Key Insights

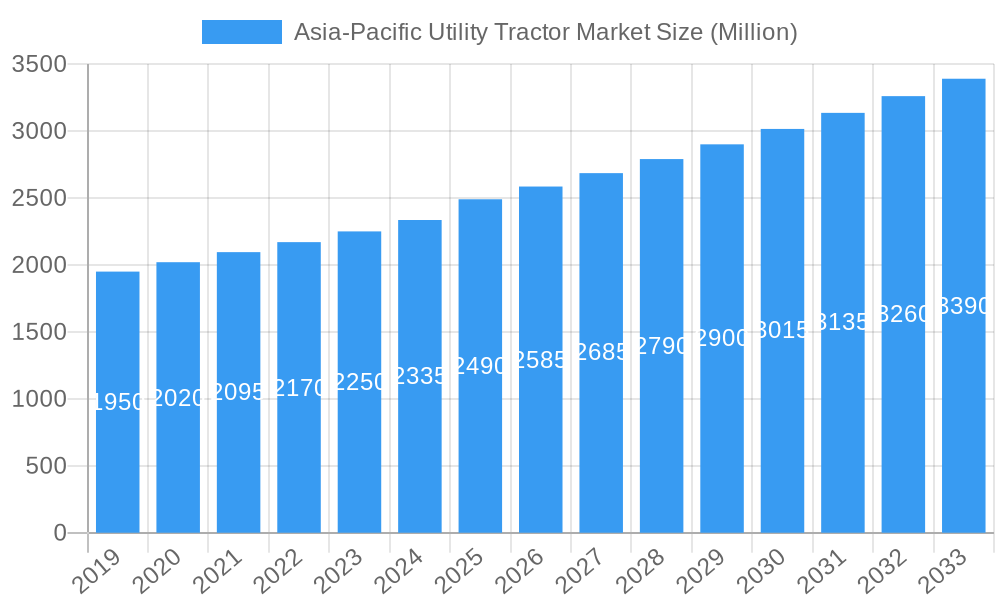

The Asia-Pacific utility tractor market is poised for significant expansion, projected to reach a USD 2.49 billion by 2025, with a steady Compound Annual Growth Rate (CAGR) of 3.9% expected to persist through 2033. This robust growth is primarily fueled by the increasing adoption of modern agricultural practices across the region, driven by a growing population that necessitates enhanced food production and improved farming efficiencies. Government initiatives supporting agricultural mechanization, coupled with rising farmer incomes and greater access to credit, are further accelerating the demand for utility tractors. The region's large agricultural base, particularly in countries like China and India, remains a cornerstone of this market. Technological advancements, including the integration of GPS technology, smart farming solutions, and more fuel-efficient engine designs, are also playing a crucial role in driving market penetration and farmer interest.

Asia-Pacific Utility Tractor Market Market Size (In Billion)

Key drivers for this market include the ongoing need for increased agricultural productivity to meet the demands of a burgeoning population and the government’s focus on modernizing the agricultural sector through subsidies and policy support. The trend towards smaller, more maneuverable tractors for diverse farming needs, especially in regions with smaller landholdings, is also a significant factor. While the market is experiencing strong growth, it is not without its challenges. High initial costs of advanced machinery can be a restraining factor for smallholder farmers, and the availability of skilled labor for maintenance and operation of sophisticated equipment needs to be addressed. Despite these hurdles, the long-term outlook for the Asia-Pacific utility tractor market remains highly positive, with continuous innovation and increasing awareness of the benefits of mechanization expected to sustain its upward trajectory.

Asia-Pacific Utility Tractor Market Company Market Share

This in-depth report provides a definitive analysis of the Asia-Pacific Utility Tractor Market, covering historical trends, current dynamics, and future projections from 2019 to 2033. With a base year of 2025, the report delves into production, consumption, import/export analysis, and price trends, offering actionable insights for stakeholders seeking to capitalize on this dynamic market. Key players like Kuhn Group, CNH Global NV, AGCO Corp, Escorts Limited, Massey Ferguson, Deere & Company, International Tractors Limited, Mahindra & Mahindra Ltd, Claas KGaA mbH, Kubota Agricultural Machinery, and Yanmar Co Ltd are thoroughly examined.

Asia-Pacific Utility Tractor Market Market Concentration & Innovation

The Asia-Pacific Utility Tractor Market exhibits a moderate to high market concentration, with a few dominant global manufacturers holding significant market share alongside a growing number of regional players. Innovation drivers are multifaceted, encompassing advancements in precision agriculture technologies such as GPS-guided systems, IoT integration for fleet management, and the development of more fuel-efficient and emission-compliant engines. Regulatory frameworks, particularly those promoting sustainable farming practices and mechanization, are increasingly influencing product development and market entry. Product substitutes, while limited for core utility tractor functions, are emerging in the form of specialized compact machinery and robotic solutions for specific agricultural tasks. End-user trends indicate a rising demand for versatile, multi-functional utility tractors capable of handling a diverse range of agricultural operations, from tilling and planting to harvesting and material handling. Mergers and acquisitions (M&A) activities are expected to continue, driven by the pursuit of market expansion, technological acquisition, and economies of scale. Significant M&A deal values, projected to reach billions of dollars over the forecast period, will reshape the competitive landscape.

Asia-Pacific Utility Tractor Market Industry Trends & Insights

The Asia-Pacific Utility Tractor Market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 6.2% from 2025 to 2033. This growth is underpinned by several key trends. Increasing adoption of advanced farming techniques and the drive towards agricultural modernization are primary growth catalysts. Governments across the region are actively promoting mechanization through subsidies and policy support, recognizing its critical role in enhancing food security and farm productivity. The rising disposable income of farmers, coupled with a growing awareness of the economic benefits of efficient machinery, is fueling demand for utility tractors. Technological disruptions, including the integration of AI, IoT, and telematics, are transforming utility tractors into smart farming solutions. These advancements enable real-time data analysis for optimized field operations, predictive maintenance, and reduced operational costs, thereby increasing market penetration of high-tech models. Consumer preferences are shifting towards tractors that offer greater fuel efficiency, reduced environmental impact, enhanced operator comfort, and advanced safety features. The competitive landscape is characterized by intense rivalry among established global players and agile regional manufacturers, who are increasingly focusing on developing cost-effective and locally relevant solutions. The market penetration of electric and hybrid utility tractors is also a nascent but growing trend, driven by sustainability initiatives and evolving environmental regulations. The economic resilience of the agricultural sector, even amidst global economic fluctuations, ensures a steady demand for essential farm equipment like utility tractors.

Dominant Markets & Segments in Asia-Pacific Utility Tractor Market

The Asia-Pacific region is the dominant force in the global utility tractor market, driven by its vast agricultural landmass and the critical importance of agriculture to its economies.

- Production Analysis: China and India lead the production of utility tractors, benefiting from large manufacturing bases, established supply chains, and supportive government policies aimed at boosting domestic agricultural machinery production. Production volume is expected to reach over xx million units by 2025, with continued growth driven by increasing domestic demand and export opportunities. Key drivers include government incentives for local manufacturing, availability of skilled labor, and a robust ecosystem of component suppliers.

- Consumption Analysis: India is the largest consumer of utility tractors in the Asia-Pacific region, followed closely by China. The sheer size of the agricultural sector, the prevalence of small and medium-sized farms, and the ongoing push for mechanization are the primary drivers of high consumption. The consumption value is projected to exceed $xx billion in 2025. End-user preference for versatile and affordable tractors remains paramount.

- Import Market Analysis (Value & Volume): While production is high, certain countries like Australia, New Zealand, and some Southeast Asian nations, which have specialized agricultural needs or smaller domestic manufacturing capabilities, represent significant import markets. The import market value is estimated to be around $xx billion in 2025. These markets often seek technologically advanced tractors that enhance efficiency and sustainability.

- Export Market Analysis (Value & Volume): China and India are not only major producers but also significant exporters of utility tractors, catering to markets in Southeast Asia, Africa, and parts of the Middle East. The export market value is anticipated to reach $xx billion in 2025. Competitive pricing and the availability of a wide range of models contribute to their export success.

- Price Trend Analysis: The price trend for utility tractors in Asia-Pacific is influenced by a combination of factors. While the overall trend is upward due to inflation, technological advancements, and rising raw material costs, the market also experiences price sensitivity. The dominance of the 20-60 HP segment, which is more affordable, influences overall price averages. However, the growing demand for higher horsepower, feature-rich tractors is pushing price points upwards in specific segments. The base year 2025 will see a varied price range, with entry-level models averaging around $5,000-$15,000 and advanced models exceeding $50,000.

Asia-Pacific Utility Tractor Market Product Developments

Recent product developments in the Asia-Pacific utility tractor market are focused on enhancing efficiency, sustainability, and operator convenience. Manufacturers are introducing tractors with improved fuel efficiency, lower emissions, and enhanced hydraulic systems for greater versatility. Innovations include the integration of precision agriculture technologies such as GPS guidance, automated steering, and telematics for remote monitoring and diagnostics. Compact utility tractors designed for smaller farms and specialized applications are gaining traction, offering maneuverability and cost-effectiveness. Furthermore, there is a growing emphasis on ergonomic cabin designs and user-friendly interfaces, improving the operator experience and reducing fatigue. These developments aim to meet the evolving needs of farmers for adaptable, technologically advanced, and environmentally conscious machinery, providing a competitive advantage.

Report Scope & Segmentation Analysis

This report offers a comprehensive segmentation of the Asia-Pacific Utility Tractor Market, encompassing Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis. Within Production Analysis, key segments include horsepower ranges (e.g., <20 HP, 20-60 HP, >60 HP) and powertrain types (diesel, electric, hybrid). Consumption Analysis is segmented by end-user industries (agriculture, construction, forestry) and farm size. Import and Export Market Analysis delves into regional trade flows and key product categories. Price Trend Analysis examines price dynamics across various horsepower segments and technological features. Growth projections and market sizes will be detailed for each segment, with competitive dynamics elucidated for the forecast period (2025-2033).

Key Drivers of Asia-Pacific Utility Tractor Market Growth

The growth of the Asia-Pacific Utility Tractor Market is propelled by several key drivers. Increasing government initiatives promoting agricultural mechanization and modernization, through subsidies and favorable policies, are paramount. The rising global demand for food security necessitates higher agricultural output, directly boosting the need for efficient farm machinery. Technological advancements in precision agriculture, automation, and IoT integration are creating demand for advanced utility tractors that offer improved productivity and reduced operational costs. Furthermore, the growing disposable income of farmers and a better understanding of the long-term economic benefits of mechanization are significant drivers.

Challenges in the Asia-Pacific Utility Tractor Market Sector

Despite robust growth prospects, the Asia-Pacific Utility Tractor Market faces several challenges. High initial investment costs for advanced utility tractors can be a barrier for smallholder farmers. Limited access to finance and credit facilities in some developing economies further exacerbates this issue. Inadequate rural infrastructure, including poor road networks and limited access to spare parts and servicing, can hinder efficient operation and maintenance. Stringent emission regulations in some countries require significant investment in R&D and compliance, potentially increasing manufacturing costs. Finally, intense competition from low-cost alternatives and the presence of a large unorganized sector in certain markets present ongoing competitive pressures.

Emerging Opportunities in Asia-Pacific Utility Tractor Market

Emerging opportunities in the Asia-Pacific Utility Tractor Market are numerous. The increasing focus on sustainable and organic farming practices presents opportunities for developing eco-friendly and precision farming-oriented tractors. The growth of the compact and sub-compact tractor segment catering to diverse agricultural needs and smaller landholdings offers significant market potential. Emergence of smart farming solutions and connected agriculture technologies will drive demand for telematics-enabled tractors. Furthermore, the expansion of agricultural activities in emerging economies within Southeast Asia and the Pacific Islands presents new avenues for market penetration. The development of electric and hybrid utility tractors aligns with global sustainability trends and growing environmental awareness.

Leading Players in the Asia-Pacific Utility Tractor Market Market

- Kuhn Group

- CNH Global NV

- AGCO Corp

- Escorts Limited

- Massey Ferguson

- Deere & Company

- International Tractors Limited

- Mahindra & Mahindra Ltd

- Claas KGaA mbH

- Kubota Agricultural Machinery

- Yanmar Co Ltd

Key Developments in Asia-Pacific Utility Tractor Market Industry

- 2024: Launch of new series of compact utility tractors with advanced fuel efficiency by Mahindra & Mahindra Ltd, targeting the smallholder farmer segment.

- 2023: AGCO Corp announces strategic partnerships to enhance its dealership network and after-sales service in Vietnam and Thailand.

- 2023: Deere & Company expands its precision agriculture offerings in India with the introduction of new GPS guidance systems for utility tractors.

- 2022: CNH Global NV invests in R&D for electric tractor prototypes, aiming for a sustainable future in agricultural mechanization.

- 2022: Kubota Agricultural Machinery focuses on expanding its presence in the Indonesian market with localized product offerings and service support.

- 2021: Escorts Limited reports significant growth in its tractor division, driven by strong domestic demand and export to neighboring countries.

- 2020: Yanmar Co Ltd introduces a range of versatile utility tractors equipped with advanced safety features for enhanced operator well-being.

Strategic Outlook for Asia-Pacific Utility Tractor Market Market

The strategic outlook for the Asia-Pacific Utility Tractor Market remains highly positive, driven by the region's critical role in global food production and ongoing agricultural modernization. Key growth catalysts include continued government support for mechanization, increasing adoption of smart farming technologies, and a rising demand for efficient and sustainable agricultural practices. Manufacturers are advised to focus on developing a diverse portfolio of utility tractors, ranging from affordable, entry-level models to technologically advanced, high-horsepower machines, to cater to the varied needs of the market. Strategic investments in R&D for electric and hybrid powertrains, along with the integration of digital solutions, will be crucial for long-term competitiveness. Expansion into emerging economies and strengthening distribution and service networks will be vital for capturing market share and ensuring customer satisfaction.

Asia-Pacific Utility Tractor Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Asia-Pacific Utility Tractor Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Utility Tractor Market Regional Market Share

Geographic Coverage of Asia-Pacific Utility Tractor Market

Asia-Pacific Utility Tractor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shortage of Skilled Labor; Government Support to Enhance Farm Mechanization

- 3.3. Market Restrains

- 3.3.1. Heavy Initial Procurement Cost and High Expenditure on Maintenance

- 3.4. Market Trends

- 3.4.1. Increasing Cost of Farm Labour

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Utility Tractor Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kuhn Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CNH Global NV

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AGCO Cor

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Escorts Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Massey Ferguson

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Deere & Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 International Tractors Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mahindra & Mahindra Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Claas KGaA mbH

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kubota Agricultural Machinery

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Yanmar Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Kuhn Group

List of Figures

- Figure 1: Asia-Pacific Utility Tractor Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Utility Tractor Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Utility Tractor Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Asia-Pacific Utility Tractor Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Asia-Pacific Utility Tractor Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Asia-Pacific Utility Tractor Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Asia-Pacific Utility Tractor Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Asia-Pacific Utility Tractor Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Utility Tractor Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: Asia-Pacific Utility Tractor Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Asia-Pacific Utility Tractor Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Asia-Pacific Utility Tractor Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Asia-Pacific Utility Tractor Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Asia-Pacific Utility Tractor Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: China Asia-Pacific Utility Tractor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Japan Asia-Pacific Utility Tractor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: South Korea Asia-Pacific Utility Tractor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: India Asia-Pacific Utility Tractor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Australia Asia-Pacific Utility Tractor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: New Zealand Asia-Pacific Utility Tractor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Indonesia Asia-Pacific Utility Tractor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Malaysia Asia-Pacific Utility Tractor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Singapore Asia-Pacific Utility Tractor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Thailand Asia-Pacific Utility Tractor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Vietnam Asia-Pacific Utility Tractor Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Philippines Asia-Pacific Utility Tractor Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Utility Tractor Market?

The projected CAGR is approximately 3.9%.

2. Which companies are prominent players in the Asia-Pacific Utility Tractor Market?

Key companies in the market include Kuhn Group, CNH Global NV, AGCO Cor, Escorts Limited, Massey Ferguson, Deere & Company, International Tractors Limited, Mahindra & Mahindra Ltd, Claas KGaA mbH, Kubota Agricultural Machinery, Yanmar Co Ltd.

3. What are the main segments of the Asia-Pacific Utility Tractor Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Shortage of Skilled Labor; Government Support to Enhance Farm Mechanization.

6. What are the notable trends driving market growth?

Increasing Cost of Farm Labour.

7. Are there any restraints impacting market growth?

Heavy Initial Procurement Cost and High Expenditure on Maintenance.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Utility Tractor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Utility Tractor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Utility Tractor Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Utility Tractor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence