Key Insights

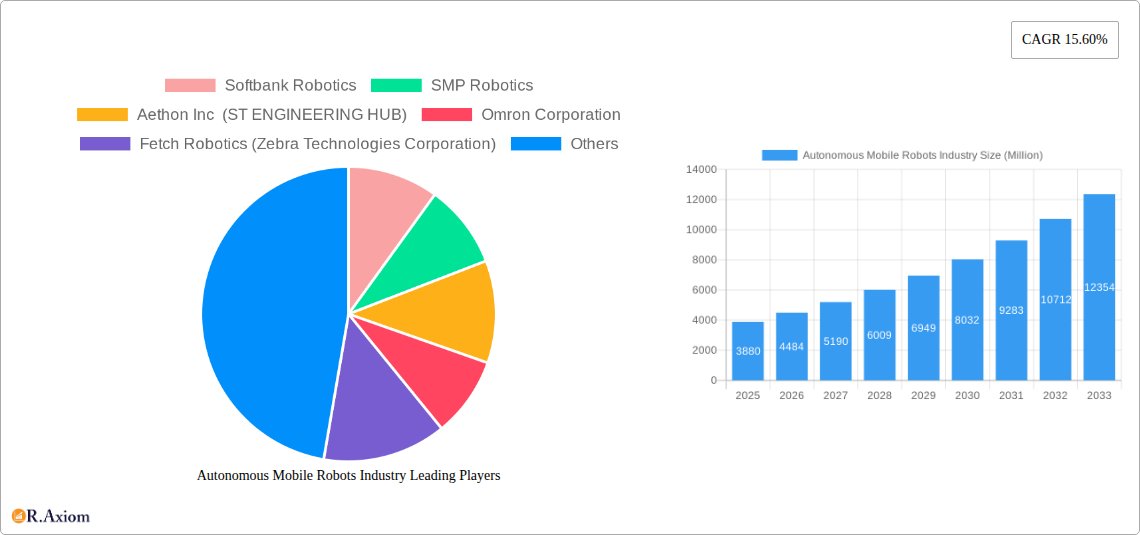

The Autonomous Mobile Robots (AMRs) industry is experiencing explosive growth, projected to reach USD 3.88 billion in market size by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 15.60% through 2033. This rapid expansion is primarily fueled by the escalating demand for automation across various end-user industries, including defense and security, warehouse and logistics, energy and power, automotive, manufacturing, and oil and gas. The inherent efficiency gains, enhanced safety protocols, and the ability to perform complex tasks in challenging environments are making AMRs an indispensable technology for businesses seeking to optimize operations and maintain a competitive edge. Key drivers include the increasing labor costs, the need for greater precision in operations, and the continuous advancements in AI, machine learning, and sensor technologies that are making AMRs more sophisticated and versatile. The market is witnessing a significant adoption of Unmanned Aerial Vehicles (UAVs) and Unmanned Ground Vehicles (UGVs) for diverse applications, from aerial surveillance and delivery to heavy lifting and intricate assembly within manufacturing floors. Humanoid robots are also gaining traction, particularly in roles requiring human-like dexterity and interaction.

Autonomous Mobile Robots Industry Market Size (In Billion)

The AMR market is characterized by dynamic trends such as the integration of advanced AI for improved decision-making and navigation, the development of collaborative robots (cobots) that work alongside humans, and the emergence of specialized AMRs tailored for niche applications in sectors like mining and minerals. While the potential for significant disruption and the promise of increased productivity are substantial, certain restraints could temper growth. These include the high initial investment cost for deploying AMR solutions, the need for specialized infrastructure and maintenance, and potential regulatory hurdles and cybersecurity concerns that require careful consideration. Geographically, North America and Europe are leading the adoption, driven by their mature industrial bases and proactive embrace of automation. However, the Asia Pacific region, particularly China and Japan, is emerging as a powerhouse of growth due to robust manufacturing sectors and government initiatives promoting technological innovation. Leading companies like Softbank Robotics, Omron Corporation, Fetch Robotics (Zebra Technologies Corporation), and OTTO Motors are at the forefront, continuously innovating and expanding their product portfolios to cater to the evolving needs of this rapidly expanding market.

Autonomous Mobile Robots Industry Company Market Share

This comprehensive report delves into the dynamic Autonomous Mobile Robots (AMR) industry, offering an in-depth analysis of market trends, key players, technological advancements, and future growth prospects. Covering the historical period of 2019-2024, the base year of 2025, and a robust forecast period extending to 2033, this report provides critical insights for stakeholders navigating this rapidly evolving sector. The global AMR market is projected to witness significant expansion, driven by increasing demand for automation across various industries.

Autonomous Mobile Robots Industry Market Concentration & Innovation

The Autonomous Mobile Robots (AMR) market exhibits a moderate concentration, with a blend of large established players and agile startups vying for market share. Innovation is primarily fueled by advancements in Artificial Intelligence (AI), machine learning, sensor technology, and enhanced navigation systems, enabling AMRs to perform complex tasks with greater autonomy and precision. Regulatory frameworks are gradually evolving to address safety standards and operational guidelines for AMRs, particularly in public spaces and industrial environments. Product substitutes, such as fixed automation systems and human labor, are being increasingly challenged by the flexibility, scalability, and cost-effectiveness offered by AMRs. End-user trends highlight a strong preference for solutions that improve operational efficiency, reduce labor costs, and enhance worker safety. Mergers and acquisitions (M&A) are a key strategy for market players to expand their product portfolios, gain access to new technologies, and consolidate their market positions. For instance, the strategic investment by Mitsubishi Electric Corporation in Clearpath Robotics (parent company of OTTO Motors) signifies a trend towards strategic partnerships to accelerate innovation and market penetration. The M&A deal value in the AMR sector is estimated to be in the billions of dollars, reflecting the significant investment and consolidation activities. The market is projected to see a significant CAGR of xx% during the forecast period.

Autonomous Mobile Robots Industry Industry Trends & Insights

The Autonomous Mobile Robots (AMR) industry is experiencing an unprecedented surge in growth, propelled by a confluence of transformative trends and technological breakthroughs. The foundational driver remains the relentless pursuit of operational efficiency and cost reduction across diverse end-user industries. Companies are increasingly recognizing the potent capabilities of AMRs to streamline workflows, optimize material handling, and minimize human error, thereby directly impacting bottom lines. This is particularly evident in the warehouse and logistics sector, where the exponential growth of e-commerce has created an urgent need for scalable and flexible automation solutions. The integration of advanced AI and machine learning algorithms is revolutionizing AMR capabilities, enabling them to perform sophisticated tasks such as dynamic path planning, object recognition, and collaborative operations with human workers. This evolution from basic material transport to intelligent task execution is a pivotal trend. Furthermore, the increasing sophistication of sensor technology, including LiDAR, depth cameras, and ultrasonic sensors, provides AMRs with enhanced environmental awareness, crucial for safe and efficient navigation in complex and dynamic settings. The market penetration of AMRs is rapidly increasing, moving beyond niche applications to become integral components of mainstream industrial operations. The projected market size is expected to reach approximately $XX Million by 2033, with a compound annual growth rate (CAGR) of xx% from 2025 to 2033. Consumer preferences are shifting towards solutions that offer greater agility and adaptability, a niche that AMRs are exceptionally well-positioned to fill. This adaptability is crucial for businesses facing fluctuating demand and evolving operational needs. Competitive dynamics are characterized by intense innovation, strategic partnerships, and increasing consolidation, as companies strive to establish a dominant presence in this high-growth market. The development of modular and interoperable AMR systems is also gaining traction, allowing businesses to create customized automation solutions that can be easily scaled and integrated into existing infrastructure. The energy and power sector, along with manufacturing, are also witnessing significant adoption, driven by the need for safety in hazardous environments and the pursuit of Industry 4.0 initiatives.

Dominant Markets & Segments in Autonomous Mobile Robots Industry

The Autonomous Mobile Robots (AMR) industry is characterized by the dominance of specific segments and regions, driven by unique economic, technological, and regulatory factors.

Type Segment Dominance:

Unmanned Ground Vehicles (UGVs): This segment currently holds the largest market share and is expected to continue its dominance throughout the forecast period.

- Key Drivers: High demand from warehouse and logistics, manufacturing, and automotive sectors for efficient material handling and internal logistics. Advances in navigation, obstacle avoidance, and payload capacity are expanding their application scope.

- Dominance Analysis: UGVs offer unparalleled flexibility in navigating complex industrial environments, performing tasks ranging from simple pallet transportation to intricate assembly line support. Their ability to adapt to changing facility layouts and integrate seamlessly with existing infrastructure makes them a preferred choice for businesses seeking immediate automation benefits. The market size for UGVs is estimated to be around $XX Million in 2025 and is projected to grow substantially by 2033.

Humanoids: While a nascent segment, humanoids are experiencing rapid growth and hold significant long-term potential.

- Key Drivers: Growing interest in applications requiring human-like dexterity and interaction, such as elder care, customer service, and specialized industrial tasks. Ongoing research and development in AI and bionics are paving the way for more sophisticated humanoid robots.

- Dominance Analysis: The adoption of humanoids is currently limited by their higher cost and more complex operational requirements. However, as technology matures and economies of scale are achieved, humanoids are poised to become critical in applications where human-robot collaboration is essential.

Unmanned Aerial Vehicles (UAVs): UAVs are carving out significant niches, particularly in inspection, surveillance, and delivery.

- Key Drivers: Applications in defense and security, agriculture, and infrastructure inspection. Advancements in battery technology, sensor payloads, and autonomous flight capabilities are expanding their utility.

- Dominance Analysis: While not directly competing with ground-based AMRs for internal logistics, UAVs play a crucial role in expanding the overall reach of autonomous systems, complementing ground-based operations.

Unmanned Marine Vehicles (UMVs): UMVs are primarily adopted in defense and research applications, with growing interest in offshore energy and environmental monitoring.

- Key Drivers: Applications in underwater exploration, surveillance, and maintenance in the oil and gas sector.

- Dominance Analysis: This segment remains relatively niche but offers substantial growth potential in specialized industrial and scientific applications.

End-User Industry Dominance:

Warehouse and Logistics: This sector is the largest consumer of AMRs and will continue to lead the market.

- Key Drivers: The exponential growth of e-commerce, the need for faster order fulfillment, labor shortages, and the drive for operational cost reduction.

- Dominance Analysis: AMRs are transforming warehouse operations by automating tasks such as picking, sorting, and inventory management, leading to significant improvements in efficiency and throughput. The collaboration between Radial, Inc. and Geek+ to deploy P800 AMRs in a new fulfillment center exemplifies this trend. The market size in this segment is projected to reach $XX Million by 2033.

Manufacturing: The manufacturing sector is a significant adopter of AMRs for internal logistics, assembly, and quality control.

- Key Drivers: Industry 4.0 initiatives, the need for flexible production lines, reduction in manual labor for repetitive tasks, and the demand for enhanced safety in production environments.

- Dominance Analysis: AMRs enable manufacturers to optimize material flow, improve production line efficiency, and reduce the risk of workplace injuries. The investment by Mitsubishi Electric in Clearpath Robotics highlights the strategic importance of AMRs in the future of manufacturing automation.

Automotive: AMRs are widely used in automotive plants for transporting components, sub-assemblies, and finished vehicles.

- Key Drivers: The highly automated nature of automotive production lines, the need for Just-In-Time (JIT) delivery of parts, and the drive for increased production speed and efficiency.

- Dominance Analysis: The automotive industry's continuous focus on lean manufacturing and production optimization makes it a prime market for AMR deployment.

Defense and Security: AMRs are deployed for reconnaissance, surveillance, logistics support, and hazardous material handling.

- Key Drivers: The need for enhanced situational awareness, reduced risk to personnel in dangerous environments, and efficient supply chain management in military operations.

- Dominance Analysis: The defense sector's investment in advanced autonomous systems contributes significantly to the overall market growth, particularly in UGV and UAV segments.

Energy and Power, Oil and Gas, Mining and Minerals: These sectors are increasingly adopting AMRs for inspection, maintenance, and material handling in challenging and hazardous environments.

- Key Drivers: The need for enhanced safety in remote and dangerous locations, cost-effective inspection of vast infrastructure, and efficient material movement in extraction operations.

- Dominance Analysis: AMRs offer a cost-effective and safer alternative to human inspection and maintenance in these high-risk industries, driving their adoption.

Autonomous Mobile Robots Industry Product Developments

Product development in the Autonomous Mobile Robots (AMR) industry is characterized by a relentless focus on enhancing autonomy, intelligence, and adaptability. Key trends include the integration of advanced AI algorithms for sophisticated navigation and decision-making, improved sensor fusion for precise environmental perception, and modular designs that allow for customization and scalability. Companies are developing AMRs with greater payload capacities, extended battery life, and the ability to operate in more diverse and challenging environments, from bustling warehouses to rugged outdoor terrains. The competitive advantage lies in offering solutions that seamlessly integrate into existing workflows, provide real-time data analytics, and facilitate collaborative human-robot operations, thereby driving significant improvements in efficiency, safety, and productivity across various end-user industries.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global Autonomous Mobile Robots (AMR) market, segmented by Type and End-user Industry. The Type segmentation includes: Unmanned Ground Vehicles (UGVs), Humanoids, Unmanned Aerial Vehicles (UAVs), and Unmanned Marine Vehicles (UMVs). Each segment's growth projections and market size are analyzed, considering their unique technological advancements and application areas. The End-user Industry segmentation covers: Defense and Security, Warehouse and Logistics, Energy and Power, Automotive, Manufacturing, Oil and Gas, Mining and Minerals, and Other End-user Industries. This granular segmentation allows for a detailed understanding of the adoption drivers and competitive dynamics within each sector, with specific market size estimations and growth forecasts for the period 2025-2033.

Key Drivers of Autonomous Mobile Robots Industry Growth

The Autonomous Mobile Robots (AMR) industry is propelled by several key growth drivers. Technologically, advancements in AI, machine learning, and sensor technologies are enabling AMRs to perform increasingly complex tasks with enhanced autonomy and safety. Economically, the rising demand for operational efficiency, reduction in labor costs, and the burgeoning e-commerce sector are significant catalysts. For example, the need to scale fulfillment operations without proportional increases in human labor is a major driver for AMR adoption in warehouses. Regulatory frameworks are slowly evolving to support the safe deployment of AMRs, further facilitating market expansion. The pursuit of Industry 4.0 initiatives by manufacturing companies also plays a crucial role, pushing for smarter and more automated production environments.

Challenges in the Autonomous Mobile Robots Industry Sector

Despite robust growth, the Autonomous Mobile Robots (AMR) industry faces several challenges. Regulatory hurdles, particularly regarding safety standards and operational guidelines in public spaces, can slow down widespread adoption. Supply chain issues, including the availability of critical components like semiconductors and specialized sensors, can impact production and increase costs. Competitive pressures from both established players and new entrants necessitate continuous innovation and competitive pricing. Furthermore, the initial capital investment required for AMR deployment can be a barrier for some small and medium-sized enterprises (SMEs). The integration of AMRs into existing legacy systems also presents a technical challenge, requiring significant planning and implementation effort.

Emerging Opportunities in Autonomous Mobile Robots Industry

The Autonomous Mobile Robots (AMR) industry is ripe with emerging opportunities. The expansion of AMRs into new end-user industries, such as healthcare for patient transport and disinfection, and agriculture for automated farming tasks, presents significant growth potential. The development of more sophisticated AI and collaborative robotics capabilities opens up new applications for human-robot interaction in complex environments. The increasing demand for sustainable and eco-friendly logistics solutions also bodes well for AMRs, as they can optimize routes and reduce energy consumption. Furthermore, the growing trend towards smart cities and automated infrastructure management offers new avenues for AMR deployment. The potential for personalized automation solutions tailored to specific business needs also represents a key opportunity.

Leading Players in the Autonomous Mobile Robots Industry Market

- Softbank Robotics

- SMP Robotics

- Aethon Inc (ST ENGINEERING HUB)

- Omron Corporation

- Fetch Robotics (Zebra Technologies Corporation)

- OTTO Motors

- Mobile Industrial Robots (Mir) (Teradyne Inc)

- HiK Robot

- Vecna Robotics Inc

- Seegrid Corporation

- Geek+ Technology Co Ltd

- Clearpath Robotics

Key Developments in Autonomous Mobile Robots Industry Industry

- May 2023: Mitsubishi Electric Corporation, a global leader in factory automation solutions, announced a strategic investment in Clearpath Robotics, the parent company of autonomous mobile robot leader OTTO Motors. The investment will likely expand the strategic relationship between OTTO Motors and Mitsubishi Electric and strengthen the two companies' commercial collaboration.

- April 2023: Radial, Inc. announced a collaboration with Geek+ to provide automation and robotics for its new 601,045-square-foot fulfillment center in Indianapolis, Indiana. Radial will be able to support high-volume order fulfillment for a well-known clothing and apparel brand thanks to the new state-of-the-art facility at 8838 East County Road. Radial is expected to ensure seamless eCommerce fulfillment operations while creating over 100 new jobs in the local community by deploying nearly 200 P800 autonomous mobile robots (AMR).

Strategic Outlook for Autonomous Mobile Robots Industry Market

The strategic outlook for the Autonomous Mobile Robots (AMR) industry is exceptionally positive, characterized by sustained innovation and expanding market adoption. The increasing integration of AI and advanced sensing technologies will lead to more intelligent and versatile AMRs, capable of handling a wider array of complex tasks. Strategic partnerships and M&A activities are expected to continue, driving consolidation and fostering synergistic growth. The global push towards automation, coupled with evolving e-commerce demands and Industry 4.0 initiatives, will further accelerate AMR deployment across diverse sectors. Emerging applications in areas like healthcare and sustainable logistics present significant untapped potential, promising continued market expansion and technological evolution. The industry is poised for substantial growth, driven by its ability to deliver tangible improvements in efficiency, productivity, and safety.

Autonomous Mobile Robots Industry Segmentation

-

1. Type

- 1.1. Unmanned Ground Vehicles

- 1.2. Humanoids

- 1.3. Unmanned Aerial Vehicles

- 1.4. Unmanned Marine Vehicles

-

2. End-user Industry

- 2.1. Defense and Security

- 2.2. Warehouse and Logistics

- 2.3. Energy and Power

- 2.4. Automotive

- 2.5. Manufacturing

- 2.6. Oil and Gas

- 2.7. Mining and Minerals

- 2.8. Other End-user Industries

Autonomous Mobile Robots Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 4. Australia and New Zealand

-

5. Latin America

- 5.1. Brazil

- 5.2. Argentina

-

6. Middle East and Africa

- 6.1. Saudi Arabia

- 6.2. United Arab Emirates

- 6.3. South Africa

Autonomous Mobile Robots Industry Regional Market Share

Geographic Coverage of Autonomous Mobile Robots Industry

Autonomous Mobile Robots Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Automation across the End-user Industries; Labor-related Challenges Coupled with Advancements in Technology

- 3.3. Market Restrains

- 3.3.1. Communication and Connectivity Issues; High Capital Requirements

- 3.4. Market Trends

- 3.4.1. Automotive Sector Expected to Register Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Autonomous Mobile Robots Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Unmanned Ground Vehicles

- 5.1.2. Humanoids

- 5.1.3. Unmanned Aerial Vehicles

- 5.1.4. Unmanned Marine Vehicles

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Defense and Security

- 5.2.2. Warehouse and Logistics

- 5.2.3. Energy and Power

- 5.2.4. Automotive

- 5.2.5. Manufacturing

- 5.2.6. Oil and Gas

- 5.2.7. Mining and Minerals

- 5.2.8. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Autonomous Mobile Robots Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Unmanned Ground Vehicles

- 6.1.2. Humanoids

- 6.1.3. Unmanned Aerial Vehicles

- 6.1.4. Unmanned Marine Vehicles

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Defense and Security

- 6.2.2. Warehouse and Logistics

- 6.2.3. Energy and Power

- 6.2.4. Automotive

- 6.2.5. Manufacturing

- 6.2.6. Oil and Gas

- 6.2.7. Mining and Minerals

- 6.2.8. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Autonomous Mobile Robots Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Unmanned Ground Vehicles

- 7.1.2. Humanoids

- 7.1.3. Unmanned Aerial Vehicles

- 7.1.4. Unmanned Marine Vehicles

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Defense and Security

- 7.2.2. Warehouse and Logistics

- 7.2.3. Energy and Power

- 7.2.4. Automotive

- 7.2.5. Manufacturing

- 7.2.6. Oil and Gas

- 7.2.7. Mining and Minerals

- 7.2.8. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Autonomous Mobile Robots Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Unmanned Ground Vehicles

- 8.1.2. Humanoids

- 8.1.3. Unmanned Aerial Vehicles

- 8.1.4. Unmanned Marine Vehicles

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Defense and Security

- 8.2.2. Warehouse and Logistics

- 8.2.3. Energy and Power

- 8.2.4. Automotive

- 8.2.5. Manufacturing

- 8.2.6. Oil and Gas

- 8.2.7. Mining and Minerals

- 8.2.8. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Autonomous Mobile Robots Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Unmanned Ground Vehicles

- 9.1.2. Humanoids

- 9.1.3. Unmanned Aerial Vehicles

- 9.1.4. Unmanned Marine Vehicles

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Defense and Security

- 9.2.2. Warehouse and Logistics

- 9.2.3. Energy and Power

- 9.2.4. Automotive

- 9.2.5. Manufacturing

- 9.2.6. Oil and Gas

- 9.2.7. Mining and Minerals

- 9.2.8. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Autonomous Mobile Robots Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Unmanned Ground Vehicles

- 10.1.2. Humanoids

- 10.1.3. Unmanned Aerial Vehicles

- 10.1.4. Unmanned Marine Vehicles

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Defense and Security

- 10.2.2. Warehouse and Logistics

- 10.2.3. Energy and Power

- 10.2.4. Automotive

- 10.2.5. Manufacturing

- 10.2.6. Oil and Gas

- 10.2.7. Mining and Minerals

- 10.2.8. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East and Africa Autonomous Mobile Robots Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Unmanned Ground Vehicles

- 11.1.2. Humanoids

- 11.1.3. Unmanned Aerial Vehicles

- 11.1.4. Unmanned Marine Vehicles

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Defense and Security

- 11.2.2. Warehouse and Logistics

- 11.2.3. Energy and Power

- 11.2.4. Automotive

- 11.2.5. Manufacturing

- 11.2.6. Oil and Gas

- 11.2.7. Mining and Minerals

- 11.2.8. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Softbank Robotics

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 SMP Robotics

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Aethon Inc (ST ENGINEERING HUB)

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Omron Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Fetch Robotics (Zebra Technologies Corporation)

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 OTTO Motors

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Mobile Industrial Robots (Mir)(Teradyne Inc )

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 HiK Robot

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Vecna Robotics Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Seegrid Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Geek+ Technology Co Ltd

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Clearpath Robotics

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Softbank Robotics

List of Figures

- Figure 1: Global Autonomous Mobile Robots Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Autonomous Mobile Robots Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Autonomous Mobile Robots Industry Revenue (Million), by Type 2025 & 2033

- Figure 4: North America Autonomous Mobile Robots Industry Volume (K Unit), by Type 2025 & 2033

- Figure 5: North America Autonomous Mobile Robots Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Autonomous Mobile Robots Industry Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Autonomous Mobile Robots Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 8: North America Autonomous Mobile Robots Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 9: North America Autonomous Mobile Robots Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: North America Autonomous Mobile Robots Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 11: North America Autonomous Mobile Robots Industry Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Autonomous Mobile Robots Industry Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Autonomous Mobile Robots Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Autonomous Mobile Robots Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Autonomous Mobile Robots Industry Revenue (Million), by Type 2025 & 2033

- Figure 16: Europe Autonomous Mobile Robots Industry Volume (K Unit), by Type 2025 & 2033

- Figure 17: Europe Autonomous Mobile Robots Industry Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Autonomous Mobile Robots Industry Volume Share (%), by Type 2025 & 2033

- Figure 19: Europe Autonomous Mobile Robots Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 20: Europe Autonomous Mobile Robots Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 21: Europe Autonomous Mobile Robots Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: Europe Autonomous Mobile Robots Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 23: Europe Autonomous Mobile Robots Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Autonomous Mobile Robots Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Autonomous Mobile Robots Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Autonomous Mobile Robots Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Autonomous Mobile Robots Industry Revenue (Million), by Type 2025 & 2033

- Figure 28: Asia Pacific Autonomous Mobile Robots Industry Volume (K Unit), by Type 2025 & 2033

- Figure 29: Asia Pacific Autonomous Mobile Robots Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Autonomous Mobile Robots Industry Volume Share (%), by Type 2025 & 2033

- Figure 31: Asia Pacific Autonomous Mobile Robots Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 32: Asia Pacific Autonomous Mobile Robots Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 33: Asia Pacific Autonomous Mobile Robots Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 34: Asia Pacific Autonomous Mobile Robots Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 35: Asia Pacific Autonomous Mobile Robots Industry Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Autonomous Mobile Robots Industry Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Autonomous Mobile Robots Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Autonomous Mobile Robots Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Australia and New Zealand Autonomous Mobile Robots Industry Revenue (Million), by Type 2025 & 2033

- Figure 40: Australia and New Zealand Autonomous Mobile Robots Industry Volume (K Unit), by Type 2025 & 2033

- Figure 41: Australia and New Zealand Autonomous Mobile Robots Industry Revenue Share (%), by Type 2025 & 2033

- Figure 42: Australia and New Zealand Autonomous Mobile Robots Industry Volume Share (%), by Type 2025 & 2033

- Figure 43: Australia and New Zealand Autonomous Mobile Robots Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 44: Australia and New Zealand Autonomous Mobile Robots Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 45: Australia and New Zealand Autonomous Mobile Robots Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: Australia and New Zealand Autonomous Mobile Robots Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: Australia and New Zealand Autonomous Mobile Robots Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Australia and New Zealand Autonomous Mobile Robots Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Australia and New Zealand Autonomous Mobile Robots Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Australia and New Zealand Autonomous Mobile Robots Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Latin America Autonomous Mobile Robots Industry Revenue (Million), by Type 2025 & 2033

- Figure 52: Latin America Autonomous Mobile Robots Industry Volume (K Unit), by Type 2025 & 2033

- Figure 53: Latin America Autonomous Mobile Robots Industry Revenue Share (%), by Type 2025 & 2033

- Figure 54: Latin America Autonomous Mobile Robots Industry Volume Share (%), by Type 2025 & 2033

- Figure 55: Latin America Autonomous Mobile Robots Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 56: Latin America Autonomous Mobile Robots Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 57: Latin America Autonomous Mobile Robots Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 58: Latin America Autonomous Mobile Robots Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 59: Latin America Autonomous Mobile Robots Industry Revenue (Million), by Country 2025 & 2033

- Figure 60: Latin America Autonomous Mobile Robots Industry Volume (K Unit), by Country 2025 & 2033

- Figure 61: Latin America Autonomous Mobile Robots Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Latin America Autonomous Mobile Robots Industry Volume Share (%), by Country 2025 & 2033

- Figure 63: Middle East and Africa Autonomous Mobile Robots Industry Revenue (Million), by Type 2025 & 2033

- Figure 64: Middle East and Africa Autonomous Mobile Robots Industry Volume (K Unit), by Type 2025 & 2033

- Figure 65: Middle East and Africa Autonomous Mobile Robots Industry Revenue Share (%), by Type 2025 & 2033

- Figure 66: Middle East and Africa Autonomous Mobile Robots Industry Volume Share (%), by Type 2025 & 2033

- Figure 67: Middle East and Africa Autonomous Mobile Robots Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 68: Middle East and Africa Autonomous Mobile Robots Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 69: Middle East and Africa Autonomous Mobile Robots Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 70: Middle East and Africa Autonomous Mobile Robots Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 71: Middle East and Africa Autonomous Mobile Robots Industry Revenue (Million), by Country 2025 & 2033

- Figure 72: Middle East and Africa Autonomous Mobile Robots Industry Volume (K Unit), by Country 2025 & 2033

- Figure 73: Middle East and Africa Autonomous Mobile Robots Industry Revenue Share (%), by Country 2025 & 2033

- Figure 74: Middle East and Africa Autonomous Mobile Robots Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Autonomous Mobile Robots Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Autonomous Mobile Robots Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Global Autonomous Mobile Robots Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Autonomous Mobile Robots Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 5: Global Autonomous Mobile Robots Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Autonomous Mobile Robots Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Autonomous Mobile Robots Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Autonomous Mobile Robots Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: Global Autonomous Mobile Robots Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Autonomous Mobile Robots Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Autonomous Mobile Robots Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Autonomous Mobile Robots Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Autonomous Mobile Robots Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Autonomous Mobile Robots Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Autonomous Mobile Robots Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Autonomous Mobile Robots Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Global Autonomous Mobile Robots Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global Autonomous Mobile Robots Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 19: Global Autonomous Mobile Robots Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Autonomous Mobile Robots Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 21: Global Autonomous Mobile Robots Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Global Autonomous Mobile Robots Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Autonomous Mobile Robots Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: United Kingdom Autonomous Mobile Robots Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Germany Autonomous Mobile Robots Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Germany Autonomous Mobile Robots Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: France Autonomous Mobile Robots Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: France Autonomous Mobile Robots Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Global Autonomous Mobile Robots Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 30: Global Autonomous Mobile Robots Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 31: Global Autonomous Mobile Robots Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 32: Global Autonomous Mobile Robots Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 33: Global Autonomous Mobile Robots Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Global Autonomous Mobile Robots Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 35: China Autonomous Mobile Robots Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: China Autonomous Mobile Robots Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Japan Autonomous Mobile Robots Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Japan Autonomous Mobile Robots Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: India Autonomous Mobile Robots Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: India Autonomous Mobile Robots Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Global Autonomous Mobile Robots Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 42: Global Autonomous Mobile Robots Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 43: Global Autonomous Mobile Robots Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 44: Global Autonomous Mobile Robots Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 45: Global Autonomous Mobile Robots Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Global Autonomous Mobile Robots Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 47: Global Autonomous Mobile Robots Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 48: Global Autonomous Mobile Robots Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 49: Global Autonomous Mobile Robots Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 50: Global Autonomous Mobile Robots Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 51: Global Autonomous Mobile Robots Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 52: Global Autonomous Mobile Robots Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 53: Brazil Autonomous Mobile Robots Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Brazil Autonomous Mobile Robots Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Argentina Autonomous Mobile Robots Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Argentina Autonomous Mobile Robots Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Global Autonomous Mobile Robots Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 58: Global Autonomous Mobile Robots Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 59: Global Autonomous Mobile Robots Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 60: Global Autonomous Mobile Robots Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 61: Global Autonomous Mobile Robots Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 62: Global Autonomous Mobile Robots Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 63: Saudi Arabia Autonomous Mobile Robots Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Saudi Arabia Autonomous Mobile Robots Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: United Arab Emirates Autonomous Mobile Robots Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: United Arab Emirates Autonomous Mobile Robots Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: South Africa Autonomous Mobile Robots Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: South Africa Autonomous Mobile Robots Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Autonomous Mobile Robots Industry?

The projected CAGR is approximately 15.60%.

2. Which companies are prominent players in the Autonomous Mobile Robots Industry?

Key companies in the market include Softbank Robotics, SMP Robotics, Aethon Inc (ST ENGINEERING HUB), Omron Corporation, Fetch Robotics (Zebra Technologies Corporation), OTTO Motors, Mobile Industrial Robots (Mir)(Teradyne Inc ), HiK Robot, Vecna Robotics Inc, Seegrid Corporation, Geek+ Technology Co Ltd, Clearpath Robotics.

3. What are the main segments of the Autonomous Mobile Robots Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Automation across the End-user Industries; Labor-related Challenges Coupled with Advancements in Technology.

6. What are the notable trends driving market growth?

Automotive Sector Expected to Register Significant Growth.

7. Are there any restraints impacting market growth?

Communication and Connectivity Issues; High Capital Requirements.

8. Can you provide examples of recent developments in the market?

May 2023: Mitsubishi Electric Corporation, a global leader in factory automation solutions, announced a strategic investment in Clearpath Robotics, the parent company of autonomous mobile robot leader OTTO Motors. The investment will likely expand the strategic relationship between OTTO Motors and Mitsubishi Electric and strengthen the two companies' commercial collaboration.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Autonomous Mobile Robots Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Autonomous Mobile Robots Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Autonomous Mobile Robots Industry?

To stay informed about further developments, trends, and reports in the Autonomous Mobile Robots Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence