Key Insights

The Asia Pacific plastic packaging film market is projected for significant growth, driven by escalating consumer demand, rapid industrialization, and the increasing need for product preservation and convenience. With an estimated market size of $6.27 million in 2025, the region is anticipated to experience a Compound Annual Growth Rate (CAGR) of 4.28% through 2033. Key growth drivers include the robust demand for flexible packaging in the food and beverage sector, particularly for confectionery, frozen foods, and dairy. The healthcare sector's requirement for sterile pharmaceutical and medical device packaging, alongside growth in personal and home care, also contributes to market dynamism. The adoption of advanced films such as Polyethylene (PE) and Polypropylene (PP) highlights their versatility, durability, and cost-effectiveness. Emerging trends include the development of bio-based films, reflecting a growing commitment to sustainability.

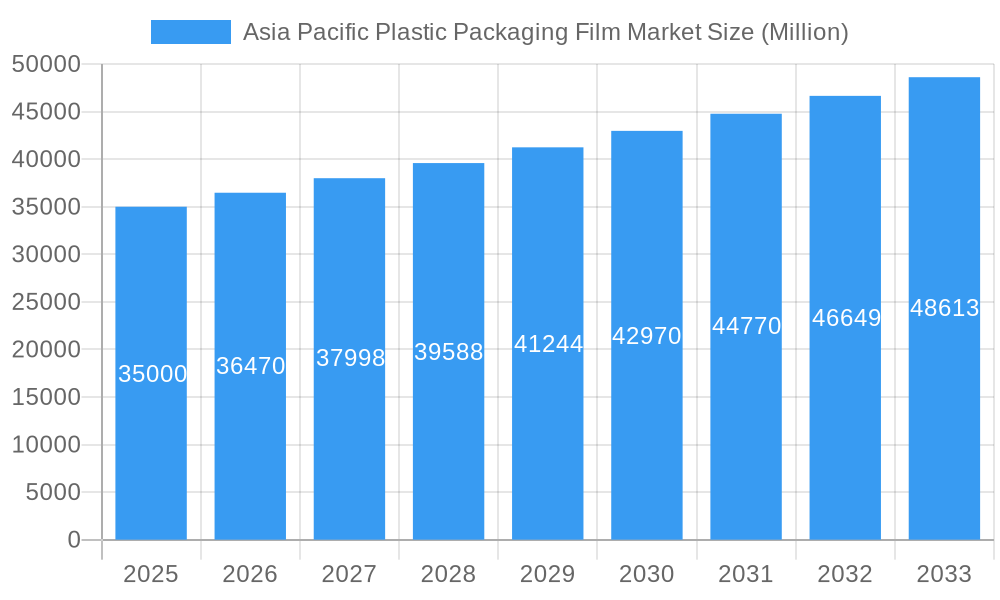

Asia Pacific Plastic Packaging Film Market Market Size (In Million)

The competitive landscape features both established global entities and agile regional manufacturers focusing on innovation and strategic expansion. Prominent companies like Toray Advanced Film Co. Ltd., UFlex Limited, and Toppan Packaging Service Co. Ltd. are investing in R&D for novel film technologies and sustainable solutions. Increased disposable incomes and evolving consumer lifestyles in key Asia Pacific economies like China, India, and Southeast Asian nations are fueling demand for packaged goods. While industrial packaging currently holds a smaller market share, it is expected to grow with the expansion of manufacturing and logistics. Potential challenges include fluctuating raw material prices and evolving regulations on plastic waste management. Despite these, the trend towards sophisticated, functional, and sustainable plastic packaging films indicates sustained economic advancement in the Asia Pacific region.

Asia Pacific Plastic Packaging Film Market Company Market Share

This report provides an in-depth analysis of the Asia Pacific plastic packaging film market, offering critical insights for stakeholders. Covering the historical period from 2019 to 2024 and projecting to 2033 with a base year of 2025, this study details market size, growth drivers, key players, and future trends. The Asia Pacific region is experiencing substantial growth in plastic packaging film demand, propelled by expanding economies, evolving consumer lifestyles, and the increasing applications of flexible packaging across various end-user industries.

Asia Pacific Plastic Packaging Film Market Market Concentration & Innovation

The Asia Pacific plastic packaging film market exhibits a moderately concentrated landscape, with a mix of large multinational corporations and significant regional players. Innovation is a key differentiator, spurred by the demand for enhanced barrier properties, extended shelf life, improved aesthetics, and crucially, sustainable packaging solutions. Key innovation drivers include advancements in polymer science, sophisticated extrusion and co-extrusion technologies, and the development of high-performance films like those incorporating EVOH for superior oxygen barriers. Regulatory frameworks are increasingly influencing product development, pushing for recyclability and the reduction of single-use plastics. Product substitutes, such as paper-based packaging and alternative biodegradable materials, pose a growing challenge, but advancements in plastic film technology are creating new functionalities that maintain their competitive edge. End-user trends, particularly the burgeoning demand for convenience foods and premium personal care products, are shaping the types of films being developed, requiring greater functionality and visual appeal. Mergers and acquisitions (M&A) activity, though not always publicly disclosed with specific deal values, are a consistent strategy for market consolidation and technology acquisition. Companies are strategically acquiring smaller innovators or expanding their geographical reach to capture market share. The market share distribution is dynamic, with leading players continuously vying for dominance through strategic investments in R&D and production capacity.

Asia Pacific Plastic Packaging Film Market Industry Trends & Insights

The Asia Pacific plastic packaging film market is on an upward trajectory, propelled by several synergistic trends that are reshaping its contours. A significant growth driver is the rapid urbanization and expanding middle class across countries like China, India, and Southeast Asian nations, leading to increased consumption of packaged goods. This demographic shift fuels demand for flexible packaging solutions in the food and beverage sector, requiring films that offer extended shelf-life, preservation of freshness, and attractive presentation. The e-commerce boom further amplifies this demand, necessitating robust and protective packaging films for a vast array of products, from electronics to apparel. Technological disruptions are central to market evolution, with a strong emphasis on developing high-performance films such as multilayer structures that combine different polymers to achieve specific barrier properties (e.g., oxygen, moisture, UV light) and mechanical strength. The integration of advanced co-extrusion techniques allows for the creation of films with tailored functionalities, meeting increasingly stringent product protection requirements. Consumer preferences are increasingly leaning towards convenience and sustainability. This translates into a demand for packaging that is lightweight, easy to open, and re-sealable, while simultaneously addressing environmental concerns. The push for circular economy principles is driving innovation in recyclable and compostable plastic films, alongside the exploration of bio-based alternatives. The competitive dynamics are characterized by intense rivalry, with companies investing heavily in R&D to stay ahead of the curve. Strategic partnerships and collaborations, as exemplified by joint development projects, are becoming more prevalent to share risks and accelerate the commercialization of novel solutions. The market penetration of advanced film types is steadily increasing as manufacturers adopt more sophisticated production processes. The Asia Pacific plastic packaging film market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period. The total market size is estimated to reach approximately USD 45,000 Million by 2025, with continued robust growth anticipated through 2033.

Dominant Markets & Segments in Asia Pacific Plastic Packaging Film Market

The Asia Pacific plastic packaging film market's dominance is intricately linked to its demographic and economic prowess, with specific segments exhibiting exceptional growth and market penetration. China stands out as the largest and most dominant market, owing to its vast manufacturing base, substantial consumer market, and significant investments in advanced packaging technologies. India follows closely, driven by its rapidly growing economy, increasing disposable incomes, and a burgeoning food processing industry. The food segment is unequivocally the largest end-user application, accounting for over 50% of the total market share. Within the food sector, dry foods (e.g., snacks, cereals, pasta) and dairy products are major contributors due to their high demand for extended shelf life and moisture protection. Fresh produce packaging is also gaining momentum, with consumers and retailers increasingly opting for films that enhance product visibility and extend freshness.

- Dominant Type Segment: Polyethylene (PE) films, particularly Low-Density Polyethylene (LDPE) and Linear Low-Density Polyethylene (LLDPE), dominate the market due to their versatility, cost-effectiveness, and excellent sealing properties, making them ideal for a wide range of applications. Polypropylene (PP) films, especially biaxially oriented polypropylene (BOPP), are also significant, offering superior clarity, stiffness, and barrier properties for demanding applications like snack packaging.

- Dominant End-User Segment: The Food end-user segment commands the largest market share, driven by the massive population and the increasing consumption of packaged food items. The sub-segments of Dry Foods, Dairy Products, and Candy & Confectionery are particularly strong performers.

- Key Drivers for Dominance:

- Economic Policies: Favorable government policies promoting manufacturing and foreign investment in countries like China and India.

- Infrastructure Development: Enhanced logistics and cold chain infrastructure supporting the distribution of packaged goods.

- Consumer Lifestyles: Rising disposable incomes and a shift towards convenience-oriented lifestyles, increasing demand for packaged food and personal care products.

- Technological Advancements: Continuous innovation in film manufacturing processes and material science leading to improved product performance and functionality.

- Population Growth: A large and growing population base across the region sustains high demand for consumer goods requiring packaging.

The Healthcare sector is emerging as a significant growth area, with a rising demand for sterile, tamper-evident, and high-barrier films for pharmaceutical packaging. Personal Care & Home Care also represents a substantial segment, utilizing films for packaging cosmetics, hygiene products, and detergents, where aesthetics and barrier properties are paramount. The Industrial Packaging segment, while mature, continues to be a steady contributor, particularly for protective films in manufacturing and logistics. The estimated market size for the Food segment is expected to reach approximately USD 25,000 Million by 2025.

Asia Pacific Plastic Packaging Film Market Product Developments

Product developments in the Asia Pacific plastic packaging film market are primarily focused on enhancing sustainability, performance, and functionality. Innovations such as high-barrier multilayer films incorporating recycled content and advanced barrier layers are gaining traction. The development of thinner, yet stronger films is reducing material usage without compromising on protection. Furthermore, the exploration of novel bio-based polymers and compostable films is driven by increasing environmental regulations and consumer demand for eco-friendly packaging. Companies are also investing in films with improved printability and aesthetics to enhance brand appeal on retail shelves. The recent joint development by Shantou Mingca Packaging and ExxonMobil Asia Pacific Research & Development of a cutting-edge shrink film solution based on double-bubble polyethylene (PE) technology, utilizing ultra-low density Exceed XP performance PE, exemplifies this trend. This next-gen polyolefin shrink film (POF) promises superior performance and versatility across diverse applications. The collaborative pilot by TOPPAN, Mitsui Chemicals Tohcello, and Mitsui Chemicals to commercialize technology for horizontally recycling packaging films into fresh, flexible packaging material highlights the industry's commitment to circularity and advanced recycling techniques. These developments are crucial for meeting evolving market demands and regulatory pressures.

Report Scope & Segmentation Analysis

This report meticulously segments the Asia Pacific plastic packaging film market to provide granular insights into specific growth areas and opportunities. The segmentation is based on key parameters:

- Type: The market is analyzed across various film types including Polypropylene (PP), Polyethylene (PE) (further segmented into LDPE, LLDPE, HDPE), Polystyrene (PS), Bio-Based Films, Polyvinyl Chloride (PVC), Ethylene Vinyl Alcohol (EVOH), PETG, and Other Film Types. The Polyethylene segment is anticipated to hold the largest market share, projected at USD 17,000 Million by 2025, due to its widespread applications.

- End User: The analysis covers critical end-user industries such as Food (with detailed sub-segments including Candy & Confectionery, Frozen Foods, Fresh Produce, Dairy Products, Dry Foods, Meat, Poultry, and Seafood, Pet Food, and Other Food Products), Healthcare, Personal Care & Home Care, Industrial Packaging, and Other End-use Industry Applications. The Food segment is projected to be the dominant end-user, estimated at USD 25,000 Million by 2025. Healthcare is expected to exhibit the highest growth rate.

The segmentation allows for a comprehensive understanding of market dynamics, enabling stakeholders to identify high-growth segments and tailor their strategies accordingly.

Key Drivers of Asia Pacific Plastic Packaging Film Market Growth

The growth of the Asia Pacific plastic packaging film market is propelled by a confluence of robust economic, technological, and demographic factors.

- Expanding Middle Class & Urbanization: Rising disposable incomes and increased urbanization across the region lead to a higher demand for packaged consumer goods, especially in the food and beverage and personal care sectors.

- Growth of E-commerce: The surge in online retail necessitates efficient, protective, and often visually appealing packaging solutions, driving demand for plastic films.

- Technological Advancements: Innovations in polymer science and film manufacturing technologies enable the production of high-performance films with enhanced barrier properties, extended shelf-life, and improved sustainability profiles.

- Food Processing Industry Expansion: A growing emphasis on processed and convenience foods, coupled with increasing demand for food safety and preservation, significantly boosts the need for specialized food packaging films.

- Government Initiatives & Investments: Supportive government policies aimed at boosting manufacturing, promoting exports, and encouraging technological adoption further fuel market expansion.

Challenges in the Asia Pacific Plastic Packaging Film Market Sector

Despite its promising growth, the Asia Pacific plastic packaging film market faces several significant challenges that can impact its trajectory.

- Environmental Regulations & Sustainability Pressure: Increasing scrutiny over plastic waste and evolving regulations concerning single-use plastics are pressuring manufacturers to adopt more sustainable alternatives, such as recyclable, biodegradable, or compostable films. This necessitates substantial investment in R&D and new production capabilities.

- Raw Material Price Volatility: The market is susceptible to fluctuations in the prices of petrochemicals, which are the primary raw materials for plastic films. Unpredictable price swings can affect production costs and profit margins.

- Intense Competition & Price Sensitivity: The market is highly competitive, with numerous players vying for market share. This often leads to price wars, especially in less differentiated segments, impacting profitability.

- Infrastructure Gaps: In certain developing regions within Asia Pacific, inadequate cold chain infrastructure and logistics networks can hinder the adoption of advanced packaging solutions that rely on a robust supply chain.

- Consumer Perception & Awareness: Negative consumer perception regarding plastic pollution can influence purchasing decisions, creating a demand for perceived eco-friendly alternatives even if performance or cost is compromised.

Emerging Opportunities in Asia Pacific Plastic Packaging Film Market

The Asia Pacific plastic packaging film market is ripe with emerging opportunities driven by evolving consumer preferences, technological advancements, and a growing focus on sustainability.

- Growth in Sustainable Packaging Solutions: The increasing demand for recyclable, compostable, and bio-based plastic films presents a significant opportunity for manufacturers that invest in these technologies. This includes developing films with higher recycled content and those made from renewable resources.

- Expansion of High-Barrier Film Applications: Advancements in food preservation and extended shelf-life requirements are driving demand for sophisticated high-barrier films, particularly for products requiring protection against oxygen, moisture, and light. This opens avenues in segments like fresh produce and advanced food packaging.

- E-commerce Packaging Innovation: The rapid growth of e-commerce necessitates specialized packaging films that offer superior protection, tamper-evidence, and ease of use, creating opportunities for smart and functional film designs.

- Healthcare Packaging Demand: The expanding healthcare sector, with its stringent requirements for sterile, safe, and protective packaging, offers substantial growth potential for high-performance plastic films.

- Regional Market Penetration: Untapped potential in emerging economies within Southeast Asia and South Asia, coupled with the growing middle class in these regions, presents opportunities for market expansion and increased adoption of plastic packaging films.

Leading Players in the Asia Pacific Plastic Packaging Film Market Market

- Toray Advanced Film Co Ltd

- UFlex Limited

- Toppan Packaging Service Co Ltd

- Kingchuan Packaging

- Cosmo Films Limited

- Berry Global Inc

- Jindal Poly Films

- Innovia Films (CCL Industries Inc )

- Sealed Air Corporation

- Futamura Chemical Co Ltd

- Ecoplast Ltd

- IFC Plastic Co Ltd

- Victory Industries Pty Ltd

- Polyplex (Thailand) Public Company Limited

List Not Exhaustive

Key Developments in Asia Pacific Plastic Packaging Film Market Industry

- March 2024: Shantou Mingca Packaging and ExxonMobil Asia Pacific Research & Development jointly unveiled a cutting-edge shrink film solution based on double-bubble polyethylene (PE) technology. This innovative product, utilizing ultra-low density Exceed XP performance PE, promises superior performance and sustainability across a broad spectrum of applications, from personal care items and electronics to medicines and household goods.

- August 2023: TOPPAN, Mitsui Chemicals Tohcello, and Mitsui Chemicals launched a collaborative pilot to commercialize a technology focused on horizontally recycling packaging films. This initiative aims to test a novel approach of recycling printed biaxially oriented polypropylene (BOPP) film into fresh, flexible packaging material, highlighting a significant step towards circular economy principles in the industry.

Strategic Outlook for Asia Pacific Plastic Packaging Film Market Market

The strategic outlook for the Asia Pacific plastic packaging film market remains exceptionally positive, driven by sustained economic growth, evolving consumer demands, and continuous technological innovation. Key growth catalysts include the burgeoning middle class, rapid urbanization, and the ever-expanding e-commerce sector, all of which significantly amplify the need for efficient and reliable packaging solutions. The industry's proactive approach to sustainability, with increasing investments in recyclable, compostable, and bio-based films, will be crucial for navigating evolving regulatory landscapes and meeting consumer expectations. Furthermore, advancements in high-barrier films and specialized packaging for sectors like healthcare are poised to open new revenue streams. Companies that focus on R&D, embrace sustainable practices, and strategically expand their market presence in high-growth regions will be best positioned to capitalize on the immense future potential of this dynamic market. The market is expected to continue its robust growth trajectory, driven by innovation and a commitment to addressing environmental concerns.

Asia Pacific Plastic Packaging Film Market Segmentation

-

1. Type

- 1.1. Polyprop

- 1.2. Polyethy

- 1.3. Polyethy

- 1.4. Polystyrene

- 1.5. Bio-Based

- 1.6. PVC, EVOH, PETG, and Other Film Types

-

2. End User

-

2.1. Food

- 2.1.1. Candy & Confectionery

- 2.1.2. Frozen Foods

- 2.1.3. Fresh Produce

- 2.1.4. Dairy Products

- 2.1.5. Dry Foods

- 2.1.6. Meat, Poultry, And Seafood

- 2.1.7. Pet Food

- 2.1.8. Other Food Products

- 2.2. Healthcare

- 2.3. Personal Care & Home Care

- 2.4. Industrial Packaging

- 2.5. Other End-use Industry Applications

-

2.1. Food

Asia Pacific Plastic Packaging Film Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Plastic Packaging Film Market Regional Market Share

Geographic Coverage of Asia Pacific Plastic Packaging Film Market

Asia Pacific Plastic Packaging Film Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Demand For Light-Weight and Sustainable Packaging Across Industries; Robust Demand From the Food

- 3.2.2 Beverage and Pharmaceutical Sector Aids Growth

- 3.3. Market Restrains

- 3.3.1 Rising Demand For Light-Weight and Sustainable Packaging Across Industries; Robust Demand From the Food

- 3.3.2 Beverage and Pharmaceutical Sector Aids Growth

- 3.4. Market Trends

- 3.4.1. The Rising Demand for BOPP Films Aids Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Plastic Packaging Film Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Polyprop

- 5.1.2. Polyethy

- 5.1.3. Polyethy

- 5.1.4. Polystyrene

- 5.1.5. Bio-Based

- 5.1.6. PVC, EVOH, PETG, and Other Film Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Food

- 5.2.1.1. Candy & Confectionery

- 5.2.1.2. Frozen Foods

- 5.2.1.3. Fresh Produce

- 5.2.1.4. Dairy Products

- 5.2.1.5. Dry Foods

- 5.2.1.6. Meat, Poultry, And Seafood

- 5.2.1.7. Pet Food

- 5.2.1.8. Other Food Products

- 5.2.2. Healthcare

- 5.2.3. Personal Care & Home Care

- 5.2.4. Industrial Packaging

- 5.2.5. Other End-use Industry Applications

- 5.2.1. Food

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Toray Advanced Film Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 UFlex Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Toppan Packaging Service Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kingchuan Packaging

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cosmo Films Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Berry Global Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jindal Poly Films

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Innovia Films (CCL Industries Inc )

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sealed Air Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Futamura Chemical Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Ecoplast Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 IFC Plastic Co Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Victory Industries Pty Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Polyplex (Thailand) Public Company Limited*List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Toray Advanced Film Co Ltd

List of Figures

- Figure 1: Asia Pacific Plastic Packaging Film Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Plastic Packaging Film Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Plastic Packaging Film Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Asia Pacific Plastic Packaging Film Market Revenue million Forecast, by End User 2020 & 2033

- Table 3: Asia Pacific Plastic Packaging Film Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Asia Pacific Plastic Packaging Film Market Revenue million Forecast, by Type 2020 & 2033

- Table 5: Asia Pacific Plastic Packaging Film Market Revenue million Forecast, by End User 2020 & 2033

- Table 6: Asia Pacific Plastic Packaging Film Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: China Asia Pacific Plastic Packaging Film Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia Pacific Plastic Packaging Film Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia Pacific Plastic Packaging Film Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: India Asia Pacific Plastic Packaging Film Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia Pacific Plastic Packaging Film Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia Pacific Plastic Packaging Film Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia Pacific Plastic Packaging Film Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia Pacific Plastic Packaging Film Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia Pacific Plastic Packaging Film Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia Pacific Plastic Packaging Film Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia Pacific Plastic Packaging Film Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia Pacific Plastic Packaging Film Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Plastic Packaging Film Market?

The projected CAGR is approximately 4.28%.

2. Which companies are prominent players in the Asia Pacific Plastic Packaging Film Market?

Key companies in the market include Toray Advanced Film Co Ltd, UFlex Limited, Toppan Packaging Service Co Ltd, Kingchuan Packaging, Cosmo Films Limited, Berry Global Inc, Jindal Poly Films, Innovia Films (CCL Industries Inc ), Sealed Air Corporation, Futamura Chemical Co Ltd, Ecoplast Ltd, IFC Plastic Co Ltd, Victory Industries Pty Ltd, Polyplex (Thailand) Public Company Limited*List Not Exhaustive.

3. What are the main segments of the Asia Pacific Plastic Packaging Film Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.27 million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand For Light-Weight and Sustainable Packaging Across Industries; Robust Demand From the Food. Beverage and Pharmaceutical Sector Aids Growth.

6. What are the notable trends driving market growth?

The Rising Demand for BOPP Films Aids Market Growth.

7. Are there any restraints impacting market growth?

Rising Demand For Light-Weight and Sustainable Packaging Across Industries; Robust Demand From the Food. Beverage and Pharmaceutical Sector Aids Growth.

8. Can you provide examples of recent developments in the market?

March 2024: Shantou Mingca Packaging, a leading shrink film manufacturer, and ExxonMobil Asia Pacific Research & Development jointly unveiled a cutting-edge shrink film solution. This innovative product, based on double-bubble polyethylene (PE) technology, is expected to revolutionize the market. Utilizing the ultra-low density Exceed XP performance PE, this next-gen polyolefin shrink film (POF) promises superior performance and sustainability. The film is also versatile. The film caters to a broad spectrum of products, ranging from personal care items and electronics to medicines and household goods.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Plastic Packaging Film Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Plastic Packaging Film Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Plastic Packaging Film Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Plastic Packaging Film Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence