Key Insights

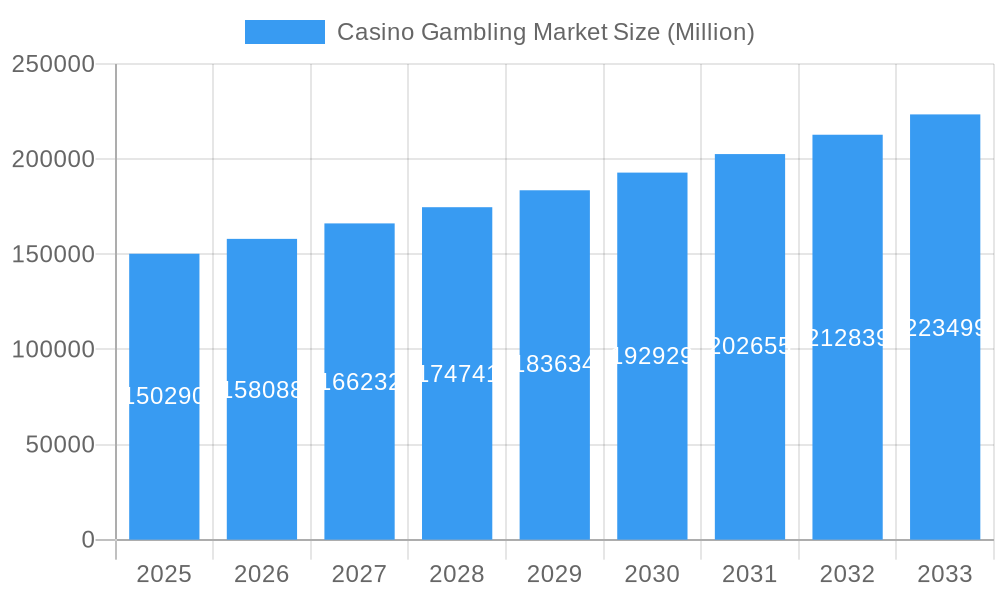

The global casino gambling market, valued at $150.29 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.95% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing disposable incomes in emerging economies, coupled with a growing preference for leisure and entertainment activities, fuels demand for casino experiences. Secondly, technological advancements, particularly the rise of online and mobile casino gaming, have broadened accessibility and significantly expanded the market's reach, attracting a younger demographic and providing convenience to established players. The integration of virtual reality (VR) and augmented reality (AR) technologies further enhances the immersive experience, driving engagement and spending. Finally, strategic marketing campaigns and the expansion of casino resorts into new geographical locations contribute to market growth. However, stringent regulations concerning gambling, coupled with social concerns surrounding addiction and responsible gaming, pose significant restraints. The market is segmented by game type (live casino, baccarat, blackjack, poker, slots, others), with slots and online casino games likely dominating market share due to their wide appeal and ease of access. North America and Asia-Pacific are projected to remain the dominant regions, driven by the established casino infrastructure in North America and the rapidly growing middle class in Asia-Pacific.

Casino Gambling Market Market Size (In Billion)

The competitive landscape is characterized by the presence of major global players such as Caesars Entertainment, Melco Resorts & Entertainment, Las Vegas Sands, and MGM Resorts International, amongst others. These companies are continually investing in innovative technologies, expanding their offerings, and leveraging strategic partnerships to maintain a competitive edge. The future of the casino gambling market hinges on the ability of these companies to adapt to evolving consumer preferences, navigate regulatory challenges, and maintain responsible gaming practices while fostering sustainable growth. The market's success also depends on the continuous innovation and development of new and engaging gaming experiences that cater to a wider audience and continue to attract new players. Growth in emerging markets will also be crucial for future market expansion.

Casino Gambling Market Company Market Share

Casino Gambling Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global casino gambling market, encompassing historical data (2019-2024), the base year (2025), and a detailed forecast (2025-2033). The study covers key market segments, leading players, and emerging trends, offering valuable insights for industry stakeholders, investors, and businesses seeking to capitalize on the growth opportunities within this dynamic sector. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Casino Gambling Market Market Concentration & Innovation

The casino gambling market exhibits a moderately concentrated structure, with a few major players holding significant market share. Caesars Entertainment, MGM Resorts International, Las Vegas Sands, and Wynn Resorts are among the leading global operators, commanding a combined market share of approximately xx%. However, regional variations exist, with specific markets displaying higher levels of fragmentation due to the presence of numerous regional and local operators.

Innovation is a key driver within the industry, fueled by advancements in technology and evolving consumer preferences. The increasing adoption of online and mobile gaming platforms has significantly reshaped the market landscape, alongside the development of innovative game formats and virtual reality (VR) and augmented reality (AR) integration. Regulatory frameworks play a crucial role in shaping innovation, with varying degrees of liberalization across different jurisdictions. The market also witnesses significant mergers and acquisitions (M&A) activity, with deal values exceeding xx Million in recent years, reflecting the consolidation trend and the pursuit of expansion by major players. For example, the recent acquisition of Push Gaming by MGM Resorts, highlights the industry’s interest in game development technology. The substitution of traditional land-based casinos with online platforms has become a major shift in recent years. Growing trends among end-users, such as mobile access and enhanced gaming experiences, further drive market changes.

- Market Concentration: High in certain regions, moderate globally.

- Innovation Drivers: Technological advancements, evolving consumer preferences, regulatory changes.

- M&A Activity: Significant deal flow, exceeding xx Million in recent years.

- Regulatory Frameworks: Varying levels of liberalization across jurisdictions, impacting innovation and market access.

- Product Substitutes: Online and mobile gaming platforms, virtual and augmented reality gaming.

- End-User Trends: Increasing preference for mobile gaming, demand for enhanced gaming experiences.

Casino Gambling Market Industry Trends & Insights

The global casino gambling market is experiencing robust growth, driven by factors such as rising disposable incomes, increasing tourism, and the expanding popularity of online gaming. The market is witnessing a significant shift towards digitalization, with online casinos and mobile gaming platforms gaining substantial traction. Technological disruptions, particularly the advent of blockchain technology and cryptocurrencies, are creating new possibilities for secure and transparent transactions. Consumer preferences are evolving, with a rising demand for personalized gaming experiences and enhanced customer engagement through loyalty programs and rewards systems. Competitive dynamics are intensifying, with companies investing heavily in innovative game development, marketing, and expansion into new markets. The market penetration of online casinos is growing at a CAGR of xx%, while the overall market exhibits a CAGR of xx%.

Dominant Markets & Segments in Casino Gambling Market

The Asia-Pacific region holds a dominant position in the global casino gambling market, driven by strong economic growth, burgeoning middle classes, and increased tourism in key markets such as Macau and Singapore. Within the market segments by type:

- Slots: This segment remains the most dominant, accounting for approximately xx% of the overall market revenue, driven by its widespread appeal and diverse game offerings.

- Live Casino: Live casino games, offering a more immersive and interactive gaming experience, are experiencing rapid growth, fueled by technological advancements in live streaming and online interaction. This segment is projected to show an xx% CAGR during the forecast period.

- Baccarat, Blackjack, Poker: These classic casino games maintain a significant presence, particularly in traditional land-based casinos.

- Other Casino Games: This category is continuously evolving, with new games and variations consistently being introduced to attract players.

Key Drivers of Regional Dominance (Asia-Pacific):

- Strong economic growth and rising disposable incomes.

- High tourism rates, leading to increased casino patronage.

- Favorable regulatory environment in certain key markets.

- Well-developed infrastructure supporting the gambling industry.

Casino Gambling Market Product Developments

Recent product innovations in the casino gambling market focus on enhancing player experience through immersive technologies, personalized gameplay, and innovative game mechanics. The integration of VR/AR technologies, the development of mobile-first gaming experiences, and the introduction of new game formats with enhanced graphics and sound design are key trends. These innovations cater to the evolving preferences of players seeking engaging and exciting gaming experiences across diverse platforms, and enhance the competitive advantage for gaming companies.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the casino gambling market based on game type, including:

- Live Casino: The live casino segment is experiencing a growth surge fueled by advancements in streaming technology and increasing internet penetration. Market size is projected at xx Million in 2025, with a competitive landscape shaped by technological capabilities and player experience.

- Baccarat: This classic card game maintains steady market demand.

- Blackjack: The popularity of blackjack continues to remain stable.

- Poker: This segment is experiencing growth in online formats.

- Slots: This remains the largest segment with market size at xx Million in 2025.

- Other Casino Games: This diverse segment encompasses various games, each with its own growth trajectory.

Key Drivers of Casino Gambling Market Growth

Several key factors propel the growth of the casino gambling market:

- Technological advancements: Online and mobile gaming platforms, VR/AR integration, and innovative game mechanics are boosting market expansion.

- Economic factors: Rising disposable incomes and increased tourism in key markets contribute to growth.

- Regulatory changes: Relaxed regulations in certain jurisdictions open new markets and increase participation.

Challenges in the Casino Gambling Market Sector

The casino gambling market faces challenges such as:

- Stringent regulations: Strict licensing and compliance requirements can hinder expansion in certain markets.

- Competition: Intense rivalry among established players and the emergence of new entrants can impact profitability.

- Economic downturns: Recessions can significantly reduce consumer spending on non-essential activities like gambling.

Emerging Opportunities in Casino Gambling Market

Promising opportunities include:

- Expansion into new markets: Untapped regions with growing economies present significant potential.

- Integration of new technologies: Blockchain, AI, and VR/AR are poised to further revolutionize the industry.

- Focus on responsible gambling: Initiatives promoting responsible gaming practices can enhance the industry's reputation and sustainability.

Leading Players in the Casino Gambling Market Market

- Caesars Entertainment

- Melco Resorts & Entertainment

- SJM Holdings

- Las Vegas Sands

- Genting Group

- Wynn Resorts

- Boyd Gaming

- Galaxy Entertainment Group

- MGM Resorts International

- Hard Rock International

Key Developments in Casino Gambling Market Industry

- May 2023: MGM Resorts International's acquisition of Push Gaming strengthens its content creation capabilities and expansion objectives.

- April 2023: Caesars Entertainment's reopening of Tropicana Online Casino in New Jersey enhances its online presence and user experience.

Strategic Outlook for Casino Gambling Market Market

The casino gambling market is poised for continued growth, driven by technological innovation, expanding online platforms, and the increasing popularity of diverse game formats. Strategic investments in technology, responsible gaming initiatives, and expansion into new markets will be critical for success. The market's future lies in offering engaging, secure, and responsible gaming experiences across various platforms, catering to evolving player preferences.

Casino Gambling Market Segmentation

-

1. Type

- 1.1. Live Casino

- 1.2. Baccarat

- 1.3. Blackjack

- 1.4. Poker

- 1.5. Slots

- 1.6. Others Casino Games

Casino Gambling Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Casino Gambling Market Regional Market Share

Geographic Coverage of Casino Gambling Market

Casino Gambling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.95% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the Number of Domestic & International Tourists Arrivals in Europe; Increasing Corporate Workplace Wellness Tourism is Driving the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled and Trained Staff; Lack of Awareness and Understanding the Benefits of Wellness

- 3.4. Market Trends

- 3.4.1. Growing Online Gambling Trends Is Driving The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Live Casino

- 5.1.2. Baccarat

- 5.1.3. Blackjack

- 5.1.4. Poker

- 5.1.5. Slots

- 5.1.6. Others Casino Games

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Live Casino

- 6.1.2. Baccarat

- 6.1.3. Blackjack

- 6.1.4. Poker

- 6.1.5. Slots

- 6.1.6. Others Casino Games

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Live Casino

- 7.1.2. Baccarat

- 7.1.3. Blackjack

- 7.1.4. Poker

- 7.1.5. Slots

- 7.1.6. Others Casino Games

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Live Casino

- 8.1.2. Baccarat

- 8.1.3. Blackjack

- 8.1.4. Poker

- 8.1.5. Slots

- 8.1.6. Others Casino Games

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Live Casino

- 9.1.2. Baccarat

- 9.1.3. Blackjack

- 9.1.4. Poker

- 9.1.5. Slots

- 9.1.6. Others Casino Games

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Casino Gambling Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Live Casino

- 10.1.2. Baccarat

- 10.1.3. Blackjack

- 10.1.4. Poker

- 10.1.5. Slots

- 10.1.6. Others Casino Games

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Caesars Entertainment

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Melco Resorts & Entertainment**List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SJM Holdings

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Las Vegas Sands

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Genting Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Wynn Resorts

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Boyd Gaming

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Galaxy Entertainment Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 MGM Resorts International

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hard Rock International

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Caesars Entertainment

List of Figures

- Figure 1: Global Casino Gambling Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Casino Gambling Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Casino Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Casino Gambling Market Revenue (Million), by Type 2025 & 2033

- Figure 7: Europe Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 8: Europe Casino Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Casino Gambling Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Asia Pacific Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Pacific Casino Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Casino Gambling Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Latin America Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Latin America Casino Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Casino Gambling Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Middle East and Africa Casino Gambling Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Middle East and Africa Casino Gambling Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Casino Gambling Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Casino Gambling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Casino Gambling Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Casino Gambling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Casino Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Casino Gambling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Casino Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Casino Gambling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Casino Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Casino Gambling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Casino Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Casino Gambling Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Casino Gambling Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Casino Gambling Market?

The projected CAGR is approximately 4.95%.

2. Which companies are prominent players in the Casino Gambling Market?

Key companies in the market include Caesars Entertainment, Melco Resorts & Entertainment**List Not Exhaustive, SJM Holdings, Las Vegas Sands, Genting Group, Wynn Resorts, Boyd Gaming, Galaxy Entertainment Group, MGM Resorts International, Hard Rock International.

3. What are the main segments of the Casino Gambling Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 150.29 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Number of Domestic & International Tourists Arrivals in Europe; Increasing Corporate Workplace Wellness Tourism is Driving the Growth of the Market.

6. What are the notable trends driving market growth?

Growing Online Gambling Trends Is Driving The Market.

7. Are there any restraints impacting market growth?

Lack of Skilled and Trained Staff; Lack of Awareness and Understanding the Benefits of Wellness.

8. Can you provide examples of recent developments in the market?

May 2023: MGM Resorts International announced the acquisition of most game developer Push Gaming Holding Limited and its subsidiaries by its wholly owned subsidiary, LeoVegas. This is Leo Vegas' first significant investment since joining MGM Resorts last year. Push Gaming's patented technology, intellectual property, and development experience are expected to strengthen LeoVegas' content creation capabilities and assist its expansion objectives.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Casino Gambling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Casino Gambling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Casino Gambling Market?

To stay informed about further developments, trends, and reports in the Casino Gambling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence