Key Insights

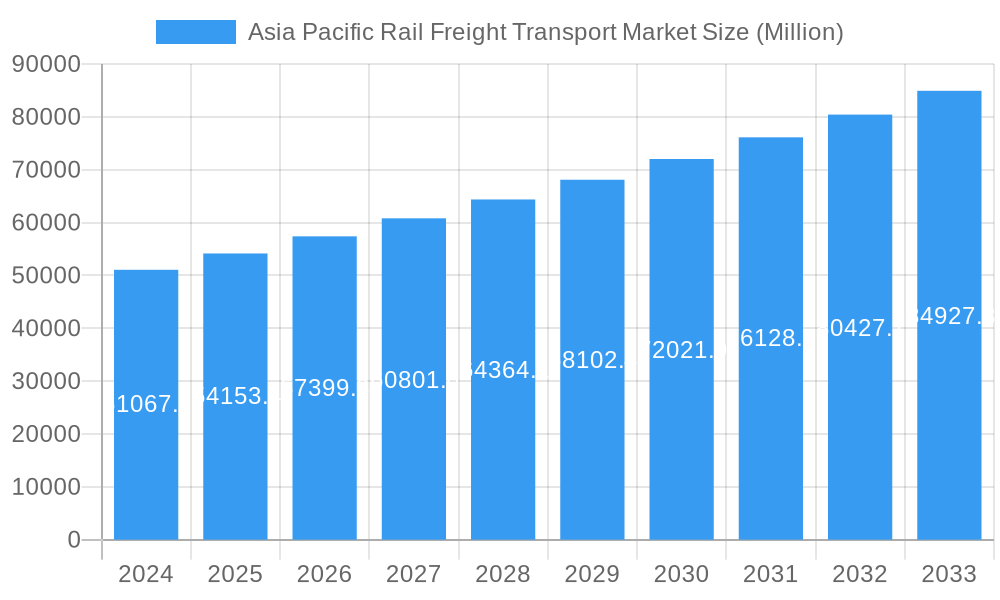

The Asia Pacific Rail Freight Transport Market is projected to experience substantial growth, reaching an estimated market size of USD 51,067.2 million by 2024. This represents a strong Compound Annual Growth Rate (CAGR) of 6.2% from 2025 to 2033. Key growth drivers include the escalating demand for efficient and sustainable logistics, supportive government policies for multimodal transport and infrastructure development, and the rapid expansion of e-commerce, which requires swift goods transit. Containerized freight, integral to intermodal transport, is anticipated to lead market share due to its efficiency and cost-effectiveness for long-distance shipments. Increased industrialization and manufacturing output in the Asia Pacific region directly contribute to higher volumes of raw materials and finished goods requiring rail transport.

Asia Pacific Rail Freight Transport Market Market Size (In Billion)

Dominant market trends involve the integration of advanced technologies such as AI for route optimization, real-time tracking, and smart rail infrastructure development to boost operational efficiency and shorten transit times. Significant investments in expanding rail networks, including high-speed freight lines and enhanced connectivity to ports and industrial centers, are also noteworthy. Market restraints include the substantial initial capital investment for infrastructure and rolling stock upgrades, alongside competition from road and maritime transport, particularly for shorter routes. Regulatory complexities and the need for regional standardization present challenges, although ongoing initiatives aim to simplify these processes. The critical role of rail freight in fostering regional trade and economic development solidifies its upward market trajectory.

Asia Pacific Rail Freight Transport Market Company Market Share

Asia Pacific Rail Freight Transport Market: Comprehensive Growth Analysis & Future Outlook (2019–2033)

Unlock the potential of the rapidly expanding Asia Pacific rail freight transport sector with this in-depth market analysis. Covering the historical period from 2019 to 2024 and projecting future growth through 2033, this report provides actionable insights into market dynamics, key players, technological advancements, and emerging opportunities. Discover the driving forces behind the robust growth of containerized and non-containerized cargo, the increasing demand for liquid bulk transport, and the evolving landscape of domestic and international rail freight. With a focus on critical industry developments, including significant M&A activities and technological upgrades, this report is an indispensable resource for logistics providers, infrastructure developers, government agencies, and investors seeking to navigate and capitalize on the Asia Pacific rail freight transport market.

Asia Pacific Rail Freight Transport Market Market Concentration & Innovation

The Asia Pacific rail freight transport market exhibits a moderate level of concentration, characterized by the presence of dominant state-owned enterprises and a growing number of private players. Innovation is increasingly driven by the need for operational efficiency, sustainability, and enhanced safety. Key innovation drivers include the adoption of advanced train control systems, digital logistics platforms, and the development of specialized rolling stock for diverse cargo types. Regulatory frameworks play a crucial role, with governments in countries like China and India actively investing in rail infrastructure and promoting policies that encourage rail freight. Product substitutes, such as road and sea freight, continue to exert competitive pressure, necessitating continuous improvement in rail freight services. End-user trends highlight a growing preference for cost-effective and environmentally friendly transportation solutions, further fueling innovation. Mergers and acquisitions (M&A) are a significant aspect of market evolution, with strategic deals aimed at expanding geographical reach and consolidating market share. For instance, Aurizon's acquisition of One Rail Australia for USD 2.35 billion in July 2022 exemplifies a major M&A activity aimed at strengthening market position and gaining access to new commodity markets.

Asia Pacific Rail Freight Transport Market Industry Trends & Insights

The Asia Pacific rail freight transport market is experiencing robust growth, propelled by a confluence of economic expansion, increasing inter-regional trade, and a strategic shift towards more sustainable logistics solutions. The projected Compound Annual Growth Rate (CAGR) for this sector is significant, indicating a sustained upward trajectory. Key growth drivers include the rapid industrialization and urbanization across the region, leading to higher demand for the movement of raw materials, intermediate goods, and finished products. Governments are making substantial investments in railway infrastructure development, including the expansion of existing networks and the construction of new high-capacity corridors, further enhancing the efficiency and reach of rail freight services. Technological disruptions are playing a pivotal role, with the integration of Artificial Intelligence (AI), Internet of Things (IoT), and Big Data analytics revolutionizing fleet management, route optimization, and predictive maintenance. This technological advancement not only improves operational efficiency but also enhances the safety and reliability of rail freight operations. Consumer preferences are increasingly leaning towards greener transportation alternatives, making rail freight a more attractive option due to its lower carbon footprint compared to road transport. This shift is further amplified by stricter environmental regulations and growing corporate sustainability initiatives. The competitive dynamics within the market are intensifying, with both established state-owned railway operators and emerging private logistics companies vying for market share. Strategic partnerships, joint ventures, and mergers and acquisitions are becoming common strategies to enhance competitive advantage, expand service offerings, and achieve economies of scale. The increasing adoption of intermodal transport solutions, seamlessly integrating rail with other modes like sea and road, is also a significant trend, offering end-to-end logistics solutions and improving supply chain efficiency across the vast Asia Pacific region. Market penetration is expected to rise as rail freight becomes a more competitive and preferred mode of transport for a wider range of commodities and industries.

Dominant Markets & Segments in Asia Pacific Rail Freight Transport Market

The Asia Pacific rail freight transport market is characterized by distinct regional dominance and segment preferences, driven by a complex interplay of economic policies, infrastructure development, and trade patterns.

Leading Region: China stands as the dominant market, owing to its vast manufacturing base, extensive railway network, and significant government investment in rail infrastructure. The country's Belt and Road Initiative (BRI) has further spurred the development of international rail corridors, connecting China with Central Asia, Europe, and beyond, significantly boosting international rail freight volumes.

Dominant Countries: Beyond China, India is emerging as a major player with ongoing modernization of its vast railway network and dedicated freight corridors aimed at improving efficiency and capacity. Japan and South Korea also contribute significantly due to their advanced industrial economies and sophisticated logistics networks. Southeast Asian nations like Vietnam and Thailand are also witnessing increased investment and focus on rail freight as a means to decongest roadways and enhance trade connectivity.

Dominant Segment - Type of Cargo:

- Containerized (Includes Intermodal): This segment holds significant dominance, driven by the globalized nature of trade and the efficiency of containerized shipping. The ease of intermodal transfer between rail, sea, and road makes containerized freight a preferred choice for a wide range of manufactured goods and consumer products. Economic policies promoting international trade and the growth of e-commerce directly contribute to the expansion of this segment.

- Non-containerized: This segment remains crucial for bulk commodities such as coal, iron ore, agricultural products, and construction materials. The sheer volume of these commodities transported by rail in countries like India and Australia underpins the importance of this segment. Infrastructure development, particularly in mining and resource-rich regions, is a key driver for non-containerized freight.

- Liquid Bulk: While often handled by specialized pipelines or tankers, rail transport of liquid bulk, including petroleum products, chemicals, and edible oils, is substantial in specific industrial corridors. The safety and efficiency of rail for long-haul liquid bulk transport contribute to its continued relevance.

Dominant Segment - Destination:

- Domestic: The sheer scale of domestic consumption and production within large economies like China and India makes domestic rail freight a primary driver of the market. This segment is crucial for connecting inland production centers with major consumption hubs and ports. Government policies focused on internal trade facilitation and infrastructure development within national borders heavily influence this segment's growth.

- International: The increasing integration of regional supply chains and the growth of transcontinental rail services, particularly those facilitated by initiatives like the BRI, are propelling the international rail freight segment. This segment is vital for connecting manufacturing hubs with international markets and for facilitating cross-border trade in raw materials and finished goods.

Asia Pacific Rail Freight Transport Market Product Developments

Product developments in the Asia Pacific rail freight transport market are centered on enhancing efficiency, sustainability, and cargo versatility. Innovations include the development of lightweight, high-strength wagons for increased payload capacity and reduced energy consumption. Advanced braking systems and aerodynamic designs are being implemented to improve safety and operational speed. Furthermore, the integration of smart sensors and real-time tracking technologies into rolling stock and cargo containers provides enhanced visibility and control over shipments. Specialized wagons designed for specific cargo types, such as temperature-controlled containers for perishables or reinforced wagons for heavy industrial equipment, are also a key focus, offering tailored solutions and competitive advantages.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Asia Pacific Rail Freight Transport Market, segmenting it based on key parameters to offer granular insights into market dynamics and future potential. The segmentation covers:

Type of Cargo:

- Containerized (Includes Intermodal): This segment encompasses the movement of goods within standardized shipping containers, often facilitated by intermodal operations. Projections indicate strong growth driven by global trade and e-commerce.

- Non-containerized: This segment includes the transport of bulk commodities such as minerals, agricultural products, and construction materials. Its market size is substantial, with growth influenced by industrial output and resource extraction.

- Liquid Bulk: This segment focuses on the rail transport of liquids like petroleum products and chemicals. Market growth is tied to industrial demand and the availability of specialized infrastructure.

Destination:

- Domestic: This segment analyzes the movement of freight within national borders. Growth is linked to internal economic activity and infrastructure development.

- International: This segment examines cross-border rail freight movements. Its expansion is driven by regional trade agreements and international connectivity initiatives.

Key Drivers of Asia Pacific Rail Freight Transport Market Growth

The Asia Pacific rail freight transport market is propelled by several key drivers. Economic expansion and increasing intra-regional trade are fundamental, leading to higher volumes of goods requiring efficient transportation. Government investments in railway infrastructure, including high-speed rail corridors and dedicated freight lines, are crucial for expanding capacity and improving network efficiency. The growing demand for sustainable logistics solutions is a significant factor, as rail freight offers a lower carbon footprint compared to road transport, aligning with global environmental goals. Technological advancements, such as digitalization, AI-powered logistics, and advanced train control systems, enhance operational efficiency, safety, and reliability. Furthermore, industrial growth and urbanization across the region necessitate robust freight movement to supply raw materials and distribute finished products.

Challenges in the Asia Pacific Rail Freight Transport Market Sector

Despite robust growth, the Asia Pacific rail freight transport sector faces several challenges. High upfront investment costs for infrastructure development and rolling stock modernization remain a significant barrier. Regulatory complexities and varying standards across different countries can hinder seamless cross-border operations and create logistical hurdles. Competition from other modes of transport, particularly road and sea freight, which may offer greater flexibility or lower costs for certain routes or cargo types, continues to exert pressure. Operational inefficiencies and aging infrastructure in some parts of the region can lead to delays and limit capacity. Furthermore, security concerns and the need for advanced tracking and monitoring systems for high-value cargo add to operational complexities and costs.

Emerging Opportunities in Asia Pacific Rail Freight Transport Market

Emerging opportunities in the Asia Pacific rail freight transport market are diverse and promising. The expansion of e-commerce and the demand for faster last-mile delivery solutions present a significant opportunity for integrated rail and road logistics networks. The development of smart freight corridors and digital platforms that enhance real-time visibility, predictive analytics, and automated operations will revolutionize the sector. Growing demand for green logistics and carbon-neutral transportation creates a strong impetus for increased rail freight adoption. Furthermore, cross-border trade initiatives and the expansion of international rail networks, such as those facilitated by the Belt and Road Initiative, offer substantial growth potential for intercontinental freight movement. The increasing focus on supply chain resilience and diversification also positions rail freight as a critical component in robust and adaptable logistics networks.

Leading Players in the Asia Pacific Rail Freight Transport Market Market

- Indian Railways

- KiwiRail Ltd

- OBB-Holding AG

- Pacific National Group

- China State Railway Group Co Ltd

- Qube Holdings Ltd

- Aurizon Holdings Ltd

- Japan Freight Railway Co

- M & W China Limited

- PT Kereta Api Indonesia

Key Developments in Asia Pacific Rail Freight Transport Market Industry

- September 2022: KiwiRail signed a supply and a fifteen-year maintenance contract with Alstom for a significant upgrade to its Train Control System (TCS). This upgrade aims to enhance automation, resiliency, and safety across New Zealand's national rail network, impacting the management of freight, commuter, and scenic trains.

- July 2022: Aurizon completed the acquisition of One Rail Australia (ORA) for USD 2.35 billion. This transformative acquisition aligns with Aurizon's growth strategy, providing expanded scope and scale, new customers, new regions, and greater exposure to emerging commodities like copper, manganese, and rare earth elements.

Strategic Outlook for Asia Pacific Rail Freight Transport Market Market

The strategic outlook for the Asia Pacific rail freight transport market is highly positive, driven by sustained economic growth, increasing trade integration, and a global push towards sustainable logistics. Investments in advanced infrastructure and technology are expected to unlock new efficiencies and expand service offerings, making rail freight a more competitive and preferred choice for a wider range of cargo. The ongoing development of intermodal connectivity and digital logistics platforms will streamline supply chains and enhance end-to-end visibility. As governments and businesses prioritize decarbonization, rail freight's inherent environmental advantages will become an even more significant growth catalyst. Strategic collaborations, mergers, and acquisitions will continue to shape the market landscape, leading to consolidated players with broader capabilities and geographical reach, further solidifying rail freight's pivotal role in the region's economic future.

Asia Pacific Rail Freight Transport Market Segmentation

-

1. Type of Cargo

- 1.1. Containerized (Includes Intermodal)

- 1.2. Non-containerized

- 1.3. Liquid Bulk

-

2. Destination

- 2.1. Domestic

- 2.2. International

Asia Pacific Rail Freight Transport Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Rail Freight Transport Market Regional Market Share

Geographic Coverage of Asia Pacific Rail Freight Transport Market

Asia Pacific Rail Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid E-commerce Growth4.; Development Of Logistics Infrastructure And Connectivity

- 3.3. Market Restrains

- 3.3.1. 4.; Logistics Integration In Last-mile Delivery

- 3.4. Market Trends

- 3.4.1. Investments in New and Existing Rail Systems

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Rail Freight Transport Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Cargo

- 5.1.1. Containerized (Includes Intermodal)

- 5.1.2. Non-containerized

- 5.1.3. Liquid Bulk

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type of Cargo

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Indian Railways

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 KiwiRail Ltd **List Not Exhaustive 7 3 Other Companie

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 OBB-Holding AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Pacific National Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 China State Railway Group Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Qube Holdings Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Aurizon Holdings Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Japan Freight Railway Co

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 M & W China Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PT Kereta Api Indonesia

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Indian Railways

List of Figures

- Figure 1: Asia Pacific Rail Freight Transport Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Rail Freight Transport Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Rail Freight Transport Market Revenue million Forecast, by Type of Cargo 2020 & 2033

- Table 2: Asia Pacific Rail Freight Transport Market Revenue million Forecast, by Destination 2020 & 2033

- Table 3: Asia Pacific Rail Freight Transport Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Asia Pacific Rail Freight Transport Market Revenue million Forecast, by Type of Cargo 2020 & 2033

- Table 5: Asia Pacific Rail Freight Transport Market Revenue million Forecast, by Destination 2020 & 2033

- Table 6: Asia Pacific Rail Freight Transport Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: China Asia Pacific Rail Freight Transport Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia Pacific Rail Freight Transport Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia Pacific Rail Freight Transport Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: India Asia Pacific Rail Freight Transport Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia Pacific Rail Freight Transport Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia Pacific Rail Freight Transport Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia Pacific Rail Freight Transport Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia Pacific Rail Freight Transport Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia Pacific Rail Freight Transport Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia Pacific Rail Freight Transport Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia Pacific Rail Freight Transport Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia Pacific Rail Freight Transport Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Rail Freight Transport Market?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the Asia Pacific Rail Freight Transport Market?

Key companies in the market include Indian Railways, KiwiRail Ltd **List Not Exhaustive 7 3 Other Companie, OBB-Holding AG, Pacific National Group, China State Railway Group Co Ltd, Qube Holdings Ltd, Aurizon Holdings Ltd, Japan Freight Railway Co, M & W China Limited, PT Kereta Api Indonesia.

3. What are the main segments of the Asia Pacific Rail Freight Transport Market?

The market segments include Type of Cargo, Destination.

4. Can you provide details about the market size?

The market size is estimated to be USD 51067.2 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid E-commerce Growth4.; Development Of Logistics Infrastructure And Connectivity.

6. What are the notable trends driving market growth?

Investments in New and Existing Rail Systems.

7. Are there any restraints impacting market growth?

4.; Logistics Integration In Last-mile Delivery.

8. Can you provide examples of recent developments in the market?

September 2022 - KiwiRail has signed a supply contract, supported by a fifteen-year maintenance contract, with French multinational Alstom for a once-in-a-generation upgrade to its Train Control System (TCS). The Train Control team manages the movement of freight, commuter and scenic trains across New Zealand and this new computer control system will provide greater automation, resiliency, and safety across the national rail network

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Rail Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Rail Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Rail Freight Transport Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Rail Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence