Key Insights

The Brazilian probiotics market is projected for substantial growth, driven by heightened consumer awareness of gut health and increasing demand for natural, functional foods. The market is estimated at $2.1 billion, with a projected Compound Annual Growth Rate (CAGR) of 9.88% from a base year of 2025 to 2033. This significant expansion within the food & beverage and dietary supplement sectors is fueled by rising disposable incomes, a focus on preventative healthcare, and a preference for natural remedies. The aging demographic and a growing understanding of the gut microbiome's impact on overall well-being further stimulate demand for probiotic-rich foods and beverages as convenient daily health solutions.

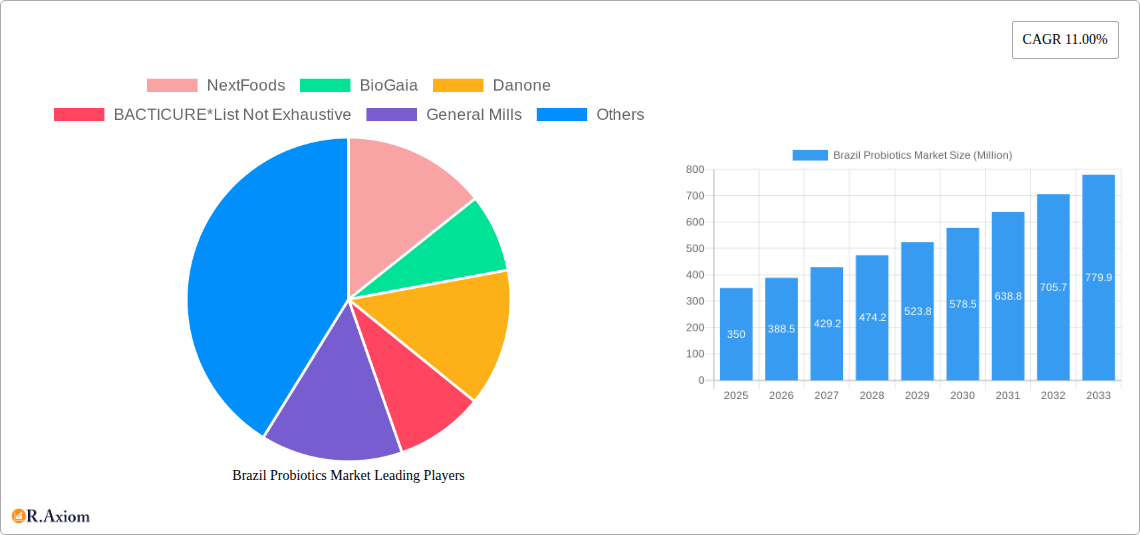

Brazil Probiotics Market Market Size (In Billion)

Key market segments include Probiotic Food, Probiotic Drinks, Dietary Supplements, and Animal Feed, with Probiotic Drinks and Dietary Supplements anticipated to exhibit the highest growth due to accessibility and specific health benefits. Supermarkets, hypermarkets, and pharmacies remain dominant distribution channels, complemented by the rapid expansion of online retail, offering consumers enhanced convenience and product selection. Leading companies such as Danone, Bio-K Plus International Inc, and Lallemand Inc are actively pursuing product innovation and market expansion. While the competitive landscape is dynamic with emerging players, potential challenges include the need for enhanced consumer education on probiotic efficacy and usage, alongside navigating regulatory frameworks for health claims.

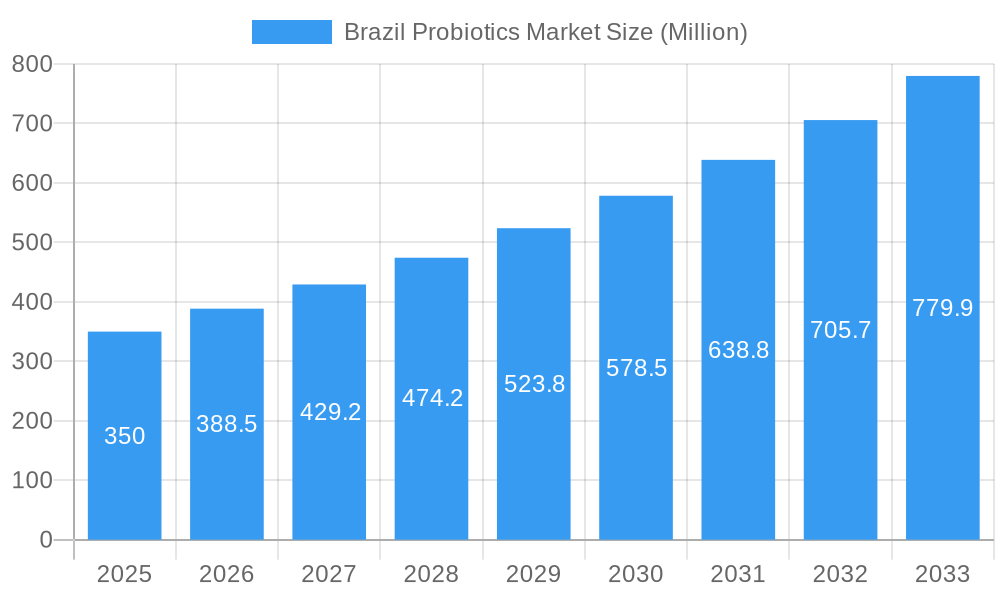

Brazil Probiotics Market Company Market Share

This comprehensive report offers an SEO-optimized overview of the Brazil Probiotics Market, detailing market size, growth trajectory, and future forecasts.

Brazil Probiotics Market Market Concentration & Innovation

The Brazil Probiotics Market exhibits a moderate concentration, with a few key players holding significant market share, estimated at XX% in 2025. Innovation is a critical driver, fueled by increasing consumer awareness of gut health and its link to overall well-being. Companies are investing heavily in R&D to develop novel probiotic strains with targeted health benefits, leading to product diversification. Regulatory frameworks, while evolving, are generally supportive of the functional food and supplement industries, though adherence to ANVISA guidelines is paramount for market entry. Product substitutes, such as prebiotics and synbiotics, offer alternative solutions but probiotics maintain a distinct advantage in direct microbial intervention. End-user trends indicate a growing demand for naturally derived probiotics, personalized nutrition, and convenient delivery formats. Merger and acquisition (M&A) activities, valued at approximately $XX Million in 2024, are strategically driven by larger corporations seeking to expand their product portfolios and market reach, acquiring smaller innovative companies to gain a competitive edge. The market share of leading players like Danone and BioGaia is estimated to be around XX% and XX% respectively in 2025.

Brazil Probiotics Market Industry Trends & Insights

The Brazil Probiotics Market is poised for significant expansion, driven by a confluence of factors that underscore its robust growth trajectory. An estimated Compound Annual Growth Rate (CAGR) of XX% is projected from 2025 to 2033, reflecting a dynamic and evolving landscape. Market penetration is steadily increasing, particularly within urban centers, as health consciousness permeates Brazilian society. Key growth drivers include an escalating consumer demand for natural and functional food products that offer tangible health benefits beyond basic nutrition. The growing prevalence of lifestyle-related health issues, such as digestive disorders and weakened immune systems, further propels the adoption of probiotics as a preventative and supportive health measure. Technological advancements in strain identification, fermentation processes, and encapsulation technologies are enabling the development of more stable, potent, and targeted probiotic formulations. This innovation allows manufacturers to cater to a wider spectrum of health needs, from gut health and immunity to mental well-being and even skin health. The competitive dynamics are characterized by a blend of established global players and emerging local brands, all vying for consumer attention through product differentiation, strategic marketing, and robust distribution networks. Online retail channels are emerging as a significant disruptor, offering consumers greater accessibility and convenience. Consumer preferences are shifting towards transparency, with a demand for clear labeling of probiotic strains, CFU counts, and scientifically backed health claims. Furthermore, the increasing adoption of probiotics in animal feed to enhance livestock health and productivity represents a substantial, albeit often overlooked, segment of the market. The overall market size for Brazil Probiotics is projected to reach $XX Million by 2033, up from an estimated $XX Million in 2025.

Dominant Markets & Segments in Brazil Probiotics Market

Within the Brazil Probiotics Market, several segments and distribution channels are exhibiting significant dominance.

Dominant Segments by Type:

- Dietary Supplements: This segment is a primary driver of market growth, accounting for an estimated XX% of the total market value in 2025. Its dominance is attributed to the increasing consumer proactive approach to health management and the widespread availability of diverse formulations targeting specific health concerns such as digestive health, immunity, and mood. The market size for dietary supplements is projected to reach $XX Million by 2033.

- Probiotic Drinks: Experiencing rapid expansion, probiotic drinks represent approximately XX% of the market in 2025 and are expected to witness robust growth. Their popularity stems from their convenience, palatability, and integration into daily routines, making them an attractive option for a health-conscious urban population. Key drivers include innovative product development by companies like Danone and NextFoods, offering refreshing and health-boosting beverages. The market size is estimated at $XX Million in 2025.

- Probiotic Food: While currently holding a smaller market share of around XX% in 2025, the probiotic food segment is poised for substantial growth. This includes yogurts, fermented dairy products, and other fortified food items. The increasing consumer preference for incorporating probiotics into their regular diet fuels this segment's expansion.

- Animal Feed: This segment, representing approximately XX% of the market in 2025, is crucial for livestock health and productivity. The demand for improved animal welfare and reduced antibiotic usage in agriculture drives investment in probiotic feed additives.

Dominant Distribution Channels:

- Supermarkets/Hypermarkets: This channel remains the largest contributor, estimated at XX% of the market share in 2025. Their widespread presence, accessibility, and ability to offer a broad range of products make them the primary point of purchase for many consumers seeking probiotics.

- Pharmacies and Drug Stores: With an estimated XX% market share in 2025, this channel is vital for reaching consumers seeking health-specific probiotic solutions and expert advice. The trust associated with pharmaceutical outlets bolsters sales of dietary supplements and specialized probiotic formulations.

- Online Retailers: Exhibiting the fastest growth rate, online retailers are projected to capture XX% of the market share by 2033. Their convenience, competitive pricing, and the ability to offer niche and imported products are significant factors driving their ascendancy. This channel is crucial for smaller brands and niche products to gain traction.

- Convenience Stores: These outlets, holding approximately XX% of the market share in 2025, cater to impulse purchases and consumers seeking immediate access to probiotic drinks and readily available supplement formats.

Brazil Probiotics Market Product Developments

Product development in the Brazil Probiotics Market is characterized by an intensified focus on strain specificity, enhanced bioavailability, and innovative delivery systems. Companies are actively researching and launching products containing clinically proven strains for targeted health benefits, such as improved digestion, immune support, and even mood enhancement. Applications are expanding beyond traditional dairy into fermented beverages, functional snacks, and specialized dietary supplements. Competitive advantages are being carved out through proprietary strain combinations, advanced encapsulation techniques for better survival in the gastrointestinal tract, and clear, science-backed health claims on packaging. The trend towards plant-based and allergen-free probiotic options is also a significant area of innovation.

Report Scope & Segmentation Analysis

This report offers a comprehensive analysis of the Brazil Probiotics Market, meticulously segmented to provide granular insights. The market is segmented by Type into Probiotic Food, Probiotic Drinks, Dietary Supplements, and Animal Feed. The Probiotic Food segment, valued at $XX Million in 2025, is characterized by a steady growth trend driven by fortified dairy and non-dairy products. The Probiotic Drinks segment, projected to reach $XX Million by 2033, is experiencing a surge in demand due to innovation in taste and convenience. The Dietary Supplements segment, estimated at $XX Million in 2025, is a dominant force, fueled by health-conscious consumers seeking targeted solutions and showing significant growth potential. The Animal Feed segment, valued at $XX Million in 2025, is integral to the agricultural sector, with consistent demand for improved animal health.

Further segmentation by Distribution Channel includes Supermarkets/Hypermarkets, Pharmacies and Drug Stores, Convenience Stores, and Online Retailers. The Supermarkets/Hypermarkets channel, with a market size of $XX Million in 2025, continues to be the largest retail outlet. Pharmacies and Drug Stores, representing $XX Million in 2025, play a crucial role in health-focused sales. Convenience Stores contribute $XX Million in 2025, serving immediate needs. Online Retailers are the fastest-growing channel, projected to reach $XX Million by 2033, offering expanding reach and accessibility.

Key Drivers of Brazil Probiotics Market Growth

The growth of the Brazil Probiotics Market is propelled by several key drivers.

- Rising Health Consciousness: An increasing awareness among Brazilians about the link between gut health and overall well-being is a primary catalyst.

- Demand for Natural and Functional Foods: Consumers are actively seeking food and beverage options that offer health benefits beyond basic nutrition, leading to a surge in demand for probiotic-fortified products.

- Technological Advancements: Innovations in probiotic strain research, fermentation, and delivery systems are leading to more effective and diverse product offerings.

- Supportive Regulatory Environment: Evolving regulations and approvals by bodies like ANVISA for probiotic claims are fostering market growth and consumer confidence.

- Growing E-commerce Penetration: The convenience and accessibility offered by online retail platforms are significantly expanding the reach of probiotic products.

Challenges in the Brazil Probiotics Market Sector

Despite robust growth, the Brazil Probiotics Market faces certain challenges.

- Consumer Education and Awareness Gaps: While awareness is rising, a segment of the population still lacks comprehensive understanding of probiotics and their specific benefits.

- Stringent Regulatory Approvals: Obtaining regulatory approval for novel probiotic strains and health claims can be a time-consuming and complex process.

- Supply Chain Complexities: Maintaining the viability and efficacy of live probiotic cultures throughout the supply chain, from manufacturing to consumption, presents logistical hurdles.

- High Product Development Costs: Research and development for new probiotic strains and formulations can be capital-intensive, impacting pricing and market accessibility.

- Competition from Substitute Products: The presence of prebiotics, synbiotics, and other health supplements necessitates continuous innovation and differentiation to maintain market share.

Emerging Opportunities in Brazil Probiotics Market

The Brazil Probiotics Market is ripe with emerging opportunities.

- Personalized Probiotic Solutions: The growing demand for tailored health approaches presents an opportunity for personalized probiotic formulations based on individual gut microbiomes and health goals.

- Expansion in Emerging Regions: Penetrating and expanding into less saturated regions within Brazil can unlock significant untapped market potential.

- Application in Specialized Health Niches: Developing probiotics for specific health conditions beyond general gut health, such as mental wellness, sports nutrition, and dermatological health, offers substantial growth avenues.

- Sustainable and Plant-Based Probiotics: The increasing consumer preference for sustainable and plant-based products opens doors for innovative vegan and eco-friendly probiotic offerings.

- Strategic Partnerships and Collaborations: Collaborating with research institutions and healthcare professionals can enhance credibility and drive further innovation and market adoption.

Leading Players in the Brazil Probiotics Market Market

- NextFoods

- BioGaia

- Danone

- BACTICURE

- General Mills

- Bio-K Plus International Inc

- Lallemand Inc

Key Developments in Brazil Probiotics Market Industry

- 2024: Danone launches a new line of probiotic-fortified yogurts targeting improved digestive health, expanding their presence in the probiotic food segment.

- 2023: BioGaia announces a strategic partnership with a Brazilian research institute to explore novel probiotic strains for immune system support.

- 2023: NextFoods introduces an innovative probiotic drink with exotic Brazilian fruit flavors, catering to evolving consumer taste preferences.

- 2022: BACTICURE expands its distribution network to include major online retail platforms, enhancing accessibility for its dietary supplements.

- 2021: Lallemand Inc. focuses on expanding its offerings in the animal feed probiotics sector, aiming to improve livestock health and reduce antibiotic reliance.

Strategic Outlook for Brazil Probiotics Market Market

The strategic outlook for the Brazil Probiotics Market is highly optimistic, driven by a convergence of increasing consumer health awareness, continuous innovation, and a growing appreciation for functional foods and supplements. The market is poised for sustained growth, fueled by the demand for personalized health solutions and the ongoing exploration of new probiotic applications. Companies that prioritize scientific validation, invest in targeted product development, and leverage the expanding online retail landscape will be best positioned to capitalize on future opportunities. Strategic partnerships, a focus on sustainable practices, and effective consumer education will be crucial for navigating the competitive environment and ensuring long-term market success. The market's trajectory suggests a strong future, with significant potential for expansion and deeper integration into the daily lives of Brazilian consumers.

Brazil Probiotics Market Segmentation

-

1. Type

- 1.1. Probiotic Food

- 1.2. Probiotic Drinks

- 1.3. Dietary Supplements

- 1.4. Animal Feed

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Pharmacies and Drug Stores

- 2.3. Convenience Stores

- 2.4. Online Retailers

- 2.5. Other Distribution Channels

Brazil Probiotics Market Segmentation By Geography

- 1. Brazil

Brazil Probiotics Market Regional Market Share

Geographic Coverage of Brazil Probiotics Market

Brazil Probiotics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.88% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Low Price and Easy Availability of Synthetic Phenethyl Alcohol

- 3.3. Market Restrains

- 3.3.1. Availability of Substitutes

- 3.4. Market Trends

- 3.4.1. Increased Demand For Probiotic Yogurt

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Probiotics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Probiotic Food

- 5.1.2. Probiotic Drinks

- 5.1.3. Dietary Supplements

- 5.1.4. Animal Feed

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Pharmacies and Drug Stores

- 5.2.3. Convenience Stores

- 5.2.4. Online Retailers

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NextFoods

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BioGaia

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Danone

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BACTICURE*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 General Mills

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bio-K Plus International Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Lallemand Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 NextFoods

List of Figures

- Figure 1: Brazil Probiotics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Brazil Probiotics Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Probiotics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Brazil Probiotics Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Brazil Probiotics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Brazil Probiotics Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Brazil Probiotics Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Brazil Probiotics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Probiotics Market?

The projected CAGR is approximately 9.88%.

2. Which companies are prominent players in the Brazil Probiotics Market?

Key companies in the market include NextFoods, BioGaia, Danone, BACTICURE*List Not Exhaustive, General Mills, Bio-K Plus International Inc, Lallemand Inc.

3. What are the main segments of the Brazil Probiotics Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Low Price and Easy Availability of Synthetic Phenethyl Alcohol.

6. What are the notable trends driving market growth?

Increased Demand For Probiotic Yogurt.

7. Are there any restraints impacting market growth?

Availability of Substitutes.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Probiotics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Probiotics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Probiotics Market?

To stay informed about further developments, trends, and reports in the Brazil Probiotics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence