Key Insights

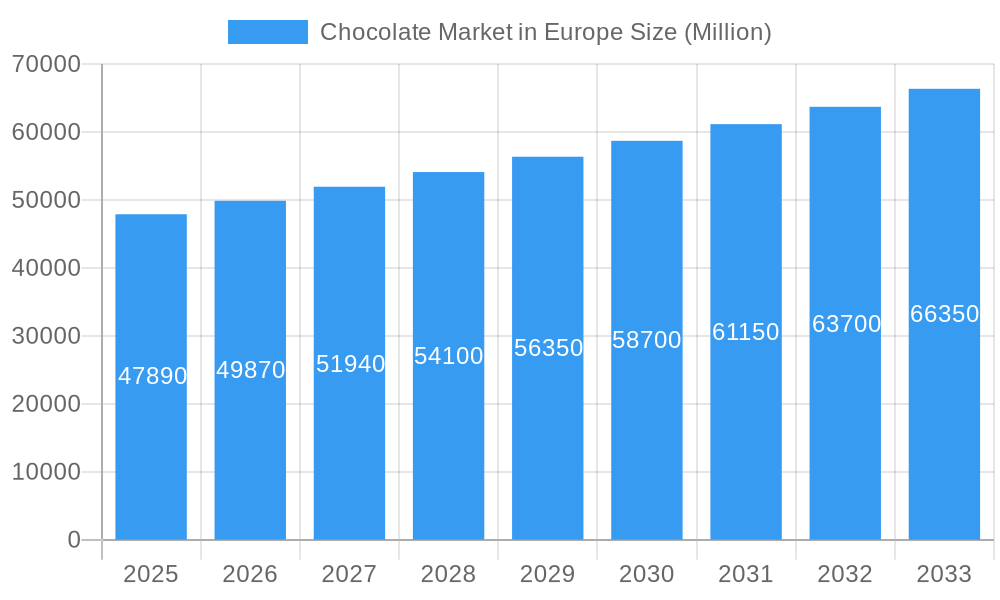

The European chocolate market is projected for robust growth, with an estimated market size of 52.38 billion by 2025, driven by a compound annual growth rate (CAGR) of 4.66% from 2025 to 2033. This expansion is fueled by increasing consumer preference for premium, artisanal, and ethically sourced chocolates, with a particular rise in demand for dark chocolate varieties due to their perceived health benefits and rich flavor profiles. While milk and white chocolate remain dominant due to their broad appeal, innovation in product offerings and evolving distribution channels, including a significant increase in online retail, are key growth enablers. Leading companies are focusing on product development, sustainable practices, and e-commerce strategies to capture market share.

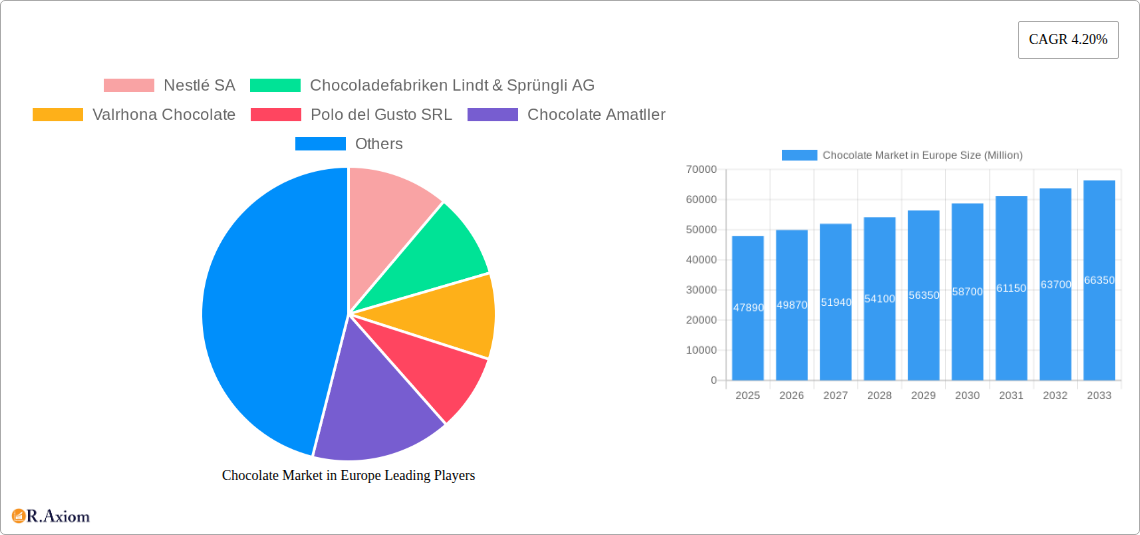

Chocolate Market in Europe Market Size (In Billion)

Despite positive growth projections, the market faces challenges, primarily the volatility of raw material prices, such as cocoa, and potential supply chain disruptions. Growing consumer health consciousness is also leading to increased demand for sugar-free and low-sugar alternatives, prompting manufacturers to adapt their product portfolios. However, the inherent appeal of chocolate as an indulgent treat and a source of emotional satisfaction, combined with continuous innovation in flavors and premium products, is expected to sustain market momentum across all distribution channels.

Chocolate Market in Europe Company Market Share

This comprehensive report offers an in-depth analysis of the European chocolate market, providing critical insights into dynamics, growth drivers, and emerging opportunities. The study, covering the period from 2019 to 2033 with a base year of 2025, is an essential resource for stakeholders, manufacturers, and investors navigating this evolving industry. We examine key market segments, major industry players, and pivotal developments shaping the future of chocolate consumption in Europe.

Chocolate Market in Europe Market Concentration & Innovation

The European chocolate market exhibits a moderately concentrated structure, with a few global giants holding significant market share, yet a vibrant ecosystem of artisanal and niche producers continues to foster innovation. Key innovation drivers include a burgeoning demand for premium and ethically sourced chocolates, advancements in sustainable packaging, and the increasing popularity of plant-based and sugar-free alternatives. Regulatory frameworks, such as EU food labeling laws and sustainability initiatives, play a crucial role in shaping product development and market access. Product substitutes, including other confectionery items and artisanal baked goods, present a competitive pressure, but premium chocolate maintains a distinct appeal. End-user trends are leaning towards indulgence, health-consciousness, and personalized flavor experiences. Merger and acquisition (M&A) activities, while not always high-value in Europe for established players, are frequently observed among smaller, innovative brands looking to scale or enter new markets, indicating strategic consolidation and acquisition of niche expertise. For instance, numerous small-scale acquisitions of artisanal chocolatiers by larger corporations are observed to tap into premium segments, with deal values ranging from a few million to tens of millions of Euros.

Chocolate Market in Europe Industry Trends & Insights

The European chocolate market is poised for robust growth, driven by a confluence of favorable factors. A primary growth driver is the increasing disposable income across many European nations, leading to a higher propensity for consumers to indulge in premium and specialty chocolates. Furthermore, a significant trend is the growing consumer awareness and demand for healthier chocolate options. This includes a rise in the popularity of dark chocolate due to its perceived health benefits, sugar-free varieties, and chocolates fortified with functional ingredients like vitamins and probiotics. The ‘plant-based’ movement has also made substantial inroads, with significant product launches and an expanding consumer base seeking dairy-free and vegan alternatives. Technological disruptions are also influencing the market, from advanced cocoa processing techniques that enhance flavor profiles to sophisticated direct-to-consumer (DTC) online retail platforms that offer personalized shopping experiences and broader product accessibility. Competitive dynamics are intensifying, with established players focusing on product diversification and innovation, while challenger brands leverage unique selling propositions like ethical sourcing, unique flavor combinations, and sustainability credentials. The CAGR for the European chocolate market is estimated to be around 3.5% for the forecast period. Market penetration of premium and artisanal chocolates is steadily increasing, particularly in Western European countries. The ongoing emphasis on traceable and sustainable cocoa sourcing is no longer a niche concern but a mainstream expectation, pushing manufacturers to invest in supply chain transparency and ethical practices. The market is witnessing a surge in customized and experiential chocolate products, catering to gifting occasions and the desire for unique sensory experiences.

Dominant Markets & Segments in Chocolate Market in Europe

The European chocolate market is characterized by the dominance of Milk and White Chocolate as the most consumed variants, driven by their widespread appeal and versatility in various confectionery applications. However, Dark Chocolate is experiencing significant growth, fueled by increasing consumer awareness of its health benefits and the rising demand for premium, single-origin, and high-cocoa content products.

Key Drivers of Dominance:

- Milk and White Chocolate:

- Broad Consumer Appeal: These variants cater to a wider demographic, including children and those with a preference for sweeter taste profiles.

- Versatility in Applications: They are extensively used in a vast array of confectionery products, from bars and pralines to baked goods and desserts.

- Established Market Presence: Decades of widespread availability and marketing have solidified their position in consumer purchasing habits.

- Dark Chocolate:

- Health and Wellness Trend: Growing consumer interest in the perceived health benefits of dark chocolate, such as antioxidants and potential cardiovascular advantages, is a major driver.

- Premiumization and Craft Chocolate: The rise of artisanal and craft chocolate makers focusing on high-quality cocoa beans and unique flavor profiles has elevated dark chocolate's status.

- Dietary Preferences: A significant segment of consumers, particularly those seeking reduced sugar intake or specific dietary choices (e.g., vegan), are turning to dark chocolate.

In terms of Distribution Channels, Supermarkets/Hypermarkets remain the dominant force, offering convenience and a wide selection to the majority of European consumers. However, the growth of Online Retail Stores is exceptionally rapid, providing consumers with access to a broader range of niche, artisanal, and international chocolate brands, as well as facilitating direct-to-consumer sales for manufacturers. Convenience Stores also play a vital role, especially for impulse purchases and on-the-go consumption.

Dominance Analysis by Segment:

- Confectionery Variant: Milk and White Chocolate hold the largest market share, estimated at over 60% of the total market value in 2025. Dark Chocolate is projected to witness the highest CAGR during the forecast period, driven by premiumization and health trends. The market for dark chocolate is projected to reach approximately $12,000 million by 2025.

- Distribution Channel: Supermarkets/Hypermarkets account for an estimated 55% of chocolate sales in Europe. Online retail is anticipated to grow at a CAGR of over 8%, reaching a market share of approximately 20% by 2033. This channel is crucial for specialty and premium chocolate brands.

Economic stability and consumer spending power across major European economies like Germany, France, and the UK continue to underpin the demand for chocolate. Infrastructure supporting efficient supply chains and retail networks is well-established. Regulatory policies regarding food safety and ingredient transparency also influence product formulation and marketing strategies.

Chocolate Market in Europe Product Developments

Product developments in the European chocolate market are increasingly focused on premiumization, health, and sustainability. Innovations include the expansion of plant-based chocolate lines, utilizing ingredients like oat milk and almond milk to achieve creamy textures and rich flavors, appealing to a growing vegan and lactose-intolerant consumer base. Sugar-free and low-sugar options, often employing natural sweeteners, are also gaining traction. Furthermore, there's a significant push towards ethically sourced and single-origin chocolates, with transparent supply chains and certifications like Fairtrade and Rainforest Alliance becoming key competitive advantages. Artisanal chocolatiers are experimenting with unique flavor infusions, such as exotic spices, floral notes, and savory elements, to cater to adventurous palates and create distinctive premium offerings.

Report Scope & Segmentation Analysis

This report meticulously segments the European chocolate market to provide granular insights. The Confectionery Variant segmentation includes detailed analysis of Dark Chocolate, Milk and White Chocolate. The Distribution Channel segmentation covers Convenience Store, Online Retail Store, Supermarket/Hypermarket, and Others (which includes specialized confectionery stores, duty-free shops, and direct-to-consumer sales via brand websites). Each segment is analyzed for its market size, growth projections, and competitive dynamics within the study period.

- Dark Chocolate: Expected to exhibit a strong CAGR of approximately 4.5% during the forecast period, driven by health-conscious consumers and the premium segment. Market size estimated at $12,000 million in 2025.

- Milk and White Chocolate: These segments collectively will continue to dominate in volume, with a projected CAGR of around 3%. Their market size is estimated at over $20,000 million in 2025.

- Supermarket/Hypermarket: The largest distribution channel, holding a significant market share, with steady growth expected at a CAGR of around 3.2%.

- Online Retail Store: The fastest-growing channel, projected to achieve a CAGR exceeding 8%, driven by convenience and access to a wider product portfolio.

- Convenience Store: Expected to maintain consistent growth at a CAGR of approximately 3.5%, catering to impulse purchases and on-the-go consumption.

- Others: This segment, encompassing niche channels, is projected to grow at a CAGR of around 4%, driven by specialized chocolate retailers and artisanal producers.

Key Drivers of Chocolate Market in Europe Growth

The growth of the European chocolate market is propelled by several key drivers. Firstly, the increasing consumer demand for premium and artisanal chocolate, characterized by high-quality ingredients and unique flavor profiles, is a significant economic factor. Secondly, a growing health and wellness consciousness is driving demand for dark chocolate, sugar-free options, and plant-based alternatives, reflecting shifts in consumer preferences. Technological advancements in cocoa processing and product development enable the creation of innovative and appealing chocolate products. Furthermore, rising disposable incomes across various European countries contribute to increased consumer spending on discretionary items like premium chocolates. Evolving distribution channels, particularly the rapid expansion of online retail, enhance market accessibility and consumer reach.

Challenges in the Chocolate Market in Europe Sector

Despite strong growth prospects, the European chocolate market faces several challenges. Fluctuations in cocoa bean prices, driven by geopolitical factors, climate change, and supply chain disruptions, can impact profitability and product pricing. Stringent regulations regarding food labeling, ingredient sourcing, and sustainability standards require continuous adaptation and investment from manufacturers. Intense competition from both established global players and agile niche brands necessitates constant innovation and effective marketing strategies. Furthermore, the increasing cost of raw materials and energy can put pressure on production costs. Supply chain vulnerabilities, as highlighted by recent global events, can lead to delays and increased logistics expenses.

Emerging Opportunities in Chocolate Market in Europe

Emerging opportunities in the European chocolate market lie in the continued expansion of the plant-based chocolate segment, catering to the growing vegan and lactose-intolerant population. The demand for ethically sourced and sustainably produced chocolate presents significant opportunities for brands that can effectively communicate their commitment to fair trade and environmental responsibility. Personalization and customization of chocolate products, offering unique flavor combinations or bespoke gifting options, are also gaining traction. The growth of the functional chocolate market, incorporating ingredients with purported health benefits like probiotics or adaptogens, represents another promising avenue. Furthermore, leveraging e-commerce and direct-to-consumer models to reach a wider audience, especially in underserved regions or for niche products, offers substantial potential for market penetration and brand building.

Leading Players in the Chocolate Market in Europe Market

- Nestlé SA

- Chocoladefabriken Lindt & Sprüngli AG

- Valrhona Chocolate

- Polo del Gusto SRL

- Chocolate Amatller

- Ferrero International SA

- Blanxart Chocolate

- Duffy's Chocolate

- Mars Incorporated

- Yıldız Holding A

- Barry Callebaut AG

- Whitakers Chocolates Ltd

- Mondelēz International Inc

- Alfred Ritter GmbH & Co KG

- Confiserie Leonidas SA

Key Developments in Chocolate Market in Europe Industry

- March 2023: Whitakers Chocolates unveiled its investment in enhancing its printing process and flow wrapping capabilities as it expands its chocolate production focused on private label ranges. The company’s launch product is a 90-gram flow wrap square pack of dark chocolate Fondant Creams.

- February 2023: Barry Callebaut AG launched plant-based chocolate in Cologne, Germany. The new chocolate is part of a wider portfolio of ‘Plant Craft’ products ranging from chocolate, cocoa, nuts, and fillings to decorations.

- January 2023: Ritter Sport launched a Travel Retail Edition Vegan Tower 5x 100g set globally, offering three varieties of non-dairy chocolate in a five-pack. The travel edition assortment flavors are Smooth Chocolate and new Roasted Peanut and Salted Caramel, which were introduced in domestic markets in January 2023.

Strategic Outlook for Chocolate Market in Europe Market

The strategic outlook for the European chocolate market remains exceptionally positive, driven by sustained consumer demand for indulgence, evolving health preferences, and a strong emphasis on ethical and sustainable sourcing. Key growth catalysts include the continued premiumization of the market, with consumers willing to pay more for high-quality, artisanal, and specialty chocolates. The burgeoning plant-based and sugar-free segments present substantial opportunities for product innovation and market penetration. Leveraging advanced e-commerce platforms and direct-to-consumer strategies will be crucial for expanding reach and building deeper customer relationships. Companies that can effectively integrate sustainability and ethical sourcing into their brand narrative and operations will likely gain a competitive edge. Future success will hinge on agility in adapting to changing consumer tastes, investing in product innovation that addresses health and wellness trends, and optimizing supply chains for resilience and transparency.

Chocolate Market in Europe Segmentation

-

1. Confectionery Variant

- 1.1. Dark Chocolate

- 1.2. Milk and White Chocolate

-

2. Distribution Channel

- 2.1. Convenience Store

- 2.2. Online Retail Store

- 2.3. Supermarket/Hypermarket

- 2.4. Others

Chocolate Market in Europe Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

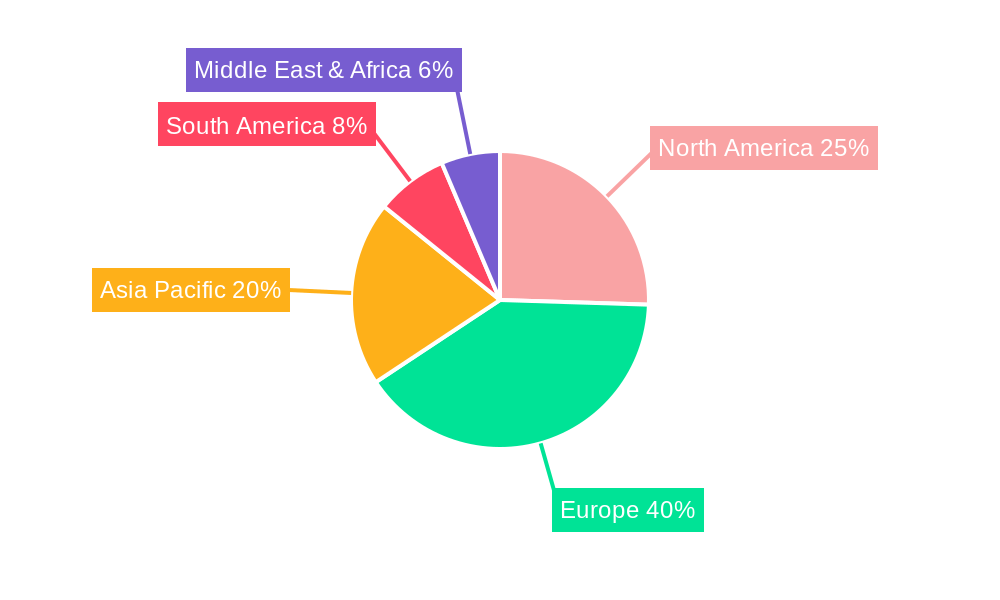

Chocolate Market in Europe Regional Market Share

Geographic Coverage of Chocolate Market in Europe

Chocolate Market in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Escalating Demand for Processed Poultry Products; Favorable Government Initiatives to Boost Production

- 3.3. Market Restrains

- 3.3.1. Rising Vegan Trend among Young Consumers; Deeper Penetration of Red Meat Across Saudi Arabia

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Chocolate Market in Europe Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 5.1.1. Dark Chocolate

- 5.1.2. Milk and White Chocolate

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Convenience Store

- 5.2.2. Online Retail Store

- 5.2.3. Supermarket/Hypermarket

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 6. North America Chocolate Market in Europe Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 6.1.1. Dark Chocolate

- 6.1.2. Milk and White Chocolate

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Convenience Store

- 6.2.2. Online Retail Store

- 6.2.3. Supermarket/Hypermarket

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 7. South America Chocolate Market in Europe Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 7.1.1. Dark Chocolate

- 7.1.2. Milk and White Chocolate

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Convenience Store

- 7.2.2. Online Retail Store

- 7.2.3. Supermarket/Hypermarket

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 8. Europe Chocolate Market in Europe Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 8.1.1. Dark Chocolate

- 8.1.2. Milk and White Chocolate

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Convenience Store

- 8.2.2. Online Retail Store

- 8.2.3. Supermarket/Hypermarket

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 9. Middle East & Africa Chocolate Market in Europe Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 9.1.1. Dark Chocolate

- 9.1.2. Milk and White Chocolate

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Convenience Store

- 9.2.2. Online Retail Store

- 9.2.3. Supermarket/Hypermarket

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 10. Asia Pacific Chocolate Market in Europe Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 10.1.1. Dark Chocolate

- 10.1.2. Milk and White Chocolate

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Convenience Store

- 10.2.2. Online Retail Store

- 10.2.3. Supermarket/Hypermarket

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Nestlé SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Chocoladefabriken Lindt & Sprüngli AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Valrhona Chocolate

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Polo del Gusto SRL

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Chocolate Amatller

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ferrero International SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Blanxart Chocolate

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Duffy's Chocolate

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mars Incorporated

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Yıldız Holding A

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Barry Callebaut AG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Whitakers Chocolates Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Mondelēz International Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Alfred Ritter GmbH & Co KG

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Confiserie Leonidas SA

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Nestlé SA

List of Figures

- Figure 1: Global Chocolate Market in Europe Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Chocolate Market in Europe Revenue (billion), by Confectionery Variant 2025 & 2033

- Figure 3: North America Chocolate Market in Europe Revenue Share (%), by Confectionery Variant 2025 & 2033

- Figure 4: North America Chocolate Market in Europe Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: North America Chocolate Market in Europe Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Chocolate Market in Europe Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Chocolate Market in Europe Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Chocolate Market in Europe Revenue (billion), by Confectionery Variant 2025 & 2033

- Figure 9: South America Chocolate Market in Europe Revenue Share (%), by Confectionery Variant 2025 & 2033

- Figure 10: South America Chocolate Market in Europe Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 11: South America Chocolate Market in Europe Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America Chocolate Market in Europe Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Chocolate Market in Europe Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Chocolate Market in Europe Revenue (billion), by Confectionery Variant 2025 & 2033

- Figure 15: Europe Chocolate Market in Europe Revenue Share (%), by Confectionery Variant 2025 & 2033

- Figure 16: Europe Chocolate Market in Europe Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 17: Europe Chocolate Market in Europe Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe Chocolate Market in Europe Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Chocolate Market in Europe Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Chocolate Market in Europe Revenue (billion), by Confectionery Variant 2025 & 2033

- Figure 21: Middle East & Africa Chocolate Market in Europe Revenue Share (%), by Confectionery Variant 2025 & 2033

- Figure 22: Middle East & Africa Chocolate Market in Europe Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: Middle East & Africa Chocolate Market in Europe Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East & Africa Chocolate Market in Europe Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Chocolate Market in Europe Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Chocolate Market in Europe Revenue (billion), by Confectionery Variant 2025 & 2033

- Figure 27: Asia Pacific Chocolate Market in Europe Revenue Share (%), by Confectionery Variant 2025 & 2033

- Figure 28: Asia Pacific Chocolate Market in Europe Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific Chocolate Market in Europe Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific Chocolate Market in Europe Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Chocolate Market in Europe Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Chocolate Market in Europe Revenue billion Forecast, by Confectionery Variant 2020 & 2033

- Table 2: Global Chocolate Market in Europe Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Chocolate Market in Europe Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Chocolate Market in Europe Revenue billion Forecast, by Confectionery Variant 2020 & 2033

- Table 5: Global Chocolate Market in Europe Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Chocolate Market in Europe Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Chocolate Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Chocolate Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Chocolate Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Chocolate Market in Europe Revenue billion Forecast, by Confectionery Variant 2020 & 2033

- Table 11: Global Chocolate Market in Europe Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global Chocolate Market in Europe Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Chocolate Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Chocolate Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Chocolate Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Chocolate Market in Europe Revenue billion Forecast, by Confectionery Variant 2020 & 2033

- Table 17: Global Chocolate Market in Europe Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global Chocolate Market in Europe Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Chocolate Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Chocolate Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Chocolate Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Chocolate Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Chocolate Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Chocolate Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Chocolate Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Chocolate Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Chocolate Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Chocolate Market in Europe Revenue billion Forecast, by Confectionery Variant 2020 & 2033

- Table 29: Global Chocolate Market in Europe Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global Chocolate Market in Europe Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Chocolate Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Chocolate Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Chocolate Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Chocolate Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Chocolate Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Chocolate Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Chocolate Market in Europe Revenue billion Forecast, by Confectionery Variant 2020 & 2033

- Table 38: Global Chocolate Market in Europe Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global Chocolate Market in Europe Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Chocolate Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Chocolate Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Chocolate Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Chocolate Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Chocolate Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Chocolate Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Chocolate Market in Europe Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chocolate Market in Europe?

The projected CAGR is approximately 4.66%.

2. Which companies are prominent players in the Chocolate Market in Europe?

Key companies in the market include Nestlé SA, Chocoladefabriken Lindt & Sprüngli AG, Valrhona Chocolate, Polo del Gusto SRL, Chocolate Amatller, Ferrero International SA, Blanxart Chocolate, Duffy's Chocolate, Mars Incorporated, Yıldız Holding A, Barry Callebaut AG, Whitakers Chocolates Ltd, Mondelēz International Inc, Alfred Ritter GmbH & Co KG, Confiserie Leonidas SA.

3. What are the main segments of the Chocolate Market in Europe?

The market segments include Confectionery Variant, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 52.38 billion as of 2022.

5. What are some drivers contributing to market growth?

Escalating Demand for Processed Poultry Products; Favorable Government Initiatives to Boost Production.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Rising Vegan Trend among Young Consumers; Deeper Penetration of Red Meat Across Saudi Arabia.

8. Can you provide examples of recent developments in the market?

March 2023: Whitakers Chocolates unveiled its investment in enhancing its printing process and flow wrapping capabilities as it expands its chocolate production focused on private label ranges. The company’s launch product is a 90-gram flow wrap square pack of dark chocolate Fondant Creams.February 2023: Barry Callebaut AG launched plant-based chocolate in Cologne, Germany. The new chocolate is part of a wider portfolio of ‘Plant Craft’ products ranging from chocolate, cocoa, nuts, and fillings to decorations.January 2023: Ritter Sport launched a Travel Retail Edition Vegan Tower 5x 100g set globally, offering three varieties of non-dairy chocolate in a five-pack. The travel edition assortment flavors are Smooth Chocolate and new Roasted Peanut and Salted Caramel, which were introduced in domestic markets in January 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chocolate Market in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chocolate Market in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chocolate Market in Europe?

To stay informed about further developments, trends, and reports in the Chocolate Market in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence