Key Insights

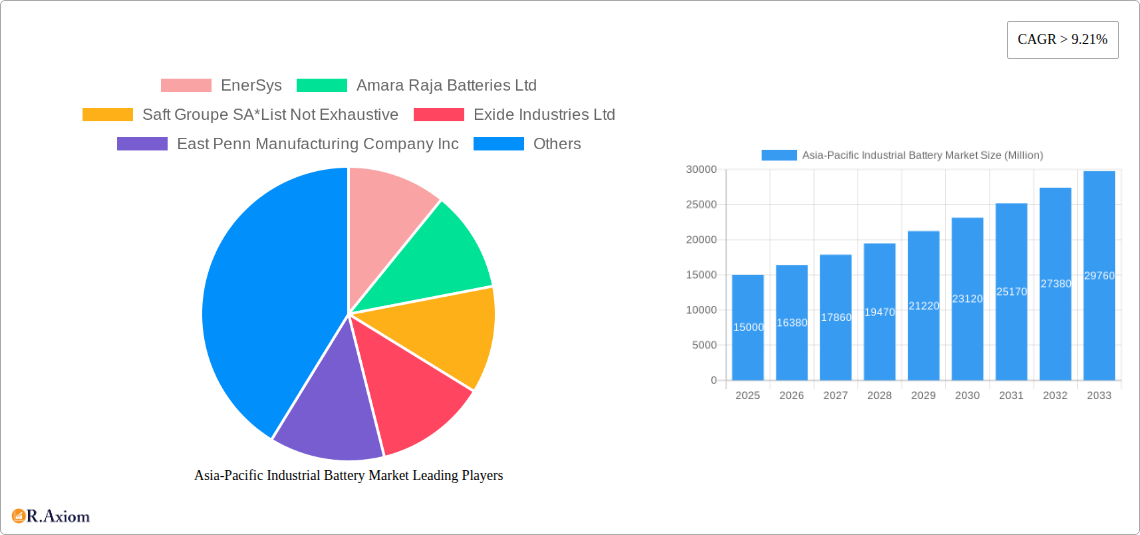

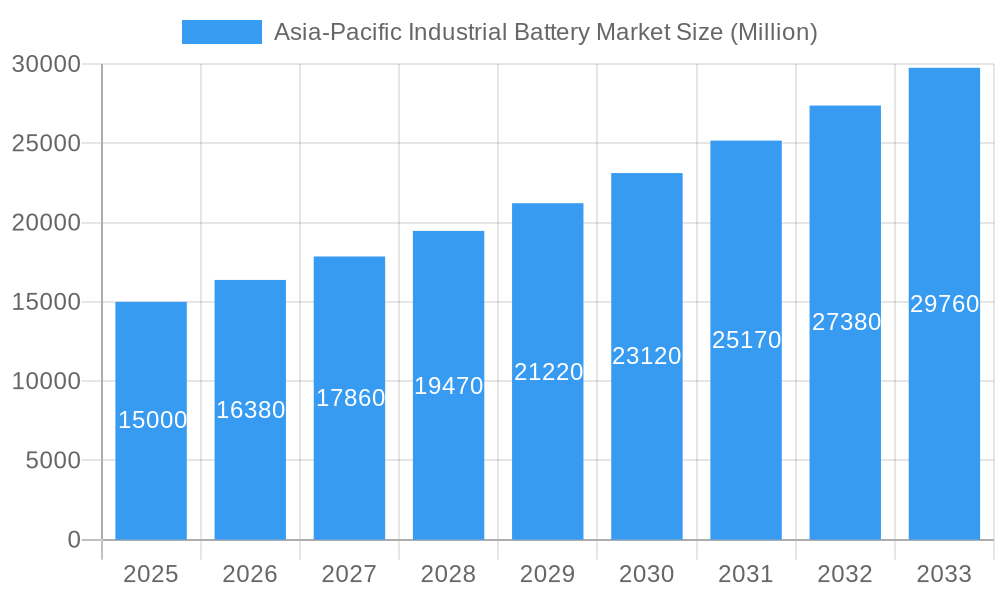

The Asia-Pacific Industrial Battery Market is poised for significant expansion, projected to reach a substantial market size with a Compound Annual Growth Rate (CAGR) exceeding 9.21% between 2025 and 2033. This robust growth is primarily fueled by the escalating demand for reliable and high-performance energy storage solutions across a spectrum of industrial applications. The burgeoning manufacturing sector, coupled with rapid urbanization and the increasing adoption of automation in industries like logistics and warehousing, necessitates a steady supply of dependable power. Key drivers include the widespread implementation of lithium-ion batteries, offering superior energy density, longer lifespans, and faster charging capabilities, which are increasingly replacing traditional lead-acid batteries in critical applications. Furthermore, the telecom sector's continuous expansion and the growing need for uninterrupted power supply (UPS) systems in data centers and critical infrastructure are also major contributors to market expansion. The evolving landscape of electric mobility, particularly in the material handling segment with the growing use of electric forklifts, further amplifies the demand for advanced industrial battery technologies.

Asia-Pacific Industrial Battery Market Market Size (In Billion)

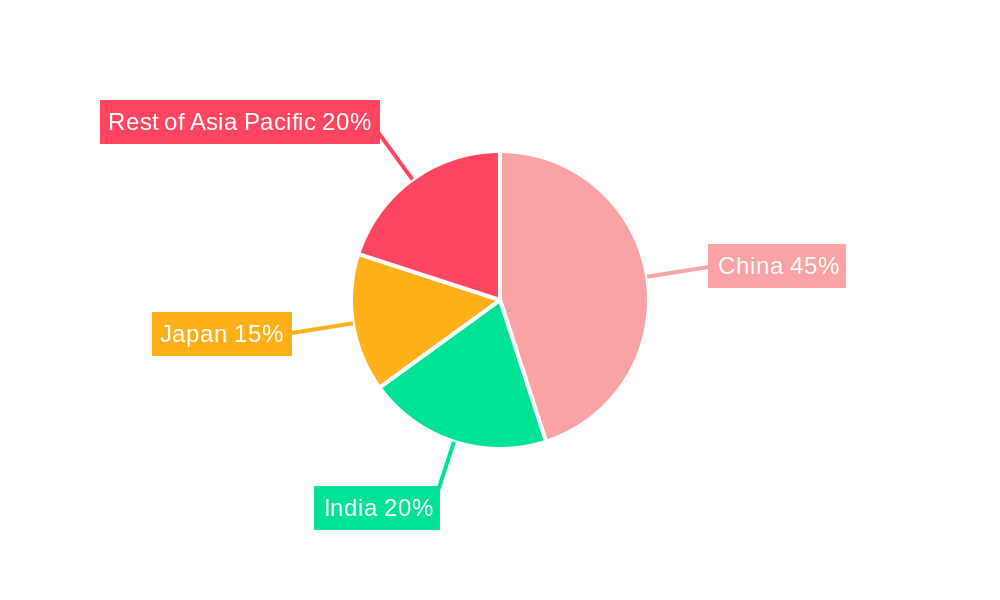

The market is characterized by strong regional performance, with China leading in both production and consumption, driven by its vast industrial base and government initiatives supporting renewable energy and electric vehicle adoption. India and Japan are also significant contributors, with India witnessing rapid industrialization and a growing emphasis on sustainable energy solutions, while Japan remains a leader in advanced battery technology and applications. The "Rest of Asia-Pacific" region also presents considerable growth opportunities as developing economies adopt advanced industrial practices. Emerging trends such as the development of more sustainable battery chemistries, advancements in battery management systems (BMS) for enhanced efficiency and safety, and the increasing focus on battery recycling and second-life applications are shaping the market's future. However, challenges such as the high initial cost of advanced battery technologies like lithium-ion, coupled with supply chain volatilities for raw materials, could pose restraints to the market's unhindered growth. Despite these challenges, the overarching trend points towards a dynamic and expanding industrial battery market driven by technological innovation and increasing industrial demands.

Asia-Pacific Industrial Battery Market Company Market Share

This in-depth report analyzes the dynamic Asia-Pacific Industrial Battery Market, providing a detailed forecast from 2025 to 2033, with historical data from 2019 to 2024 and a base year of 2025. We delve into critical segments including Lithium-ion Battery, Lead-acid Battery, and Other Technologies, across key applications like Forklifts, Telecom, UPS, and Others. Geographically, the report focuses on China, India, Japan, and the Rest of Asia-Pacific, offering actionable insights for industry stakeholders, investors, and manufacturers seeking to capitalize on this rapidly expanding market.

Asia-Pacific Industrial Battery Market Market Concentration & Innovation

The Asia-Pacific Industrial Battery Market exhibits a moderate to high level of concentration, with a few dominant players controlling significant market share. Key companies like EnerSys, Amara Raja Batteries Ltd, Saft Groupe SA, Exide Industries Ltd, East Penn Manufacturing Company Inc, GS Yuasa Corporation, C&D Technologies Pvt Ltd, and Panasonic Corporation are at the forefront of innovation and market development. Innovation is primarily driven by the escalating demand for energy-efficient and sustainable battery solutions, coupled with advancements in battery chemistries and manufacturing processes. Regulatory frameworks across countries are increasingly emphasizing environmental sustainability, pushing for the adoption of eco-friendly battery technologies. Product substitutes, while existing, are gradually being phased out as performance and longevity advantages of newer battery types become more pronounced. End-user trends point towards a growing preference for higher energy density, longer cycle life, and faster charging capabilities, particularly in the rapidly evolving electric forklift and telecommunications sectors. Mergers and acquisitions (M&A) activities are expected to play a crucial role in market consolidation and strategic expansion, with significant deal values anticipated as companies seek to enhance their technological portfolios and market reach.

Asia-Pacific Industrial Battery Market Industry Trends & Insights

The Asia-Pacific Industrial Battery Market is experiencing a period of robust growth, propelled by a confluence of economic, technological, and regulatory factors. The projected Compound Annual Growth Rate (CAGR) for this market is substantial, indicating significant expansion over the forecast period. A primary growth driver is the increasing electrification of industries, ranging from material handling with electric forklifts to the ever-expanding telecommunications infrastructure requiring reliable backup power. The growing adoption of Uninterruptible Power Supply (UPS) systems across data centers, healthcare facilities, and financial institutions further fuels demand. Technological disruptions are a defining characteristic, with Lithium-ion batteries rapidly gaining market penetration due to their superior energy density, longer lifespan, and lighter weight compared to traditional Lead-acid batteries. However, Lead-acid batteries continue to hold a significant share in cost-sensitive applications and where established infrastructure exists. Consumer preferences are shifting towards higher performance, enhanced safety, and sustainable energy storage solutions, compelling manufacturers to invest heavily in research and development. Competitive dynamics are intensifying, with both established players and emerging entrants vying for market dominance through product innovation, strategic partnerships, and geographical expansion. The "Rest of Asia-Pacific" region, encompassing countries with emerging economies and increasing industrialization, presents a substantial untapped market potential.

Dominant Markets & Segments in Asia-Pacific Industrial Battery Market

Dominance of Lithium-ion Batteries: The Lithium-ion Battery segment is emerging as the dominant force within the Asia-Pacific industrial battery landscape.

- Technological Superiority: Its high energy density, longer cycle life, and faster charging capabilities make it the preferred choice for advanced applications.

- Growth Drivers: The escalating demand for electric forklifts, the expansion of 5G telecommunications networks, and the growing need for efficient energy storage in renewable energy systems are key drivers.

- Market Penetration: Lithium-ion batteries are rapidly increasing their market penetration, displacing traditional Lead-acid technologies in many applications.

China's Leadership in the Market: China stands as the leading geographical market for industrial batteries in the Asia-Pacific region.

- Economic Policies: Favorable government policies supporting manufacturing, electrification, and technological innovation have significantly boosted the sector.

- Manufacturing Hub: China's established manufacturing prowess allows for large-scale production and competitive pricing.

- Infrastructure Development: Extensive investment in infrastructure, including logistics and data centers, drives demand for UPS and forklift batteries.

Forklift and Telecom Applications Leading the Charge: The Forklift and Telecom application segments are major contributors to the industrial battery market's growth.

- Forklift Growth: The rise of e-commerce and the need for efficient warehouse operations are propelling the demand for electric forklifts and their associated battery systems.

- Telecom Expansion: The continuous expansion and upgrading of telecommunications infrastructure, particularly with the rollout of 5G, necessitates a robust and reliable power backup, driving demand for industrial batteries.

- UPS Significance: The critical need for uninterrupted power supply in data centers, financial institutions, and healthcare facilities solidifies the importance of the UPS segment.

Asia-Pacific Industrial Battery Market Product Developments

Product development in the Asia-Pacific industrial battery market is characterized by a relentless pursuit of enhanced performance, efficiency, and sustainability. Key innovations focus on improving energy density, extending cycle life, and accelerating charging times for Lithium-ion battery chemistries. Developments also include advancements in battery management systems (BMS) for optimized performance and safety. The integration of smart features for remote monitoring and predictive maintenance is also gaining traction. These product developments aim to cater to the evolving needs of applications like electric forklifts, telecommunications infrastructure, and uninterruptible power supplies, offering competitive advantages through superior reliability and cost-effectiveness.

Report Scope & Segmentation Analysis

This report comprehensively segments the Asia-Pacific Industrial Battery Market by Technology (Lithium-ion Battery, Lead-acid Battery, Other Technologies), Application (Forklift, Telecom, UPS, Others), and Geography (China, India, Japan, Rest of Asia-Pacific). The Lithium-ion Battery segment is projected for significant growth, driven by its superior performance characteristics. The Lead-acid Battery segment will continue to hold a considerable share, particularly in cost-sensitive applications. In terms of applications, Forklift and Telecom are expected to exhibit robust growth trajectories. Geographically, China is anticipated to maintain its dominance, with substantial growth expected from India and the Rest of Asia-Pacific countries.

Key Drivers of Asia-Pacific Industrial Battery Market Growth

The Asia-Pacific Industrial Battery Market is propelled by several key drivers. Technological advancements in Lithium-ion battery chemistry, leading to higher energy density and longer lifespans, are fundamental. Increasing industrial automation and the electrification of material handling equipment, such as forklifts, are driving significant demand. Furthermore, the rapid expansion of telecommunications infrastructure, particularly 5G deployment, necessitates reliable backup power solutions. Government initiatives promoting renewable energy adoption and electric mobility also play a crucial role. The growing need for uninterrupted power supply in critical sectors like data centers and healthcare further bolsters market growth.

Challenges in the Asia-Pacific Industrial Battery Market Sector

Despite the robust growth, the Asia-Pacific Industrial Battery Market faces several challenges. Raw material price volatility, particularly for lithium and cobalt, can impact manufacturing costs and profit margins. Stringent environmental regulations concerning battery disposal and recycling, while essential, can increase compliance costs for manufacturers. Intensifying competition from both domestic and international players can lead to price pressures. Supply chain disruptions, as highlighted by global events, can affect the availability of key components. Furthermore, developing and maintaining adequate charging infrastructure for electric industrial vehicles remains a hurdle in certain regions.

Emerging Opportunities in Asia-Pacific Industrial Battery Market

Emerging opportunities within the Asia-Pacific Industrial Battery Market are diverse and promising. The growing demand for energy storage solutions for renewable energy integration presents a significant avenue for growth. The "smart grid" initiatives and the need for grid stabilization are creating new application areas. Advancements in battery recycling and the development of circular economy models for batteries offer sustainability-driven business opportunities. The expansion of electric mobility beyond passenger cars into commercial vehicles and industrial equipment opens up new market segments. Furthermore, the increasing focus on advanced battery management systems (BMS) and IoT integration for enhanced performance and predictive maintenance represents a key growth area.

Leading Players in the Asia-Pacific Industrial Battery Market Market

- EnerSys

- Amara Raja Batteries Ltd

- Saft Groupe SA

- Exide Industries Ltd

- East Penn Manufacturing Company Inc

- GS Yuasa Corporation

- C&D Technologies Pvt Ltd

- Panasonic Corporation

Key Developments in Asia-Pacific Industrial Battery Market Industry

- January 2022: China Lithium Battery Technology signed two contracts with two cities in the southern Chinese province of Guangdong to build new production facilities with an annual capacity of 50 GWh. The factories will be located in Guangzhou and Jiangmen.

- January 2022: BYD and FAW are planning a production facility for electric car batteries with an annual capacity of 45 GWh in north-eastern China. A joint venture between BYD and FAW called FAW FinDreams New Energy Technology was established, with a registered capital of EUR 140 million. BYD holds 51% of the JV, and FAW Group owns the remaining.

Strategic Outlook for Asia-Pacific Industrial Battery Market Market

The strategic outlook for the Asia-Pacific Industrial Battery Market is overwhelmingly positive, driven by continuous technological innovation and the escalating demand for electrification across various industries. Companies that focus on developing advanced Lithium-ion battery technologies with improved energy density, faster charging, and enhanced safety features will be well-positioned. Strategic partnerships and mergers and acquisitions will be crucial for expanding market reach and acquiring cutting-edge technologies. Investing in sustainable manufacturing practices and robust recycling initiatives will also be key differentiators. The growing emphasis on smart energy storage solutions and grid integration presents significant future growth catalysts, enabling the market to meet the evolving energy demands of the region.

Asia-Pacific Industrial Battery Market Segmentation

-

1. Technology

- 1.1. Lithium-ion Battery

- 1.2. Lead-acid Battery

- 1.3. Other Te

-

2. Application

- 2.1. Forklift

- 2.2. Telecom

- 2.3. UPS

- 2.4. Others

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia-Pacific

Asia-Pacific Industrial Battery Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Rest of Asia Pacific

Asia-Pacific Industrial Battery Market Regional Market Share

Geographic Coverage of Asia-Pacific Industrial Battery Market

Asia-Pacific Industrial Battery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.33% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Lithium-ion Battery Prices4.; Rising Renewable Energy Integration Worldwide

- 3.3. Market Restrains

- 3.3.1. 4.; Uncertainty in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Lithium-ion Battery (LIB) Technology to Witness Significant Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Industrial Battery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Lithium-ion Battery

- 5.1.2. Lead-acid Battery

- 5.1.3. Other Te

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Forklift

- 5.2.2. Telecom

- 5.2.3. UPS

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. China Asia-Pacific Industrial Battery Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Lithium-ion Battery

- 6.1.2. Lead-acid Battery

- 6.1.3. Other Te

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Forklift

- 6.2.2. Telecom

- 6.2.3. UPS

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. India Asia-Pacific Industrial Battery Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Lithium-ion Battery

- 7.1.2. Lead-acid Battery

- 7.1.3. Other Te

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Forklift

- 7.2.2. Telecom

- 7.2.3. UPS

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Japan Asia-Pacific Industrial Battery Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Lithium-ion Battery

- 8.1.2. Lead-acid Battery

- 8.1.3. Other Te

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Forklift

- 8.2.2. Telecom

- 8.2.3. UPS

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Rest of Asia Pacific Asia-Pacific Industrial Battery Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Lithium-ion Battery

- 9.1.2. Lead-acid Battery

- 9.1.3. Other Te

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Forklift

- 9.2.2. Telecom

- 9.2.3. UPS

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 EnerSys

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Amara Raja Batteries Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Saft Groupe SA*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Exide Industries Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 East Penn Manufacturing Company Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 GS Yuasa Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 C&D Technologies Pvt Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Panasonic Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 EnerSys

List of Figures

- Figure 1: Asia-Pacific Industrial Battery Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Industrial Battery Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 2: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 3: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 7: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 10: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 11: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 14: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 18: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 19: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 20: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 21: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 22: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 26: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 27: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 28: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 29: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 30: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 31: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 33: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 34: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Technology 2020 & 2033

- Table 35: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 36: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 37: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 38: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 39: Asia-Pacific Industrial Battery Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: Asia-Pacific Industrial Battery Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Industrial Battery Market?

The projected CAGR is approximately 16.33%.

2. Which companies are prominent players in the Asia-Pacific Industrial Battery Market?

Key companies in the market include EnerSys, Amara Raja Batteries Ltd, Saft Groupe SA*List Not Exhaustive, Exide Industries Ltd, East Penn Manufacturing Company Inc, GS Yuasa Corporation, C&D Technologies Pvt Ltd, Panasonic Corporation.

3. What are the main segments of the Asia-Pacific Industrial Battery Market?

The market segments include Technology, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Lithium-ion Battery Prices4.; Rising Renewable Energy Integration Worldwide.

6. What are the notable trends driving market growth?

Lithium-ion Battery (LIB) Technology to Witness Significant Demand.

7. Are there any restraints impacting market growth?

4.; Uncertainty in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

January 2022: China Lithium Battery Technology signed two contracts with two cities in the southern Chinese province of Guangdong to build new production facilities with an annual capacity of 50 GWh. The factories will be located in Guangzhou and Jiangmen.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Industrial Battery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Industrial Battery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Industrial Battery Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Industrial Battery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence