Key Insights

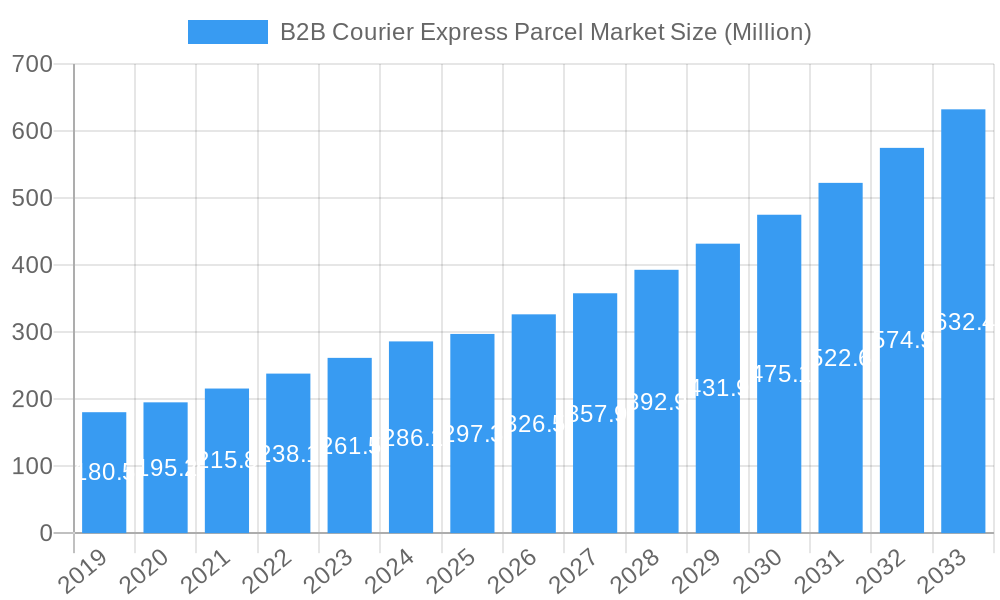

The global B2B Courier Express Parcel (CEP) market is poised for significant expansion, projected to reach a valuation of $297.30 million with a robust Compound Annual Growth Rate (CAGR) of 9.93% between 2025 and 2033. This growth is primarily propelled by the insatiable demand for efficient and reliable logistics solutions across diverse business sectors. The burgeoning e-commerce landscape, a key driver, necessitates swift and secure delivery of goods, fueling the expansion of the wholesale and retail trade segment. Furthermore, the increasing complexity of global supply chains and the need for timely delivery of critical components in manufacturing, construction, and utilities further underscore the market's upward trajectory. Domestic and international destinations are experiencing heightened activity, with businesses increasingly relying on express parcel services to maintain competitiveness and meet customer expectations in an ever-accelerating global marketplace.

B2B Courier Express Parcel Market Market Size (In Million)

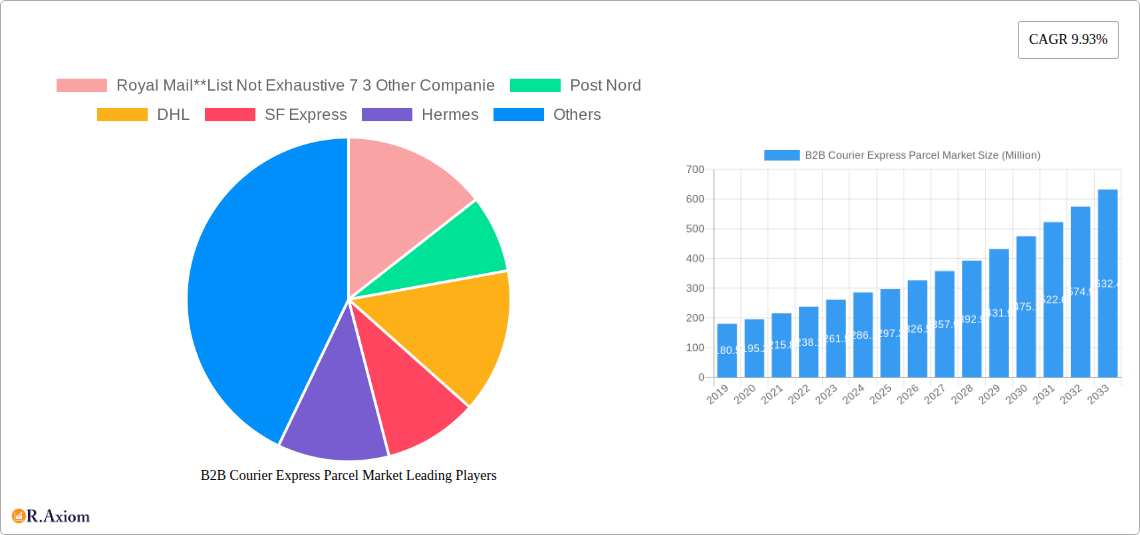

The market is characterized by a dynamic competitive landscape, with established giants like DHL, FedEx, UPS, and TNT Express vying for market share alongside regional players such as Royal Mail, Post Nord, SF Express, Hermes, GLS, and Aramex. These companies are investing heavily in technological advancements, including AI-powered route optimization, real-time tracking, and automated sorting facilities, to enhance operational efficiency and customer experience. Emerging trends include a growing emphasis on sustainable logistics, with a focus on reducing carbon emissions through electric vehicle fleets and optimized delivery networks. While the market demonstrates strong growth potential, certain restraints may emerge, such as fluctuating fuel prices and evolving regulatory frameworks in different regions, which could impact operational costs and cross-border logistics. Nevertheless, the overarching trend of digitalization and the continuous growth of e-commerce are expected to outweigh these challenges, ensuring sustained demand for B2B courier express parcel services.

B2B Courier Express Parcel Market Company Market Share

This in-depth report provides a detailed analysis of the B2B Courier Express Parcel Market, offering critical insights into market dynamics, growth drivers, emerging trends, and strategic opportunities. Covering the study period from 2019 to 2033, with a base and estimated year of 2025, this report is an essential resource for industry stakeholders seeking to navigate the evolving landscape of business-to-business logistics and express parcel delivery.

B2B Courier Express Parcel Market Market Concentration & Innovation

The B2B Courier Express Parcel Market is characterized by a moderate to high level of market concentration, with key players like FedEx, UPS, DHL, and Royal Mail dominating significant market share, estimated to be in excess of 70 Million in combined revenue for the top five entities. Innovation is a critical differentiator, driven by advancements in technology such as AI-powered route optimization, robotic automation in sorting facilities, and enhanced tracking systems. Regulatory frameworks, while generally supportive of trade, can also pose challenges, particularly concerning international customs and environmental regulations. Product substitutes, while limited in express parcel delivery, include slower freight services and specialized logistics providers. End-user trends show a strong preference for speed, reliability, and transparent tracking. Merger and acquisition (M&A) activities are a notable feature, with recent deals valued in the hundreds of millions of dollars, aimed at expanding service portfolios, geographical reach, and operational capabilities. For instance, acquisitions focused on strengthening final-mile delivery networks are prevalent.

B2B Courier Express Parcel Market Industry Trends & Insights

The B2B Courier Express Parcel Market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period of 2025-2033. This surge is propelled by the accelerating adoption of e-commerce across various B2B sectors, the globalization of supply chains, and the increasing demand for expedited delivery services. Technological advancements are fundamentally reshaping the industry. The integration of Artificial Intelligence (AI) and Machine Learning (ML) is optimizing delivery routes, improving load balancing, and enhancing predictive maintenance for fleets, leading to significant cost efficiencies. Automation, particularly in fulfillment centers and sorting hubs, is addressing labor shortages and increasing throughput. The rise of the "on-demand" economy is influencing B2B expectations, with businesses demanding faster, more flexible, and real-time delivery solutions. Consumer preferences, even in a B2B context, are increasingly mirroring B2C expectations for seamless, trackable, and environmentally conscious delivery options. Competitive dynamics are intensifying, with established players investing heavily in technology and service innovation, while new entrants, often digitally native, challenge traditional models. Market penetration for express parcel services within the broader logistics sector is estimated to be around 45 Million units in terms of daily shipments within developed economies. The increasing complexity of global trade and the need for robust supply chain resilience further fuel the demand for reliable courier express parcel services. Digitalization of booking, tracking, and payment processes is becoming a standard expectation.

Dominant Markets & Segments in B2B Courier Express Parcel Market

The International destination segment currently holds a dominant position in the B2B Courier Express Parcel Market, driven by the increasing globalization of trade and the expansion of e-commerce across borders. The Wholesale and Retail Trade (E-commerce) end-user segment is also a significant contributor to market growth, benefiting from the digital transformation of business operations and the sustained demand for rapid product delivery to both businesses and end consumers.

Key Drivers for International Dominance:

- Globalization of Supply Chains: Businesses are increasingly sourcing and selling products globally, necessitating reliable international shipping.

- E-commerce Growth: Cross-border e-commerce sales continue to rise, requiring efficient international parcel delivery solutions.

- Trade Agreements: Favorable trade policies and agreements between nations facilitate smoother international transit.

- Technological Advancements: Improved tracking, customs clearance technology, and advanced logistics networks enable faster and more transparent international shipments.

Key Drivers for Wholesale and Retail Trade (E-commerce) Dominance:

- Digital Transformation: Businesses are migrating online, leading to a substantial increase in B2B e-commerce transactions.

- Consumer Demand: The expectation for quick and convenient delivery, even for business purchases, is high.

- Inventory Management: Just-in-time inventory strategies rely on efficient and timely parcel delivery.

- Last-Mile Delivery Innovation: Enhanced last-mile capabilities are crucial for meeting e-commerce delivery speed expectations.

While Domestic services remain a cornerstone, the rapid expansion of international trade and the digital economy propel the international segment and the e-commerce-driven wholesale and retail trade segment to the forefront of market dominance. The Services segment also exhibits strong growth due to the increasing demand for business-to-business document and package delivery.

B2B Courier Express Parcel Market Product Developments

Product developments in the B2B Courier Express Parcel Market are heavily focused on enhancing efficiency, sustainability, and customer experience. Innovations include the deployment of AI for predictive analytics in delivery routing, the integration of blockchain technology for enhanced supply chain transparency, and the adoption of electric vehicles (EVs) for greener last-mile deliveries. Advanced tracking systems with real-time visibility, automated sorting technologies, and smart locker solutions are also key developments. These innovations provide competitive advantages by reducing transit times, lowering operational costs, and offering superior service reliability, meeting the evolving demands of businesses for speed, security, and environmental responsibility.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the B2B Courier Express Parcel Market across key segmentation parameters. The Destination segmentation includes: Domestic (intra-country) and International (cross-border) shipments, both crucial for different business needs. The End User segmentation encompasses: Services (documents, business supplies), Wholesale and Retail Trade (E-commerce) (business-to-business e-commerce orders), Manufacturing (parts, components, finished goods), Construction and Utilities (equipment, materials), and Primary industries (raw materials, agricultural products). Each segment presents unique logistical challenges and growth trajectories, with e-commerce and international segments expected to witness the highest growth rates, projected to capture over 60 Million in market value by 2033.

Key Drivers of B2B Courier Express Parcel Market Growth

The B2B Courier Express Parcel Market is driven by several potent factors. The relentless expansion of e-commerce and digital marketplaces fuels demand for rapid, reliable business-to-business deliveries. Globalization continues to necessitate efficient cross-border shipping solutions. Technological advancements, including AI-powered logistics, automation in sorting, and real-time tracking, enhance operational efficiency and customer satisfaction. Furthermore, evolving business models that prioritize agility and just-in-time supply chains rely heavily on express parcel services. Favorable economic conditions and supportive trade policies also contribute to market expansion.

Challenges in the B2B Courier Express Parcel Market Sector

Despite robust growth, the B2B Courier Express Parcel Market faces significant challenges. Intense competition among established players and emerging disruptors can lead to price wars and margin erosion. Increasing fuel costs and labor shortages pose operational and financial strains. Complex international regulations, customs procedures, and geopolitical uncertainties can lead to delays and increased costs. Furthermore, the growing pressure for sustainable logistics operations requires substantial investment in greener technologies and infrastructure, which can be a barrier for smaller players. Cybersecurity threats to digital platforms also represent a critical concern.

Emerging Opportunities in B2B Courier Express Parcel Market

Emerging opportunities within the B2B Courier Express Parcel Market lie in several key areas. The continued growth of niche B2B e-commerce sectors, such as specialized industrial parts and medical supplies, presents untapped potential. The demand for specialized logistics solutions, like cold chain or oversized parcel delivery, offers avenues for differentiation. The increasing focus on sustainability is driving demand for eco-friendly delivery options, creating opportunities for companies investing in electric fleets and optimized routing. Furthermore, emerging markets in Asia, Africa, and Latin America offer significant growth potential as their economies and digital infrastructure develop.

Leading Players in the B2B Courier Express Parcel Market Market

- FedEx

- UPS

- DHL

- Royal Mail

- TNT Express

- GLS

- Hermes

- SF Express

- Aramex

- Post Nord

- 7 3 Other Companie

Key Developments in B2B Courier Express Parcel Market Industry

- September 2023: The Otto Group planned to deploy Covariant robots to increase operational efficiency, build resilience against labor market challenges, and improve the overall quality of work within their fulfillment centers.

- February 2023: DPD UK, part of the DPDgroup, announced the acquisition of a longstanding final mile courier company with a fleet of circa 200 couriers serving more than 2,500 clients.

Strategic Outlook for B2B Courier Express Parcel Market Market

The strategic outlook for the B2B Courier Express Parcel Market remains highly positive. Growth catalysts include the ongoing digital transformation of businesses, the increasing demand for faster and more transparent supply chains, and the expansion of global trade. Investments in advanced technologies, such as AI for route optimization and automation in fulfillment, will be crucial for maintaining a competitive edge. Companies that can offer sustainable logistics solutions and cater to the growing needs of specific industry verticals will likely experience significant growth. The focus on enhancing the customer experience through improved tracking and seamless integration with business systems will also be a key determinant of future success, with market potential expected to exceed 80 Million in annual shipments by 2033.

B2B Courier Express Parcel Market Segmentation

-

1. Destination

- 1.1. Domestic

- 1.2. International

-

2. End User

- 2.1. Services

- 2.2. Wholesale and Retail Trade (E-commerce)

- 2.3. Manufacturing, Construction, and Utilities

- 2.4. Primary

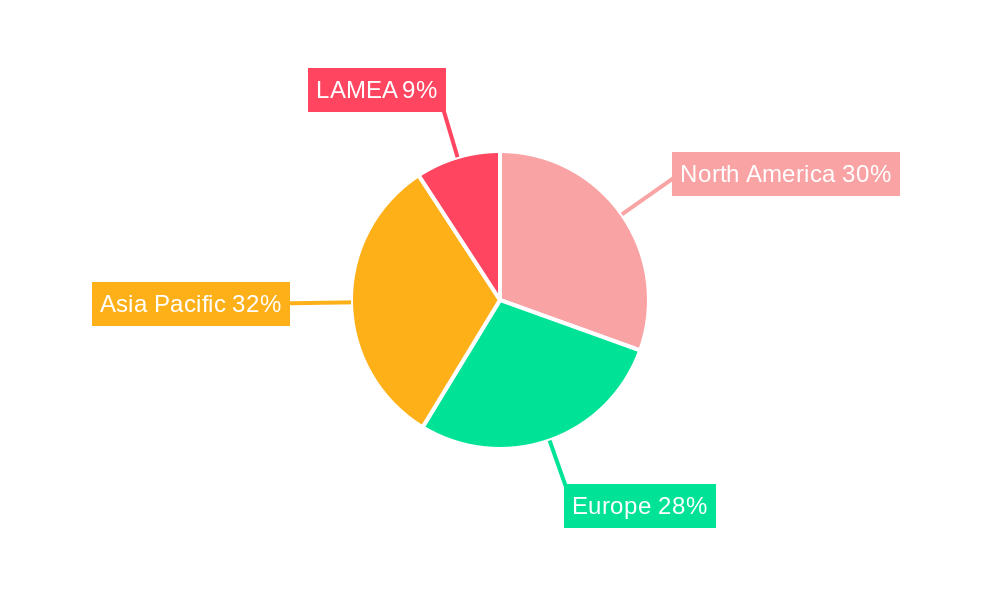

B2B Courier Express Parcel Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. United Kingdom

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. South Korea

- 3.4. India

- 3.5. Rest of Asia Pacific

-

4. LAMEA

- 4.1. Brazil

- 4.2. South Africa

- 4.3. GCC

- 4.4. Rest of LAMEA

B2B Courier Express Parcel Market Regional Market Share

Geographic Coverage of B2B Courier Express Parcel Market

B2B Courier Express Parcel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.93% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. E-commerce Boom; Same-day and Next-day Delivery

- 3.3. Market Restrains

- 3.3.1. Regulatory Challenges; Infrastructure Limitations

- 3.4. Market Trends

- 3.4.1. Expanding Domestic B2B CEP Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global B2B Courier Express Parcel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 5.1.1. Domestic

- 5.1.2. International

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Services

- 5.2.2. Wholesale and Retail Trade (E-commerce)

- 5.2.3. Manufacturing, Construction, and Utilities

- 5.2.4. Primary

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. LAMEA

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 6. North America B2B Courier Express Parcel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Destination

- 6.1.1. Domestic

- 6.1.2. International

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Services

- 6.2.2. Wholesale and Retail Trade (E-commerce)

- 6.2.3. Manufacturing, Construction, and Utilities

- 6.2.4. Primary

- 6.1. Market Analysis, Insights and Forecast - by Destination

- 7. Europe B2B Courier Express Parcel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Destination

- 7.1.1. Domestic

- 7.1.2. International

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Services

- 7.2.2. Wholesale and Retail Trade (E-commerce)

- 7.2.3. Manufacturing, Construction, and Utilities

- 7.2.4. Primary

- 7.1. Market Analysis, Insights and Forecast - by Destination

- 8. Asia Pacific B2B Courier Express Parcel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Destination

- 8.1.1. Domestic

- 8.1.2. International

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Services

- 8.2.2. Wholesale and Retail Trade (E-commerce)

- 8.2.3. Manufacturing, Construction, and Utilities

- 8.2.4. Primary

- 8.1. Market Analysis, Insights and Forecast - by Destination

- 9. LAMEA B2B Courier Express Parcel Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Destination

- 9.1.1. Domestic

- 9.1.2. International

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Services

- 9.2.2. Wholesale and Retail Trade (E-commerce)

- 9.2.3. Manufacturing, Construction, and Utilities

- 9.2.4. Primary

- 9.1. Market Analysis, Insights and Forecast - by Destination

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Royal Mail**List Not Exhaustive 7 3 Other Companie

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Post Nord

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 DHL

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 SF Express

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Hermes

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 GLS

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 UPS

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 FedEx

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 TNT Express

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Aramex

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Royal Mail**List Not Exhaustive 7 3 Other Companie

List of Figures

- Figure 1: Global B2B Courier Express Parcel Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America B2B Courier Express Parcel Market Revenue (Million), by Destination 2025 & 2033

- Figure 3: North America B2B Courier Express Parcel Market Revenue Share (%), by Destination 2025 & 2033

- Figure 4: North America B2B Courier Express Parcel Market Revenue (Million), by End User 2025 & 2033

- Figure 5: North America B2B Courier Express Parcel Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America B2B Courier Express Parcel Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America B2B Courier Express Parcel Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe B2B Courier Express Parcel Market Revenue (Million), by Destination 2025 & 2033

- Figure 9: Europe B2B Courier Express Parcel Market Revenue Share (%), by Destination 2025 & 2033

- Figure 10: Europe B2B Courier Express Parcel Market Revenue (Million), by End User 2025 & 2033

- Figure 11: Europe B2B Courier Express Parcel Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe B2B Courier Express Parcel Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe B2B Courier Express Parcel Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific B2B Courier Express Parcel Market Revenue (Million), by Destination 2025 & 2033

- Figure 15: Asia Pacific B2B Courier Express Parcel Market Revenue Share (%), by Destination 2025 & 2033

- Figure 16: Asia Pacific B2B Courier Express Parcel Market Revenue (Million), by End User 2025 & 2033

- Figure 17: Asia Pacific B2B Courier Express Parcel Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific B2B Courier Express Parcel Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific B2B Courier Express Parcel Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: LAMEA B2B Courier Express Parcel Market Revenue (Million), by Destination 2025 & 2033

- Figure 21: LAMEA B2B Courier Express Parcel Market Revenue Share (%), by Destination 2025 & 2033

- Figure 22: LAMEA B2B Courier Express Parcel Market Revenue (Million), by End User 2025 & 2033

- Figure 23: LAMEA B2B Courier Express Parcel Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: LAMEA B2B Courier Express Parcel Market Revenue (Million), by Country 2025 & 2033

- Figure 25: LAMEA B2B Courier Express Parcel Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global B2B Courier Express Parcel Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 2: Global B2B Courier Express Parcel Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global B2B Courier Express Parcel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global B2B Courier Express Parcel Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 5: Global B2B Courier Express Parcel Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global B2B Courier Express Parcel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States B2B Courier Express Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada B2B Courier Express Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico B2B Courier Express Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global B2B Courier Express Parcel Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 11: Global B2B Courier Express Parcel Market Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global B2B Courier Express Parcel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany B2B Courier Express Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France B2B Courier Express Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom B2B Courier Express Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe B2B Courier Express Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global B2B Courier Express Parcel Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 18: Global B2B Courier Express Parcel Market Revenue Million Forecast, by End User 2020 & 2033

- Table 19: Global B2B Courier Express Parcel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China B2B Courier Express Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Japan B2B Courier Express Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Korea B2B Courier Express Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: India B2B Courier Express Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific B2B Courier Express Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global B2B Courier Express Parcel Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 26: Global B2B Courier Express Parcel Market Revenue Million Forecast, by End User 2020 & 2033

- Table 27: Global B2B Courier Express Parcel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Brazil B2B Courier Express Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: South Africa B2B Courier Express Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: GCC B2B Courier Express Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of LAMEA B2B Courier Express Parcel Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the B2B Courier Express Parcel Market?

The projected CAGR is approximately 9.93%.

2. Which companies are prominent players in the B2B Courier Express Parcel Market?

Key companies in the market include Royal Mail**List Not Exhaustive 7 3 Other Companie, Post Nord, DHL, SF Express, Hermes, GLS, UPS, FedEx, TNT Express, Aramex.

3. What are the main segments of the B2B Courier Express Parcel Market?

The market segments include Destination, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 297.30 Million as of 2022.

5. What are some drivers contributing to market growth?

E-commerce Boom; Same-day and Next-day Delivery.

6. What are the notable trends driving market growth?

Expanding Domestic B2B CEP Segment.

7. Are there any restraints impacting market growth?

Regulatory Challenges; Infrastructure Limitations.

8. Can you provide examples of recent developments in the market?

September 2023: The Otto Group planned to deploy Covariant robots to increase operational efficiency, build resilience against labor market challenges, and improve the overall quality of work within their fulfillment centers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "B2B Courier Express Parcel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the B2B Courier Express Parcel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the B2B Courier Express Parcel Market?

To stay informed about further developments, trends, and reports in the B2B Courier Express Parcel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence