Key Insights

The Canadian automotive parts zinc die casting market is experiencing robust growth, driven by the increasing demand for lightweight and durable automotive components. The market's Compound Annual Growth Rate (CAGR) exceeding 2.50% since 2019 reflects a sustained upward trajectory, fueled by the automotive industry's ongoing shift towards fuel efficiency and emission reduction. This trend necessitates the use of lightweight materials like zinc, leading to increased adoption of zinc die casting in various automotive applications. Key segments within the market include pressure die casting and vacuum die casting processes, catering to the production of engine parts, transmission components, and body parts. Major players such as Ashok Minda Group, Sandhar Technologies Ltd, and others are strategically investing in advanced technologies and expanding their production capacities to meet the growing demand. The market is further segmented geographically, with Eastern, Western, and Central Canada each contributing to the overall growth. While precise market sizing data for 2025 is unavailable, based on the provided CAGR and the general growth trend in the automotive industry, a reasonable estimation would place the market value in the tens of millions of Canadian dollars.

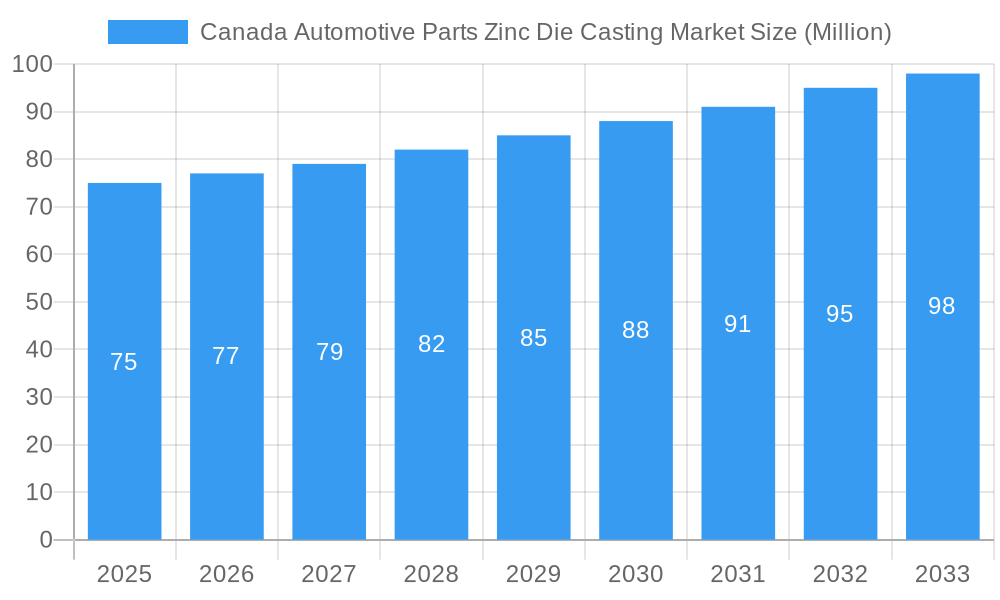

Canada Automotive Parts Zinc Die Casting Market Market Size (In Million)

The continued expansion of the Canadian automotive industry and government initiatives promoting sustainable transportation are significant factors bolstering market growth. However, challenges remain, including fluctuations in raw material prices and potential supply chain disruptions. The increasing adoption of electric vehicles (EVs) presents both opportunities and challenges; while EVs require lighter components, potentially increasing zinc die casting demand, the production processes may need adaptation to meet the unique requirements of EV components. Over the forecast period (2025-2033), the market is expected to maintain its growth momentum, primarily driven by sustained demand for lightweight and high-performance automotive parts and the ongoing expansion of the Canadian automotive manufacturing sector. Competition among existing players is expected to remain intense, with companies focusing on product innovation, process optimization, and strategic partnerships to secure market share.

Canada Automotive Parts Zinc Die Casting Market Company Market Share

Canada Automotive Parts Zinc Die Casting Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Canada Automotive Parts Zinc Die Casting Market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The report leverages rigorous data analysis and expert insights to present a clear picture of market trends, growth drivers, challenges, and opportunities. Key players such as Ashok Minda Group, Sandhar Technologies Ltd, Empire Casting Co, Pace Industries, Carteret Die Casting Corp, Ridco Zinc Die Casting Company, Brillcast Manufacturing LLC, Cascade Die Casting Group Inc, Northwest Die Casting Company, and Dynacast are profiled, providing crucial competitive intelligence.

Canada Automotive Parts Zinc Die Casting Market Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory landscape, substitute products, end-user trends, and mergers and acquisitions (M&A) activity within the Canadian automotive parts zinc die casting market. The market is moderately concentrated, with the top five players holding an estimated xx% market share in 2025. Innovation is driven by the need for lighter, stronger, and more cost-effective components, fueled by advancements in die casting technologies like high-pressure die casting and vacuum die casting. Stringent regulatory frameworks concerning emissions and safety standards influence the industry, prompting the adoption of innovative materials and manufacturing processes. The rise of lightweight materials poses a threat to zinc die casting, but ongoing innovations in surface treatments and alloy compositions mitigate this. End-user preferences for enhanced fuel efficiency and vehicle aesthetics drive demand for high-precision die-cast parts. M&A activity has been moderate, with deal values averaging xx Million annually over the past five years, primarily focused on expanding geographic reach and technological capabilities. This section will include a detailed breakdown of market share by key players and an analysis of recent M&A trends.

Canada Automotive Parts Zinc Die Casting Market Industry Trends & Insights

This section explores the key trends shaping the Canada Automotive Parts Zinc Die Casting Market. The market is expected to experience a CAGR of xx% during the forecast period (2025-2033), driven by the growth of the automotive industry, increasing demand for lightweight vehicles, and technological advancements in die casting processes. Technological disruptions such as automation and digitalization are improving efficiency and precision in manufacturing. Consumer preferences for fuel-efficient and aesthetically pleasing vehicles drive demand for intricate and lightweight die-cast components. Competitive dynamics are characterized by intense competition among established players and the emergence of new entrants offering specialized die casting solutions. Market penetration of advanced die casting technologies is steadily increasing, particularly in the production of engine and transmission components. The rising adoption of electric vehicles (EVs) presents both opportunities and challenges, with the need for specialized die casting solutions for EV components while facing potential reduced overall demand compared to the internal combustion engine market.

Dominant Markets & Segments in Canada Automotive Parts Zinc Die Casting Market

This section identifies the dominant segments within the Canadian automotive parts zinc die casting market.

Dominant Production Process Type: Pressure die casting remains the dominant production process type, holding approximately xx% of the market share in 2025 due to its high production speed and cost-effectiveness. Vacuum die casting, although a smaller segment, is experiencing growth due to its ability to produce high-quality parts with intricate details.

Dominant Application Type: Engine parts constitute the largest application segment, accounting for xx% of the market in 2025. This is driven by the high demand for engine components in both gasoline and diesel vehicles. Transmission components are also a significant segment, followed by body parts. The growth of each segment is influenced by various factors.

- Engine Parts: Driven by increasing vehicle production and stringent emission regulations.

- Transmission Components: Fueled by advancements in automatic transmission technology and the growing popularity of SUVs and light trucks.

- Body Parts: Demand influenced by aesthetic trends and the increasing use of lightweight materials.

The Ontario region is expected to be the dominant market within Canada, benefiting from established automotive manufacturing clusters and supportive government policies.

Canada Automotive Parts Zinc Die Casting Market Product Developments

Recent product innovations focus on developing zinc alloys with enhanced mechanical properties, corrosion resistance, and surface finishes. New applications are emerging in areas like electric vehicle components, requiring specialized die casting solutions for battery housings and other parts. Competitive advantages are gained through technological leadership, superior quality control, and efficient manufacturing processes. Technological trends are towards automation, digitalization, and the integration of advanced simulation tools in the design and manufacturing process. This aligns perfectly with the market’s demand for higher precision, cost efficiency, and faster turnaround times.

Report Scope & Segmentation Analysis

The report segments the Canada Automotive Parts Zinc Die Casting Market based on production process type (Pressure Die Casting, Vacuum Die Casting, Others) and application type (Engine Parts, Transmission Components, Body Parts, Others). Pressure die casting is expected to grow at a CAGR of xx% during the forecast period, driven by its cost-effectiveness and high production rate. Vacuum die casting, although a smaller segment, is projected to experience faster growth due to the demand for higher-quality and more intricate parts. In terms of application, Engine Parts will maintain its dominance due to its large share of the total market, while other segments, like Body Parts and Transmission Components will display moderate growth according to the demand.

Key Drivers of Canada Automotive Parts Zinc Die Casting Market Growth

The growth of the Canadian automotive parts zinc die casting market is primarily driven by factors such as increasing automotive production, the demand for lightweight vehicles to enhance fuel efficiency, and the adoption of advanced die casting technologies. Government initiatives promoting domestic manufacturing and investments in automotive R&D also contribute significantly. The rising adoption of electric vehicles (EVs), while initially posing challenges, offers opportunities with the need for new die casting solutions for components in EV powertrains.

Challenges in the Canada Automotive Parts Zinc Die Casting Market Sector

Challenges include intense competition among established and new market entrants, fluctuations in raw material prices (zinc), environmental regulations regarding emissions from die casting processes, and potential supply chain disruptions. These factors can impact production costs and profitability, necessitating strategic adjustments for market players. The rising adoption of alternative materials also presents a challenge for the industry.

Emerging Opportunities in Canada Automotive Parts Zinc Die Casting Market

Emerging opportunities include the increasing demand for lightweight components in electric vehicles, advancements in die casting technologies offering improved precision and surface finish, and the expansion into new applications within the automotive industry and beyond (e.g., consumer electronics). The growing adoption of automation and digital manufacturing processes also presents a significant opportunity for enhancing efficiency and reducing costs.

Leading Players in the Canada Automotive Parts Zinc Die Casting Market Market

- Ashok Minda Group

- Sandhar Technologies Ltd

- Empire Casting Co

- Pace Industries

- Carteret Die Casting Corp

- Ridco Zinc Die Casting Company

- Brillcast Manufacturing LLC

- Cascade Die Casting Group Inc

- Northwest Die Casting Company

- Dynacast

Key Developments in Canada Automotive Parts Zinc Die Casting Market Industry

- 2022 Q4: Dynacast announced a new investment in automation technologies.

- 2023 Q1: Ashok Minda Group acquired a smaller die casting company. (Further details would be added based on actual data)

- 2024 Q2: New environmental regulations were introduced impacting die casting processes. (Further details would be added based on actual data)

(Further data on key developments will be included in the final report)

Strategic Outlook for Canada Automotive Parts Zinc Die Casting Market Market

The future of the Canadian automotive parts zinc die casting market appears promising, driven by sustained growth in the automotive industry, the increasing demand for lightweight vehicles, and continuous advancements in die casting technologies. Strategic opportunities lie in embracing automation, focusing on developing specialized solutions for electric vehicles, and expanding into new applications beyond the automotive sector. The market is expected to experience continued growth, albeit with challenges related to competition, raw material costs, and environmental regulations. Proactive adaptation and innovation will be key for success in this dynamic market.

Canada Automotive Parts Zinc Die Casting Market Segmentation

-

1. Production Process Type

- 1.1. Pressure Die Casting

- 1.2. Vacuum Die Casting

- 1.3. Others

-

2. Application Type

- 2.1. Engine Parts

- 2.2. Transmission Components

- 2.3. Body Parts

- 2.4. Others

Canada Automotive Parts Zinc Die Casting Market Segmentation By Geography

- 1. Canada

Canada Automotive Parts Zinc Die Casting Market Regional Market Share

Geographic Coverage of Canada Automotive Parts Zinc Die Casting Market

Canada Automotive Parts Zinc Die Casting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing EV Sales is Driving the Market Growth

- 3.3. Market Restrains

- 3.3.1. Lack of Proper Charging Infrastructure is a Chgallenge

- 3.4. Market Trends

- 3.4.1. Rising Demand for Vacuum Die Casting and Enactment of Stringent Emission Regulations

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Automotive Parts Zinc Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Pressure Die Casting

- 5.1.2. Vacuum Die Casting

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Engine Parts

- 5.2.2. Transmission Components

- 5.2.3. Body Parts

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ashok Minda Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sandhar Technologies Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Empire Casting Co

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Pace Industries

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Carteret Die Casting Corp

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ridco Zinc Die Casting Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Brillcast Manufacturing LLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cascade Die Casting Group Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Northwest Die Casting Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dynacast

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ashok Minda Group

List of Figures

- Figure 1: Canada Automotive Parts Zinc Die Casting Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Canada Automotive Parts Zinc Die Casting Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Automotive Parts Zinc Die Casting Market Revenue undefined Forecast, by Production Process Type 2020 & 2033

- Table 2: Canada Automotive Parts Zinc Die Casting Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 3: Canada Automotive Parts Zinc Die Casting Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Canada Automotive Parts Zinc Die Casting Market Revenue undefined Forecast, by Production Process Type 2020 & 2033

- Table 5: Canada Automotive Parts Zinc Die Casting Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 6: Canada Automotive Parts Zinc Die Casting Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Automotive Parts Zinc Die Casting Market?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the Canada Automotive Parts Zinc Die Casting Market?

Key companies in the market include Ashok Minda Group, Sandhar Technologies Ltd, Empire Casting Co, Pace Industries, Carteret Die Casting Corp, Ridco Zinc Die Casting Company, Brillcast Manufacturing LLC, Cascade Die Casting Group Inc, Northwest Die Casting Company, Dynacast.

3. What are the main segments of the Canada Automotive Parts Zinc Die Casting Market?

The market segments include Production Process Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing EV Sales is Driving the Market Growth.

6. What are the notable trends driving market growth?

Rising Demand for Vacuum Die Casting and Enactment of Stringent Emission Regulations.

7. Are there any restraints impacting market growth?

Lack of Proper Charging Infrastructure is a Chgallenge.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Automotive Parts Zinc Die Casting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Automotive Parts Zinc Die Casting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Automotive Parts Zinc Die Casting Market?

To stay informed about further developments, trends, and reports in the Canada Automotive Parts Zinc Die Casting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence