Key Insights

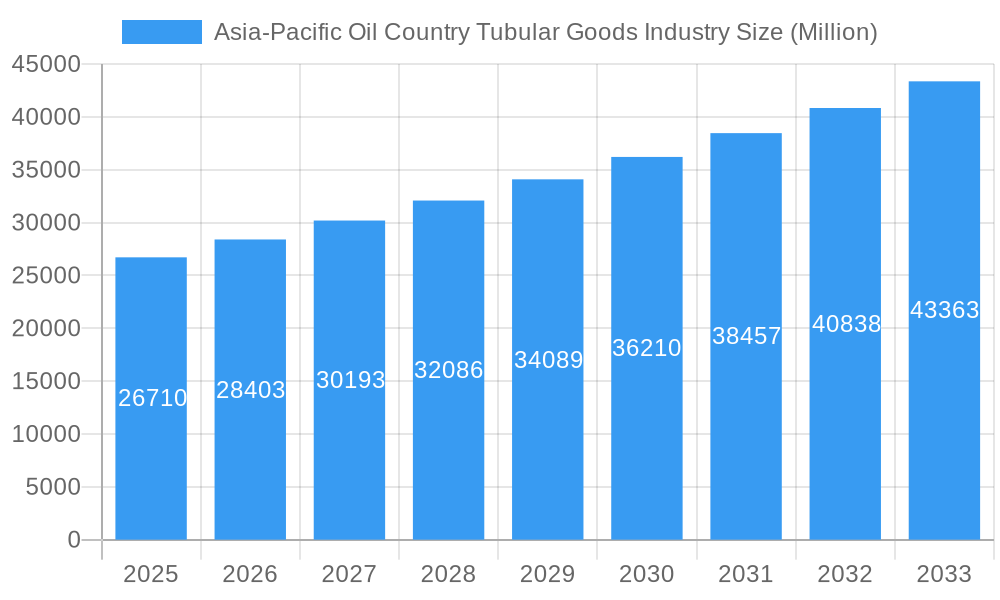

The Asia-Pacific Oil Country Tubular Goods (OCTG) market is poised for robust expansion, with an estimated market size of USD 26.71 billion in 2025, projecting a Compound Annual Growth Rate (CAGR) of 6.4% through 2033. This significant growth is propelled by escalating energy demands across the region, particularly from emerging economies like India and China, which are heavily investing in oil and gas exploration and production activities. The continuous need to replace aging infrastructure and develop new reserves fuels the demand for OCTG products, including seamless and electric resistance welded pipes. Premium and API grades are expected to see increased adoption due to stringent industry standards and the growing complexity of exploration projects, requiring durable and high-performance tubular goods.

Asia-Pacific Oil Country Tubular Goods Industry Market Size (In Billion)

Key drivers for this market include the ongoing efforts to enhance domestic energy production to meet burgeoning consumption, coupled with substantial investments in upstream oil and gas infrastructure development. Technological advancements in drilling techniques and the increasing focus on maintaining and upgrading existing oil fields also contribute significantly to market growth. While the market benefits from strong demand, potential restraints such as fluctuating crude oil prices, stringent environmental regulations, and the increasing adoption of renewable energy sources could moderate the pace of expansion. Nonetheless, the inherent need for fossil fuels in the region's energy mix and strategic government initiatives to bolster energy security ensure a sustained demand for OCTG products across key geographies like India, China, Japan, and South Korea.

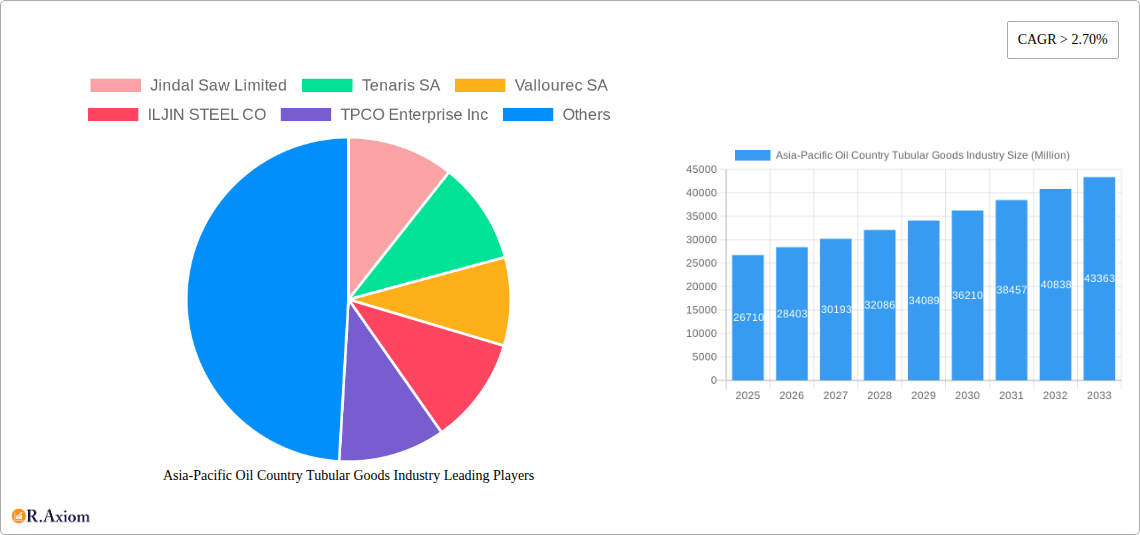

Asia-Pacific Oil Country Tubular Goods Industry Company Market Share

Asia-Pacific Oil Country Tubular Goods Industry Market Concentration & Innovation

The Asia-Pacific Oil Country Tubular Goods (OCTG) industry exhibits a moderately concentrated market structure, with key players like Jindal Saw Limited, Tenaris SA, Vallourec SA, ILJIN STEEL CO, TPCO Enterprise Inc, JFE Steel Corp, National-Oilwell Varco Inc, TMK Ipsco Enterprises Inc, ArcelorMittal SA, and Nippon Steel Corp dominating significant market shares. Innovation is a critical differentiator, driven by the increasing demand for high-performance OCTG solutions capable of withstanding extreme drilling conditions, deeper wells, and corrosive environments. Advancements in material science, manufacturing processes (e.g., enhanced seamless and ERW techniques), and specialized coatings are paramount. Regulatory frameworks, particularly concerning environmental standards and safety protocols for exploration and production (E&P) activities, play a crucial role in shaping product development and market entry strategies. While direct product substitutes are limited, the exploration of alternative energy sources and the efficiency improvements in traditional oil and gas extraction technologies can indirectly influence OCTG demand. End-user trends are heavily influenced by global energy demand, fluctuating oil prices, and geopolitical stability, leading to an increased focus on cost-efficiency and supply chain reliability. Mergers and acquisitions (M&A) activities, with deal values in the billions, are observed as companies seek to consolidate their market positions, gain access to new technologies, and expand their geographical footprints across the Asia-Pacific region. For instance, strategic alliances and acquisitions aimed at bolstering production capacities or integrating upstream and downstream operations are common. The market is dynamic, with continuous efforts to optimize production cycles and reduce the lead times for critical OCTG supplies.

Asia-Pacific Oil Country Tubular Goods Industry Industry Trends & Insights

The Asia-Pacific Oil Country Tubular Goods (OCTG) industry is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.8% over the forecast period from 2025 to 2033. This expansion is primarily fueled by the escalating global demand for energy, coupled with significant investments in oil and gas exploration and production activities across the region. Countries like China and India, with their rapidly growing economies and increasing energy consumption, are central to this demand. Technological advancements are revolutionizing the OCTG market, with a discernible shift towards premium grade OCTG products that offer enhanced durability, resistance to corrosion and high pressures, and improved sealing capabilities. These premium grades are essential for deepwater drilling, unconventional resource extraction, and operations in challenging geological environments, thereby increasing their market penetration. The manufacturing process segment is witnessing innovation in both seamless and Electric Resistance Welded (ERW) technologies, with manufacturers striving for greater precision, higher yield, and cost-effectiveness. Seamless OCTG continues to hold a dominant share due to its inherent strength and reliability, particularly for high-pressure applications. However, advancements in ERW technology are making it a more viable and cost-competitive option for a wider range of applications, especially in onshore and less demanding offshore projects. Consumer preferences are increasingly geared towards suppliers who can provide integrated solutions, including specialized OCTG products, advanced threading, and comprehensive after-sales support. Competitive dynamics are intense, with established global players and burgeoning regional manufacturers vying for market share. Companies are focusing on expanding their production capacities, optimizing supply chains, and investing in research and development to stay ahead of the curve. The ongoing digital transformation within the industry, including the adoption of AI and IoT for predictive maintenance and supply chain management, is also a significant trend shaping competitive advantages and operational efficiencies. Geographically, the "Rest of Asia-Pacific" segment, encompassing nations like Indonesia, Malaysia, and Australia, is also expected to witness substantial growth, driven by their significant hydrocarbon reserves and ongoing E&P initiatives.

Dominant Markets & Segments in Asia-Pacific Oil Country Tubular Goods Industry

China stands out as the dominant market within the Asia-Pacific Oil Country Tubular Goods (OCTG) industry, primarily due to its massive domestic oil and gas consumption, substantial investments in upstream exploration and production, and the presence of leading national oil companies driving demand for OCTG. The sheer volume of drilling activity, including both conventional and unconventional reserves, positions China as a critical market. Economic policies supporting energy self-sufficiency and the development of domestic production capacities further bolster its dominance.

Manufacturing Process Dominance:

- Seamless: The seamless manufacturing process is a dominant segment due to its superior mechanical properties, high strength, and integrity, making it indispensable for demanding applications such as deep wells, high-pressure environments, and sour gas service. Key drivers for its dominance include stringent industry standards (API Grade) and the need for reliable performance in critical E&P operations.

- Key Drivers: Requirement for high-pressure containment, resistance to fatigue and collapse, long service life, and compatibility with premium thread connections.

- Electric Resistance Welded (ERW): While seamless leads in high-end applications, ERW is gaining traction due to advancements in welding technology, leading to improved quality and cost-effectiveness for moderate pressure applications. Its growing market share is driven by the demand for cost-efficient solutions in onshore projects and certain offshore developments.

- Key Drivers: Cost competitiveness, increasing efficiency of ERW technology, wider availability for standard applications, and faster production cycles for certain diameters.

Grade Dominance:

- API Grade: API (American Petroleum Institute) Grade OCTG products represent a foundational segment due to their widespread adoption and adherence to internationally recognized standards for quality and performance. The extensive network of existing oil fields and ongoing exploration activities that rely on these established specifications contribute to its sustained demand.

- Key Drivers: Global standardization, established industry acceptance, proven reliability in various operating conditions, and requirement for regulatory compliance in many regions.

- Premium Grade: The demand for premium grade OCTG is rapidly increasing, driven by the industry's push for enhanced safety, efficiency, and the ability to access more challenging reservoirs. These grades offer superior performance characteristics like higher collapse and tensile strength, improved corrosion resistance, and specialized connection integrity, essential for complex drilling operations.

- Key Drivers: Accessing deepwater and ultra-deepwater fields, drilling in sour gas and high-temperature environments, minimizing non-productive time (NPT) due to connection integrity failures, and the pursuit of enhanced production efficiency.

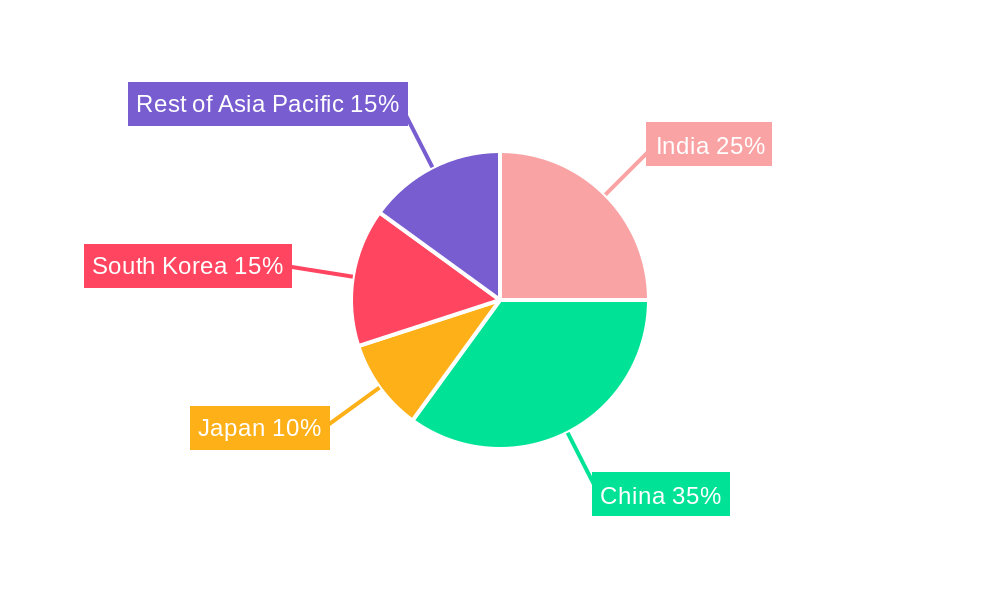

Geographical Dominance:

- China: As mentioned, China's vast energy market, coupled with government initiatives to boost domestic production, makes it the leading geographical segment. The country’s significant investments in both onshore and offshore exploration and production necessitate a massive supply of OCTG.

- Key Drivers: Growing energy demand, government support for energy security, large domestic oil and gas reserves, and the presence of major state-owned oil companies.

- India: India represents another high-growth market due to its increasing energy needs and efforts to ramp up domestic oil and gas production. The government's focus on reducing import dependency fuels demand for OCTG.

- Key Drivers: Rapid economic growth, rising energy consumption, strategic initiatives to enhance domestic hydrocarbon production, and significant offshore exploration potential.

- South Korea: While a smaller producer, South Korea is a significant player in the manufacturing of high-quality OCTG, particularly advanced and premium grades, catering to both domestic and international markets. Its technological prowess in steel manufacturing contributes to its importance.

- Key Drivers: Advanced steel manufacturing capabilities, export-oriented production of high-value OCTG, and a focus on research and development for specialized products.

Asia-Pacific Oil Country Tubular Goods Industry Product Developments

Product developments in the Asia-Pacific OCTG industry are characterized by a strong emphasis on enhancing material performance and addressing the evolving challenges of oil and gas extraction. Innovations include the development of higher-strength steel alloys capable of withstanding extreme pressures and temperatures, as well as advanced coatings and treatments to combat corrosion and erosion in sour or abrasive environments. Companies are also focusing on the design and manufacturing of premium, high-performance threaded connections that ensure superior seal integrity and resistance to fatigue, thereby minimizing operational risks and non-productive time. The integration of digital technologies for product traceability and quality control is also a growing trend, providing end-users with greater confidence in product reliability and performance in demanding applications.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Asia-Pacific Oil Country Tubular Goods (OCTG) industry, covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033. The market is segmented across key parameters to offer granular insights into its dynamics.

- Manufacturing Process: The report analyzes the market share and growth projections for Seamless and Electric Resistance Welded (ERW) OCTG. Seamless OCTG is expected to maintain a significant share due to its high-performance capabilities, while ERW is projected to witness steady growth driven by cost efficiencies and technological advancements.

- Grade: Segmentation by grade includes Premium Grade and API Grade. While API Grade OCTG will continue to represent a substantial portion of the market due to established industry standards, Premium Grade OCTG is anticipated to experience higher growth rates, fueled by the increasing complexity of exploration and production activities.

- Geography: The study divides the market into India, China, Japan, South Korea, and the Rest of Asia-Pacific. China and India are expected to lead in terms of market size and growth, driven by their substantial energy demands and upstream investments. Japan and South Korea will be significant contributors through their advanced manufacturing capabilities, especially in premium grades. The Rest of Asia-Pacific, encompassing nations like Australia and Indonesia, presents substantial growth opportunities due to untapped hydrocarbon reserves.

Key Drivers of Asia-Pacific Oil Country Tubular Goods Industry Growth

The Asia-Pacific Oil Country Tubular Goods (OCTG) industry's growth is propelled by several key drivers. Foremost is the escalating global and regional demand for energy, necessitating sustained investments in oil and gas exploration and production (E&P). Technological advancements in drilling techniques, leading to deeper and more complex well designs, are driving the demand for high-performance, premium grade OCTG. Furthermore, government initiatives across many Asia-Pacific nations aimed at enhancing energy security and boosting domestic hydrocarbon production play a crucial role. The expansion of infrastructure, including new pipelines and processing facilities, also indirectly stimulates OCTG demand. Economic growth in countries like China and India further fuels energy consumption, creating a sustained need for oil and gas, thereby driving OCTG market expansion.

Challenges in the Asia-Pacific Oil Country Tubular Goods Industry Sector

Despite robust growth prospects, the Asia-Pacific Oil Country Tubular Goods (OCTG) industry faces several challenges. Fluctuating global oil prices can significantly impact E&P investments, leading to project delays or cancellations and subsequently affecting OCTG demand. Intense competition from both domestic and international manufacturers can exert downward pressure on prices and profit margins. Regulatory hurdles and evolving environmental standards in various countries can add to compliance costs and impact operational flexibility. Supply chain disruptions, exacerbated by geopolitical events or natural disasters, can lead to delays in material sourcing and product delivery, impacting project timelines. The increasing shift towards renewable energy sources, while still nascent in its impact on OCTG demand, poses a long-term strategic challenge to the industry's growth trajectory.

Emerging Opportunities in Asia-Pacific Oil Country Tubular Goods Industry

Emerging opportunities in the Asia-Pacific Oil Country Tubular Goods (OCTG) industry lie in the increasing demand for specialized and premium OCTG products required for challenging E&P environments, such as ultra-deepwater drilling and unconventional resource extraction. The development of advanced materials and coatings offering enhanced corrosion resistance and durability presents significant market potential. Furthermore, the growing focus on efficiency and sustainability within the oil and gas sector is driving demand for OCTG solutions that reduce non-productive time and extend well life. The "Rest of Asia-Pacific" region, with its untapped hydrocarbon reserves, offers substantial untapped market potential. The adoption of digital technologies for supply chain optimization and predictive maintenance also presents opportunities for value-added services and integrated solutions.

Leading Players in the Asia-Pacific Oil Country Tubular Goods Industry Market

- Jindal Saw Limited

- Tenaris SA

- Vallourec SA

- ILJIN STEEL CO

- TPCO Enterprise Inc

- JFE Steel Corp

- National-Oilwell Varco Inc

- TMK Ipsco Enterprises Inc

- ArcelorMittal SA

- Nippon Steel Corp

Key Developments in Asia-Pacific Oil Country Tubular Goods Industry Industry

- 2023 October: Jindal Saw Limited announced significant investments in expanding its OCTG manufacturing capacity in India to meet growing domestic and export demand.

- 2023 July: Tenaris SA reported robust order book for premium OCTG, driven by exploration activities in Southeast Asia.

- 2023 May: Vallourec SA secured a major contract for the supply of specialized OCTG for a deepwater project in Australia.

- 2022 December: TPCO Enterprise Inc. invested in advanced welding technologies to enhance the quality and efficiency of its ERW OCTG production.

- 2022 August: JFE Steel Corp developed a new high-strength steel alloy for OCTG, designed for extreme temperature and pressure conditions.

- 2021 November: ILJIN STEEL CO. focused on expanding its global distribution network for premium OCTG to cater to emerging markets.

- 2021 April: National-Oilwell Varco Inc. introduced digital solutions for OCTG management and inventory tracking.

- 2020 September: TMK Ipsco Enterprises Inc. integrated advanced quality control systems to ensure compliance with stringent API Grade specifications.

- 2020 February: ArcelorMittal SA announced strategic partnerships to strengthen its OCTG supply chain in the Asia-Pacific region.

- 2019 October: Nippon Steel Corp. unveiled innovative coating technologies to improve the corrosion resistance of its OCTG products.

Strategic Outlook for Asia-Pacific Oil Country Tubular Goods Industry Market

The strategic outlook for the Asia-Pacific Oil Country Tubular Goods (OCTG) market is characterized by continued growth driven by increasing energy demand and sustained upstream investments, particularly in emerging economies like India and China. The market will see a heightened focus on premium OCTG solutions that offer enhanced performance, safety, and reliability for complex drilling operations. Companies that can demonstrate technological superiority, cost-competitiveness, and robust supply chain management will be best positioned for success. Strategic partnerships, technological collaborations, and targeted M&A activities will likely shape the competitive landscape. Furthermore, the adoption of digital transformation initiatives to improve operational efficiency and customer service will be a critical differentiator, ensuring long-term growth and market leadership in this dynamic sector.

Asia-Pacific Oil Country Tubular Goods Industry Segmentation

-

1. Manufacturing Process

- 1.1. Seamless

- 1.2. Electric Resistance Welded

-

2. Grade

- 2.1. Premium Grade

- 2.2. API Grade

-

3. Geography

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia-Pacific

Asia-Pacific Oil Country Tubular Goods Industry Segmentation By Geography

- 1. India

- 2. China

- 3. Japan

- 4. South Korea

- 5. Rest of Asia Pacific

Asia-Pacific Oil Country Tubular Goods Industry Regional Market Share

Geographic Coverage of Asia-Pacific Oil Country Tubular Goods Industry

Asia-Pacific Oil Country Tubular Goods Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Demand to Develop the Natural Gas Infrastructure4.; Increase in Offshore Oil and Gas Exploration and Production (E&P) Activities

- 3.3. Market Restrains

- 3.3.1. 4.; High Volatility of Oil and Gas Prices

- 3.4. Market Trends

- 3.4.1. Premium Grade OCTG to Witness Significant Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Oil Country Tubular Goods Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Manufacturing Process

- 5.1.1. Seamless

- 5.1.2. Electric Resistance Welded

- 5.2. Market Analysis, Insights and Forecast - by Grade

- 5.2.1. Premium Grade

- 5.2.2. API Grade

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. India

- 5.3.2. China

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.4.2. China

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Manufacturing Process

- 6. India Asia-Pacific Oil Country Tubular Goods Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Manufacturing Process

- 6.1.1. Seamless

- 6.1.2. Electric Resistance Welded

- 6.2. Market Analysis, Insights and Forecast - by Grade

- 6.2.1. Premium Grade

- 6.2.2. API Grade

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. India

- 6.3.2. China

- 6.3.3. Japan

- 6.3.4. South Korea

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Manufacturing Process

- 7. China Asia-Pacific Oil Country Tubular Goods Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Manufacturing Process

- 7.1.1. Seamless

- 7.1.2. Electric Resistance Welded

- 7.2. Market Analysis, Insights and Forecast - by Grade

- 7.2.1. Premium Grade

- 7.2.2. API Grade

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. India

- 7.3.2. China

- 7.3.3. Japan

- 7.3.4. South Korea

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Manufacturing Process

- 8. Japan Asia-Pacific Oil Country Tubular Goods Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Manufacturing Process

- 8.1.1. Seamless

- 8.1.2. Electric Resistance Welded

- 8.2. Market Analysis, Insights and Forecast - by Grade

- 8.2.1. Premium Grade

- 8.2.2. API Grade

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. India

- 8.3.2. China

- 8.3.3. Japan

- 8.3.4. South Korea

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Manufacturing Process

- 9. South Korea Asia-Pacific Oil Country Tubular Goods Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Manufacturing Process

- 9.1.1. Seamless

- 9.1.2. Electric Resistance Welded

- 9.2. Market Analysis, Insights and Forecast - by Grade

- 9.2.1. Premium Grade

- 9.2.2. API Grade

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. India

- 9.3.2. China

- 9.3.3. Japan

- 9.3.4. South Korea

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Manufacturing Process

- 10. Rest of Asia Pacific Asia-Pacific Oil Country Tubular Goods Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Manufacturing Process

- 10.1.1. Seamless

- 10.1.2. Electric Resistance Welded

- 10.2. Market Analysis, Insights and Forecast - by Grade

- 10.2.1. Premium Grade

- 10.2.2. API Grade

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. India

- 10.3.2. China

- 10.3.3. Japan

- 10.3.4. South Korea

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Manufacturing Process

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Jindal Saw Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tenaris SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Vallourec SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ILJIN STEEL CO

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 TPCO Enterprise Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 JFE Steel Corp

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 National-Oilwell Varco Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 TMK Ipsco Enterprises Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ArcelorMittal SA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nippon Steel Corp

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Jindal Saw Limited

List of Figures

- Figure 1: Asia-Pacific Oil Country Tubular Goods Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Oil Country Tubular Goods Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Oil Country Tubular Goods Industry Revenue undefined Forecast, by Manufacturing Process 2020 & 2033

- Table 2: Asia-Pacific Oil Country Tubular Goods Industry Volume K Unit Forecast, by Manufacturing Process 2020 & 2033

- Table 3: Asia-Pacific Oil Country Tubular Goods Industry Revenue undefined Forecast, by Grade 2020 & 2033

- Table 4: Asia-Pacific Oil Country Tubular Goods Industry Volume K Unit Forecast, by Grade 2020 & 2033

- Table 5: Asia-Pacific Oil Country Tubular Goods Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific Oil Country Tubular Goods Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 7: Asia-Pacific Oil Country Tubular Goods Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Asia-Pacific Oil Country Tubular Goods Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Asia-Pacific Oil Country Tubular Goods Industry Revenue undefined Forecast, by Manufacturing Process 2020 & 2033

- Table 10: Asia-Pacific Oil Country Tubular Goods Industry Volume K Unit Forecast, by Manufacturing Process 2020 & 2033

- Table 11: Asia-Pacific Oil Country Tubular Goods Industry Revenue undefined Forecast, by Grade 2020 & 2033

- Table 12: Asia-Pacific Oil Country Tubular Goods Industry Volume K Unit Forecast, by Grade 2020 & 2033

- Table 13: Asia-Pacific Oil Country Tubular Goods Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 14: Asia-Pacific Oil Country Tubular Goods Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Oil Country Tubular Goods Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Oil Country Tubular Goods Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Oil Country Tubular Goods Industry Revenue undefined Forecast, by Manufacturing Process 2020 & 2033

- Table 18: Asia-Pacific Oil Country Tubular Goods Industry Volume K Unit Forecast, by Manufacturing Process 2020 & 2033

- Table 19: Asia-Pacific Oil Country Tubular Goods Industry Revenue undefined Forecast, by Grade 2020 & 2033

- Table 20: Asia-Pacific Oil Country Tubular Goods Industry Volume K Unit Forecast, by Grade 2020 & 2033

- Table 21: Asia-Pacific Oil Country Tubular Goods Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 22: Asia-Pacific Oil Country Tubular Goods Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: Asia-Pacific Oil Country Tubular Goods Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Asia-Pacific Oil Country Tubular Goods Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Oil Country Tubular Goods Industry Revenue undefined Forecast, by Manufacturing Process 2020 & 2033

- Table 26: Asia-Pacific Oil Country Tubular Goods Industry Volume K Unit Forecast, by Manufacturing Process 2020 & 2033

- Table 27: Asia-Pacific Oil Country Tubular Goods Industry Revenue undefined Forecast, by Grade 2020 & 2033

- Table 28: Asia-Pacific Oil Country Tubular Goods Industry Volume K Unit Forecast, by Grade 2020 & 2033

- Table 29: Asia-Pacific Oil Country Tubular Goods Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 30: Asia-Pacific Oil Country Tubular Goods Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 31: Asia-Pacific Oil Country Tubular Goods Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Asia-Pacific Oil Country Tubular Goods Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 33: Asia-Pacific Oil Country Tubular Goods Industry Revenue undefined Forecast, by Manufacturing Process 2020 & 2033

- Table 34: Asia-Pacific Oil Country Tubular Goods Industry Volume K Unit Forecast, by Manufacturing Process 2020 & 2033

- Table 35: Asia-Pacific Oil Country Tubular Goods Industry Revenue undefined Forecast, by Grade 2020 & 2033

- Table 36: Asia-Pacific Oil Country Tubular Goods Industry Volume K Unit Forecast, by Grade 2020 & 2033

- Table 37: Asia-Pacific Oil Country Tubular Goods Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 38: Asia-Pacific Oil Country Tubular Goods Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 39: Asia-Pacific Oil Country Tubular Goods Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: Asia-Pacific Oil Country Tubular Goods Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Asia-Pacific Oil Country Tubular Goods Industry Revenue undefined Forecast, by Manufacturing Process 2020 & 2033

- Table 42: Asia-Pacific Oil Country Tubular Goods Industry Volume K Unit Forecast, by Manufacturing Process 2020 & 2033

- Table 43: Asia-Pacific Oil Country Tubular Goods Industry Revenue undefined Forecast, by Grade 2020 & 2033

- Table 44: Asia-Pacific Oil Country Tubular Goods Industry Volume K Unit Forecast, by Grade 2020 & 2033

- Table 45: Asia-Pacific Oil Country Tubular Goods Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 46: Asia-Pacific Oil Country Tubular Goods Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 47: Asia-Pacific Oil Country Tubular Goods Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 48: Asia-Pacific Oil Country Tubular Goods Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Oil Country Tubular Goods Industry?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the Asia-Pacific Oil Country Tubular Goods Industry?

Key companies in the market include Jindal Saw Limited, Tenaris SA, Vallourec SA, ILJIN STEEL CO, TPCO Enterprise Inc, JFE Steel Corp, National-Oilwell Varco Inc, TMK Ipsco Enterprises Inc, ArcelorMittal SA, Nippon Steel Corp.

3. What are the main segments of the Asia-Pacific Oil Country Tubular Goods Industry?

The market segments include Manufacturing Process, Grade, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Demand to Develop the Natural Gas Infrastructure4.; Increase in Offshore Oil and Gas Exploration and Production (E&P) Activities.

6. What are the notable trends driving market growth?

Premium Grade OCTG to Witness Significant Demand.

7. Are there any restraints impacting market growth?

4.; High Volatility of Oil and Gas Prices.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Oil Country Tubular Goods Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Oil Country Tubular Goods Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Oil Country Tubular Goods Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Oil Country Tubular Goods Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence