Key Insights

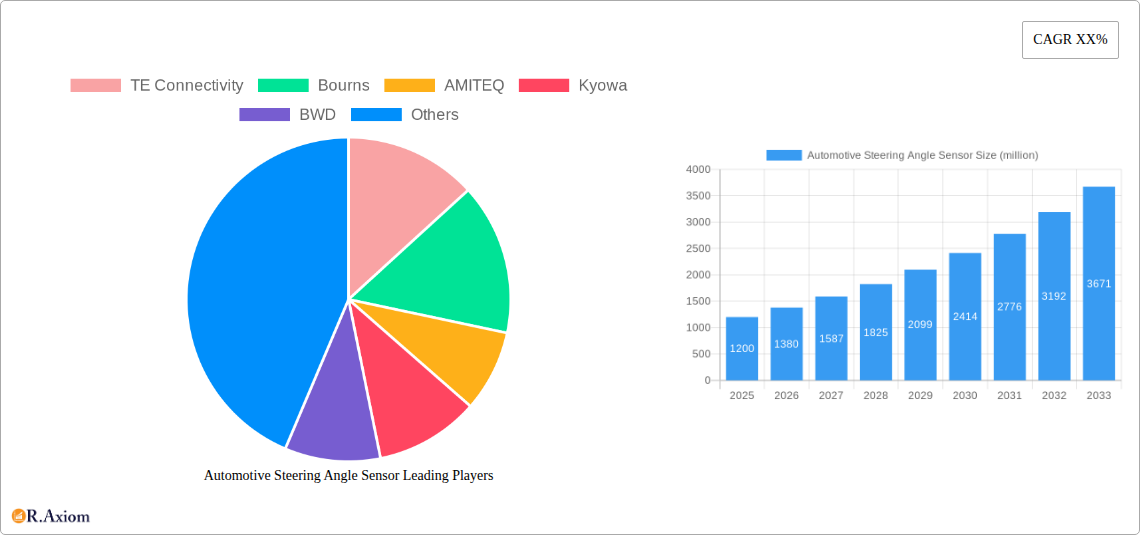

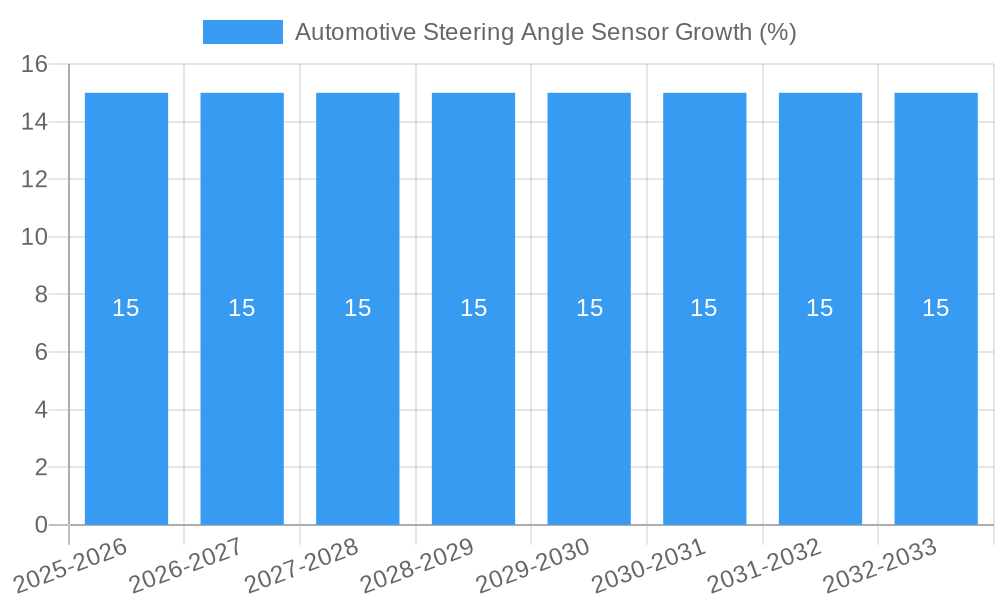

The Automotive Steering Angle Sensor market is poised for substantial growth, projected to reach an estimated $1,200 million by 2025, with a Compound Annual Growth Rate (CAGR) of 15% through 2033. This robust expansion is primarily fueled by the increasing integration of advanced driver-assistance systems (ADAS) in both passenger and commercial vehicles. Features like electronic stability control (ESC), adaptive cruise control, and automated parking systems heavily rely on precise steering angle data for their functionality. Furthermore, the escalating demand for enhanced vehicle safety and the growing adoption of autonomous driving technologies are significant market drivers. The ongoing evolution of automotive electronics, coupled with stringent safety regulations globally, is compelling manufacturers to equip vehicles with sophisticated sensor technologies, thus stimulating market demand for steering angle sensors.

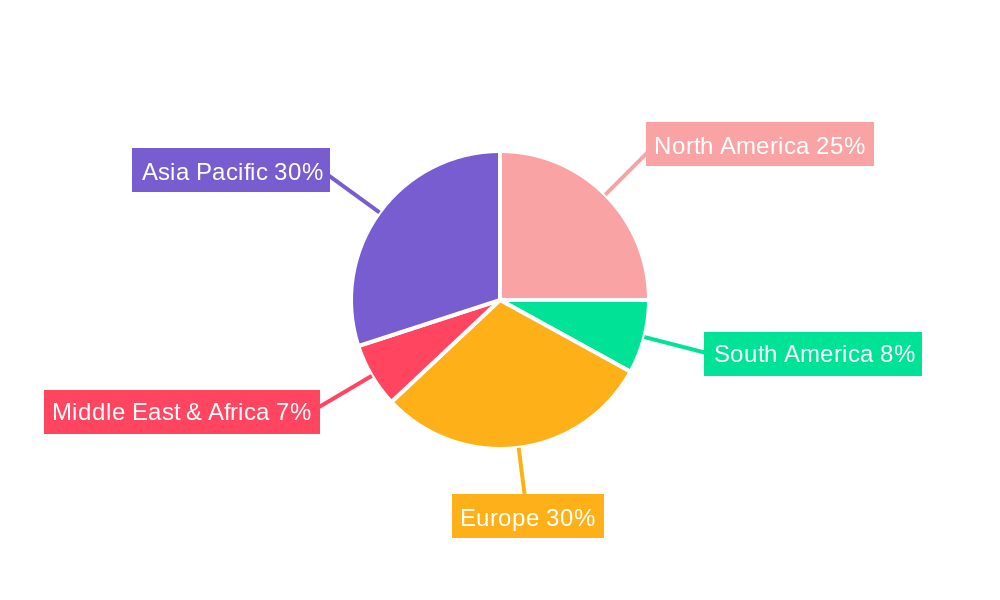

The market is segmented into digital and analog sensors, with digital sensors gaining prominence due to their superior accuracy, reliability, and ease of integration with modern vehicle electronic architectures. Applications span across passenger vehicles, which constitute the larger share of the market, and commercial vehicles, where the adoption of ADAS and advanced safety features is rapidly increasing. Geographically, Asia Pacific, led by China and Japan, is expected to emerge as the fastest-growing region, driven by its massive automotive production and the rapid adoption of new vehicle technologies. North America and Europe, with established automotive industries and a strong focus on safety, will continue to be significant markets. Key industry players like Bosch, TE Connectivity, and Hella are at the forefront, investing in research and development to innovate and cater to the evolving demands of the automotive sector.

Here is a comprehensive, SEO-optimized report description for the Automotive Steering Angle Sensor Market:

Automotive Steering Angle Sensor Market Concentration & Innovation

The Automotive Steering Angle Sensor market is characterized by a moderate to high concentration, with a significant market share held by a few leading players. Innovation is primarily driven by the increasing demand for advanced driver-assistance systems (ADAS), autonomous driving features, and enhanced vehicle safety. Regulatory frameworks mandating safety standards and emission controls further propel the adoption of sophisticated steering angle sensors. Product substitutes, such as mechanical steering systems without electronic angle sensing, are steadily being phased out in favor of electronic solutions due to performance and safety benefits. End-user trends indicate a growing preference for comfort, convenience, and proactive safety features in vehicles, directly impacting the demand for precise steering angle data. Mergers and acquisitions (M&A) activities, with reported deal values in the hundreds of millions, are a key strategy for companies to consolidate market positions, acquire new technologies, and expand their product portfolios. The market is dynamic, with ongoing investments in research and development to improve sensor accuracy, reliability, and cost-effectiveness.

Automotive Steering Angle Sensor Industry Trends & Insights

The global Automotive Steering Angle Sensor market is poised for substantial growth, projecting a Compound Annual Growth Rate (CAGR) of approximately 8.5% from 2025 to 2033. This robust expansion is fueled by a confluence of powerful market growth drivers, including the accelerating integration of advanced driver-assistance systems (ADAS) such as electronic stability control (ESC), adaptive cruise control (ACC), and lane-keeping assist (LKA). As vehicle electrification and autonomous driving technologies mature, the demand for highly precise and reliable steering angle sensors intensifies, becoming an indispensable component for vehicle dynamics control and autonomous decision-making. Technological disruptions, notably the advancement from traditional magnetic encoders to more sophisticated non-contact Hall effect and optical sensors, are enhancing performance, reducing component wear, and lowering manufacturing costs. Consumer preferences are increasingly shifting towards vehicles offering a higher degree of safety, comfort, and advanced technological features. This is evident in the growing penetration of ADAS in both passenger and commercial vehicles. The competitive dynamics within the industry are shaped by intense R&D efforts, strategic partnerships between sensor manufacturers and automotive OEMs, and a continuous drive for miniaturization and cost reduction. The market penetration of steering angle sensors is expected to reach over 90% in new passenger vehicles by 2033, with significant adoption in the commercial vehicle segment as well, driven by fleet management and safety regulations. The overall market size is anticipated to surpass ten billion dollars by the end of the forecast period, reflecting sustained demand and technological evolution.

Dominant Markets & Segments in Automotive Steering Angle Sensor

The Passenger Vehicle segment is the dominant force within the Automotive Steering Angle Sensor market, accounting for an estimated 85% of the total market share. This dominance is driven by several key factors. Firstly, the sheer volume of passenger vehicle production globally, with annual production figures in the tens of millions, creates a massive demand base. Secondly, stringent safety regulations in major automotive markets, such as those enforced by the NHTSA in the United States and Euro NCAP in Europe, mandate the inclusion of ESC and other stability control systems, which inherently rely on accurate steering angle data. Economic policies that encourage vehicle ownership and advancements in automotive technology trickle down to the passenger vehicle segment more rapidly. The infrastructure for automotive manufacturing and aftermarket services is well-established, further supporting the widespread adoption of these sensors.

Within the Types segmentation, Digital Sensors are exhibiting faster growth and are projected to capture a larger market share, estimated at 70% by 2033. This is due to their superior accuracy, improved noise immunity, and ability to integrate seamlessly with modern automotive electronic control units (ECUs). Digital sensors are crucial for complex ADAS functions and autonomous driving systems that require high-precision data processing. The development of advanced algorithms for vehicle control further amplifies the preference for digital sensor outputs.

The Commercial Vehicle segment, while smaller in current market share (estimated at 15%), is experiencing a significant growth trajectory. This is attributed to increasing safety mandates for trucks and buses, the adoption of fleet management systems that leverage steering data for efficiency and safety, and the growing complexity of advanced driver-assistance systems in heavy-duty vehicles. Infrastructure development, particularly in logistics and transportation networks, indirectly fuels the demand for safer and more efficient commercial vehicles.

Analog Sensors, while still relevant, are gradually ceding market share to their digital counterparts, projected to hold around 30% of the market by 2033. Their current utility is often found in less complex vehicle systems or as a cost-effective solution where extreme precision is not paramount. However, the trend towards greater automation and connectivity in all vehicle types suggests a long-term decline in the relative market share of analog sensors.

Automotive Steering Angle Sensor Product Developments

Recent product developments in the Automotive Steering Angle Sensor market focus on enhancing sensor precision, miniaturization, and integration capabilities. Innovations include the development of non-contact sensors that offer greater durability and reduced wear, such as advanced Hall effect and optical sensing technologies. These advancements are enabling smaller, more power-efficient sensors that can be integrated into increasingly compact steering column modules. Competitive advantages are being gained by companies offering sensors with built-in diagnostics, enhanced resistance to environmental factors like vibration and temperature fluctuations, and improved cybersecurity features to protect against tampering. The trend towards redundant sensing systems for critical safety functions is also driving the development of dual-channel or even triple-channel steering angle sensors.

Report Scope & Segmentation Analysis

This report provides an in-depth analysis of the global Automotive Steering Angle Sensor market. The segmentation covers key application areas: Passenger Vehicle and Commercial Vehicle. In the Passenger Vehicle segment, the market is driven by mass production volumes, increasing safety regulations for ADAS, and consumer demand for advanced features, with projected market growth of 9.0% CAGR. The Commercial Vehicle segment, while smaller, is experiencing rapid growth (estimated 7.5% CAGR) due to safety mandates for fleets, telematics integration, and increasing complexity in heavy-duty vehicle safety systems.

The report also segments the market by sensor Types: Digital Sensors and Analog Sensors. The Digital Sensors segment is expected to dominate, with a projected market share of 70% by 2033 and a CAGR of 9.5%, due to their precision and integration capabilities for ADAS and autonomous driving. The Analog Sensors segment, holding an estimated 30% market share, is projected to grow at a more moderate CAGR of 6.0%, catering to specific applications where cost is a primary consideration or advanced functionality is not essential.

Key Drivers of Automotive Steering Angle Sensor Growth

The automotive steering angle sensor market is propelled by several critical growth drivers. Foremost among these is the relentless expansion of Advanced Driver-Assistance Systems (ADAS) and the ongoing development of autonomous driving technologies, both of which necessitate highly accurate and reliable steering angle data. Regulatory mandates worldwide, focusing on vehicle safety and accident prevention (e.g., ESC, AEB), are indirectly but powerfully driving demand for these sensors. The increasing sophistication of vehicle electronics and the trend towards software-defined vehicles, where functionalities are increasingly controlled by software, further boost the need for precise sensor inputs like steering angle. Economic prosperity in developing regions, leading to increased vehicle sales, and government initiatives promoting automotive innovation and electrification also contribute significantly to market expansion.

Challenges in the Automotive Steering Angle Sensor Sector

Despite robust growth, the Automotive Steering Angle Sensor sector faces several challenges. Fierce price competition among manufacturers, driven by the commoditization of some sensor types, puts pressure on profit margins. Supply chain disruptions, exacerbated by geopolitical events and shortages of key electronic components, can impact production timelines and costs. Evolving regulatory landscapes and the constant need to meet increasingly stringent safety and performance standards require continuous and significant investment in R&D. The complexity of integrating new sensor technologies into existing vehicle platforms, coupled with the need for robust cybersecurity measures to prevent hacking and ensure data integrity, presents ongoing technical hurdles. Furthermore, the lengthy automotive product development cycles mean that technological advancements must be carefully integrated to avoid obsolescence.

Emerging Opportunities in Automotive Steering Angle Sensor

Emerging opportunities in the Automotive Steering Angle Sensor market are abundant and diverse. The rapidly growing electric vehicle (EV) segment presents a significant avenue for growth, as EVs often incorporate advanced features that leverage steering angle data for optimized regenerative braking and torque vectoring. The expansion of connected car services and V2X (Vehicle-to-Everything) communication opens doors for steering angle data to be used in traffic management and predictive maintenance. The increasing adoption of autonomous driving technologies in ride-sharing fleets and logistics services will drive demand for high-redundancy and ultra-reliable steering angle sensing solutions. Furthermore, the development of next-generation steering systems, such as steer-by-wire, will create entirely new opportunities for advanced steering angle sensors with enhanced functionality and safety features, requiring millions in R&D investment.

Leading Players in the Automotive Steering Angle Sensor Market

- TE Connectivity

- Bourns

- AMITEQ

- Kyowa

- BWD

- Hella

- Valeo

- Kistler

- Ruili Group

- Bosch

- Danfoss

- Go-World

Key Developments in Automotive Steering Angle Sensor Industry

- 2023/Q4: Bosch launches a new generation of compact and highly accurate steering angle sensors, enhancing ADAS integration for premium passenger vehicles.

- 2023/Q3: TE Connectivity announces a strategic partnership with an autonomous driving software provider to co-develop integrated sensing and control solutions, valued at millions in development contracts.

- 2022/Q2: Hella introduces a steer-by-wire compatible steering angle sensor, demonstrating readiness for future automotive architectures.

- 2021/Q1: Valeo expands its ADAS sensor portfolio with advanced steering angle sensing capabilities, targeting cost-effective solutions for mass-market vehicles.

- 2020/Q4: Kistler showcases its latest non-contact steering angle sensor technology, promising enhanced durability and performance in harsh automotive environments.

Strategic Outlook for Automotive Steering Angle Sensor Market

The strategic outlook for the Automotive Steering Angle Sensor market remains exceptionally strong, fueled by the ongoing evolution of automotive technology. The relentless pursuit of enhanced vehicle safety, the burgeoning adoption of ADAS, and the inevitable progression towards higher levels of vehicle autonomy will continue to be primary growth catalysts. Companies that invest in R&D for next-generation sensing technologies, focus on miniaturization and cost optimization, and forge strong partnerships with automotive OEMs are well-positioned for success. The increasing demand for integrated solutions that combine steering angle sensing with other crucial vehicle data will present significant opportunities for market leaders to expand their value proposition and secure long-term contracts, potentially worth millions in recurring revenue.

Automotive Steering Angle Sensor Segmentation

-

1. Application

- 1.1. Passenger Vehicle

- 1.2. Commercial Vehicle

-

2. Types

- 2.1. Digital Sensors

- 2.2. Analog Sensors

Automotive Steering Angle Sensor Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Automotive Steering Angle Sensor REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Steering Angle Sensor Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Passenger Vehicle

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Digital Sensors

- 5.2.2. Analog Sensors

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Automotive Steering Angle Sensor Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Passenger Vehicle

- 6.1.2. Commercial Vehicle

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Digital Sensors

- 6.2.2. Analog Sensors

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Automotive Steering Angle Sensor Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Passenger Vehicle

- 7.1.2. Commercial Vehicle

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Digital Sensors

- 7.2.2. Analog Sensors

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Automotive Steering Angle Sensor Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Passenger Vehicle

- 8.1.2. Commercial Vehicle

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Digital Sensors

- 8.2.2. Analog Sensors

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Automotive Steering Angle Sensor Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Passenger Vehicle

- 9.1.2. Commercial Vehicle

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Digital Sensors

- 9.2.2. Analog Sensors

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Automotive Steering Angle Sensor Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Passenger Vehicle

- 10.1.2. Commercial Vehicle

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Digital Sensors

- 10.2.2. Analog Sensors

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 TE Connectivity

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bourns

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AMITEQ

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kyowa

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BWD

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hella

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Valeo

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kistler

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ruili Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bosch

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Danfoss

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Go-World

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 TE Connectivity

List of Figures

- Figure 1: Global Automotive Steering Angle Sensor Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Automotive Steering Angle Sensor Revenue (million), by Application 2024 & 2032

- Figure 3: North America Automotive Steering Angle Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Automotive Steering Angle Sensor Revenue (million), by Types 2024 & 2032

- Figure 5: North America Automotive Steering Angle Sensor Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Automotive Steering Angle Sensor Revenue (million), by Country 2024 & 2032

- Figure 7: North America Automotive Steering Angle Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Automotive Steering Angle Sensor Revenue (million), by Application 2024 & 2032

- Figure 9: South America Automotive Steering Angle Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Automotive Steering Angle Sensor Revenue (million), by Types 2024 & 2032

- Figure 11: South America Automotive Steering Angle Sensor Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Automotive Steering Angle Sensor Revenue (million), by Country 2024 & 2032

- Figure 13: South America Automotive Steering Angle Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Automotive Steering Angle Sensor Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Automotive Steering Angle Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Automotive Steering Angle Sensor Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Automotive Steering Angle Sensor Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Automotive Steering Angle Sensor Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Automotive Steering Angle Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Automotive Steering Angle Sensor Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Automotive Steering Angle Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Automotive Steering Angle Sensor Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Automotive Steering Angle Sensor Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Automotive Steering Angle Sensor Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Automotive Steering Angle Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Automotive Steering Angle Sensor Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Automotive Steering Angle Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Automotive Steering Angle Sensor Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Automotive Steering Angle Sensor Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Automotive Steering Angle Sensor Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Automotive Steering Angle Sensor Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Automotive Steering Angle Sensor Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Automotive Steering Angle Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Automotive Steering Angle Sensor Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Automotive Steering Angle Sensor Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Automotive Steering Angle Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Automotive Steering Angle Sensor Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Automotive Steering Angle Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Automotive Steering Angle Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Automotive Steering Angle Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Automotive Steering Angle Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Automotive Steering Angle Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Automotive Steering Angle Sensor Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Automotive Steering Angle Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Automotive Steering Angle Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Automotive Steering Angle Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Automotive Steering Angle Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Automotive Steering Angle Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Automotive Steering Angle Sensor Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Automotive Steering Angle Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Automotive Steering Angle Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Automotive Steering Angle Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Automotive Steering Angle Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Automotive Steering Angle Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Automotive Steering Angle Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Automotive Steering Angle Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Automotive Steering Angle Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Automotive Steering Angle Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Automotive Steering Angle Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Automotive Steering Angle Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Automotive Steering Angle Sensor Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Automotive Steering Angle Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Automotive Steering Angle Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Automotive Steering Angle Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Automotive Steering Angle Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Automotive Steering Angle Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Automotive Steering Angle Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Automotive Steering Angle Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Automotive Steering Angle Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Automotive Steering Angle Sensor Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Automotive Steering Angle Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Automotive Steering Angle Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Automotive Steering Angle Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Automotive Steering Angle Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Automotive Steering Angle Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Automotive Steering Angle Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Automotive Steering Angle Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Automotive Steering Angle Sensor Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Steering Angle Sensor?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Automotive Steering Angle Sensor?

Key companies in the market include TE Connectivity, Bourns, AMITEQ, Kyowa, BWD, Hella, Valeo, Kistler, Ruili Group, Bosch, Danfoss, Go-World.

3. What are the main segments of the Automotive Steering Angle Sensor?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Steering Angle Sensor," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Steering Angle Sensor report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Steering Angle Sensor?

To stay informed about further developments, trends, and reports in the Automotive Steering Angle Sensor, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence