Key Insights

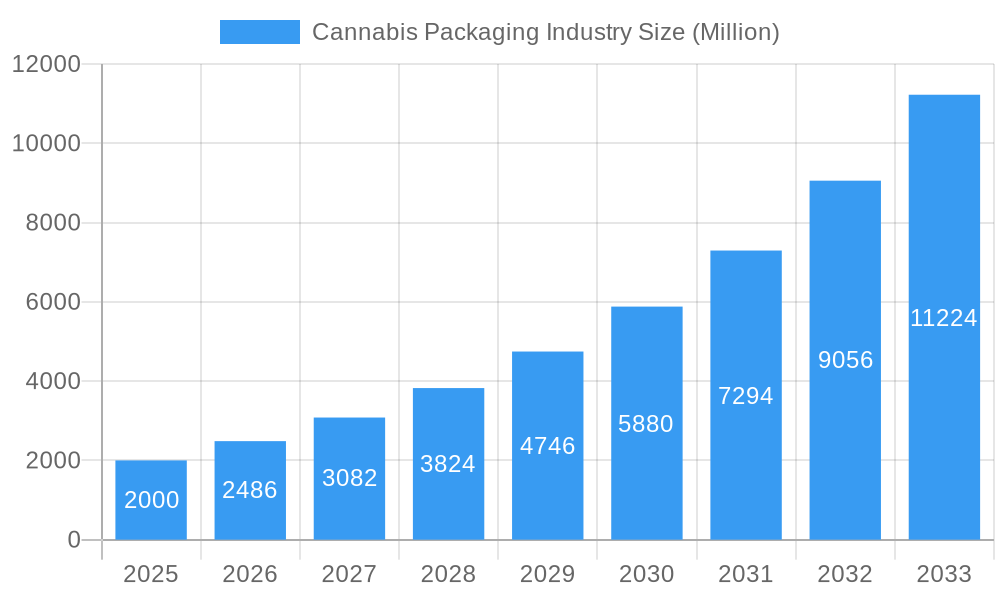

The global cannabis packaging market is experiencing significant expansion, projected to reach a substantial size by 2033. Driven by a compound annual growth rate (CAGR) of 7.1% from 2025 to 2033, this growth is propelled by several key factors. Increasing global legalization of cannabis fuels demand for specialized packaging that ensures product safety, freshness, and child resistance. Consumer preference for sustainable, eco-friendly materials like recyclable plastics and cardboard is also driving innovation. Furthermore, stringent regulatory requirements for labeling and child-proofing are shaping packaging design and increasing demand for sophisticated, compliant solutions. The market is segmented by packaging type (rigid and flexible) and material (glass, metal, plastics, cardboard). North America is expected to maintain a leading position, but Europe and Latin America are poised for significant expansion as legalization spreads.

Cannabis Packaging Industry Market Size (In Billion)

Continued market growth will be influenced by advancements in packaging technology, evolving consumer preferences, and the expansion of the cannabis industry. Challenges include regulatory fluctuations, the cost of compliant materials, and the need for continuous innovation. Companies focusing on sustainability and providing innovative, compliant packaging solutions are best positioned for success. The market presents a dynamic landscape with opportunities for both established players and new entrants who can adapt to the evolving regulatory and consumer demands.

Cannabis Packaging Industry Company Market Share

Cannabis Packaging Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Cannabis Packaging Industry, offering invaluable insights for stakeholders, investors, and industry professionals. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report projects a xx Million market value by 2033, driven by factors including increasing cannabis legalization, evolving consumer preferences, and technological advancements.

Cannabis Packaging Industry Market Concentration & Innovation

The cannabis packaging market exhibits a moderately concentrated landscape with several key players vying for market share. While precise market share figures for each company are unavailable, estimates place Elevate Packaging Inc, KushCo Holdings Inc, and Greenlane Holdings Inc among the leading companies, each holding a significant, though unspecified, percentage. Smaller players, including JL Clarks Inc, Kaya Packaging, N2 Packaging Systems LLC, Berry Global Inc, Cannaline Cannabis Packaging Solutions, Dymapak, and Diamond Packaging, contribute significantly to the overall market. The industry is characterized by ongoing innovation, particularly in sustainable and child-resistant packaging solutions, driven by stringent regulatory requirements and environmentally conscious consumer demands. Mergers and acquisitions (M&A) activity has been significant in recent years, with deal values reaching xx Million in 2024 (estimated). These activities are primarily focused on expanding product portfolios, market reach, and technological capabilities. The competitive landscape is further shaped by the introduction of innovative materials, such as biodegradable plastics and recyclable containers. The regulatory framework varies across jurisdictions, creating both opportunities and challenges for packaging providers. Consumer preference for eco-friendly packaging is a crucial factor driving innovation.

Cannabis Packaging Industry Industry Trends & Insights

The cannabis packaging market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily fueled by the expanding legalization of cannabis for both recreational and medicinal use globally. Technological advancements, such as the introduction of tamper-evident seals and sophisticated labeling solutions, enhance product security and traceability, further driving market expansion. Consumer preferences are shifting towards sustainable and aesthetically pleasing packaging, pushing manufacturers to adopt eco-friendly materials and innovative designs. The competitive landscape is marked by intense competition, with both large multinational corporations and smaller specialized companies vying for market share. Market penetration of sustainable packaging options is projected to reach xx% by 2033, reflecting a growing emphasis on environmental responsibility.

Dominant Markets & Segments in Cannabis Packaging Industry

North America (particularly the US and Canada) currently dominates the cannabis packaging market, driven by early legalization and a substantial consumer base. However, European markets are showing significant growth potential with increasing legalization efforts. Within segments, rigid packaging holds a larger market share compared to flexible packaging, owing to its better protection of cannabis products. However, flexible packaging is gaining traction due to its cost-effectiveness and adaptability for different product types.

- By Type:

- Rigid Packaging: High demand due to its superior product protection. The segment is expected to grow at a CAGR of xx% during the forecast period.

- Flexible Packaging: Increasing popularity due to cost-effectiveness and versatility. Expected CAGR of xx% during the forecast period.

- By Packaging Materials:

- Glass: Preferred for its inert properties and premium feel, but faces challenges related to fragility and cost.

- Metal: Provides excellent barrier properties, though it is relatively expensive and may not be fully recyclable in all regions.

- Plastics: Cost-effective and widely available, but concerns about environmental impact and recyclability are growing.

- Cardboard Containers: Environmentally friendly and cost-effective option gaining popularity, particularly for pre-rolls and other smaller items.

Key drivers for market dominance include favorable economic policies supporting the cannabis industry, robust infrastructure to support the packaging supply chain, and consumer preferences for specific packaging types.

Cannabis Packaging Industry Product Developments

Recent product innovations focus on enhancing child-resistance, tamper-evidence, and sustainability. New materials like biodegradable plastics and compostable cardboard are gaining traction. Technological advancements include smart packaging incorporating QR codes for traceability and authenticity verification. These developments cater to evolving regulatory requirements and consumer demand for environmentally conscious and secure packaging solutions.

Report Scope & Segmentation Analysis

This report comprehensively segments the cannabis packaging market by type (rigid and flexible) and packaging materials (glass, metal, plastics, and cardboard containers). Each segment's growth projection, market size, and competitive dynamics are analyzed in detail, providing a granular understanding of the market's structure and future potential. For example, the rigid packaging segment is anticipated to witness substantial growth, driven by high demand for superior product protection, while the flexible packaging segment is expected to expand due to its cost-effectiveness and diverse applications.

Key Drivers of Cannabis Packaging Industry Growth

The cannabis packaging industry's growth is propelled by several factors, including the burgeoning legal cannabis market, stringent regulations necessitating specialized packaging, the rising demand for eco-friendly packaging, and continuous innovation in materials and designs. Technological advancements like smart packaging and tamper-evident seals contribute significantly to the industry's expansion. The increasing legalization and acceptance of cannabis worldwide further fuels market growth.

Challenges in the Cannabis Packaging Industry Sector

The cannabis packaging industry faces significant challenges, including strict regulations varying by region, which increase compliance costs and complexities. Supply chain disruptions can impact production and delivery, while intense competition necessitates continuous innovation to stay ahead. Fluctuations in cannabis prices and market demand also pose challenges for packaging manufacturers.

Emerging Opportunities in Cannabis Packaging Industry

Emerging opportunities lie in the growing demand for sustainable packaging materials, innovative designs enhancing brand differentiation, and expansion into international markets with emerging cannabis legalization. The integration of technology into packaging, such as smart packaging features and traceability solutions, represents another significant growth opportunity. The increasing demand for child-resistant and tamper-evident packaging is also creating a significant market opportunity.

Leading Players in the Cannabis Packaging Industry Market

- Elevate Packaging Inc

- JL Clarks Inc

- KushCo Holdings Inc

- Green Rush Packaging

- Kaya Packaging

- N2 Packaging Systems LLC

- Berry Global Inc

- Cannaline Cannabis Packaging Solutions

- Greenlane Holdings Inc

- Dymapak

- Diamond Packaging

Key Developments in Cannabis Packaging Industry Industry

- November 2021: The Niagara Herbalist launched a packaging buyback program, offering store credits for returned cannabis packaging, promoting sustainability and reducing waste.

- January 2022: Origin Pharma Packaging launched a child-resistant jar for medicinal cannabis flower, addressing safety and regulatory requirements in the European market.

Strategic Outlook for Cannabis Packaging Industry Market

The cannabis packaging market presents significant long-term growth potential, driven by expanding legalization, evolving consumer preferences, and continuous innovation. Companies focused on sustainable packaging solutions, advanced technologies, and superior customer service are poised for significant success in this dynamic and rapidly growing market. The increasing demand for customized packaging and branding opportunities further adds to this potential.

Cannabis Packaging Industry Segmentation

-

1. Type

- 1.1. Rigid Packaging

- 1.2. Flexible Packaging

-

2. Packaging Materials

- 2.1. Glass

- 2.2. Metal

- 2.3. Plastics

- 2.4. Cardboard Containers

Cannabis Packaging Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Latin America

- 4. Rest of the World

Cannabis Packaging Industry Regional Market Share

Geographic Coverage of Cannabis Packaging Industry

Cannabis Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Medical and Recreational Cannabis Products; Legalization of Cannabis in Various North American Countries

- 3.3. Market Restrains

- 3.3.1. Stringent Regulation Related to Cannabis Packaging

- 3.4. Market Trends

- 3.4.1. Plastic Packaging Holds a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cannabis Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Rigid Packaging

- 5.1.2. Flexible Packaging

- 5.2. Market Analysis, Insights and Forecast - by Packaging Materials

- 5.2.1. Glass

- 5.2.2. Metal

- 5.2.3. Plastics

- 5.2.4. Cardboard Containers

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Latin America

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Cannabis Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Rigid Packaging

- 6.1.2. Flexible Packaging

- 6.2. Market Analysis, Insights and Forecast - by Packaging Materials

- 6.2.1. Glass

- 6.2.2. Metal

- 6.2.3. Plastics

- 6.2.4. Cardboard Containers

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Cannabis Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Rigid Packaging

- 7.1.2. Flexible Packaging

- 7.2. Market Analysis, Insights and Forecast - by Packaging Materials

- 7.2.1. Glass

- 7.2.2. Metal

- 7.2.3. Plastics

- 7.2.4. Cardboard Containers

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Latin America Cannabis Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Rigid Packaging

- 8.1.2. Flexible Packaging

- 8.2. Market Analysis, Insights and Forecast - by Packaging Materials

- 8.2.1. Glass

- 8.2.2. Metal

- 8.2.3. Plastics

- 8.2.4. Cardboard Containers

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Cannabis Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Rigid Packaging

- 9.1.2. Flexible Packaging

- 9.2. Market Analysis, Insights and Forecast - by Packaging Materials

- 9.2.1. Glass

- 9.2.2. Metal

- 9.2.3. Plastics

- 9.2.4. Cardboard Containers

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Elevate Packaging Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 JL Clarks Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 KushCo Holdings Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Green Rush Packaging

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Kaya Packaging

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 N2 Packaging Systems LLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Berry Global Inc *List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Cannaline Cannabis Packaging Solutions

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Greenlane Holdings Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Dymapak

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Diamond Packaging

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Elevate Packaging Inc

List of Figures

- Figure 1: Global Cannabis Packaging Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Cannabis Packaging Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Cannabis Packaging Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Cannabis Packaging Industry Revenue (billion), by Packaging Materials 2025 & 2033

- Figure 5: North America Cannabis Packaging Industry Revenue Share (%), by Packaging Materials 2025 & 2033

- Figure 6: North America Cannabis Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Cannabis Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Cannabis Packaging Industry Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Cannabis Packaging Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Cannabis Packaging Industry Revenue (billion), by Packaging Materials 2025 & 2033

- Figure 11: Europe Cannabis Packaging Industry Revenue Share (%), by Packaging Materials 2025 & 2033

- Figure 12: Europe Cannabis Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Cannabis Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Cannabis Packaging Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Latin America Cannabis Packaging Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Latin America Cannabis Packaging Industry Revenue (billion), by Packaging Materials 2025 & 2033

- Figure 17: Latin America Cannabis Packaging Industry Revenue Share (%), by Packaging Materials 2025 & 2033

- Figure 18: Latin America Cannabis Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Latin America Cannabis Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Cannabis Packaging Industry Revenue (billion), by Type 2025 & 2033

- Figure 21: Rest of the World Cannabis Packaging Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Rest of the World Cannabis Packaging Industry Revenue (billion), by Packaging Materials 2025 & 2033

- Figure 23: Rest of the World Cannabis Packaging Industry Revenue Share (%), by Packaging Materials 2025 & 2033

- Figure 24: Rest of the World Cannabis Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the World Cannabis Packaging Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cannabis Packaging Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Cannabis Packaging Industry Revenue billion Forecast, by Packaging Materials 2020 & 2033

- Table 3: Global Cannabis Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Cannabis Packaging Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Cannabis Packaging Industry Revenue billion Forecast, by Packaging Materials 2020 & 2033

- Table 6: Global Cannabis Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Cannabis Packaging Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Cannabis Packaging Industry Revenue billion Forecast, by Packaging Materials 2020 & 2033

- Table 9: Global Cannabis Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Cannabis Packaging Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Cannabis Packaging Industry Revenue billion Forecast, by Packaging Materials 2020 & 2033

- Table 12: Global Cannabis Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Cannabis Packaging Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Cannabis Packaging Industry Revenue billion Forecast, by Packaging Materials 2020 & 2033

- Table 15: Global Cannabis Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cannabis Packaging Industry?

The projected CAGR is approximately 7.1%.

2. Which companies are prominent players in the Cannabis Packaging Industry?

Key companies in the market include Elevate Packaging Inc, JL Clarks Inc, KushCo Holdings Inc, Green Rush Packaging, Kaya Packaging, N2 Packaging Systems LLC, Berry Global Inc *List Not Exhaustive, Cannaline Cannabis Packaging Solutions, Greenlane Holdings Inc, Dymapak, Diamond Packaging.

3. What are the main segments of the Cannabis Packaging Industry?

The market segments include Type, Packaging Materials.

4. Can you provide details about the market size?

The market size is estimated to be USD 50.05 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Medical and Recreational Cannabis Products; Legalization of Cannabis in Various North American Countries.

6. What are the notable trends driving market growth?

Plastic Packaging Holds a Significant Market Share.

7. Are there any restraints impacting market growth?

Stringent Regulation Related to Cannabis Packaging.

8. Can you provide examples of recent developments in the market?

January 2022: Origin Pharma Packaging launched a piece of packaging dedicated to the medicinal cannabis industry, a child-resistant Jar to support the 'flower# product, which is often prescribed in certain European countries.,

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cannabis Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cannabis Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cannabis Packaging Industry?

To stay informed about further developments, trends, and reports in the Cannabis Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence