Key Insights

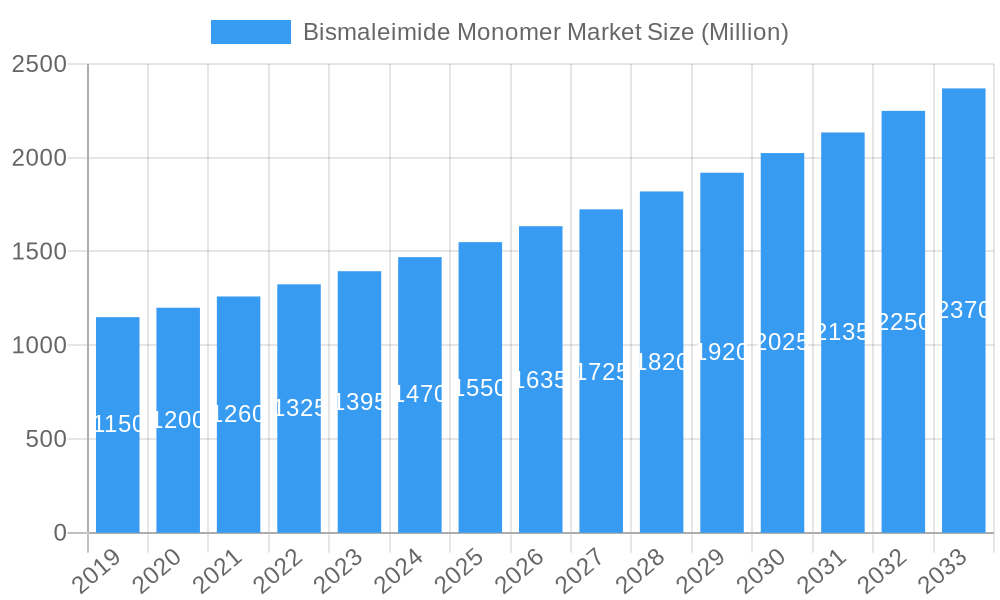

The global Bismaleimide Monomer Market is poised for robust growth, projected to surpass an estimated market size of approximately USD 1.5 billion by 2025, with a Compound Annual Growth Rate (CAGR) exceeding 5.00% during the forecast period of 2025-2033. This expansion is primarily fueled by the increasing demand from the aviation and aerospace industry, where Bismaleimide (BMI) resins are critical for manufacturing lightweight, high-strength composite materials essential for aircraft components. The electrical and electronics sector also presents a significant growth avenue, driven by the need for advanced materials with superior thermal and electrical insulation properties in sophisticated electronic devices and circuit boards. Emerging applications in other end-user industries, including automotive and industrial machinery, are further contributing to market diversification and sustained upward trajectory.

Bismaleimide Monomer Market Market Size (In Billion)

Key market drivers include the continuous innovation in material science leading to enhanced BMI resin formulations with improved performance characteristics, such as higher thermal stability and chemical resistance. The growing emphasis on fuel efficiency in aviation and the pursuit of lighter, more durable components in other sectors are creating sustained demand for BMI monomers. However, the market faces certain restraints, including the relatively high cost of production and processing challenges associated with BMI resins compared to conventional materials. Nevertheless, ongoing research and development efforts are focused on cost optimization and process simplification, alongside a strong push towards sustainable and environmentally friendly manufacturing practices, which are expected to mitigate these challenges and ensure continued market penetration. Prominent players like HHBM, Evonik Nutrition & Care GmbH, Solvay, TCI Chemicals (India) Pvt Ltd, Huntsman International LLC, Willing New Materials Technology Co Ltd, and ALB Technology Limited are actively engaged in R&D and strategic collaborations to capture market share.

Bismaleimide Monomer Market Company Market Share

Here's the SEO-optimized, detailed report description for the Bismaleimide Monomer Market, incorporating high-traffic keywords and structured as requested:

Bismaleimide Monomer Market Market Concentration & Innovation

The global Bismaleimide (BMI) monomer market exhibits a moderate to high concentration, with key players like Evonik Nutrition & Care GmbH, Huntsman International LLC, and Solvay holding significant market share, estimated to be approximately 65% combined. Innovation is a critical driver, fueled by the demand for advanced materials with superior thermal and mechanical properties, particularly in high-performance sectors. R&D efforts are focused on developing BMI resins with enhanced processability, lower cure temperatures, and improved flame retardancy. Regulatory frameworks, such as REACH in Europe and TSCA in the United States, are increasingly influencing product development and manufacturing processes, demanding greater emphasis on safety and environmental sustainability. While direct product substitutes are limited in high-end applications, alternative resin systems like epoxies and polyurethanes can address certain cost-sensitive or less demanding use cases. End-user trends are strongly shaped by the growth in the aviation and aerospace sectors, driven by the need for lightweight, durable, and heat-resistant components. Mergers and acquisitions (M&A) activity, though not rampant, plays a role in consolidating market presence and acquiring technological expertise. Recent M&A deal values are estimated to be in the range of tens of millions to hundreds of millions of dollars, strategically bolstering the portfolios of leading companies.

Bismaleimide Monomer Market Industry Trends & Insights

The Bismaleimide (BMI) monomer market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025–2033. This significant market penetration is primarily driven by the escalating demand for high-performance composite materials across critical industries. The aviation and aerospace sector stands out as a primary consumer, where BMI resins are indispensable for manufacturing lightweight structural components, engine parts, and interior elements due to their exceptional thermal stability, chemical resistance, and mechanical strength at elevated temperatures. The electrical and electronics industry also contributes substantially, utilizing BMI for printed circuit boards (PCBs), encapsulants, and insulating materials that require high-temperature resistance and excellent dielectric properties. Technological disruptions, such as advancements in resin formulation for improved toughness and reduced brittleness, alongside the development of faster curing systems, are continuously reshaping the competitive landscape. Consumer preferences are increasingly leaning towards materials that offer superior performance, safety, and longevity, directly benefiting the adoption of BMI monomers. The competitive dynamics are characterized by strategic collaborations, product differentiation through specialized formulations, and a focus on cost-optimization without compromising quality. Market players are actively investing in R&D to address emerging application needs and enhance the sustainability profile of BMI-based materials, with the market size projected to reach over $3,500 million by 2033. The increasing adoption of advanced manufacturing techniques, such as additive manufacturing, also presents new avenues for BMI applications, further solidifying its market position.

Dominant Markets & Segments in Bismaleimide Monomer Market

The Aviation and Aerospace sector unequivocally dominates the Bismaleimide (BMI) monomer market. This segment's supremacy is underscored by the stringent performance requirements and the continuous drive for weight reduction and enhanced fuel efficiency in aircraft and spacecraft.

- Key Drivers of Dominance in Aviation and Aerospace:

- Demand for Lightweight Composites: BMI resins, when reinforced with carbon fibers, create composites that are significantly lighter than traditional metallic materials, leading to substantial fuel savings in aviation.

- High-Temperature Performance: Aircraft engines and other critical components operate under extreme thermal conditions. BMI's inherent high glass transition temperature (Tg) makes it an ideal material for these applications, with typical Tg values exceeding 250°C.

- Structural Integrity and Durability: The need for robust and long-lasting components that can withstand rigorous operational demands, including fatigue and environmental stress, is met by the superior mechanical properties of BMI composites.

- Reduced Manufacturing Complexity: Advanced composite manufacturing techniques, enabled by BMI resins, allow for the creation of complex, integrated parts, reducing assembly time and costs.

- Safety Regulations: Stringent safety regulations in aviation necessitate materials with excellent flame retardancy and low smoke emission, properties that BMI monomers can be formulated to achieve.

The Electrical and Electronics segment represents the second-largest market for BMI monomers, driven by the insatiable demand for high-performance electronic components.

- Key Drivers of Dominance in Electrical and Electronics:

- High Electrical Insulation Properties: BMI resins offer excellent dielectric strength and low dielectric loss, making them crucial for high-frequency applications and advanced printed circuit boards (PCBs) used in telecommunications and computing.

- Thermal Management: As electronic devices become more powerful and compact, heat dissipation becomes a critical challenge. BMI's thermal stability helps in managing heat generated by components, preventing performance degradation.

- Miniaturization Trends: The drive towards smaller and more integrated electronic devices requires materials that can withstand higher operating temperatures and provide reliable insulation in confined spaces.

- Reliability in Demanding Environments: Applications in automotive electronics, industrial control systems, and defense electronics often expose components to harsh temperatures and chemical agents, where BMI's resilience is advantageous.

The Other End-user Industries segment, while smaller, is exhibiting steady growth and includes diverse applications.

- Key Drivers of Growth in Other End-user Industries:

- Automotive Industry: Increasing use of lightweight composite parts for performance vehicles, including structural components and under-the-hood applications requiring heat resistance.

- Industrial Equipment: Manufacturing of high-performance tools, molds, and components for demanding industrial processes.

- Sporting Goods: Development of advanced sporting equipment requiring high strength-to-weight ratios and stiffness.

- Medical Devices: Certain specialized medical equipment may benefit from BMI's biocompatibility (when formulated correctly) and resistance to sterilization processes.

Bismaleimide Monomer Market Product Developments

Product developments in the Bismaleimide (BMI) monomer market are largely focused on enhancing processability and expanding application suitability. Innovations include lower-viscosity BMI resins for improved infusion and resin transfer molding (RTM), as well as formulations with reduced exotherm during curing, leading to more controlled manufacturing processes. The development of BMI systems with enhanced toughness and crack resistance is crucial for aerospace and automotive applications, addressing a historical limitation. Furthermore, research into hybrid BMI systems, often incorporating other thermosetting resins like epoxies or cyanate esters, aims to achieve a superior balance of properties, including cost-effectiveness and improved impact strength, thereby broadening their market appeal and competitive advantage in demanding applications.

Report Scope & Segmentation Analysis

The Bismaleimide (BMI) monomer market is meticulously analyzed across its key end-user industries, offering detailed insights into each segment's growth trajectory and market dynamics.

- Aviation and Aerospace: This segment is projected to witness significant growth due to the increasing demand for lightweight, high-strength, and temperature-resistant materials in aircraft and spacecraft. Market size in this sector is estimated to reach approximately $1,500 million by 2033, with a strong CAGR driven by new aircraft development and increasing production rates.

- Electrical and Electronics: This segment is expected to show consistent expansion, fueled by the need for advanced materials in high-performance PCBs, semiconductors, and electronic components. The market size for this segment is projected to reach around $1,200 million by 2033, with steady growth driven by technological advancements and the expanding electronics industry.

- Other End-user Industries: This diverse segment, encompassing automotive, industrial equipment, and sporting goods, is anticipated to experience robust growth. Its market size is estimated to be approximately $800 million by 2033, propelled by the increasing adoption of composite materials for performance enhancement and weight reduction across various manufacturing sectors.

Key Drivers of Bismaleimide Monomer Market Growth

The Bismaleimide (BMI) monomer market growth is propelled by several key factors. Primarily, the relentless demand from the aviation and aerospace industry for lightweight, high-temperature resistant composite materials, crucial for fuel efficiency and structural integrity, is a major catalyst. Secondly, the burgeoning electrical and electronics sector, requiring advanced materials for high-performance printed circuit boards and components that can withstand elevated operating temperatures, significantly contributes to market expansion. Thirdly, technological advancements in BMI resin formulations, leading to improved processability, enhanced toughness, and reduced cure times, are making these materials more accessible and attractive for a wider range of applications. Finally, increasing investments in advanced manufacturing and the development of novel end-use applications are creating new avenues for growth.

Challenges in the Bismaleimide Monomer Market Sector

Despite its robust growth, the Bismaleimide (BMI) monomer market faces several challenges. The high cost of production and raw materials compared to some alternative thermosetting resins can limit its adoption in price-sensitive applications. The processing complexity of BMI resins, often requiring higher curing temperatures and specialized handling, can also be a barrier for manufacturers without established expertise. Furthermore, environmental regulations concerning the production and disposal of certain chemical components used in BMI formulations necessitate continuous innovation in developing more sustainable alternatives. Supply chain disruptions and the availability of key precursor chemicals can also pose a challenge, impacting production volumes and pricing stability.

Emerging Opportunities in Bismaleimide Monomer Market

Emerging opportunities in the Bismaleimide (BMI) monomer market are manifold. The growing demand for advanced composite materials in the automotive sector, particularly for electric vehicles seeking weight reduction and improved performance, presents a significant growth avenue. Furthermore, the exploration of BMI in additive manufacturing (3D printing) for producing complex, high-performance parts is an emerging frontier. The development of hybrid BMI systems that combine the benefits of BMI with other resins like epoxies offers opportunities for tailored material properties and cost optimization, broadening their applicability. Increased focus on sustainable BMI monomer production and the development of bio-based precursors also represent a promising area for innovation and market differentiation.

Leading Players in the Bismaleimide Monomer Market Market

- HHBM

- Evonik Nutrition & Care GmbH

- Solvay

- TCI Chemicals (India) Pvt Ltd

- Huntsman International LLC

- Willing New Materials Technology Co Ltd

- ALB Technology Limited

Key Developments in Bismaleimide Monomer Market Industry

- 2023/08: Huntsman International LLC launched a new line of advanced BMI resins with improved toughness for aerospace applications, aiming to enhance structural integrity and reduce material fatigue.

- 2022/11: Evonik Nutrition & Care GmbH announced significant investments in expanding its BMI monomer production capacity to meet the growing global demand, particularly from the aerospace sector.

- 2022/05: Solvay introduced a novel BMI formulation designed for faster curing cycles, enabling increased manufacturing efficiency in the automotive industry.

- 2021/10: Willing New Materials Technology Co Ltd showcased innovative BMI solutions for high-temperature electronic encapsulation, addressing the increasing thermal challenges in advanced electronics.

- 2020/07: ALB Technology Limited focused on R&D for developing eco-friendlier BMI precursors, aligning with increasing environmental regulations and sustainability initiatives.

Strategic Outlook for Bismaleimide Monomer Market Market

The strategic outlook for the Bismaleimide (BMI) monomer market remains highly positive, driven by sustained demand from its core sectors and the emergence of new application areas. Continued investment in research and development focused on enhancing material properties like toughness, processability, and cost-effectiveness will be critical for market leaders. The growing emphasis on lightweighting in the automotive and aerospace industries, coupled with the relentless advancement in electronics, provides a strong foundation for future growth. Companies that can innovate in developing more sustainable and environmentally friendly BMI solutions will likely gain a competitive edge. Furthermore, strategic partnerships and potential consolidation activities within the industry could reshape the market landscape, optimizing supply chains and fostering collaborative innovation to meet the evolving needs of global industries.

Bismaleimide Monomer Market Segmentation

-

1. End-user Industry

- 1.1. Aviation and Aerospace

- 1.2. Electrical and Electronics

- 1.3. Other End-user Industries

Bismaleimide Monomer Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. United Kingdom

- 3.2. France

- 3.3. Germany

- 3.4. Italy

- 3.5. Rest of Europe

- 4. Rest of the World

Bismaleimide Monomer Market Regional Market Share

Geographic Coverage of Bismaleimide Monomer Market

Bismaleimide Monomer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand from Aerospace Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Environmental Concerns Related to Organic Coatings; Availability of Substitutes

- 3.4. Market Trends

- 3.4.1. Increasing demand from Electrical and Electronics Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bismaleimide Monomer Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Aviation and Aerospace

- 5.1.2. Electrical and Electronics

- 5.1.3. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.2.2. North America

- 5.2.3. Europe

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Asia Pacific Bismaleimide Monomer Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Aviation and Aerospace

- 6.1.2. Electrical and Electronics

- 6.1.3. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. North America Bismaleimide Monomer Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Aviation and Aerospace

- 7.1.2. Electrical and Electronics

- 7.1.3. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Europe Bismaleimide Monomer Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Aviation and Aerospace

- 8.1.2. Electrical and Electronics

- 8.1.3. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. Rest of the World Bismaleimide Monomer Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. Aviation and Aerospace

- 9.1.2. Electrical and Electronics

- 9.1.3. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 HHBM

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Evonik Nutrition & Care GmbH

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Solvay

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 TCI Chemicals (India) Pvt Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Huntsman International LLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Willing New Materials Technology Co Ltd *List Not Exhaustive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 ALB Technology Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 HHBM

List of Figures

- Figure 1: Global Bismaleimide Monomer Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Bismaleimide Monomer Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 3: Asia Pacific Bismaleimide Monomer Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 4: Asia Pacific Bismaleimide Monomer Market Revenue (Million), by Country 2025 & 2033

- Figure 5: Asia Pacific Bismaleimide Monomer Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: North America Bismaleimide Monomer Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America Bismaleimide Monomer Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Bismaleimide Monomer Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Bismaleimide Monomer Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Bismaleimide Monomer Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe Bismaleimide Monomer Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Bismaleimide Monomer Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Bismaleimide Monomer Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Bismaleimide Monomer Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: Rest of the World Bismaleimide Monomer Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Rest of the World Bismaleimide Monomer Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Rest of the World Bismaleimide Monomer Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Bismaleimide Monomer Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 2: Global Bismaleimide Monomer Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Bismaleimide Monomer Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Bismaleimide Monomer Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: China Bismaleimide Monomer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: India Bismaleimide Monomer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Japan Bismaleimide Monomer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: South Korea Bismaleimide Monomer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of Asia Pacific Bismaleimide Monomer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Bismaleimide Monomer Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Bismaleimide Monomer Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United States Bismaleimide Monomer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Canada Bismaleimide Monomer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Mexico Bismaleimide Monomer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Global Bismaleimide Monomer Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Bismaleimide Monomer Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: United Kingdom Bismaleimide Monomer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Bismaleimide Monomer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Germany Bismaleimide Monomer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Italy Bismaleimide Monomer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Bismaleimide Monomer Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Bismaleimide Monomer Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 23: Global Bismaleimide Monomer Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bismaleimide Monomer Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Bismaleimide Monomer Market?

Key companies in the market include HHBM, Evonik Nutrition & Care GmbH, Solvay, TCI Chemicals (India) Pvt Ltd, Huntsman International LLC, Willing New Materials Technology Co Ltd *List Not Exhaustive, ALB Technology Limited.

3. What are the main segments of the Bismaleimide Monomer Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand from Aerospace Industry; Other Drivers.

6. What are the notable trends driving market growth?

Increasing demand from Electrical and Electronics Sector.

7. Are there any restraints impacting market growth?

Environmental Concerns Related to Organic Coatings; Availability of Substitutes.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bismaleimide Monomer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bismaleimide Monomer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bismaleimide Monomer Market?

To stay informed about further developments, trends, and reports in the Bismaleimide Monomer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence