Key Insights

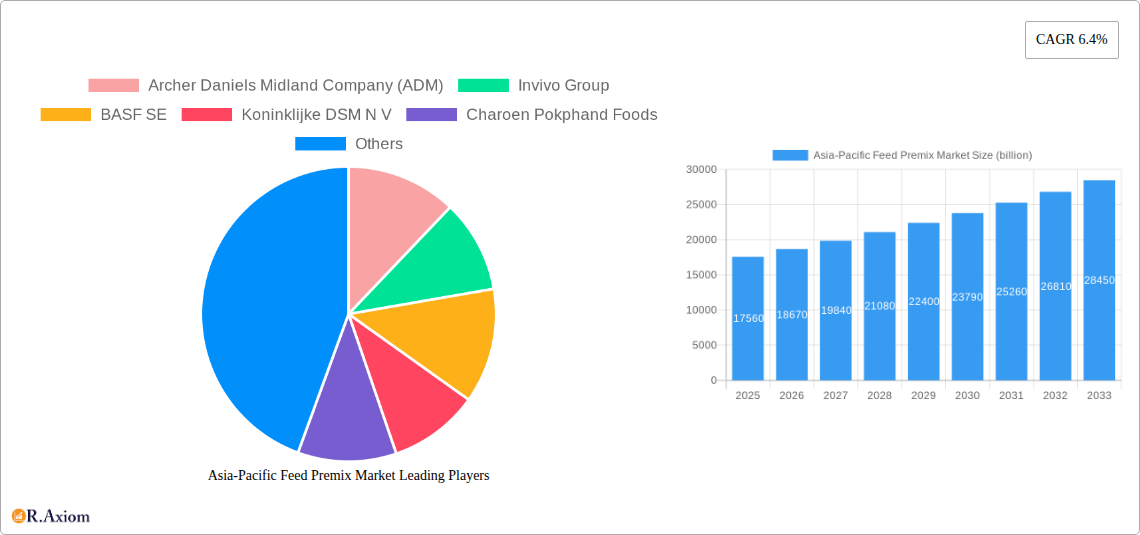

The Asia-Pacific feed premix market is poised for substantial growth, projected to reach an estimated USD 17.56 billion in 2025. This expansion is driven by a robust Compound Annual Growth Rate (CAGR) of 6.4%, indicating a dynamic and expanding industry. The increasing global demand for animal protein, coupled with a rising awareness of animal health and nutrition among livestock farmers in the region, are key catalysts. Furthermore, the growing aquaculture sector, particularly in countries like China and Southeast Asian nations, is significantly contributing to market expansion as feed premixes are crucial for optimizing fish growth and health. The demand for essential nutrients like vitamins, minerals, and amino acids to enhance animal productivity and reduce disease incidence is also a significant driver. Emerging economies in the Asia-Pacific region are witnessing a rise in disposable incomes, leading to increased consumption of meat, dairy, and seafood, which in turn fuels the demand for high-quality animal feed and, consequently, feed premixes.

Asia-Pacific Feed Premix Market Market Size (In Billion)

The market is segmented across various ingredient types, with antibiotics, vitamins, antioxidants, amino acids, and minerals forming the core components. Poultry and swine segments are expected to dominate due to the large-scale production of these animals for meat and egg consumption. However, the ruminant and aquaculture segments are showing rapid growth potential. Geographically, China and India represent the largest markets due to their vast livestock populations and significant agricultural output. Other key markets include Japan, Australia, and Thailand, each contributing to the regional growth. While the market presents strong growth opportunities, challenges such as fluctuating raw material prices and stringent regulatory policies in some countries can pose restraints. Nonetheless, the overall trajectory points towards sustained growth, with major companies actively investing in research and development to introduce innovative feed premix solutions tailored to the specific nutritional needs of diverse animal types and farming practices across the Asia-Pacific region.

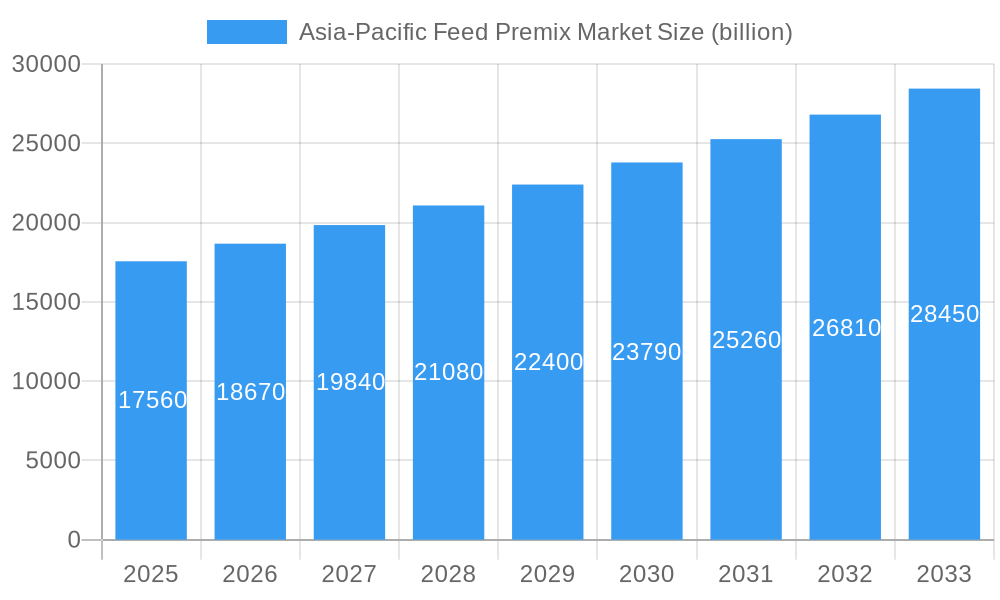

Asia-Pacific Feed Premix Market Company Market Share

This in-depth report provides a thorough analysis of the Asia-Pacific feed premix market, a critical sector supporting animal nutrition and agricultural productivity across the region. With a study period spanning from 2019 to 2033, and detailed segmentation by ingredient type, animal type, and geography, this report offers actionable insights for stakeholders. The base year is 2025, with estimates and forecasts provided for the period 2025–2033. The historical period covered is 2019–2024.

Asia-Pacific Feed Premix Market Market Concentration & Innovation

The Asia-Pacific feed premix market exhibits a moderate to high level of concentration, with key global players and several strong regional manufacturers vying for market share. Innovation is primarily driven by the escalating demand for improved animal health and productivity, coupled with an increasing focus on sustainable and antibiotic-free feed solutions. Regulatory frameworks are evolving across the region, with a growing emphasis on food safety, animal welfare, and the responsible use of feed additives. Product substitutes, such as individual feed ingredients, are available but often lack the balanced nutritional profile and convenience of premixes. End-user trends are shifting towards higher quality feed formulations that enhance growth rates, improve feed conversion ratios, and reduce disease incidence. Mergers and acquisitions (M&A) are a significant aspect of market dynamics, with deal values in the hundreds of millions to billions of US dollars, as companies seek to expand their product portfolios, geographical reach, and technological capabilities. For instance, strategic acquisitions have enabled key players to integrate novel technologies and expand their market penetration in high-growth economies.

Asia-Pacific Feed Premix Market Industry Trends & Insights

The Asia-Pacific feed premix market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period. This growth is fueled by several interconnected trends. Firstly, the burgeoning global population, particularly in Asia, is driving an unprecedented demand for animal protein, necessitating increased efficiency and output from the livestock and aquaculture sectors. Feed premixes play a pivotal role in optimizing animal nutrition, ensuring that animals receive a balanced and complete profile of essential vitamins, minerals, amino acids, and other additives crucial for growth, health, and disease prevention. The increasing awareness among farmers regarding the benefits of scientific animal feeding practices, leading to improved feed conversion ratios and reduced mortality rates, further propels the adoption of feed premixes. Technological advancements are also transforming the industry. Innovations in feed formulation, such as the development of customized premixes tailored to specific animal breeds, life stages, and production goals, are gaining traction. The integration of advanced analytical techniques for precise nutrient profiling and the development of novel feed additives with enhanced bioavailability are also contributing to market expansion. Furthermore, the growing consumer preference for safe and high-quality animal products, coupled with stricter government regulations on antibiotic usage in animal feed, is creating a substantial demand for antibiotic-free premixes and alternative solutions like probiotics, prebiotics, and essential oils. This shift towards natural and sustainable feed additives is a significant market trend. Competitive dynamics are characterized by intense R&D efforts, strategic partnerships, and an increasing focus on market penetration in developing economies within the Asia-Pacific region. Companies are investing heavily in expanding their production capacities and distribution networks to cater to the diverse needs of the regional market. Market penetration of advanced feed premixes is steadily increasing, especially in countries with well-developed agricultural sectors. The market size is expected to reach over $15 billion by 2033, driven by these compelling industry trends.

Dominant Markets & Segments in Asia-Pacific Feed Premix Market

The Asia-Pacific feed premix market is a dynamic landscape, with significant variations in dominance across different segments.

Leading Geography: China China's dominant position in the Asia-Pacific feed premix market is undeniable, driven by its colossal animal production scale and rapidly evolving agricultural sector.

- Economic Policies: Supportive government policies aimed at enhancing food security and modernizing agriculture have significantly boosted investment in the feed industry, including premixes.

- Infrastructure: Advanced logistics and a well-established supply chain network facilitate the widespread distribution of feed premixes across the country.

- Market Size: China accounts for a substantial portion of the regional market, estimated at over $4 billion in 2025.

- Growth Drivers: The immense demand for poultry, swine, and aquaculture products, coupled with a growing adoption of scientific feeding practices, fuels China's market leadership.

Dominant Ingredient Type: Amino Acids Amino acids represent a key segment, crucial for optimizing protein synthesis and animal growth.

- Market Share: Amino acids constitute approximately 25% of the total Asia-Pacific feed premix market, valued at over $3.7 billion in 2025.

- Growth Drivers: The increasing emphasis on precision nutrition and the growing trend towards reducing crude protein levels in animal diets to minimize nitrogen excretion are driving demand for specific amino acids like lysine, methionine, and threonine.

- Technological Advancements: Innovations in fermentation technology have made amino acid production more efficient and cost-effective, further supporting their widespread use.

Dominant Animal Type: Poultry The poultry sector is the largest consumer of feed premixes in the Asia-Pacific region, owing to its high production volumes and efficient feed conversion.

- Market Share: Poultry premixes are estimated to hold a market share of over 30%, representing a market value of approximately $4.5 billion in 2025.

- Growth Drivers: The escalating demand for affordable and readily available protein sources, coupled with the rapid expansion of commercial poultry farming, underpins this dominance. Poultry's shorter growth cycles and higher feed intake necessitate precise and balanced nutrition.

- Consumer Preferences: Growing health consciousness among consumers is driving demand for poultry produced with optimized nutrition, leading to better quality and healthier meat.

Other Influential Segments:

- Minerals: Essential for bone health, immune function, and metabolic processes, minerals are a consistently high-demand ingredient type.

- Vitamins: Crucial for a myriad of physiological functions, vitamins are indispensable in any balanced feed premix formulation.

- Swine: As a significant source of animal protein in the region, the swine sector also represents a substantial market for feed premixes.

- Aquaculture: With the rapid growth of aquaculture in countries like Thailand and Vietnam, this segment is emerging as a high-growth area for specialized feed premixes.

Asia-Pacific Feed Premix Market Product Developments

Product development in the Asia-Pacific feed premix market is increasingly focused on enhancing animal health, optimizing growth performance, and promoting sustainability. Innovations include the formulation of customized premixes tailored to specific regional animal breeds and environmental conditions. The development of advanced vitamin and mineral complexes with improved bioavailability and stability is a key trend, ensuring greater nutrient absorption and efficacy. There is also a significant push towards antibiotic-free solutions, with a growing emphasis on premixes incorporating probiotics, prebiotics, essential oils, and organic acids to boost immunity and gut health naturally. These developments offer competitive advantages by addressing the evolving demands of the market for safer, healthier, and more efficient animal production.

Report Scope & Segmentation Analysis

This report meticulously segments the Asia-Pacific feed premix market across crucial parameters. The Ingredient Type segmentation includes Antibiotics, Vitamins, Antioxidants, Amino Acids, Minerals, and Other Ingredient Types, providing insights into the demand and growth trajectory of each category. The Animal Type segmentation covers Ruminant, Poultry, Swine, Aquaculture, and Other Animal types, reflecting the diverse applications of premixes in various livestock sectors. Geographically, the market is analyzed across China, India, Japan, Australia, Thailand, and the Rest of Asia-Pacific, highlighting regional variations in market size, growth, and influencing factors. Each segment is analyzed for its projected market size, growth rates, and key competitive dynamics within the study period.

Key Drivers of Asia-Pacific Feed Premix Market Growth

The Asia-Pacific feed premix market's growth is propelled by a confluence of powerful drivers.

- Rising Demand for Animal Protein: A burgeoning population and increasing disposable incomes across Asia are fueling a higher consumption of meat, dairy, and eggs, necessitating expanded and more efficient animal farming operations.

- Advancements in Animal Nutrition Science: A deeper understanding of animal physiology and nutritional requirements is leading to the development of more sophisticated and effective feed premix formulations, enhancing animal health, growth, and feed conversion ratios.

- Government Initiatives and Regulations: Supportive government policies aimed at boosting agricultural productivity and food security, along with stricter regulations on antibiotic use, are driving the adoption of scientifically formulated premixes and antibiotic-free alternatives.

- Technological Innovations: Continuous R&D in premix formulation, delivery systems, and the development of novel additives like probiotics and prebiotics contribute to improved product performance and market appeal.

Challenges in the Asia-Pacific Feed Premix Market Sector

Despite the promising growth trajectory, the Asia-Pacific feed premix market faces several significant challenges.

- Volatile Raw Material Prices: Fluctuations in the prices of key ingredients, such as vitamins, minerals, and amino acids, can impact manufacturing costs and profitability, leading to price instability.

- Stringent Regulatory Landscapes: Varying and evolving regulatory frameworks across different countries regarding feed additive approvals, safety standards, and labeling requirements can create complexities for market entry and product compliance.

- Supply Chain Disruptions: Geopolitical events, logistical challenges, and the COVID-19 pandemic have highlighted the vulnerability of global supply chains, potentially impacting the availability and timely delivery of raw materials and finished premixes.

- Competition from Generic Products: The presence of numerous smaller, local manufacturers offering generic feed additives can create intense price competition and challenge the market share of premium and specialized premix providers.

Emerging Opportunities in Asia-Pacific Feed Premix Market

The Asia-Pacific feed premix market presents a wealth of emerging opportunities for growth and innovation.

- Growth in Aquaculture: The rapid expansion of the aquaculture sector across the region offers a significant opportunity for specialized premixes that cater to the unique nutritional needs of various fish and shrimp species, promoting faster growth and disease resistance.

- Demand for Organic and Natural Additives: The increasing consumer preference for healthy and sustainably produced animal products is driving demand for antibiotic-free premixes and those incorporating natural ingredients like essential oils, plant extracts, and probiotics.

- Technological Integration and Customization: Opportunities lie in developing advanced premixes utilizing precision nutrition technologies, offering customized formulations based on specific animal genetics, dietary needs, and environmental factors, thereby enhancing efficiency and reducing environmental impact.

- Expansion in Developing Economies: Untapped potential exists in less developed markets within the Asia-Pacific region, where the adoption of modern animal husbandry practices is on the rise, creating a demand for effective feed premixes.

Leading Players in the Asia-Pacific Feed Premix Market Market

- Archer Daniels Midland Company (ADM)

- Invivo Group

- BASF SE

- Koninklijke DSM N V

- Charoen Pokphand Foods

- Cargill Inc

- BDT Group

- ForFramers B V

- Danish Agro

- De Hues Grou

- Godrej Agrovet Limited

Key Developments in Asia-Pacific Feed Premix Market Industry

- 2023: BASF SE launched a new range of antioxidant solutions to improve feed stability and animal health in the Asia-Pacific region.

- 2022: Cargill Inc. expanded its feed premix manufacturing facility in Vietnam to meet the growing demand for poultry and swine feed additives.

- 2021: Royal DSM N.V. entered into a strategic partnership with a leading Chinese feed producer to develop innovative feed premixes for the swine market.

- 2020: Archer Daniels Midland Company (ADM) acquired a significant stake in a Thai feed additive company to strengthen its presence in the Southeast Asian aquaculture sector.

- 2019: Invivo Group introduced a novel probiotic-based feed premix for poultry, aimed at improving gut health and reducing the need for antibiotics.

Strategic Outlook for Asia-Pacific Feed Premix Market Market

The strategic outlook for the Asia-Pacific feed premix market is exceptionally positive, driven by sustained demand for animal protein, increasing adoption of advanced animal nutrition, and a proactive regulatory push towards sustainable and antibiotic-free practices. Companies focusing on innovation in areas like precision nutrition, gut health solutions, and environmentally friendly additives are well-positioned for success. Expanding manufacturing capabilities and distribution networks to cater to the diverse needs of emerging economies within the region will be crucial. Furthermore, strategic collaborations and potential acquisitions to enhance technological portfolios and market reach will likely shape the competitive landscape. The market's future trajectory will be defined by its ability to adapt to evolving consumer preferences and regulatory demands, ensuring the production of safe, efficient, and high-quality animal-derived food products.

Asia-Pacific Feed Premix Market Segmentation

-

1. Ingredient Type

- 1.1. Antibiotics

- 1.2. Vitamins

- 1.3. Antioxidants

- 1.4. Amino Acids

- 1.5. Minerals

- 1.6. Other Ingredient Types

-

2. Animal Type

- 2.1. Ruminant

- 2.2. Poultry

- 2.3. Swine

- 2.4. Acquaculture

- 2.5. Other Animal

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

- 3.5. Thailand

- 3.6. Rest of Asia-Pacific

Asia-Pacific Feed Premix Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Australia

- 5. Thailand

- 6. Rest of Asia Pacific

Asia-Pacific Feed Premix Market Regional Market Share

Geographic Coverage of Asia-Pacific Feed Premix Market

Asia-Pacific Feed Premix Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Demand for High Value Animal Protein

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 5.1.1. Antibiotics

- 5.1.2. Vitamins

- 5.1.3. Antioxidants

- 5.1.4. Amino Acids

- 5.1.5. Minerals

- 5.1.6. Other Ingredient Types

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Ruminant

- 5.2.2. Poultry

- 5.2.3. Swine

- 5.2.4. Acquaculture

- 5.2.5. Other Animal

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. Australia

- 5.3.5. Thailand

- 5.3.6. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. Australia

- 5.4.5. Thailand

- 5.4.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 6. China Asia-Pacific Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 6.1.1. Antibiotics

- 6.1.2. Vitamins

- 6.1.3. Antioxidants

- 6.1.4. Amino Acids

- 6.1.5. Minerals

- 6.1.6. Other Ingredient Types

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Ruminant

- 6.2.2. Poultry

- 6.2.3. Swine

- 6.2.4. Acquaculture

- 6.2.5. Other Animal

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. Australia

- 6.3.5. Thailand

- 6.3.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 7. India Asia-Pacific Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 7.1.1. Antibiotics

- 7.1.2. Vitamins

- 7.1.3. Antioxidants

- 7.1.4. Amino Acids

- 7.1.5. Minerals

- 7.1.6. Other Ingredient Types

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Ruminant

- 7.2.2. Poultry

- 7.2.3. Swine

- 7.2.4. Acquaculture

- 7.2.5. Other Animal

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. Australia

- 7.3.5. Thailand

- 7.3.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 8. Japan Asia-Pacific Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 8.1.1. Antibiotics

- 8.1.2. Vitamins

- 8.1.3. Antioxidants

- 8.1.4. Amino Acids

- 8.1.5. Minerals

- 8.1.6. Other Ingredient Types

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Ruminant

- 8.2.2. Poultry

- 8.2.3. Swine

- 8.2.4. Acquaculture

- 8.2.5. Other Animal

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. Australia

- 8.3.5. Thailand

- 8.3.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 9. Australia Asia-Pacific Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 9.1.1. Antibiotics

- 9.1.2. Vitamins

- 9.1.3. Antioxidants

- 9.1.4. Amino Acids

- 9.1.5. Minerals

- 9.1.6. Other Ingredient Types

- 9.2. Market Analysis, Insights and Forecast - by Animal Type

- 9.2.1. Ruminant

- 9.2.2. Poultry

- 9.2.3. Swine

- 9.2.4. Acquaculture

- 9.2.5. Other Animal

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. Australia

- 9.3.5. Thailand

- 9.3.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 10. Thailand Asia-Pacific Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 10.1.1. Antibiotics

- 10.1.2. Vitamins

- 10.1.3. Antioxidants

- 10.1.4. Amino Acids

- 10.1.5. Minerals

- 10.1.6. Other Ingredient Types

- 10.2. Market Analysis, Insights and Forecast - by Animal Type

- 10.2.1. Ruminant

- 10.2.2. Poultry

- 10.2.3. Swine

- 10.2.4. Acquaculture

- 10.2.5. Other Animal

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. Australia

- 10.3.5. Thailand

- 10.3.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 11. Rest of Asia Pacific Asia-Pacific Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 11.1.1. Antibiotics

- 11.1.2. Vitamins

- 11.1.3. Antioxidants

- 11.1.4. Amino Acids

- 11.1.5. Minerals

- 11.1.6. Other Ingredient Types

- 11.2. Market Analysis, Insights and Forecast - by Animal Type

- 11.2.1. Ruminant

- 11.2.2. Poultry

- 11.2.3. Swine

- 11.2.4. Acquaculture

- 11.2.5. Other Animal

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. India

- 11.3.3. Japan

- 11.3.4. Australia

- 11.3.5. Thailand

- 11.3.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Archer Daniels Midland Company (ADM)

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Invivo Group

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 BASF SE

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Koninklijke DSM N V

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Charoen Pokphand Foods

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Cargill Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 BDT Group

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 ForFramers B V

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Danish Agro

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 De Hues Grou

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Godrej Agrovet Limited

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Archer Daniels Midland Company (ADM)

List of Figures

- Figure 1: Asia-Pacific Feed Premix Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Feed Premix Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Ingredient Type 2020 & 2033

- Table 2: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 3: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Ingredient Type 2020 & 2033

- Table 6: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 7: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Ingredient Type 2020 & 2033

- Table 10: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 11: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Ingredient Type 2020 & 2033

- Table 14: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 15: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Ingredient Type 2020 & 2033

- Table 18: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 19: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Ingredient Type 2020 & 2033

- Table 22: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 23: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Ingredient Type 2020 & 2033

- Table 26: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Animal Type 2020 & 2033

- Table 27: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: Asia-Pacific Feed Premix Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Feed Premix Market?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the Asia-Pacific Feed Premix Market?

Key companies in the market include Archer Daniels Midland Company (ADM), Invivo Group, BASF SE, Koninklijke DSM N V, Charoen Pokphand Foods, Cargill Inc, BDT Group, ForFramers B V, Danish Agro, De Hues Grou, Godrej Agrovet Limited.

3. What are the main segments of the Asia-Pacific Feed Premix Market?

The market segments include Ingredient Type, Animal Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.56 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Increasing Demand for High Value Animal Protein.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Feed Premix Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Feed Premix Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Feed Premix Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Feed Premix Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence