Key Insights

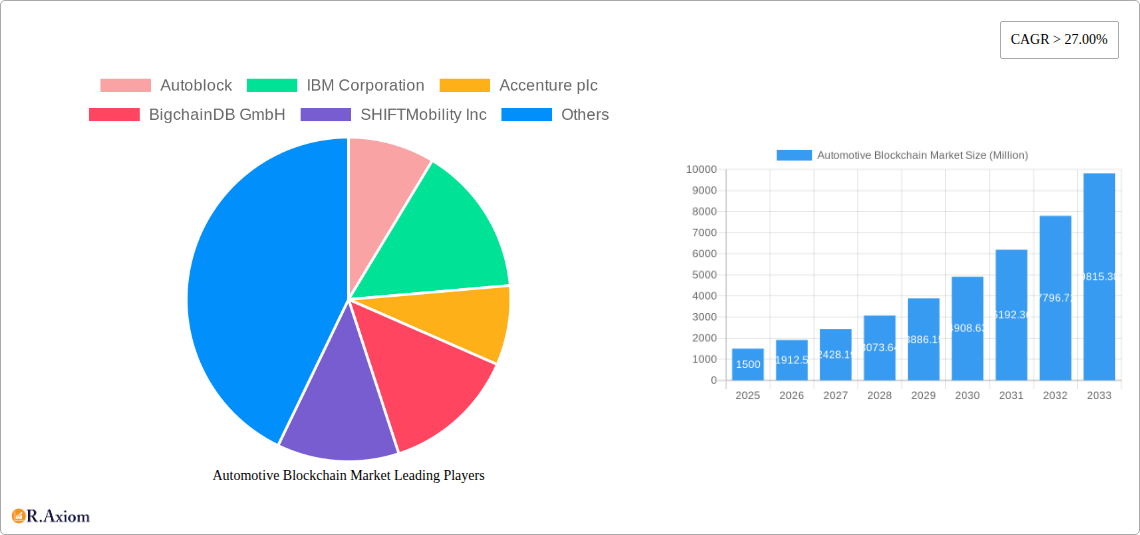

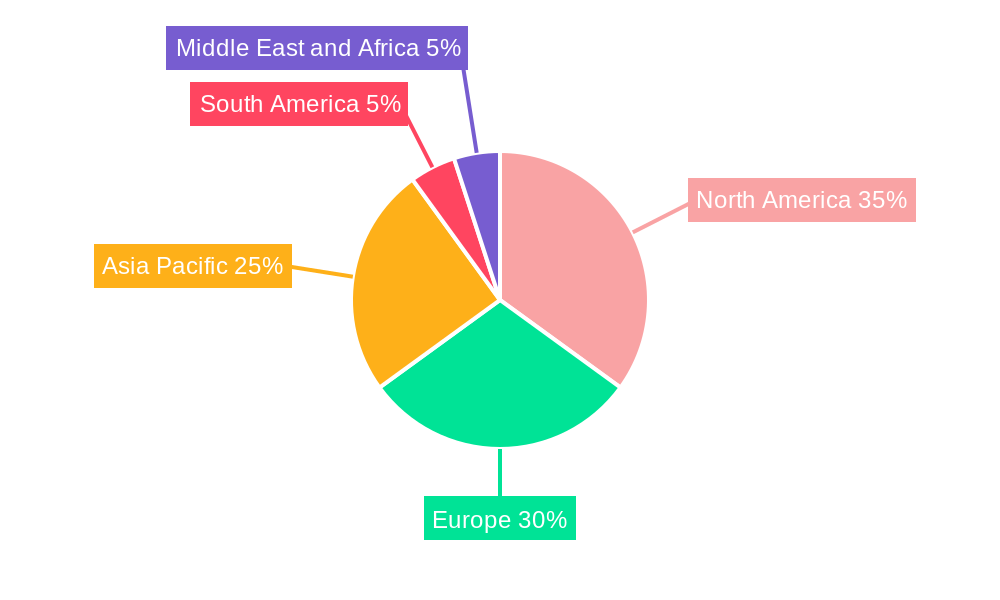

The automotive blockchain market is poised for significant expansion, projected to grow at a Compound Annual Growth Rate (CAGR) of 29%. This growth is primarily driven by the imperative for enhanced supply chain security and transparency. Blockchain technology's inherent immutability provides a robust solution for vehicle and component tracking, thereby reducing fraud and improving traceability. Furthermore, the proliferation of connected vehicles and the subsequent surge in data generation are creating fertile ground for blockchain-based solutions to securely manage data ownership and sharing. The industry is also leveraging blockchain for secure financial transactions, including payments and insurance claim processing. Market segmentation across applications (manufacturing, supply chain, insurance, financial transactions), end-users (OEMs, vehicle owners, MaaS providers), and blockchain types (public, private, hybrid) indicates strong growth across all categories. While North America and Europe currently lead in market share, the Asia-Pacific region is anticipated to experience rapid expansion driven by escalating vehicle production and technological advancements.

Automotive Blockchain Market Market Size (In Million)

Despite this robust growth trajectory, the market confronts challenges such as high implementation costs and the complexity of integrating blockchain into existing automotive infrastructure. Regulatory uncertainties and a lack of standardization across platforms also present significant hurdles. However, continuous technological innovation, increasing industry collaboration, and supportive government initiatives are expected to mitigate these challenges. The market is likely to witness strategic consolidations as companies strive to develop scalable and user-friendly solutions. The long-term outlook remains exceptionally positive, with blockchain poised to revolutionize multiple facets of the automotive sector.

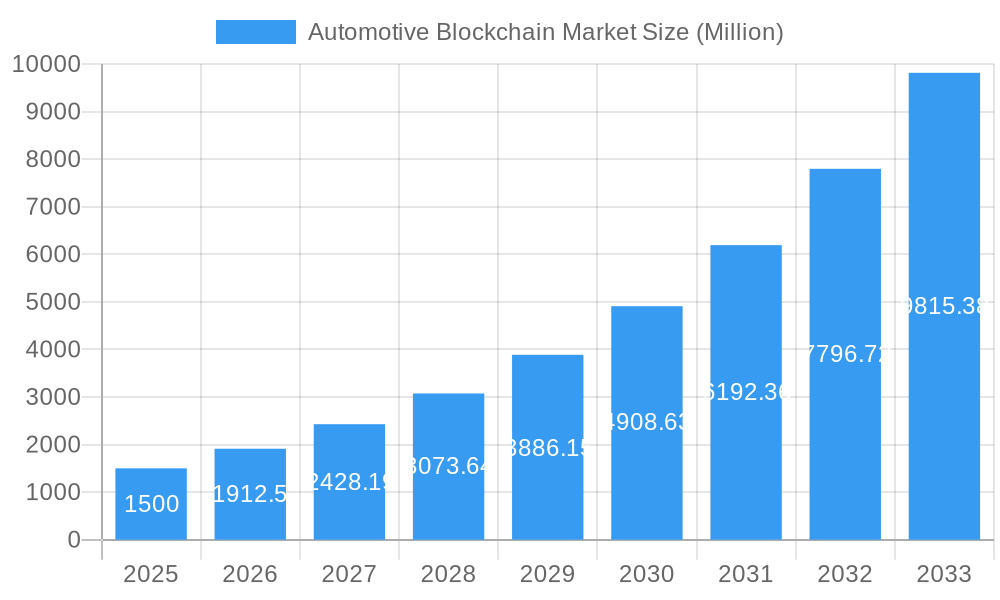

Automotive Blockchain Market Company Market Share

Automotive Blockchain Market Analysis: 2019-2033

This comprehensive analysis offers critical insights into the automotive blockchain market for stakeholders, investors, and businesses navigating this dynamic landscape. The study encompasses the period from 2019 to 2033, with a specific focus on the base year 2025 and a forecast period from 2025 to 2033. Key areas explored include market segmentation, competitive intelligence, growth catalysts, and challenges, supported by actionable data and strategic recommendations. The market size is valued at 380 million in 2025 and is forecast to reach substantial figures by 2033, driven by the aforementioned 29% CAGR.

Automotive Blockchain Market Concentration & Innovation

This section analyzes the competitive landscape of the Automotive Blockchain market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities. The market is characterized by a moderately fragmented structure, with several key players vying for market share. However, the emergence of strategic partnerships and acquisitions signals a shift towards consolidation.

Market Share: While precise market share data for individual companies requires proprietary information, preliminary estimations suggest a relatively balanced distribution among the top players. Autoblock, IBM Corporation, and Accenture plc are likely among the leading companies.

M&A Activities: The automotive blockchain space has witnessed a moderate level of M&A activity in recent years, with deal values ranging from xx Million to xx Million depending on the size and scope of the companies involved. These acquisitions often aim to expand technological capabilities and market reach.

Innovation Drivers: The primary drivers of innovation include the need for enhanced data security, improved supply chain transparency, and the development of new financial transaction models within the automotive industry. Regulatory frameworks, while still evolving, are also prompting innovation to ensure compliance.

End-User Trends: OEMs are driving substantial demand for blockchain solutions to streamline their manufacturing processes, enhance supply chain management, and improve data security. Similarly, there is growing interest among vehicle owners and Mobility-as-a-Service providers in leveraging blockchain technologies for various applications.

Regulatory Frameworks: The regulatory landscape for blockchain technology is dynamic and varies across jurisdictions. This creates both challenges and opportunities, stimulating innovation in areas such as regulatory compliance and data privacy.

Automotive Blockchain Market Industry Trends & Insights

This section explores the key trends shaping the Automotive Blockchain market, including market growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The market is experiencing robust growth, driven by factors such as increasing adoption of connected vehicles, growing demand for data security and transparency, and the need for efficient supply chain management.

The market is witnessing a surge in technological advancements, leading to the development of more sophisticated blockchain solutions tailored to the unique requirements of the automotive industry. Consumer preferences are evolving towards increased transparency and security, boosting the demand for blockchain-based solutions that offer enhanced traceability and data protection. Competitive dynamics are characterized by strategic partnerships, collaborations, and M&A activities, indicating ongoing consolidation in the market.

Dominant Markets & Segments in Automotive Blockchain Market

This section identifies the leading regions, countries, and market segments within the Automotive Blockchain market. Analysis suggests that North America and Europe currently represent the largest markets, driven by early adoption of blockchain technology and the presence of significant players. However, Asia-Pacific is poised for rapid growth in the coming years due to the increasing penetration of connected vehicles and digital transformation initiatives.

Application: The supply chain management segment is currently dominating the application landscape, followed closely by financial transactions and manufacturing.

End Users: OEMs are the primary end-users, driving the largest share of market demand. However, the vehicle owners and Mobility-as-a-Service (MaaS) segments are expected to witness significant growth in the future.

Type: Private blockchains currently hold the largest market share due to their enhanced security and control features. However, public and hybrid blockchains are also witnessing increasing adoption as the technology matures and regulatory frameworks evolve.

Key Drivers: The dominance of certain regions and segments is attributed to a variety of factors, including supportive government policies, well-established automotive industries, favorable regulatory environments, and robust technological infrastructure.

Automotive Blockchain Market Product Developments

Recent product innovations focus on integrating blockchain technology with existing automotive systems and applications. This includes developing solutions for secure vehicle identification, supply chain traceability, and tamper-proof data management. The competitive landscape is characterized by a continuous race to offer superior solutions that provide enhanced security, scalability, and interoperability. New products are increasingly focused on addressing specific challenges within the automotive ecosystem, reflecting a shift toward specialized and integrated blockchain solutions.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation analysis of the Automotive Blockchain market across various parameters.

Application: Manufacturing, Supply Chain, Insurance, Financial Transactions, Others (each segment's growth projections and market sizes are available in the full report)

End Users: OEMs, Vehicle Owners, Mobility as a Service Providers, Others (each segment's growth projections and market sizes are available in the full report)

Type: Public Blockchain, Private Blockchain, Hybrid Blockchain (each segment's growth projections and market sizes are available in the full report)

Each segment's competitive landscape is analyzed based on factors such as market share, product innovation, and strategic partnerships.

Key Drivers of Automotive Blockchain Market Growth

The Automotive Blockchain market is experiencing robust growth due to several key factors. These include the increasing demand for secure and transparent data management in the automotive industry, the rising adoption of connected and autonomous vehicles, the need for improved supply chain visibility and efficiency, and favorable government regulations promoting the use of blockchain technology. Specific examples include initiatives by OEMs to enhance supply chain transparency and efforts to improve data security in connected vehicle applications.

Challenges in the Automotive Blockchain Market Sector

The growth of the Automotive Blockchain market faces certain challenges. These include the relatively high cost of implementation, the need for robust cybersecurity measures, the complexity of integrating blockchain technology with existing automotive systems, and the evolving regulatory landscape. These challenges represent a significant barrier to entry for many companies and may hinder the widespread adoption of blockchain technology in the automotive sector. Further, concerns over data privacy and scalability remain significant obstacles.

Emerging Opportunities in Automotive Blockchain Market

Despite challenges, significant opportunities exist. The increasing use of data analytics within the automotive industry creates opportunities for blockchain to provide better data security and management. The growing adoption of autonomous vehicles presents a key opportunity, as blockchain can ensure secure and reliable data transmission for these vehicles. Moreover, new business models built around blockchain-enabled services, such as vehicle sharing and data monetization, present significant growth potential.

Leading Players in the Automotive Blockchain Market Market

- Autoblock

- IBM Corporation

- Accenture plc

- BigchainDB GmbH

- SHIFTMobility Inc

- Microsoft Corporation

- GEM

- Axt

- Tech Mahindra Limited

- Loyyal Corporatio

- carVertical

Key Developments in Automotive Blockchain Market Industry

- April 2021: Tech Mahindra Ltd partnered with Quantoz to launch 'Stablecoin-As-A-Service' blockchain solutions, expanding its offerings in the automotive sector.

- October 2020: Skoda Auto DigiLab collaborated with Lumos Labs and Microsoft to explore blockchain solutions for manufacturing, showcasing the growing interest in applying blockchain technology to optimize automotive production processes.

Strategic Outlook for Automotive Blockchain Market Market

The future of the Automotive Blockchain market appears promising. Continued technological advancements, coupled with increasing regulatory clarity and growing industry adoption, are expected to drive significant market expansion in the coming years. Opportunities lie in developing innovative solutions that address specific industry needs, enhancing security, scalability, and interoperability of existing blockchain platforms. The market is poised for significant growth, driven by the convergence of technology, regulatory developments, and evolving industry demands.

Automotive Blockchain Market Segmentation

-

1. Application

- 1.1. Manufacturing

- 1.2. Supplychain

- 1.3. Insurance

- 1.4. Financial Transactions

- 1.5. Others

-

2. End Users

- 2.1. OEMs

- 2.2. Vehicle Owners

- 2.3. Mobility as a Service Provider

- 2.4. Others

-

3. Type

- 3.1. Public Blockchain

- 3.2. Private Blockchain

- 3.3. Hybrid Blockchain

Automotive Blockchain Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. UAE

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Automotive Blockchain Market Regional Market Share

Geographic Coverage of Automotive Blockchain Market

Automotive Blockchain Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Stringent Emission Regulations are Fueling the Market Growth

- 3.3. Market Restrains

- 3.3.1. High Cost of Electric Commercial Vehicle May Hamper the Growth

- 3.4. Market Trends

- 3.4.1. The vehicle manufacturing will see the largest use of blockchain technology

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Blockchain Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Manufacturing

- 5.1.2. Supplychain

- 5.1.3. Insurance

- 5.1.4. Financial Transactions

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by End Users

- 5.2.1. OEMs

- 5.2.2. Vehicle Owners

- 5.2.3. Mobility as a Service Provider

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. Public Blockchain

- 5.3.2. Private Blockchain

- 5.3.3. Hybrid Blockchain

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Automotive Blockchain Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Manufacturing

- 6.1.2. Supplychain

- 6.1.3. Insurance

- 6.1.4. Financial Transactions

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by End Users

- 6.2.1. OEMs

- 6.2.2. Vehicle Owners

- 6.2.3. Mobility as a Service Provider

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by Type

- 6.3.1. Public Blockchain

- 6.3.2. Private Blockchain

- 6.3.3. Hybrid Blockchain

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Automotive Blockchain Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Manufacturing

- 7.1.2. Supplychain

- 7.1.3. Insurance

- 7.1.4. Financial Transactions

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by End Users

- 7.2.1. OEMs

- 7.2.2. Vehicle Owners

- 7.2.3. Mobility as a Service Provider

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by Type

- 7.3.1. Public Blockchain

- 7.3.2. Private Blockchain

- 7.3.3. Hybrid Blockchain

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Automotive Blockchain Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Manufacturing

- 8.1.2. Supplychain

- 8.1.3. Insurance

- 8.1.4. Financial Transactions

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by End Users

- 8.2.1. OEMs

- 8.2.2. Vehicle Owners

- 8.2.3. Mobility as a Service Provider

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by Type

- 8.3.1. Public Blockchain

- 8.3.2. Private Blockchain

- 8.3.3. Hybrid Blockchain

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Automotive Blockchain Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Manufacturing

- 9.1.2. Supplychain

- 9.1.3. Insurance

- 9.1.4. Financial Transactions

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by End Users

- 9.2.1. OEMs

- 9.2.2. Vehicle Owners

- 9.2.3. Mobility as a Service Provider

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by Type

- 9.3.1. Public Blockchain

- 9.3.2. Private Blockchain

- 9.3.3. Hybrid Blockchain

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Automotive Blockchain Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Manufacturing

- 10.1.2. Supplychain

- 10.1.3. Insurance

- 10.1.4. Financial Transactions

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by End Users

- 10.2.1. OEMs

- 10.2.2. Vehicle Owners

- 10.2.3. Mobility as a Service Provider

- 10.2.4. Others

- 10.3. Market Analysis, Insights and Forecast - by Type

- 10.3.1. Public Blockchain

- 10.3.2. Private Blockchain

- 10.3.3. Hybrid Blockchain

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Autoblock

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 IBM Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Accenture plc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BigchainDB GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SHIFTMobility Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Microsoft Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 GEM

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Axt

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Tech Mahindra Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Loyyal Corporatio

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 carVertical

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Autoblock

List of Figures

- Figure 1: Global Automotive Blockchain Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Blockchain Market Revenue (million), by Application 2025 & 2033

- Figure 3: North America Automotive Blockchain Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Automotive Blockchain Market Revenue (million), by End Users 2025 & 2033

- Figure 5: North America Automotive Blockchain Market Revenue Share (%), by End Users 2025 & 2033

- Figure 6: North America Automotive Blockchain Market Revenue (million), by Type 2025 & 2033

- Figure 7: North America Automotive Blockchain Market Revenue Share (%), by Type 2025 & 2033

- Figure 8: North America Automotive Blockchain Market Revenue (million), by Country 2025 & 2033

- Figure 9: North America Automotive Blockchain Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Automotive Blockchain Market Revenue (million), by Application 2025 & 2033

- Figure 11: Europe Automotive Blockchain Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Automotive Blockchain Market Revenue (million), by End Users 2025 & 2033

- Figure 13: Europe Automotive Blockchain Market Revenue Share (%), by End Users 2025 & 2033

- Figure 14: Europe Automotive Blockchain Market Revenue (million), by Type 2025 & 2033

- Figure 15: Europe Automotive Blockchain Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Automotive Blockchain Market Revenue (million), by Country 2025 & 2033

- Figure 17: Europe Automotive Blockchain Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Automotive Blockchain Market Revenue (million), by Application 2025 & 2033

- Figure 19: Asia Pacific Automotive Blockchain Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: Asia Pacific Automotive Blockchain Market Revenue (million), by End Users 2025 & 2033

- Figure 21: Asia Pacific Automotive Blockchain Market Revenue Share (%), by End Users 2025 & 2033

- Figure 22: Asia Pacific Automotive Blockchain Market Revenue (million), by Type 2025 & 2033

- Figure 23: Asia Pacific Automotive Blockchain Market Revenue Share (%), by Type 2025 & 2033

- Figure 24: Asia Pacific Automotive Blockchain Market Revenue (million), by Country 2025 & 2033

- Figure 25: Asia Pacific Automotive Blockchain Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Automotive Blockchain Market Revenue (million), by Application 2025 & 2033

- Figure 27: South America Automotive Blockchain Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: South America Automotive Blockchain Market Revenue (million), by End Users 2025 & 2033

- Figure 29: South America Automotive Blockchain Market Revenue Share (%), by End Users 2025 & 2033

- Figure 30: South America Automotive Blockchain Market Revenue (million), by Type 2025 & 2033

- Figure 31: South America Automotive Blockchain Market Revenue Share (%), by Type 2025 & 2033

- Figure 32: South America Automotive Blockchain Market Revenue (million), by Country 2025 & 2033

- Figure 33: South America Automotive Blockchain Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Automotive Blockchain Market Revenue (million), by Application 2025 & 2033

- Figure 35: Middle East and Africa Automotive Blockchain Market Revenue Share (%), by Application 2025 & 2033

- Figure 36: Middle East and Africa Automotive Blockchain Market Revenue (million), by End Users 2025 & 2033

- Figure 37: Middle East and Africa Automotive Blockchain Market Revenue Share (%), by End Users 2025 & 2033

- Figure 38: Middle East and Africa Automotive Blockchain Market Revenue (million), by Type 2025 & 2033

- Figure 39: Middle East and Africa Automotive Blockchain Market Revenue Share (%), by Type 2025 & 2033

- Figure 40: Middle East and Africa Automotive Blockchain Market Revenue (million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Automotive Blockchain Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Blockchain Market Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global Automotive Blockchain Market Revenue million Forecast, by End Users 2020 & 2033

- Table 3: Global Automotive Blockchain Market Revenue million Forecast, by Type 2020 & 2033

- Table 4: Global Automotive Blockchain Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Automotive Blockchain Market Revenue million Forecast, by Application 2020 & 2033

- Table 6: Global Automotive Blockchain Market Revenue million Forecast, by End Users 2020 & 2033

- Table 7: Global Automotive Blockchain Market Revenue million Forecast, by Type 2020 & 2033

- Table 8: Global Automotive Blockchain Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States Automotive Blockchain Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada Automotive Blockchain Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Automotive Blockchain Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global Automotive Blockchain Market Revenue million Forecast, by Application 2020 & 2033

- Table 13: Global Automotive Blockchain Market Revenue million Forecast, by End Users 2020 & 2033

- Table 14: Global Automotive Blockchain Market Revenue million Forecast, by Type 2020 & 2033

- Table 15: Global Automotive Blockchain Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Germany Automotive Blockchain Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Automotive Blockchain Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: France Automotive Blockchain Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Automotive Blockchain Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Global Automotive Blockchain Market Revenue million Forecast, by Application 2020 & 2033

- Table 21: Global Automotive Blockchain Market Revenue million Forecast, by End Users 2020 & 2033

- Table 22: Global Automotive Blockchain Market Revenue million Forecast, by Type 2020 & 2033

- Table 23: Global Automotive Blockchain Market Revenue million Forecast, by Country 2020 & 2033

- Table 24: India Automotive Blockchain Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: China Automotive Blockchain Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Japan Automotive Blockchain Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Automotive Blockchain Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global Automotive Blockchain Market Revenue million Forecast, by Application 2020 & 2033

- Table 29: Global Automotive Blockchain Market Revenue million Forecast, by End Users 2020 & 2033

- Table 30: Global Automotive Blockchain Market Revenue million Forecast, by Type 2020 & 2033

- Table 31: Global Automotive Blockchain Market Revenue million Forecast, by Country 2020 & 2033

- Table 32: Brazil Automotive Blockchain Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Automotive Blockchain Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Automotive Blockchain Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: Global Automotive Blockchain Market Revenue million Forecast, by Application 2020 & 2033

- Table 36: Global Automotive Blockchain Market Revenue million Forecast, by End Users 2020 & 2033

- Table 37: Global Automotive Blockchain Market Revenue million Forecast, by Type 2020 & 2033

- Table 38: Global Automotive Blockchain Market Revenue million Forecast, by Country 2020 & 2033

- Table 39: UAE Automotive Blockchain Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: Saudi Arabia Automotive Blockchain Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East and Africa Automotive Blockchain Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Blockchain Market?

The projected CAGR is approximately 29%.

2. Which companies are prominent players in the Automotive Blockchain Market?

Key companies in the market include Autoblock, IBM Corporation, Accenture plc, BigchainDB GmbH, SHIFTMobility Inc, Microsoft Corporation, GEM, Axt, Tech Mahindra Limited, Loyyal Corporatio, carVertical.

3. What are the main segments of the Automotive Blockchain Market?

The market segments include Application, End Users, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 380 million as of 2022.

5. What are some drivers contributing to market growth?

Stringent Emission Regulations are Fueling the Market Growth.

6. What are the notable trends driving market growth?

The vehicle manufacturing will see the largest use of blockchain technology.

7. Are there any restraints impacting market growth?

High Cost of Electric Commercial Vehicle May Hamper the Growth.

8. Can you provide examples of recent developments in the market?

In April 2021, Tech Mahindra Ltd has entered into an agreement with the Netherlands-based Blockchain technology application incubator Quantoz to launch 'Stablecoin-As-A-Service' blockchain solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Blockchain Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Blockchain Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Blockchain Market?

To stay informed about further developments, trends, and reports in the Automotive Blockchain Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence