Key Insights

The Asia-Pacific package testing market is projected for significant expansion, expected to reach 21.58 billion by 2033, growing at a Compound Annual Growth Rate (CAGR) of 5.25% from the base year 2025. This growth is attributed to the thriving e-commerce sector, requiring robust testing for product integrity during transit. Increasing consumer demand for sustainable packaging also drives demand for performance and environmental impact assessments. Stringent regulatory frameworks for food safety and healthcare products across Asia-Pacific nations further bolster market expansion. The adoption of advanced testing methodologies, including accelerated life testing and virtual prototyping, enhances efficiency and accuracy, contributing to market growth. Key industry players are also making substantial investments in R&D to deliver innovative testing solutions.

Asia-Pacific Package Testing Industry Market Size (In Billion)

China, India, and Japan are expected to lead growth, fueled by expanding manufacturing sectors and rising consumer expenditure. The market encompasses testing for diverse packaging materials such as glass, paper, plastic, and metal, covering physical performance, chemical, and environmental evaluations. Key end-user industries include food & beverage, healthcare, and industrial sectors. However, high testing costs, especially for advanced techniques, and regional variations in testing standards present challenges. Addressing these through standardization and technological innovation will be vital. The future outlook for the Asia-Pacific package testing market is positive, offering substantial opportunities.

Asia-Pacific Package Testing Industry Company Market Share

Asia-Pacific Package Testing Industry: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the Asia-Pacific package testing industry, offering invaluable insights for stakeholders across the value chain. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, segment performance, key players, and future growth prospects. The report incorporates extensive data and analysis, providing actionable intelligence for strategic decision-making.

Asia-Pacific Package Testing Industry Market Concentration & Innovation

The Asia-Pacific package testing market exhibits a moderately concentrated landscape, with a few major players holding significant market share. ALS Limited, Intertek Group PLC, and SGS SA are among the leading companies, driving innovation through advanced testing methodologies and expanding geographical reach. Market share estimates for 2025 place ALS Limited at approximately 15%, Intertek Group PLC at 12%, and SGS SA at 10%, with the remaining share distributed amongst numerous regional and smaller players. The industry is characterized by ongoing mergers and acquisitions (M&A) activities, with deal values exceeding $XX Million in the past five years, primarily driven by expansion strategies and the consolidation of smaller testing firms.

Several factors drive innovation within the sector:

- Stringent regulatory frameworks: Increasingly strict regulations related to product safety and environmental compliance necessitate advanced testing capabilities.

- Evolving consumer preferences: Growing demand for sustainable and eco-friendly packaging fuels the development of new testing methods focused on recyclability and environmental impact.

- Technological advancements: The adoption of automation, AI, and advanced analytical techniques enhances testing efficiency and accuracy.

- Product substitution: The shift towards sustainable packaging materials (e.g., biodegradable plastics) necessitates the development of new testing protocols to assess their performance and safety.

Asia-Pacific Package Testing Industry Industry Trends & Insights

The Asia-Pacific package testing market is experiencing robust growth, driven by several key factors. The Compound Annual Growth Rate (CAGR) is projected at XX% during the forecast period (2025-2033), exceeding the global average. This growth is fueled by expanding e-commerce activities, increasing consumer spending on packaged goods, and a rising focus on product safety and quality across diverse end-user industries. Technological disruptions, particularly the adoption of automation and digital technologies, are significantly impacting the efficiency and scalability of testing services. Furthermore, the rising awareness of environmental concerns is driving a shift towards sustainable packaging, creating new testing requirements and opportunities for specialized services. The market penetration of advanced testing methods such as environmental testing is increasing steadily, reaching an estimated XX% in 2025. Competitive dynamics are shaping the market, with major players investing in capacity expansion, technological upgrades, and strategic acquisitions to maintain their market positions.

Dominant Markets & Segments in Asia-Pacific Package Testing Industry

China and India are the dominant markets in the Asia-Pacific region, accounting for over XX% of the total market value in 2025. This dominance is driven by:

- Rapid economic growth: Strong economic growth in these countries fuels increased industrial production and consumption of packaged goods.

- Expanding manufacturing sector: The robust manufacturing base creates a high demand for package testing services across various industries.

- Favorable government policies: Supportive government policies promoting industrial development and product quality contribute to market growth.

Within segments, Plastic is the most dominant primary material, followed by Paper and Metal. Physical Performance Testing holds the largest share among testing types, followed by Chemical and Environmental testing. The Food and Beverage and Healthcare sectors dominate end-user industries, reflecting the stringent safety and quality regulations in these sectors.

Asia-Pacific Package Testing Industry Product Developments

Recent product innovations in the Asia-Pacific package testing industry focus on enhancing the speed, accuracy, and cost-effectiveness of testing procedures. This includes advanced analytical techniques, automated testing equipment, and specialized software for data analysis and reporting. These innovations are aimed at improving efficiency, meeting increasing regulatory demands, and providing clients with faster turnaround times. The market is also witnessing the development of specialized testing services catering to emerging trends like sustainable packaging materials and e-commerce logistics.

Report Scope & Segmentation Analysis

This report segments the Asia-Pacific package testing market based on:

Primary Material: Glass, Paper, Plastic, Metal. The Plastic segment is expected to maintain its dominance due to its widespread use across various industries.

Type of Testing: Physical Performance Testing, Chemical Testing, Environmental Testing. Physical Performance Testing is projected to experience the highest growth rate due to the increasing demand for robust and reliable packaging.

End-user Industry: Food and Beverage, Healthcare, Industrial, Personal and Household Products, Other End-user Industries. The Food and Beverage and Healthcare sectors will continue to drive significant demand due to strict quality and safety regulations.

Each segment's market size, growth projections, and competitive dynamics are analyzed in detail within the report.

Key Drivers of Asia-Pacific Package Testing Industry Growth

Several factors drive the growth of the Asia-Pacific package testing industry:

- Stringent regulatory compliance: Governments in the region are implementing stricter regulations regarding product safety and environmental protection, leading to increased demand for testing services.

- E-commerce boom: The rapid growth of e-commerce necessitates robust packaging and increased testing to ensure product integrity during transit.

- Focus on quality control: Companies are increasingly prioritizing quality control and assurance throughout their supply chains, driving demand for comprehensive testing services.

- Rise of sustainable packaging: Growing environmental awareness is leading to a shift towards sustainable packaging materials, creating opportunities for specialized testing services.

Challenges in the Asia-Pacific Package Testing Industry Sector

The industry faces several challenges:

- High infrastructure costs: Setting up and maintaining advanced testing facilities requires significant investments, particularly in developing economies.

- Intense competition: The market is characterized by intense competition among both established players and emerging firms.

- Shortage of skilled labor: A shortage of skilled technicians and scientists hinders the industry's ability to meet growing demand.

- Regulatory complexities: Varying regulations across different countries can create complexities for companies operating across the region.

Emerging Opportunities in Asia-Pacific Package Testing Industry

Several emerging opportunities exist:

- Expansion into emerging markets: Untapped potential exists in several rapidly developing economies across the region.

- Development of specialized testing services: Demand for customized testing solutions for specific industries and applications is growing.

- Adoption of innovative technologies: Integration of AI, automation, and advanced analytics can significantly improve efficiency and accuracy.

- Focus on sustainable and eco-friendly testing practices: There is an increasing need for testing methods that minimize environmental impact.

Leading Players in the Asia-Pacific Package Testing Industry Market

- ALS Limited

- Intertek Group PLC

- Cryopak

- Nefab Group

- Turner Packaging Limited

- National Technical Systems

- SGS SA

- DDL Inc

- Advance Packaging

- CSZ Testing Services Laboratories

Key Developments in Asia-Pacific Package Testing Industry Industry

- January 2023: SGS SA expands its fiber fragmentation testing services to new geographies (Bangladesh, India, Turkey, the United States, and Vietnam) after receiving TMC approvals.

- May 2022: Intertek Group PLC secures contract extension for Bulk and Break Bulk Cargo Clearance Enhancement Program in the Philippines.

Strategic Outlook for Asia-Pacific Package Testing Industry Market

The Asia-Pacific package testing industry is poised for sustained growth, driven by several factors such as increasing regulatory scrutiny, burgeoning e-commerce, and the rising demand for sustainable packaging. Companies focusing on technological innovation, strategic partnerships, and expansion into emerging markets are expected to capture significant market share. The industry's future trajectory is closely tied to economic growth, consumer trends, and technological advancements within the broader packaging sector.

Asia-Pacific Package Testing Industry Segmentation

-

1. Primary Material

- 1.1. Glass

- 1.2. Paper

- 1.3. Plastic

- 1.4. Metal

-

2. Type of Testing

- 2.1. Physical Performance Testing

- 2.2. Chemical Testing

- 2.3. Environmental Testing

-

3. End-user Industry

- 3.1. Food and Beverage

- 3.2. Healthcare

- 3.3. Industrial

- 3.4. Personal and Household Products

- 3.5. Other End-user Industries

-

4. Geography

- 4.1. China

- 4.2. India

- 4.3. Japan

- 4.4. Rest of Asia-Pacific

Asia-Pacific Package Testing Industry Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Rest of Asia Pacific

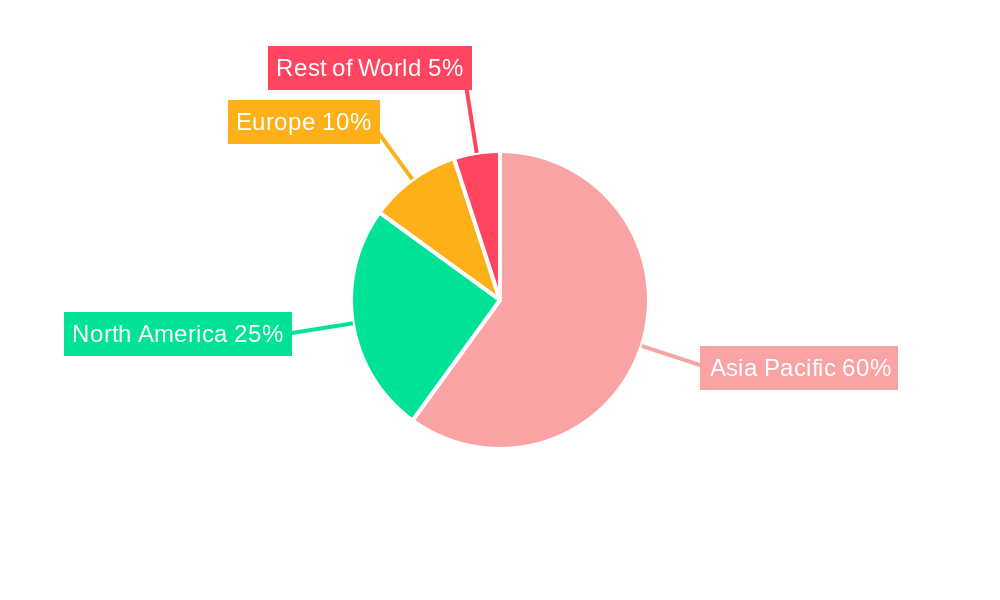

Asia-Pacific Package Testing Industry Regional Market Share

Geographic Coverage of Asia-Pacific Package Testing Industry

Asia-Pacific Package Testing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rigorous Control Regulations and Administration and Qualification Demands; Demand for Longer Shelf Life of the Products Under Varying Conditions

- 3.3. Market Restrains

- 3.3.1. High Costs of Equipment

- 3.4. Market Trends

- 3.4.1. Plastic Packaging is Expected to Witness Significant Adoption

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Package Testing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 5.1.1. Glass

- 5.1.2. Paper

- 5.1.3. Plastic

- 5.1.4. Metal

- 5.2. Market Analysis, Insights and Forecast - by Type of Testing

- 5.2.1. Physical Performance Testing

- 5.2.2. Chemical Testing

- 5.2.3. Environmental Testing

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food and Beverage

- 5.3.2. Healthcare

- 5.3.3. Industrial

- 5.3.4. Personal and Household Products

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. India

- 5.5.3. Japan

- 5.5.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 6. China Asia-Pacific Package Testing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Primary Material

- 6.1.1. Glass

- 6.1.2. Paper

- 6.1.3. Plastic

- 6.1.4. Metal

- 6.2. Market Analysis, Insights and Forecast - by Type of Testing

- 6.2.1. Physical Performance Testing

- 6.2.2. Chemical Testing

- 6.2.3. Environmental Testing

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Food and Beverage

- 6.3.2. Healthcare

- 6.3.3. Industrial

- 6.3.4. Personal and Household Products

- 6.3.5. Other End-user Industries

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. India

- 6.4.3. Japan

- 6.4.4. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Primary Material

- 7. India Asia-Pacific Package Testing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Primary Material

- 7.1.1. Glass

- 7.1.2. Paper

- 7.1.3. Plastic

- 7.1.4. Metal

- 7.2. Market Analysis, Insights and Forecast - by Type of Testing

- 7.2.1. Physical Performance Testing

- 7.2.2. Chemical Testing

- 7.2.3. Environmental Testing

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Food and Beverage

- 7.3.2. Healthcare

- 7.3.3. Industrial

- 7.3.4. Personal and Household Products

- 7.3.5. Other End-user Industries

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. India

- 7.4.3. Japan

- 7.4.4. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Primary Material

- 8. Japan Asia-Pacific Package Testing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Primary Material

- 8.1.1. Glass

- 8.1.2. Paper

- 8.1.3. Plastic

- 8.1.4. Metal

- 8.2. Market Analysis, Insights and Forecast - by Type of Testing

- 8.2.1. Physical Performance Testing

- 8.2.2. Chemical Testing

- 8.2.3. Environmental Testing

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Food and Beverage

- 8.3.2. Healthcare

- 8.3.3. Industrial

- 8.3.4. Personal and Household Products

- 8.3.5. Other End-user Industries

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. India

- 8.4.3. Japan

- 8.4.4. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Primary Material

- 9. Rest of Asia Pacific Asia-Pacific Package Testing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Primary Material

- 9.1.1. Glass

- 9.1.2. Paper

- 9.1.3. Plastic

- 9.1.4. Metal

- 9.2. Market Analysis, Insights and Forecast - by Type of Testing

- 9.2.1. Physical Performance Testing

- 9.2.2. Chemical Testing

- 9.2.3. Environmental Testing

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Food and Beverage

- 9.3.2. Healthcare

- 9.3.3. Industrial

- 9.3.4. Personal and Household Products

- 9.3.5. Other End-user Industries

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. India

- 9.4.3. Japan

- 9.4.4. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Primary Material

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ALS limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Intertek Group PLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Cryopak

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Nefab Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Turner Packaging Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 National Technical Systems

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 SGS SA

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 DDL Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Advance Packaging

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 CSZ Testing Services Laboratories

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 ALS limited

List of Figures

- Figure 1: Asia-Pacific Package Testing Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Package Testing Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 2: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Type of Testing 2020 & 2033

- Table 3: Asia-Pacific Package Testing Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 7: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Type of Testing 2020 & 2033

- Table 8: Asia-Pacific Package Testing Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 9: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 12: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Type of Testing 2020 & 2033

- Table 13: Asia-Pacific Package Testing Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 14: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 17: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Type of Testing 2020 & 2033

- Table 18: Asia-Pacific Package Testing Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 19: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 22: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Type of Testing 2020 & 2033

- Table 23: Asia-Pacific Package Testing Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 24: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Package Testing Industry?

The projected CAGR is approximately 5.25%.

2. Which companies are prominent players in the Asia-Pacific Package Testing Industry?

Key companies in the market include ALS limited, Intertek Group PLC, Cryopak, Nefab Group, Turner Packaging Limited, National Technical Systems, SGS SA, DDL Inc, Advance Packaging, CSZ Testing Services Laboratories.

3. What are the main segments of the Asia-Pacific Package Testing Industry?

The market segments include Primary Material, Type of Testing, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.58 billion as of 2022.

5. What are some drivers contributing to market growth?

Rigorous Control Regulations and Administration and Qualification Demands; Demand for Longer Shelf Life of the Products Under Varying Conditions.

6. What are the notable trends driving market growth?

Plastic Packaging is Expected to Witness Significant Adoption.

7. Are there any restraints impacting market growth?

High Costs of Equipment.

8. Can you provide examples of recent developments in the market?

January 2023 - A further five laboratories, located in Bangladesh, India, Turkey, the United States, and Vietnam, have been approved by The Microfibre Consortium (TMC), extending the scope of SGS's fiber fragmentation testing services to new geographies and industries. When TMC initially approved SGS's labs in Hong Kong, Shanghai, and Taipei City in 2021, SGS became the organization's first third-party laboratory. SGS offers practical solutions for the textile industry to reduce fiber fragmentation and its release into the environment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Package Testing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Package Testing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Package Testing Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Package Testing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence