Key Insights

The Asia Pacific electric vehicle (EV) industry is poised for explosive growth, with a current market size of $250.40 million expected to surge at an impressive Compound Annual Growth Rate (CAGR) of 19.10% between 2025 and 2033. This robust expansion is primarily fueled by a confluence of favorable government policies, increasing consumer environmental consciousness, and significant technological advancements in battery technology and charging infrastructure. The region, particularly China, is leading the global transition towards electric mobility, driven by ambitious emissions reduction targets and substantial investments in EV manufacturing and adoption. Key propulsion types like Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs) are dominating the market, catering to both passenger cars and commercial vehicle segments. The ongoing development of both normal and fast-charging solutions is further alleviating range anxiety and enhancing the practicality of EV ownership. Major automotive players, including BYD, Tesla, and Toyota, are heavily investing in and expanding their EV portfolios within this dynamic region, signaling a fierce competitive landscape and a commitment to sustainable transportation solutions.

Asia Pacific Electric Vehicle Industry Market Size (In Million)

Looking ahead, the Asia Pacific EV market is projected to witness sustained demand, driven by an evolving consumer preference for greener alternatives and the continuous innovation in EV performance, affordability, and convenience. The expansion of charging networks, coupled with government incentives such as subsidies and tax breaks, will continue to be instrumental in accelerating adoption rates. While the market is highly optimistic, potential restraints such as the initial high cost of EVs, the need for more widespread charging infrastructure, and the availability of raw materials for battery production will require strategic management. However, the sheer scale of the market, particularly in China and emerging economies like India and Southeast Asian nations, combined with the proactive stance of regional governments, strongly suggests that these challenges will be overcome. The ongoing shift from internal combustion engine (ICE) vehicles to EVs in Asia Pacific represents a fundamental transformation in the automotive sector, promising a cleaner and more sustainable future for mobility.

Asia Pacific Electric Vehicle Industry Company Market Share

Asia Pacific Electric Vehicle Industry Market Concentration & Innovation

The Asia Pacific electric vehicle (EV) market exhibits a dynamic blend of high concentration in key economies and a burgeoning landscape of innovation. Major players like BYD Company Ltd, Toyota Motor Corporation, and Hyundai Motor Company dominate significant market shares, driven by substantial investments in R&D and robust manufacturing capabilities. The innovation pipeline is fueled by advancements in battery technology, leading to increased energy density and reduced costs, alongside the development of faster charging solutions. Regulatory frameworks across countries such as China, Japan, and South Korea are instrumental in shaping this landscape, with stringent emission standards and attractive subsidies encouraging EV adoption. Product substitutes, primarily traditional internal combustion engine (ICE) vehicles, are facing increasing pressure as EV performance and range improve. End-user trends indicate a growing preference for eco-friendly transportation, coupled with rising disposable incomes and urbanization. Mergers and acquisitions (M&A) activities are also on the rise, with deal values projected to reach USD 50 Billion by 2033, as established automakers seek to acquire cutting-edge technologies and expand their market reach. Key M&A activities in the forecast period include joint ventures for battery production and technology sharing agreements.

Asia Pacific Electric Vehicle Industry Industry Trends & Insights

The Asia Pacific electric vehicle industry is poised for exponential growth, driven by a confluence of factors that are reshaping the automotive sector. The market is anticipated to witness a Compound Annual Growth Rate (CAGR) of 25% from 2025 to 2033, with market penetration reaching 40% by the end of the forecast period. A primary growth driver is the increasing environmental consciousness among consumers and governments, leading to supportive policies and mandates for zero-emission vehicles. Technological disruptions are at the forefront, with continuous improvements in battery technology leading to longer driving ranges and faster charging times, making EVs more practical and appealing. The development of solid-state batteries and advanced charging infrastructure, including widespread adoption of fast-charging stations, are key trends. Consumer preferences are evolving rapidly, with a growing demand for SUVs and premium electric models, driven by enhanced performance, lower running costs, and a desire for technologically advanced vehicles. Competitive dynamics are intensifying, with both legacy automakers and new EV startups vying for market dominance. Established companies are investing heavily in electrifying their lineups, while agile startups are pushing the boundaries of innovation with novel designs and business models. The rapid expansion of charging infrastructure, coupled with government incentives and subsidies, is further accelerating market penetration. The emergence of autonomous driving features and connected car technologies integrated into EVs is also creating new market segments and appealing to tech-savvy consumers. Furthermore, the shift towards fleet electrification by ride-sharing services and logistics companies is a significant contributor to overall EV sales volume.

Dominant Markets & Segments in Asia Pacific Electric Vehicle Industry

The Battery Electric Vehicles (BEVs) segment is the undeniable leader within the Asia Pacific electric vehicle industry, commanding an estimated market share of 85% in 2025 and projected to grow to 90% by 2033. This dominance is propelled by a combination of supportive government policies, rapid advancements in battery technology, and a growing consumer preference for fully electric powertrains.

Propulsion Type Dominance:

- Battery Electric Vehicles (BEVs): Driven by zero tailpipe emissions, lower running costs, and increasing driving range, BEVs are the primary focus for consumers and manufacturers. Government incentives, such as purchase subsidies and tax exemptions, further bolster their appeal.

- Plug-in Hybrid Electric Vehicles (PHEVs): While still significant, PHEVs are gradually ceding market share to BEVs as charging infrastructure expands and battery technology improves. They offer a transitional solution for consumers concerned about range anxiety.

- Hybrid Electric Vehicles (HEVs): HEVs continue to hold a steady market presence, particularly in regions with less developed charging infrastructure, offering improved fuel efficiency over traditional ICE vehicles.

- Fuel Cell Electric Vehicles (FCEVs): FCEVs represent a niche but promising segment, with ongoing development and strategic investments, particularly in hydrogen-powered commercial transport.

Vehicle Type Dominance:

- Passenger Cars: This segment represents the largest portion of the EV market, catering to individual mobility needs. The growing affordability and wider variety of electric passenger car models are key drivers.

- Commercial Vehicles: The electrification of commercial fleets, including delivery vans and trucks, is gaining momentum due to stringent emission regulations and the potential for significant operational cost savings.

Charging Type Dominance:

- Fast Charging: The increasing demand for convenience and reduced charging times is making fast-charging solutions increasingly dominant, especially for public charging infrastructure.

- Normal Charging: Home charging and workplace charging, primarily utilizing normal charging speeds, remain crucial for daily usage and are expected to maintain a significant presence.

Key drivers for this dominance include:

- Economic Policies: Favorable government incentives, tax breaks, and subsidies in countries like China and South Korea are significantly boosting EV adoption. China, in particular, has been a global frontrunner in EV sales and production.

- Infrastructure Development: The rapid expansion of charging infrastructure, both public and private, is crucial for alleviating range anxiety and encouraging widespread EV adoption. Governments and private entities are investing heavily in building a comprehensive charging network.

- Technological Advancements: Continuous innovation in battery technology, leading to increased energy density, faster charging capabilities, and lower costs, is making EVs more competitive and attractive to a broader consumer base.

Asia Pacific Electric Vehicle Industry Product Developments

The Asia Pacific EV market is characterized by a rapid influx of innovative products. Manufacturers are focusing on enhancing battery efficiency and range, with new models offering over 500 kilometers on a single charge. Advancements in charging technology, including ultra-fast charging capabilities, are reducing downtime significantly. Emphasis is also placed on creating more stylish and feature-rich vehicles, integrating advanced infotainment systems and driver-assistance technologies. Competitive advantages are being built through sustainable material sourcing, modular platform designs for cost-efficiency, and the integration of smart connectivity features, positioning EVs as not just transportation but as connected lifestyle devices.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Asia Pacific Electric Vehicle Industry, segmenting the market by Propulsion Type: Battery Electric Vehicles (BEVs), Hybrid Electric Vehicles (HEVs), Fuel Cell Electric Vehicles (FCEVs), and Plug-in Hybrid Electric Vehicles (PHEVs). It also provides detailed insights into the Vehicle Type segmentation, including Passenger Cars and Commercial Vehicles. Furthermore, the report examines the Charging Type landscape, covering Normal Charging and Fast Charging. Market sizes, growth projections, and competitive dynamics are meticulously analyzed for each segment, offering a granular understanding of market opportunities and future trends.

- Battery Electric Vehicles (BEVs): This segment is expected to witness substantial growth, driven by increasing consumer acceptance and supportive government policies. Market size is projected to exceed USD 500 Billion by 2033.

- Hybrid Electric Vehicles (HEVs): While still significant, HEVs are anticipated to experience moderate growth as the market transitions towards fully electric solutions.

- Fuel Cell Electric Vehicles (FCEVs): This segment, though nascent, holds significant long-term potential, particularly for heavy-duty transport, with ongoing research and development.

- Plug-in Hybrid Electric Vehicles (PHEVs): PHEVs will continue to serve as a transitional technology, offering a bridge for consumers between traditional and full electric mobility.

- Passenger Cars: This segment will remain the largest contributor to EV sales, driven by increasing model availability and consumer demand.

- Commercial Vehicles: Electrification of commercial fleets is set to accelerate, spurred by regulatory pressures and operational cost savings.

- Normal Charging: This remains a foundational charging method for home and workplace charging, crucial for everyday use.

- Fast Charging: The demand for faster charging solutions will continue to grow, especially for public charging infrastructure and long-distance travel.

Key Drivers of Asia Pacific Electric Vehicle Industry Growth

The Asia Pacific electric vehicle industry's growth is propelled by a powerful synergy of technological advancements, supportive government initiatives, and evolving consumer preferences. Rapid innovation in battery technology, leading to increased range and faster charging, is a primary driver, making EVs more practical and appealing. Governments across the region are implementing stringent emission regulations and offering substantial incentives, such as subsidies and tax exemptions, to accelerate EV adoption. Furthermore, growing environmental awareness among consumers and a desire for lower operating costs are significantly influencing purchasing decisions. The expansion of charging infrastructure is also crucial, making EV ownership more convenient.

Challenges in the Asia Pacific Electric Vehicle Industry Sector

Despite the optimistic outlook, the Asia Pacific electric vehicle industry faces several challenges. High upfront costs of EVs compared to conventional vehicles remain a significant barrier for some consumers. The availability and speed of charging infrastructure, while improving, still lag behind in certain areas, contributing to range anxiety. Supply chain constraints, particularly for critical raw materials like lithium and cobalt, can impact production volumes and costs. Additionally, competition from established internal combustion engine (ICE) vehicle manufacturers and the need for consumer education about EV benefits present ongoing hurdles.

Emerging Opportunities in Asia Pacific Electric Vehicle Industry

The Asia Pacific electric vehicle industry is ripe with emerging opportunities. The development of affordable, long-range EV models tailored for mass-market appeal is a significant avenue. Expansion of charging infrastructure, including battery swapping technologies and smart grid integration, presents considerable potential. The burgeoning market for electric commercial vehicles, driven by logistics and last-mile delivery needs, offers substantial growth prospects. Furthermore, the integration of vehicle-to-grid (V2G) technology and advancements in battery recycling and second-life applications are creating new value chains and sustainable business models.

Leading Players in the Asia Pacific Electric Vehicle Industry Market

- Stellantis NV

- Nissan Motor Co Ltd

- Honda Motor Company Ltd

- General Motors

- Volkswagen AG

- Hyundai Motor Company

- Tesla Inc

- Mercedes-Benz Group AG

- BYD Company Ltd

- Toyota Motor Corporation

Key Developments in Asia Pacific Electric Vehicle Industry Industry

- September 2023: The Mercedes-Benz EQE SUV was launched in India, available in one fully loaded variant and across nine color schemes.

- November 2024: Kia launched its new EV5 electric SUV in China, with a starting price of around USD 20K (149,800 yuan), poised to compete with Tesla’s Model Y.

- December 2023: Kia Motors announced the upcoming launch of its electric SUV EV9 in the Indian Market in 2024.

Strategic Outlook for Asia Pacific Electric Vehicle Industry Market

The strategic outlook for the Asia Pacific electric vehicle industry is exceptionally bright, driven by sustained government support, accelerating technological innovation, and a burgeoning consumer demand for sustainable mobility. Key growth catalysts include the continuous improvement of battery technology, leading to longer ranges and faster charging times, which directly address consumer concerns. The expansion of charging infrastructure, both public and private, will be critical in further driving adoption rates. Focus on electrifying commercial vehicle fleets presents a significant opportunity for volume growth. Furthermore, the development of localized supply chains and emphasis on circular economy principles for battery production and recycling will solidify the region's leadership position in the global EV landscape, ensuring long-term market potential.

Asia Pacific Electric Vehicle Industry Segmentation

-

1. Propulsion Type

- 1.1. Battery Electric Vehicles

- 1.2. Hybrid Electric Vehicles

- 1.3. Fuel Cell Electric Vehicles

- 1.4. Plug-in Hybrid Electric Vehicles

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

-

3. Charging Type

- 3.1. Normal Charging

- 3.2. Fast Charging

Asia Pacific Electric Vehicle Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

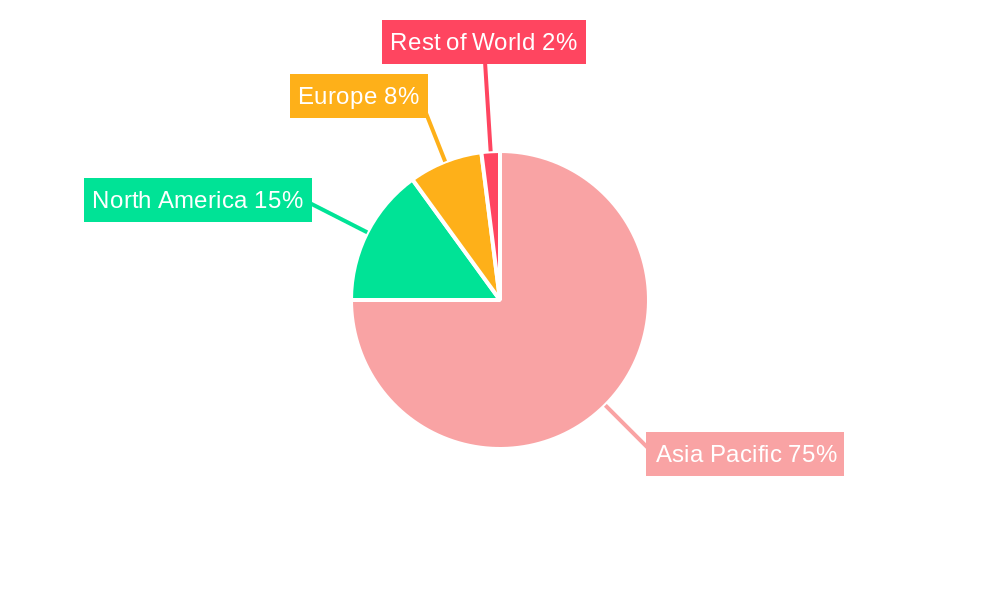

Asia Pacific Electric Vehicle Industry Regional Market Share

Geographic Coverage of Asia Pacific Electric Vehicle Industry

Asia Pacific Electric Vehicle Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives to Promote Sales of Electric Vehicle

- 3.3. Market Restrains

- 3.3.1. High Initial Investment for Installing Electric Vehicle Charging Infrastructure

- 3.4. Market Trends

- 3.4.1. Passenger Car holds Highest Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Electric Vehicle Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. Battery Electric Vehicles

- 5.1.2. Hybrid Electric Vehicles

- 5.1.3. Fuel Cell Electric Vehicles

- 5.1.4. Plug-in Hybrid Electric Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Charging Type

- 5.3.1. Normal Charging

- 5.3.2. Fast Charging

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Stellantis NV*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nissan Motor Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Honda Motor Company Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 General Motors

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Volkswagen AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hyundai Motor Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tesla Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mercedes-Benz Group AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BYD Company Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Toyota Motor Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Stellantis NV*List Not Exhaustive

List of Figures

- Figure 1: Asia Pacific Electric Vehicle Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Electric Vehicle Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Electric Vehicle Industry Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 2: Asia Pacific Electric Vehicle Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 3: Asia Pacific Electric Vehicle Industry Revenue Million Forecast, by Charging Type 2020 & 2033

- Table 4: Asia Pacific Electric Vehicle Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Asia Pacific Electric Vehicle Industry Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 6: Asia Pacific Electric Vehicle Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 7: Asia Pacific Electric Vehicle Industry Revenue Million Forecast, by Charging Type 2020 & 2033

- Table 8: Asia Pacific Electric Vehicle Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Asia Pacific Electric Vehicle Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia Pacific Electric Vehicle Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia Pacific Electric Vehicle Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: India Asia Pacific Electric Vehicle Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia Pacific Electric Vehicle Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia Pacific Electric Vehicle Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia Pacific Electric Vehicle Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia Pacific Electric Vehicle Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia Pacific Electric Vehicle Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia Pacific Electric Vehicle Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia Pacific Electric Vehicle Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia Pacific Electric Vehicle Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Electric Vehicle Industry?

The projected CAGR is approximately 19.10%.

2. Which companies are prominent players in the Asia Pacific Electric Vehicle Industry?

Key companies in the market include Stellantis NV*List Not Exhaustive, Nissan Motor Co Ltd, Honda Motor Company Ltd, General Motors, Volkswagen AG, Hyundai Motor Company, Tesla Inc, Mercedes-Benz Group AG, BYD Company Ltd, Toyota Motor Corporation.

3. What are the main segments of the Asia Pacific Electric Vehicle Industry?

The market segments include Propulsion Type, Vehicle Type, Charging Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 250.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives to Promote Sales of Electric Vehicle.

6. What are the notable trends driving market growth?

Passenger Car holds Highest Share in the Market.

7. Are there any restraints impacting market growth?

High Initial Investment for Installing Electric Vehicle Charging Infrastructure.

8. Can you provide examples of recent developments in the market?

In September 2023, the Mercedes-Benz EQE SUV was launched in India, and it is available in one fully loaded variant and across nine color schemes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Electric Vehicle Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Electric Vehicle Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Electric Vehicle Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Electric Vehicle Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence