Key Insights

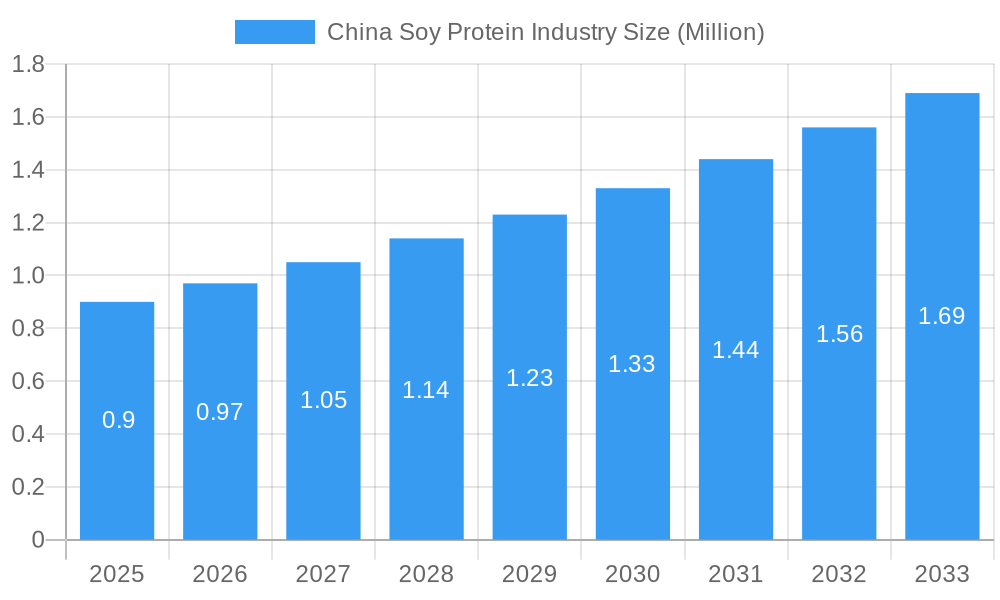

The China Soy Protein Industry is poised for substantial growth, with a current market size estimated at 0.9 Million Value Unit. The market is projected to expand at a Compound Annual Growth Rate (CAGR) of 8.49% through 2033, indicating a robust upward trajectory. This expansion is driven by a confluence of factors, including increasing consumer demand for plant-based protein alternatives, growing awareness of soy protein's health benefits, and its versatility across various applications. The burgeoning health and wellness sector, coupled with a rising middle class in China, further fuels the demand for nutritious and sustainable food options. Key growth drivers include the escalating adoption of soy protein in the food and beverage sector, particularly in bakery products, dairy alternatives, and meat substitutes, catering to both mainstream consumers and those seeking specialized diets. The personal care and cosmetics industry also presents a significant avenue for growth, leveraging soy protein's moisturizing and antioxidant properties. Furthermore, the animal feed segment continues to be a cornerstone, benefiting from the need for cost-effective and high-quality protein sources for livestock.

China Soy Protein Industry Market Size (In Million)

The market is segmented into various forms, with Concentrates, Isolates, and Textured/Hydrolyzed proteins each serving distinct applications and consumer preferences. Isolates, known for their high protein content and purity, are increasingly favored in specialized nutrition products. Textured soy protein (TSP) is experiencing rapid adoption as a meat alternative, aligning with global trends towards flexitarianism and environmental consciousness. In the supplements segment, soy protein is finding strong traction in baby food, infant formula, elderly nutrition, and sports/performance nutrition, highlighting its broad appeal across different life stages and lifestyle choices. Despite the positive outlook, the industry may face challenges such as fluctuating raw material prices and potential consumer perception issues related to genetically modified organisms (GMOs). However, ongoing innovation in processing technologies and the development of non-GMO soy protein variants are expected to mitigate these concerns. Leading global players like ADM, Wilmar International Limited, and Cargill Incorporated are actively investing in the Chinese market, underscoring its strategic importance and growth potential.

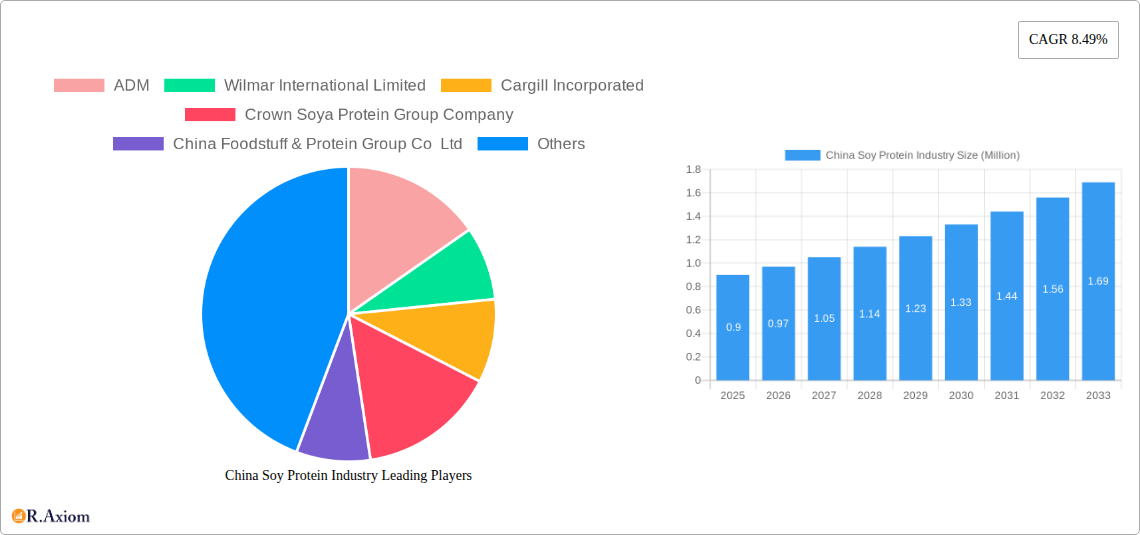

China Soy Protein Industry Company Market Share

This comprehensive report delivers an in-depth analysis of the China Soy Protein Industry, providing crucial insights for stakeholders aiming to navigate this dynamic and rapidly expanding market. Covering the historical period of 2019–2024, base year 2025, and a robust forecast period from 2025–2033, this study offers data-driven projections and actionable intelligence. The report delves into market concentration, key industry trends, dominant segments, product innovations, growth drivers, challenges, and emerging opportunities. With an estimated market size of XX Million in 2025, the China Soy Protein Industry is poised for significant growth. High-traffic keywords such as "China soy protein," "plant-based protein China," "soy protein isolates," "soy protein concentrates," "textured soy protein," and "soy protein market trends" are integrated throughout for maximum search visibility.

China Soy Protein Industry Market Concentration & Innovation

The China Soy Protein Industry exhibits a moderate level of market concentration, with a few major international and domestic players holding significant market share. Key companies like ADM, Wilmar International Limited, Cargill Incorporated, Crown Soya Protein Group Company, and China Foodstuff & Protein Group Co Ltd are at the forefront, driving innovation and shaping market dynamics. Innovation is primarily fueled by increasing consumer demand for healthier, sustainable, and plant-based food options, alongside advancements in processing technologies that enhance protein functionality and digestibility. Regulatory frameworks, particularly those related to food safety and labeling standards for plant-based products, play a pivotal role in market accessibility and product development. Product substitutes, such as pea protein and whey protein, present a competitive challenge, necessitating continuous product differentiation and value proposition enhancement. End-user trends, especially the surge in demand for protein in food and beverages and supplements, are compelling manufacturers to expand their product portfolios. Mergers and acquisitions (M&A) activities are expected to continue shaping the landscape, with significant deal values indicating a consolidation trend aimed at achieving economies of scale and expanding market reach. For instance, the Bunge-Viterra merger, while global, underscores the strategic importance of integrated supply chains and scale in the broader protein market.

China Soy Protein Industry Industry Trends & Insights

The China Soy Protein Industry is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of XX% between 2025 and 2033. This impressive growth is primarily propelled by a confluence of factors, including a burgeoning middle class with increasing disposable income and a growing awareness of health and wellness. The persistent demand for protein-rich diets, coupled with the rising popularity of flexitarian, vegetarian, and vegan lifestyles, has significantly boosted the market penetration of soy-based protein products. Technological disruptions are playing a crucial role, with advancements in extraction and processing techniques yielding higher-quality soy protein ingredients with improved functional properties, such as better solubility, emulsification, and texture. This allows for broader applications across various food and beverage categories, from meat alternatives to dairy-free products. Consumer preferences are shifting towards cleaner labels and natural ingredients, driving demand for minimally processed soy protein options. The competitive dynamics within the industry are intensifying, with both established multinational corporations and agile domestic players vying for market share. Strategic partnerships and R&D investments are paramount for companies to maintain a competitive edge and cater to evolving consumer demands for taste, texture, and nutritional value in plant-based offerings. The overall market sentiment is highly positive, indicating a sustained upward trajectory for soy protein consumption in China.

Dominant Markets & Segments in China Soy Protein Industry

The Food and Beverages segment is unequivocally the dominant market within the China Soy Protein Industry, driven by the nation's vast population and evolving dietary habits. Within this segment, Meat/Poultry/Seafood and Meat Alternative Products are experiencing exceptional growth, as consumers increasingly seek plant-based substitutes that mimic the taste and texture of conventional animal proteins. The Dairy and Dairy Alternative Products sub-segment also holds significant market share, with the demand for soy milk, yogurt, and cheese alternatives surging due to lactose intolerance and ethical considerations.

- Key Drivers in Food and Beverages:

- Growing Health Consciousness: Consumers are actively seeking healthier protein sources to manage weight, improve overall well-being, and prevent chronic diseases.

- Flexitarian and Vegan Diets: The widespread adoption of these dietary patterns necessitates the availability of palatable and versatile plant-based protein options.

- Taste and Texture Innovation: Manufacturers are investing heavily in R&D to overcome historical challenges related to the taste and texture of soy-based products, making them more appealing to a broader audience.

- Affordability and Accessibility: Soy protein remains a relatively cost-effective protein source compared to many animal-based alternatives, making it accessible to a larger consumer base.

The Supplements segment, particularly Sport/Performance Nutrition and Baby Food and Infant Formula, is also a significant contributor to market growth. The increasing emphasis on fitness and athletic performance fuels demand for protein supplements, while the nutritional benefits of soy protein make it a vital ingredient in infant nutrition.

- Key Drivers in Supplements:

- Active Lifestyle Trends: The growing popularity of sports and fitness activities drives the demand for protein supplements.

- Nutritional Superiority for Infants: Soy protein is a common alternative for infants with cow's milk allergies or intolerance.

- Elderly Nutrition: The aging population's need for adequate protein intake for muscle maintenance and recovery supports the demand in this sub-segment.

In terms of Form, Soy Protein Isolates are leading due to their high protein content (over 90%) and versatile functionality, making them ideal for a wide range of applications from beverages to meat analogues. Soy Protein Concentrates follow closely, offering a balance of protein and other soy components at a more cost-effective price point. Textured/Hydrolyzed Soy Protein is crucial for its ability to mimic the texture of meat, making it indispensable in the rapidly growing meat alternative market.

China Soy Protein Industry Product Developments

Recent product developments in the China Soy Protein Industry are characterized by an intensified focus on enhancing taste, texture, and nutritional profiles to meet evolving consumer demands. Innovations in enzymatic hydrolysis and advanced texturization techniques are yielding soy protein ingredients with superior mouthfeel and meat-like characteristics, making them ideal for plant-based meat alternatives. Furthermore, there is a growing emphasis on developing clean-label, non-GMO, and organic soy protein options to cater to the health-conscious consumer base. Companies are also exploring novel applications of soy protein in functional foods and beverages, such as protein-fortified snacks and dairy alternatives with improved emulsification properties. These advancements are crucial for maintaining competitive advantage and capturing market share in a rapidly innovating industry.

Report Scope & Segmentation Analysis

This report meticulously segments the China Soy Protein Industry by Form and End-User. The Form segmentation includes Soy Protein Concentrates, Isolates, and Textured/Hydrolyzed proteins. The End-User segmentation encompasses Animal Feed, Personal Care and Cosmetics, Food and Beverages (further detailed into Bakery, Breakfast Cereals, Condiments/Sauces, Dairy and Dairy Alternative Products, Meat/Poultry/Seafood and Meat Alternative Products, RTE/RTC Food Products, Snacks), and Supplements (including Baby Food and Infant Formula, Elderly Nutrition and Medical Nutrition, and Sport/Performance Nutrition). Each segment is analyzed for its market size, growth projections, and competitive dynamics, offering a granular understanding of the industry's landscape and future potential. The Food and Beverages segment, particularly meat alternatives, is projected to witness the highest growth, driven by increasing consumer adoption of plant-based diets.

Key Drivers of China Soy Protein Industry Growth

The China Soy Protein Industry is experiencing substantial growth driven by several key factors. Firstly, the escalating demand for plant-based protein sources, fueled by increasing health consciousness and environmental concerns, is a primary catalyst. Secondly, advancements in processing technologies are leading to the development of higher-quality, more palatable, and functionally versatile soy protein ingredients. Thirdly, supportive government policies promoting food security and sustainable agriculture indirectly benefit the soy protein sector. Lastly, the growing disposable income of the Chinese population allows for greater expenditure on premium and health-oriented food products, including those fortified with soy protein.

Challenges in the China Soy Protein Industry Sector

Despite its robust growth, the China Soy Protein Industry faces several challenges. A significant hurdle is the perception of soy protein, with some consumers still associating it with an "earthy" or undesirable taste and texture, necessitating continuous product innovation and marketing efforts. Stringent and evolving food safety regulations, while essential, can also pose compliance challenges for manufacturers. Additionally, price volatility of raw soybeans due to global agricultural factors and trade dynamics can impact production costs and profit margins. The competitive landscape is also intensifying with the emergence of alternative plant-based proteins, requiring constant differentiation and value addition to maintain market share.

Emerging Opportunities in China Soy Protein Industry

The China Soy Protein Industry is ripe with emerging opportunities. The rapidly expanding market for plant-based meat and dairy alternatives presents a significant avenue for growth, as consumers increasingly seek sustainable and ethical food choices. The burgeoning sports nutrition and health supplement markets, driven by an aging population and a growing fitness culture, also offer substantial potential for specialized soy protein products. Furthermore, the development of novel food applications, such as plant-based functional foods and beverages with enhanced nutritional benefits, represents a promising frontier. Innovations in extraction and processing to create higher-value, specialized soy protein ingredients with tailored functionalities will unlock new market segments.

Leading Players in the China Soy Protein Industry Market

- ADM

- Wilmar International Limited

- Cargill Incorporated

- Crown Soya Protein Group Company

- China Foodstuff & Protein Group Co Ltd

- International Flavours and Fragrances Inc

- CJ Group

- DuPont de Nemours Inc

- Bunge Limited

- Kerry Group

Key Developments in China Soy Protein Industry Industry

- June 2023: Bunge merged with Viterra, solidifying its position as one of the world's foremost grain companies. This strategic union is expected to expedite Bunge's mission of connecting farmers to consumers and facilitating the delivery of essential food, feed, and fuel to people around the globe.

- August 2022: Cargill entered into a transformative partnership with Benson Hill to amplify the production of cutting-edge Ultra-High Protein Soy. This long-term collaboration is designed to meet the surging demand for plant-based proteins by scaling up innovative soy ingredients.

- February 2021: DuPont orchestrated a merger of its Nutrition Business with International Flavors & Fragrances (IFF), forming a formidable company poised to become a preeminent supplier of ingredients to the food industry.

Strategic Outlook for China Soy Protein Industry Market

The strategic outlook for the China Soy Protein Industry remains exceptionally positive, driven by sustained consumer demand for plant-based nutrition and ongoing technological advancements. Key growth catalysts include the continued expansion of meat and dairy alternative markets, the increasing penetration of soy protein in sports nutrition and functional foods, and the potential for developing high-value, specialized soy protein ingredients. Companies that focus on product innovation, sustainable sourcing, and catering to evolving consumer preferences for taste, texture, and clean labels will be best positioned for success. Strategic partnerships and potential M&A activities will further consolidate the market, fostering greater efficiency and innovation. The industry is expected to play a crucial role in China's food security and public health initiatives, ensuring a sustained upward trajectory in market potential and opportunities.

China Soy Protein Industry Segmentation

-

1. Form

- 1.1. Concentrates

- 1.2. Isolates

- 1.3. Textured/Hydrolyzed

-

2. End-User

- 2.1. Animal Feed

- 2.2. Personal Care and Cosmetics

-

2.3. Food and Beverages

- 2.3.1. Bakery

- 2.3.2. Breakfast Cereals

- 2.3.3. Condiments/Sauces

- 2.3.4. Dairy and Dairy Alternative Products

- 2.3.5. Meat/Poultry/Seafood and Meat Alternative Products

- 2.3.6. RTE/RTC Food Products

- 2.3.7. Snacks

-

2.4. Supplements

- 2.4.1. Baby Food and Infant Formula

- 2.4.2. Elderly Nutrition and Medical Nutrition

- 2.4.3. Sport/Performance Nutrition

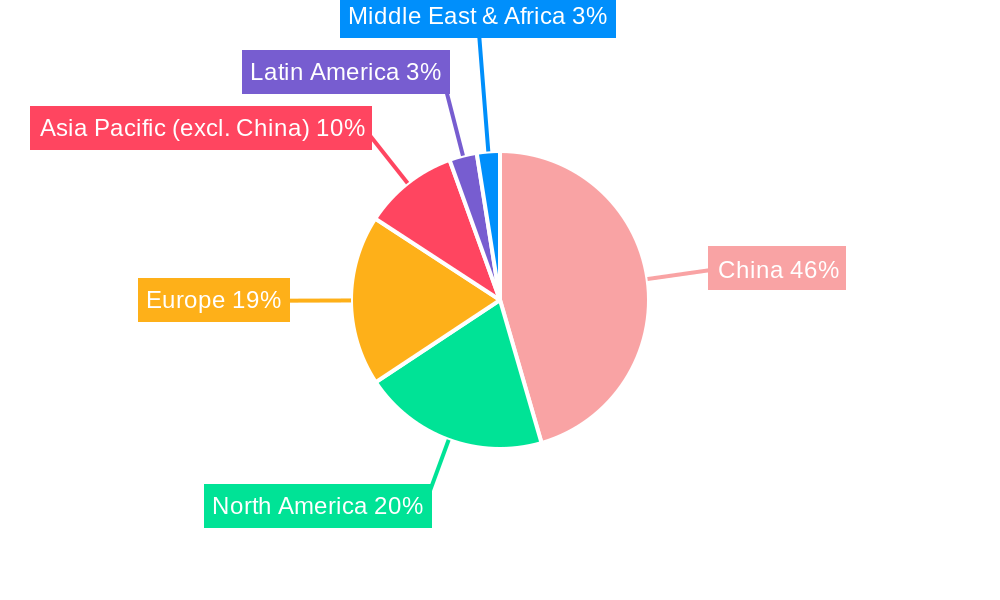

China Soy Protein Industry Segmentation By Geography

- 1. China

China Soy Protein Industry Regional Market Share

Geographic Coverage of China Soy Protein Industry

China Soy Protein Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.49% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Health and Wellness Trends Drives the Market; Rising Demand for functional Food Drives the Market

- 3.3. Market Restrains

- 3.3.1. High Competition from Other Protein Sources

- 3.4. Market Trends

- 3.4.1. Growing Demand for Protein Rich Food Increases the Soybean Meal Consumption

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Soy Protein Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Concentrates

- 5.1.2. Isolates

- 5.1.3. Textured/Hydrolyzed

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Animal Feed

- 5.2.2. Personal Care and Cosmetics

- 5.2.3. Food and Beverages

- 5.2.3.1. Bakery

- 5.2.3.2. Breakfast Cereals

- 5.2.3.3. Condiments/Sauces

- 5.2.3.4. Dairy and Dairy Alternative Products

- 5.2.3.5. Meat/Poultry/Seafood and Meat Alternative Products

- 5.2.3.6. RTE/RTC Food Products

- 5.2.3.7. Snacks

- 5.2.4. Supplements

- 5.2.4.1. Baby Food and Infant Formula

- 5.2.4.2. Elderly Nutrition and Medical Nutrition

- 5.2.4.3. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ADM

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Wilmar International Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cargill Incorporated

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Crown Soya Protein Group Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 China Foodstuff & Protein Group Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 International Flavours and Fragrance Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CJ Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DuPont de Nemours Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bunge Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kerry Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ADM

List of Figures

- Figure 1: China Soy Protein Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Soy Protein Industry Share (%) by Company 2025

List of Tables

- Table 1: China Soy Protein Industry Revenue Million Forecast, by Form 2020 & 2033

- Table 2: China Soy Protein Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: China Soy Protein Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: China Soy Protein Industry Revenue Million Forecast, by Form 2020 & 2033

- Table 5: China Soy Protein Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: China Soy Protein Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Soy Protein Industry?

The projected CAGR is approximately 8.49%.

2. Which companies are prominent players in the China Soy Protein Industry?

Key companies in the market include ADM, Wilmar International Limited, Cargill Incorporated, Crown Soya Protein Group Company, China Foodstuff & Protein Group Co Ltd, International Flavours and Fragrance Inc, CJ Group, DuPont de Nemours Inc, Bunge Limited, Kerry Group.

3. What are the main segments of the China Soy Protein Industry?

The market segments include Form, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.9 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Health and Wellness Trends Drives the Market; Rising Demand for functional Food Drives the Market.

6. What are the notable trends driving market growth?

Growing Demand for Protein Rich Food Increases the Soybean Meal Consumption.

7. Are there any restraints impacting market growth?

High Competition from Other Protein Sources.

8. Can you provide examples of recent developments in the market?

June 2023: Bunge merged with Viterra, solidifying its position as one of the world's foremost grain companies. This strategic union is expected to expedite Bunge's mission of connecting farmers to consumers and facilitating the delivery of essential food, feed, and fuel to people around the globe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Soy Protein Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Soy Protein Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Soy Protein Industry?

To stay informed about further developments, trends, and reports in the China Soy Protein Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence