Key Insights

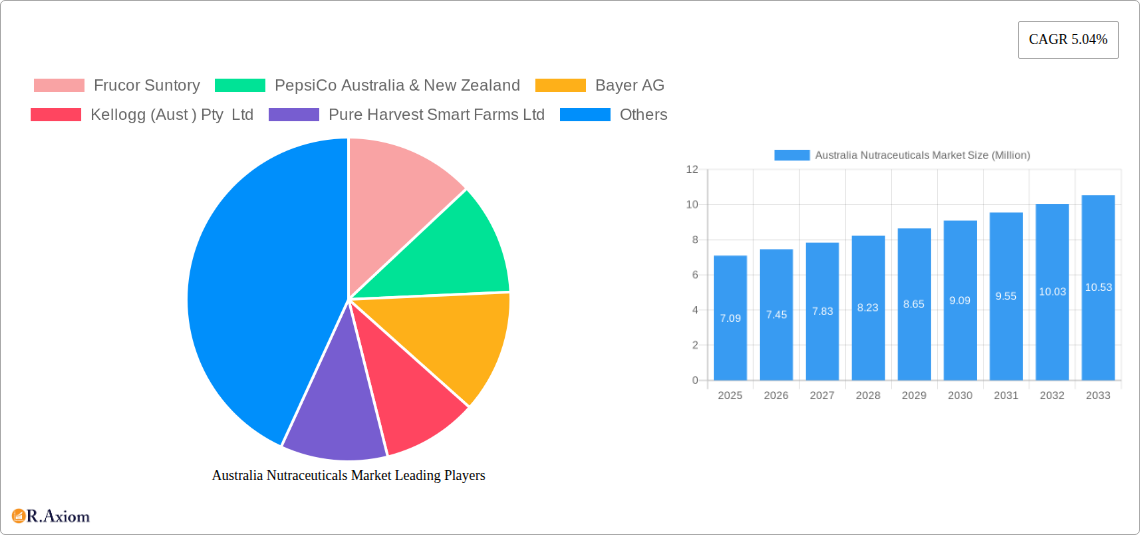

The Australian nutraceuticals market is poised for robust growth, projected to reach approximately AUD 7.09 million in 2025 with a Compound Annual Growth Rate (CAGR) of 5.04% through to 2033. This expansion is fueled by a confluence of factors, primarily the increasing consumer awareness regarding preventative healthcare and the tangible benefits of functional foods and beverages in maintaining overall well-being. As Australians become more proactive about their health, there's a discernible shift towards incorporating nutraceuticals into daily diets to bolster immunity, manage chronic conditions, and enhance physical and mental performance. The rising prevalence of lifestyle-related diseases also acts as a significant catalyst, driving demand for products that offer therapeutic advantages beyond basic nutrition. Furthermore, evolving dietary trends, including a growing preference for plant-based alternatives and clean-label products, are shaping product innovation and market offerings, aligning with the growing demand for natural and sustainable health solutions.

Australia Nutraceuticals Market Market Size (In Million)

The market's segmentation reveals a dynamic landscape across product types, distribution channels, and key players. Functional foods, encompassing cereals, bakery and confectionery, dairy, and snacks, are expected to witness steady demand, complemented by the burgeoning functional beverage segment, which includes energy drinks, sports drinks, fortified juices, and dairy alternatives. Dietary supplements, a cornerstone of the nutraceutical industry, will continue to be a major revenue driver, with vitamins, minerals, botanicals, and proteins leading the charge. The distribution channel analysis indicates a strong and growing preference for online retail stores, reflecting broader e-commerce trends, while specialty stores, supermarkets, and pharmacies will remain crucial for accessibility. Major companies like PepsiCo Australia & New Zealand, Bayer AG, Kellogg, and Nestle Australia are actively investing in product development and market penetration, intensifying competition and driving innovation within this expanding Australian nutraceuticals sector.

Australia Nutraceuticals Market Company Market Share

This in-depth report provides a detailed examination of the Australia Nutraceuticals Market, offering critical insights into its current landscape, key trends, dominant segments, and future trajectory. Encompassing a comprehensive study period from 2019 to 2033, with a base year of 2025, this report leverages a wealth of data to project a robust CAGR of approximately 7.5% during the forecast period of 2025–2033. We delve into the dynamic interplay of market concentration, innovation, regulatory frameworks, and evolving consumer preferences that are shaping this rapidly expanding sector. From functional foods and beverages to dietary supplements and cutting-edge product developments, this report equips industry stakeholders with actionable intelligence to navigate the competitive Australian nutraceuticals market.

Australia Nutraceuticals Market Market Concentration & Innovation

The Australia Nutraceuticals Market exhibits a moderately concentrated landscape, characterized by the presence of both large multinational corporations and agile local players. Innovation remains a primary driver, fueled by a growing consumer demand for scientifically backed health and wellness solutions. Key innovation areas include the development of novel delivery systems for supplements, the creation of plant-based functional foods and beverages, and the integration of personalized nutrition approaches. The regulatory framework, overseen by bodies such as Food Standards Australia New Zealand (FSANZ), plays a crucial role in ensuring product safety and efficacy, influencing product development and market entry strategies. While product substitutes exist in the broader food and beverage market, the specific health benefits offered by nutraceuticals create a distinct market segment. End-user trends strongly favor products that support immune health, gut health, mental well-being, and energy levels. Merger and acquisition (M&A) activities, though not extensively documented with specific deal values publicly available for all transactions, are indicative of a market seeking to consolidate expertise, expand product portfolios, and gain market share. For instance, strategic partnerships and smaller-scale acquisitions are anticipated to be prevalent as companies aim to enhance their R&D capabilities and distribution networks. The market share distribution is dynamic, with major players holding significant portions, but niche markets offer substantial growth potential for specialized products.

Australia Nutraceuticals Market Industry Trends & Insights

The Australia Nutraceuticals Market is experiencing a significant surge in growth, driven by a confluence of powerful trends that underscore a profound shift in consumer priorities towards proactive health management and disease prevention. This evolving consumer mindset, amplified by increased health awareness and a desire for preventative healthcare solutions, has propelled the demand for nutraceutical products across all categories. The market penetration of nutraceuticals is steadily increasing, with consumers actively seeking products that offer tangible health benefits beyond basic nutrition. Technological advancements are playing a pivotal role, enabling the development of more bioavailable supplements, innovative functional food formulations, and sophisticated delivery mechanisms. For example, advancements in encapsulation technologies enhance the efficacy and stability of active ingredients, leading to premium product offerings.

The CAGR for the Australia Nutraceuticals Market is projected to be approximately 7.5% from 2025 to 2033, a testament to the sector's robust expansion. This growth is intrinsically linked to an increasing consumer willingness to invest in health and wellness, viewing nutraceuticals as an integral part of their lifestyle. The rise of personalized nutrition, empowered by advancements in genetic testing and AI-driven dietary recommendations, is creating new avenues for tailored supplement and functional food solutions, further stimulating market growth.

Competitive dynamics are intensifying, with established players expanding their product lines and new entrants leveraging niche market opportunities. Companies are increasingly focusing on transparent sourcing, natural ingredients, and scientifically validated claims to build consumer trust and differentiate themselves in a crowded marketplace. The influence of social media and health influencers also plays a significant role in shaping consumer perceptions and driving product adoption. Furthermore, the aging Australian population, coupled with a growing prevalence of lifestyle-related chronic diseases, is creating a sustained demand for nutraceuticals that address specific health concerns such as cardiovascular health, joint support, and cognitive function. This demographic shift, alongside a growing emphasis on mental well-being and stress management, is expected to continue fueling market expansion.

Dominant Markets & Segments in Australia Nutraceuticals Market

The Australia Nutraceuticals Market is characterized by strong performance across several key segments, with Dietary Supplements emerging as a dominant force. This segment, valued at an estimated XX Million in 2025, is further subdivided into crucial categories, each contributing significantly to the overall market’s expansion.

- Vitamins: This sub-segment, projected to reach approximately XX Million by 2025, consistently leads due to widespread consumer recognition and demand for essential nutrient supplementation.

- Minerals: Valued at around XX Million in 2025, minerals are another cornerstone of the dietary supplement market, addressing deficiencies and supporting various bodily functions.

- Botanicals: With a market size estimated at XX Million in 2025, botanicals are witnessing robust growth driven by consumer interest in natural remedies and traditional health practices. Key economic policies supporting the growth of the natural health sector, coupled with expanding scientific research into plant-based compounds, are significant drivers.

- Proteins: The protein supplement sub-segment, projected to be valued at approximately XX Million in 2025, is boosted by the fitness and sports nutrition trends.

Functional Beverages represent another significant and rapidly growing segment, expected to reach XX Million by 2025. Within this category, specific sub-segments are demonstrating exceptional momentum:

- Energy Drinks: This sub-segment, estimated at XX Million in 2025, continues to be a major contributor, driven by demand for quick energy boosts and improved performance.

- Sports Drinks: Valued at approximately XX Million in 2025, sports drinks are benefiting from increased participation in physical activities and a growing understanding of electrolyte replenishment.

- Dairy and Dairy Alternative Beverages: This category, projected to reach XX Million in 2025, is experiencing rapid growth, especially plant-based alternatives, fueled by health-conscious consumers and ethical considerations. Infrastructure development in the food processing industry supports the scalability of these products.

Functional Foods, while a more diverse segment, is also demonstrating consistent growth, with an estimated market size of XX Million in 2025.

- Dairy: This sub-segment, valued at around XX Million in 2025, includes fortified yogurts and dairy-based functional products.

- Snacks: With an estimated market of XX Million in 2025, functional snacks are gaining popularity as convenient health options.

The dominant distribution channels reflect evolving consumer shopping habits. Supermarkets/Hypermarkets continue to hold a significant share, valued at XX Million in 2025, due to their wide reach and accessibility. However, Online Retail Stores are experiencing exponential growth, projected to reach XX Million by 2025, driven by convenience, wider product selection, and competitive pricing. This trend is supported by robust digital infrastructure and e-commerce penetration across Australia. Drug Stores/Pharmacies also play a crucial role, particularly for dietary supplements, estimated at XX Million in 2025, owing to the trust consumers place in these outlets for health-related products.

Australia Nutraceuticals Market Product Developments

The Australia Nutraceuticals Market is marked by continuous product innovation driven by consumer demand for enhanced health and wellness. Recent developments highlight a strong focus on natural ingredients, functional benefits, and convenience. Companies are introducing novel formulations for dietary supplements, such as chewable gummies and effervescent tablets, to improve palatability and ease of consumption. Functional foods are seeing advancements in shelf-stable formats and the incorporation of specific bioactives for targeted health outcomes, like gut health and cognitive function. The competitive advantage lies in scientifically substantiated claims, unique ingredient combinations, and appealing product formats that align with modern lifestyles.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Australia Nutraceuticals Market across its comprehensive segmentation. The Product Type segment is categorized into Functional Food, Functional Beverage, and Dietary Supplements. Functional Food further breaks down into Cereals, Bakery and Confectionery, Dairy, Snacks, and Other Functional Foods. Functional Beverages include Energy Drinks, Sports Drinks, Fortified Juice, Dairy and Dairy Alternative Beverages, and Other Functional Beverages. Dietary Supplements encompass Vitamins, Minerals, Botanicals, Enzymes, Fatty Acids, Proteins, and Other Dietary Supplements. The Distribution Channel segment analyzes Specialty Stores, Supermarkets/Hypermarkets, Convenience Stores, Drug Stores/Pharmacies, and Online Retail Stores. Each segment is assessed for its current market size, projected growth rates, and competitive dynamics, providing a granular understanding of market opportunities and challenges. For example, the Online Retail Stores segment, expected to grow at a CAGR of approximately 15% during the forecast period, presents significant expansion potential.

Key Drivers of Australia Nutraceuticals Market Growth

The Australia Nutraceuticals Market is propelled by several key growth drivers. A primary catalyst is the increasing consumer awareness of the link between diet and long-term health, leading to a proactive approach to wellness. This is further amplified by a growing aging population seeking solutions for age-related health concerns. Technological advancements in ingredient sourcing, formulation, and delivery systems are enabling the development of more effective and appealing nutraceutical products. Government initiatives promoting healthy lifestyles and preventative healthcare also contribute positively. Furthermore, the rising disposable income in Australia allows consumers to allocate more resources towards premium health products.

Challenges in the Australia Nutraceuticals Market Sector

Despite robust growth, the Australia Nutraceuticals Market faces several challenges. Stringent regulatory frameworks and evolving compliance requirements can create barriers to entry and necessitate significant investment in research and development and quality control. Supply chain complexities, particularly for specialized or imported ingredients, can lead to cost fluctuations and potential stockouts. Intense competition from both established brands and new entrants, coupled with price sensitivity among some consumer segments, can impact profit margins. The need for ongoing consumer education regarding the benefits and appropriate use of nutraceuticals remains a challenge in combating misinformation and ensuring responsible consumption.

Emerging Opportunities in Australia Nutraceuticals Market

Emerging opportunities within the Australia Nutraceuticals Market are abundant and varied. The burgeoning demand for plant-based and sustainable nutraceuticals presents significant growth avenues. Personalized nutrition, leveraging advancements in genetic testing and AI, offers the potential for highly targeted and effective product development. The expanding market for mental wellness products, addressing stress, anxiety, and cognitive function, is a rapidly growing niche. Furthermore, the increasing integration of nutraceuticals into everyday food and beverage products, such as fortified yogurts and functional snacks, caters to convenience-seeking consumers. Exploring emerging markets within the broader Asia-Pacific region, with Australia as a gateway, also presents substantial long-term growth potential.

Leading Players in the Australia Nutraceuticals Market Market

- Frucor Suntory

- PepsiCo Australia & New Zealand

- Bayer AG

- Kellogg (Aust) Pty Ltd

- Pure Harvest Smart Farms Ltd

- Pharmacare Laboratories Pty Ltd

- Remedy Drinks

- General Mills Australia Pty Ltd

- GlaxoSmithKline Plc

- Health & Happiness (H&H) International Holdings Ltd

- Herbalife Australia

- Nestle Australia Ltd

Key Developments in Australia Nutraceuticals Market Industry

- October 2022: Remedy Drinks introduced Remedy K! CK, an all-natural clean energy drink available at 7-Eleven stores across Australia in three fruity flavors - Blackberry, Lemon Lime, and Mango Pineapple.

- July 2022: PureHarvest, an Australian organic and natural food company, launched four new plant-based kinds of milk: Organic Hazelnut Milk, Organic Cashew Milk, Australian Macadamia Milk, and Creamy Oat Milk, expanding their existing range.

- June 2021: V Energy launched its new 'Can You Feel It' campaign in collaboration with Clemenger BBDO and Psyop, celebrating feeling your best and spreading positive vibes.

Strategic Outlook for Australia Nutraceuticals Market Market

The strategic outlook for the Australia Nutraceuticals Market remains exceptionally positive, driven by sustained consumer demand for health-conscious products and a robust innovation pipeline. Future growth will likely be fueled by continued advancements in personalized nutrition, the development of functional foods and beverages with increasingly sophisticated health benefits, and the expansion of online distribution channels. Companies that prioritize transparency, scientifically backed claims, and sustainable sourcing will gain a competitive edge. Strategic partnerships, particularly between ingredient suppliers and product manufacturers, and further M&A activities are anticipated to consolidate market positions and drive expansion. The market's resilience and adaptability to evolving consumer preferences position it for significant and consistent growth in the coming years.

Australia Nutraceuticals Market Segmentation

-

1. Product Type

-

1.1. Functional Food

- 1.1.1. Cereals

- 1.1.2. Bakery and Confectionery

- 1.1.3. Dairy

- 1.1.4. Snacks

- 1.1.5. Other Functional Foods

-

1.2. Functional Beverage

- 1.2.1. Energy Drinks

- 1.2.2. Sports Drinks

- 1.2.3. Fortified Juice

- 1.2.4. Dairy and Dairy Alternative Beverages

- 1.2.5. Other Functional Beverages

-

1.3. Dietary Supplements

- 1.3.1. Vitamins

- 1.3.2. Minerals

- 1.3.3. Botanicals

- 1.3.4. Enzymes

- 1.3.5. Fatty Acids

- 1.3.6. Proteins

- 1.3.7. Other Dietary Supplements

-

1.1. Functional Food

-

2. Distribution Channel

- 2.1. Specialty Stores

- 2.2. Supermarkets/Hypermarkets

- 2.3. Convenience Stores

- 2.4. Drug Stores/Pharmacies

- 2.5. Online Retail Stores

Australia Nutraceuticals Market Segmentation By Geography

- 1. Australia

Australia Nutraceuticals Market Regional Market Share

Geographic Coverage of Australia Nutraceuticals Market

Australia Nutraceuticals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.04% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Organic Ingredients in the Food Industry; Increasing Popularity of "Super Fruit" Ingredients in Functional Foods and Beverages

- 3.3. Market Restrains

- 3.3.1. Stringent Food Safety Regulations

- 3.4. Market Trends

- 3.4.1. Increasing Elderly Population boosting Nutraceuticals Market in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Nutraceuticals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Functional Food

- 5.1.1.1. Cereals

- 5.1.1.2. Bakery and Confectionery

- 5.1.1.3. Dairy

- 5.1.1.4. Snacks

- 5.1.1.5. Other Functional Foods

- 5.1.2. Functional Beverage

- 5.1.2.1. Energy Drinks

- 5.1.2.2. Sports Drinks

- 5.1.2.3. Fortified Juice

- 5.1.2.4. Dairy and Dairy Alternative Beverages

- 5.1.2.5. Other Functional Beverages

- 5.1.3. Dietary Supplements

- 5.1.3.1. Vitamins

- 5.1.3.2. Minerals

- 5.1.3.3. Botanicals

- 5.1.3.4. Enzymes

- 5.1.3.5. Fatty Acids

- 5.1.3.6. Proteins

- 5.1.3.7. Other Dietary Supplements

- 5.1.1. Functional Food

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Specialty Stores

- 5.2.2. Supermarkets/Hypermarkets

- 5.2.3. Convenience Stores

- 5.2.4. Drug Stores/Pharmacies

- 5.2.5. Online Retail Stores

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Frucor Suntory

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PepsiCo Australia & New Zealand

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bayer AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kellogg (Aust ) Pty Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Pure Harvest Smart Farms Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pharmacare Laboratories Pty Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Remedy Drinks

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 General Mills Australia Pty Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GlaxoSmithKline Plc*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Health & Happiness (H&H) International Holdings Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Herbalife Australia

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Nestle Australia Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Frucor Suntory

List of Figures

- Figure 1: Australia Nutraceuticals Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Nutraceuticals Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Nutraceuticals Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Australia Nutraceuticals Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Australia Nutraceuticals Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Australia Nutraceuticals Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Australia Nutraceuticals Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Australia Nutraceuticals Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Nutraceuticals Market?

The projected CAGR is approximately 5.04%.

2. Which companies are prominent players in the Australia Nutraceuticals Market?

Key companies in the market include Frucor Suntory, PepsiCo Australia & New Zealand, Bayer AG, Kellogg (Aust ) Pty Ltd, Pure Harvest Smart Farms Ltd, Pharmacare Laboratories Pty Ltd, Remedy Drinks, General Mills Australia Pty Ltd, GlaxoSmithKline Plc*List Not Exhaustive, Health & Happiness (H&H) International Holdings Ltd, Herbalife Australia, Nestle Australia Ltd.

3. What are the main segments of the Australia Nutraceuticals Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.09 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Organic Ingredients in the Food Industry; Increasing Popularity of "Super Fruit" Ingredients in Functional Foods and Beverages.

6. What are the notable trends driving market growth?

Increasing Elderly Population boosting Nutraceuticals Market in the Country.

7. Are there any restraints impacting market growth?

Stringent Food Safety Regulations.

8. Can you provide examples of recent developments in the market?

In October 2022, Remedy Drinks introduced Remedy K! CK, an all-natural clean energy drink available at 7-Eleven stores across Australia. Remedy K! CK is available in three fruity flavors - Blackberry, Lemon Lime, and Mango Pineapple.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Nutraceuticals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Nutraceuticals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Nutraceuticals Market?

To stay informed about further developments, trends, and reports in the Australia Nutraceuticals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence