Key Insights

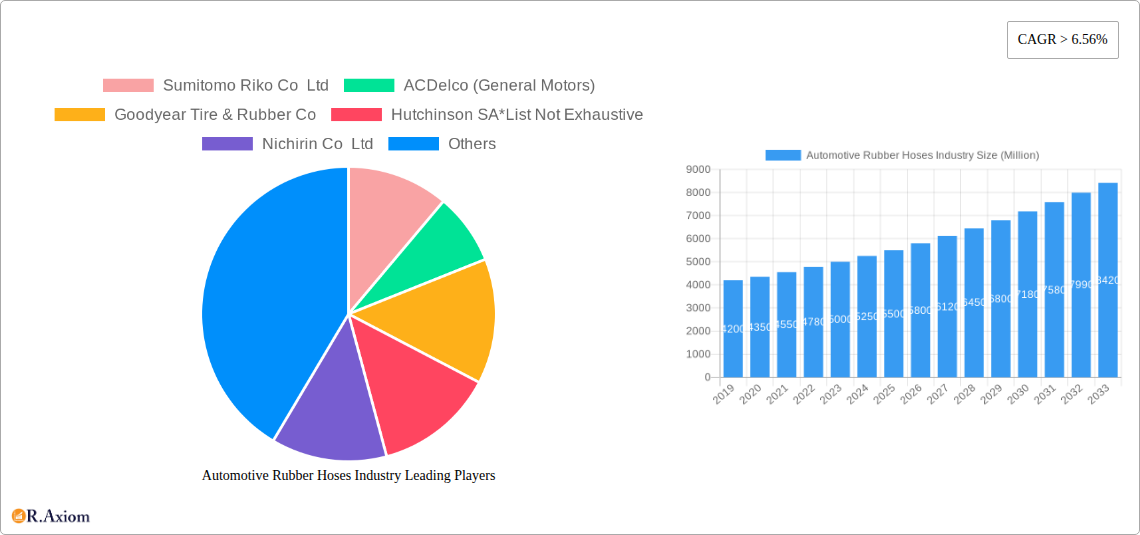

The global Automotive Rubber Hoses Market is poised for robust expansion, projected to reach a significant market size estimated at USD 5,500 million by 2025 and grow at a Compound Annual Growth Rate (CAGR) exceeding 6.56% through 2033. This upward trajectory is primarily fueled by the increasing global vehicle production, a growing demand for sophisticated emission control systems, and the continuous advancement in automotive technologies necessitating specialized and high-performance rubber hoses. The market is also benefiting from the rising adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs), which, while differing in hose requirements, still depend on specialized rubber components for thermal management, fluid transfer, and braking systems. Key drivers include the escalating production of passenger cars and commercial vehicles, particularly in emerging economies, and the stringent regulatory landscape demanding improved fuel efficiency and reduced emissions, thereby driving innovation in hose materials and designs.

Automotive Rubber Hoses Industry Market Size (In Billion)

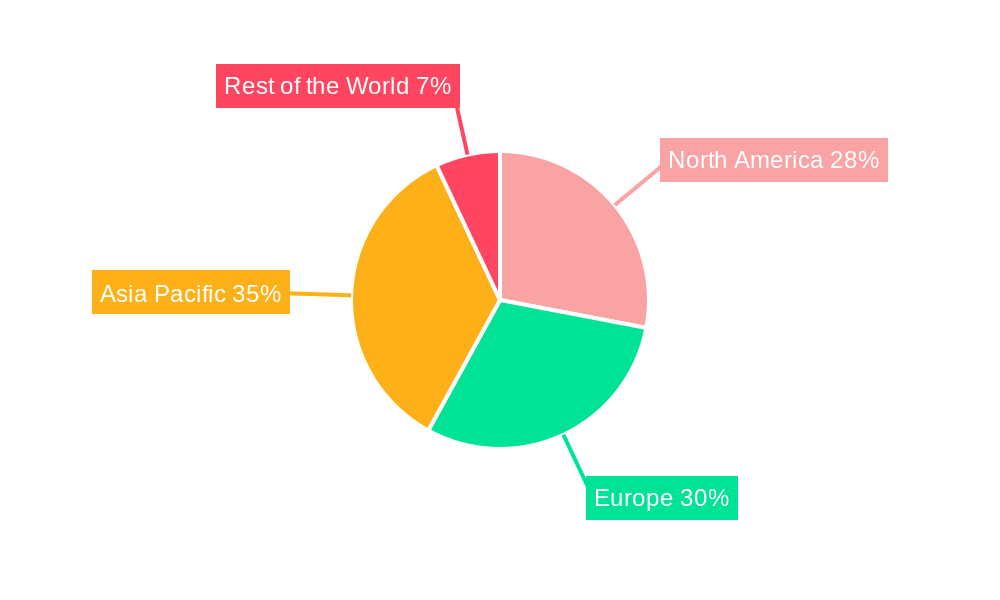

The market segmentation reveals a dynamic landscape with Drive Belts and Timing Belts holding significant sway within the belt segment, and Fuel Delivery System Hoses and Heating and Cooling System Hoses being crucial within the hose segment. Passenger cars represent the largest vehicle type segment, though commercial vehicles are demonstrating substantial growth due to increased logistics and transportation needs. Geographically, the Asia Pacific region, led by China and India, is expected to be the fastest-growing market, driven by its vast manufacturing base and burgeoning automotive sector. North America and Europe remain mature yet significant markets, with a focus on technological advancements and replacement demand. Key players like Sumitomo Riko, Continental AG, and Dayco are actively investing in research and development to enhance product performance, durability, and environmental sustainability, further shaping the market's competitive and innovative future.

Automotive Rubber Hoses Industry Company Market Share

Automotive Rubber Hoses Industry: Comprehensive Market Analysis 2019-2033

This in-depth report offers a comprehensive analysis of the global Automotive Rubber Hoses market, spanning from 2019 to 2033, with a base year of 2025. The report delves into market dynamics, key trends, segmentation, leading players, and future outlook, providing actionable insights for industry stakeholders. With a projected market value of $XX Million in the base year 2025, and a CAGR of XX% during the forecast period 2025-2033, this study is an essential resource for understanding the trajectory of automotive rubber hose manufacturers, suppliers, and investors. High-traffic keywords such as "automotive hoses," "rubber hoses," "vehicle components," "fluid transfer systems," "engine cooling hoses," "braking hoses," and "turbocharger hoses" have been integrated to ensure maximum search visibility.

Automotive Rubber Hoses Industry Market Concentration & Innovation

The Automotive Rubber Hoses market exhibits moderate to high concentration, with key players like Sumitomo Riko Co Ltd, ACDelco (General Motors), Goodyear Tire & Rubber Co, and Hutchinson SA leading the landscape. Innovations in material science, particularly the development of advanced rubber compounds and reinforced hoses, are crucial for meeting stringent performance and durability requirements. Regulatory frameworks, such as emissions standards and safety regulations, directly influence product development and material choices. The emergence of electric vehicles (EVs) presents a unique challenge and opportunity, with a potential shift away from certain combustion engine-specific hoses. M&A activities, with estimated deal values in the $XX Million range, are observed as companies seek to expand their product portfolios, geographic reach, and technological capabilities. The market share of key players is estimated to be between XX% and XX%.

- Market Concentration: Dominated by a few major global players, alongside a significant number of regional and specialized manufacturers.

- Innovation Drivers: Advanced material development, lightweighting solutions, enhanced heat and chemical resistance, and solutions for electrified powertrains.

- Regulatory Frameworks: Emission standards (Euro 7, EPA), safety directives (FMVSS), and material compliance (RoHS).

- Product Substitutes: While direct substitutes for rubber hoses are limited in core applications, advancements in alternative materials for specific components within fluid transfer systems are being explored.

- End-User Trends: Increasing demand for high-performance, durable, and eco-friendly automotive components.

- M&A Activities: Strategic acquisitions to consolidate market position, gain access to new technologies, and expand product offerings.

Automotive Rubber Hoses Industry Industry Trends & Insights

The global Automotive Rubber Hoses market is poised for significant growth, driven by the continuous expansion of the automotive industry worldwide and the increasing complexity of vehicle systems. The ongoing transition towards electrified vehicles, while altering the demand for certain traditional hoses, is simultaneously creating new opportunities for specialized cooling and fluid management systems. Advanced materials, such as silicone and EPDM rubber, are gaining prominence due to their superior resistance to extreme temperatures and chemicals, essential for modern engine and powertrain designs. The increasing adoption of turbochargers in both passenger cars and commercial vehicles is directly boosting the demand for high-performance turbocharger hoses capable of withstanding elevated temperatures and pressures. Furthermore, stringent safety regulations and the growing emphasis on vehicle reliability are compelling manufacturers to invest in robust and durable braking system hoses and power steering system hoses. The aftermarket segment is also contributing substantially to market growth, fueled by routine maintenance and replacement needs. The market penetration for advanced hose solutions is estimated to reach XX% by the end of the forecast period. The projected CAGR for the Automotive Rubber Hoses industry stands at an impressive XX% during the forecast period (2025-2033).

Dominant Markets & Segments in Automotive Rubber Hoses Industry

The Automotive Rubber Hoses market demonstrates significant regional dominance and segment-specific growth. Asia Pacific is the leading region, driven by the massive production of vehicles and a burgeoning automotive aftermarket. Countries like China, Japan, and South Korea are major contributors to this dominance, supported by strong domestic manufacturing capabilities and significant export activities. Within this region, Passenger Cars represent the largest vehicle type segment, accounting for an estimated XX% of the total market volume.

Among the hose types, Heating and Cooling System Hoses currently hold the largest market share, estimated at XX%, due to their essential role in maintaining optimal engine temperature and cabin comfort across all vehicle types. The increasing adoption of advanced thermal management systems in both internal combustion engine (ICE) vehicles and EVs further solidifies this segment's position. Following closely, Fuel Delivery System Hoses are critical for the efficient and safe delivery of fuel, with demand directly linked to the global vehicle parc.

The Drive Belt segment within the broader belt type category is also a significant contributor, essential for powering various automotive accessories. However, with the rise of EVs, the demand for traditional drive belts may see a gradual shift, while Timing Belts, crucial for internal combustion engine synchronization, continue to hold a stable market share, especially in existing vehicle fleets.

- Leading Region: Asia Pacific, driven by robust automotive manufacturing and consumption.

- Key Drivers: Favorable economic policies, significant automotive production hubs, increasing disposable incomes, and a large consumer base.

- Dominant Vehicle Type: Passenger Cars, accounting for an estimated XX% of the market.

- Key Drivers: High global vehicle production, evolving consumer preferences for personal mobility, and the introduction of new models.

- Dominant Hose Type: Heating and Cooling System Hoses, representing an estimated XX% of the market.

- Key Drivers: Essential for engine performance and passenger comfort, advancements in thermal management, and the need for reliable fluid transfer.

- Significant Belt Type Segment: Drive Belt, crucial for powering auxiliary systems.

- Key Drivers: Continuous operation of essential vehicle functions like power steering, air conditioning, and alternators.

Automotive Rubber Hoses Industry Product Developments

Product innovation in the automotive rubber hoses sector focuses on enhancing durability, temperature resistance, and chemical compatibility. Manufacturers are developing advanced rubber compounds and reinforced structures to withstand higher pressures and extreme operating conditions, particularly for turbocharger and high-performance braking systems. The integration of smart materials and sensor technologies for real-time monitoring of hose integrity is an emerging trend. These developments aim to improve vehicle safety, reduce maintenance costs, and support the evolving demands of modern automotive powertrains, including those in electric and hybrid vehicles, which require specialized thermal management solutions.

Report Scope & Segmentation Analysis

This report provides a granular analysis of the Automotive Rubber Hoses market across key segments. The Belt Type segmentation includes Drive Belt and Timing Belt. The Hose Type segmentation encompasses Fuel Delivery System Hoses, Braking System Hoses, Power Steering System Hoses, Heating and Cooling System Hoses, and Turbocharger Hoses. The Vehicle Type segmentation covers Passenger Cars and Commercial Vehicles. Each segment is analyzed for its market size, growth projections, and competitive dynamics, offering insights into segment-specific opportunities and challenges within the broader market landscape. The estimated market size for the Passenger Cars segment is $XX Million, projected to grow at a CAGR of XX%. For Commercial Vehicles, the market size is estimated at $XX Million, with a projected CAGR of XX%.

Key Drivers of Automotive Rubber Hoses Industry Growth

The growth of the Automotive Rubber Hoses industry is propelled by several key factors. The continuous expansion of the global automotive production, particularly in emerging economies, directly translates to increased demand for essential components like rubber hoses. Technological advancements in vehicle design, leading to more complex engine and powertrain systems, necessitate the use of specialized, high-performance hoses. Furthermore, stringent automotive safety and emission regulations worldwide mandate the use of reliable and durable fluid transfer systems, driving the demand for premium quality hoses. The increasing adoption of turbocharging technology in vehicles to improve fuel efficiency and performance also significantly boosts the demand for turbocharger hoses.

Challenges in the Automotive Rubber Hoses Industry Sector

Despite robust growth, the Automotive Rubber Hoses industry faces several challenges. The increasing transition towards electric vehicles (EVs) poses a long-term challenge for traditional combustion engine-related hose demand. Fluctuations in raw material prices, particularly for natural and synthetic rubber, can impact manufacturing costs and profit margins. Intense competition among numerous global and regional players leads to pricing pressures. Additionally, stringent environmental regulations regarding the disposal and recyclability of rubber products require manufacturers to invest in sustainable production practices and materials.

Emerging Opportunities in Automotive Rubber Hoses Industry

The Automotive Rubber Hoses industry is presented with significant emerging opportunities. The burgeoning electric vehicle market is creating a demand for specialized thermal management hoses to regulate battery and powertrain temperatures. Advancements in material science are enabling the development of lightweight, high-strength, and eco-friendly rubber compounds. The growing trend of vehicle lightweighting also drives demand for innovative hose solutions. Furthermore, the expansion of autonomous driving technology may lead to new hose requirements for integrated sensor and cooling systems. The aftermarket segment continues to offer steady growth opportunities through replacement and maintenance needs.

Leading Players in the Automotive Rubber Hoses Industry Market

- Sumitomo Riko Co Ltd

- ACDelco (General Motors)

- Goodyear Tire & Rubber Co

- Hutchinson SA

- Nichirin Co Ltd

- Continental AG

- Dayco IP Holdings LLC

- Schaeffler AG

- Toyoda Gosei Co Ltd

- Yokohama Rubber Co Ltd

Key Developments in Automotive Rubber Hoses Industry Industry

- September 2022: KA merged Fluid Transfer Systems (FTS) and Couplings business units to create a new 'Flow Control Systems business unit. KA's FTS business unit supplies PTFE hoses and hose assemblies to various industrial and automotive markets. The couplings business is a supplier of compressed air couplings to the global commercial vehicle market, indicating strategic consolidation and market focus.

- July 2022: Continental AG's industrial segment ContiTech announced the major restructuring of hose sites in Germany, citing an oversupply of rubber hoses for combustion engines due to the automobile industry's transition. This highlights the impact of industry shifts on production strategies.

- February 2021: Yokohama Rubber announced the development of an AI system to predict rubber compound physical properties, launched under their HAICoLab concept. Teijin Frontier intends to promote new adhesives for tires, belts, and hoses, demonstrating advancements in material development and prediction technologies.

- August 2021: The UK-based Leyland Hose & Silicone Services (LHSS) established its first European manufacturing unit in Hungary. As an automotive supplier with over 30 years of silicone hose experience, this expansion addresses market demand and signifies geographic growth for specialized hose manufacturers.

Strategic Outlook for Automotive Rubber Hoses Industry Market

The strategic outlook for the Automotive Rubber Hoses market is characterized by adaptation and innovation. Manufacturers are focusing on diversifying their product portfolios to cater to the evolving needs of electric vehicles, particularly in thermal management systems. Investments in research and development for advanced materials and smart hose technologies are crucial for maintaining a competitive edge. Strategic partnerships and collaborations, along with potential M&A activities, will likely shape market consolidation. The continuous drive for sustainability, including the use of recycled materials and eco-friendly production processes, will also be a key differentiator. Overall, the industry is poised for steady growth, driven by the ongoing evolution of the global automotive landscape.

Automotive Rubber Hoses Industry Segmentation

-

1. Belt Type

- 1.1. Drive Belt

- 1.2. Timing Belt

-

2. Hose Type

- 2.1. Fuel Delivery System Hoses

- 2.2. Braking System Hoses

- 2.3. Power Steering System Hoses

- 2.4. Heating and Cooling System Hoses

- 2.5. Turbocharger Hoses

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

Automotive Rubber Hoses Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. South Africa

- 4.3. Other Countries

Automotive Rubber Hoses Industry Regional Market Share

Geographic Coverage of Automotive Rubber Hoses Industry

Automotive Rubber Hoses Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Passenger Car Sales Propelling Market Growth

- 3.3. Market Restrains

- 3.3.1. Fluctuation in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Rising Sales of Passenger Cars to Enhance Market Growth During Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Rubber Hoses Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Belt Type

- 5.1.1. Drive Belt

- 5.1.2. Timing Belt

- 5.2. Market Analysis, Insights and Forecast - by Hose Type

- 5.2.1. Fuel Delivery System Hoses

- 5.2.2. Braking System Hoses

- 5.2.3. Power Steering System Hoses

- 5.2.4. Heating and Cooling System Hoses

- 5.2.5. Turbocharger Hoses

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Belt Type

- 6. North America Automotive Rubber Hoses Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Belt Type

- 6.1.1. Drive Belt

- 6.1.2. Timing Belt

- 6.2. Market Analysis, Insights and Forecast - by Hose Type

- 6.2.1. Fuel Delivery System Hoses

- 6.2.2. Braking System Hoses

- 6.2.3. Power Steering System Hoses

- 6.2.4. Heating and Cooling System Hoses

- 6.2.5. Turbocharger Hoses

- 6.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.3.1. Passenger Cars

- 6.3.2. Commercial Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Belt Type

- 7. Europe Automotive Rubber Hoses Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Belt Type

- 7.1.1. Drive Belt

- 7.1.2. Timing Belt

- 7.2. Market Analysis, Insights and Forecast - by Hose Type

- 7.2.1. Fuel Delivery System Hoses

- 7.2.2. Braking System Hoses

- 7.2.3. Power Steering System Hoses

- 7.2.4. Heating and Cooling System Hoses

- 7.2.5. Turbocharger Hoses

- 7.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.3.1. Passenger Cars

- 7.3.2. Commercial Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Belt Type

- 8. Asia Pacific Automotive Rubber Hoses Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Belt Type

- 8.1.1. Drive Belt

- 8.1.2. Timing Belt

- 8.2. Market Analysis, Insights and Forecast - by Hose Type

- 8.2.1. Fuel Delivery System Hoses

- 8.2.2. Braking System Hoses

- 8.2.3. Power Steering System Hoses

- 8.2.4. Heating and Cooling System Hoses

- 8.2.5. Turbocharger Hoses

- 8.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.3.1. Passenger Cars

- 8.3.2. Commercial Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Belt Type

- 9. Rest of the World Automotive Rubber Hoses Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Belt Type

- 9.1.1. Drive Belt

- 9.1.2. Timing Belt

- 9.2. Market Analysis, Insights and Forecast - by Hose Type

- 9.2.1. Fuel Delivery System Hoses

- 9.2.2. Braking System Hoses

- 9.2.3. Power Steering System Hoses

- 9.2.4. Heating and Cooling System Hoses

- 9.2.5. Turbocharger Hoses

- 9.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.3.1. Passenger Cars

- 9.3.2. Commercial Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Belt Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Sumitomo Riko Co Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 ACDelco (General Motors)

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Goodyear Tire & Rubber Co

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Hutchinson SA*List Not Exhaustive

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Nichirin Co Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Continental AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Dayco IP Holdings LLC

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Schaeffler AG

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Toyoda Gosei Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Yokohama Rubber Co Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Sumitomo Riko Co Ltd

List of Figures

- Figure 1: Global Automotive Rubber Hoses Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Rubber Hoses Industry Revenue (Million), by Belt Type 2025 & 2033

- Figure 3: North America Automotive Rubber Hoses Industry Revenue Share (%), by Belt Type 2025 & 2033

- Figure 4: North America Automotive Rubber Hoses Industry Revenue (Million), by Hose Type 2025 & 2033

- Figure 5: North America Automotive Rubber Hoses Industry Revenue Share (%), by Hose Type 2025 & 2033

- Figure 6: North America Automotive Rubber Hoses Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 7: North America Automotive Rubber Hoses Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 8: North America Automotive Rubber Hoses Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Automotive Rubber Hoses Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Automotive Rubber Hoses Industry Revenue (Million), by Belt Type 2025 & 2033

- Figure 11: Europe Automotive Rubber Hoses Industry Revenue Share (%), by Belt Type 2025 & 2033

- Figure 12: Europe Automotive Rubber Hoses Industry Revenue (Million), by Hose Type 2025 & 2033

- Figure 13: Europe Automotive Rubber Hoses Industry Revenue Share (%), by Hose Type 2025 & 2033

- Figure 14: Europe Automotive Rubber Hoses Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 15: Europe Automotive Rubber Hoses Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Europe Automotive Rubber Hoses Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Automotive Rubber Hoses Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Automotive Rubber Hoses Industry Revenue (Million), by Belt Type 2025 & 2033

- Figure 19: Asia Pacific Automotive Rubber Hoses Industry Revenue Share (%), by Belt Type 2025 & 2033

- Figure 20: Asia Pacific Automotive Rubber Hoses Industry Revenue (Million), by Hose Type 2025 & 2033

- Figure 21: Asia Pacific Automotive Rubber Hoses Industry Revenue Share (%), by Hose Type 2025 & 2033

- Figure 22: Asia Pacific Automotive Rubber Hoses Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 23: Asia Pacific Automotive Rubber Hoses Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: Asia Pacific Automotive Rubber Hoses Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Automotive Rubber Hoses Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Automotive Rubber Hoses Industry Revenue (Million), by Belt Type 2025 & 2033

- Figure 27: Rest of the World Automotive Rubber Hoses Industry Revenue Share (%), by Belt Type 2025 & 2033

- Figure 28: Rest of the World Automotive Rubber Hoses Industry Revenue (Million), by Hose Type 2025 & 2033

- Figure 29: Rest of the World Automotive Rubber Hoses Industry Revenue Share (%), by Hose Type 2025 & 2033

- Figure 30: Rest of the World Automotive Rubber Hoses Industry Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 31: Rest of the World Automotive Rubber Hoses Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 32: Rest of the World Automotive Rubber Hoses Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Automotive Rubber Hoses Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Rubber Hoses Industry Revenue Million Forecast, by Belt Type 2020 & 2033

- Table 2: Global Automotive Rubber Hoses Industry Revenue Million Forecast, by Hose Type 2020 & 2033

- Table 3: Global Automotive Rubber Hoses Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 4: Global Automotive Rubber Hoses Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Automotive Rubber Hoses Industry Revenue Million Forecast, by Belt Type 2020 & 2033

- Table 6: Global Automotive Rubber Hoses Industry Revenue Million Forecast, by Hose Type 2020 & 2033

- Table 7: Global Automotive Rubber Hoses Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 8: Global Automotive Rubber Hoses Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Automotive Rubber Hoses Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Automotive Rubber Hoses Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Automotive Rubber Hoses Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Automotive Rubber Hoses Industry Revenue Million Forecast, by Belt Type 2020 & 2033

- Table 13: Global Automotive Rubber Hoses Industry Revenue Million Forecast, by Hose Type 2020 & 2033

- Table 14: Global Automotive Rubber Hoses Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 15: Global Automotive Rubber Hoses Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Automotive Rubber Hoses Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Automotive Rubber Hoses Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Automotive Rubber Hoses Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Automotive Rubber Hoses Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Spain Automotive Rubber Hoses Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Automotive Rubber Hoses Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Automotive Rubber Hoses Industry Revenue Million Forecast, by Belt Type 2020 & 2033

- Table 23: Global Automotive Rubber Hoses Industry Revenue Million Forecast, by Hose Type 2020 & 2033

- Table 24: Global Automotive Rubber Hoses Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 25: Global Automotive Rubber Hoses Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: China Automotive Rubber Hoses Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: India Automotive Rubber Hoses Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Japan Automotive Rubber Hoses Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: South Korea Automotive Rubber Hoses Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Automotive Rubber Hoses Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Global Automotive Rubber Hoses Industry Revenue Million Forecast, by Belt Type 2020 & 2033

- Table 32: Global Automotive Rubber Hoses Industry Revenue Million Forecast, by Hose Type 2020 & 2033

- Table 33: Global Automotive Rubber Hoses Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 34: Global Automotive Rubber Hoses Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 35: Brazil Automotive Rubber Hoses Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: South Africa Automotive Rubber Hoses Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Other Countries Automotive Rubber Hoses Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Rubber Hoses Industry?

The projected CAGR is approximately > 6.56%.

2. Which companies are prominent players in the Automotive Rubber Hoses Industry?

Key companies in the market include Sumitomo Riko Co Ltd, ACDelco (General Motors), Goodyear Tire & Rubber Co, Hutchinson SA*List Not Exhaustive, Nichirin Co Ltd, Continental AG, Dayco IP Holdings LLC, Schaeffler AG, Toyoda Gosei Co Ltd, Yokohama Rubber Co Ltd.

3. What are the main segments of the Automotive Rubber Hoses Industry?

The market segments include Belt Type, Hose Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Passenger Car Sales Propelling Market Growth.

6. What are the notable trends driving market growth?

Rising Sales of Passenger Cars to Enhance Market Growth During Forecast Period.

7. Are there any restraints impacting market growth?

Fluctuation in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

In September 2022, KA)merged Fluid Transfer Systems (FTS) and Couplings business units to create a new 'Flow Control Systems business unit. KA's FTS business unit supplies PTFE hoses and hose assemblies to various industrial and automotive markets. The couplings business is a supplier of compressed air couplings to the global commercial vehicle market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Rubber Hoses Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Rubber Hoses Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Rubber Hoses Industry?

To stay informed about further developments, trends, and reports in the Automotive Rubber Hoses Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence