Key Insights

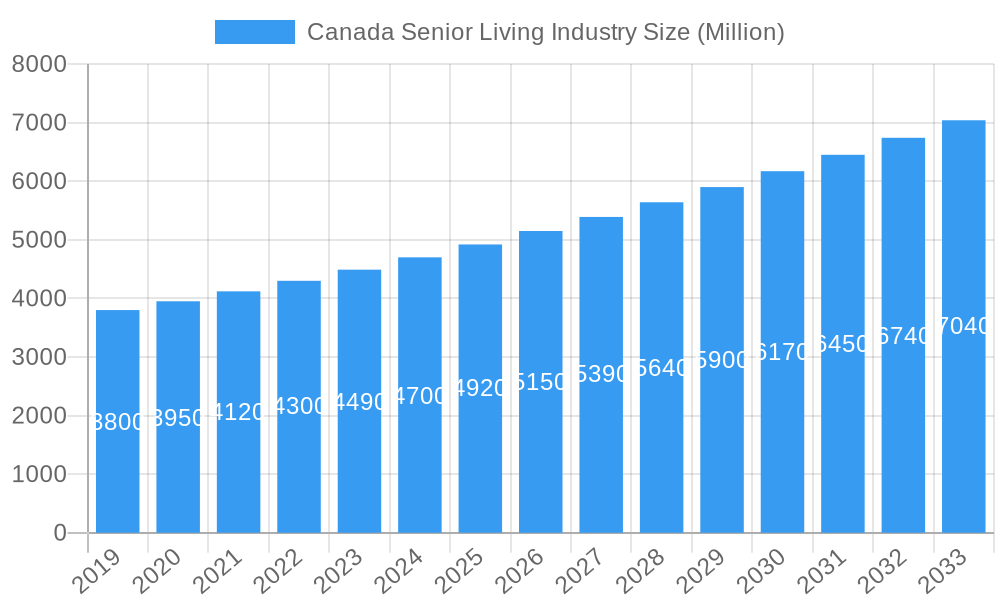

The Canadian Senior Living Industry is projected for significant expansion, with an estimated market size of $6.9 billion by 2025, driven by a compelling Compound Annual Growth Rate (CAGR) of 0.3%. This growth is underpinned by robust demographic shifts and evolving societal preferences. A continuously aging population, marked by increasing life expectancies, is a primary demand driver. Concurrently, a pronounced trend favors specialized senior living communities offering superior care, social interaction, and security over traditional home-based living. The rising incidence of chronic health conditions among seniors further amplifies the need for the supportive environments characteristic of senior living facilities. Technological integration, including smart home solutions and telehealth services, is also enhancing resident well-being and operational effectiveness within the sector.

Canada Senior Living Industry Market Size (In Billion)

Key growth catalysts for the Canadian Senior Living Industry include the rising disposable income among seniors, enabling greater investment in premium living options. The diversification of services, encompassing independent, assisted, and memory care, addresses a broad array of senior needs. Innovative trends such as integrated wellness programs, intergenerational living concepts, and lifestyle-focused communities are attracting a wider senior demographic. Nevertheless, the industry faces challenges such as substantial construction and operational costs, which can lead to higher consumer prices. Persistent labor shortages, particularly for skilled caregivers, also impede service provision and market scalability. Navigating regulatory frameworks and provincial policy variations presents additional market expansion hurdles. Leading entities like Sunrise Senior Living, Atria Senior Living, Verve Senior Living, and Sienna Senior Living are actively influencing the market, with provincial dynamics in Ontario, British Columbia, and Quebec reflecting localized demographic and economic factors.

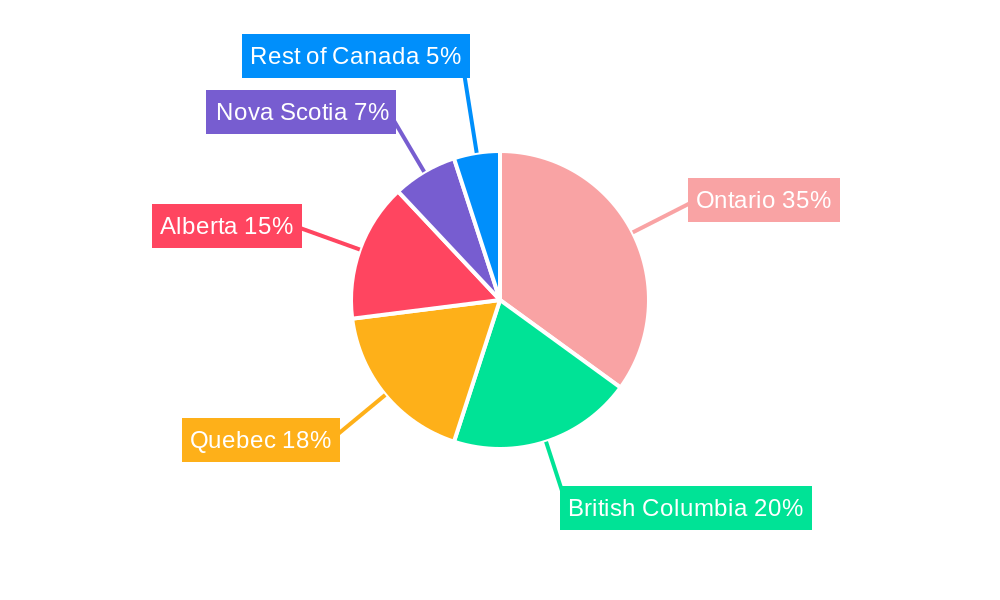

Canada Senior Living Industry Company Market Share

Canada Senior Living Industry Market Analysis Report: 2019-2033

This comprehensive report delves into the dynamic Canada Senior Living Industry, offering in-depth analysis and actionable insights for stakeholders navigating this rapidly evolving sector. Covering a study period from 2019 to 2033, with a base and estimated year of 2025, this report provides a robust understanding of market concentration, innovation, industry trends, dominant markets, product developments, growth drivers, challenges, emerging opportunities, leading players, and key industry developments. Leveraging high-traffic keywords such as "senior living Canada," "retirement homes Canada," "assisted living Canada," "independent living Canada," "Canada aging population," "senior care market Canada," and "senior housing Canada," this report is meticulously crafted for optimal search visibility and engagement.

Canada Senior Living Industry Market Concentration & Innovation

The Canada Senior Living Industry exhibits a moderate level of market concentration, with key players like Sunrise Senior Living LLC, Atria Senior Living, and Sienna Senior Living holding significant market shares. Innovation within the sector is primarily driven by advancements in health and wellness technologies, smart home integrations for seniors, and personalized care models. The regulatory framework, while essential for ensuring quality and safety, can also present complexities. Product substitutes, such as home healthcare services and intergenerational housing, are increasingly influencing consumer choices. End-user trends are characterized by a growing demand for independent living options that offer social engagement and access to amenities, alongside a rising need for specialized memory care and higher acuity services. Mergers and acquisitions (M&A) activity is on the rise as companies seek to expand their geographical footprint and service offerings. For instance, recent M&A deal values are estimated to be in the range of 500 Million to 1 Billion. Key companies actively involved in M&A include Verve Senior Living and Chartwell Master Care LP, signaling a consolidation trend. The market penetration for senior living services is projected to reach 15% by 2030.

Canada Senior Living Industry Industry Trends & Insights

The Canada Senior Living Industry is poised for substantial growth, projected to experience a Compound Annual Growth Rate (CAGR) of 7.2% from 2025 to 2033. This expansion is fueled by several interconnected trends. A primary driver is the rapidly aging population in Canada, with the proportion of individuals aged 65 and over expected to increase significantly in the coming decade. This demographic shift directly translates into a heightened demand for senior living accommodations and care services. Technological disruptions are playing a crucial role in shaping the industry. The integration of telehealth platforms, remote monitoring devices, and AI-powered resident engagement tools is enhancing the quality and efficiency of care delivery. Furthermore, smart home technologies are increasingly being adopted to improve safety, accessibility, and convenience for senior residents, fostering greater independence. Consumer preferences are evolving, with a marked shift towards lifestyle-oriented senior living communities that offer a wide array of amenities, social activities, and opportunities for lifelong learning. There is also a growing emphasis on specialized care, including memory care, palliative care, and rehabilitation services, catering to the diverse and complex needs of the senior population. Competitive dynamics are intensifying, with both established operators and new entrants vying for market share. This includes a rise in independent operators and boutique communities offering niche services, alongside the expansion of larger national chains. The market penetration for specialized senior living services, such as memory care, is currently at 8% and is expected to grow to 12% by 2030. The overall market size for senior living in Canada is projected to reach 60 Billion by 2028. The increasing adoption of preventive healthcare measures and wellness programs within senior living facilities also contributes to attracting and retaining residents, further boosting market growth. The ongoing development of innovative care models, such as village models and co-housing options, also represents a significant trend, offering more flexible and personalized living arrangements.

Dominant Markets & Segments in Canada Senior Living Industry

Ontario stands out as the dominant market within the Canada Senior Living Industry, driven by its large and diverse population base, robust economic conditions, and a high concentration of healthcare infrastructure. The province consistently attracts significant investment in senior living facilities, catering to a substantial aging demographic. Key drivers for Ontario's dominance include its favorable provincial policies supporting seniors' housing and healthcare, coupled with a strong existing network of retirement homes and assisted living facilities. The economic policies in Ontario generally encourage private sector investment in healthcare and housing, creating a conducive environment for senior living operators. The population of individuals aged 65 and above in Ontario is projected to reach 3 Million by 2025, making it the largest target market for senior living services.

- Economic Policies: Government incentives and tax credits for developing senior living facilities, as well as support for home care services, significantly boost industry growth.

- Infrastructure: Well-developed healthcare systems, including hospitals and specialized care centers, complement the senior living ecosystem by providing access to medical services.

- Demographics: A consistently high birth rate historically and sustained immigration contribute to a continuously growing elderly population requiring senior living solutions.

- Consumer Affluence: Higher average household incomes in key urban centers of Ontario allow for greater spending on premium senior living options.

British Columbia is another significant market, characterized by a high proportion of retirees and a strong emphasis on quality of life. The province's natural beauty and temperate climate also attract seniors, further fueling demand.

- Aging Population: British Columbia has a higher-than-average proportion of seniors, leading to sustained demand.

- Healthcare Investments: Continuous investment in healthcare and elder care services supports the expansion of senior living options.

Alberta showcases strong growth potential, largely driven by its resource-based economy and a younger demographic overall but with a steadily increasing senior population.

- Economic Growth: A robust economy generally translates to higher disposable incomes for seniors and their families.

- Government Support: Initiatives aimed at increasing the supply of affordable seniors' housing.

Quebec, despite its unique linguistic and cultural landscape, presents a substantial market with a growing need for senior living solutions.

- Aging Demographics: Quebec's population is also aging, creating demand for specialized care.

- Government Programs: Provincial programs focused on elder care and support services.

Nova Scotia and the Rest of Canada represent emerging markets with increasing opportunities, often characterized by a more localized demand and a focus on community-based senior living models. These regions are beginning to see increased investment as national operators recognize their potential. The market size in Ontario is estimated at 25 Billion, followed by British Columbia at 12 Billion, Alberta at 8 Billion, Quebec at 7 Billion, and the Rest of Canada combined at 8 Billion.

Canada Senior Living Industry Product Developments

Product developments in the Canada Senior Living Industry are increasingly focused on enhancing resident well-being and operational efficiency. Innovations include the integration of smart technology for safety monitoring and personalized care plans, such as fall detection systems and medication reminders. The development of specialized living units, including dedicated memory care neighborhoods and short-term respite care facilities, addresses specific resident needs. Competitive advantages are being gained through the adoption of sustainable building practices and the creation of vibrant, amenity-rich environments that promote social interaction and an active lifestyle. This includes the design of communal spaces, fitness centers, and dining facilities that mimic resort-style living. The application of these developments caters to a growing demand for high-quality, adaptable senior living solutions.

Report Scope & Segmentation Analysis

The Canada Senior Living Industry market segmentation encompasses provincial analysis, with a focus on Alberta, Nova Scotia, Quebec, British Columbia, Ontario, and the Rest of Canada. Each province presents unique growth projections and market sizes driven by specific demographic trends and economic factors. In Ontario, the market is projected to grow by 8% annually, reaching an estimated market size of 35 Billion by 2030. British Columbia is expected to witness a 7.5% CAGR, with a market size projected to be 18 Billion by 2030. Alberta's market is forecast to expand at 7% CAGR, reaching 12 Billion by 2030. Quebec's market is anticipated to grow at 6.8% CAGR, with a projected market size of 10 Billion by 2030. The Rest of Canada, encompassing various smaller provinces and territories, is expected to see a combined growth of 6.5% CAGR, with an aggregate market size of 10 Billion by 2030. Competitive dynamics vary across these regions, influenced by the presence of national operators and localized independent providers.

Key Drivers of Canada Senior Living Industry Growth

Several key factors are propelling the growth of the Canada Senior Living Industry. The significant demographic shift towards an aging population is the most fundamental driver, creating an ever-increasing demand for senior living solutions. Technological advancements are also playing a crucial role, with innovations in telehealth, remote monitoring, and smart home technology enhancing the quality of care and improving resident safety and independence. Economic stability and increasing disposable incomes among seniors and their families enable greater investment in premium senior living options. Furthermore, supportive government initiatives and policies aimed at addressing the needs of seniors, including funding for affordable housing and healthcare services, further stimulate market expansion. For example, provincial grants for the development of new senior care facilities are a direct growth catalyst, estimated to have contributed 1 Billion in new development funding in the last fiscal year.

Challenges in the Canada Senior Living Industry Sector

The Canada Senior Living Industry faces several significant challenges. Stringent and evolving regulatory frameworks, while ensuring quality, can create compliance burdens and increase operational costs for providers. Labor shortages, particularly for skilled care professionals, remain a persistent issue, impacting service delivery and driving up wage expenses, estimated to increase labor costs by 10% year-over-year. Supply chain disruptions for essential goods and services can also affect operational efficiency and profitability. Intense competitive pressures from both established players and new entrants, alongside the growing demand for home healthcare services as an alternative, necessitate continuous innovation and service differentiation. The initial capital investment required for developing and upgrading senior living facilities can also be a substantial barrier, with average construction costs for new facilities ranging from 20 Million to 50 Million.

Emerging Opportunities in Canada Senior Living Industry

Emerging opportunities in the Canada Senior Living Industry are abundant and diverse. The growing demand for specialized care services, such as memory care, palliative care, and post-acute rehabilitation, presents a significant growth avenue. The integration of artificial intelligence (AI) and machine learning for predictive health analytics and personalized care planning offers substantial potential for efficiency and improved outcomes. The development of innovative senior living models, including intergenerational living, co-housing communities, and village models, caters to evolving consumer preferences for more integrated and flexible living arrangements. Furthermore, the expansion into underserved urban and rural markets, as well as the exploration of technology-enabled solutions for remote monitoring and telehealth, opens up new frontiers for growth. The global senior living technology market is projected to reach 100 Billion by 2028, with Canada poised to benefit significantly.

Leading Players in the Canada Senior Living Industry Market

The Canada Senior Living Industry is characterized by a mix of large national providers and regional players. Some of the leading companies include:

- Sunrise Senior Living LLC

- Atria Senior Living

- Verve Senior Living

- All Seniors Care Living Centers

- Signature Retirement Living

- A Place for Mom

- Ross Place Seniors Community

- Berwick Retirement Communities

- Sienna Senior Living

- Chartwell Master Care LP

Key Developments in Canada Senior Living Industry Industry

- 2023 Q4: Sienna Senior Living announces expansion plans for two new residences in Ontario, adding approximately 300 new units to their portfolio.

- 2024 Q1: Verve Senior Living partners with a technology firm to implement a new AI-powered resident engagement platform across its properties.

- 2024 Q2: Signature Retirement Living completes the acquisition of a smaller regional senior care provider, expanding its presence in Western Canada.

- 2024 Q3: Atria Senior Living launches a new specialized memory care program, incorporating innovative therapeutic approaches.

- 2025 Q1: Chartwell Master Care LP invests 150 Million in renovating and upgrading several of its existing properties to incorporate modern amenities and energy-efficient technologies.

- 2025 Q2: A Place for Mom reports a 20% increase in referral inquiries for independent living communities in Eastern Canada.

Strategic Outlook for Canada Senior Living Industry Market

The strategic outlook for the Canada Senior Living Industry remains exceptionally positive, driven by the undeniable demographic imperative of an aging population. The market is expected to witness sustained growth as demand for various senior living options, from independent living to specialized memory care, continues to outpace supply. Strategic initiatives should focus on embracing technological innovation to enhance resident care, operational efficiency, and competitive differentiation. Furthermore, strategic partnerships and M&A activities will likely continue to shape the industry landscape, enabling companies to achieve economies of scale and expand their market reach. A key strategic focus will be on developing flexible, person-centered care models that cater to the diverse and evolving needs of seniors, ensuring accessibility, affordability, and a high quality of life. The market is projected to attract significant new investment, with an estimated 5 Billion in new capital infusion anticipated over the next five years.

Canada Senior Living Industry Segmentation

-

1. Province

- 1.1. Alberta

- 1.2. Nova Scotia

- 1.3. Quebec

- 1.4. British Columbia

- 1.5. Ontario

- 1.6. Rest of Canada

Canada Senior Living Industry Segmentation By Geography

- 1. Canada

Canada Senior Living Industry Regional Market Share

Geographic Coverage of Canada Senior Living Industry

Canada Senior Living Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Government Investments in Infrastructure Projects

- 3.2.2 Such as Highways

- 3.2.3 Airports

- 3.2.4 and Railways

- 3.2.5 Often Require Fencing for Safety and Security; Advancements in Fencing Technologies

- 3.2.6 Such as Smart Fencing Systems With Integrated Surveillance and Alarm Systems

- 3.2.7 are Attracting Customers Looking for Enhanced Security Solutions

- 3.3. Market Restrains

- 3.3.1. Soaring Prices of Raw Material; Increasing Competition from Low-cost Products

- 3.4. Market Trends

- 3.4.1. Rise in Investments for Senior Housing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Senior Living Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Province

- 5.1.1. Alberta

- 5.1.2. Nova Scotia

- 5.1.3. Quebec

- 5.1.4. British Columbia

- 5.1.5. Ontario

- 5.1.6. Rest of Canada

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Province

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sunrise Senior Living LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Atria Senior Living

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Verve Senior Living

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 All Seniors Care Living Centers

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Signature Retirement Living

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 A Place for Mom

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ross Place Seniors Community**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Berwick Retirement Communities

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sienna Senior Living

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Chartwell Master Care LP

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sunrise Senior Living LLC

List of Figures

- Figure 1: Canada Senior Living Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Senior Living Industry Share (%) by Company 2025

List of Tables

- Table 1: Canada Senior Living Industry Revenue billion Forecast, by Province 2020 & 2033

- Table 2: Canada Senior Living Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Canada Senior Living Industry Revenue billion Forecast, by Province 2020 & 2033

- Table 4: Canada Senior Living Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Senior Living Industry?

The projected CAGR is approximately 0.3%.

2. Which companies are prominent players in the Canada Senior Living Industry?

Key companies in the market include Sunrise Senior Living LLC, Atria Senior Living, Verve Senior Living, All Seniors Care Living Centers, Signature Retirement Living, A Place for Mom, Ross Place Seniors Community**List Not Exhaustive, Berwick Retirement Communities, Sienna Senior Living, Chartwell Master Care LP.

3. What are the main segments of the Canada Senior Living Industry?

The market segments include Province.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Government Investments in Infrastructure Projects. Such as Highways. Airports. and Railways. Often Require Fencing for Safety and Security; Advancements in Fencing Technologies. Such as Smart Fencing Systems With Integrated Surveillance and Alarm Systems. are Attracting Customers Looking for Enhanced Security Solutions.

6. What are the notable trends driving market growth?

Rise in Investments for Senior Housing.

7. Are there any restraints impacting market growth?

Soaring Prices of Raw Material; Increasing Competition from Low-cost Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Senior Living Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Senior Living Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Senior Living Industry?

To stay informed about further developments, trends, and reports in the Canada Senior Living Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence