Key Insights

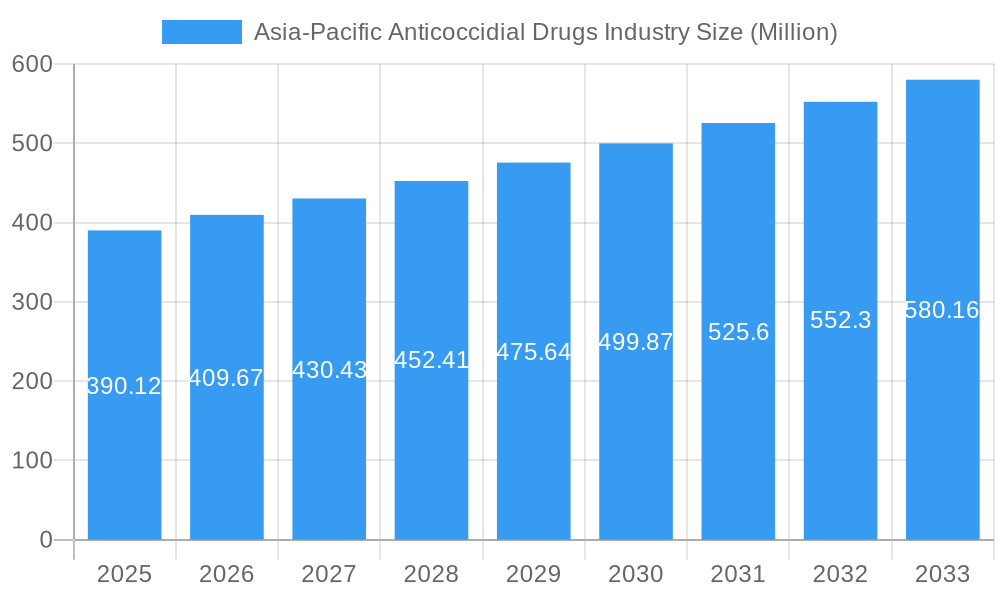

The Asia-Pacific Anticoccidial Drugs market, valued at $390.12 million in 2025, is projected to experience robust growth, driven by a rising livestock population, increasing poultry farming, and the growing awareness of coccidiosis prevention and control measures across the region. This substantial market is segmented by animal type (livestock and companion animals), distribution channel (veterinary hospitals, retail pharmacies, and other channels), drug class (ionophores, antibiotics, sulfonamides, chemical derivatives, and others), and drug action (coccidiostatic and coccidiocidal). The market's expansion is fueled by the increasing adoption of preventive measures to mitigate economic losses due to coccidiosis infections, particularly within intensive farming systems. Key players like Ceva Animal Health, Elanco, Boehringer Ingelheim, Novartis, Zoetis, and others are actively involved in developing and marketing innovative anticoccidial drugs to cater to this growing demand. Government initiatives supporting animal health and disease prevention further contribute to the market’s positive outlook.

Asia-Pacific Anticoccidial Drugs Industry Market Size (In Million)

While the market enjoys significant growth prospects, challenges exist. These include the emergence of drug resistance among coccidia parasites, necessitating the development of novel drug formulations. Stricter regulatory frameworks and environmental concerns surrounding the use of certain drug classes also pose constraints. However, ongoing research and development focusing on novel drug classes and sustainable animal husbandry practices are likely to mitigate these challenges. The market is expected to maintain a Compound Annual Growth Rate (CAGR) of 4.89% from 2025 to 2033, indicating a significant expansion potential within the forecast period. This growth is particularly noticeable in countries experiencing rapid economic development and increasing meat consumption, significantly boosting the demand for livestock and poultry farming.

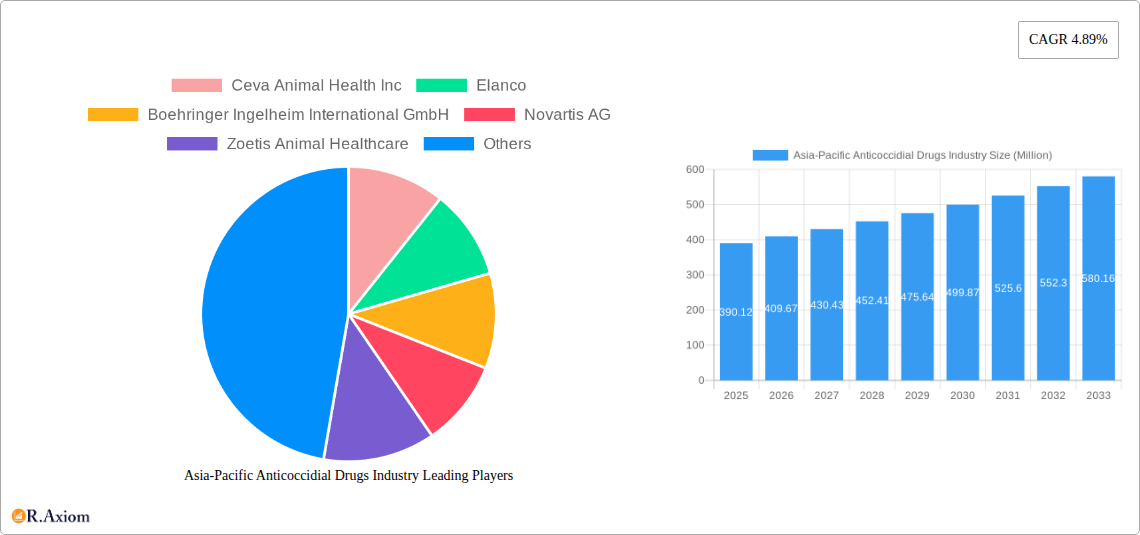

Asia-Pacific Anticoccidial Drugs Industry Company Market Share

Asia-Pacific Anticoccidial Drugs Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Asia-Pacific Anticoccidial Drugs industry, offering invaluable insights for stakeholders, investors, and industry professionals. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Key market segments, leading players, and future growth opportunities are thoroughly examined. The report utilizes rigorous data analysis to provide accurate market sizing and growth projections in Millions.

Asia-Pacific Anticoccidial Drugs Industry Market Concentration & Innovation

This section analyzes the competitive landscape, innovation trends, regulatory environment, and market dynamics within the Asia-Pacific Anticoccidial Drugs industry. The highly fragmented nature of the market is evident, with numerous players vying for market share. Key factors influencing market concentration include:

- Market Share: While precise market share data for each company requires detailed proprietary data analysis, preliminary estimates suggest a relatively even distribution amongst the top players (Ceva Animal Health Inc, Elanco, Boehringer Ingelheim International GmbH, Novartis AG, Zoetis Animal Healthcare, Vetoquinol SA, Impextraco NV, MSD Animal Health, Huvepharma, and Virbac). Further analysis within the full report will provide more precise figures.

- Mergers & Acquisitions (M&A): The industry witnesses sporadic M&A activity, primarily driven by expansion strategies and portfolio diversification. For example, Ceva Animal Health's joint venture in Japan in 2022 and Elanco's partnership in Sri Lanka in 2021 illustrate this trend. The full report will provide a detailed analysis of M&A deal values and their impact on market consolidation. Estimated total M&A deal value for the period 2019-2024 is approximately xx Million.

- Innovation Drivers: R&D efforts focused on developing novel drug classes, improving efficacy, and addressing drug resistance are key innovation drivers. The push for safer and more effective products also significantly impacts market competition.

- Regulatory Frameworks: Stringent regulatory approvals and compliance requirements influence product development and market entry, impacting market concentration and innovation.

- Product Substitutes: The availability of alternative treatments for coccidiosis (both chemical and natural) creates competitive pressure and influences market dynamics.

- End-User Trends: Increasing awareness of animal health and welfare, coupled with growing demand for higher-quality animal products, drives the market.

Asia-Pacific Anticoccidial Drugs Industry Industry Trends & Insights

The Asia-Pacific Anticoccidial Drugs market is experiencing substantial growth, fueled by several factors. The report projects a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is attributed to several key trends:

- Rising Livestock Population: The burgeoning livestock population across the Asia-Pacific region is a primary driver of market expansion. This increase in demand for animal health solutions directly fuels the need for anticoccidial drugs.

- Increasing Prevalence of Coccidiosis: Coccidiosis remains a significant threat to livestock productivity, driving demand for effective prevention and treatment strategies.

- Growing Veterinary Infrastructure: Improvements in veterinary infrastructure and expertise enhance the diagnostic capabilities and treatment options available, contributing to market growth.

- Technological Advancements: Innovations in drug delivery systems and formulations are improving efficacy and reducing side effects, thereby driving market penetration.

- Changing Consumer Preferences: Increased consumer awareness of food safety and animal welfare is pushing for safer and more sustainable animal husbandry practices, impacting anticoccidial drug usage.

- Competitive Dynamics: Intense competition among established players and emerging companies drives innovation and pricing strategies, shaping market trends. Market penetration of Ionophore drugs is estimated at xx% in 2025.

Dominant Markets & Segments in Asia-Pacific Anticoccidial Drugs Industry

The report identifies key segments and regions driving market growth within the Asia-Pacific region.

Leading Region: China is anticipated to remain the dominant market, followed by India and other Southeast Asian countries. This dominance stems from factors such as a large livestock population, rising poultry production, and increasing investments in animal health infrastructure.

Dominant Segments:

- Animal Type: Livestock animals, particularly poultry, constitute the largest segment, driven by high disease prevalence and intensive farming practices. Companion animals represent a smaller, but growing, segment.

- Distribution Channel: Veterinary hospitals and retail pharmacies are the major distribution channels, with a growing role for online platforms.

- Drug Class: Ionophore anticoccidials hold a significant market share due to their efficacy and cost-effectiveness. However, concerns surrounding drug resistance are pushing innovation in other drug classes, such as chemical derivatives and antibiotics.

- Drug Action: Coccidiostatic drugs are widely used for prevention, while coccidiocidal drugs are used for treatment of severe infections.

Key Drivers:

- Economic Policies: Government initiatives supporting animal husbandry and veterinary services stimulate market growth.

- Infrastructure Development: Improved infrastructure in veterinary care enhances diagnosis and treatment capabilities.

Asia-Pacific Anticoccidial Drugs Industry Product Developments

Recent years have witnessed significant product innovations, focusing on improved efficacy, reduced side effects, and targeted delivery systems. The development of novel formulations, such as extended-release and slow-release products, is gaining traction to improve treatment compliance and reduce the frequency of administration. These advancements cater to the growing demand for more efficient and sustainable solutions in animal health management, enhancing the competitive advantages of manufacturers. Technological trends, such as the use of nanotechnology in drug delivery, are being explored.

Report Scope & Segmentation Analysis

This report comprehensively segments the Asia-Pacific Anticoccidial Drugs market based on animal type (Livestock Animals, Companion Animals), distribution channel (Veterinary Hospitals, Retail Pharmacy, Other Distribution Channels), drug class (Ionophore, Antibiotic, Sulphonamides, Chemical Derivative, Other Drug Classes), and drug action (Coccidiostatic, Coccidiocidal). Each segment's market size, growth projections, and competitive dynamics are analyzed in detail within the full report. For example, the Ionophore segment is projected to grow at xx% CAGR during the forecast period, driven by its cost-effectiveness and wide applicability.

Key Drivers of Asia-Pacific Anticoccidial Drugs Industry Growth

The Asia-Pacific Anticoccidial Drugs market growth is driven by factors such as:

- Technological advancements: Development of novel drug formulations, improved diagnostic tools, and advanced drug delivery systems.

- Economic growth: Rising disposable incomes in developing countries increase demand for animal protein, driving livestock production.

- Favorable regulatory environment: Supportive government policies and initiatives promoting animal health and welfare. This includes initiatives to control and prevent disease outbreaks.

Challenges in the Asia-Pacific Anticoccidial Drugs Industry Sector

The industry faces challenges including:

- Drug resistance: The development of drug-resistant coccidia strains necessitates the development of new anticoccidial drugs.

- Stringent regulatory approvals: The lengthy and rigorous approval processes for new drugs can delay market entry.

- Supply chain disruptions: Global events can cause interruptions in the supply of raw materials and finished products. This may lead to increased costs.

- Pricing pressure: Intense competition may exert pressure on product pricing, affecting profitability.

Emerging Opportunities in Asia-Pacific Anticoccidial Drugs Industry

Significant opportunities exist in:

- Development of novel anticoccidial drugs: Addressing drug resistance through innovative drug classes and formulations.

- Expansion into emerging markets: Untapped potential in less-developed countries with growing livestock populations.

- Development of integrated animal health solutions: Providing holistic solutions encompassing prevention, diagnosis, and treatment.

Leading Players in the Asia-Pacific Anticoccidial Drugs Industry Market

- Ceva Animal Health Inc

- Elanco

- Boehringer Ingelheim International GmbH

- Novartis AG

- Zoetis Animal Healthcare

- Vetoquinol SA

- Impextraco NV

- MSD Animal Health

- Huvepharma

- Virbac

- Huvepharma

Key Developments in Asia-Pacific Anticoccidial Drugs Industry Industry

- April 2022: Ceva Santé Animale forms a joint venture with Mitsui & Co., Ltd. to establish Ceva Bussan Animal Health K.K. in Japan, focusing on food safety and animal disease control.

- March 2021: Elanco Animal Health launches two new veterinary products in Sri Lanka, including an anticoccidial feed additive.

Strategic Outlook for Asia-Pacific Anticoccidial Drugs Industry Market

The Asia-Pacific Anticoccidial Drugs market presents significant growth potential driven by increasing livestock populations, rising consumer demand for animal protein, and ongoing technological advancements. Companies focusing on innovation, strategic partnerships, and expansion into emerging markets are well-positioned to capitalize on this growth. The focus on sustainable and environmentally friendly practices will also significantly impact future market dynamics. The market is projected to witness robust growth throughout the forecast period, presenting lucrative opportunities for investors and industry players alike.

Asia-Pacific Anticoccidial Drugs Industry Segmentation

-

1. Drug Class

- 1.1. Ionophore

- 1.2. Antibiotic

- 1.3. Sulphonamides

- 1.4. Chemical Derivative

- 1.5. Other Drug Classes

-

2. Drug Action

- 2.1. Coccidiostatic

- 2.2. Coccidiocidal

-

3. Animal

-

3.1. Livestock Animals

- 3.1.1. Cattle

- 3.1.2. Poultry

- 3.1.3. Other Livestock Animals

-

3.2. Companion Animals

- 3.2.1. Dogs

- 3.2.2. Cats

- 3.2.3. Other Companion Animals

-

3.1. Livestock Animals

-

4. Distribution Channel

- 4.1. Veterinary Hospitals

- 4.2. Retail Pharmacy

- 4.3. Other Distribution Channels

Asia-Pacific Anticoccidial Drugs Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

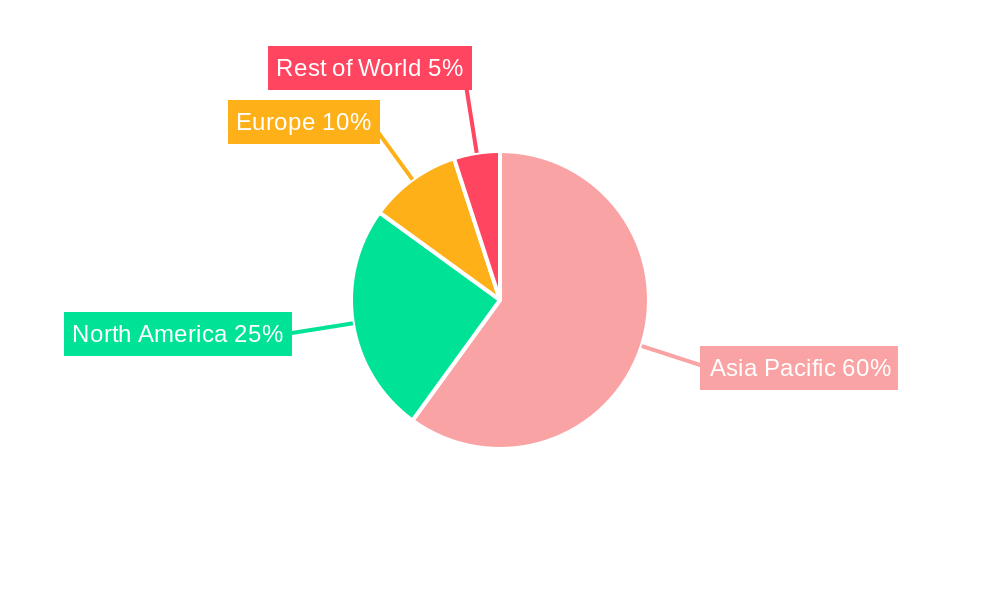

Asia-Pacific Anticoccidial Drugs Industry Regional Market Share

Geographic Coverage of Asia-Pacific Anticoccidial Drugs Industry

Asia-Pacific Anticoccidial Drugs Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Incidence of Coccidiosis; Advancements in Veterinary Healthcare

- 3.3. Market Restrains

- 3.3.1. Availability of Alternative Treatment Options in the Market

- 3.4. Market Trends

- 3.4.1. Poultry Segment is Expected to hold a Significant Share in the Anticoccidial Drugs Market Over The Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Anticoccidial Drugs Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Drug Class

- 5.1.1. Ionophore

- 5.1.2. Antibiotic

- 5.1.3. Sulphonamides

- 5.1.4. Chemical Derivative

- 5.1.5. Other Drug Classes

- 5.2. Market Analysis, Insights and Forecast - by Drug Action

- 5.2.1. Coccidiostatic

- 5.2.2. Coccidiocidal

- 5.3. Market Analysis, Insights and Forecast - by Animal

- 5.3.1. Livestock Animals

- 5.3.1.1. Cattle

- 5.3.1.2. Poultry

- 5.3.1.3. Other Livestock Animals

- 5.3.2. Companion Animals

- 5.3.2.1. Dogs

- 5.3.2.2. Cats

- 5.3.2.3. Other Companion Animals

- 5.3.1. Livestock Animals

- 5.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.4.1. Veterinary Hospitals

- 5.4.2. Retail Pharmacy

- 5.4.3. Other Distribution Channels

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Drug Class

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ceva Animal Health Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Elanco

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Boehringer Ingelheim International GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Novartis AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Zoetis Animal Healthcare

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Vetoquinol SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Impextraco NV

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 MSD Animal Health

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Huvepharma

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Virbac

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Huvepharma

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Ceva Animal Health Inc

List of Figures

- Figure 1: Asia-Pacific Anticoccidial Drugs Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Anticoccidial Drugs Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Anticoccidial Drugs Industry Revenue Million Forecast, by Drug Class 2020 & 2033

- Table 2: Asia-Pacific Anticoccidial Drugs Industry Volume Dosage Forecast, by Drug Class 2020 & 2033

- Table 3: Asia-Pacific Anticoccidial Drugs Industry Revenue Million Forecast, by Drug Action 2020 & 2033

- Table 4: Asia-Pacific Anticoccidial Drugs Industry Volume Dosage Forecast, by Drug Action 2020 & 2033

- Table 5: Asia-Pacific Anticoccidial Drugs Industry Revenue Million Forecast, by Animal 2020 & 2033

- Table 6: Asia-Pacific Anticoccidial Drugs Industry Volume Dosage Forecast, by Animal 2020 & 2033

- Table 7: Asia-Pacific Anticoccidial Drugs Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Asia-Pacific Anticoccidial Drugs Industry Volume Dosage Forecast, by Distribution Channel 2020 & 2033

- Table 9: Asia-Pacific Anticoccidial Drugs Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Asia-Pacific Anticoccidial Drugs Industry Volume Dosage Forecast, by Region 2020 & 2033

- Table 11: Asia-Pacific Anticoccidial Drugs Industry Revenue Million Forecast, by Drug Class 2020 & 2033

- Table 12: Asia-Pacific Anticoccidial Drugs Industry Volume Dosage Forecast, by Drug Class 2020 & 2033

- Table 13: Asia-Pacific Anticoccidial Drugs Industry Revenue Million Forecast, by Drug Action 2020 & 2033

- Table 14: Asia-Pacific Anticoccidial Drugs Industry Volume Dosage Forecast, by Drug Action 2020 & 2033

- Table 15: Asia-Pacific Anticoccidial Drugs Industry Revenue Million Forecast, by Animal 2020 & 2033

- Table 16: Asia-Pacific Anticoccidial Drugs Industry Volume Dosage Forecast, by Animal 2020 & 2033

- Table 17: Asia-Pacific Anticoccidial Drugs Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 18: Asia-Pacific Anticoccidial Drugs Industry Volume Dosage Forecast, by Distribution Channel 2020 & 2033

- Table 19: Asia-Pacific Anticoccidial Drugs Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Asia-Pacific Anticoccidial Drugs Industry Volume Dosage Forecast, by Country 2020 & 2033

- Table 21: China Asia-Pacific Anticoccidial Drugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: China Asia-Pacific Anticoccidial Drugs Industry Volume (Dosage) Forecast, by Application 2020 & 2033

- Table 23: Japan Asia-Pacific Anticoccidial Drugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Japan Asia-Pacific Anticoccidial Drugs Industry Volume (Dosage) Forecast, by Application 2020 & 2033

- Table 25: South Korea Asia-Pacific Anticoccidial Drugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: South Korea Asia-Pacific Anticoccidial Drugs Industry Volume (Dosage) Forecast, by Application 2020 & 2033

- Table 27: India Asia-Pacific Anticoccidial Drugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: India Asia-Pacific Anticoccidial Drugs Industry Volume (Dosage) Forecast, by Application 2020 & 2033

- Table 29: Australia Asia-Pacific Anticoccidial Drugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Australia Asia-Pacific Anticoccidial Drugs Industry Volume (Dosage) Forecast, by Application 2020 & 2033

- Table 31: New Zealand Asia-Pacific Anticoccidial Drugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: New Zealand Asia-Pacific Anticoccidial Drugs Industry Volume (Dosage) Forecast, by Application 2020 & 2033

- Table 33: Indonesia Asia-Pacific Anticoccidial Drugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Indonesia Asia-Pacific Anticoccidial Drugs Industry Volume (Dosage) Forecast, by Application 2020 & 2033

- Table 35: Malaysia Asia-Pacific Anticoccidial Drugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Malaysia Asia-Pacific Anticoccidial Drugs Industry Volume (Dosage) Forecast, by Application 2020 & 2033

- Table 37: Singapore Asia-Pacific Anticoccidial Drugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Singapore Asia-Pacific Anticoccidial Drugs Industry Volume (Dosage) Forecast, by Application 2020 & 2033

- Table 39: Thailand Asia-Pacific Anticoccidial Drugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Thailand Asia-Pacific Anticoccidial Drugs Industry Volume (Dosage) Forecast, by Application 2020 & 2033

- Table 41: Vietnam Asia-Pacific Anticoccidial Drugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Vietnam Asia-Pacific Anticoccidial Drugs Industry Volume (Dosage) Forecast, by Application 2020 & 2033

- Table 43: Philippines Asia-Pacific Anticoccidial Drugs Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Philippines Asia-Pacific Anticoccidial Drugs Industry Volume (Dosage) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Anticoccidial Drugs Industry?

The projected CAGR is approximately 4.89%.

2. Which companies are prominent players in the Asia-Pacific Anticoccidial Drugs Industry?

Key companies in the market include Ceva Animal Health Inc, Elanco, Boehringer Ingelheim International GmbH, Novartis AG, Zoetis Animal Healthcare, Vetoquinol SA, Impextraco NV, MSD Animal Health, Huvepharma, Virbac, Huvepharma.

3. What are the main segments of the Asia-Pacific Anticoccidial Drugs Industry?

The market segments include Drug Class, Drug Action, Animal, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 390.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Incidence of Coccidiosis; Advancements in Veterinary Healthcare.

6. What are the notable trends driving market growth?

Poultry Segment is Expected to hold a Significant Share in the Anticoccidial Drugs Market Over The Forecast Period.

7. Are there any restraints impacting market growth?

Availability of Alternative Treatment Options in the Market.

8. Can you provide examples of recent developments in the market?

In April 2022, to speed up the expansion of the veterinary laboratory in Japan, Ceva Santé Animale, a French-based animal health company, initiated a joint venture with Mitsui & Co., Ltd., one of the largest Japanese conglomerates to form Ceva Bussan Animal Health K.K. in Japan. This development was marked to address the food safety and animal disease control challenges in Japan.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Dosage.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Anticoccidial Drugs Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Anticoccidial Drugs Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Anticoccidial Drugs Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Anticoccidial Drugs Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence