti-Caking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Chemical Type

- 5.1.1. Silicon-based

- 5.1.2. Sodium-based

- 5.1.3. Calcium-based

- 5.1.4. Potassium-based

- 5.1.5. Other Chemical Types

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Ruminants

- 5.2.2. Poultry

- 5.2.3. Swine

- 5.2.4. Aquaculture

- 5.2.5. Other Animal Types

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. Australia

- 5.3.5. Rest ofAsia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. Australia

- 5.4.5. Rest ofAsia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Chemical Type

- 6. China Asia-Pacific Anti-Caking Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Chemical Type

- 6.1.1. Silicon-based

- 6.1.2. Sodium-based

- 6.1.3. Calcium-based

- 6.1.4. Potassium-based

- 6.1.5. Other Chemical Types

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Ruminants

- 6.2.2. Poultry

- 6.2.3. Swine

- 6.2.4. Aquaculture

- 6.2.5. Other Animal Types

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. Australia

- 6.3.5. Rest ofAsia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Chemical Type

- 7. India Asia-Pacific Anti-Caking Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Chemical Type

- 7.1.1. Silicon-based

- 7.1.2. Sodium-based

- 7.1.3. Calcium-based

- 7.1.4. Potassium-based

- 7.1.5. Other Chemical Types

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Ruminants

- 7.2.2. Poultry

- 7.2.3. Swine

- 7.2.4. Aquaculture

- 7.2.5. Other Animal Types

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. Australia

- 7.3.5. Rest ofAsia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Chemical Type

- 8. Japan Asia-Pacific Anti-Caking Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Chemical Type

- 8.1.1. Silicon-based

- 8.1.2. Sodium-based

- 8.1.3. Calcium-based

- 8.1.4. Potassium-based

- 8.1.5. Other Chemical Types

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Ruminants

- 8.2.2. Poultry

- 8.2.3. Swine

- 8.2.4. Aquaculture

- 8.2.5. Other Animal Types

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. Australia

- 8.3.5. Rest ofAsia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Chemical Type

- 9. Australia Asia-Pacific Anti-Caking Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Chemical Type

- 9.1.1. Silicon-based

- 9.1.2. Sodium-based

- 9.1.3. Calcium-based

- 9.1.4. Potassium-based

- 9.1.5. Other Chemical Types

- 9.2. Market Analysis, Insights and Forecast - by Animal Type

- 9.2.1. Ruminants

- 9.2.2. Poultry

- 9.2.3. Swine

- 9.2.4. Aquaculture

- 9.2.5. Other Animal Types

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. Australia

- 9.3.5. Rest ofAsia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Chemical Type

- 10. Rest ofAsia Pacific Asia-Pacific Anti-Caking Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Chemical Type

- 10.1.1. Silicon-based

- 10.1.2. Sodium-based

- 10.1.3. Calcium-based

- 10.1.4. Potassium-based

- 10.1.5. Other Chemical Types

- 10.2. Market Analysis, Insights and Forecast - by Animal Type

- 10.2.1. Ruminants

- 10.2.2. Poultry

- 10.2.3. Swine

- 10.2.4. Aquaculture

- 10.2.5. Other Animal Types

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. Australia

- 10.3.5. Rest ofAsia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Chemical Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ecolab

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Huber Engineered Material

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Archer Daniels Midland Co

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PPG Industries Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 NOVUS INTERNATIONAL

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BASF SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kemin Industries Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kao Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Evonik Industries

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Ecolab

List of Figures

- Figure 1: Asia-Pacific Anti-Caking Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Anti-Caking Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Anti-Caking Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 2: Asia-Pacific Anti-Caking Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 3: Asia-Pacific Anti-Caking Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Anti-Caking Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Anti-Caking Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 6: Asia-Pacific Anti-Caking Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 7: Asia-Pacific Anti-Caking Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Anti-Caking Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Asia-Pacific Anti-Caking Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 10: Asia-Pacific Anti-Caking Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 11: Asia-Pacific Anti-Caking Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Anti-Caking Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Anti-Caking Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 14: Asia-Pacific Anti-Caking Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 15: Asia-Pacific Anti-Caking Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Asia-Pacific Anti-Caking Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Anti-Caking Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 18: Asia-Pacific Anti-Caking Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 19: Asia-Pacific Anti-Caking Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific Anti-Caking Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Anti-Caking Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 22: Asia-Pacific Anti-Caking Market Revenue undefined Forecast, by Animal Type 2020 & 2033

- Table 23: Asia-Pacific Anti-Caking Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 24: Asia-Pacific Anti-Caking Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Anti-Caking Market?

The projected CAGR is approximately 4.8%.

2. Which companies are prominent players in the Asia-Pacific Anti-Caking Market?

Key companies in the market include Ecolab, Huber Engineered Material, Archer Daniels Midland Co, PPG Industries Inc, NOVUS INTERNATIONAL, BASF SE, Kemin Industries Inc, Kao Corporation, Evonik Industries.

3. What are the main segments of the Asia-Pacific Anti-Caking Market?

The market segments include Chemical Type, Animal Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increased Pet Humanization; Growing Trend of E-commerce.

6. What are the notable trends driving market growth?

Increase in Livestock Production is Driving the Market Growth.

7. Are there any restraints impacting market growth?

Rising Cost of Raw Material Production; Growing Concern Over Environment and Pet Health.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Anti-Caking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Anti-Caking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Anti-Caking Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Anti-Caking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence