Key Insights

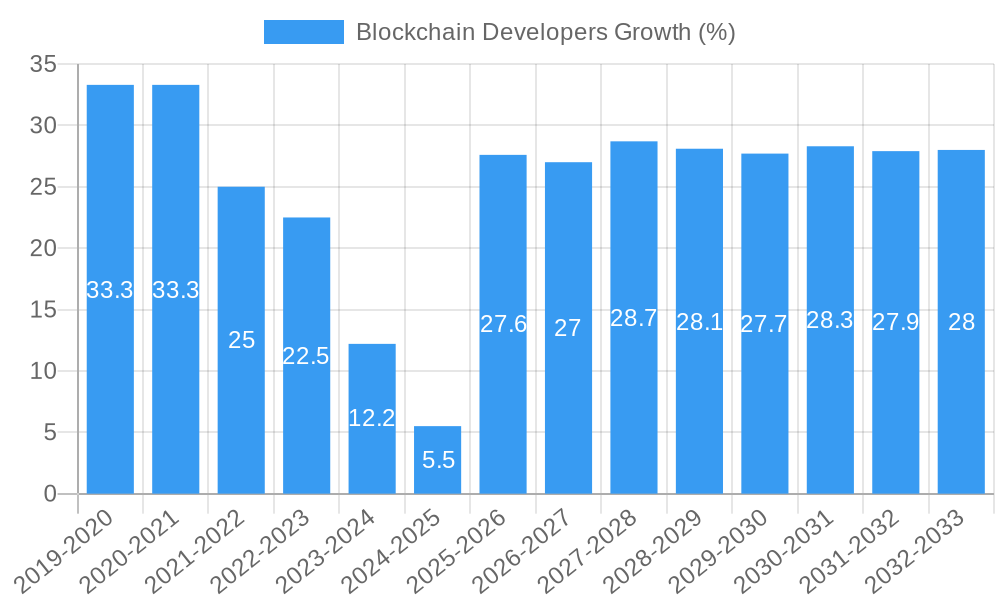

The global blockchain developer market is poised for significant expansion, driven by the increasing adoption of decentralized technologies across diverse industries. With an estimated market size of approximately $5.8 billion in 2025, this sector is projected to experience a robust Compound Annual Growth Rate (CAGR) of around 28% through 2033. This surge is largely fueled by the growing demand for enhanced security, transparency, and efficiency in financial transactions, supply chain management, and digital identity verification. The finance and banking sector remains a primary adopter, leveraging blockchain for secure and faster cross-border payments, fraud reduction, and streamlined regulatory compliance. Simultaneously, the retail and e-commerce industries are embracing blockchain for supply chain traceability, loyalty programs, and secure online payments, while healthcare utilizes it for secure patient data management and drug provenance. The increasing integration of blockchain in gaming, particularly with NFTs and play-to-earn models, further contributes to market dynamism.

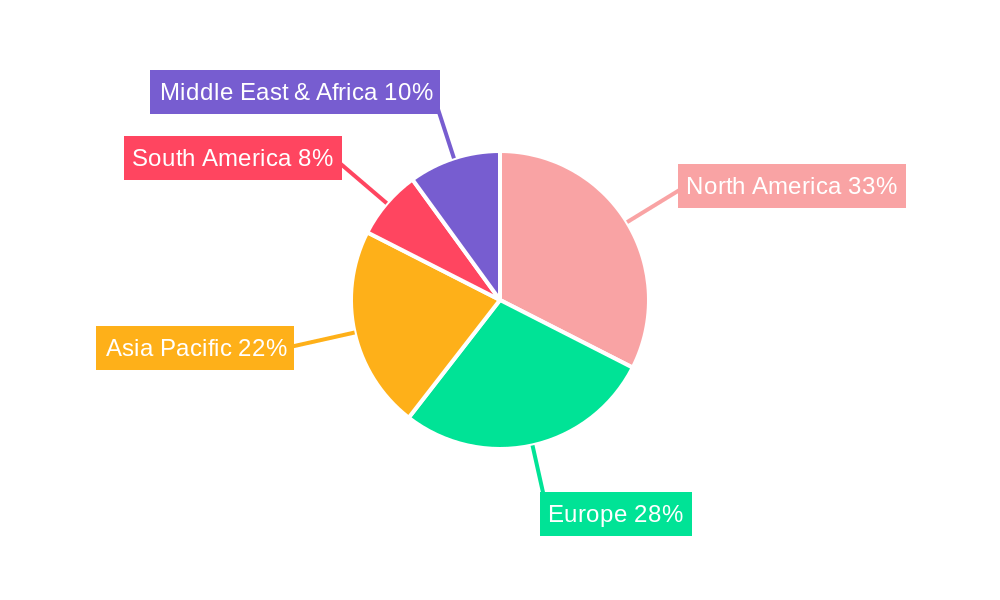

The market's growth is further propelled by advancements in blockchain application development, the creation of robust cryptocurrency mining software, and the development of secure blockchain wallet and exchange platforms. Smart contract development is also a critical segment, enabling automated and trustless execution of agreements. Despite this optimistic outlook, certain restraints, such as regulatory uncertainties and the complexity of implementing blockchain solutions, pose challenges. However, the ongoing innovation in decentralized finance (DeFi), non-fungible tokens (NFTs), and the metaverse, coupled with increasing venture capital investment, are expected to overcome these hurdles. Geographically, North America and Europe are anticipated to lead the market due to early adoption and established technological infrastructure, while the Asia Pacific region, driven by countries like China and India, is expected to witness rapid growth due to a burgeoning tech landscape and increasing government interest in blockchain innovation.

This in-depth report provides a strategic analysis of the global Blockchain Developers market, offering unparalleled insights for industry stakeholders. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this report delves into market dynamics, growth drivers, challenges, and future opportunities. We explore the evolving landscape of blockchain technology, its application across diverse sectors, and the key players shaping its trajectory. Gain a competitive edge with actionable intelligence on market concentration, innovation trends, dominant segments, and strategic developments.

Blockchain Developers Market Concentration & Innovation

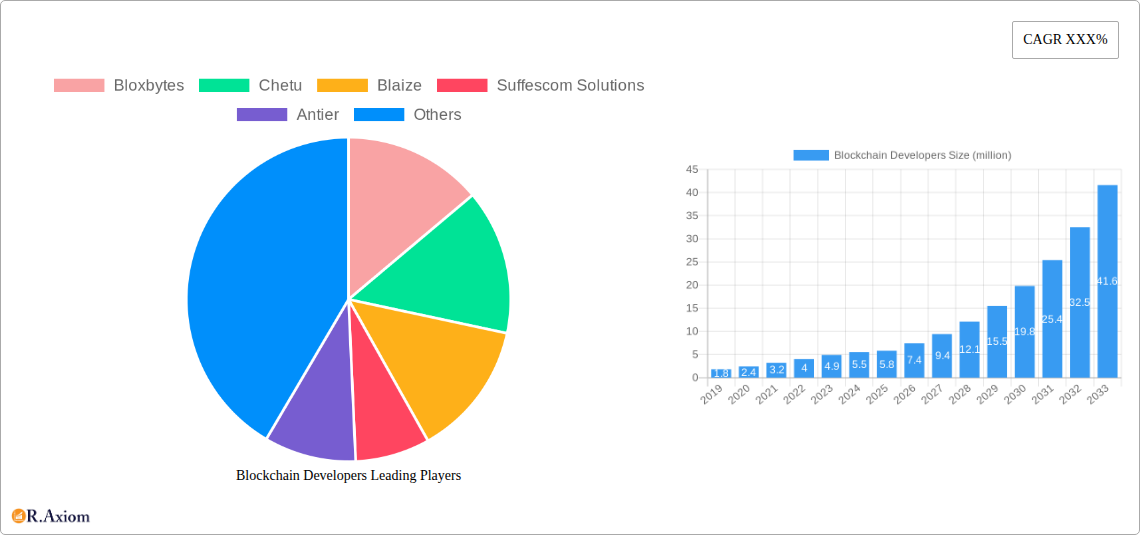

The global Blockchain Developers market exhibits a dynamic concentration pattern, driven by rapid technological advancements and increasing adoption across industries. While a few key players command significant market share, the landscape is characterized by a vibrant ecosystem of innovative startups and established technology firms. Innovation is primarily fueled by the pursuit of enhanced security, scalability, and interoperability of blockchain solutions. Regulatory frameworks, while still evolving, are playing a crucial role in shaping market development, influencing the types of applications and services being developed. The emergence of new product substitutes, such as advanced distributed ledger technologies, presents both challenges and opportunities. End-user trends indicate a growing demand for decentralized applications (dApps) in finance, supply chain management, and gaming. Mergers and acquisitions (M&A) activity is a notable feature, with estimated deal values in the billions of dollars, as larger entities seek to integrate cutting-edge blockchain expertise. For instance, key M&A activities are anticipated to reach values of over XX million dollars in the next fiscal year, consolidating market power and fostering innovation. Market share for leading development firms is projected to fluctuate, with some expected to hold over 10% of the market by 2028.

- Market Concentration Drivers:

- Technological expertise and intellectual property.

- Access to venture capital and funding.

- Strong existing client relationships.

- Innovation Focus Areas:

- Scalability solutions (e.g., layer-2 protocols).

- Interoperability between different blockchain networks.

- Privacy-preserving technologies.

- User experience enhancements for dApps.

- Regulatory Impact:

- Compliance with KYC/AML regulations for financial applications.

- Data privacy laws influencing healthcare blockchain solutions.

- Intellectual property protection for smart contracts.

- M&A Activity:

- Acquisition of specialized blockchain development firms.

- Strategic partnerships to expand service offerings.

- Investment in blockchain startups with disruptive technologies.

Blockchain Developers Industry Trends & Insights

The Blockchain Developers industry is poised for substantial growth, driven by a confluence of technological, economic, and societal factors. The projected Compound Annual Growth Rate (CAGR) for the market is expected to be a robust XX%, indicating significant expansion over the forecast period. Market penetration of blockchain solutions is steadily increasing across various sectors, with early adopters demonstrating tangible benefits in efficiency, transparency, and security. Key growth drivers include the increasing demand for decentralized finance (DeFi) applications, the need for secure and transparent supply chain management, and the burgeoning interest in non-fungible tokens (NFTs) for digital ownership. Technological disruptions, such as the advancements in consensus mechanisms, the development of more efficient smart contract languages, and the integration of AI with blockchain, are further accelerating innovation. Consumer preferences are shifting towards greater control over personal data and a desire for more secure and transparent digital interactions. This is fueling the development of user-centric blockchain solutions. Competitive dynamics within the industry are intensifying, with both established technology giants and agile startups vying for market leadership. Companies are increasingly focusing on niche specializations and offering end-to-end blockchain development services to cater to diverse client needs. The estimated market size for blockchain development services is projected to exceed XX billion dollars by 2028, reflecting the growing value proposition of these solutions. The increasing adoption of blockchain in enterprise solutions, moving beyond initial proof-of-concepts to full-scale implementations, is a critical trend. Furthermore, the development of specialized blockchain platforms for specific industries, such as healthcare record management and real estate tokenization, is expanding the market's reach. The ongoing evolution of Web3 technologies, emphasizing decentralization and user ownership, is also a significant catalyst for the blockchain developer community. The investment in research and development by leading technology firms is expected to continue, driving the discovery of novel use cases and enhancing the performance of existing blockchain protocols. The demand for skilled blockchain developers remains exceptionally high, leading to competitive talent acquisition strategies and a focus on continuous learning and upskilling within the workforce. The global market for blockchain development services is projected to reach a valuation of over XX million by the end of 2033, signifying a monumental surge in demand and adoption. The integration of blockchain with emerging technologies like the Internet of Things (IoT) is opening up new avenues for innovation, enabling secure and automated data exchange between devices. The rise of decentralized autonomous organizations (DAOs) also presents new models for governance and collaboration, requiring specialized development expertise. The increasing focus on sustainability and the use of blockchain for carbon credit tracking and renewable energy management further diversifies the application landscape.

Dominant Markets & Segments in Blockchain Developers

The dominance within the Blockchain Developers market is characterized by regional strengths and a clear preference for specific application types and development services. North America, particularly the United States, currently leads in market share, driven by significant investments in blockchain research, a robust startup ecosystem, and supportive regulatory environments for innovation. Asia Pacific is emerging as a fast-growing region, with countries like China and India demonstrating strong adoption rates and a burgeoning developer talent pool.

In terms of Application segments, Finance & Banking remains the dominant sector, accounting for an estimated XX% of the total blockchain development market. This dominance is attributed to the inherent need for security, transparency, and efficiency in financial transactions, leading to widespread adoption of blockchain for payments, remittances, trade finance, and digital asset management. The market size for blockchain in finance is projected to reach XX billion dollars by 2028.

- Finance & Banking Dominance Drivers:

- Disintermediation of traditional financial processes.

- Enhanced security for financial transactions.

- Faster and cheaper cross-border payments.

- Growth of decentralized finance (DeFi) ecosystems.

- Tokenization of assets.

The Type of blockchain development services experiencing the most significant traction is Blockchain Application Development and Blockchain Smart Contract Development. These segments are projected to capture over XX% of the market share collectively by 2028. The demand for custom dApps across various industries, coupled with the critical role of smart contracts in automating agreements and ensuring trust, fuels this growth.

- Dominant Development Types:

- Blockchain Application Development: Tailored solutions for specific industry needs, from enterprise resource planning (ERP) integration to customer loyalty programs.

- Blockchain Smart Contract Development: Creation and deployment of self-executing contracts for automated processes, token generation, and dApp functionality.

- Blockchain Wallet & Exchange Software: Increasing demand for secure and user-friendly platforms for managing digital assets.

- Blockchain Cryptocurrency Exchange: Continued growth in the development of centralized and decentralized exchanges.

Supply Chain is another rapidly expanding segment, projected to grow at a CAGR of XX% over the forecast period. Blockchain's ability to provide end-to-end transparency, traceability, and provenance in supply chains is driving adoption in logistics, manufacturing, and agriculture. The market size for blockchain in supply chain is estimated to reach XX billion dollars by 2028.

- Supply Chain Growth Drivers:

- Enhanced transparency and traceability of goods.

- Reduction of fraud and counterfeiting.

- Improved inventory management.

- Streamlined customs and trade processes.

The Retail & E-Commerce sector is also witnessing significant growth, driven by the potential for loyalty programs, secure payment gateways, and enhanced customer experience through verifiable digital identities. The Healthcare segment is increasingly leveraging blockchain for secure patient record management, drug traceability, and clinical trial data integrity. Real Estate is exploring blockchain for property tokenization, fractional ownership, and streamlining property transactions. The Gaming industry is experiencing a boom with the integration of NFTs for in-game assets and play-to-earn models. The projected market size for blockchain in gaming is expected to reach XX billion dollars by 2028.

Blockchain Developers Product Developments

Product innovations in the Blockchain Developers sector are continuously pushing the boundaries of what is possible. Key developments include the creation of more scalable and energy-efficient blockchain protocols, such as the advancements in Proof-of-Stake (PoS) consensus mechanisms, which have significantly reduced energy consumption compared to older Proof-of-Work (PoW) systems. Companies are also developing sophisticated smart contract templates and frameworks that accelerate the development process and enhance security. Furthermore, there is a strong focus on building user-friendly interfaces and developer tools to lower the barrier to entry for blockchain adoption. Competitive advantages are being gained through specialized solutions that address specific industry pain points, such as decentralized identity management for enhanced privacy or immutable audit trails for compliance in regulated industries. The integration of AI and machine learning with blockchain is leading to more intelligent and autonomous decentralized applications.

Report Scope & Segmentation Analysis

This report encompasses a comprehensive analysis of the global Blockchain Developers market, segmented by Application, Type, and Region. The Application segments include Finance & Banking, Supply Chain, Retail & E-Commerce, Healthcare, Real Estate, Gaming, and Others. The Type segments cover Blockchain Application Development, Cryptocurrency Mining Software, Blockchain Wallet & Exchange Software, Blockchain Smart Contract Development, Blockchain Cryptocurrency Exchange, and Others. Regional analysis will focus on North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

- Finance & Banking Segment: Expected to maintain its leading position with a projected market size of over XX billion dollars by 2028, driven by DeFi and institutional adoption.

- Supply Chain Segment: Poised for rapid growth, with an estimated market size of XX billion dollars by 2028, fueled by the demand for transparency and traceability.

- Retail & E-Commerce Segment: Anticipated to grow significantly, with a projected market size of XX billion dollars by 2028, driven by loyalty programs and secure payments.

- Healthcare Segment: Experiencing steady growth, with a projected market size of XX billion dollars by 2028, focused on data security and integrity.

- Real Estate Segment: Emerging as a key growth area, with an estimated market size of XX billion dollars by 2028, driven by tokenization and fractional ownership.

- Gaming Segment: Experiencing a boom, with a projected market size of XX billion dollars by 2028, propelled by NFTs and play-to-earn models.

- Blockchain Application Development: The largest service type segment, expected to reach XX billion dollars by 2028, offering customized dApps.

- Blockchain Smart Contract Development: A critical component for most blockchain solutions, with a projected market size of XX billion dollars by 2028.

- Blockchain Wallet & Exchange Software: Essential infrastructure for digital asset management, with an estimated market size of XX billion dollars by 2028.

Key Drivers of Blockchain Developers Growth

The growth of the Blockchain Developers market is propelled by several key factors, including the increasing global demand for secure and transparent transaction systems. The ongoing digital transformation across industries necessitates robust solutions for data integrity and decentralized operations, which blockchain provides. Technological advancements, such as the development of scalable and interoperable blockchain protocols, are making the technology more accessible and practical for widespread adoption. Economic factors, including the rise of cryptocurrencies and the growing interest in tokenized assets, are creating new opportunities for blockchain developers. Furthermore, evolving regulatory frameworks, while sometimes challenging, are also providing clarity and fostering greater institutional confidence in blockchain technology.

Challenges in the Blockchain Developers Sector

Despite its immense potential, the Blockchain Developers sector faces several significant challenges. Regulatory uncertainty and the lack of standardized global regulations pose a considerable hurdle, creating complexities for businesses operating across different jurisdictions. The scalability of certain blockchain networks remains a concern, impacting transaction speeds and costs for high-volume applications. Interoperability between different blockchain platforms is another area requiring further development to enable seamless data exchange and asset transfer. Additionally, the shortage of skilled blockchain developers globally limits the pace of innovation and implementation. Security vulnerabilities in smart contracts and the potential for data breaches, although decreasing with advancements, continue to be a concern for end-users. The initial high cost of implementation and integration with existing legacy systems also presents a barrier for some businesses.

Emerging Opportunities in Blockchain Developers

The Blockchain Developers market is ripe with emerging opportunities, driven by innovation and expanding use cases. The continued growth of Decentralized Finance (DeFi) presents a vast landscape for developing new financial instruments, lending platforms, and decentralized exchanges. The increasing adoption of Non-Fungible Tokens (NFTs) extends beyond art and collectibles into areas like digital identity, ticketing, and supply chain provenance. The evolution of Web3 technologies and the metaverse opens up new avenues for creating decentralized economies, virtual worlds, and immersive experiences, all requiring specialized blockchain development. The integration of blockchain with the Internet of Things (IoT) offers opportunities for secure and automated data management and device interaction. Furthermore, the growing demand for sustainable blockchain solutions, such as those used for carbon tracking and renewable energy credits, presents a significant ethical and commercial opportunity.

Leading Players in the Blockchain Developers Market

- Bloxbytes

- Chetu

- Blaize

- Suffescom Solutions

- Antier

- OpenXcell

- INC4

- KIRHYIP

- 482solutions

- 4soft

- Aalpha Information Systems

- Accubits

- CDN Solutions

- Fulminous

- Geniusee

- SparxIT

- Appinventiv

- Toptal

- LeewayHertz

- ScienceSoft

- 10Pearls

- Webisoft

- PixelPlex

- SoluLab

- ValueCoders

Key Developments in Blockchain Developers Industry

- Q1 2023: Launch of a new scalable blockchain protocol focusing on energy efficiency, aiming to reduce transaction costs by XX%.

- Q2 2023: Major tech firm announces strategic partnership to integrate blockchain-based supply chain solutions, impacting XX million supply chain transactions annually.

- Q3 2023: Significant increase in venture capital funding for blockchain startups, with total investments reaching over XX million dollars globally.

- Q4 2023: Release of advanced smart contract development tools, reducing development time by XX% for common applications.

- Q1 2024: Expansion of regulated stablecoin offerings, boosting institutional adoption in the DeFi space, with market capitalization exceeding XX billion dollars.

- Q2 2024: Announcement of a significant merger between two leading blockchain development firms, creating a powerhouse with an estimated market share of XX%.

- Q3 2024: Emergence of new blockchain use cases in sustainable energy management, with pilot projects impacting XX gigawatts of renewable energy.

- Q4 2024: Growing adoption of decentralized identity solutions, with projected user base growth of XX% by 2025.

Strategic Outlook for Blockchain Developers Market

- Q1 2023: Launch of a new scalable blockchain protocol focusing on energy efficiency, aiming to reduce transaction costs by XX%.

- Q2 2023: Major tech firm announces strategic partnership to integrate blockchain-based supply chain solutions, impacting XX million supply chain transactions annually.

- Q3 2023: Significant increase in venture capital funding for blockchain startups, with total investments reaching over XX million dollars globally.

- Q4 2023: Release of advanced smart contract development tools, reducing development time by XX% for common applications.

- Q1 2024: Expansion of regulated stablecoin offerings, boosting institutional adoption in the DeFi space, with market capitalization exceeding XX billion dollars.

- Q2 2024: Announcement of a significant merger between two leading blockchain development firms, creating a powerhouse with an estimated market share of XX%.

- Q3 2024: Emergence of new blockchain use cases in sustainable energy management, with pilot projects impacting XX gigawatts of renewable energy.

- Q4 2024: Growing adoption of decentralized identity solutions, with projected user base growth of XX% by 2025.

Strategic Outlook for Blockchain Developers Market

The strategic outlook for the Blockchain Developers market remains exceptionally positive, driven by sustained innovation and increasing integration across a multitude of industries. The ongoing evolution of Web3, the metaverse, and decentralized applications promises to unlock new revenue streams and transformative business models. Companies that focus on developing scalable, secure, and user-friendly blockchain solutions, while adeptly navigating evolving regulatory landscapes, are best positioned for success. Strategic investments in research and development, coupled with a focus on talent acquisition and retention, will be crucial for maintaining a competitive edge. The growing demand for specialized blockchain expertise in sectors like finance, supply chain, and healthcare indicates a robust future for skilled blockchain developers and development firms. The projected market expansion to over XX billion dollars by 2030 underscores the significant growth catalysts at play.

Blockchain Developers Segmentation

-

1. Application

- 1.1. Finance & Banking

- 1.2. Supply Chain

- 1.3. Retail & E-Commerce

- 1.4. Healthcare

- 1.5. Real Estate

- 1.6. Gaming

- 1.7. Others

-

2. Type

- 2.1. Blockchain Application Development

- 2.2. Cryptocurrency Mining Software

- 2.3. Blockchain Wallet & Exchange Software

- 2.4. Blockchain Smart Contract Development

- 2.5. Blockchain Cryptocurrency Exchange

- 2.6. Others

Blockchain Developers Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Blockchain Developers REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Blockchain Developers Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Finance & Banking

- 5.1.2. Supply Chain

- 5.1.3. Retail & E-Commerce

- 5.1.4. Healthcare

- 5.1.5. Real Estate

- 5.1.6. Gaming

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Blockchain Application Development

- 5.2.2. Cryptocurrency Mining Software

- 5.2.3. Blockchain Wallet & Exchange Software

- 5.2.4. Blockchain Smart Contract Development

- 5.2.5. Blockchain Cryptocurrency Exchange

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Blockchain Developers Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Finance & Banking

- 6.1.2. Supply Chain

- 6.1.3. Retail & E-Commerce

- 6.1.4. Healthcare

- 6.1.5. Real Estate

- 6.1.6. Gaming

- 6.1.7. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Blockchain Application Development

- 6.2.2. Cryptocurrency Mining Software

- 6.2.3. Blockchain Wallet & Exchange Software

- 6.2.4. Blockchain Smart Contract Development

- 6.2.5. Blockchain Cryptocurrency Exchange

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Blockchain Developers Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Finance & Banking

- 7.1.2. Supply Chain

- 7.1.3. Retail & E-Commerce

- 7.1.4. Healthcare

- 7.1.5. Real Estate

- 7.1.6. Gaming

- 7.1.7. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Blockchain Application Development

- 7.2.2. Cryptocurrency Mining Software

- 7.2.3. Blockchain Wallet & Exchange Software

- 7.2.4. Blockchain Smart Contract Development

- 7.2.5. Blockchain Cryptocurrency Exchange

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Blockchain Developers Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Finance & Banking

- 8.1.2. Supply Chain

- 8.1.3. Retail & E-Commerce

- 8.1.4. Healthcare

- 8.1.5. Real Estate

- 8.1.6. Gaming

- 8.1.7. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Blockchain Application Development

- 8.2.2. Cryptocurrency Mining Software

- 8.2.3. Blockchain Wallet & Exchange Software

- 8.2.4. Blockchain Smart Contract Development

- 8.2.5. Blockchain Cryptocurrency Exchange

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Blockchain Developers Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Finance & Banking

- 9.1.2. Supply Chain

- 9.1.3. Retail & E-Commerce

- 9.1.4. Healthcare

- 9.1.5. Real Estate

- 9.1.6. Gaming

- 9.1.7. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Blockchain Application Development

- 9.2.2. Cryptocurrency Mining Software

- 9.2.3. Blockchain Wallet & Exchange Software

- 9.2.4. Blockchain Smart Contract Development

- 9.2.5. Blockchain Cryptocurrency Exchange

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Blockchain Developers Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Finance & Banking

- 10.1.2. Supply Chain

- 10.1.3. Retail & E-Commerce

- 10.1.4. Healthcare

- 10.1.5. Real Estate

- 10.1.6. Gaming

- 10.1.7. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Blockchain Application Development

- 10.2.2. Cryptocurrency Mining Software

- 10.2.3. Blockchain Wallet & Exchange Software

- 10.2.4. Blockchain Smart Contract Development

- 10.2.5. Blockchain Cryptocurrency Exchange

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Bloxbytes

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Chetu

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Blaize

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Suffescom Solutions

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Antier

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 OpenXcell

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 INC4

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 KIRHYIP

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 482solutions

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 4soft

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Aalpha Information Systems

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Accubits

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 CDN Solutions

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Fulminous

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Geniusee

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 SparxIT

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Appinventiv

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Toptal

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 LeewayHertz

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 ScienceSoft

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 10Pearls

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Webisoft

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 PixelPlex

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 SoluLab

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 ValueCoders

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.1 Bloxbytes

List of Figures

- Figure 1: Global Blockchain Developers Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Blockchain Developers Revenue (million), by Application 2024 & 2032

- Figure 3: North America Blockchain Developers Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Blockchain Developers Revenue (million), by Type 2024 & 2032

- Figure 5: North America Blockchain Developers Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Blockchain Developers Revenue (million), by Country 2024 & 2032

- Figure 7: North America Blockchain Developers Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Blockchain Developers Revenue (million), by Application 2024 & 2032

- Figure 9: South America Blockchain Developers Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Blockchain Developers Revenue (million), by Type 2024 & 2032

- Figure 11: South America Blockchain Developers Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Blockchain Developers Revenue (million), by Country 2024 & 2032

- Figure 13: South America Blockchain Developers Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Blockchain Developers Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Blockchain Developers Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Blockchain Developers Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Blockchain Developers Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Blockchain Developers Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Blockchain Developers Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Blockchain Developers Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Blockchain Developers Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Blockchain Developers Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Blockchain Developers Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Blockchain Developers Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Blockchain Developers Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Blockchain Developers Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Blockchain Developers Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Blockchain Developers Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Blockchain Developers Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Blockchain Developers Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Blockchain Developers Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Blockchain Developers Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Blockchain Developers Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Blockchain Developers Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Blockchain Developers Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Blockchain Developers Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Blockchain Developers Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Blockchain Developers Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Blockchain Developers Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Blockchain Developers Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Blockchain Developers Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Blockchain Developers Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Blockchain Developers Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Blockchain Developers Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Blockchain Developers Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Blockchain Developers Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Blockchain Developers Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Blockchain Developers Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Blockchain Developers Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Blockchain Developers Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Blockchain Developers Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Blockchain Developers Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Blockchain Developers Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Blockchain Developers Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Blockchain Developers Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Blockchain Developers Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Blockchain Developers Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Blockchain Developers Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Blockchain Developers Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Blockchain Developers Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Blockchain Developers Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Blockchain Developers Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Blockchain Developers Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Blockchain Developers Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Blockchain Developers Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Blockchain Developers Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Blockchain Developers Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Blockchain Developers Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Blockchain Developers Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Blockchain Developers Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Blockchain Developers Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Blockchain Developers Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Blockchain Developers Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Blockchain Developers Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Blockchain Developers Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Blockchain Developers Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Blockchain Developers Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Blockchain Developers Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Blockchain Developers?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Blockchain Developers?

Key companies in the market include Bloxbytes, Chetu, Blaize, Suffescom Solutions, Antier, OpenXcell, INC4, KIRHYIP, 482solutions, 4soft, Aalpha Information Systems, Accubits, CDN Solutions, Fulminous, Geniusee, SparxIT, Appinventiv, Toptal, LeewayHertz, ScienceSoft, 10Pearls, Webisoft, PixelPlex, SoluLab, ValueCoders.

3. What are the main segments of the Blockchain Developers?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Blockchain Developers," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Blockchain Developers report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Blockchain Developers?

To stay informed about further developments, trends, and reports in the Blockchain Developers, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence