Key Insights

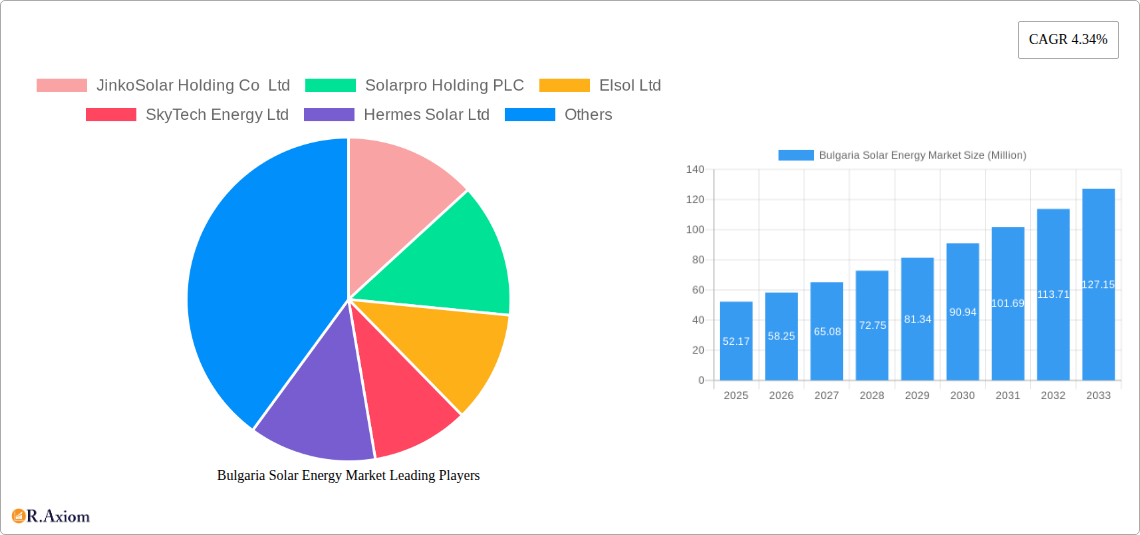

The Bulgarian solar energy market is poised for significant expansion, projected to reach $52.17 million by 2025, driven by a robust 11.67% CAGR. This growth is underpinned by a confluence of favorable government policies, increasing investor confidence, and a strong societal push towards renewable energy adoption. Key drivers include supportive feed-in tariffs and net-metering schemes that enhance the economic viability of solar installations for both commercial and residential users. Furthermore, the declining costs of solar photovoltaic (PV) technology, coupled with advancements in energy storage solutions, are making solar power an increasingly attractive and accessible alternative to traditional energy sources. The market's trajectory is also influenced by Bulgaria's commitment to meeting EU climate targets, which necessitates a substantial increase in renewable energy generation capacity. This creates a fertile ground for innovation and investment in solar infrastructure.

Bulgaria Solar Energy Market Market Size (In Million)

The market's expansion is further fueled by a growing awareness of energy independence and security, particularly in light of global energy market volatilities. Solarpro Holding PLC, JinkoSolar Holding Co Ltd, and other key players are actively investing in expanding their operational presence and product offerings within Bulgaria. The segment analysis reveals a balanced growth across production, consumption, import, and export, indicating a well-rounded development of the domestic solar ecosystem. While the energy market in Bulgaria is dynamic, the established growth patterns and proactive policy environment suggest that the predicted $52.17 million market size in 2025, with a 11.67% CAGR, is a realistic and achievable target. Continued investment in grid infrastructure and the integration of smart technologies will be crucial for sustaining this upward momentum.

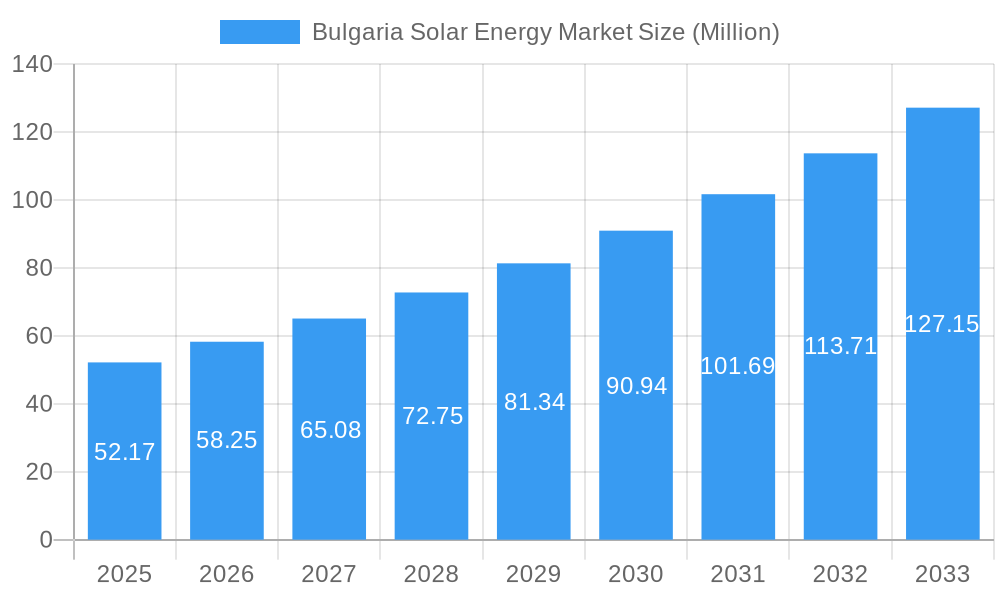

Bulgaria Solar Energy Market Company Market Share

This in-depth market research report provides a granular analysis of the Bulgaria Solar Energy Market, covering the historical period of 2019–2024, base and estimated year of 2025, and a comprehensive forecast period extending to 2033. The report offers invaluable insights for industry stakeholders, investors, and policymakers seeking to understand the dynamics, trends, and future trajectory of Bulgaria's rapidly expanding solar energy sector. Leveraging high-traffic keywords such as "Bulgaria solar power," "renewable energy Bulgaria," "solar panel installation Bulgaria," "photovoltaic market Bulgaria," and "energy transition Bulgaria," this report is meticulously structured to maximize search visibility and engagement.

This report focuses on key aspects including Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis. We delve into the competitive landscape, identifying leading players and examining critical industry developments.

Bulgaria Solar Energy Market Market Concentration & Innovation

The Bulgaria Solar Energy Market exhibits a moderate level of market concentration, with a few prominent players dominating key segments, while a growing number of smaller companies contribute to innovation and competition. Major companies such as Solarpro Holding PLC and JinkoSolar Holding Co Ltd hold significant market share, particularly in utility-scale projects and panel supply, respectively. Innovation drivers are multifaceted, encompassing advancements in solar panel efficiency, energy storage solutions, and smart grid integration. The regulatory framework in Bulgaria, including feed-in tariffs and net-metering policies, plays a crucial role in shaping investment decisions and fostering innovation. Product substitutes, while limited in direct competition with solar energy's core function, include other renewable sources and energy efficiency technologies. End-user trends indicate a growing demand for distributed generation, particularly from commercial and industrial sectors, driven by cost savings and sustainability goals. Mergers and acquisitions (M&A) activities are gradually increasing, as larger entities seek to consolidate their presence and smaller innovators look for strategic partnerships. For instance, recent M&A deals in the Balkan region, impacting Bulgarian market entry, have been valued in the tens of millions of Euros, signaling growing investor confidence. The market share of the top three players is estimated to be around 60% in utility-scale installations.

Bulgaria Solar Energy Market Industry Trends & Insights

The Bulgaria Solar Energy Market is poised for substantial growth, driven by a confluence of favorable trends and supportive policies. The market is projected to experience a Compound Annual Growth Rate (CAGR) of approximately 15% over the forecast period. This robust expansion is primarily fueled by Bulgaria's commitment to renewable energy targets, aligning with European Union directives and the broader global energy transition. Technological advancements in photovoltaic (PV) technology, leading to higher efficiency and lower manufacturing costs, are making solar energy increasingly competitive against conventional energy sources. Consumer preferences are shifting towards sustainable energy solutions, with both residential and commercial sectors actively seeking to reduce their carbon footprint and electricity bills. The market penetration of solar energy, currently at around 10% of the total electricity generation capacity, is expected to climb significantly. Government incentives, such as investment grants and tax exemptions, are crucial in driving both utility-scale and distributed generation projects. The competitive landscape is characterized by a mix of local developers and international manufacturers, each vying for market share through innovative solutions and competitive pricing. The integration of energy storage systems is becoming a key trend, addressing the intermittency of solar power and enhancing grid stability. Furthermore, digitalization and the adoption of smart technologies are revolutionizing solar energy management, leading to greater operational efficiency and enhanced grid integration. The increasing adoption of electric vehicles and the electrification of other sectors will further augment the demand for clean energy, providing a significant tailwind for the solar market.

Dominant Markets & Segments in Bulgaria Solar Energy Market

The Bulgaria Solar Energy Market showcases dominance across several key segments, driven by a combination of economic policies, infrastructure development, and strategic investments.

Production Analysis:

- Dominant Driver: Government incentives and EU funding programs are the primary drivers for increased domestic solar component manufacturing and assembly, aiming to meet a projected production capacity of 1,500 million watts by 2028.

- Key Segments: The production of solar panels and inverters are the most prominent sub-segments, with localized manufacturing efforts supported by international technology transfers.

Consumption Analysis:

- Dominant Driver: The commercial and industrial (C&I) sector leads consumption, driven by the pursuit of cost savings and corporate sustainability goals. This segment is projected to account for over 60% of total solar energy consumption.

- Key Segments: Rooftop solar installations for self-consumption and grid-connected solar farms for wholesale electricity supply represent the dominant consumption patterns. Projected consumption is expected to reach 1,200 million kilowatt-hours by 2027.

Import Market Analysis (Value & Volume):

- Dominant Driver: The need for advanced solar modules and specialized components, not yet manufactured domestically at scale, drives imports. The import market value is estimated at over 250 million Euros in 2025, with a projected volume of 1,000 million watts.

- Key Segments: High-efficiency solar panels (monocrystalline and polycrystalline) and advanced inverters constitute the majority of imported products.

Export Market Analysis (Value & Volume):

- Dominant Driver: While still nascent, Bulgaria's export market is driven by the country's strategic location and emerging expertise in solar project development. Exports of solar-powered equipment and project development services are anticipated to reach 50 million Euros by 2030, with a volume of 150 million watts.

- Key Segments: Smaller-scale solar installations for neighboring Balkan countries and specialized solar components are the primary export categories.

Price Trend Analysis:

- Dominant Driver: Global supply chain dynamics, raw material costs (e.g., polysilicon), and technological advancements in manufacturing significantly influence solar panel prices. The average price per watt is projected to decline by approximately 5% annually.

- Key Segments: The price of utility-scale solar farm components is more sensitive to bulk purchasing and economies of scale compared to residential rooftop systems. The projected average price for solar panels in 2025 is around 0.20 Euros per watt.

Bulgaria Solar Energy Market Product Developments

Product developments in the Bulgaria Solar Energy Market are characterized by a focus on enhancing efficiency, reducing costs, and improving integration capabilities. Innovations in bifacial solar panels, which capture sunlight from both sides, are gaining traction, offering increased energy yields. Advancements in inverter technology are leading to smarter, more responsive systems capable of better grid integration and energy management. The development of more robust and cost-effective energy storage solutions, including lithium-ion battery technologies, is crucial for addressing the intermittency of solar power. These product developments provide competitive advantages by enabling higher energy generation per unit area, lower overall system costs, and improved reliability, making solar energy a more attractive and viable option for a wider range of applications.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the Bulgaria Solar Energy Market. The Production Analysis examines the manufacturing capacity and output of solar components within Bulgaria, with projections for growth in areas like panel assembly and inverter production. The Consumption Analysis delves into the demand side, segmenting the market by end-user (residential, commercial, industrial, utility-scale) and application (electricity generation, self-consumption). The Import Market Analysis quantifies the value and volume of solar products entering Bulgaria, identifying key suppliers and product types. Conversely, the Export Market Analysis assesses the potential and current performance of Bulgarian solar products and services entering international markets. Finally, the Price Trend Analysis dissects the pricing dynamics of solar panels, inverters, and installation costs, forecasting future price movements. Each segment is analyzed with market sizes and projected growth rates, highlighting competitive dynamics and the impact of regulatory policies.

Key Drivers of Bulgaria Solar Energy Market Growth

The growth of the Bulgaria Solar Energy Market is propelled by a combination of significant drivers. Favorable government policies and incentives, including feed-in tariffs, net metering, and investment subsidies, are instrumental in encouraging solar project development. Bulgaria's ambitious renewable energy targets, aligned with EU directives, create a sustained demand for solar power capacity. Decreasing solar technology costs, particularly for photovoltaic panels and inverters, have made solar energy increasingly economically viable and competitive with traditional energy sources. Growing environmental awareness and corporate sustainability initiatives are driving demand from commercial and industrial sectors seeking to reduce their carbon footprint. Furthermore, advancements in energy storage solutions are addressing the intermittency challenge, enhancing the reliability and attractiveness of solar power.

Challenges in the Bulgaria Solar Energy Market Sector

Despite its growth potential, the Bulgaria Solar Energy Market faces several challenges. Regulatory uncertainties and bureaucratic hurdles can slow down project approvals and implementation. Grid integration limitations and the need for significant infrastructure upgrades to accommodate the increasing influx of solar power pose a technical challenge. Supply chain disruptions and fluctuating raw material costs can impact the affordability and availability of solar components. Competition from established fossil fuel industries and potential shifts in energy policy also represent a competitive pressure. Limited access to financing for smaller-scale projects can hinder widespread adoption.

Emerging Opportunities in Bulgaria Solar Energy Market

The Bulgaria Solar Energy Market presents numerous emerging opportunities. The expansion of distributed generation and rooftop solar installations for residential and commercial consumers offers significant growth potential. The development of agrivoltaics, integrating solar power generation with agricultural activities, presents a unique opportunity for land optimization. Emerging technologies in energy storage and smart grid solutions are creating new market niches and enhancing the value proposition of solar energy. Furthermore, the potential for regional collaboration and export of solar project development expertise to neighboring countries is a promising avenue for growth. The increasing demand for green hydrogen production powered by solar energy also opens up new, large-scale opportunities.

Leading Players in the Bulgaria Solar Energy Market Market

- JinkoSolar Holding Co Ltd

- Solarpro Holding PLC

- Elsol Ltd

- SkyTech Energy Ltd

- Hermes Solar Ltd

- NEMCOM Energy Company

- Green Yellow

Key Developments in Bulgaria Solar Energy Market Industry

- 2023: Government announces new tender rounds for renewable energy capacity, including solar farms, to meet national targets.

- 2023 (Q3): Solarpro Holding PLC completes construction of a significant utility-scale solar park, contributing 100 million watts to the national grid.

- 2024 (Q1): JinkoSolar Holding Co Ltd expands its distribution network in Bulgaria, aiming to increase market share for its high-efficiency solar panels.

- 2024 (Q2): Elsol Ltd reports a 20% increase in residential solar installation inquiries, driven by rising energy prices and government incentives.

- 2024 (Q3): New regulations are introduced to streamline permitting processes for distributed solar generation, aiming to accelerate adoption.

- 2025 (Forecast): Expected significant growth in energy storage integration with solar PV systems, driven by demand for grid stability.

Strategic Outlook for Bulgaria Solar Energy Market Market

The strategic outlook for the Bulgaria Solar Energy Market is highly positive, driven by strong governmental support, declining technology costs, and increasing environmental consciousness. The market is expected to witness sustained expansion, characterized by a shift towards more sophisticated solar solutions, including integrated storage and smart grid technologies. Opportunities lie in leveraging EU funding for large-scale projects, fostering domestic manufacturing capabilities, and promoting distributed generation. Strategic focus on innovation, cost competitiveness, and reliable project execution will be crucial for players to capitalize on the burgeoning demand for clean and sustainable energy in Bulgaria. The integration of solar energy into a diversified renewable energy mix will pave the way for a more resilient and decarbonized energy future for the country.

Bulgaria Solar Energy Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Bulgaria Solar Energy Market Segmentation By Geography

- 1. Bulgaria

Bulgaria Solar Energy Market Regional Market Share

Geographic Coverage of Bulgaria Solar Energy Market

Bulgaria Solar Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Demand for Solar Photovoltaic Installations4.; Growing Investments

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Wind Energy Installations

- 3.4. Market Trends

- 3.4.1. Nuclear Power Expected to Restrain the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Bulgaria Solar Energy Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Bulgaria

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 JinkoSolar Holding Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Solarpro Holding PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Elsol Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SkyTech Energy Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hermes Solar Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NEMCOM Energy Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Green Yellow

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 JinkoSolar Holding Co Ltd

List of Figures

- Figure 1: Bulgaria Solar Energy Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Bulgaria Solar Energy Market Share (%) by Company 2025

List of Tables

- Table 1: Bulgaria Solar Energy Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Bulgaria Solar Energy Market Volume gigawatt Forecast, by Production Analysis 2020 & 2033

- Table 3: Bulgaria Solar Energy Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 4: Bulgaria Solar Energy Market Volume gigawatt Forecast, by Consumption Analysis 2020 & 2033

- Table 5: Bulgaria Solar Energy Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: Bulgaria Solar Energy Market Volume gigawatt Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: Bulgaria Solar Energy Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: Bulgaria Solar Energy Market Volume gigawatt Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: Bulgaria Solar Energy Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: Bulgaria Solar Energy Market Volume gigawatt Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: Bulgaria Solar Energy Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 12: Bulgaria Solar Energy Market Volume gigawatt Forecast, by Region 2020 & 2033

- Table 13: Bulgaria Solar Energy Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 14: Bulgaria Solar Energy Market Volume gigawatt Forecast, by Production Analysis 2020 & 2033

- Table 15: Bulgaria Solar Energy Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 16: Bulgaria Solar Energy Market Volume gigawatt Forecast, by Consumption Analysis 2020 & 2033

- Table 17: Bulgaria Solar Energy Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: Bulgaria Solar Energy Market Volume gigawatt Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Bulgaria Solar Energy Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Bulgaria Solar Energy Market Volume gigawatt Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: Bulgaria Solar Energy Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: Bulgaria Solar Energy Market Volume gigawatt Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: Bulgaria Solar Energy Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Bulgaria Solar Energy Market Volume gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bulgaria Solar Energy Market?

The projected CAGR is approximately 11.67%.

2. Which companies are prominent players in the Bulgaria Solar Energy Market?

Key companies in the market include JinkoSolar Holding Co Ltd, Solarpro Holding PLC, Elsol Ltd, SkyTech Energy Ltd, Hermes Solar Ltd, NEMCOM Energy Company, Green Yellow.

3. What are the main segments of the Bulgaria Solar Energy Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Demand for Solar Photovoltaic Installations4.; Growing Investments.

6. What are the notable trends driving market growth?

Nuclear Power Expected to Restrain the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Wind Energy Installations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bulgaria Solar Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bulgaria Solar Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bulgaria Solar Energy Market?

To stay informed about further developments, trends, and reports in the Bulgaria Solar Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence