Key Insights

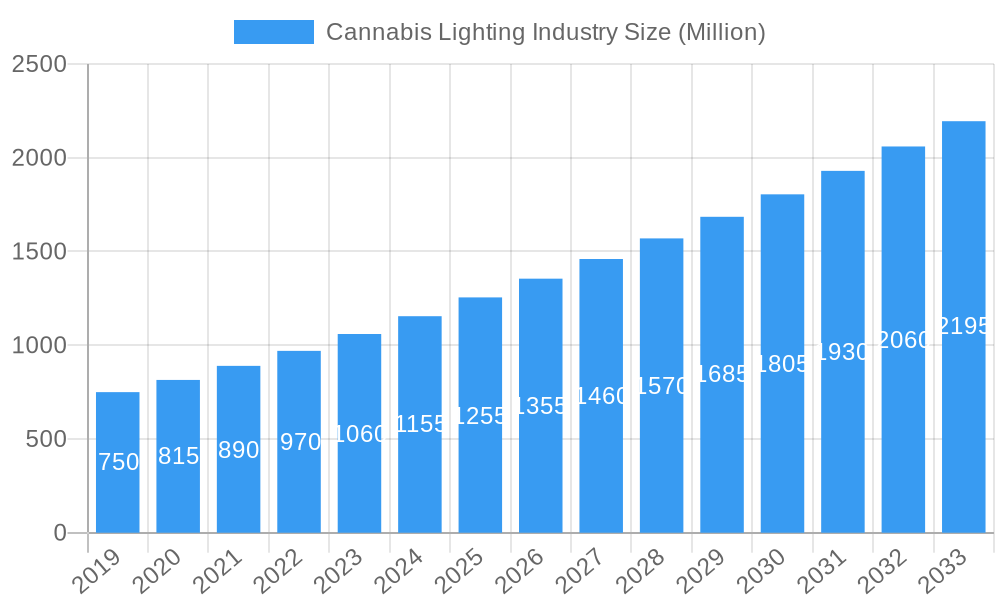

The Global Cannabis Lighting market is poised for substantial growth, projected to reach $5.15 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 25.6% through 2033. This expansion is propelled by increasing cannabis legalization globally for both medical and recreational use. As cultivation operations expand, the demand for advanced, energy-efficient lighting solutions intensifies. Key growth drivers include the pursuit of optimized plant growth, enhanced yields, and superior cannabinoid and terpene profiles, all critically dependent on light quality and spectrum. Technological innovation, particularly the widespread adoption of Light Emitting Diodes (LEDs), is transforming the sector. LEDs offer significant advantages in energy efficiency, longevity, and spectrum control over traditional lighting, making them the industry standard for modern cannabis cultivation. The shift from older technologies such as T5 High Output Fluorescent Lights and Ceramic Metal Halide Lights to LEDs is a dominant trend.

Cannabis Lighting Industry Market Size (In Billion)

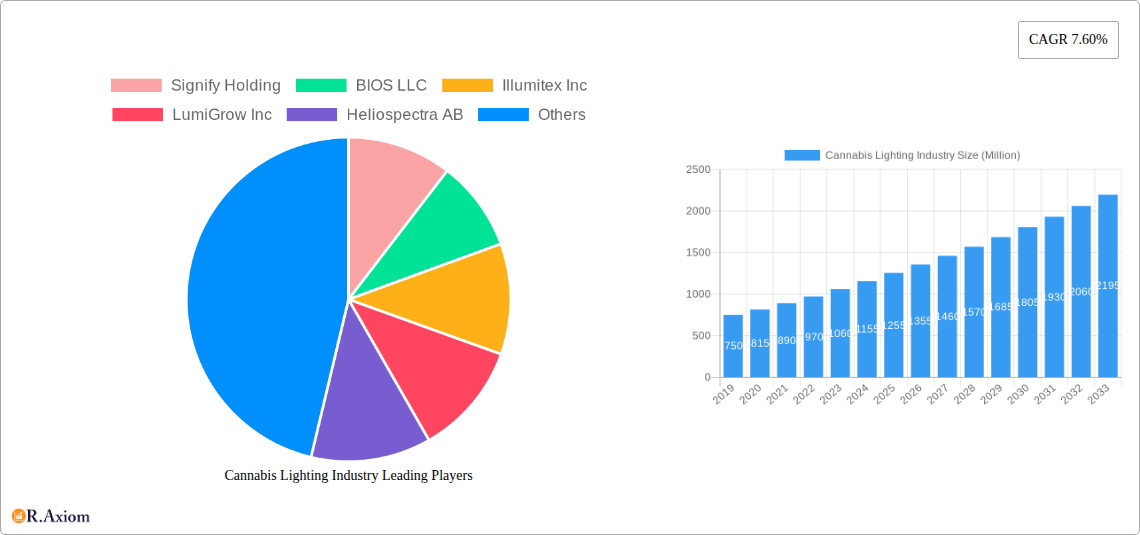

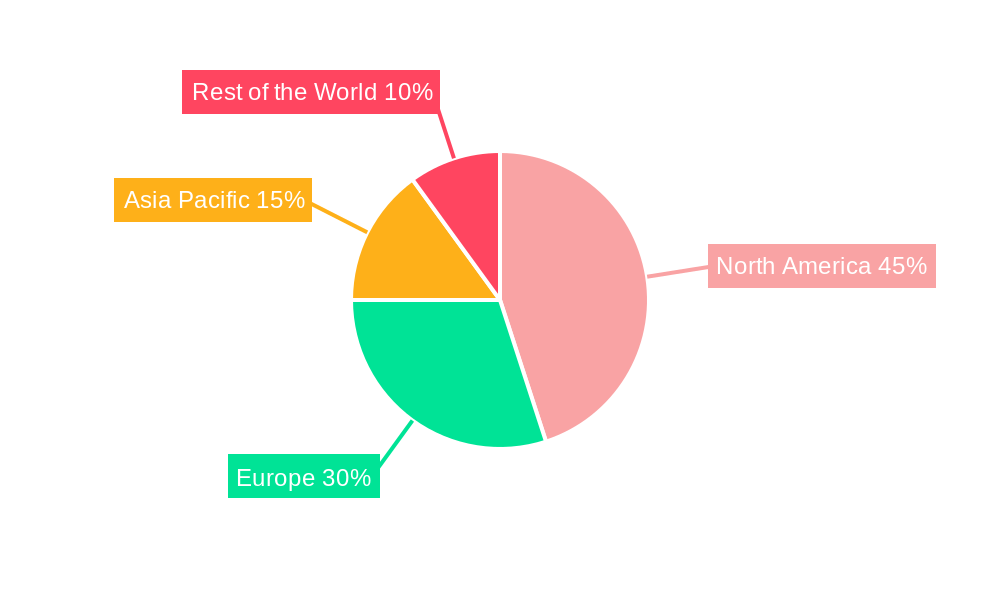

The market's growth is further supported by a deepening scientific understanding of horticultural lighting. Vertical farming and indoor cultivation, which heavily rely on artificial lighting, are gaining prominence due to land constraints and the need for controlled environments, thereby increasing demand for specialized cannabis lighting. Potential market restraints include the initial investment costs for sophisticated LED systems and the requirement for skilled personnel to manage complex lighting installations. However, the long-term benefits of reduced energy consumption and increased crop yields typically offset these upfront expenses. Geographically, North America leads the market, fueled by its established cannabis industry, followed by Europe, which is rapidly expanding its cultivation capacity. The Asia Pacific region also presents considerable growth opportunities as cannabis regulations evolve. Leading companies such as Signify Holding, BIOS LLC, and LumiGrow Inc. are pioneering innovations to address the dynamic needs of the cannabis cultivation industry.

Cannabis Lighting Industry Company Market Share

This SEO-optimized report offers a comprehensive overview of the Cannabis Lighting Industry, including market size, growth projections, and key trends, designed for immediate application.

Cannabis Lighting Industry Market Concentration & Innovation

The global Cannabis Lighting Industry is characterized by a dynamic market concentration, with key players like Signify Holding, BIOS LLC, Illumitex Inc, LumiGrow Inc, Heliospectra AB, Cultilux, OSRAM Licht AG, Gavita Holland BV, General Electric Company, Vivosun, and Sun System* holding significant influence. Innovation is the primary driver, propelled by advancements in LED technology, spectral optimization for plant growth, and energy efficiency. Regulatory frameworks, while evolving, significantly shape market entry and product development. The presence of viable product substitutes, such as advancements in natural sunlight optimization techniques and less energy-intensive horticultural practices, exerts competitive pressure. End-user trends are increasingly favoring sustainable and cost-effective lighting solutions, leading to a demand for high-efficiency LEDs. Mergers and acquisitions (M&A) activities are anticipated to continue, with estimated deal values reaching into the hundreds of millions, as larger corporations seek to expand their horticultural lighting portfolios and gain a competitive edge. Market share for leading LED manufacturers is estimated to be over 70% within the specialized cannabis lighting segment.

Cannabis Lighting Industry Industry Trends & Insights

The Cannabis Lighting Industry is poised for substantial growth, driven by the expanding global cannabis market, increasing legalization efforts, and a growing emphasis on controlled environment agriculture (CEA). The industry is projected to witness a robust Compound Annual Growth Rate (CAGR) of over 15% throughout the forecast period of 2025–2033. This significant expansion is fueled by a confluence of factors, including the demand for optimized crop yields, consistent quality, and year-round production capabilities. Technological disruptions, particularly in the realm of Light Emitting Diodes (LEDs), are revolutionizing horticultural lighting. Innovations in spectral tuning, light intensity control, and energy efficiency are enabling growers to achieve superior results while reducing operational costs. Consumer preferences are increasingly shifting towards sustainably grown, high-quality cannabis products, which necessitates advanced lighting solutions that mimic natural sunlight or provide tailored spectrums for specific plant needs. The competitive landscape is intensifying, with established lighting giants and specialized horticultural lighting companies vying for market share. Market penetration for advanced LED solutions is expected to surge past 80% in developed cannabis markets by 2030.

Dominant Markets & Segments in Cannabis Lighting Industry

The Cannabis Lighting Industry's dominance is clearly evident in regions and countries with progressive cannabis legalization policies and robust horticultural sectors. North America, particularly the United States and Canada, currently leads in market share due to extensive adult-use and medical cannabis markets. Asia-Pacific is emerging as a significant growth region, driven by increasing medical cannabis acceptance and government support for CEA.

Within Lighting Technology:

- Light Emitting Diodes (LEDs) are unequivocally the dominant segment, holding an estimated market share exceeding 75%. Key drivers include unparalleled energy efficiency, long lifespan, precise spectrum control, and reduced heat output, leading to lower operational costs and improved plant health. The development of specialized horticultural LEDs with tunable spectrums offers significant competitive advantages.

- T5 High Output Fluorescent Light represents a declining segment, with its market share diminishing as LED technology matures and becomes more accessible. While initially cost-effective, their lower energy efficiency and shorter lifespan make them less attractive for large-scale commercial operations.

- Ceramic Metal Halide Light (CMH), once a popular choice, is also seeing its market share shrink due to the superior performance and efficiency of LEDs. CMH lights offer good spectrum quality but are outpaced by the controllability and energy savings of modern LEDs.

- Compact Fluorescent Light (CFL) is largely relegated to hobbyist or small-scale operations due to its limited light output and spectrum control capabilities, making it unsuitable for commercial cannabis cultivation.

- Magnetic Induction Light is a niche segment with limited adoption in the cannabis industry, often seen as an alternative for specific applications where its unique properties might be beneficial, but it lacks the widespread appeal of LEDs.

- Other Lighting Preferences, encompassing technologies like High-Pressure Sodium (HPS) and Metal Halide (MH), are gradually being phased out in favor of LED solutions due to their energy inefficiency and less precise spectrum control.

Within Application:

- Greenhouse cultivation remains a significant application, benefiting from natural sunlight augmented by efficient artificial lighting. The market share for greenhouses is substantial, estimated at around 40%.

- Indoor cultivation, particularly full-spectrum LED-lit facilities, commands a dominant share, projected to reach over 50% of the market. This is driven by the need for complete environmental control and consistent production year-round.

- Vertical Farming is the fastest-growing application segment, estimated to grow at a CAGR exceeding 20%. The ability to stack crops in controlled environments, maximizing space utilization, makes it an attractive model, with advanced lighting being a critical enabler for high-density cultivation.

Cannabis Lighting Industry Product Developments

The Cannabis Lighting Industry is experiencing rapid product innovation, driven by the quest for optimized plant growth and energy efficiency. Leading companies are continuously developing advanced LED fixtures with customizable spectrums, enabling growers to tailor light output to specific plant stages and desired cannabinoid profiles. Innovations include features like integrated dimming, remote control, and advanced thermal management for extended fixture life and reduced maintenance. The competitive advantage lies in enhanced crop yields, improved cannabinoid and terpene production, and significant reductions in energy consumption and operational costs for cultivators. The recent launch of ams OSRAM's OSLON Optimal family of LEDs exemplifies this trend, offering superior efficiency and performance for horticultural applications.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Cannabis Lighting Industry, encompassing key market segments and their growth trajectories. The Lighting Technology segmentation includes Light Emitting Diodes (LEDs), T5 High Output Fluorescent Light, Ceramic Metal Halide Light, Compact Fluorescent Light, Magnetic Induction Light, and Other Lighting Preferences. The Application segmentation covers Greenhouse, Indoor, and Vertical Farming. For LEDs, growth projections are robust, with estimated market sizes in the billions, driven by their superior efficiency and controllability. Greenhouse applications continue to be a significant market, benefiting from hybrid lighting solutions, while Indoor cultivation is experiencing exponential growth due to increasing demand for controlled environments. Vertical farming, though a smaller segment currently, is projected to witness the highest CAGR, fueled by urbanization and the need for localized, sustainable food production systems. Competitive dynamics are intense across all segments, with a clear shift towards technologically advanced and energy-efficient solutions.

Key Drivers of Cannabis Lighting Industry Growth

The growth of the Cannabis Lighting Industry is primarily propelled by the increasing global demand for cannabis, both for medical and recreational purposes, leading to expanded cultivation operations. The ongoing legalization and decriminalization of cannabis in numerous jurisdictions worldwide create new markets and opportunities for lighting manufacturers. Technological advancements in LED lighting, offering superior energy efficiency, customizable spectrums for optimized plant growth, and reduced operational costs, are significant drivers. Furthermore, the growing adoption of controlled environment agriculture (CEA) practices, including vertical farming and advanced greenhouses, necessitates sophisticated lighting solutions to ensure consistent yields and quality. Government incentives for energy-efficient technologies and sustainable cultivation practices also contribute to market expansion.

Challenges in the Cannabis Lighting Industry Sector

Despite its promising growth, the Cannabis Lighting Industry faces several challenges. Strict and evolving regulatory frameworks across different regions can create compliance hurdles and market access barriers. High upfront costs associated with advanced LED lighting systems can be a deterrent for some smaller growers, impacting market penetration. Supply chain disruptions, fluctuating raw material prices, and intense competition among numerous players can also pose significant challenges. Furthermore, the need for specialized knowledge in horticultural lighting to optimize spectrums and light intensity for specific cannabis strains requires ongoing education and training for growers, acting as a restraint on rapid adoption for less experienced cultivators.

Emerging Opportunities in Cannabis Lighting Industry

Emerging opportunities in the Cannabis Lighting Industry are abundant, driven by innovation and market expansion. The development of AI-powered lighting systems that can dynamically adjust spectrums and intensities based on real-time plant feedback presents a significant advancement. Expansion into emerging markets with newly legalized cannabis sectors, particularly in Europe and Asia, offers substantial growth potential. The increasing consumer demand for sustainably grown and "clean" cannabis products is driving interest in energy-efficient lighting solutions and integrated pest management systems that work in tandem with lighting. Furthermore, the exploration of photobiomodulation and its potential impact on cannabis plant development opens new avenues for specialized lighting research and product development.

Leading Players in the Cannabis Lighting Industry Market

- Signify Holding

- BIOS LLC

- Illumitex Inc

- LumiGrow Inc

- Heliospectra AB

- Cultilux

- OSRAM Licht AG

- Gavita Holland BV

- General Electric Company

- Vivosun

- Sun System

Key Developments in Cannabis Lighting Industry Industry

- May 2022: OSRAM, a global leader in optical solutions, announced the launch of the OSLON Optimal family of LEDs for horticulture lighting, based on the latest ams OSRAM 1mm2 chip, which offers an outstanding combination of high efficiency, dependable performance, and great value.

- 2023: Several companies intensified their focus on developing spectral tuning capabilities within their LED offerings, allowing for precise control over light wavelengths to optimize cannabinoid and terpene production.

- 2024: Increased investment in research and development for integrated lighting and automation solutions for vertical farming operations, aiming to improve efficiency and reduce labor costs.

- 2024: Market analysts observed a growing trend of consolidation, with larger players acquiring smaller, innovative horticultural lighting companies to expand their technology portfolios and market reach.

Strategic Outlook for Cannabis Lighting Industry Market

The strategic outlook for the Cannabis Lighting Industry is exceptionally positive, driven by sustained demand for high-quality cannabis and the continuous evolution of horticultural technology. Key growth catalysts include the ongoing global legalization of cannabis, coupled with advancements in LED efficiency and spectral control, enabling growers to achieve higher yields and superior product quality while minimizing energy consumption. The expansion of controlled environment agriculture, particularly vertical farming, presents a significant opportunity for sophisticated lighting solutions. Companies that focus on developing integrated, smart lighting systems that offer data-driven insights and automation will be well-positioned for future success. Strategic partnerships and continued innovation in spectral science will be crucial for capturing market share and driving industry-wide progress.

Cannabis Lighting Industry Segmentation

-

1. Lighting Technology

- 1.1. Light Emitting Diodes (LEDs)

- 1.2. T5 High Output Fluorescent Light

- 1.3. Ceramic Metal Halide Light

- 1.4. Compact Fluorescent Light

- 1.5. Magnetic Induction Light

- 1.6. Other Lighting Preferences

-

2. Application

- 2.1. Greenhouse

- 2.2. Indoor

- 2.3. Vertical Farming

Cannabis Lighting Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Cannabis Lighting Industry Regional Market Share

Geographic Coverage of Cannabis Lighting Industry

Cannabis Lighting Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 25.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Legalization of Medical Cannabis in Various Countries

- 3.3. Market Restrains

- 3.3.1. Increasing Adoption of Cloud; Cost Ineffectiveness with High Data Growth

- 3.4. Market Trends

- 3.4.1. LED Light is Expected to Occupy Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cannabis Lighting Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Lighting Technology

- 5.1.1. Light Emitting Diodes (LEDs)

- 5.1.2. T5 High Output Fluorescent Light

- 5.1.3. Ceramic Metal Halide Light

- 5.1.4. Compact Fluorescent Light

- 5.1.5. Magnetic Induction Light

- 5.1.6. Other Lighting Preferences

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Greenhouse

- 5.2.2. Indoor

- 5.2.3. Vertical Farming

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Lighting Technology

- 6. North America Cannabis Lighting Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Lighting Technology

- 6.1.1. Light Emitting Diodes (LEDs)

- 6.1.2. T5 High Output Fluorescent Light

- 6.1.3. Ceramic Metal Halide Light

- 6.1.4. Compact Fluorescent Light

- 6.1.5. Magnetic Induction Light

- 6.1.6. Other Lighting Preferences

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Greenhouse

- 6.2.2. Indoor

- 6.2.3. Vertical Farming

- 6.1. Market Analysis, Insights and Forecast - by Lighting Technology

- 7. Europe Cannabis Lighting Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Lighting Technology

- 7.1.1. Light Emitting Diodes (LEDs)

- 7.1.2. T5 High Output Fluorescent Light

- 7.1.3. Ceramic Metal Halide Light

- 7.1.4. Compact Fluorescent Light

- 7.1.5. Magnetic Induction Light

- 7.1.6. Other Lighting Preferences

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Greenhouse

- 7.2.2. Indoor

- 7.2.3. Vertical Farming

- 7.1. Market Analysis, Insights and Forecast - by Lighting Technology

- 8. Asia Pacific Cannabis Lighting Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Lighting Technology

- 8.1.1. Light Emitting Diodes (LEDs)

- 8.1.2. T5 High Output Fluorescent Light

- 8.1.3. Ceramic Metal Halide Light

- 8.1.4. Compact Fluorescent Light

- 8.1.5. Magnetic Induction Light

- 8.1.6. Other Lighting Preferences

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Greenhouse

- 8.2.2. Indoor

- 8.2.3. Vertical Farming

- 8.1. Market Analysis, Insights and Forecast - by Lighting Technology

- 9. Rest of the World Cannabis Lighting Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Lighting Technology

- 9.1.1. Light Emitting Diodes (LEDs)

- 9.1.2. T5 High Output Fluorescent Light

- 9.1.3. Ceramic Metal Halide Light

- 9.1.4. Compact Fluorescent Light

- 9.1.5. Magnetic Induction Light

- 9.1.6. Other Lighting Preferences

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Greenhouse

- 9.2.2. Indoor

- 9.2.3. Vertical Farming

- 9.1. Market Analysis, Insights and Forecast - by Lighting Technology

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Signify Holding

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 BIOS LLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Illumitex Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 LumiGrow Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Heliospectra AB

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Cultilux

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 OSRAM Licht AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Gavita Holland BV

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 General Electric Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Vivosun

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Sun System*List Not Exhaustive

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Signify Holding

List of Figures

- Figure 1: Global Cannabis Lighting Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Cannabis Lighting Industry Revenue (billion), by Lighting Technology 2025 & 2033

- Figure 3: North America Cannabis Lighting Industry Revenue Share (%), by Lighting Technology 2025 & 2033

- Figure 4: North America Cannabis Lighting Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Cannabis Lighting Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Cannabis Lighting Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Cannabis Lighting Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Cannabis Lighting Industry Revenue (billion), by Lighting Technology 2025 & 2033

- Figure 9: Europe Cannabis Lighting Industry Revenue Share (%), by Lighting Technology 2025 & 2033

- Figure 10: Europe Cannabis Lighting Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Cannabis Lighting Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Cannabis Lighting Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Cannabis Lighting Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Cannabis Lighting Industry Revenue (billion), by Lighting Technology 2025 & 2033

- Figure 15: Asia Pacific Cannabis Lighting Industry Revenue Share (%), by Lighting Technology 2025 & 2033

- Figure 16: Asia Pacific Cannabis Lighting Industry Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific Cannabis Lighting Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Cannabis Lighting Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Cannabis Lighting Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Cannabis Lighting Industry Revenue (billion), by Lighting Technology 2025 & 2033

- Figure 21: Rest of the World Cannabis Lighting Industry Revenue Share (%), by Lighting Technology 2025 & 2033

- Figure 22: Rest of the World Cannabis Lighting Industry Revenue (billion), by Application 2025 & 2033

- Figure 23: Rest of the World Cannabis Lighting Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Rest of the World Cannabis Lighting Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the World Cannabis Lighting Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cannabis Lighting Industry Revenue billion Forecast, by Lighting Technology 2020 & 2033

- Table 2: Global Cannabis Lighting Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Cannabis Lighting Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Cannabis Lighting Industry Revenue billion Forecast, by Lighting Technology 2020 & 2033

- Table 5: Global Cannabis Lighting Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Cannabis Lighting Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Cannabis Lighting Industry Revenue billion Forecast, by Lighting Technology 2020 & 2033

- Table 8: Global Cannabis Lighting Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Global Cannabis Lighting Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Cannabis Lighting Industry Revenue billion Forecast, by Lighting Technology 2020 & 2033

- Table 11: Global Cannabis Lighting Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global Cannabis Lighting Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Cannabis Lighting Industry Revenue billion Forecast, by Lighting Technology 2020 & 2033

- Table 14: Global Cannabis Lighting Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global Cannabis Lighting Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cannabis Lighting Industry?

The projected CAGR is approximately 25.6%.

2. Which companies are prominent players in the Cannabis Lighting Industry?

Key companies in the market include Signify Holding, BIOS LLC, Illumitex Inc, LumiGrow Inc, Heliospectra AB, Cultilux, OSRAM Licht AG, Gavita Holland BV, General Electric Company, Vivosun, Sun System*List Not Exhaustive.

3. What are the main segments of the Cannabis Lighting Industry?

The market segments include Lighting Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.15 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Legalization of Medical Cannabis in Various Countries.

6. What are the notable trends driving market growth?

LED Light is Expected to Occupy Significant Share.

7. Are there any restraints impacting market growth?

Increasing Adoption of Cloud; Cost Ineffectiveness with High Data Growth.

8. Can you provide examples of recent developments in the market?

May 2022 - OSRM, a global leader in optical solutions, announced the launch of the OSLON Optimal family of LEDs for horticulture lighting, based on the latest ams OSRAM 1mm2 chip, which offers an outstanding combination of high efficiency, dependable performance, and great value.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cannabis Lighting Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cannabis Lighting Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cannabis Lighting Industry?

To stay informed about further developments, trends, and reports in the Cannabis Lighting Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence