Key Insights

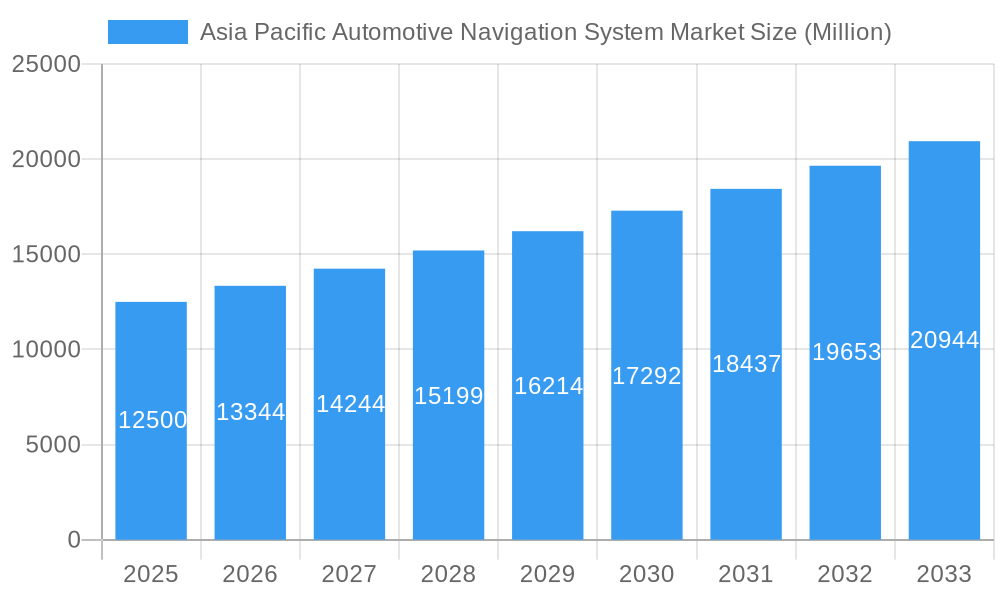

The Asia Pacific Automotive Navigation System Market is projected for substantial growth, expected to reach $16.6 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 9.4% from the base year 2024. This expansion is driven by rising consumer demand for advanced in-car connectivity and safety, rapid adoption of smart devices, and a growing automotive industry. Emerging economies, particularly China and India, are key contributors, with consumers seeking enhanced driving experiences. Government initiatives supporting smart cities and intelligent transportation systems further bolster market integration. The market is increasingly characterized by advanced solutions like real-time traffic updates, voice guidance, and smartphone integration, enhancing efficiency and convenience.

Asia Pacific Automotive Navigation System Market Market Size (In Billion)

Segmentation by vehicle type reveals passenger cars as the dominant segment, with commercial vehicles showing significant growth driven by logistics and fleet management. The Original Equipment Manufacturer (OEM) segment leads sales channels as navigation systems become standard features. The aftermarket segment is also expanding as consumers upgrade existing vehicles. Geographically, China holds the largest market share, followed by India, Japan, and South Korea. The "Rest of Asia-Pacific" region is also poised for significant growth. Leading players are investing in R&D to introduce innovative navigation solutions.

Asia Pacific Automotive Navigation System Market Company Market Share

Asia Pacific Automotive Navigation System Market: Key Insights and Forecast (2024-2033)

This report offers a comprehensive analysis of the Asia Pacific Automotive Navigation System Market, detailing market dynamics, drivers, challenges, and opportunities. Covering the historical period up to 2024, with a base year of 2024, it provides precise market size estimations for 2024 and forecasts performance through 2033. This study is valuable for automotive manufacturers, navigation system developers, technology providers, policymakers, and investors. Focused on keywords like "automotive navigation system," "in-car GPS," "automotive infotainment," and "connected car technology," this report enhances market visibility.

Asia Pacific Automotive Navigation System Market Market Concentration & Innovation

The Asia Pacific automotive navigation system market exhibits a moderate level of market concentration, characterized by the presence of both established global players and increasingly innovative regional manufacturers. Key players such as Clarion, Mitsubishi Electric Corporation, Continental AG, Aisin Aw Co Ltd, Garmin, Denso Corporation, Pioneer, and Alpine Electronics are actively shaping market trends through continuous innovation. The primary drivers of innovation include the integration of Artificial Intelligence (AI) for predictive navigation, the development of advanced driver-assistance systems (ADAS) integration with navigation, and the enhancement of user experience through augmented reality (AR) overlays. Regulatory frameworks in countries like China and Japan are fostering the adoption of safety-critical navigation features, further stimulating innovation. Product substitutes, while present in the form of smartphone-based navigation, are increasingly being integrated into OEM systems, blurring the lines and pushing for enhanced functionality. End-user trends indicate a strong demand for seamless connectivity, real-time traffic updates, personalized routing, and intuitive interfaces. Mergers and Acquisitions (M&A) activities, though not extensively detailed in public disclosures, are anticipated to play a crucial role in consolidating market share and acquiring cutting-edge technologies, with estimated M&A deal values reaching several hundred million dollars, particularly in strategic acquisitions of specialized software and AI companies. The market share distribution is highly competitive, with leading companies holding substantial portions of the market, driven by their extensive product portfolios and strong distribution networks.

Asia Pacific Automotive Navigation System Market Industry Trends & Insights

The Asia Pacific automotive navigation system market is experiencing robust growth, driven by a confluence of technological advancements, evolving consumer preferences, and favorable economic conditions. The estimated Compound Annual Growth Rate (CAGR) for the forecast period is expected to be in the range of 8% to 10%, underscoring the significant expansion potential. A pivotal trend is the increasing integration of navigation systems with broader automotive infotainment and connectivity platforms. This trend is fueled by the widespread adoption of smartphones and the growing demand for connected car features, such as over-the-air (OTA) updates for maps and software, real-time traffic information, and personalized point-of-interest (POI) recommendations. The rise of electric vehicles (EVs) and autonomous driving technologies is also creating new opportunities and demands for sophisticated navigation solutions. For instance, EV navigation systems need to incorporate charging station availability and route optimization based on battery range, while autonomous vehicles require highly accurate, high-definition (HD) maps and precise localization capabilities. Technological disruptions, including the advancements in AI and machine learning, are enabling more intelligent navigation experiences. These technologies are being leveraged to predict driver behavior, optimize routes based on learned preferences, and offer proactive navigation suggestions. The increasing penetration of smart devices and the growing digital literacy among consumers in emerging markets like India and Southeast Asia are further accelerating the adoption of navigation systems. Consumer preferences are shifting towards systems that offer a personalized and intuitive user experience, with a demand for voice-activated controls, seamless integration with personal devices, and advanced safety features. The competitive landscape is characterized by intense rivalry among established automotive suppliers, electronics giants, and emerging tech startups, each vying for market share through product differentiation, strategic partnerships, and aggressive pricing strategies. The market penetration of advanced navigation systems is projected to reach over 70% of new vehicle sales by 2030, indicating a substantial market opportunity for innovation and expansion.

Dominant Markets & Segments in Asia Pacific Automotive Navigation System Market

China stands out as the most dominant market within the Asia Pacific Automotive Navigation System market, driven by its sheer vehicle production volume and a rapidly growing consumer base with an increasing appetite for advanced in-car technologies. The Chinese market's dominance is further amplified by its significant contributions across both Passenger Cars and Commercial Vehicles.

- China (Passenger Cars): The passenger car segment in China is the largest contributor to the overall market.

- Economic Policies and Government Initiatives: Strong government support for the automotive industry, coupled with incentives for the adoption of smart and connected vehicles, has propelled demand. Policies promoting intelligent transportation systems and autonomous driving research have directly benefited the navigation system market.

- Rising Disposable Incomes and Consumer Sophistication: An expanding middle class with increasing disposable income is readily adopting premium features, including advanced navigation and infotainment systems, as standard or optional upgrades.

- OEM Integration and Localized Innovation: Major Chinese automotive OEMs are heavily investing in in-house navigation development and partnering with local tech giants to offer highly customized and feature-rich navigation experiences tailored to Chinese driving habits and preferences. The market size for passenger car navigation systems in China is estimated to be over $6,000 million in 2025.

- China (Commercial Vehicles): The commercial vehicle segment in China, encompassing trucks, buses, and logistics vehicles, also represents a substantial and growing market.

- Logistics and E-commerce Boom: The burgeoning e-commerce sector and the need for efficient logistics operations drive the demand for robust fleet management and navigation solutions. Real-time tracking, route optimization, and delivery management are critical functionalities.

- Government Focus on Transportation Efficiency: Initiatives aimed at improving national transportation infrastructure and optimizing logistics networks further encourage the adoption of advanced navigation for commercial fleets.

- Fleet Management Solutions: The demand for integrated fleet management systems, which include advanced navigation as a core component, is high, leading to a market size estimated at over $2,500 million in 2025.

Japan remains a significant market, characterized by high technological adoption rates and a strong focus on quality and reliability in automotive electronics. The market size for Japan is projected to be around $3,000 million in 2025, with a substantial portion coming from the OEM segment.

- Technological Prowess and Early Adoption: Japan has a long history of technological innovation and early adoption of advanced automotive features, including sophisticated navigation systems.

- Established Automotive Ecosystem: The presence of major global automotive manufacturers and component suppliers fosters a competitive and innovative environment.

South Korea also represents a vital market, driven by its technologically advanced automotive industry and a strong consumer inclination towards premium in-car experiences. The market size for South Korea is estimated at approximately $1,500 million in 2025.

- Advanced Infotainment and Connectivity: South Korean automakers are renowned for their integration of cutting-edge infotainment systems, where navigation plays a central role.

- Focus on User Experience: There is a strong emphasis on intuitive interfaces, personalized features, and seamless connectivity.

India is emerging as a high-growth market, with its rapid economic development and a booming automotive sector. The market size for India is projected to reach over $1,800 million in 2025, with significant growth driven by both OEM and aftermarket segments.

- Rapidly Growing Automotive Sales: The sheer volume of new vehicle sales, coupled with increasing affordability of mid-range vehicles, is fueling demand for navigation systems.

- Increasing Demand for Connectivity: Indian consumers are increasingly seeking connected features and value-added services in their vehicles.

- Aftermarket Penetration: The aftermarket segment in India is particularly strong, with consumers opting for retrofitted navigation solutions in older vehicles.

Rest of Asia-Pacific (including Southeast Asia, Australia, and New Zealand) presents a diverse and evolving market landscape. This segment, estimated at over $2,000 million in 2025, is characterized by varying levels of economic development and technological adoption.

- Emerging Markets (Southeast Asia): Countries like Indonesia, Thailand, and Vietnam are witnessing rapid growth in their automotive industries, driven by increasing urbanization and disposable incomes.

- Mature Markets (Australia and New Zealand): These markets exhibit a steady demand for advanced navigation systems, with a strong focus on safety and convenience features.

- Diversified Consumer Preferences: This broad region encompasses a wide range of consumer preferences, from budget-conscious buyers to those seeking premium in-car experiences.

Across these geographies, the OEM (Original Equipment Manufacturer) sales channel generally holds a larger market share due to the integration of navigation systems directly into new vehicles. However, the Aftermarket segment, particularly in India and other developing economies, continues to be a significant growth area. In terms of vehicle type, Passenger Cars dominate the market due to higher sales volumes compared to Commercial Vehicles, although the latter segment is experiencing robust growth driven by logistics and fleet management needs.

Asia Pacific Automotive Navigation System Market Product Developments

Product innovation in the Asia Pacific automotive navigation system market is primarily focused on enhancing user experience, improving accuracy, and integrating with emerging automotive technologies. Key developments include the integration of AI-powered voice assistants for hands-free control and personalized routing, the adoption of augmented reality (AR) for intuitive visual navigation overlays, and the development of high-definition (HD) maps crucial for autonomous driving. Companies are also focusing on seamless connectivity for real-time traffic updates, predictive maintenance alerts, and integration with smart city infrastructure. These advancements aim to provide drivers with safer, more efficient, and more engaging navigation experiences, offering a significant competitive advantage in a rapidly evolving market.

Report Scope & Segmentation Analysis

The Asia Pacific Automotive Navigation System Market is meticulously segmented to provide a granular understanding of its dynamics. The report analyzes the market across key dimensions: Vehicle Type, encompassing Passenger Cars and Commercial Vehicles; Sales Channel Type, distinguishing between OEM and Aftermarket sales; and Geography, with in-depth analysis of China (further segmented into its Passenger Cars and Commercial Vehicles markets), India, Japan, South Korea, and the Rest of Asia-Pacific.

- Passenger Car Segment: This segment is projected to hold the largest market share, driven by increasing vehicle sales and consumer demand for integrated navigation. Growth is expected to be robust, fueled by technological advancements and OEM strategies.

- Commercial Vehicle Segment: This segment is witnessing significant growth due to the rising demand for efficient logistics and fleet management solutions. The market size is expanding as businesses invest in technologies that optimize operations.

- OEM Segment: The OEM channel is expected to dominate the market, as navigation systems are increasingly becoming standard features in new vehicles. This segment benefits from strong partnerships between automakers and navigation providers.

- Aftermarket Segment: While smaller, the aftermarket segment is crucial, particularly in emerging economies, offering retrofitting solutions and catering to a broader consumer base. Its growth is driven by affordability and the desire to upgrade existing vehicles.

- China: As the largest automotive market, China is segmented into its Passenger Cars and Commercial Vehicles segments, each exhibiting substantial market size and growth potential driven by domestic demand and technological innovation.

- India: This high-growth market is characterized by increasing vehicle adoption and a strong aftermarket presence, with significant potential across both passenger and commercial vehicle segments.

- Japan & South Korea: These technologically advanced markets exhibit mature navigation system penetration with a focus on premium features and integration with advanced infotainment systems.

- Rest of Asia-Pacific: This diverse region includes emerging markets with rapid automotive sector growth and more established markets with steady demand for advanced navigation solutions.

Key Drivers of Asia Pacific Automotive Navigation System Market Growth

The Asia Pacific automotive navigation system market's growth is propelled by several key factors. Technological advancements, including the integration of AI, machine learning, and augmented reality, are enhancing navigation accuracy and user experience. The increasing adoption of connected car technologies, facilitating real-time data exchange for traffic and map updates, is a significant driver. Furthermore, the booming automotive industry across the region, particularly in China and India, coupled with rising disposable incomes and consumer demand for in-car convenience and safety features, fuels market expansion. Government initiatives promoting smart cities and intelligent transportation systems also play a crucial role in fostering the adoption of advanced navigation solutions. The shift towards electric and autonomous vehicles is also creating new demands and opportunities for sophisticated navigation systems capable of managing charging infrastructure and supporting advanced driving functionalities.

Challenges in the Asia Pacific Automotive Navigation System Market Sector

Despite its strong growth trajectory, the Asia Pacific automotive navigation system market faces several challenges. Intense competition among a large number of players, including established global brands and emerging local companies, can lead to price wars and reduced profit margins. The high cost of developing and integrating advanced navigation technologies, particularly those involving AI and high-definition mapping, can be a barrier to entry for smaller players and a significant investment for all. Evolving regulatory landscapes, especially concerning data privacy and cybersecurity in connected vehicles, can pose compliance challenges. Furthermore, the rapid pace of technological change necessitates continuous investment in research and development to stay competitive, which can be resource-intensive. Supply chain disruptions, as experienced globally, can impact the availability of critical components, leading to production delays and increased costs. The reliance on smartphone navigation as a free alternative also continues to present a competitive pressure, requiring navigation system providers to constantly demonstrate superior value and integrated functionality.

Emerging Opportunities in Asia Pacific Automotive Navigation System Market

The Asia Pacific automotive navigation system market is ripe with emerging opportunities. The burgeoning market for electric vehicles (EVs) presents a significant opportunity for navigation systems that can optimize charging routes, locate charging stations, and estimate range accurately. The rapid advancement and increasing adoption of autonomous driving technologies will necessitate highly sophisticated, high-definition mapping and precise localization capabilities, creating a niche for specialized navigation providers. The expansion of smart city initiatives across the region offers opportunities for navigation systems to integrate with urban infrastructure for traffic management, parking availability, and public transport information. Furthermore, the growing demand for personalized and contextualized navigation experiences, driven by AI and data analytics, opens avenues for tailored routing, destination suggestions, and in-car concierge services. The increasing internet penetration and smartphone adoption in developing economies like Southeast Asia and India are creating a large addressable market for both OEM and aftermarket navigation solutions.

Leading Players in the Asia Pacific Automotive Navigation System Market Market

- Clarion

- Mitsubishi Electric Corporation

- Continental AG

- Aisin Aw Co Ltd

- Garmin

- Denso Corporation

- Pioneer

- Alpine Electronics

Key Developments in Asia Pacific Automotive Navigation System Market Industry

- May 2022: What3words announced a new collaboration with Alpine Marketing Co., Ltd., a leading developer, manufacturer, and distributor of electronic components and car electronics-related products. The partnership brings exciting developments as the company's car navigation system, "big x connect" from the big x series, now fully supports what3words. This integration empowers customers in Japan to effortlessly navigate to any precise location using just three words.

- May 2022: Mercedes Benz revealed its decision to adopt Faurecia's Aptoide technology to enhance the navigation and infotainment capabilities of its vehicles. The cutting-edge Aptoide technology promises to deliver a seamless user experience within the company's cars, providing advanced navigation functionalities and other exciting features.

- January 2021: Continental, HERE, and Leia Inc. formed a strategic partnership aimed at revolutionizing display solutions for vehicle cockpits. The trio's collaboration brings three-dimensional navigation to life, offering drivers a safe and intuitive in-vehicle user experience with a remarkable wow factor. The innovative display solutions promise to create a transformative driving experience by providing enhanced visibility and usability for navigation and other crucial infotainment functions.

Strategic Outlook for Asia Pacific Automotive Navigation System Market Market

The strategic outlook for the Asia Pacific automotive navigation system market remains exceptionally positive, driven by persistent technological innovation and expanding consumer adoption. The increasing integration of navigation systems with advanced driver-assistance systems (ADAS) and the growing maturity of autonomous driving technologies will necessitate more sophisticated and reliable navigation solutions, creating substantial opportunities for market leaders. The ongoing expansion of the connected car ecosystem, coupled with the proliferation of 5G technology, will enable richer, real-time data services, further enhancing the value proposition of in-car navigation. The strategic focus for market participants will be on developing AI-powered personalized navigation, integrating with smart city infrastructure, and providing seamless experiences across different vehicle types and consumer segments. Partnerships and collaborations will be crucial for addressing complex technological challenges and expanding market reach, particularly in high-growth emerging economies. The market is poised for sustained growth, offering significant potential for companies that can innovate, adapt, and deliver compelling navigation solutions to a diverse and dynamic regional consumer base.

Asia Pacific Automotive Navigation System Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Car

- 1.2. Commercial Vehicle

-

2. Sales Channel Type

- 2.1. OEM

- 2.2. Aftermarket

-

3. Geography

-

3.1. China

- 3.1.1. Passenger Cars

- 3.1.2. Commercial Vehicles

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia-Pacific

-

3.1. China

Asia Pacific Automotive Navigation System Market Segmentation By Geography

-

1. China

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. India

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

-

3. Japan

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

-

4. South Korea

- 4.1. Passenger Cars

- 4.2. Commercial Vehicles

-

5. Rest of Asia Pacific

- 5.1. Passenger Cars

- 5.2. Commercial Vehicles

Asia Pacific Automotive Navigation System Market Regional Market Share

Geographic Coverage of Asia Pacific Automotive Navigation System Market

Asia Pacific Automotive Navigation System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand For Connected Cars; Others

- 3.3. Market Restrains

- 3.3.1. High Price Of In-dash Navigation Systems; Others

- 3.4. Market Trends

- 3.4.1. GPS is Largely Used in E-Commerce and Online Cab Booking Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Automotive Navigation System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Car

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Sales Channel Type

- 5.2.1. OEM

- 5.2.2. Aftermarket

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.1.1. Passenger Cars

- 5.3.1.2. Commercial Vehicles

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Rest of Asia-Pacific

- 5.3.1. China

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. China Asia Pacific Automotive Navigation System Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Passenger Car

- 6.1.2. Commercial Vehicle

- 6.2. Market Analysis, Insights and Forecast - by Sales Channel Type

- 6.2.1. OEM

- 6.2.2. Aftermarket

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.1.1. Passenger Cars

- 6.3.1.2. Commercial Vehicles

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. South Korea

- 6.3.5. Rest of Asia-Pacific

- 6.3.1. China

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. India Asia Pacific Automotive Navigation System Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Passenger Car

- 7.1.2. Commercial Vehicle

- 7.2. Market Analysis, Insights and Forecast - by Sales Channel Type

- 7.2.1. OEM

- 7.2.2. Aftermarket

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.1.1. Passenger Cars

- 7.3.1.2. Commercial Vehicles

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. South Korea

- 7.3.5. Rest of Asia-Pacific

- 7.3.1. China

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Japan Asia Pacific Automotive Navigation System Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Passenger Car

- 8.1.2. Commercial Vehicle

- 8.2. Market Analysis, Insights and Forecast - by Sales Channel Type

- 8.2.1. OEM

- 8.2.2. Aftermarket

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.1.1. Passenger Cars

- 8.3.1.2. Commercial Vehicles

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. South Korea

- 8.3.5. Rest of Asia-Pacific

- 8.3.1. China

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. South Korea Asia Pacific Automotive Navigation System Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Passenger Car

- 9.1.2. Commercial Vehicle

- 9.2. Market Analysis, Insights and Forecast - by Sales Channel Type

- 9.2.1. OEM

- 9.2.2. Aftermarket

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.1.1. Passenger Cars

- 9.3.1.2. Commercial Vehicles

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. South Korea

- 9.3.5. Rest of Asia-Pacific

- 9.3.1. China

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Rest of Asia Pacific Asia Pacific Automotive Navigation System Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.1.1. Passenger Car

- 10.1.2. Commercial Vehicle

- 10.2. Market Analysis, Insights and Forecast - by Sales Channel Type

- 10.2.1. OEM

- 10.2.2. Aftermarket

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.1.1. Passenger Cars

- 10.3.1.2. Commercial Vehicles

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. South Korea

- 10.3.5. Rest of Asia-Pacific

- 10.3.1. China

- 10.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Clarion

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Mitsubishi Electric Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Continental AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Aisin Aw Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Garmin

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Denso Corporatio

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Pioneer

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Alpine Electronics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Clarion

List of Figures

- Figure 1: Asia Pacific Automotive Navigation System Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Automotive Navigation System Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Automotive Navigation System Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: Asia Pacific Automotive Navigation System Market Revenue billion Forecast, by Sales Channel Type 2020 & 2033

- Table 3: Asia Pacific Automotive Navigation System Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Asia Pacific Automotive Navigation System Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia Pacific Automotive Navigation System Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 6: Asia Pacific Automotive Navigation System Market Revenue billion Forecast, by Sales Channel Type 2020 & 2033

- Table 7: Asia Pacific Automotive Navigation System Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Asia Pacific Automotive Navigation System Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Passenger Cars Asia Pacific Automotive Navigation System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Commercial Vehicles Asia Pacific Automotive Navigation System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Asia Pacific Automotive Navigation System Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 12: Asia Pacific Automotive Navigation System Market Revenue billion Forecast, by Sales Channel Type 2020 & 2033

- Table 13: Asia Pacific Automotive Navigation System Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: Asia Pacific Automotive Navigation System Market Revenue billion Forecast, by Country 2020 & 2033

- Table 15: Passenger Cars Asia Pacific Automotive Navigation System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Commercial Vehicles Asia Pacific Automotive Navigation System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Asia Pacific Automotive Navigation System Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 18: Asia Pacific Automotive Navigation System Market Revenue billion Forecast, by Sales Channel Type 2020 & 2033

- Table 19: Asia Pacific Automotive Navigation System Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Asia Pacific Automotive Navigation System Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Passenger Cars Asia Pacific Automotive Navigation System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Commercial Vehicles Asia Pacific Automotive Navigation System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Asia Pacific Automotive Navigation System Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 24: Asia Pacific Automotive Navigation System Market Revenue billion Forecast, by Sales Channel Type 2020 & 2033

- Table 25: Asia Pacific Automotive Navigation System Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 26: Asia Pacific Automotive Navigation System Market Revenue billion Forecast, by Country 2020 & 2033

- Table 27: Passenger Cars Asia Pacific Automotive Navigation System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Commercial Vehicles Asia Pacific Automotive Navigation System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Asia Pacific Automotive Navigation System Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 30: Asia Pacific Automotive Navigation System Market Revenue billion Forecast, by Sales Channel Type 2020 & 2033

- Table 31: Asia Pacific Automotive Navigation System Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 32: Asia Pacific Automotive Navigation System Market Revenue billion Forecast, by Country 2020 & 2033

- Table 33: Passenger Cars Asia Pacific Automotive Navigation System Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Commercial Vehicles Asia Pacific Automotive Navigation System Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Automotive Navigation System Market?

The projected CAGR is approximately 9.4%.

2. Which companies are prominent players in the Asia Pacific Automotive Navigation System Market?

Key companies in the market include Clarion, Mitsubishi Electric Corporation, Continental AG, Aisin Aw Co Ltd, Garmin, Denso Corporatio, Pioneer, Alpine Electronics.

3. What are the main segments of the Asia Pacific Automotive Navigation System Market?

The market segments include Vehicle Type, Sales Channel Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand For Connected Cars; Others.

6. What are the notable trends driving market growth?

GPS is Largely Used in E-Commerce and Online Cab Booking Services.

7. Are there any restraints impacting market growth?

High Price Of In-dash Navigation Systems; Others.

8. Can you provide examples of recent developments in the market?

May 2022: What3words announced a new collaboration with Alpine Marketing Co., Ltd., a leading developer, manufacturer, and distributor of electronic components and car electronics-related products. The partnership brings exciting developments as the company's car navigation system, "big x connect" from the big x series, now fully supports what3words. This integration empowers customers in Japan to effortlessly navigate to any precise location using just three words.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Automotive Navigation System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Automotive Navigation System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Automotive Navigation System Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Automotive Navigation System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence