Key Insights

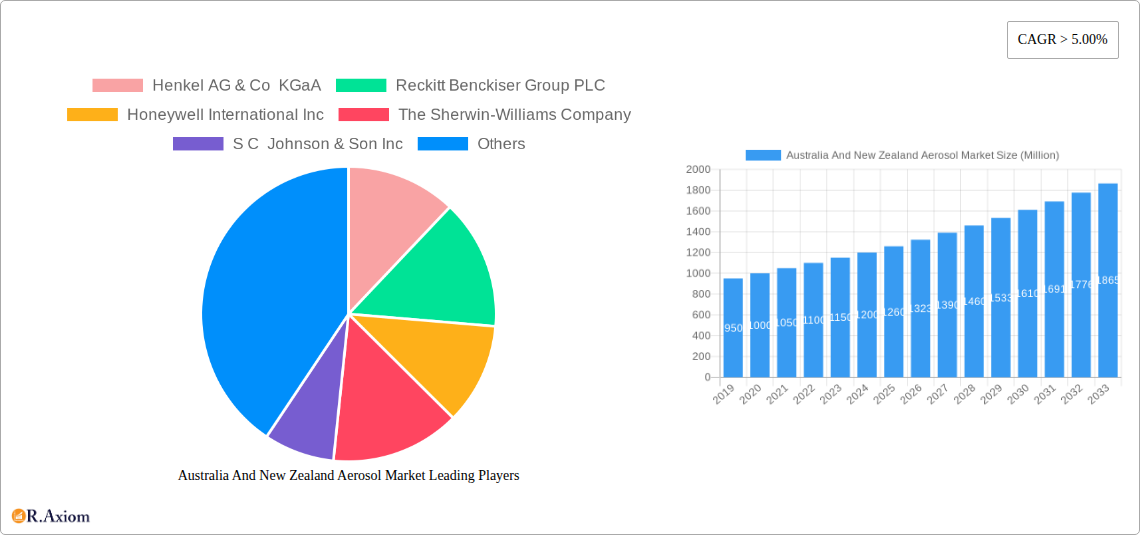

The Australia and New Zealand aerosol market is projected for robust growth, estimated at over 1.20 million units in value, with a compelling CAGR exceeding 5.00%. This sustained expansion is primarily fueled by increasing consumer demand across diverse applications, notably in automotive care, personal grooming, and household products. The convenience and efficacy of aerosol packaging continue to drive adoption, particularly among a younger demographic seeking efficient solutions. Within the materials segment, steel and aluminium remain dominant due to their cost-effectiveness and recyclability, though emerging material innovations are also being explored. Key growth drivers include escalating disposable incomes, a growing awareness of hygiene and personal care products, and the expanding e-commerce landscape, which facilitates wider product accessibility across both nations. The industrial and technical segment also presents significant opportunities, with advancements in specialized aerosol formulations for manufacturing and maintenance.

Australia And New Zealand Aerosol Market Market Size (In Million)

The market landscape is characterized by a competitive environment featuring established global players alongside agile local manufacturers. Restraints such as increasing environmental regulations and the growing preference for alternative packaging solutions are being addressed through innovation in propellants and container design, focusing on sustainability and reduced environmental impact. Key trends involve the development of eco-friendly aerosols, the integration of smart packaging features, and a focus on premium and niche product offerings. Geographically, while both Australia and New Zealand represent distinct markets, their consumer preferences and regulatory frameworks often exhibit convergence, creating synergistic opportunities for market penetration. The forecast period anticipates a steady upward trajectory, with ongoing product innovation and strategic market plays by leading companies like Henkel, Reckitt Benckiser, and S.C. Johnson to capture a larger share of this dynamic sector.

Australia And New Zealand Aerosol Market Company Market Share

The Australia and New Zealand aerosol market exhibits a moderate to high concentration, with a few dominant players like Henkel AG & Co KGaA, Reckitt Benckiser Group PLC, and S C Johnson & Son Inc. holding significant market share. Innovation in this sector is primarily driven by the demand for sustainable and eco-friendly solutions, particularly in personal care and household products. Regulatory frameworks, such as those concerning VOC emissions and product safety, are crucial in shaping product development. For instance, the shift towards ozone-friendly propellants is a key innovation driver. Product substitutes, like pumps and sticks, pose a competitive challenge, especially in the deodorant and antiperspirant segments, pushing aerosol manufacturers to enhance their product offerings. End-user trends are increasingly favoring convenience, efficacy, and natural ingredients, leading to the development of advanced aerosol formulations. Mergers and acquisitions (M&A) activities are observed, though specific deal values are often confidential. Companies are strategically acquiring smaller players or investing in new technologies to expand their market reach and product portfolios. The estimated market share of key players is dynamic, with ongoing R&D efforts and strategic partnerships aiming to capture a larger portion of the market.

- Innovation Drivers: Sustainability, Eco-friendly propellants, Natural ingredients, Enhanced product efficacy, Consumer convenience.

- Regulatory Impact: VOC emission standards, Product safety regulations, Ozone layer protection initiatives.

- Competitive Landscape: Dominance of multinational corporations, Strategic M&A activities, Growing presence of niche manufacturers.

Australia And New Zealand Aerosol Market Industry Trends & Insights

The Australia and New Zealand aerosol market is poised for significant growth, driven by a confluence of evolving consumer preferences, technological advancements, and expanding application areas. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.5% during the forecast period of 2025-2033. This robust growth trajectory is underpinned by several key trends. Firstly, increasing disposable incomes and a burgeoning middle class in both Australia and New Zealand are fueling demand for premium personal care products, including shaving creams, hairsprays, and deodorants, which are predominantly packaged in aerosol cans. The convenience and effectiveness offered by aerosol formulations continue to be highly valued by consumers.

Technological disruptions are playing a pivotal role in reshaping the industry. Manufacturers are investing heavily in R&D to develop more sustainable aerosol solutions, including the use of environmentally friendly propellants and recyclable packaging materials. The adoption of advanced filling technologies and precision spray mechanisms is also enhancing product performance and user experience. Furthermore, the integration of smart packaging solutions, offering features like dosage control and product authentication, is an emerging trend that could further differentiate products in the market.

Consumer preferences are shifting towards natural, organic, and ethically sourced products. This trend is compelling aerosol manufacturers to reformulate their products and explore novel ingredients. The growing awareness about environmental impact is also driving demand for aerosols with reduced carbon footprints and those made from recycled materials. The personal care segment, in particular, is witnessing a surge in demand for natural deodorants and hair styling products in aerosol format.

Competitive dynamics in the Australia and New Zealand aerosol market are intense. Leading global players such as Henkel AG & Co KGaA, Reckitt Benckiser Group PLC, and S C Johnson & Son Inc. are vying for market share through product innovation, strategic partnerships, and aggressive marketing campaigns. Local players like Chemz Limited and MMP Industrial are carving out niches by focusing on specific industrial applications or offering customized solutions. The increasing market penetration of e-commerce platforms is also changing the distribution landscape, enabling wider reach for both established brands and emerging players. The market penetration of aerosol products across various applications is steadily increasing, indicating a strong consumer acceptance and a broad range of utility.

Dominant Markets & Segments in Australia And New Zealand Aerosol Market

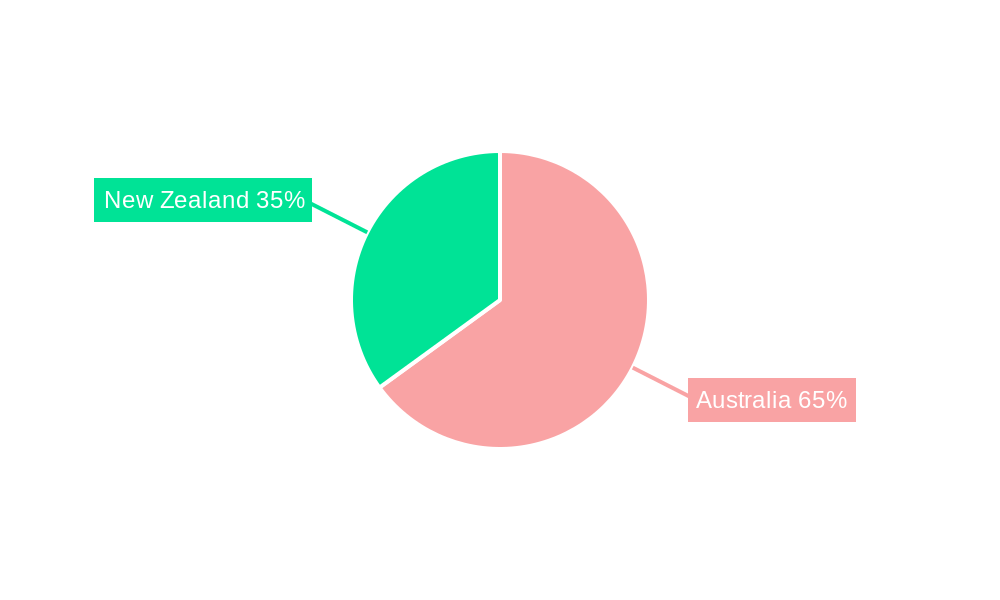

The Australia and New Zealand aerosol market is characterized by the strong dominance of Australia as the larger economy and consumer base. Within Australia, the metropolitan regions, driven by higher population density and disposable incomes, represent the most significant consumption hubs for aerosol products. New Zealand, while smaller, exhibits a steady demand, particularly in sectors influenced by its agricultural and tourism industries.

In terms of Material, Steel aerosols hold a dominant position due to their cost-effectiveness, durability, and suitability for a wide range of products. Aluminium aerosols are gaining traction, especially in the premium personal care segment, owing to their lighter weight and perceived aesthetic appeal. However, their higher cost can be a limiting factor. Other materials, such as composite cans, are emerging as niche solutions for specific applications, driven by innovation and sustainability concerns.

The Application segmentation reveals the pervasive influence of Personal Care products in the Australian and New Zealand aerosol market. This segment includes a broad array of items such as deodorants, antiperspirants, hair sprays, shaving foams, and dry shampoos, all of which benefit from the convenience and controlled dispensing offered by aerosols. Household Products, encompassing insecticides, air fresheners, and cleaning agents, also represent a substantial segment, driven by the need for efficient and targeted application.

The Paint and Coatings segment is another major contributor, with aerosols providing convenient and portable solutions for DIY enthusiasts and professional painters for touch-ups, primers, and specialty finishes. The Automotive sector utilizes aerosols for products like car care sprays, lubricants, and tire inflators, benefiting from their ease of use and on-the-go application capabilities.

The Industrial and Technical segment, while perhaps less visible to the average consumer, is crucial for the market. It includes lubricants, degreasers, mold releases, and other specialized industrial sprays. The Food Products segment, although smaller in volume compared to others, is significant for specific applications like cooking sprays and whipped cream, where hygiene and controlled dispensing are paramount. Medical applications, such as metered-dose inhalers and topical sprays, are highly regulated but represent a growing area for specialized aerosol technologies.

- Key Drivers for Australia's Dominance: Higher population, Strong economic performance, Advanced retail infrastructure, High consumer spending power.

- Key Drivers for Steel Aerosols: Cost-effectiveness, Wide availability, Durability, Versatility across applications.

- Key Drivers for Personal Care Dominance: Consumer demand for convenience, Product efficacy, Variety of formulations, Strong brand presence.

- Key Drivers for Household Products: Need for effective pest control, Home hygiene, Air freshening solutions, Ease of use.

Australia And New Zealand Aerosol Market Product Developments

The Australia and New Zealand aerosol market is witnessing continuous product innovation driven by consumer demand for convenience, efficacy, and sustainability. Companies are focusing on developing eco-friendly formulations, utilizing propellants with lower environmental impact, and enhancing the recyclability of aerosol cans. Product developments include advanced spray technologies for better dispersion and control, natural ingredient-based personal care products, and specialized industrial aerosols with improved performance characteristics. The integration of unique scents and textures in personal care aerosols, along with the introduction of multi-functional products in the household segment, are also key trends enhancing competitive advantages and market fit.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Australia and New Zealand aerosol market, covering material, application, and geographical segments. The Material segmentation includes Steel, Aluminium, and Other Materials, offering insights into their market share and growth projections based on demand trends and manufacturing capabilities. The Application segmentation is extensive, encompassing Automotive, Personal Care, Food Products, Herbicide, Household Products, Insecticide, Industrial and Technical, Medical, Paint and Coatings, and Other Applications, detailing the market size, growth drivers, and competitive dynamics within each. Geographically, the report focuses on Australia and New Zealand, providing country-specific market data, consumer behavior analysis, and regulatory landscapes that influence the aerosol industry.

- Material Segmentation: Analysis of market share and growth for Steel, Aluminium, and Other Materials, focusing on material innovation and sustainability.

- Application Segmentation: Detailed breakdown of market size and trends across Automotive, Personal Care, Food Products, Herbicide, Household Products, Insecticide, Industrial and Technical, Medical, Paint and Coatings, and Other Applications.

- Geographical Segmentation: In-depth analysis of the Australian and New Zealand aerosol markets, including country-specific economic factors and consumer preferences.

Key Drivers of Australia And New Zealand Aerosol Market Growth

The growth of the Australia and New Zealand aerosol market is propelled by several key factors. Increasing consumer demand for convenience and ease of use across various product categories, particularly in personal care and household items, is a primary driver. Technological advancements in aerosol technology, leading to more efficient and sustainable product formulations, are also contributing significantly. The expanding applications in industrial and automotive sectors, coupled with the growing popularity of DIY painting and maintenance, further fuel market expansion. Furthermore, favorable economic conditions and rising disposable incomes in both countries support the purchasing power for aerosol products.

- Consumer Convenience: Aerosols offer user-friendly dispensing for everyday products.

- Technological Advancements: Innovations in propellants and valve systems enhance product performance and sustainability.

- Expanding Applications: Growing use in industrial, automotive, and DIY sectors.

- Economic Factors: Rising disposable incomes and consumer spending power.

Challenges in the Australia And New Zealand Aerosol Market Sector

Despite robust growth, the Australia and New Zealand aerosol market faces several challenges. Stringent environmental regulations concerning volatile organic compound (VOC) emissions and the disposal of aerosol cans can increase manufacturing costs and necessitate product reformulation. Fluctuations in raw material prices, particularly for metals like steel and aluminium, can impact profit margins. The increasing availability and adoption of alternative dispensing technologies, such as pumps and sticks, pose a competitive threat, especially in segments like deodorants. Supply chain disruptions, global logistics issues, and the need for specialized filling and packaging infrastructure also present ongoing challenges for market players.

- Regulatory Hurdles: Compliance with environmental and safety standards.

- Raw Material Price Volatility: Fluctuations in steel, aluminium, and propellant costs.

- Competition from Alternatives: Rise of non-aerosol dispensing systems.

- Supply Chain Complexities: Global logistics and infrastructure demands.

Emerging Opportunities in Australia And New Zealand Aerosol Market

The Australia and New Zealand aerosol market presents several emerging opportunities. The growing consumer preference for natural and sustainable products is driving innovation in eco-friendly aerosol formulations and packaging. The expansion of the e-commerce channel provides a significant opportunity for broader market reach and direct-to-consumer sales. Furthermore, the increasing demand for specialized industrial aerosols and automotive care products in these developed economies offers niche growth avenues. The development of smart aerosol packaging with features like dosage tracking and enhanced safety also presents a significant technological opportunity.

- Sustainable Aerosols: Demand for eco-friendly propellants and recyclable packaging.

- E-commerce Expansion: Increased reach and direct consumer engagement.

- Niche Industrial Applications: Growth in specialized industrial and automotive sprays.

- Smart Packaging: Innovations in connected and intelligent aerosol containers.

Leading Players in the Australia And New Zealand Aerosol Market Market

- Henkel AG & Co KGaA

- Reckitt Benckiser Group PLC

- Honeywell International Inc

- The Sherwin-Williams Company

- S C Johnson & Son Inc

- BASF

- Akzo Nobel NV

- PPG Industries Inc

- Colep Consumer Products

- Damar

- Liquid Engineering NZ

- Chemz Limited

- Unilever

- MMP Industrial

- Aerosolve

Key Developments in Australia And New Zealand Aerosol Market Industry

- September 2022: Unilever launched its new certified natural aerosol deodorant brand, Schmidt's, in its first campaign in Australia and New Zealand. The brand's ozone-friendly aerosol products were announced just weeks after Unilever ANZ earned its B Corp status, making it one of the largest companies to win the Purpose Driven Business award.

- July 2022: Jamestrong Packaging announced an investment of USD 6 million to expand its aerosol can production facility in Taree, New South Wales, to meet the increased demand for its products.

Strategic Outlook for Australia And New Zealand Aerosol Market Market

The strategic outlook for the Australia and New Zealand aerosol market remains positive, driven by a continued focus on product innovation, sustainability, and expanding applications. Companies are expected to invest further in developing eco-friendly aerosol technologies and recyclable packaging solutions to align with evolving consumer and regulatory demands. The growth of e-commerce will offer new avenues for market penetration and direct consumer engagement. Furthermore, the increasing adoption of aerosols in industrial, automotive, and niche medical applications presents substantial growth catalysts. Strategic collaborations and potential M&A activities will likely shape the competitive landscape, enabling players to enhance their product portfolios and market reach, ensuring sustained market potential and opportunities for growth in the coming years.

Australia And New Zealand Aerosol Market Segmentation

-

1. Material

- 1.1. Steel

- 1.2. Aluminium

- 1.3. Other Materials

-

2. Application

- 2.1. Automotive

- 2.2. Personal Care

- 2.3. Food Products

- 2.4. Herbicide

- 2.5. Household Products

- 2.6. Insecticide

- 2.7. Industrial and Technical

- 2.8. Medical

- 2.9. Paint and Coatings

- 2.10. Other Applications

-

3. Geography

- 3.1. Australia

- 3.2. New Zealand

Australia And New Zealand Aerosol Market Segmentation By Geography

- 1. Australia

- 2. New Zealand

Australia And New Zealand Aerosol Market Regional Market Share

Geographic Coverage of Australia And New Zealand Aerosol Market

Australia And New Zealand Aerosol Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Aerosol Cans from the Paint and Coatings Industry; Increasing Awareness of Hygiene and Personal Care

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations Related to Use of Aerosol

- 3.4. Market Trends

- 3.4.1. Increasing Awareness Regarding Hygiene and Personal Care

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia And New Zealand Aerosol Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Steel

- 5.1.2. Aluminium

- 5.1.3. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Automotive

- 5.2.2. Personal Care

- 5.2.3. Food Products

- 5.2.4. Herbicide

- 5.2.5. Household Products

- 5.2.6. Insecticide

- 5.2.7. Industrial and Technical

- 5.2.8. Medical

- 5.2.9. Paint and Coatings

- 5.2.10. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Australia

- 5.3.2. New Zealand

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Australia

- 5.4.2. New Zealand

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Australia Australia And New Zealand Aerosol Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Steel

- 6.1.2. Aluminium

- 6.1.3. Other Materials

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Automotive

- 6.2.2. Personal Care

- 6.2.3. Food Products

- 6.2.4. Herbicide

- 6.2.5. Household Products

- 6.2.6. Insecticide

- 6.2.7. Industrial and Technical

- 6.2.8. Medical

- 6.2.9. Paint and Coatings

- 6.2.10. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Australia

- 6.3.2. New Zealand

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. New Zealand Australia And New Zealand Aerosol Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Steel

- 7.1.2. Aluminium

- 7.1.3. Other Materials

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Automotive

- 7.2.2. Personal Care

- 7.2.3. Food Products

- 7.2.4. Herbicide

- 7.2.5. Household Products

- 7.2.6. Insecticide

- 7.2.7. Industrial and Technical

- 7.2.8. Medical

- 7.2.9. Paint and Coatings

- 7.2.10. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Australia

- 7.3.2. New Zealand

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 Henkel AG & Co KGaA

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Reckitt Benckiser Group PLC

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Honeywell International Inc

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 The Sherwin-Williams Company

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 S C Johnson & Son Inc

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 BASF

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Akzo Nobel NV

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 PPG Industries Inc

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Colep Consumer Products

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 Damar

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.11 Liquid Engineering NZ

- 8.2.11.1. Overview

- 8.2.11.2. Products

- 8.2.11.3. SWOT Analysis

- 8.2.11.4. Recent Developments

- 8.2.11.5. Financials (Based on Availability)

- 8.2.12 Chemz Limited

- 8.2.12.1. Overview

- 8.2.12.2. Products

- 8.2.12.3. SWOT Analysis

- 8.2.12.4. Recent Developments

- 8.2.12.5. Financials (Based on Availability)

- 8.2.13 Unilever*List Not Exhaustive

- 8.2.13.1. Overview

- 8.2.13.2. Products

- 8.2.13.3. SWOT Analysis

- 8.2.13.4. Recent Developments

- 8.2.13.5. Financials (Based on Availability)

- 8.2.14 MMP Industrial

- 8.2.14.1. Overview

- 8.2.14.2. Products

- 8.2.14.3. SWOT Analysis

- 8.2.14.4. Recent Developments

- 8.2.14.5. Financials (Based on Availability)

- 8.2.15 Aerosolve

- 8.2.15.1. Overview

- 8.2.15.2. Products

- 8.2.15.3. SWOT Analysis

- 8.2.15.4. Recent Developments

- 8.2.15.5. Financials (Based on Availability)

- 8.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: Australia And New Zealand Aerosol Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia And New Zealand Aerosol Market Share (%) by Company 2025

List of Tables

- Table 1: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Material 2020 & 2033

- Table 6: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Material 2020 & 2033

- Table 10: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia And New Zealand Aerosol Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Australia And New Zealand Aerosol Market?

Key companies in the market include Henkel AG & Co KGaA, Reckitt Benckiser Group PLC, Honeywell International Inc, The Sherwin-Williams Company, S C Johnson & Son Inc, BASF, Akzo Nobel NV, PPG Industries Inc, Colep Consumer Products, Damar, Liquid Engineering NZ, Chemz Limited, Unilever*List Not Exhaustive, MMP Industrial, Aerosolve.

3. What are the main segments of the Australia And New Zealand Aerosol Market?

The market segments include Material, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Aerosol Cans from the Paint and Coatings Industry; Increasing Awareness of Hygiene and Personal Care.

6. What are the notable trends driving market growth?

Increasing Awareness Regarding Hygiene and Personal Care.

7. Are there any restraints impacting market growth?

Stringent Regulations Related to Use of Aerosol.

8. Can you provide examples of recent developments in the market?

September 2022: Unilever launched its new certified natural aerosol deodorant brand, Schmidt's, in its first campaign in Australia and New Zealand. The brand's ozone-friendly aerosol products were announced just weeks after Unilever ANZ earned its B Corp status, making it one of the largest companies to win the Purpose Driven Business award.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia And New Zealand Aerosol Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia And New Zealand Aerosol Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia And New Zealand Aerosol Market?

To stay informed about further developments, trends, and reports in the Australia And New Zealand Aerosol Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence