Key Insights

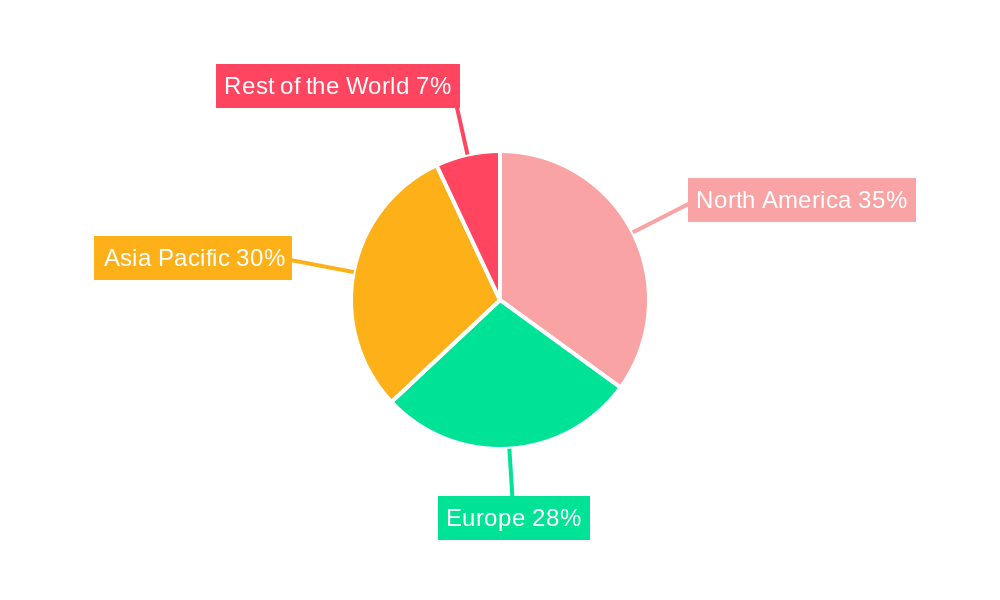

The automotive GPS system market, valued at $35.89 billion in 2025, is projected to experience robust growth, driven by increasing vehicle production, rising consumer demand for advanced navigation features, and the integration of GPS technology with infotainment systems. The market's Compound Annual Growth Rate (CAGR) of 7.65% from 2025 to 2033 indicates a significant expansion in market size over the forecast period. Key growth drivers include the rising adoption of connected cars, the increasing demand for real-time traffic updates and route optimization, and the integration of GPS with other vehicle functionalities such as emergency assistance and fleet management solutions. The market is segmented by screen size (less than 6 inches, 6-10 inches, more than 10 inches), vehicle type (passenger cars and commercial vehicles), and sales channel (OEMs and aftermarket). The passenger car segment is expected to dominate due to higher vehicle sales volumes. Growth is anticipated across all regions, with North America and Asia Pacific expected to be leading markets, fueled by strong economic growth and high vehicle ownership rates in these regions. Competitive dynamics are characterized by the presence of established players such as Denso, Visteon, and Garmin, alongside emerging players vying for market share through technological innovation and strategic partnerships. The aftermarket segment offers a significant growth opportunity due to the increasing adoption of aftermarket GPS devices by car owners seeking enhanced navigation capabilities and features beyond standard OEM offerings.

Automotive GPS System Market Market Size (In Billion)

The restraining factors for market growth include concerns regarding data privacy and security, the increasing popularity of smartphone navigation apps (offering similar functionalities at a lower cost), and the potential for disruptions caused by technological advancements in autonomous driving systems. However, ongoing innovations in GPS technology, including the integration of advanced features like augmented reality navigation and cloud-based services, are expected to mitigate these challenges and drive sustained growth in the coming years. The increasing demand for improved fuel efficiency and optimized routing for commercial vehicle fleets is also projected to contribute positively to the overall market expansion. Furthermore, the rise of subscription-based services, offering real-time traffic information and advanced features, represents a key market trend, altering the revenue models within the industry.

Automotive GPS System Market Company Market Share

Automotive GPS System Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Automotive GPS System Market, encompassing market size, segmentation, growth drivers, challenges, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers actionable insights for industry stakeholders, investors, and businesses operating within this dynamic sector. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Automotive GPS System Market Market Concentration & Innovation

The Automotive GPS System Market exhibits a moderately concentrated landscape, with several key players holding significant market share. While precise market share figures for individual companies require further detailed analysis, industry giants like Denso Corporation, Robert Bosch GmbH, and Garmin Ltd. command substantial portions of the market. The market is characterized by continuous innovation driven by the integration of advanced technologies like cloud-based navigation, AI-powered features, and enhanced user interfaces. This innovation is largely influenced by regulatory frameworks promoting road safety and connected vehicle technology. The automotive industry's ongoing transition towards electric vehicles (EVs) and autonomous driving systems is a significant innovation driver, further pushing the demand for advanced GPS systems. Product substitutes, such as smartphone navigation apps, present a competitive challenge, but the increasing demand for seamless in-car integration continues to favor dedicated automotive GPS systems. End-user preferences are shifting towards user-friendly interfaces, real-time traffic updates, and personalized features. Mergers and acquisitions (M&A) activity within the sector has been moderate in recent years. While specific M&A deal values are unavailable for this report at this time, activity focuses on expanding technological capabilities and geographical reach. For example, partnerships like the one between Mapbox and Toyota demonstrate the strategic value of collaborations in enhancing navigation features.

Automotive GPS System Market Industry Trends & Insights

The Automotive GPS System Market is experiencing robust growth, driven by several key factors. The increasing adoption of connected cars, fueled by the rising demand for infotainment systems and advanced driver-assistance systems (ADAS), is a major contributor to market expansion. Technological advancements, such as the integration of 5G technology, improved mapping accuracy, and real-time traffic updates, are enhancing the functionality and appeal of these systems. Consumer preferences are leaning towards integrated, intuitive, and personalized GPS solutions. This trend is leading to a rise in voice-activated navigation and the integration of smartphone functionalities within automotive GPS systems. Competitive dynamics are shaped by ongoing innovation, strategic partnerships, and the increasing integration of GPS technology into other vehicle systems. Market penetration continues to grow, particularly in emerging markets with expanding automotive industries. The overall market growth is projected to maintain a healthy CAGR of xx% during the forecast period.

Dominant Markets & Segments in Automotive GPS System Market

Leading Region/Country: North America and Europe currently dominate the Automotive GPS System Market due to high vehicle ownership rates and robust automotive industries. However, rapid growth is expected in Asia-Pacific, driven by increasing vehicle production and rising disposable incomes.

By Screen Size: The 6-10 inches screen size segment holds the largest market share currently, owing to its optimal balance between screen real estate and dashboard integration. The larger-than-10-inch segment is also exhibiting rapid growth, propelled by demand for sophisticated infotainment features. The less-than-6-inch segment is a more cost-effective alternative.

By Vehicle Type: Passenger cars account for the lion's share of the market, reflecting their large number compared to commercial vehicles. However, the commercial vehicle segment is gaining traction due to the growing demand for fleet management and navigation solutions within logistics and transportation sectors.

By Sales Channel: Original Equipment Manufacturers (OEMs) represent the dominant sales channel, as integrated GPS systems are increasingly offered as standard or optional features in new vehicles. The aftermarket segment provides replacement and upgrade options but is presently smaller.

Key drivers for specific segments include:

- Economic Policies: Government incentives for vehicle electrification and automation indirectly boost the demand for advanced GPS systems in EVs and autonomous vehicles.

- Infrastructure: Improved infrastructure development in emerging economies helps the expansion of the automotive sector and drives the demand for navigation systems.

Automotive GPS System Market Product Developments

The Automotive GPS System Market is witnessing rapid product innovation, with a focus on enhancing user experience, improving mapping accuracy, integrating cloud-based services, and incorporating advanced features like augmented reality (AR) navigation and AI-powered route optimization. These advancements reflect the integration of GPS technology with broader automotive trends such as autonomous driving and connected car initiatives. Competitive advantages stem from superior mapping data, advanced features, seamless integration with other in-vehicle systems, and strong brand recognition.

Report Scope & Segmentation Analysis

This report segments the Automotive GPS System Market by:

By Screen Size: Less than 6 Inches, 6-10 Inches, More than 10 Inches. Each segment shows varied growth projections driven by consumer preferences and vehicle type integration. The 6-10 inch segment is predicted to have the largest market size over the forecast period.

By Vehicle Type: Passenger Cars, Commercial Vehicles. Growth is projected to be higher in the passenger car segment due to increased demand for infotainment systems. Commercial vehicle demand is growing, especially for fleet tracking and route optimization.

By Sales Channel: Original Equipment Manufacturers (OEMs), Aftermarket. The OEM channel holds the larger market share and faster growth, while the aftermarket offers replacement options. Competitive dynamics differ in each segment; OEMs focus on integration with vehicles, while the aftermarket emphasizes upgrades and custom solutions.

Key Drivers of Automotive GPS System Market Growth

Several factors are driving the growth of the Automotive GPS System Market. Technological advancements, such as the development of more accurate mapping technologies and the integration of cloud-based services, provide better real-time data and advanced features. The rising popularity of connected cars and the increasing demand for advanced driver-assistance systems (ADAS) significantly impact growth. Furthermore, supportive government policies promoting road safety and intelligent transportation systems are bolstering market expansion.

Challenges in the Automotive GPS System Market Sector

The Automotive GPS System Market faces several challenges. High initial investment costs for advanced technologies and the increasing complexity of system integration can be barriers to entry for some players. Supply chain disruptions and fluctuations in raw material prices can negatively impact production costs. Stringent regulatory standards and compliance requirements present additional challenges to market players. Competition from smartphone-based navigation apps and other alternative navigation solutions poses a constant threat. The exact quantifiable impact of these challenges requires more granular data but their overall impact is expected to cause some market slowdown.

Emerging Opportunities in Automotive GPS System Market

Emerging opportunities include the integration of GPS systems with autonomous driving technologies, the expansion of services in emerging markets, and the growing demand for advanced features such as augmented reality navigation and personalized route planning. The increasing adoption of electric vehicles (EVs) and the need for efficient charging station location services present further expansion possibilities. The development of more energy-efficient GPS systems represents a key area for growth.

Leading Players in the Automotive GPS System Market Market

- Denso Corporation

- Visteon Corporation

- TomTom International BV

- LG Electronics Inc

- Aisin Corporation

- Garmin Ltd

- Mitsubishi Electric Corporation

- JVC Kenwood Corporation

- Harman International Industries

- Robert Bosch GmbH

- Faurecia Clarion Electronics Co Ltd

- Panasonic Holdings Corporation

Key Developments in Automotive GPS System Market Industry

August 2023: EVgo Inc.'s partnership with Amazon integrates Alexa voice control for EV charging station searches, enhancing user experience and market convenience.

January 2023: Mapbox's collaboration with Toyota Motor Europe streamlines in-car navigation system integration, reducing development time and improving the user experience.

May 2022: Volvo Car USA integrates Google built-in features (Assistant, Maps, Play) into its 2023 lineup, demonstrating a trend toward advanced infotainment integration.

April 2022: HERE Technologies provides Isuzu Trucks with its navigation solution, highlighting the increasing demand for integrated navigation systems in commercial vehicles.

Strategic Outlook for Automotive GPS System Market Market

The Automotive GPS System Market is poised for continued growth, driven by technological innovation, increasing vehicle connectivity, and the expanding adoption of autonomous driving technologies. The integration of advanced features, such as augmented reality navigation and AI-powered route optimization, will further enhance the user experience and drive market demand. The focus on user-friendly interfaces and seamless integration with other in-vehicle systems will be critical for success. Continued expansion into emerging markets offers significant opportunities for growth.

Automotive GPS System Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Sales Channel

- 2.1. Original Equipment Manufacturers (OEMs)

- 2.2. Aftermarket

-

3. Screen Size

- 3.1. Less than 6 Inches

- 3.2. 6-10 Inches

- 3.3. More than 10 Inches

Automotive GPS System Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive GPS System Market Regional Market Share

Geographic Coverage of Automotive GPS System Market

Automotive GPS System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.65% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shifting Preference of Consumers to Avail Private Medium of Transportation

- 3.3. Market Restrains

- 3.3.1. High Purchase and Installation Costs

- 3.4. Market Trends

- 3.4.1. Aftermarket Segment to Gain Traction during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive GPS System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Sales Channel

- 5.2.1. Original Equipment Manufacturers (OEMs)

- 5.2.2. Aftermarket

- 5.3. Market Analysis, Insights and Forecast - by Screen Size

- 5.3.1. Less than 6 Inches

- 5.3.2. 6-10 Inches

- 5.3.3. More than 10 Inches

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Automotive GPS System Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Passenger Cars

- 6.1.2. Commercial Vehicles

- 6.2. Market Analysis, Insights and Forecast - by Sales Channel

- 6.2.1. Original Equipment Manufacturers (OEMs)

- 6.2.2. Aftermarket

- 6.3. Market Analysis, Insights and Forecast - by Screen Size

- 6.3.1. Less than 6 Inches

- 6.3.2. 6-10 Inches

- 6.3.3. More than 10 Inches

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Automotive GPS System Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Passenger Cars

- 7.1.2. Commercial Vehicles

- 7.2. Market Analysis, Insights and Forecast - by Sales Channel

- 7.2.1. Original Equipment Manufacturers (OEMs)

- 7.2.2. Aftermarket

- 7.3. Market Analysis, Insights and Forecast - by Screen Size

- 7.3.1. Less than 6 Inches

- 7.3.2. 6-10 Inches

- 7.3.3. More than 10 Inches

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Automotive GPS System Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Passenger Cars

- 8.1.2. Commercial Vehicles

- 8.2. Market Analysis, Insights and Forecast - by Sales Channel

- 8.2.1. Original Equipment Manufacturers (OEMs)

- 8.2.2. Aftermarket

- 8.3. Market Analysis, Insights and Forecast - by Screen Size

- 8.3.1. Less than 6 Inches

- 8.3.2. 6-10 Inches

- 8.3.3. More than 10 Inches

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of the World Automotive GPS System Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Passenger Cars

- 9.1.2. Commercial Vehicles

- 9.2. Market Analysis, Insights and Forecast - by Sales Channel

- 9.2.1. Original Equipment Manufacturers (OEMs)

- 9.2.2. Aftermarket

- 9.3. Market Analysis, Insights and Forecast - by Screen Size

- 9.3.1. Less than 6 Inches

- 9.3.2. 6-10 Inches

- 9.3.3. More than 10 Inches

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Denso Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Visteon Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 TomTom International BV

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 LG Electronics Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Aisin Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Garmin Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Mitsubishi Electric Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 JVC Kenwood Corporatio

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Harman International Industries

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Robert Bosch GmbH

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Faurecia Clarion Electronics Co Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Panasonic Holdings Corporation

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Denso Corporation

List of Figures

- Figure 1: Global Automotive GPS System Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive GPS System Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 3: North America Automotive GPS System Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Automotive GPS System Market Revenue (Million), by Sales Channel 2025 & 2033

- Figure 5: North America Automotive GPS System Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 6: North America Automotive GPS System Market Revenue (Million), by Screen Size 2025 & 2033

- Figure 7: North America Automotive GPS System Market Revenue Share (%), by Screen Size 2025 & 2033

- Figure 8: North America Automotive GPS System Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Automotive GPS System Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Automotive GPS System Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 11: Europe Automotive GPS System Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: Europe Automotive GPS System Market Revenue (Million), by Sales Channel 2025 & 2033

- Figure 13: Europe Automotive GPS System Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 14: Europe Automotive GPS System Market Revenue (Million), by Screen Size 2025 & 2033

- Figure 15: Europe Automotive GPS System Market Revenue Share (%), by Screen Size 2025 & 2033

- Figure 16: Europe Automotive GPS System Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Automotive GPS System Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Automotive GPS System Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 19: Asia Pacific Automotive GPS System Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 20: Asia Pacific Automotive GPS System Market Revenue (Million), by Sales Channel 2025 & 2033

- Figure 21: Asia Pacific Automotive GPS System Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 22: Asia Pacific Automotive GPS System Market Revenue (Million), by Screen Size 2025 & 2033

- Figure 23: Asia Pacific Automotive GPS System Market Revenue Share (%), by Screen Size 2025 & 2033

- Figure 24: Asia Pacific Automotive GPS System Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Automotive GPS System Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Automotive GPS System Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 27: Rest of the World Automotive GPS System Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: Rest of the World Automotive GPS System Market Revenue (Million), by Sales Channel 2025 & 2033

- Figure 29: Rest of the World Automotive GPS System Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 30: Rest of the World Automotive GPS System Market Revenue (Million), by Screen Size 2025 & 2033

- Figure 31: Rest of the World Automotive GPS System Market Revenue Share (%), by Screen Size 2025 & 2033

- Figure 32: Rest of the World Automotive GPS System Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Automotive GPS System Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive GPS System Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Automotive GPS System Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 3: Global Automotive GPS System Market Revenue Million Forecast, by Screen Size 2020 & 2033

- Table 4: Global Automotive GPS System Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Automotive GPS System Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global Automotive GPS System Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 7: Global Automotive GPS System Market Revenue Million Forecast, by Screen Size 2020 & 2033

- Table 8: Global Automotive GPS System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Automotive GPS System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Automotive GPS System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Automotive GPS System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Automotive GPS System Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 13: Global Automotive GPS System Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 14: Global Automotive GPS System Market Revenue Million Forecast, by Screen Size 2020 & 2033

- Table 15: Global Automotive GPS System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Automotive GPS System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Automotive GPS System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Automotive GPS System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Automotive GPS System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Automotive GPS System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Automotive GPS System Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 22: Global Automotive GPS System Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 23: Global Automotive GPS System Market Revenue Million Forecast, by Screen Size 2020 & 2033

- Table 24: Global Automotive GPS System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: China Automotive GPS System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Automotive GPS System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Automotive GPS System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: South Korea Automotive GPS System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Automotive GPS System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Automotive GPS System Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 31: Global Automotive GPS System Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 32: Global Automotive GPS System Market Revenue Million Forecast, by Screen Size 2020 & 2033

- Table 33: Global Automotive GPS System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: South America Automotive GPS System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Middle East and Africa Automotive GPS System Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive GPS System Market?

The projected CAGR is approximately 7.65%.

2. Which companies are prominent players in the Automotive GPS System Market?

Key companies in the market include Denso Corporation, Visteon Corporation, TomTom International BV, LG Electronics Inc, Aisin Corporation, Garmin Ltd, Mitsubishi Electric Corporation, JVC Kenwood Corporatio, Harman International Industries, Robert Bosch GmbH, Faurecia Clarion Electronics Co Ltd, Panasonic Holdings Corporation.

3. What are the main segments of the Automotive GPS System Market?

The market segments include Vehicle Type, Sales Channel, Screen Size.

4. Can you provide details about the market size?

The market size is estimated to be USD 35.89 Million as of 2022.

5. What are some drivers contributing to market growth?

Shifting Preference of Consumers to Avail Private Medium of Transportation.

6. What are the notable trends driving market growth?

Aftermarket Segment to Gain Traction during the Forecast Period.

7. Are there any restraints impacting market growth?

High Purchase and Installation Costs.

8. Can you provide examples of recent developments in the market?

August 2023: EVgo Inc. announced its collaboration with Amazon to launch an Alexa-enabled electric vehicle charging experience for customers. The PlugShare API integration creates a seamless charging experience for Alexa-enabled EVs, including Nissan ARIYA, Ford Mustang Mach-E, and F-150 Lightning. Through simple voice requests such as, ‘Alexa, find EV charging stations near me,’ customers can locate and drive to the nearest charging station, eliminating the need to stop and search for available stations manually.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive GPS System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive GPS System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive GPS System Market?

To stay informed about further developments, trends, and reports in the Automotive GPS System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence