Key Insights

The Asia-Pacific Digestive Health Supplements Market is projected for substantial growth, driven by increasing consumer awareness of gut health's impact on overall well-being, a rising incidence of digestive disorders, and an aging demographic. Enhanced disposable incomes are empowering consumers to invest in premium supplements like probiotics and prebiotics, fueled by their recognized benefits for the gut microbiome. The expanding e-commerce sector is improving accessibility to a wider range of digestive health products, stimulating market penetration. Product innovations, including targeted delivery systems and novel ingredients, further contribute to market dynamism and consumer interest.

Asia-Pacific Digestive Health Supplements Market Market Size (In Billion)

Key market trends include a growing demand for scientifically validated supplements and a preference for natural, organic ingredients, with consumers seeking transparent sourcing and clear efficacy claims. Distribution channels are diversifying, with online retail complementing traditional pharmacies and supermarkets, offering expanded reach and personalized shopping experiences. Potential challenges include navigating varying regulatory frameworks and educating consumers on the long-term benefits and proper usage of digestive health supplements. Despite these, strong market sentiment, continuous product development, and expanding reach underscore the promising outlook for the Asia-Pacific Digestive Health Supplements Market.

Asia-Pacific Digestive Health Supplements Market Company Market Share

Gain actionable intelligence on the burgeoning Asia-Pacific Digestive Health Supplements Market. This comprehensive report analyzes market dynamics, segmentation, key players, and future projections from 2019 to 2033. It offers critical insights into prebiotics, probiotics, enzymes, and other digestive aid formulations, alongside an examination of distribution channels including supermarkets, pharmacies, and online retail. This report provides essential data for stakeholders aiming to capitalize on the escalating demand for gut health solutions across China, Japan, India, Australia, and the broader Asia-Pacific region. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of 8.5%, reaching a market size of 62 billion by the base year of 2025.

Asia-Pacific Digestive Health Supplements Market Market Concentration & Innovation

The Asia-Pacific digestive health supplements market exhibits a moderate to high market concentration, with a mix of global giants and agile local players vying for market share. Key industry participants like Nestle Inc., Bayer AG, GNC Holdings LLC, Nordic Naturals, Abbott Laboratories, Amway, Herbalife Nutrition, NOW Foods, DuPont de Nemours, and ORGANIC INDIA are actively shaping the competitive landscape. Innovation is a crucial differentiator, driven by increasing consumer awareness of the gut-brain axis and the microbiome's impact on overall well-being. Regulatory frameworks, while evolving, are generally supportive of functional food and supplement development, although regional variations require careful navigation. Product substitutes, ranging from functional foods with inherent digestive benefits to over-the-counter medications, present a constant challenge and necessitate ongoing product differentiation. End-user trends lean towards natural, science-backed formulations and personalized nutrition solutions. Mergers and acquisitions (M&A) activity remains a significant avenue for market consolidation and expansion. Notable M&A deal values are not publicly disclosed but are understood to be substantial as companies seek to acquire innovative technologies and expand their geographical reach. The market share distribution is dynamic, with leading players holding an estimated aggregate of 60-70% of the market.

Asia-Pacific Digestive Health Supplements Market Industry Trends & Insights

The Asia-Pacific digestive health supplements market is experiencing robust growth, fueled by a confluence of powerful trends. A primary growth driver is the increasing consumer awareness and education regarding the critical role of gut health in overall well-being. As research illuminates the connection between the microbiome and conditions ranging from digestive disorders to immune function and even mental health, consumers are actively seeking proactive solutions. This heightened awareness is translating into a significant rise in market penetration for digestive health supplements, estimated to be around 25-30% in developed markets like Australia and Japan, with rapid growth in emerging economies like India and China. Technological disruptions are playing a pivotal role, with advancements in delivery mechanisms for probiotics, such as encapsulation techniques, enhancing their survival rates and efficacy. Furthermore, the development of personalized probiotic strains and synergistic prebiotic formulations tailored to specific gut profiles is gaining traction.

Consumer preferences are evolving towards natural, plant-based, and scientifically validated ingredients. There is a discernible shift away from synthetic additives towards holistic wellness approaches. The growing prevalence of digestive issues, including Irritable Bowel Syndrome (IBS), bloating, and indigestion, exacerbated by changing dietary habits and stressful lifestyles, further propels demand. The competitive dynamics are characterized by intense product innovation, strategic partnerships, and aggressive marketing campaigns. Companies are investing heavily in research and development to launch novel formulations that address specific unmet needs. The Compound Annual Growth Rate (CAGR) for the Asia-Pacific digestive health supplements market is projected to be a strong 7.5% during the forecast period of 2025–2033. This growth is underpinned by a growing middle class with increased disposable income and a greater willingness to invest in preventative healthcare. The online retail segment, in particular, is witnessing explosive growth, offering convenience and wider product accessibility.

Dominant Markets & Segments in Asia-Pacific Digestive Health Supplements Market

The Asia-Pacific digestive health supplements market is characterized by distinct regional strengths and segment preferences. China stands out as the dominant market, driven by its enormous population, rapidly growing middle class, and increasing health consciousness. Significant economic policies focused on healthcare and wellness, coupled with vast improvements in retail infrastructure and a booming e-commerce landscape, contribute to China's leading position. The country's vast population base and a proactive approach to adopting health supplements make it a prime market. India is another crucial and rapidly expanding market, fueled by a burgeoning population, rising disposable incomes, and a growing acceptance of western health supplements alongside traditional remedies. Government initiatives promoting health and wellness, coupled with strong domestic manufacturing capabilities, further bolster India's market share.

Within the Type segmentation, Probiotics are currently the most dominant segment, accounting for an estimated 45% of the market. This is largely due to extensive research highlighting their benefits for gut microbiome balance and immune support. Prebiotics, closely following at around 30% market share, are gaining significant traction as consumers understand their role in feeding beneficial gut bacteria. The Enzymes segment, holding approximately 20% market share, is expected to see steady growth as awareness of their role in nutrient absorption increases. "Other Types," including combinations and synbiotics, represent the remaining 5% but offer significant potential for innovation.

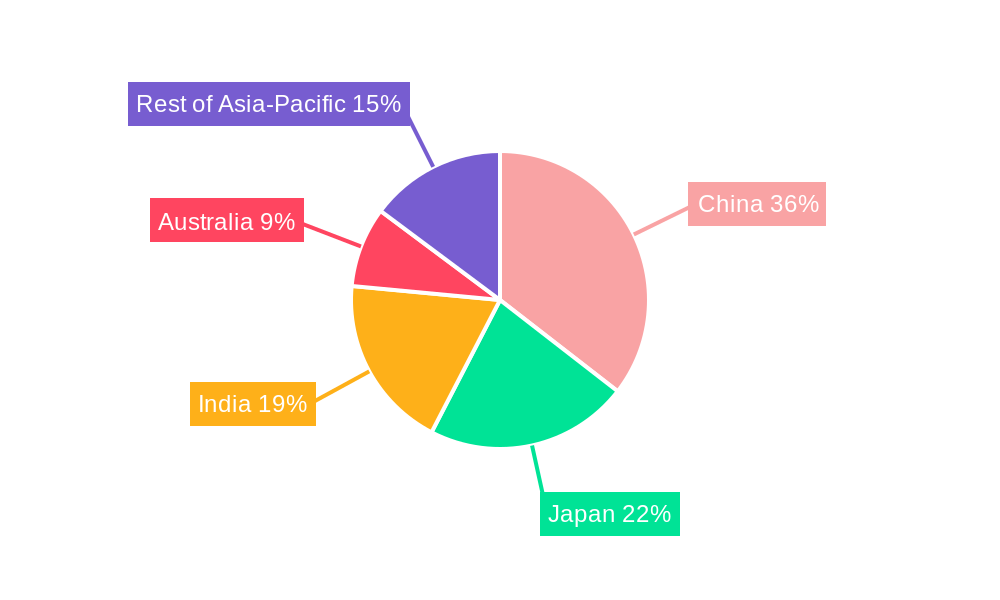

In terms of Distribution Channel, Pharmacies and Drugstores continue to hold a substantial market share, estimated at 40%, due to consumer trust in regulated environments and pharmacist recommendations. However, Online Retailers are rapidly emerging as a dominant force, projected to capture 35% of the market. This surge is attributed to convenience, wider product availability, competitive pricing, and targeted marketing. Supermarkets/Hypermarkets, while important for accessibility, hold an estimated 20% market share, primarily for mass-market offerings. "Other Distribution Channels," such as direct-to-consumer (DTC) models and health clinics, account for the remaining 5% and are expected to grow with specialized offerings. The Geography segment is led by China, followed by India, Japan, and Australia, with the Rest of Asia-Pacific representing a significant and growing market collectively.

Asia-Pacific Digestive Health Supplements Market Product Developments

Product innovation in the Asia-Pacific digestive health supplements market is rapidly evolving to meet diverse consumer needs. Companies are focusing on developing advanced delivery systems for probiotics, such as delayed-release capsules and microencapsulation technologies, to ensure higher survivability in the digestive tract and enhanced efficacy. The emergence of postbiotic formulations, like the one highlighted in the Soulfuel protein powder, is a significant trend, offering targeted benefits without the need for live microorganisms. Furthermore, synergistic combinations of prebiotics, probiotics, and digestive enzymes are gaining traction, providing a comprehensive approach to gut health. Companies are also emphasizing natural and plant-based ingredients, catering to the growing demand for clean-label products. These developments offer competitive advantages by addressing specific digestive concerns, improving product palatability, and enhancing overall consumer satisfaction.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Asia-Pacific Digestive Health Supplements Market, segmented across key areas. The Type segmentation includes Prebiotics, Probiotics, Enzymes, and Other Types, each offering unique benefits for gut health and catering to distinct consumer needs. Growth projections and market sizes will be detailed for each. The Distribution Channel segmentation encompasses Supermarkets/Hypermarkets, Pharmacies and Drugstores, Online Retailers, and Other Distribution Channels, reflecting the diverse avenues through which consumers access these products and the evolving retail landscape. The Geography segmentation breaks down the market into China, Japan, India, Australia, and the Rest of Asia-Pacific, enabling a granular understanding of regional dynamics, market sizes, and competitive intensity in each area.

Key Drivers of Asia-Pacific Digestive Health Supplements Market Growth

Several key factors are propelling the growth of the Asia-Pacific digestive health supplements market. Rising consumer awareness regarding the link between gut health and overall well-being is paramount, driving demand for preventative and therapeutic solutions. The increasing prevalence of digestive disorders, influenced by modern lifestyles, diets, and stress, further fuels market expansion. Technological advancements in formulation and delivery systems are leading to more effective and targeted products. Government support for the healthcare and wellness sectors, coupled with growing disposable incomes across the region, allows consumers to invest more in health-enhancing supplements. Finally, the burgeoning e-commerce sector provides unparalleled accessibility and convenience, expanding the market's reach.

Challenges in the Asia-Pacific Digestive Health Supplements Market Sector

Despite robust growth, the Asia-Pacific digestive health supplements market faces several challenges. Stringent and varying regulatory landscapes across different countries can complicate product approvals and market entry. Consumer skepticism and the need for greater scientific education regarding the efficacy and benefits of certain supplements can hinder widespread adoption. Intense competition from established players and emerging brands, often with aggressive pricing strategies, puts pressure on profit margins. Supply chain disruptions, particularly for specialized ingredients, can impact product availability. Furthermore, counterfeit products and a lack of clear product differentiation in a crowded market can erode consumer trust.

Emerging Opportunities in Asia-Pacific Digestive Health Supplements Market

The Asia-Pacific digestive health supplements market presents significant emerging opportunities. The growing interest in personalized nutrition offers a fertile ground for tailored probiotic strains and customized prebiotic formulations based on individual gut microbiomes. Expansion into emerging economies within the Rest of Asia-Pacific, with their rapidly developing healthcare sectors and increasing consumer spending power, represents a vast untapped market. The integration of digestive health supplements with other wellness categories, such as immunity, mood, and weight management, creates synergistic product development opportunities. Furthermore, the increasing demand for plant-based and sustainable ingredients opens avenues for innovative product development and niche market penetration.

Leading Players in the Asia-Pacific Digestive Health Supplements Market Market

- Nestle Inc

- Bayer AG

- GNC Holdings LLC

- Nordic Naturals

- Abbott Laboratories

- Amway

- Herbalife Nutrition

- NOW Foods

- DuPont de Nemours

- ORGANIC INDIA

Key Developments in Asia-Pacific Digestive Health Supplements Market Industry

- May 2022: Mumbai-based wellness brand Soulfuel launched the Soulfuel protein powder. The product is focused on strengthening the gut with a new blend of post-biotic with the brand name Epicor, prebiotic Inulin, and digestive enzymes.

- February 2022: Organic India launched daily pack supplements. These are on-the-go supplements that feature whole herb formulas designed for specific needs, such as stress and mood changes, immunity, and cognitive and digestive health.

Strategic Outlook for Asia-Pacific Digestive Health Supplements Market Market

The strategic outlook for the Asia-Pacific digestive health supplements market is highly promising. Continued investment in research and development to unlock novel ingredients and enhance product efficacy will be crucial. Companies should focus on educational marketing campaigns to build consumer trust and highlight the scientific backing of their products. Strategic partnerships and collaborations with healthcare professionals and research institutions can further strengthen market credibility. Embracing the digital landscape for targeted marketing, e-commerce expansion, and direct-to-consumer engagement will be vital for capturing market share. Furthermore, a focus on sustainability and ethical sourcing will resonate with an increasingly conscientious consumer base, positioning brands for long-term success in this dynamic and growing market.

Asia-Pacific Digestive Health Supplements Market Segmentation

-

1. Type

- 1.1. Prebiotics

- 1.2. Probiotics

- 1.3. Enzymes

- 1.4. Other Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Pharmacies and Drugstores

- 2.3. Online Retailers

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia-Pacific

Asia-Pacific Digestive Health Supplements Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

- 5. Rest of Asia Pacific

Asia-Pacific Digestive Health Supplements Market Regional Market Share

Geographic Coverage of Asia-Pacific Digestive Health Supplements Market

Asia-Pacific Digestive Health Supplements Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for healthy alternative food products; Advancements in vitamin infusion into food products

- 3.3. Market Restrains

- 3.3.1. Expensive pricing of vitamin-infused food products

- 3.4. Market Trends

- 3.4.1. Growing Concern about Gut Health

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Digestive Health Supplements Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Prebiotics

- 5.1.2. Probiotics

- 5.1.3. Enzymes

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Pharmacies and Drugstores

- 5.2.3. Online Retailers

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. India

- 5.3.4. Australia

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia-Pacific Digestive Health Supplements Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Prebiotics

- 6.1.2. Probiotics

- 6.1.3. Enzymes

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Pharmacies and Drugstores

- 6.2.3. Online Retailers

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. Japan

- 6.3.3. India

- 6.3.4. Australia

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Japan Asia-Pacific Digestive Health Supplements Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Prebiotics

- 7.1.2. Probiotics

- 7.1.3. Enzymes

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Pharmacies and Drugstores

- 7.2.3. Online Retailers

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. Japan

- 7.3.3. India

- 7.3.4. Australia

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. India Asia-Pacific Digestive Health Supplements Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Prebiotics

- 8.1.2. Probiotics

- 8.1.3. Enzymes

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Pharmacies and Drugstores

- 8.2.3. Online Retailers

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. Japan

- 8.3.3. India

- 8.3.4. Australia

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia Asia-Pacific Digestive Health Supplements Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Prebiotics

- 9.1.2. Probiotics

- 9.1.3. Enzymes

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Pharmacies and Drugstores

- 9.2.3. Online Retailers

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. Japan

- 9.3.3. India

- 9.3.4. Australia

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Asia Pacific Asia-Pacific Digestive Health Supplements Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Prebiotics

- 10.1.2. Probiotics

- 10.1.3. Enzymes

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Pharmacies and Drugstores

- 10.2.3. Online Retailers

- 10.2.4. Other Distribution Channels

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. Japan

- 10.3.3. India

- 10.3.4. Australia

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Nestle Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bayer AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 GNC Holdings LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nordic Naturals

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Abbott Laboratories

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Amway

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Herbalife Nutrition

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 NOW Foods

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 DuPont de Nemours

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ORGANIC INDIA*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Nestle Inc

List of Figures

- Figure 1: Asia-Pacific Digestive Health Supplements Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Digestive Health Supplements Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Digestive Health Supplements Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Digestive Health Supplements Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Asia-Pacific Digestive Health Supplements Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Digestive Health Supplements Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Digestive Health Supplements Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Asia-Pacific Digestive Health Supplements Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Asia-Pacific Digestive Health Supplements Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Digestive Health Supplements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Asia-Pacific Digestive Health Supplements Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Asia-Pacific Digestive Health Supplements Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Asia-Pacific Digestive Health Supplements Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Digestive Health Supplements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Digestive Health Supplements Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Asia-Pacific Digestive Health Supplements Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Asia-Pacific Digestive Health Supplements Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Asia-Pacific Digestive Health Supplements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Digestive Health Supplements Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Asia-Pacific Digestive Health Supplements Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 19: Asia-Pacific Digestive Health Supplements Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific Digestive Health Supplements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Digestive Health Supplements Market Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Asia-Pacific Digestive Health Supplements Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 23: Asia-Pacific Digestive Health Supplements Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Asia-Pacific Digestive Health Supplements Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Digestive Health Supplements Market?

The projected CAGR is approximately 8.5%.

2. Which companies are prominent players in the Asia-Pacific Digestive Health Supplements Market?

Key companies in the market include Nestle Inc, Bayer AG, GNC Holdings LLC, Nordic Naturals, Abbott Laboratories, Amway, Herbalife Nutrition, NOW Foods, DuPont de Nemours, ORGANIC INDIA*List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Digestive Health Supplements Market?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 62 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for healthy alternative food products; Advancements in vitamin infusion into food products.

6. What are the notable trends driving market growth?

Growing Concern about Gut Health.

7. Are there any restraints impacting market growth?

Expensive pricing of vitamin-infused food products.

8. Can you provide examples of recent developments in the market?

May 2022: Mumbai-based wellness brand Soulfuel launched the Soulfuel protein powder. The product is focused on strengthening the gut with a new blend of post-biotic with the brand name Epicor, prebiotic Inulin, and digestive enzymes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Digestive Health Supplements Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Digestive Health Supplements Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Digestive Health Supplements Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Digestive Health Supplements Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence