Key Insights

The global Behavioral Biometrics Market is poised for explosive growth, driven by an escalating need for robust security solutions across diverse industries. With a current market size of approximately USD 2.13 billion and a remarkable projected Compound Annual Growth Rate (CAGR) of 27.64%, this market is set to experience a significant expansion from its base year of 2025 through 2033. This rapid ascent is fueled by the inherent limitations of traditional authentication methods in combating sophisticated fraud and evolving cyber threats. Behavioral biometrics offers a unique advantage by analyzing unique patterns in user behavior, such as keystroke dynamics, gait, voice, and signature, to continuously authenticate identities. This continuous authentication capability is paramount in sectors like BFSI, retail, and e-commerce, where the financial implications of fraud are substantial. Furthermore, increasing regulatory compliance requirements and the growing adoption of cloud-based solutions are acting as significant catalysts for market penetration.

Behavioral Biometrics Market Market Size (In Billion)

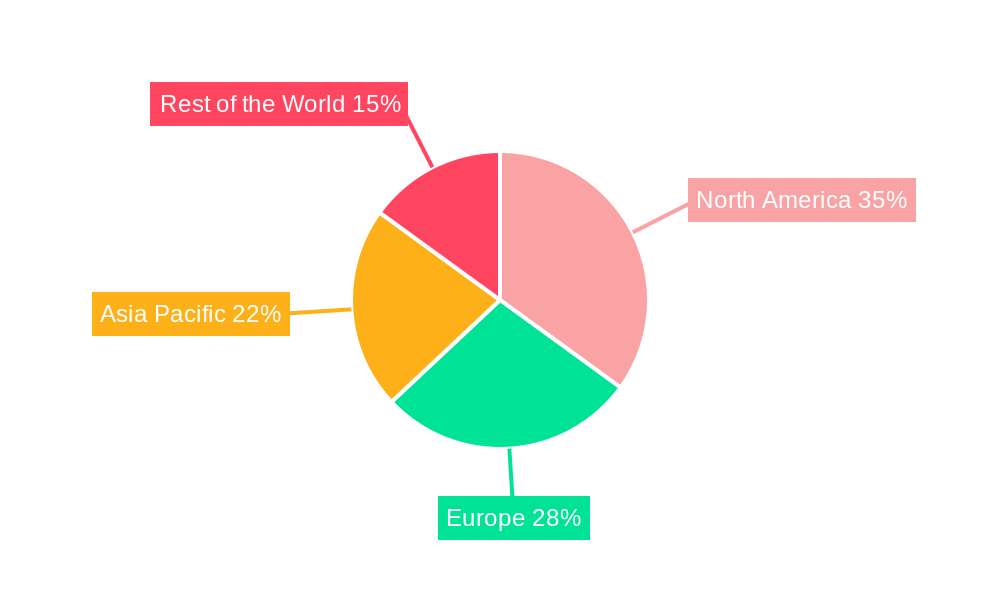

The market's expansion is further shaped by key trends including the increasing sophistication of fraud techniques and a growing demand for seamless, user-friendly security. As a result, applications like identity proofing, continuous authentication, risk and compliance management, and advanced fraud detection and prevention are witnessing substantial investment. While the market is on a strong upward trajectory, potential restraints such as data privacy concerns and the initial implementation costs for some organizations may present challenges. However, the overwhelming benefits of enhanced security and improved user experience are expected to outweigh these concerns. Geographically, North America is anticipated to lead the market, followed closely by Europe and the rapidly growing Asia Pacific region, indicating a global shift towards more advanced biometric authentication methods. Leading players like Nuance Communications Inc., UnifyID Inc., and Mastercard Incorporated (NuData Security) are actively innovating and expanding their offerings to capture this burgeoning market.

Behavioral Biometrics Market Company Market Share

Behavioral Biometrics Market Market Concentration & Innovation

The Behavioral Biometrics Market is characterized by moderate to high concentration, driven by a dynamic interplay of innovation, evolving regulatory landscapes, and strategic mergers and acquisitions. Key players are investing heavily in research and development to refine algorithms and expand the applicability of behavioral biometrics across diverse use cases. This innovation is spurred by the constant need for more sophisticated fraud detection and prevention mechanisms, alongside the growing demand for seamless and secure user authentication. Regulatory frameworks, particularly those concerning data privacy and digital identity, are increasingly influencing market strategies, pushing for more robust and compliant solutions. While direct product substitutes for behavioral biometrics are limited, advancements in traditional biometrics and multi-factor authentication present indirect competitive pressures. End-user adoption trends, especially in sectors like BFSI and Retail, are acting as significant innovation drivers, demanding solutions that offer both enhanced security and improved customer experience. Mergers and acquisitions are a notable feature, with deal values reflecting the strategic importance of acquiring specialized technologies and expanding market reach. For instance, the substantial funding rounds secured by companies like BioCatch signify investor confidence and a consolidation trend. The market share of leading companies is gradually increasing as they acquire smaller competitors and expand their product portfolios, further shaping the competitive landscape.

Behavioral Biometrics Market Industry Trends & Insights

The global Behavioral Biometrics Market is poised for robust expansion, fueled by a confluence of escalating cybersecurity threats, the proliferation of digital transactions, and the imperative for continuous user authentication. The market is projected to witness a significant Compound Annual Growth Rate (CAGR) throughout the forecast period, driven by the increasing adoption of advanced technologies that enable the analysis of unique human behavioral patterns for identity verification. Digital transformation across various industries has led to a surge in online activities, creating a fertile ground for sophisticated fraud schemes. Behavioral biometrics offers a passive and continuous method of authentication, minimizing friction for legitimate users while effectively identifying malicious actors. Technological disruptions, such as the integration of machine learning and artificial intelligence, are enhancing the accuracy and efficiency of behavioral biometrics solutions, enabling them to detect subtle anomalies in user behavior that might indicate fraudulent intent. Consumer preferences are shifting towards more intuitive and secure authentication methods, making behavioral biometrics a compelling choice over traditional password-based systems or even active biometric checks. The competitive dynamics are characterized by intense innovation and strategic partnerships, as companies strive to offer comprehensive solutions that address the evolving needs of enterprises. Market penetration is expected to deepen as organizations recognize the value proposition of behavioral biometrics in mitigating financial losses, protecting sensitive data, and ensuring regulatory compliance. The increasing prevalence of remote work and the growing use of mobile devices further amplify the demand for these advanced security measures, as they provide a crucial layer of defense against emerging threats in decentralized digital environments.

Dominant Markets & Segments in Behavioral Biometrics Market

The Behavioral Biometrics Market exhibits distinct regional and segment-specific dominance, with significant growth drivers influencing their leadership positions.

Leading Region: North America currently holds a dominant position in the behavioral biometrics market, attributed to its early adoption of advanced technologies, stringent regulatory requirements for data security, and a high concentration of BFSI and technology companies that are early adopters of innovative security solutions. The presence of a well-established cybersecurity ecosystem and significant investments in R&D further bolster its leadership.

Dominant Deployment: The On-cloud deployment segment is experiencing rapid growth and is expected to dominate the market in the coming years. This is driven by the scalability, flexibility, and cost-effectiveness offered by cloud-based solutions, allowing organizations of all sizes to implement advanced behavioral biometrics without substantial upfront infrastructure investments. The ease of integration and maintenance further contributes to its widespread adoption.

Dominant Application: Continuous Authentication is emerging as the most dominant application within the behavioral biometrics market. As organizations increasingly focus on real-time threat detection and prevention, the ability of behavioral biometrics to continuously monitor user behavior throughout a session provides an unparalleled layer of security. This approach effectively mitigates risks associated with compromised credentials or account takeovers, offering a proactive defense mechanism.

Dominant End-User: The BFSI (Banking, Financial Services, and Insurance) sector is the leading end-user vertical for behavioral biometrics. This dominance is a direct consequence of the high-value nature of financial transactions and the immense pressure on financial institutions to combat sophisticated fraud, money laundering, and identity theft. Stringent regulatory compliance mandates in the BFSI sector further necessitate the adoption of advanced security technologies like behavioral biometrics.

Dominant Type: Keystroke Dynamics and Voice Recognition are currently the most prevalent types of behavioral biometrics being adopted. Keystroke dynamics, due to its passive nature and ease of integration into existing workflows, is widely used for continuous authentication. Voice recognition is gaining traction, particularly in call centers and for voice-based interactions, offering a convenient yet secure authentication method.

Behavioral Biometrics Market Product Developments

Product developments in the Behavioral Biometrics Market are heavily focused on enhancing accuracy, reducing false positives, and expanding the range of detectable behavioral patterns. Innovations often involve the integration of advanced machine learning algorithms and AI to interpret subtle nuances in user interactions, such as typing speed, mouse movements, and navigation patterns. Companies are also developing solutions that can leverage multiple behavioral biometrics simultaneously, creating a more robust and resilient authentication system. The competitive advantage lies in offering solutions that are not only highly secure but also seamlessly integrated into user workflows, minimizing friction and improving the overall user experience. Furthermore, developments are geared towards enabling behavioral biometrics for a wider array of applications, from web and mobile interactions to IoT devices.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the global Behavioral Biometrics Market, encompassing a detailed segmentation across key parameters.

Type: The market is segmented by Type into Signature Analysis, Keystroke Dynamics, Voice Recognition, and Gait Analysis. Each type offers distinct advantages and applications, with Keystroke Dynamics and Voice Recognition currently leading in adoption due to their passive nature and broad applicability.

Deployment: The market is bifurcated based on Deployment into On-premise and On-cloud solutions. The On-cloud segment is projected for significant growth, driven by its scalability and cost-effectiveness.

Application: Key applications covered include Identity Proofing, Continuous Authentication, Risk and Compliance, and Fraud Detection and Prevention. Continuous Authentication is anticipated to witness the highest growth rate as organizations prioritize real-time security.

End-User: The report analyzes the market across various End-User Verticals: BFSI, Retail and E-commerce, Healthcare, Government and Public Sector, and Other End-user Verticals. The BFSI sector remains the dominant end-user, followed by the growing adoption in Retail and E-commerce.

Key Drivers of Behavioral Biometrics Market Growth

Several factors are propelling the growth of the Behavioral Biometrics Market. The escalating sophistication and frequency of cyberattacks, including account takeovers and phishing schemes, are a primary driver, compelling organizations to seek advanced authentication methods. The increasing volume of digital transactions and the widespread adoption of online services across industries necessitate robust security solutions that go beyond traditional passwords. Regulatory mandates, such as GDPR and CCPA, that emphasize data protection and privacy, also push for more secure and compliant authentication technologies. Furthermore, the growing demand for frictionless user experiences is a significant catalyst, as behavioral biometrics offers a passive and seamless authentication process that enhances customer satisfaction while bolstering security. The integration of AI and machine learning is further refining the capabilities of behavioral biometrics, leading to improved accuracy and effectiveness.

Challenges in the Behavioral Biometrics Market Sector

Despite its promising growth, the Behavioral Biometrics Market faces several challenges. Concerns surrounding data privacy and the ethical use of behavioral data can create user apprehension and regulatory scrutiny. The accuracy and reliability of behavioral biometrics can be affected by changes in user behavior due to external factors like fatigue or environmental distractions, potentially leading to false positives or negatives. High implementation costs, especially for comprehensive enterprise-wide deployments, can be a barrier for smaller organizations. The need for extensive data collection and continuous learning poses technical challenges, requiring robust infrastructure and expertise. Furthermore, the market is still relatively nascent, and widespread awareness and understanding of its benefits among potential users are still developing, requiring significant educational efforts.

Emerging Opportunities in Behavioral Biometrics Market

Emerging opportunities in the Behavioral Biometrics Market are abundant, driven by technological advancements and expanding use cases. The increasing adoption of the Internet of Things (IoT) presents a significant opportunity for behavioral biometrics to secure connected devices and the data they generate. The growth of the digital health sector, with the rise of telemedicine and remote patient monitoring, opens avenues for behavioral biometrics in healthcare identity verification and data security. The gaming industry's exploration of behavioral biometrics for account security and fair play is another nascent but promising area. Furthermore, the development of more sophisticated AI and machine learning models is enabling new applications, such as predicting user intent or detecting insider threats more effectively. The increasing focus on privacy-enhancing technologies will also drive innovation in how behavioral data is collected and utilized, creating opportunities for differential privacy and federated learning approaches.

Leading Players in the Behavioral Biometrics Market Market

- Nuance Communications Inc

- UnifyID Inc

- Plurilock Security Solutions Inc

- Threat Mark SRO

- Mastercard Incorporated (NuData Security)

- SecureAuth Corporation

- SecuredTouch Inc

- BehavioSec Inc

- Zighra Inc

- BioCatch Ltd

Key Developments in Behavioral Biometrics Market Industry

- October 2020: BioCatch managed to raise a total of USD 91 million in new funding. It added USD 20 million to its Series C bringing in a total of USD 168 million for the round of investment until October 2020. The investment was led by major banks Barclays, Citi, HSBC, and National Australia Bank (NAB). This development highlights significant investor confidence and market validation for advanced behavioral biometrics solutions, signaling a trend towards consolidation and growth in the sector.

- June 2020: US-based identity security independent software vendor (ISV) SecureAuth has signed a distribution agreement with Arrow Electronics for Australia and New Zealand. The agreement will see Arrow exclusively offer SecureAuth'sentire technology portfolio in A/NZ through its Enterprise Computing Solutions (ECS) business, making it the first time the vendor has had a presence in the region, the distributor claimed. This strategic expansion into new geographical markets signifies the increasing global demand for behavioral biometrics and highlights efforts by key players to broaden their reach and customer base.

Strategic Outlook for Behavioral Biometrics Market Market

The strategic outlook for the Behavioral Biometrics Market is exceptionally positive, driven by an unwavering demand for enhanced digital security and a seamless user experience. The market is expected to witness continued innovation, with a focus on AI-driven analytics, multi-modal behavioral biometrics, and privacy-preserving techniques. Key growth catalysts include the increasing adoption of remote work, the expansion of e-commerce, and the ongoing digital transformation across all industries, each creating new attack surfaces that necessitate advanced authentication. Strategic partnerships and mergers are anticipated to continue shaping the competitive landscape, as companies seek to leverage complementary technologies and expand their market share. The growing emphasis on regulatory compliance and data protection will further solidify the position of behavioral biometrics as a critical component of modern cybersecurity strategies, making it an indispensable tool for organizations aiming to protect their assets and customer trust in an increasingly digital world.

Behavioral Biometrics Market Segmentation

-

1. Type

- 1.1. Signature Analysis

- 1.2. Keystroke Dynamics

- 1.3. Voice Recognition

- 1.4. Gait Analysis

-

2. Deployment

- 2.1. On-premise

- 2.2. On-cloud

-

3. Application

- 3.1. Identity Proofing

- 3.2. Continuous Authentication

- 3.3. Risk and Compliance

- 3.4. Fraud Detection and Prevention

-

4. End-User

- 4.1. BFSI

- 4.2. Retail and E-commerce

- 4.3. Healthcare

- 4.4. Government and Public Sector

- 4.5. Other End-user Verticals

Behavioral Biometrics Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Behavioral Biometrics Market Regional Market Share

Geographic Coverage of Behavioral Biometrics Market

Behavioral Biometrics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 27.64% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Applications of Biometric Technology in the Commercial and Government Sectors; Increase in Online Transactions and Fraudulent Activities

- 3.3. Market Restrains

- 3.3.1. Privacy Intrusion Concerns

- 3.4. Market Trends

- 3.4.1. Increasing Data Breaches in BFSI will Drive the Growth of this Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Behavioral Biometrics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Signature Analysis

- 5.1.2. Keystroke Dynamics

- 5.1.3. Voice Recognition

- 5.1.4. Gait Analysis

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. On-premise

- 5.2.2. On-cloud

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Identity Proofing

- 5.3.2. Continuous Authentication

- 5.3.3. Risk and Compliance

- 5.3.4. Fraud Detection and Prevention

- 5.4. Market Analysis, Insights and Forecast - by End-User

- 5.4.1. BFSI

- 5.4.2. Retail and E-commerce

- 5.4.3. Healthcare

- 5.4.4. Government and Public Sector

- 5.4.5. Other End-user Verticals

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Behavioral Biometrics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Signature Analysis

- 6.1.2. Keystroke Dynamics

- 6.1.3. Voice Recognition

- 6.1.4. Gait Analysis

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. On-premise

- 6.2.2. On-cloud

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Identity Proofing

- 6.3.2. Continuous Authentication

- 6.3.3. Risk and Compliance

- 6.3.4. Fraud Detection and Prevention

- 6.4. Market Analysis, Insights and Forecast - by End-User

- 6.4.1. BFSI

- 6.4.2. Retail and E-commerce

- 6.4.3. Healthcare

- 6.4.4. Government and Public Sector

- 6.4.5. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Behavioral Biometrics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Signature Analysis

- 7.1.2. Keystroke Dynamics

- 7.1.3. Voice Recognition

- 7.1.4. Gait Analysis

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. On-premise

- 7.2.2. On-cloud

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Identity Proofing

- 7.3.2. Continuous Authentication

- 7.3.3. Risk and Compliance

- 7.3.4. Fraud Detection and Prevention

- 7.4. Market Analysis, Insights and Forecast - by End-User

- 7.4.1. BFSI

- 7.4.2. Retail and E-commerce

- 7.4.3. Healthcare

- 7.4.4. Government and Public Sector

- 7.4.5. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Behavioral Biometrics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Signature Analysis

- 8.1.2. Keystroke Dynamics

- 8.1.3. Voice Recognition

- 8.1.4. Gait Analysis

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. On-premise

- 8.2.2. On-cloud

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Identity Proofing

- 8.3.2. Continuous Authentication

- 8.3.3. Risk and Compliance

- 8.3.4. Fraud Detection and Prevention

- 8.4. Market Analysis, Insights and Forecast - by End-User

- 8.4.1. BFSI

- 8.4.2. Retail and E-commerce

- 8.4.3. Healthcare

- 8.4.4. Government and Public Sector

- 8.4.5. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Behavioral Biometrics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Signature Analysis

- 9.1.2. Keystroke Dynamics

- 9.1.3. Voice Recognition

- 9.1.4. Gait Analysis

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. On-premise

- 9.2.2. On-cloud

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Identity Proofing

- 9.3.2. Continuous Authentication

- 9.3.3. Risk and Compliance

- 9.3.4. Fraud Detection and Prevention

- 9.4. Market Analysis, Insights and Forecast - by End-User

- 9.4.1. BFSI

- 9.4.2. Retail and E-commerce

- 9.4.3. Healthcare

- 9.4.4. Government and Public Sector

- 9.4.5. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Nuance Communications Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 UnifyID Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Plurilock Security Solutions Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Threat Mark SRO

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Mastercard Incorporated (NuData Security)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 SecureAuth Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 SecuredTouch Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 BehavioSec Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Zighra Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 BioCatch Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Nuance Communications Inc

List of Figures

- Figure 1: Global Behavioral Biometrics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Behavioral Biometrics Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Behavioral Biometrics Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Behavioral Biometrics Market Revenue (Million), by Deployment 2025 & 2033

- Figure 5: North America Behavioral Biometrics Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 6: North America Behavioral Biometrics Market Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Behavioral Biometrics Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Behavioral Biometrics Market Revenue (Million), by End-User 2025 & 2033

- Figure 9: North America Behavioral Biometrics Market Revenue Share (%), by End-User 2025 & 2033

- Figure 10: North America Behavioral Biometrics Market Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Behavioral Biometrics Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Behavioral Biometrics Market Revenue (Million), by Type 2025 & 2033

- Figure 13: Europe Behavioral Biometrics Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Behavioral Biometrics Market Revenue (Million), by Deployment 2025 & 2033

- Figure 15: Europe Behavioral Biometrics Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 16: Europe Behavioral Biometrics Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Europe Behavioral Biometrics Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Behavioral Biometrics Market Revenue (Million), by End-User 2025 & 2033

- Figure 19: Europe Behavioral Biometrics Market Revenue Share (%), by End-User 2025 & 2033

- Figure 20: Europe Behavioral Biometrics Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Behavioral Biometrics Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Behavioral Biometrics Market Revenue (Million), by Type 2025 & 2033

- Figure 23: Asia Pacific Behavioral Biometrics Market Revenue Share (%), by Type 2025 & 2033

- Figure 24: Asia Pacific Behavioral Biometrics Market Revenue (Million), by Deployment 2025 & 2033

- Figure 25: Asia Pacific Behavioral Biometrics Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 26: Asia Pacific Behavioral Biometrics Market Revenue (Million), by Application 2025 & 2033

- Figure 27: Asia Pacific Behavioral Biometrics Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Behavioral Biometrics Market Revenue (Million), by End-User 2025 & 2033

- Figure 29: Asia Pacific Behavioral Biometrics Market Revenue Share (%), by End-User 2025 & 2033

- Figure 30: Asia Pacific Behavioral Biometrics Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Behavioral Biometrics Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Rest of the World Behavioral Biometrics Market Revenue (Million), by Type 2025 & 2033

- Figure 33: Rest of the World Behavioral Biometrics Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: Rest of the World Behavioral Biometrics Market Revenue (Million), by Deployment 2025 & 2033

- Figure 35: Rest of the World Behavioral Biometrics Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 36: Rest of the World Behavioral Biometrics Market Revenue (Million), by Application 2025 & 2033

- Figure 37: Rest of the World Behavioral Biometrics Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Rest of the World Behavioral Biometrics Market Revenue (Million), by End-User 2025 & 2033

- Figure 39: Rest of the World Behavioral Biometrics Market Revenue Share (%), by End-User 2025 & 2033

- Figure 40: Rest of the World Behavioral Biometrics Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Rest of the World Behavioral Biometrics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Behavioral Biometrics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Behavioral Biometrics Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 3: Global Behavioral Biometrics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Behavioral Biometrics Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 5: Global Behavioral Biometrics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Behavioral Biometrics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Global Behavioral Biometrics Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 8: Global Behavioral Biometrics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Global Behavioral Biometrics Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 10: Global Behavioral Biometrics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Behavioral Biometrics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Behavioral Biometrics Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 13: Global Behavioral Biometrics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Behavioral Biometrics Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 15: Global Behavioral Biometrics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Behavioral Biometrics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Behavioral Biometrics Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 18: Global Behavioral Biometrics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 19: Global Behavioral Biometrics Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 20: Global Behavioral Biometrics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Behavioral Biometrics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Behavioral Biometrics Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 23: Global Behavioral Biometrics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Behavioral Biometrics Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 25: Global Behavioral Biometrics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Behavioral Biometrics Market?

The projected CAGR is approximately 27.64%.

2. Which companies are prominent players in the Behavioral Biometrics Market?

Key companies in the market include Nuance Communications Inc, UnifyID Inc, Plurilock Security Solutions Inc, Threat Mark SRO, Mastercard Incorporated (NuData Security), SecureAuth Corporation, SecuredTouch Inc, BehavioSec Inc, Zighra Inc, BioCatch Ltd.

3. What are the main segments of the Behavioral Biometrics Market?

The market segments include Type, Deployment, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.13 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in Applications of Biometric Technology in the Commercial and Government Sectors; Increase in Online Transactions and Fraudulent Activities.

6. What are the notable trends driving market growth?

Increasing Data Breaches in BFSI will Drive the Growth of this Market.

7. Are there any restraints impacting market growth?

Privacy Intrusion Concerns.

8. Can you provide examples of recent developments in the market?

October 2020 - BioCatch managed to raise a total of USD 91 million in new funding. It added USD 20 million to its Series C bringing in a total of USD 168 million for the round of investment until October 2020. The investment was led by major banks Barclays, Citi, HSBC, and National Australia Bank (NAB).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Behavioral Biometrics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Behavioral Biometrics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Behavioral Biometrics Market?

To stay informed about further developments, trends, and reports in the Behavioral Biometrics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence