Key Insights

The Asia-Pacific Swine Feed Premix Market is set for substantial expansion, projected to reach $114.78 billion by 2025. This growth is underpinned by a projected Compound Annual Growth Rate (CAGR) of 4.5% through 2033. Key drivers include the rising global demand for pork, necessitating high-quality swine feed to enhance animal health, productivity, and meat quality. The adoption of advanced swine farming techniques and intensified operations across the region further fuels demand for scientifically formulated feed premixes. Government initiatives supporting improved animal husbandry and food safety also contribute significantly to market development. The market is segmented by essential ingredients, including antibiotics, vitamins, antioxidants, amino acids, and minerals, vital for optimal swine nutrition. China and India are anticipated to lead this market due to their substantial swine populations and evolving agricultural sectors.

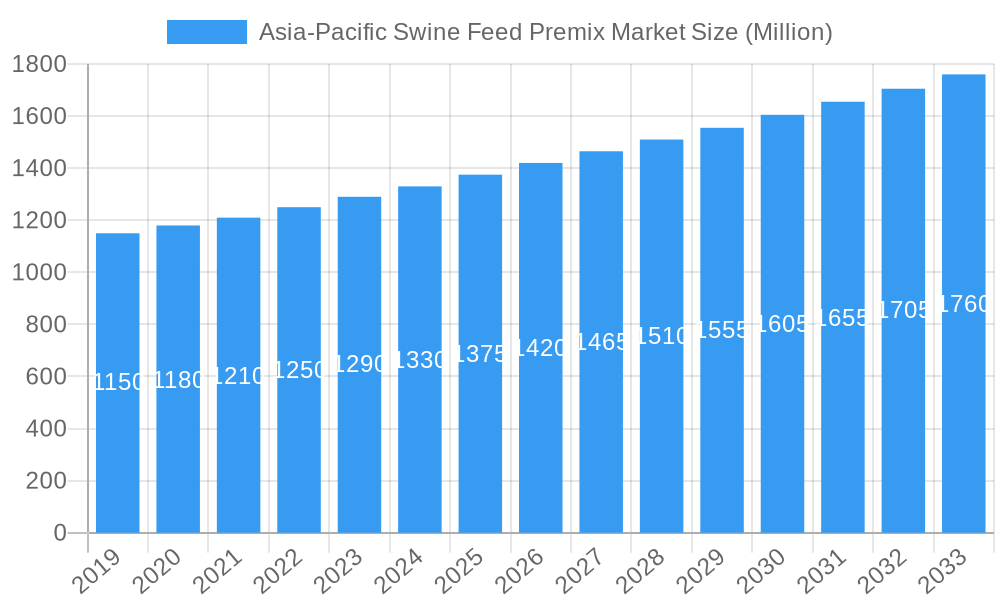

Asia-Pacific Swine Feed Premix Market Market Size (In Billion)

Evolving consumer preferences for healthier, safer meat products are influencing the Asia-Pacific Swine Feed Premix Market, driving demand for premium feed additives. Emerging trends encompass precision nutrition solutions, the development of antibiotic-free premixes to counter antimicrobial resistance concerns, and the incorporation of functional ingredients for gut health and immunity. Challenges include stringent feed additive regulations in select nations and raw material price volatility. Major industry players such as Cargill Incorporated, DSM Animal Nutrition, and BASF SE are actively engaged in research, development, and strategic expansions. These companies are focused on innovation and delivering customized solutions to meet the diverse nutritional requirements of swine throughout their life stages, propelling market advancement.

Asia-Pacific Swine Feed Premix Market Company Market Share

Asia-Pacific Swine Feed Premix Market: Comprehensive Report Description

This in-depth report provides a detailed analysis of the Asia-Pacific Swine Feed Premix Market, offering invaluable insights for industry stakeholders, investors, and strategic planners. Covering the study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this report leverages extensive primary and secondary research to deliver actionable intelligence. The market is segmented by key ingredients and geographic regions, offering a granular view of the competitive landscape and growth opportunities within this vital sector.

Asia-Pacific Swine Feed Premix Market Market Concentration & Innovation

The Asia-Pacific Swine Feed Premix Market is characterized by a moderate level of market concentration, with key players like Cargill Incorporated, DSM Animal Nutrition, Biomin, BASF SE, Alltech Inc, Land O Lakes Inc, Adisseo, and Godrej Agrovet holding significant shares. Innovation is a crucial driver, fueled by increasing demand for high-performance animal nutrition, disease prevention, and sustainable farming practices. Regulatory frameworks across countries like China and India are evolving, influencing product formulations and market access. Substitutes, such as direct feed additives or alternative protein sources, exist but are yet to significantly disrupt the premix market's dominance due to their comprehensive nutritional benefits. End-user trends favor customized premixes addressing specific growth stages, health challenges, and regional dietary needs. Mergers and acquisitions (M&A) activities, with deal values in the range of xx Million, are expected to continue, consolidating market positions and expanding product portfolios. For instance, a hypothetical acquisition in 2023 by a major player for an estimated xx Million could reshape the competitive dynamics in a specific sub-region. The increasing emphasis on feed efficiency and reduced environmental impact further propels innovation in novel ingredient development and delivery systems.

Asia-Pacific Swine Feed Premix Market Industry Trends & Insights

The Asia-Pacific Swine Feed Premix Market is poised for robust growth, driven by a confluence of factors including a rapidly expanding swine population, rising per capita income, and a growing consumer preference for protein-rich diets. The escalating demand for high-quality pork products necessitates improved animal health and productivity, directly benefiting the swine feed premix market. Technological advancements in feed formulation and nutrient delivery systems are enabling the development of more effective and sustainable premixes. The market is witnessing a significant shift towards premixes that enhance gut health, immune function, and reduce the reliance on antibiotics, aligning with global trends towards antimicrobial stewardship. This trend is further amplified by increasing consumer awareness regarding food safety and animal welfare. The projected Compound Annual Growth Rate (CAGR) for the Asia-Pacific Swine Feed Premix Market is estimated to be around xx%, reaching a market size of approximately XXX Million by 2033. Market penetration is high in developed economies like Japan and Australia, while emerging economies such as China and India present substantial untapped potential due to their large agricultural sectors and increasing adoption of modern farming techniques. Competitive dynamics are intensifying, with established global players vying for market share against emerging regional manufacturers, fostering innovation and price competitiveness. The growing adoption of precision nutrition and digital farming solutions is also influencing product development, leading to data-driven premix formulations tailored to specific farm conditions and genetic lines.

Dominant Markets & Segments in Asia-Pacific Swine Feed Premix Market

China stands out as the dominant market within the Asia-Pacific Swine Feed Premix landscape, driven by its massive swine population and significant contribution to global pork production. The country's economic policies, which increasingly focus on food security and agricultural modernization, have a direct impact on the demand for high-quality swine feed premixes. Government initiatives promoting the adoption of advanced animal husbandry practices further bolster this dominance. In terms of ingredients, Amino Acids are projected to hold a substantial market share, reflecting the industry's focus on optimizing growth rates and feed conversion ratios. The demand for essential amino acids like lysine and methionine is consistently high, driven by the need for balanced diets that support rapid swine development. Vitamins also represent a significant segment, crucial for maintaining optimal health, immune response, and reproductive performance in swine.

- China: Its sheer scale of swine farming, coupled with increasing investments in improving herd health and productivity, makes it the undisputed leader. Government regulations supporting feed safety and the move away from antibiotic growth promoters are further driving the demand for specialized premixes.

- India: With a rapidly growing population and an expanding middle class, India presents a substantial growth opportunity. The government's focus on boosting agricultural output and improving livestock productivity is creating a favorable environment for the swine feed premix market.

- Japan & Australia: These developed markets, while smaller in volume, are characterized by a high adoption rate of premium and specialized feed premixes, focusing on animal welfare, sustainability, and niche market demands.

- Rest of Asia-Pacific: This diverse region includes countries like Vietnam, Thailand, and Indonesia, which are witnessing increasing investments in modern pig farming, offering considerable untapped potential for market expansion.

The Amino Acids segment’s dominance is further supported by technological advancements in their production, leading to improved purity and bioavailability. This ensures that swine receive optimal nutrition, leading to enhanced growth and reduced feed costs. The trend towards antibiotic-free pork production is also indirectly boosting the demand for amino acid-rich premixes, as they contribute to overall animal health and resilience.

Asia-Pacific Swine Feed Premix Market Product Developments

Product innovations in the Asia-Pacific Swine Feed Premix Market are increasingly focused on gut health solutions, enhanced immunity, and sustainable nutrition. Manufacturers are developing premixes incorporating probiotics, prebiotics, and organic acids to improve gut microbiota and nutrient absorption. Competitive advantages are being achieved through the development of highly bioavailable mineral and vitamin formulations, leading to better feed efficiency and reduced excretion. The trend towards antibiotic-free production is spurring innovation in natural growth promoters and immunomodulatory compounds.

Report Scope & Segmentation Analysis

This report meticulously segments the Asia-Pacific Swine Feed Premix Market across critical dimensions. The Ingredients segmentation includes Antibiotics, Vitamins, Antioxidants, Amino Acids, Minerals, and Other Ingredients, each analyzed for their market size and growth projections. The Geography segmentation covers China, India, Japan, Australia, and the Rest of Asia-Pacific. Growth projections for each segment range from xx% to xx% CAGR, with current market sizes estimated between XXX Million and XXX Million for 2025. Competitive dynamics within each segment vary, with China and Amino Acids exhibiting the most significant market influence.

Key Drivers of Asia-Pacific Swine Feed Premix Market Growth

The growth of the Asia-Pacific Swine Feed Premix Market is propelled by several key drivers. Firstly, the escalating global demand for protein, particularly pork, is a primary catalyst. Secondly, increasing disposable incomes across Asia-Pacific nations are fueling higher consumption of meat products. Thirdly, advancements in animal nutrition science are leading to the development of more effective and specialized premixes that enhance swine health and productivity. Fourthly, growing awareness regarding food safety and the desire for antibiotic-free meat products are pushing the demand for natural and health-promoting premixes. Finally, supportive government policies and investments in the agricultural sector across the region are fostering market expansion.

Challenges in the Asia-Pacific Swine Feed Premix Market Sector

Despite the strong growth outlook, the Asia-Pacific Swine Feed Premix Market faces several challenges. Stringent and diverse regulatory frameworks across different countries can hinder market entry and product approvals. Fluctuations in raw material prices, such as vitamins and amino acids, can impact profit margins and pricing strategies. Intense competition from both established global players and emerging local manufacturers exerts downward pressure on prices. Supply chain disruptions, exacerbated by geopolitical factors or natural disasters, can affect the availability and cost of essential premix components. Furthermore, the transition towards antibiotic-free production requires significant investment in research and development of alternative solutions, posing a challenge for smaller market participants.

Emerging Opportunities in Asia-Pacific Swine Feed Premix Market

Emerging opportunities in the Asia-Pacific Swine Feed Premix Market are abundant and diverse. The growing demand for premium and niche pork products, such as organic or free-range pork, presents opportunities for specialized premixes. The increasing adoption of precision nutrition and digital farming technologies allows for the development of highly customized premixes tailored to specific farm conditions and genetic profiles. Furthermore, the expansion of swine farming in Southeast Asian countries, beyond the major markets, offers significant untapped potential. The development of sustainable and eco-friendly premixes, utilizing by-products or novel ingredients, also aligns with growing environmental consciousness.

Leading Players in the Asia-Pacific Swine Feed Premix Market Market

Cargill Incorporated DSM Animal Nutrition Biomin BASF SE Alltech Inc Land O Lakes Inc Adisseo Godrej Agrovet

Key Developments in Asia-Pacific Swine Feed Premix Market Industry

- 2023/08: DSM Animal Nutrition launched a new range of gut health solutions for piglets, focusing on reducing antibiotic reliance.

- 2023/05: BASF SE announced a strategic partnership to enhance the production of essential amino acids in Southeast Asia.

- 2023/02: Alltech Inc invested in research for novel feed additives to improve swine immune response.

- 2022/11: Biomin introduced a new mycotoxin management program for swine farms in China.

- 2022/07: Cargill Incorporated expanded its animal nutrition facilities in India to cater to the growing demand.

Strategic Outlook for Asia-Pacific Swine Feed Premix Market Market

The strategic outlook for the Asia-Pacific Swine Feed Premix Market is exceptionally positive, driven by a confluence of sustained demand for pork, advancements in animal nutrition, and increasing farmer focus on health and sustainability. Key growth catalysts include the ongoing trend towards antibiotic-free pork production, which necessitates advanced premix solutions for immune and gut health. The rapid adoption of precision feeding technologies will further fuel demand for customized and data-driven premixes. Manufacturers are advised to focus on innovation in areas like natural growth promoters, functional ingredients, and sustainable sourcing to capture market share. Strategic partnerships and targeted M&A activities will be crucial for expanding geographical reach and product portfolios, especially in rapidly developing markets like India and other parts of Southeast Asia.

Asia-Pacific Swine Feed Premix Market Segmentation

-

1. Ingredients

- 1.1. Antibiotics

- 1.2. Vitamins

- 1.3. Antioxidants

- 1.4. Amino Acids

- 1.5. Minerals

- 1.6. Other Ingredients

-

2. Geography

- 2.1. China

- 2.2. India

- 2.3. Japan

- 2.4. Australia

- 2.5. Rest of Asia-Pacific

Asia-Pacific Swine Feed Premix Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Australia

- 5. Rest of Asia Pacific

Asia-Pacific Swine Feed Premix Market Regional Market Share

Geographic Coverage of Asia-Pacific Swine Feed Premix Market

Asia-Pacific Swine Feed Premix Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Demand for Quality Pork Meat

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Swine Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ingredients

- 5.1.1. Antibiotics

- 5.1.2. Vitamins

- 5.1.3. Antioxidants

- 5.1.4. Amino Acids

- 5.1.5. Minerals

- 5.1.6. Other Ingredients

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. India

- 5.2.3. Japan

- 5.2.4. Australia

- 5.2.5. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. Australia

- 5.3.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Ingredients

- 6. China Asia-Pacific Swine Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Ingredients

- 6.1.1. Antibiotics

- 6.1.2. Vitamins

- 6.1.3. Antioxidants

- 6.1.4. Amino Acids

- 6.1.5. Minerals

- 6.1.6. Other Ingredients

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. India

- 6.2.3. Japan

- 6.2.4. Australia

- 6.2.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Ingredients

- 7. India Asia-Pacific Swine Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Ingredients

- 7.1.1. Antibiotics

- 7.1.2. Vitamins

- 7.1.3. Antioxidants

- 7.1.4. Amino Acids

- 7.1.5. Minerals

- 7.1.6. Other Ingredients

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. India

- 7.2.3. Japan

- 7.2.4. Australia

- 7.2.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Ingredients

- 8. Japan Asia-Pacific Swine Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Ingredients

- 8.1.1. Antibiotics

- 8.1.2. Vitamins

- 8.1.3. Antioxidants

- 8.1.4. Amino Acids

- 8.1.5. Minerals

- 8.1.6. Other Ingredients

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. India

- 8.2.3. Japan

- 8.2.4. Australia

- 8.2.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Ingredients

- 9. Australia Asia-Pacific Swine Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Ingredients

- 9.1.1. Antibiotics

- 9.1.2. Vitamins

- 9.1.3. Antioxidants

- 9.1.4. Amino Acids

- 9.1.5. Minerals

- 9.1.6. Other Ingredients

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. India

- 9.2.3. Japan

- 9.2.4. Australia

- 9.2.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Ingredients

- 10. Rest of Asia Pacific Asia-Pacific Swine Feed Premix Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Ingredients

- 10.1.1. Antibiotics

- 10.1.2. Vitamins

- 10.1.3. Antioxidants

- 10.1.4. Amino Acids

- 10.1.5. Minerals

- 10.1.6. Other Ingredients

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. India

- 10.2.3. Japan

- 10.2.4. Australia

- 10.2.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Ingredients

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Cargill Incorporated

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DSM Animal Nutrition

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Biomin

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BASF SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Alltech Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Land O Lakes Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Adisseo

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Godrej Agrovet

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Cargill Incorporated

List of Figures

- Figure 1: Asia-Pacific Swine Feed Premix Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Swine Feed Premix Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Swine Feed Premix Market Revenue billion Forecast, by Ingredients 2020 & 2033

- Table 2: Asia-Pacific Swine Feed Premix Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: Asia-Pacific Swine Feed Premix Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Asia-Pacific Swine Feed Premix Market Revenue billion Forecast, by Ingredients 2020 & 2033

- Table 5: Asia-Pacific Swine Feed Premix Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific Swine Feed Premix Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Asia-Pacific Swine Feed Premix Market Revenue billion Forecast, by Ingredients 2020 & 2033

- Table 8: Asia-Pacific Swine Feed Premix Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: Asia-Pacific Swine Feed Premix Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Asia-Pacific Swine Feed Premix Market Revenue billion Forecast, by Ingredients 2020 & 2033

- Table 11: Asia-Pacific Swine Feed Premix Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Swine Feed Premix Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Swine Feed Premix Market Revenue billion Forecast, by Ingredients 2020 & 2033

- Table 14: Asia-Pacific Swine Feed Premix Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Swine Feed Premix Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Swine Feed Premix Market Revenue billion Forecast, by Ingredients 2020 & 2033

- Table 17: Asia-Pacific Swine Feed Premix Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Asia-Pacific Swine Feed Premix Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Swine Feed Premix Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the Asia-Pacific Swine Feed Premix Market?

Key companies in the market include Cargill Incorporated, DSM Animal Nutrition, Biomin, BASF SE, Alltech Inc, Land O Lakes Inc, Adisseo, Godrej Agrovet.

3. What are the main segments of the Asia-Pacific Swine Feed Premix Market?

The market segments include Ingredients, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 114.78 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Rising Demand for Quality Pork Meat.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Swine Feed Premix Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Swine Feed Premix Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Swine Feed Premix Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Swine Feed Premix Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence