Key Insights

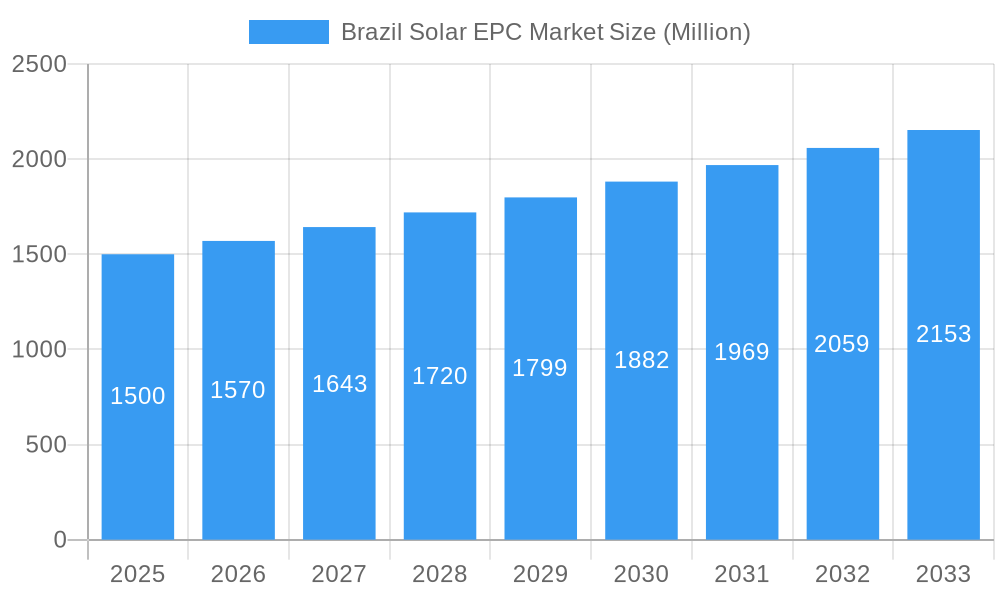

The Brazilian Solar Engineering, Procurement, and Construction (EPC) market is poised for significant expansion, with an estimated market size of $1.5 billion in 2025. This growth is fueled by a strong compound annual growth rate (CAGR) of 4.7% projected over the forecast period. Key drivers underpinning this surge include favorable government policies promoting renewable energy adoption, decreasing solar panel costs, and a growing demand for sustainable energy solutions across commercial, industrial, and residential sectors. Brazil’s vast geographical expanse and abundant solar resources present a compelling landscape for solar power development, making it an attractive destination for both domestic and international investors. The increasing emphasis on energy independence and environmental sustainability further bolsters the market's trajectory.

Brazil Solar EPC Market Market Size (In Billion)

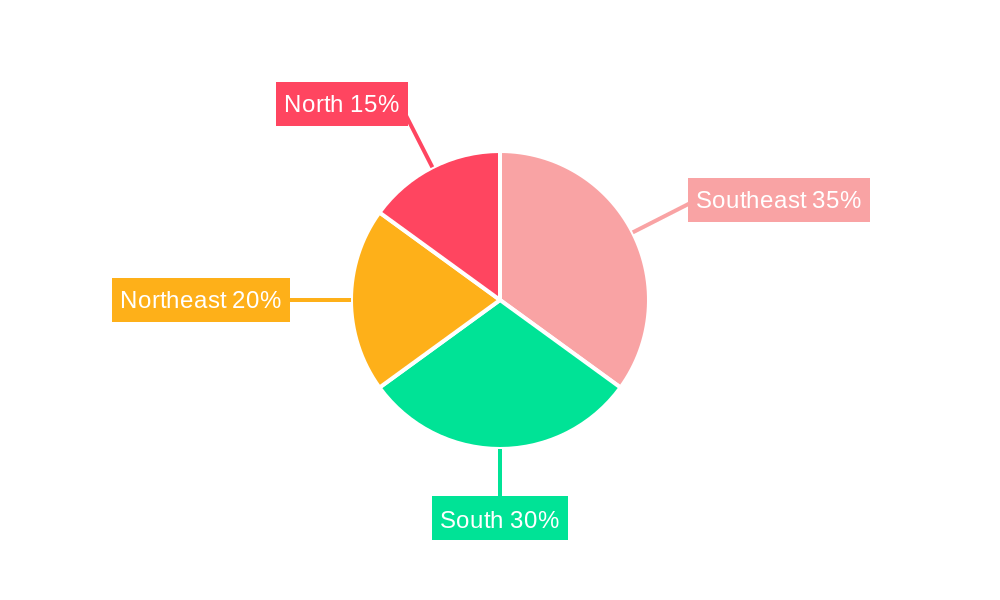

The market is characterized by a dynamic interplay of emerging trends and existing restraints. While the demand for solar energy is robust, the market also faces challenges such as grid integration complexities, the need for skilled labor, and fluctuating regulatory environments. Renewable energy is the dominant segment within the solar EPC market, encompassing photovoltaic (PV) and concentrated solar power (CSP) technologies. The end-user segments are diverse, with commercial and industrial sectors leading in adoption due to their substantial energy needs and corporate sustainability initiatives. Residential adoption is also on an upward trend as energy costs rise and awareness about solar benefits increases. Geographically, the Southeast and South regions are anticipated to lead in market share due to established infrastructure and higher economic activity, though the North and Northeast regions offer substantial untapped potential. Leading companies like Siemens Renewable Energy SA, Techint Engenharia e Construcao SA, and ENEL SpA are actively shaping the market through innovative solutions and project developments.

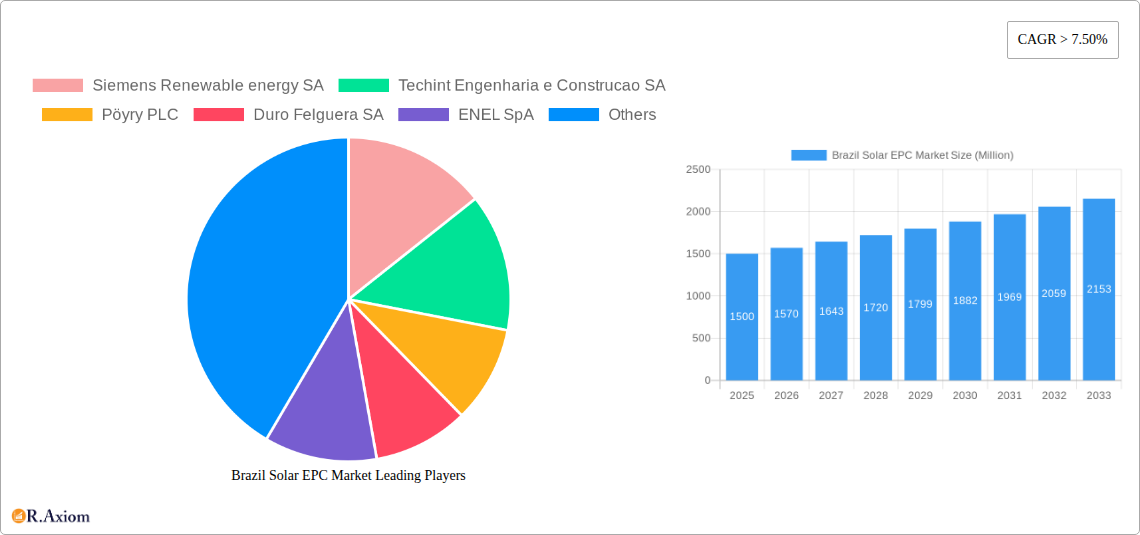

Brazil Solar EPC Market Company Market Share

This comprehensive report offers an in-depth analysis of the Brazil Solar EPC Market, providing critical insights for stakeholders seeking to navigate this dynamic sector. With a study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period of 2025–2033, this report delivers actionable intelligence on market dynamics, growth drivers, and competitive landscapes.

Brazil Solar EPC Market Market Concentration & Innovation

The Brazil Solar EPC Market exhibits a moderate level of concentration, with a few key players holding significant market share. Innovation in this sector is primarily driven by advancements in solar photovoltaic (PV) technology, including higher efficiency panels, advanced inverters, and energy storage solutions. Regulatory frameworks, such as government incentives for renewable energy adoption and evolving grid connection standards, play a crucial role in shaping market dynamics and fostering innovation. The increasing demand for sustainable energy solutions is a significant innovation driver, pushing EPC companies to develop more cost-effective and efficient solar installations. Product substitutes, while present in the form of other renewable energy sources and fossil fuels, are becoming less competitive due to falling solar costs and environmental concerns. End-user trends are shifting towards greater adoption of distributed generation and utility-scale solar projects. Mergers and acquisitions (M&A) activities have been observed, indicating a consolidation phase where larger players acquire smaller, specialized firms to enhance their capabilities and market reach. For instance, M&A deals in the past have ranged from tens of millions to over a billion dollars, reflecting strategic consolidations. The market share of leading companies is estimated to be between 5% and 15% individually, with the top 5-10 companies accounting for approximately 40-60% of the market.

Brazil Solar EPC Market Industry Trends & Insights

The Brazil Solar EPC Market is poised for substantial growth, projected to witness a Compound Annual Growth Rate (CAGR) of over 15% during the forecast period. This expansion is propelled by a confluence of factors, including supportive government policies aimed at increasing the share of renewable energy in the national energy matrix, a declining cost of solar technology, and an increasing awareness of environmental sustainability among businesses and consumers. The market penetration of solar energy, particularly in the utility-scale and distributed generation segments, is rapidly increasing. Technological disruptions, such as the advent of bifacial solar panels, perovskite solar cells, and advanced battery storage systems, are revolutionizing solar project efficiency and applicability. These innovations are not only enhancing the energy yield of solar installations but also improving their reliability and reducing their overall cost of ownership. Consumer preferences are increasingly leaning towards clean energy solutions, driven by both economic benefits of reduced electricity bills and a growing sense of corporate social responsibility. Industrial and commercial sectors are actively investing in solar power to hedge against rising electricity prices and achieve their sustainability targets. The residential segment, though historically smaller, is also experiencing a surge in adoption, facilitated by accessible financing options and simplified installation processes. Competitive dynamics within the market are intensifying, with both established international EPC players and emerging local companies vying for market share. This competition is leading to further price reductions and an emphasis on providing comprehensive service packages, including financing, installation, and ongoing maintenance. The market is characterized by a growing demand for integrated energy solutions, where solar power is combined with energy storage and smart grid technologies to optimize energy consumption and management.

Dominant Markets & Segments in Brazil Solar EPC Market

The Renewable energy segment, specifically solar photovoltaic (PV) technology, is unequivocally the dominant force within the Brazil Solar EPC Market. This dominance is underpinned by Brazil's abundant solar resources, particularly in regions with high solar irradiation.

- Region: Northeast stands out as the leading geographical segment. The Northeast boasts the highest solar irradiation levels in the country, making it an ideal location for large-scale solar power generation. Government incentives and the availability of vast tracts of land further bolster its prominence.

- End-user: Industrial segment is a major driver of growth. Large industrial consumers are increasingly adopting solar power to reduce operational costs, enhance energy independence, and meet their corporate sustainability goals. Favorable economic policies and the potential for significant cost savings make solar an attractive investment for this sector.

- Type: Renewable is the overarching dominant type. Within this, solar PV is leading the charge.

- Solar PV Applications: This includes both utility-scale solar farms and distributed generation systems for commercial and residential use. The decreasing cost of solar panels and inverters, coupled with advancements in energy storage, makes solar PV the most competitive renewable energy option.

- Key Drivers in the Northeast:

- High Solar Irradiance: Consistently high levels of sunlight throughout the year.

- Government Support: Tax incentives, financing schemes, and renewable energy auctions.

- Land Availability: Large, undeveloped areas suitable for utility-scale projects.

- Economic Viability: Falling solar technology costs make it competitive with traditional energy sources.

- Key Drivers in the Industrial Segment:

- Cost Reduction: Significant savings on electricity bills.

- Energy Security: Reduced reliance on volatile grid electricity prices.

- Sustainability Mandates: Corporate social responsibility and environmental, social, and governance (ESG) targets.

- Predictable Energy Costs: Long-term contracts for solar power provide cost stability.

While other segments like Thermal, Gas, Nuclear, and Other Types exist, their growth and impact within the EPC market are dwarfed by the meteoric rise of solar energy. The future trajectory of the Brazil Solar EPC Market is intrinsically linked to the continued expansion and innovation within the solar PV sector, further solidifying the dominance of Renewable energy.

Brazil Solar EPC Market Product Developments

Recent product developments in the Brazil Solar EPC Market are significantly enhancing the efficiency and applicability of solar energy solutions. Innovations include the increasing adoption of bifacial solar panels, which capture sunlight from both sides, leading to a 10-20% increase in energy yield. Advanced inverter technologies, such as string inverters with integrated monitoring and optimization capabilities, are improving performance and reducing operational costs. Furthermore, the integration of solar power with battery energy storage systems (BESS) is becoming more sophisticated, enabling grid stabilization, peak shaving, and enhanced energy independence for end-users. These developments offer competitive advantages by increasing the return on investment for solar projects and expanding their suitability to a wider range of applications and geographical locations.

Report Scope & Segmentation Analysis

This report segment covers the Brazil Solar EPC Market by Type, End-user, and Region.

- Type Segmentation: The market is analyzed across Thermal, Gas, Renewable, Nuclear, and Other Types. The Renewable segment, dominated by solar PV, is projected to experience the highest growth.

- End-user Segmentation: This includes Commercial, Industrial, and Residential sectors. The Industrial and Commercial segments are expected to lead in terms of installed capacity and EPC investments due to their significant energy consumption and sustainability initiatives.

- Region Segmentation: The analysis spans the Southeast, South, Northeast, and North regions of Brazil. The Northeast and Southeast regions are anticipated to witness the most robust growth due to favorable solar irradiation, supportive policies, and established industrial bases.

Key Drivers of Brazil Solar EPC Market Growth

The Brazil Solar EPC Market is primarily propelled by several key drivers. Firstly, supportive government policies, including renewable energy auctions, tax incentives, and favorable financing schemes, are creating a conducive environment for solar project development. Secondly, the consistent decline in the cost of solar photovoltaic (PV) technology, from panels to inverters and balance of system components, has made solar energy increasingly cost-competitive with traditional energy sources. Thirdly, Brazil's abundant solar resource, particularly in the Northeast region, offers significant potential for large-scale solar power generation. Finally, a growing awareness of climate change and a desire for energy independence are driving both corporate and residential consumers to invest in clean energy solutions.

Challenges in the Brazil Solar EPC Market Sector

Despite robust growth, the Brazil Solar EPC Market faces several challenges. Regulatory hurdles, including complex permitting processes, grid connection delays, and potential changes in policy frameworks, can hinder project timelines and increase costs. Supply chain issues, such as the availability and cost of imported components, can also impact project feasibility and profitability. Furthermore, intense competition among EPC providers is driving down margins, requiring companies to optimize their operational efficiencies and explore value-added services. The financial aspect, including access to affordable project financing and currency fluctuations, can also pose challenges for large-scale solar developments.

Emerging Opportunities in Brazil Solar EPC Market

Emerging opportunities in the Brazil Solar EPC Market are primarily centered around technological advancements and evolving market demands. The growing demand for integrated energy solutions, combining solar PV with battery energy storage systems (BESS), presents a significant opportunity for EPC companies to offer more comprehensive and resilient power solutions. The expansion of distributed generation, particularly in the commercial and residential sectors, fueled by favorable net metering policies, is another key area for growth. Furthermore, the development of smart grid technologies and the increasing adoption of electric vehicles (EVs) create synergistic opportunities for solar EPC providers to integrate charging infrastructure with renewable energy generation. Exploring new geographical markets within Brazil and offering innovative financing models can also unlock further growth potential.

Leading Players in the Brazil Solar EPC Market Market

- Siemens Renewable energy SA

- Techint Engenharia e Construcao SA

- Pöyry PLC

- Duro Felguera SA

- ENEL SpA

- Canadian Solar Inc

- Omexom Belo Horizonte

- General Electric Company

- Fluor Daniel Brasil Ltda

Key Developments in Brazil Solar EPC Market Industry

- 2023: Several major solar auctions concluded, awarding significant capacity for utility-scale solar projects.

- 2023: Increased investment in battery energy storage systems (BESS) integrated with solar farms.

- 2024: New government initiatives announced to accelerate renewable energy deployment and streamline permitting processes.

- 2024: Growing trend of commercial and industrial companies investing in behind-the-meter solar installations to reduce energy costs.

- 2024: Expansion of distributed generation incentives, driving uptake in residential and small commercial sectors.

Strategic Outlook for Brazil Solar EPC Market Market

The strategic outlook for the Brazil Solar EPC Market remains exceptionally positive. Continued government support, coupled with the inherent economic advantages of solar energy, will fuel sustained growth. The market will likely see further consolidation as established players acquire smaller firms to expand their service offerings and geographical reach. Innovation in energy storage and smart grid integration will be crucial for EPC companies to offer comprehensive, high-value solutions. Focus on operational efficiency, project financing optimization, and strong supply chain management will be key to maintaining profitability in a competitive landscape. The increasing demand for sustainable energy solutions from all sectors positions Brazil as a prime market for solar EPC services in the coming years.

Brazil Solar EPC Market Segmentation

-

1. Type

- 1.1. Thermal

- 1.2. Gas

- 1.3. Renewable

- 1.4. Nuclear

- 1.5. Other Types

-

2. End-user

- 2.1. Commercial

- 2.2. Industrial

- 2.3. Residential

-

3. Region

- 3.1. Southeast

- 3.2. South

- 3.3. Northeast

- 3.4. North

Brazil Solar EPC Market Segmentation By Geography

- 1. Brazil

Brazil Solar EPC Market Regional Market Share

Geographic Coverage of Brazil Solar EPC Market

Brazil Solar EPC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Industrial Operations

- 3.3. Market Restrains

- 3.3.1. 4.; Advancement in Technology such as Photovoltic (PV)Cell

- 3.4. Market Trends

- 3.4.1. Renewable Energy to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Solar EPC Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Thermal

- 5.1.2. Gas

- 5.1.3. Renewable

- 5.1.4. Nuclear

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Commercial

- 5.2.2. Industrial

- 5.2.3. Residential

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Southeast

- 5.3.2. South

- 5.3.3. Northeast

- 5.3.4. North

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Siemens Renewable energy SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Techint Engenharia e Construcao SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pöyry PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Duro Felguera SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ENEL SpA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Canadian Solar Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Omexom Belo Horizonte

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 General Electric Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Fluor Daniel Brasil Ltda

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Siemens Renewable energy SA

List of Figures

- Figure 1: Brazil Solar EPC Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Brazil Solar EPC Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Solar EPC Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Brazil Solar EPC Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 3: Brazil Solar EPC Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Brazil Solar EPC Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Brazil Solar EPC Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Brazil Solar EPC Market Revenue undefined Forecast, by End-user 2020 & 2033

- Table 7: Brazil Solar EPC Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Brazil Solar EPC Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Solar EPC Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the Brazil Solar EPC Market?

Key companies in the market include Siemens Renewable energy SA, Techint Engenharia e Construcao SA, Pöyry PLC, Duro Felguera SA, ENEL SpA, Canadian Solar Inc, Omexom Belo Horizonte, General Electric Company, Fluor Daniel Brasil Ltda.

3. What are the main segments of the Brazil Solar EPC Market?

The market segments include Type, End-user, Region.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Industrial Operations.

6. What are the notable trends driving market growth?

Renewable Energy to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Advancement in Technology such as Photovoltic (PV)Cell.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Solar EPC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Solar EPC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Solar EPC Market?

To stay informed about further developments, trends, and reports in the Brazil Solar EPC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence