Key Insights

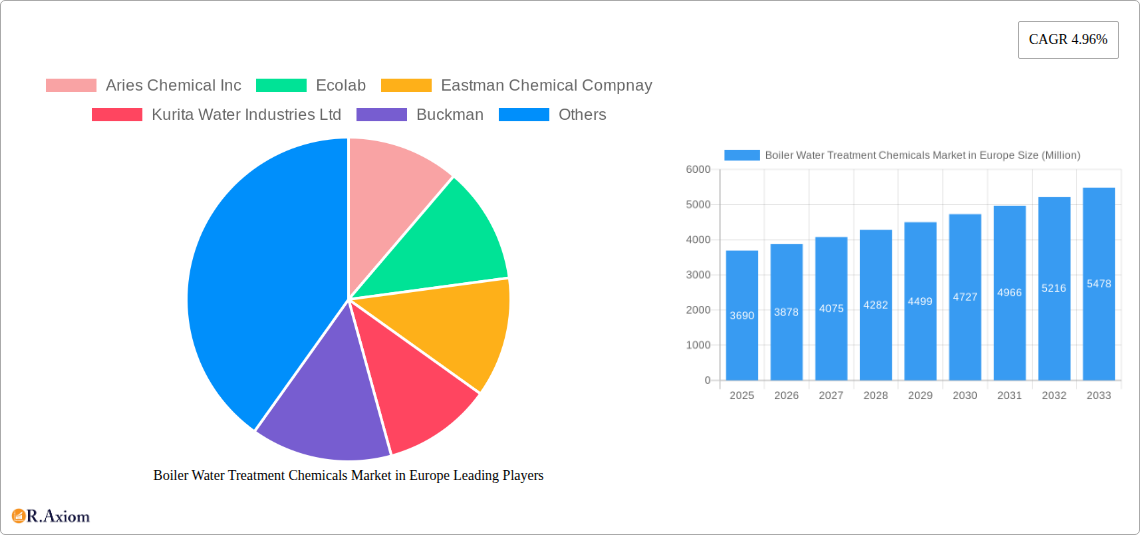

The European boiler water treatment chemicals market, valued at €3.69 billion in 2025, is projected to experience robust growth, driven by increasing industrialization and stringent environmental regulations. The market's Compound Annual Growth Rate (CAGR) of 4.96% from 2025 to 2033 indicates a significant expansion, fueled by rising demand from power generation, steel and metal, and chemical & petrochemical industries. These sectors heavily rely on efficient boiler systems, necessitating the use of chemicals to prevent scaling, corrosion, and fouling, thereby ensuring optimal performance and extended equipment lifespan. Further growth drivers include the increasing adoption of advanced treatment technologies, stricter water discharge regulations pushing for enhanced water treatment solutions, and the rising awareness of the economic benefits of preventing boiler system failures. The market is segmented by chemical type (scale and corrosion inhibitors, coagulants and flocculants, pH boosters, oxygen scavengers, and others), chemistry (basic and blended/specialty chemicals), and end-user industry. While Germany, France, Italy, and the UK represent major market segments within Europe, growth is expected across the region. Competitive dynamics are shaped by a mix of established global players and regional specialists, leading to ongoing innovation and a diverse product landscape.

Boiler Water Treatment Chemicals Market in Europe Market Size (In Billion)

The market's growth trajectory is influenced by several factors. The escalating cost of energy and the push for enhanced energy efficiency are key drivers for optimized boiler operation, increasing the demand for effective treatment chemicals. Technological advancements, such as the development of environmentally friendly and more efficient chemicals, also contribute to market expansion. However, potential restraints include fluctuations in raw material prices and the increasing focus on sustainable and eco-friendly solutions, requiring manufacturers to invest in research and development of more environmentally compatible chemicals. The competitive landscape involves strategic partnerships, mergers, and acquisitions, indicating a dynamic market with opportunities for both established players and new entrants focusing on specialized solutions and sustainable practices. The forecast period of 2025-2033 promises continued growth, albeit possibly at a slightly moderated pace as the market matures and reaches a higher level of saturation.

Boiler Water Treatment Chemicals Market in Europe Company Market Share

Boiler Water Treatment Chemicals Market in Europe: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Boiler Water Treatment Chemicals market in Europe, covering the period 2019-2033. It offers actionable insights into market dynamics, growth drivers, challenges, and opportunities, empowering stakeholders to make informed strategic decisions. The report incorporates detailed segmentation analysis, competitive landscape assessment, and future market projections, making it an invaluable resource for industry professionals, investors, and researchers.

Boiler Water Treatment Chemicals Market in Europe Market Concentration & Innovation

The European Boiler Water Treatment Chemicals market is characterized by a dynamic and moderately concentrated landscape. Leading global entities such as Ecolab, BASF SE, Kemira, Solenis, and Kurita Water Industries Ltd command a significant portion of the market share. It is estimated that the top five players collectively held approximately 60-70% of the market share in 2023, with projections for a similar or slightly higher concentration by 2025. Alongside these giants, a robust ecosystem of smaller, highly specialized companies thrives, offering niche solutions tailored to specific industrial needs. Innovation remains a pivotal force, driven by an unyielding demand for sustainable and highly efficient water treatment solutions. The rigorous environmental regulations enforced across European nations are a primary catalyst, compelling manufacturers to develop and deploy chemicals with minimal ecological footprints. This has intensified investment in pioneering research and development, focusing on cutting-edge technologies like nanotechnology-based inhibitors, advanced biocides, and intelligent monitoring systems. The market has also experienced notable consolidation through strategic mergers and acquisitions (M&A) in recent years. These transactions, with reported deal values ranging from €10 Million to €100 Million, are largely motivated by the pursuit of strategic market expansion, technological synergy, and enhanced product portfolios. While advancements in alternative water treatment methodologies, such as sophisticated membrane technologies, present a degree of product substitution, chemical treatment continues to be the cornerstone for a vast array of industrial applications. Evolving end-user trends, including the escalating adoption of renewable energy sources impacting the Power Generation segment and the burgeoning demand for advanced water management in high-tech industries like Pharmaceuticals and Chemicals & Petrochemicals, are continuously shaping the trajectory of this market.

Boiler Water Treatment Chemicals Market in Europe Industry Trends & Insights

The European Boiler Water Treatment Chemicals market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily fueled by the increasing demand for efficient and reliable power generation, industrial processes, and stringent environmental regulations. The market penetration of advanced chemicals, especially blended/specialty chemicals, is rising steadily as end-users increasingly prioritize optimized boiler operation and environmental sustainability. Technological disruptions such as the development of smart water treatment systems and predictive maintenance tools, are enhancing efficiency and reducing operational costs. Consumer preferences are shifting towards sustainable and environmentally friendly solutions, driving the demand for bio-based and less toxic chemicals. Competitive dynamics are characterized by intense rivalry among established players, focused on product innovation, cost optimization, and expanding market share through strategic partnerships and acquisitions. The market is also witnessing the entry of new players, particularly those specializing in eco-friendly solutions. The market is further shaped by fluctuating raw material prices and the overall economic conditions across European nations.

Dominant Markets & Segments in Boiler Water Treatment Chemicals Market in Europe

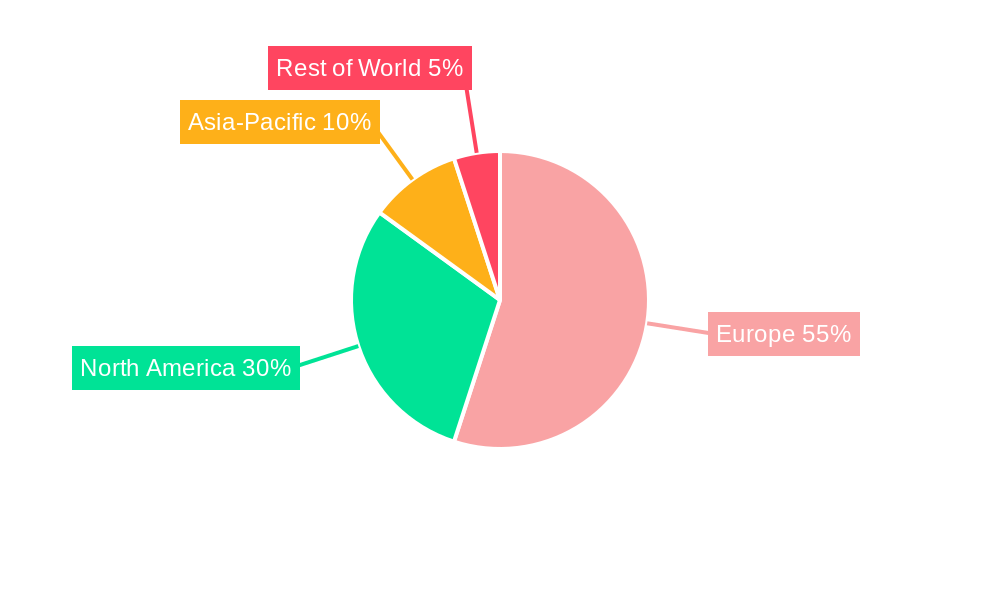

- Leading Region: Western Europe, with Germany, France, and the United Kingdom at the forefront, continues to lead the market. This dominance is underpinned by their highly developed industrial infrastructure, significant energy consumption, and some of the most stringent environmental regulations globally.

- Leading Type: Scale and corrosion inhibitors remain the largest and most critical segment. Their indispensability lies in their role in safeguarding boiler systems from damage, ensuring optimal operational efficiency, and extending equipment lifespan.

- Leading Chemistry: Blended and specialty chemicals are experiencing a pronounced surge in demand. This trend is attributed to their superior, tailor-made performance characteristics and significantly enhanced efficacy when compared to single-component or basic chemical formulations.

- Leading End-user Industry: The Power Generation sector stands out as the preeminent consumer of boiler water treatment chemicals. The criticality of efficient and uninterrupted steam generation for electricity production makes effective water treatment an absolute necessity.

Key Drivers:

- Stringent Environmental Regulations: The European Union's steadfast commitment to minimizing water pollution and championing sustainable industrial practices serves as a powerful impetus for the widespread adoption of eco-friendly and compliant water treatment chemicals.

- Robust Growth of Industrial Sectors: The continuous expansion of key industrial activities, particularly within the chemical, petrochemical, pharmaceutical, and power generation industries, directly fuels the sustained demand for effective boiler water treatment solutions.

- Infrastructure Development and Modernization: Significant investments in the upgrading of existing industrial facilities and the construction of new power plants and industrial complexes worldwide are creating substantial new demand for boiler water treatment chemicals.

The prevailing dominance of these specific segments and geographical regions is a direct consequence of a confluence of factors, including advanced industrial frameworks, substantial energy requirements, rigorous environmental mandates, and robust economic growth. While currently smaller, other segments are anticipated to experience vigorous growth throughout the forecast period, propelled by evolving application-specific demands and ongoing technological advancements.

Boiler Water Treatment Chemicals Market in Europe Product Developments

Recent product developments focus on enhancing the efficiency and environmental profile of boiler water treatment chemicals. Innovations include the introduction of advanced polymer-based inhibitors with improved performance and reduced toxicity, along with the development of intelligent dosing systems that optimize chemical usage and minimize waste. These advancements aim to address the growing concerns about environmental sustainability while maintaining the effectiveness of boiler water treatment. The market is witnessing a strong shift towards eco-friendly solutions, which is driving competition and further innovation.

Report Scope & Segmentation Analysis

This report segments the European Boiler Water Treatment Chemicals market by Type (Scale and Corrosion Inhibitors, Coagulants and Flocculants, pH Boosters, Oxygen Scavengers, Others), Chemistry (Basic Chemicals, Blended/Specialty Chemicals), and End-user Industry (Power Generation, Steel and Metal Industry, Oil Refinery, Chemical and Petrochemical, Textile and Dye Industry, Sugar Mill, Paper Mill, Food and Beverage, Institutional, Pharmaceutical, Other End-user Industries). Each segment is analyzed based on its market size, growth rate, and competitive dynamics. Growth projections for each segment vary, with blended specialty chemicals and the power generation end-user sector expected to exhibit the fastest growth rates. The competitive landscape is analyzed at the segment level, highlighting key players and their market positions.

Key Drivers of Boiler Water Treatment Chemicals Market in Europe Growth

The growth of the Boiler Water Treatment Chemicals market in Europe is driven by several factors. Stringent environmental regulations are pushing the adoption of eco-friendly solutions. The expansion of industrial sectors, especially energy and manufacturing, fuels the demand. Technological advancements in chemical formulations enhance efficiency and reduce environmental impact. Infrastructure development in power generation and industrial facilities continues to drive market growth. Lastly, increasing awareness of the importance of water treatment for efficient and sustainable operations in various end-user sectors propels the market forward.

Challenges in the Boiler Water Treatment Chemicals Market in Europe Sector

The European Boiler Water Treatment Chemicals market navigates a complex terrain marked by several significant challenges. Fluctuations in the prices of raw materials can substantially impact production costs and overall profitability. Adhering to increasingly stringent regulatory requirements often necessitates significant investments in compliance, adding to operational burdens. The market also grapples with intense competition, not only among established global players but also from agile emerging companies. Furthermore, the potential for supply chain disruptions, whether due to geopolitical events, logistical issues, or material shortages, can adversely affect product availability and pricing stability. These multifaceted challenges collectively pose risks to market profitability and growth, although strategic investments in innovation, collaborative partnerships, and operational agility can serve to effectively mitigate many of these obstacles.

Emerging Opportunities in Boiler Water Treatment Chemicals Market in Europe

Emerging opportunities include the growing demand for sustainable and eco-friendly chemicals, increasing adoption of advanced technologies like smart water treatment systems, and the expansion of industrial sectors in emerging European economies. The development of specialized solutions tailored for specific end-user needs offers significant growth potential. The focus on improving energy efficiency in industrial processes further presents growth opportunities.

Leading Players in the Boiler Water Treatment Chemicals Market in Europe Market

- Aries Chemical Inc

- Ecolab

- Eastman Chemical Company

- Kurita Water Industries Ltd

- Buckman

- BASF SE

- Kemira

- Solenis

- Suez

- Cannon Water Technology

- Lenntech B.V.

- Veolia Water Technologies

- (This list is representative and not exhaustive.)

Key Developments in Boiler Water Treatment Chemicals Market in Europe Industry

- 2022 Q4: Ecolab unveiled an innovative portfolio of sustainable boiler water treatment chemicals designed to meet stringent environmental standards and enhance operational efficiency for industrial clients.

- 2023 Q1: BASF SE announced a significant strategic partnership with a leading technology provider, aiming to co-develop and deploy advanced digital solutions for comprehensive water treatment management.

- 2023 Q2: Kurita Water Industries successfully completed the acquisition of a specialized firm focusing on niche boiler water treatment applications, strengthening its expertise in specialized chemical formulations.

- 2023 Q3: Kemira expanded its manufacturing capacity for key boiler water treatment chemicals in Central Europe to meet growing regional demand and ensure supply chain resilience.

- 2024 Q1: Solenis introduced a new line of high-performance, bio-based water treatment chemicals, underscoring its commitment to sustainability and innovation.

- (Further significant developments and market insights will be detailed in the comprehensive market report.)

Strategic Outlook for Boiler Water Treatment Chemicals Market in Europe Market

The European Boiler Water Treatment Chemicals market is poised for significant growth, driven by increasing industrialization, stringent environmental regulations, and technological advancements. The focus on sustainable and efficient solutions will continue to shape the market. Companies that can effectively adapt to evolving regulations and consumer preferences, while investing in R&D and strategic partnerships, are well-positioned to capitalize on the market's growth potential. The increasing adoption of digital technologies for optimizing water treatment processes will further enhance market expansion.

Boiler Water Treatment Chemicals Market in Europe Segmentation

-

1. Type

- 1.1. Scale and Corrosion Inhibitors

- 1.2. Coagulants and Flocculants

- 1.3. pH Boosters

- 1.4. Oxygen Scavengers

- 1.5. Others

-

2. Chemistry

- 2.1. Basic Chemicals

- 2.2. Blended/Specialty Chemicals

-

3. End-user Industry

- 3.1. Power Generation

- 3.2. Steel and Metal Industry

- 3.3. Oil Refinery

- 3.4. Chemical and Petrochemical

- 3.5. Textile and Dye Industry

- 3.6. Sugar Mill

- 3.7. Paper Mill

- 3.8. Food and Beverage

- 3.9. Institutional

- 3.10. Pharmaceutical

- 3.11. Other End-user Industries

Boiler Water Treatment Chemicals Market in Europe Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Rest of Europe

Boiler Water Treatment Chemicals Market in Europe Regional Market Share

Geographic Coverage of Boiler Water Treatment Chemicals Market in Europe

Boiler Water Treatment Chemicals Market in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand from Power Industry; Growing Popularity of the Blowdown Liquids; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Hazardous Nature of Hydrazine; Other Restraints

- 3.4. Market Trends

- 3.4.1. Power Generation To Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Boiler Water Treatment Chemicals Market in Europe Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Scale and Corrosion Inhibitors

- 5.1.2. Coagulants and Flocculants

- 5.1.3. pH Boosters

- 5.1.4. Oxygen Scavengers

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Chemistry

- 5.2.1. Basic Chemicals

- 5.2.2. Blended/Specialty Chemicals

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Power Generation

- 5.3.2. Steel and Metal Industry

- 5.3.3. Oil Refinery

- 5.3.4. Chemical and Petrochemical

- 5.3.5. Textile and Dye Industry

- 5.3.6. Sugar Mill

- 5.3.7. Paper Mill

- 5.3.8. Food and Beverage

- 5.3.9. Institutional

- 5.3.10. Pharmaceutical

- 5.3.11. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. United Kingdom

- 5.4.3. France

- 5.4.4. Italy

- 5.4.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Boiler Water Treatment Chemicals Market in Europe Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Scale and Corrosion Inhibitors

- 6.1.2. Coagulants and Flocculants

- 6.1.3. pH Boosters

- 6.1.4. Oxygen Scavengers

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Chemistry

- 6.2.1. Basic Chemicals

- 6.2.2. Blended/Specialty Chemicals

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Power Generation

- 6.3.2. Steel and Metal Industry

- 6.3.3. Oil Refinery

- 6.3.4. Chemical and Petrochemical

- 6.3.5. Textile and Dye Industry

- 6.3.6. Sugar Mill

- 6.3.7. Paper Mill

- 6.3.8. Food and Beverage

- 6.3.9. Institutional

- 6.3.10. Pharmaceutical

- 6.3.11. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom Boiler Water Treatment Chemicals Market in Europe Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Scale and Corrosion Inhibitors

- 7.1.2. Coagulants and Flocculants

- 7.1.3. pH Boosters

- 7.1.4. Oxygen Scavengers

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Chemistry

- 7.2.1. Basic Chemicals

- 7.2.2. Blended/Specialty Chemicals

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Power Generation

- 7.3.2. Steel and Metal Industry

- 7.3.3. Oil Refinery

- 7.3.4. Chemical and Petrochemical

- 7.3.5. Textile and Dye Industry

- 7.3.6. Sugar Mill

- 7.3.7. Paper Mill

- 7.3.8. Food and Beverage

- 7.3.9. Institutional

- 7.3.10. Pharmaceutical

- 7.3.11. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France Boiler Water Treatment Chemicals Market in Europe Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Scale and Corrosion Inhibitors

- 8.1.2. Coagulants and Flocculants

- 8.1.3. pH Boosters

- 8.1.4. Oxygen Scavengers

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Chemistry

- 8.2.1. Basic Chemicals

- 8.2.2. Blended/Specialty Chemicals

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Power Generation

- 8.3.2. Steel and Metal Industry

- 8.3.3. Oil Refinery

- 8.3.4. Chemical and Petrochemical

- 8.3.5. Textile and Dye Industry

- 8.3.6. Sugar Mill

- 8.3.7. Paper Mill

- 8.3.8. Food and Beverage

- 8.3.9. Institutional

- 8.3.10. Pharmaceutical

- 8.3.11. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Italy Boiler Water Treatment Chemicals Market in Europe Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Scale and Corrosion Inhibitors

- 9.1.2. Coagulants and Flocculants

- 9.1.3. pH Boosters

- 9.1.4. Oxygen Scavengers

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Chemistry

- 9.2.1. Basic Chemicals

- 9.2.2. Blended/Specialty Chemicals

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Power Generation

- 9.3.2. Steel and Metal Industry

- 9.3.3. Oil Refinery

- 9.3.4. Chemical and Petrochemical

- 9.3.5. Textile and Dye Industry

- 9.3.6. Sugar Mill

- 9.3.7. Paper Mill

- 9.3.8. Food and Beverage

- 9.3.9. Institutional

- 9.3.10. Pharmaceutical

- 9.3.11. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Europe Boiler Water Treatment Chemicals Market in Europe Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Scale and Corrosion Inhibitors

- 10.1.2. Coagulants and Flocculants

- 10.1.3. pH Boosters

- 10.1.4. Oxygen Scavengers

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Chemistry

- 10.2.1. Basic Chemicals

- 10.2.2. Blended/Specialty Chemicals

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Power Generation

- 10.3.2. Steel and Metal Industry

- 10.3.3. Oil Refinery

- 10.3.4. Chemical and Petrochemical

- 10.3.5. Textile and Dye Industry

- 10.3.6. Sugar Mill

- 10.3.7. Paper Mill

- 10.3.8. Food and Beverage

- 10.3.9. Institutional

- 10.3.10. Pharmaceutical

- 10.3.11. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Aries Chemical Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ecolab

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Eastman Chemical Compnay

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kurita Water Industries Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Buckman

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BASF SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kemira

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Solenis

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Suez

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Cannon Water Technology

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Lenntech B V

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Veolia Water Technologies*List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Aries Chemical Inc

List of Figures

- Figure 1: Boiler Water Treatment Chemicals Market in Europe Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Boiler Water Treatment Chemicals Market in Europe Share (%) by Company 2025

List of Tables

- Table 1: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by Chemistry 2020 & 2033

- Table 4: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by Chemistry 2020 & 2033

- Table 5: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 7: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by Type 2020 & 2033

- Table 11: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by Chemistry 2020 & 2033

- Table 12: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by Chemistry 2020 & 2033

- Table 13: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 15: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by Type 2020 & 2033

- Table 19: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by Chemistry 2020 & 2033

- Table 20: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by Chemistry 2020 & 2033

- Table 21: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 22: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 23: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by Type 2020 & 2033

- Table 27: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by Chemistry 2020 & 2033

- Table 28: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by Chemistry 2020 & 2033

- Table 29: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 30: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 31: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by Country 2020 & 2033

- Table 33: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by Type 2020 & 2033

- Table 34: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by Type 2020 & 2033

- Table 35: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by Chemistry 2020 & 2033

- Table 36: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by Chemistry 2020 & 2033

- Table 37: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 38: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 39: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by Country 2020 & 2033

- Table 41: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by Type 2020 & 2033

- Table 42: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by Type 2020 & 2033

- Table 43: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by Chemistry 2020 & 2033

- Table 44: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by Chemistry 2020 & 2033

- Table 45: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 46: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 47: Boiler Water Treatment Chemicals Market in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Boiler Water Treatment Chemicals Market in Europe Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Boiler Water Treatment Chemicals Market in Europe?

The projected CAGR is approximately 4.96%.

2. Which companies are prominent players in the Boiler Water Treatment Chemicals Market in Europe?

Key companies in the market include Aries Chemical Inc, Ecolab, Eastman Chemical Compnay, Kurita Water Industries Ltd, Buckman, BASF SE, Kemira, Solenis, Suez, Cannon Water Technology, Lenntech B V, Veolia Water Technologies*List Not Exhaustive.

3. What are the main segments of the Boiler Water Treatment Chemicals Market in Europe?

The market segments include Type, Chemistry, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.69 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand from Power Industry; Growing Popularity of the Blowdown Liquids; Other Drivers.

6. What are the notable trends driving market growth?

Power Generation To Dominate the Market.

7. Are there any restraints impacting market growth?

; Hazardous Nature of Hydrazine; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Boiler Water Treatment Chemicals Market in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Boiler Water Treatment Chemicals Market in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Boiler Water Treatment Chemicals Market in Europe?

To stay informed about further developments, trends, and reports in the Boiler Water Treatment Chemicals Market in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence