Key Insights

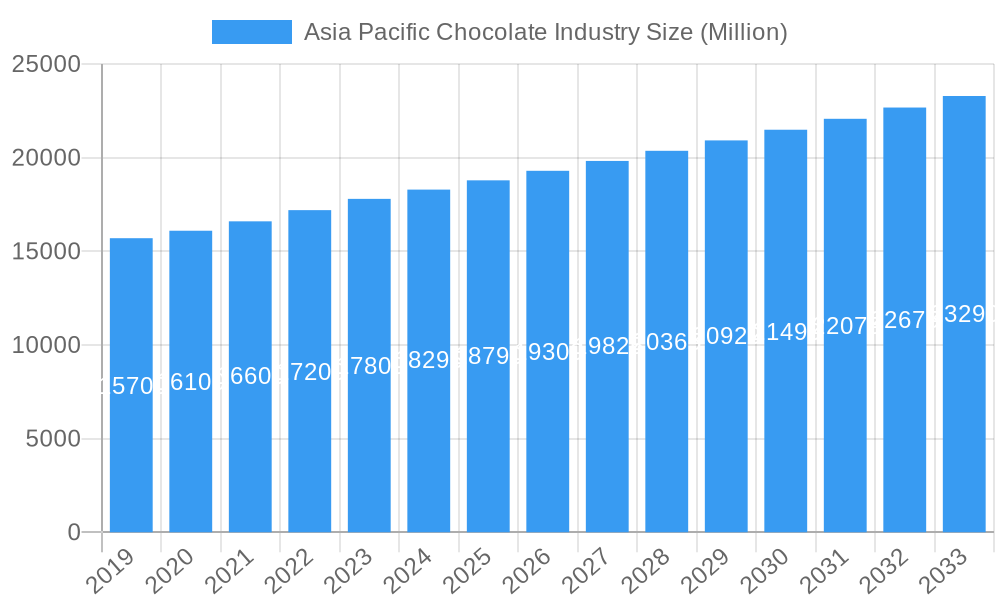

The Asia Pacific chocolate industry is poised for substantial growth, projected to reach a market size of USD 18,790 Million by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 4.69% from 2019 to 2033. This expansion is fueled by a confluence of factors, including a rising disposable income across the region, increasing urbanization, and a growing consumer preference for premium and artisanal chocolate products. The demand for dark chocolate is escalating as consumers become more health-conscious, while milk and white chocolate continue to hold a strong appeal due to their familiar and indulgent taste profiles. Distribution channels are also diversifying, with online retail stores experiencing a significant surge in popularity, complementing traditional outlets like convenience stores and supermarkets/hypermarkets. Key players such as Nestlé SA, Mondelēz International Inc., and The Hershey Company are strategically expanding their product portfolios and marketing efforts to capture market share.

Asia Pacific Chocolate Industry Market Size (In Billion)

Furthermore, the region's diverse demographics and evolving consumer tastes present unique opportunities. Emerging economies within Asia Pacific, particularly India and Southeast Asian nations like Vietnam and the Philippines, are expected to be significant growth engines. The increasing exposure to global chocolate trends through digital media and travel is driving demand for innovative flavors and ethically sourced cocoa. While the market is robust, potential restraints such as fluctuating raw material prices and intense competition among established and new entrants will require strategic management. However, the overall outlook remains highly optimistic, driven by sustained consumer interest in chocolate as both an affordable indulgence and a premium gifting item, further solidifying its position as a key segment within the broader confectionery market in Asia Pacific.

Asia Pacific Chocolate Industry Company Market Share

Asia Pacific Chocolate Industry Market Concentration & Innovation

The Asia Pacific chocolate industry is characterized by a dynamic interplay of global giants and burgeoning local players, indicating a moderately concentrated market. Major companies like Nestlé SA, Mars Incorporated, Mondelēz International Inc., and Ferrero International SA hold significant market share, driven by extensive brand portfolios and sophisticated distribution networks. Innovation in this region is heavily influenced by evolving consumer preferences, with a strong demand for premium, artisanal, and health-conscious chocolate products. Key innovation drivers include the adoption of sustainable sourcing practices, the introduction of novel flavor profiles (e.g., exotic fruits, spices), and the development of sugar-free and plant-based alternatives. Regulatory frameworks across Asia Pacific vary, impacting everything from import tariffs and food safety standards to labeling requirements. Companies must navigate these diverse landscapes, often requiring localized product formulations and marketing strategies.

- Market Share Leaders: Nestlé SA, Mars Incorporated, Mondelēz International Inc.

- Key Innovation Focus Areas:

- Sustainable sourcing and ethical production.

- Unique flavor combinations and premium ingredients.

- Health and wellness oriented products (sugar-free, plant-based).

- Personalized and artisanal chocolate experiences.

- M&A Activities: Recent M&A activities, such as Reliance Consumer Products (RCPL) acquiring a controlling stake in Lotus Chocolate Company Ltd., highlight consolidation efforts and strategic expansion by key players to strengthen their market presence and product offerings. The estimated value of such strategic acquisitions can range from tens to hundreds of millions of dollars, significantly impacting competitive landscapes.

- Product Substitutes: While direct substitutes are limited, competitors in the broader confectionery and snack categories, such as biscuits, gummies, and other sweet treats, exert indirect pressure.

Asia Pacific Chocolate Industry Industry Trends & Insights

The Asia Pacific chocolate industry is poised for robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 5.5% over the forecast period of 2025–2033. This expansion is fueled by a confluence of favorable demographic shifts, rising disposable incomes, and evolving consumer lifestyles across the region. Urbanization continues to drive demand for convenient and accessible chocolate products, particularly in emerging economies. The increasing penetration of modern retail channels, including supermarkets and online platforms, is making a wider variety of chocolate offerings readily available to a larger consumer base. Furthermore, a growing awareness of the potential health benefits associated with moderate dark chocolate consumption, coupled with a rising trend towards premiumization, is encouraging consumers to opt for higher-quality, value-added chocolate products.

Technological advancements are also playing a pivotal role in shaping the industry's trajectory. Innovations in processing technologies are enabling manufacturers to create more diverse textures and flavor profiles, catering to the sophisticated palates of Asian consumers. The rise of e-commerce and digital marketing has opened new avenues for direct-to-consumer sales, allowing smaller artisanal chocolatiers to reach a wider audience and established brands to enhance customer engagement through personalized promotions and loyalty programs. Competitive dynamics are intensifying, with both multinational corporations and local manufacturers vying for market share. This competition is driving product differentiation, with companies focusing on unique ingredient sourcing, ethical practices, and innovative packaging to capture consumer attention. The demand for premium and artisanal chocolates is particularly on the rise, as consumers are willing to pay more for products that offer superior taste, unique origins, and sustainable credentials. Market penetration of premium chocolate segments is expected to increase by an estimated 10% over the forecast period.

Consumer preferences are becoming increasingly sophisticated, with a growing interest in traceability, ingredient transparency, and ethical sourcing. This trend is pushing manufacturers to invest in supply chain management and sustainability initiatives. The influence of social media and digital platforms in shaping consumer trends cannot be overstated; viral marketing campaigns and influencer endorsements often dictate purchasing decisions, especially among younger demographics. The Asia Pacific region, with its vast and diverse population, presents a significant opportunity for market expansion, with specific countries demonstrating particularly high growth potential due to their rapidly developing economies and expanding middle class.

Dominant Markets & Segments in Asia Pacific Chocolate Industry

The Asia Pacific chocolate industry is dominated by several key markets and segments, driven by a combination of economic prowess, evolving consumer habits, and strategic market penetration by leading players. Among the confectionery variants, Milk and White Chocolate consistently holds a dominant position due to its broad appeal across age groups and its association with indulgence and comfort. This segment benefits from widespread availability in almost all distribution channels and a strong presence in the portfolios of major companies like Nestlé SA, Mars Incorporated, and Mondelēz International Inc.

Leading Countries:

- China: The largest and fastest-growing market, driven by increasing disposable incomes, a burgeoning middle class, and a significant shift towards Western consumption patterns. Economic policies encouraging foreign investment and robust retail infrastructure further bolster its dominance.

- Japan: A mature yet significant market characterized by a strong demand for premium and artisanal chocolates, with companies like Morinaga & Co LTD and Yuraku Confectionery Co Ltd holding strong positions. High consumer spending power and a culture of gifting contribute to its importance.

- India: A rapidly expanding market with immense growth potential, fueled by a young population, increasing urbanization, and a growing appetite for confectionery. The entry and expansion of players like Reliance Industries Ltd. through acquisitions are reshaping its landscape.

- Australia: A developed market with a strong preference for premium and ethically sourced chocolate. Companies like Atypic Chocolate Pty Ltd are gaining traction in niche segments.

Dominant Segments:

- Confectionery Variant: Milk and White Chocolate:

- Key Drivers: Broad consumer appeal, affordability, versatility in product applications, and extensive marketing efforts by major brands.

- Market Dominance: This segment accounts for an estimated 70% of the overall chocolate market value in the region. Supermarkets/Hypermarkets are the primary distribution channels, followed by convenience stores, reflecting their everyday purchase nature.

- Distribution Channel: Supermarket/Hypermarket:

- Key Drivers: Wide product assortment, competitive pricing, convenience for bulk purchases, and strong promotional activities. These outlets serve as primary hubs for household grocery shopping.

- Market Dominance: Supermarkets and hypermarkets are estimated to capture over 50% of chocolate sales in the Asia Pacific region, providing essential visibility for both mass-market and premium brands.

- Distribution Channel: Convenience Store:

- Key Drivers: Impulse purchases, accessibility in urban and suburban areas, and availability of smaller, on-the-go pack sizes.

- Market Dominance: While smaller in overall volume than supermarkets, convenience stores play a crucial role in capturing impulse buys, especially for everyday chocolate consumption. Their share is estimated at approximately 25%.

- Distribution Channel: Online Retail Store:

- Key Drivers: Growing e-commerce penetration, convenience of home delivery, wider selection often including niche and international brands, and personalized offers.

- Market Dominance: This channel is experiencing the fastest growth, projected to increase its market share significantly in the coming years, potentially reaching 20% by 2030. Online platforms like Meiji Holdings Company Ltd. and specialized e-commerce sites are key players.

- Confectionery Variant: Milk and White Chocolate:

The dominance of Milk and White Chocolate, coupled with the strong performance of Supermarket/Hypermarket and Convenience Store distribution channels, reflects the mass-market appeal and accessibility that underpins the current structure of the Asia Pacific chocolate industry. However, the burgeoning growth of Online Retail Stores signals a significant shift in consumer purchasing behavior.

Asia Pacific Chocolate Industry Product Developments

Product innovation in the Asia Pacific chocolate industry is a key differentiator, driven by a deep understanding of local tastes and a global push for healthier and more sustainable options. Companies are actively developing products that cater to a diverse range of preferences. This includes the introduction of unique flavor fusions, such as chili-infused dark chocolate for markets like Mexico and Southeast Asia, or matcha-flavored white chocolate for Japan and Korea. There is a significant trend towards sugar-reduced and sugar-free options, appealing to the growing health-conscious consumer base across the region. The use of plant-based ingredients and dairy-free formulations is also gaining traction, driven by a rising vegan and lactose-intolerant population. Barry Callebaut AG's focus on sustainable cocoa sourcing and transparent ingredient lists provides a competitive advantage, resonating with consumers who prioritize ethical consumption.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Asia Pacific Chocolate Industry, encompassing a detailed segmentation of the market. The study period spans from 2019 to 2033, with a base year of 2025, offering in-depth insights into historical trends and future projections. The forecast period is from 2025 to 2033.

- Confectionery Variant: Dark Chocolate: This segment is expected to witness steady growth, driven by increasing consumer awareness of its perceived health benefits and a rising demand for premium, bitter-sweet taste profiles. Projected market size for this segment is expected to reach approximately $5 Billion by 2033, with a CAGR of 4.8%. Competitive intensity is moderate, with a focus on quality ingredients and single-origin products.

- Confectionery Variant: Milk and White Chocolate: This remains the largest segment due to its widespread appeal and versatility. It is projected to continue its growth trajectory, driven by impulse purchases and mainstream consumption. Expected market size is around $18 Billion by 2033, with a CAGR of 5.2%. Competition is high, with major players like Nestlé SA and Mars Incorporated dominating.

- Distribution Channel: Convenience Store: This channel is crucial for impulse purchases and on-the-go consumption. Its market share is expected to remain significant, driven by extensive networks in urban areas. Projected market share of around 25% by 2033. Key players are leveraging smaller pack sizes and strategic placement.

- Distribution Channel: Online Retail Store: This segment is poised for the fastest growth, fueled by increasing e-commerce adoption and consumer convenience. Its market share is projected to rise substantially, potentially reaching 20% by 2033. Companies are investing in direct-to-consumer strategies and online marketing.

- Distribution Channel: Supermarket/Hypermarket: This traditional channel continues to be a dominant force, offering a wide product range and competitive pricing. Expected to hold a market share of approximately 45% by 2033. This segment is characterized by intense competition and extensive promotional activities.

- Distribution Channel: Others: This category includes specialty stores, pharmacies, and food service. It is expected to grow at a moderate pace, catering to niche markets and specific consumer needs.

Key Drivers of Asia Pacific Chocolate Industry Growth

The Asia Pacific chocolate industry's growth is propelled by several interconnected factors. Rising disposable incomes and a burgeoning middle class across countries like China and India are significantly increasing consumer spending power on premium and everyday chocolate products. Urbanization further fuels demand by making these products more accessible. Technological advancements in manufacturing and product development allow for greater product diversification, catering to evolving consumer preferences for unique flavors, textures, and healthier options, such as sugar-free and plant-based chocolates. E-commerce penetration and the expansion of modern retail channels, including supermarkets and convenience stores, are enhancing product accessibility and driving sales. Furthermore, growing health consciousness is spurring demand for dark chocolate variants and products with perceived health benefits, alongside a strong inclination towards artisanal and ethically sourced chocolates.

Challenges in the Asia Pacific Chocolate Industry Sector

Despite significant growth, the Asia Pacific chocolate industry faces several challenges. Volatile cocoa bean prices, influenced by weather patterns, geopolitical factors, and supply chain disruptions, can impact raw material costs and profit margins. Navigating diverse and evolving regulatory frameworks across different countries, including food safety standards, labeling requirements, and import/export duties, presents a continuous hurdle for manufacturers. Intense competition from both global giants and a growing number of local and artisanal brands necessitates continuous innovation and aggressive marketing strategies. Supply chain complexities, particularly in sourcing sustainable cocoa and ensuring efficient distribution across vast and geographically diverse regions, remain a persistent challenge. Furthermore, rising health and wellness trends can impact traditional confectionery sales, requiring adaptation towards healthier product formulations.

Emerging Opportunities in Asia Pacific Chocolate Industry

Emerging opportunities in the Asia Pacific chocolate industry are abundant, driven by evolving consumer behaviors and technological advancements. The growing demand for premium and artisanal chocolates, particularly those with unique flavor profiles and ethically sourced ingredients, presents a significant avenue for growth. The burgeoning health and wellness trend is creating a substantial market for sugar-free, low-calorie, and plant-based chocolate alternatives. E-commerce and direct-to-consumer (DTC) channels offer unparalleled reach and engagement opportunities, allowing brands to build direct relationships with consumers and offer personalized experiences. Furthermore, tapping into emerging markets with rapidly growing economies and increasing disposable incomes, such as Vietnam and the Philippines, offers immense potential for market expansion. The increasing popularity of chocolate as a gift item, especially during festive seasons, also presents opportunities for tailored product offerings and promotional campaigns.

Leading Players in the Asia Pacific Chocolate Industry Market

- Nestlé SA

- Mars Incorporated

- Mondelēz International Inc.

- Ferrero International SA

- Barry Callebaut AG

- The Hershey Company

- Morinaga & Co LTD

- Meiji Holdings Company Ltd.

- Yuraku Confectionery Co Ltd.

- ROYCE' Confect Co Ltd.

- Yıldız Holding A.Ş.

- Gujarat Co-operative Milk Marketing Federation Ltd.

- Reliance Industries Ltd.

- ITC Limited

- Chocoladefabriken Lindt & Sprüngli AG

- Atypic Chocolate Pty Ltd

Key Developments in Asia Pacific Chocolate Industry Industry

- May 2023: Reliance Consumer Products (RCPL), the FMCG arm of Reliance Retail Ventures (RRVL), completed the acquisition of a controlling stake in Lotus Chocolate Company Ltd., signifying a significant consolidation and expansion within the Indian chocolate market.

- February 2023: The Hershey Company launched limited-edition chocolate bars to honor the celebration of International Women’s Day, demonstrating a strategic focus on purpose-driven marketing and consumer engagement.

- February 2023: Ferrero International SA expanded its business by introducing a new chocolate variant under its brand, Kinder® Chocolate Mini Friends. This expansion is based on its strategic move to increase its consumer base by offering unique flavored products, highlighting product innovation as a growth driver.

Strategic Outlook for Asia Pacific Chocolate Industry Market

The strategic outlook for the Asia Pacific chocolate industry is optimistic, driven by sustained growth catalysts. The increasing disposable incomes and expanding middle class across the region will continue to fuel demand for both mass-market and premium chocolate offerings. Embracing digital transformation, particularly through e-commerce and data analytics, will be crucial for enhancing consumer engagement, personalized marketing, and efficient distribution. Innovation in product development, focusing on health and wellness trends such as sugar-free, plant-based, and ethically sourced options, will capture the attention of an increasingly discerning consumer base. Strategic mergers and acquisitions, similar to recent activities, will likely continue as companies seek to consolidate market share, expand their geographical reach, and diversify their product portfolios. Furthermore, building resilient and sustainable supply chains will be paramount to navigate the complexities of raw material sourcing and distribution, ensuring long-term profitability and market leadership.

Asia Pacific Chocolate Industry Segmentation

-

1. Confectionery Variant

- 1.1. Dark Chocolate

- 1.2. Milk and White Chocolate

-

2. Distribution Channel

- 2.1. Convenience Store

- 2.2. Online Retail Store

- 2.3. Supermarket/Hypermarket

- 2.4. Others

Asia Pacific Chocolate Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Chocolate Industry Regional Market Share

Geographic Coverage of Asia Pacific Chocolate Industry

Asia Pacific Chocolate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.69% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Consumption of Baked Goods; Demand for Indigenous Fermented Foods

- 3.3. Market Restrains

- 3.3.1. Potential Side-effects of Yeast

- 3.4. Market Trends

- 3.4.1. Japan and India drove the chocolate consumption in the region with the share of almost 50% by value with increasing focus on innovative premium chocolates

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Chocolate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 5.1.1. Dark Chocolate

- 5.1.2. Milk and White Chocolate

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Convenience Store

- 5.2.2. Online Retail Store

- 5.2.3. Supermarket/Hypermarket

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nestlé SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Morinaga & Co LTD

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Chocoladefabriken Lindt & Sprüngli AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Reliance Industries Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Atypic Chocolate Pty Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ferrero International SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mars Incorporated

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Yıldız Holding A

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Yuraku Confectionery Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Barry callebaut AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Mondelēz International Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Meiji Holdings Company Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Gujarat Co-operative Milk Marketing Federation Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 ITC Limited

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 The Hershey Company

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 ROYCE' Confect Co Ltd

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 Nestlé SA

List of Figures

- Figure 1: Asia Pacific Chocolate Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Chocolate Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Chocolate Industry Revenue Million Forecast, by Confectionery Variant 2020 & 2033

- Table 2: Asia Pacific Chocolate Industry Volume K Tons Forecast, by Confectionery Variant 2020 & 2033

- Table 3: Asia Pacific Chocolate Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Asia Pacific Chocolate Industry Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 5: Asia Pacific Chocolate Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Asia Pacific Chocolate Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Asia Pacific Chocolate Industry Revenue Million Forecast, by Confectionery Variant 2020 & 2033

- Table 8: Asia Pacific Chocolate Industry Volume K Tons Forecast, by Confectionery Variant 2020 & 2033

- Table 9: Asia Pacific Chocolate Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Asia Pacific Chocolate Industry Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 11: Asia Pacific Chocolate Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Asia Pacific Chocolate Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: China Asia Pacific Chocolate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: China Asia Pacific Chocolate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: Japan Asia Pacific Chocolate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Japan Asia Pacific Chocolate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: South Korea Asia Pacific Chocolate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: South Korea Asia Pacific Chocolate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: India Asia Pacific Chocolate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: India Asia Pacific Chocolate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Australia Asia Pacific Chocolate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Australia Asia Pacific Chocolate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: New Zealand Asia Pacific Chocolate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: New Zealand Asia Pacific Chocolate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Indonesia Asia Pacific Chocolate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Indonesia Asia Pacific Chocolate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: Malaysia Asia Pacific Chocolate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Malaysia Asia Pacific Chocolate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: Singapore Asia Pacific Chocolate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Singapore Asia Pacific Chocolate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Thailand Asia Pacific Chocolate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Thailand Asia Pacific Chocolate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 33: Vietnam Asia Pacific Chocolate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Vietnam Asia Pacific Chocolate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 35: Philippines Asia Pacific Chocolate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Philippines Asia Pacific Chocolate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Chocolate Industry?

The projected CAGR is approximately 4.69%.

2. Which companies are prominent players in the Asia Pacific Chocolate Industry?

Key companies in the market include Nestlé SA, Morinaga & Co LTD, Chocoladefabriken Lindt & Sprüngli AG, Reliance Industries Ltd, Atypic Chocolate Pty Ltd, Ferrero International SA, Mars Incorporated, Yıldız Holding A, Yuraku Confectionery Co Ltd, Barry callebaut AG, Mondelēz International Inc, Meiji Holdings Company Ltd, Gujarat Co-operative Milk Marketing Federation Ltd, ITC Limited, The Hershey Company, ROYCE' Confect Co Ltd.

3. What are the main segments of the Asia Pacific Chocolate Industry?

The market segments include Confectionery Variant, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 18790 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Consumption of Baked Goods; Demand for Indigenous Fermented Foods.

6. What are the notable trends driving market growth?

Japan and India drove the chocolate consumption in the region with the share of almost 50% by value with increasing focus on innovative premium chocolates.

7. Are there any restraints impacting market growth?

Potential Side-effects of Yeast.

8. Can you provide examples of recent developments in the market?

May 2023: Reliance Consumer Products (RCPL), the FMCG arm of Reliance Retail Ventures (RRVL), completed the acquisition of a controlling stake in Lotus Chocolate Company Ltd.February 2023: The Hershey Company launched limited-edition chocolate bars to honor the celebration of International Women’s Day.February 2023: Ferrero International SA expanded its business by introducing a new chocolate variant under its brand, Kinder® Chocolate Mini Friends. The expansion is based on its strategic move to increase its consumer base by offering unique flavored products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Chocolate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Chocolate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Chocolate Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Chocolate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence